Automated Windows Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432963 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automated Windows Market Size

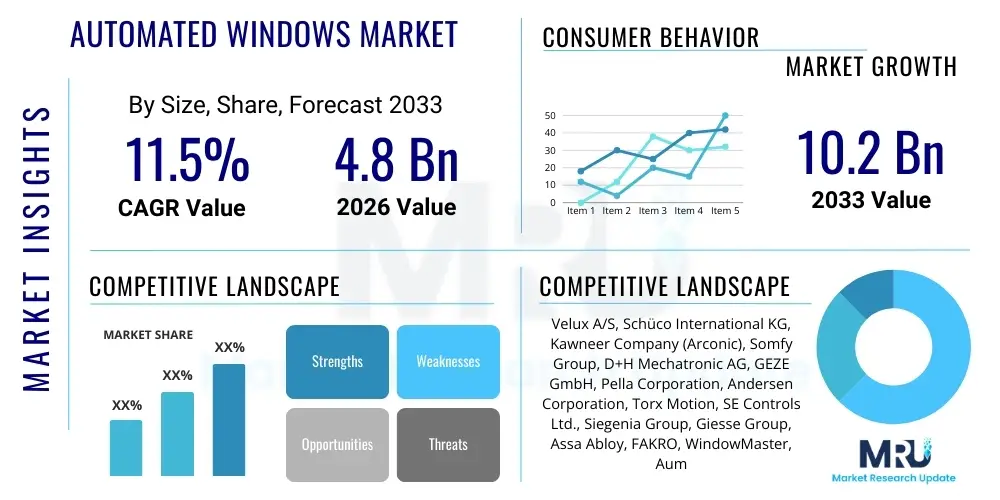

The Automated Windows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.2 Billion by the end of the forecast period in 2033.

Automated Windows Market introduction

The Automated Windows Market encompasses the design, manufacturing, and installation of window systems equipped with motorized actuators, sensors, and control units that facilitate automatic opening, closing, and locking functions. These systems are integral components of modern Building Automation Systems (BAS) and Smart Home ecosystems, offering enhanced functionality related to ventilation, daylight management, security, and energy efficiency. The technology primarily relies on electric motors integrated within the window frame or sash, controlled via wall switches, remote controls, or, increasingly, sophisticated IoT platforms and smartphone applications. These automated solutions are rapidly becoming standard in high-end commercial buildings and energy-conscious residential constructions.

Major applications of automated windows span across several sectors, including residential buildings, commercial spaces (offices, retail centers), industrial facilities, and healthcare institutions. In commercial settings, automated windows are crucial for dynamic facade management, often integrating with HVAC systems to optimize internal climate control and reduce reliance on mechanical ventilation, thereby significantly lowering operational energy costs. Furthermore, in environments requiring stringent safety protocols, such as fire safety systems, automated windows can serve as critical smoke ventilation outlets, demonstrating their multifaceted utility beyond mere convenience.

Key driving factors accelerating the adoption of automated windows include the global mandate for green building standards and stringent energy efficiency regulations, particularly in developed economies. The increasing consumer demand for smart and connected homes, driven by the desire for improved comfort and convenience, also plays a pivotal role. The benefits derived from these systems—such as maximized natural light, enhanced air quality through automated ventilation scheduling, improved security features via automated locking mechanisms, and the crucial ability to manage ventilation in hard-to-reach areas—underscore their growing market penetration and long-term viability within the modern construction landscape.

Automated Windows Market Executive Summary

The global Automated Windows Market is exhibiting robust growth, driven primarily by technological advancements in IoT integration and the global shift towards sustainable and energy-efficient building infrastructure. Key business trends indicate a strong focus on developing wireless and retrofit solutions, allowing older buildings to adopt automation without extensive structural modifications. Manufacturers are increasingly partnering with software developers and home automation platform providers (like Google Home and Amazon Alexa) to ensure seamless interoperability, positioning automated windows not as standalone products but as essential nodes within a cohesive smart environment. Furthermore, the market is characterized by intense competition centered on actuator durability, noise reduction, and the sophistication of sensor arrays used for rain detection, wind monitoring, and temperature regulation.

Regional trends reveal that Europe and North America currently dominate the market, largely due to established regulatory frameworks promoting Zero Energy Buildings (ZEB) and high consumer willingness to invest in sophisticated building automation technologies. The Asia Pacific region, particularly China and India, is poised for the fastest growth, propelled by rapid urbanization, massive infrastructure projects, and increasing government investments in smart city initiatives. These emerging markets represent significant opportunities for mass deployment, although challenges related to product standardization and cost sensitivity remain prevalent. Latin America and the Middle East and Africa are showing steady uptake, primarily driven by luxury residential complexes and high-profile commercial developments aiming for international green certifications.

Segment trends highlight the dominance of motorized sliding windows based on sales volume, though the hinged (casement and awning) automated windows segment is gaining traction due to better sealing and ventilation capabilities. Control systems are rapidly migrating from basic switches to advanced smart control modules utilizing machine learning for predictive ventilation scheduling based on weather patterns and occupancy data. The residential sector remains the largest end-user segment, but the commercial sector is expected to demonstrate higher value growth, fueled by larger-scale installations requiring complex integration with central Building Management Systems (BMS) for centralized environmental control and monitoring across vast corporate campuses or high-rise structures.

AI Impact Analysis on Automated Windows Market

User queries regarding the integration of Artificial Intelligence (AI) into the Automated Windows Market frequently center on predictive capabilities, data security, and system autonomy. Common questions involve how AI can optimize energy savings beyond simple sensor response, the robustness of self-learning algorithms in adapting to varied occupant behaviors and microclimates, and concerns about potential system failure or breaches in connectivity. Users expect AI to move systems from reactive (responding to a current temperature reading) to truly proactive (predicting optimal ventilation needs hours in advance based on forecasted occupancy and weather data). There is also significant interest in AI-driven diagnostics for preventative maintenance, reducing system downtime and extending the lifespan of the mechanical components.

The consensus theme is the transition from rule-based automation to adaptive intelligence. AI algorithms are essential for processing the massive influx of data generated by weather stations, internal environmental sensors, security cameras, and occupant feedback loops. This data synthesis allows automated window systems to dynamically adjust opening angles and schedules to achieve the perfect balance between indoor air quality (IAQ), thermal comfort, and minimizing energy expenditure for heating, cooling, and lighting. By learning daily and seasonal patterns specific to a building, AI ensures that automated windows contribute maximally to the building's overall sustainability performance without manual intervention, fundamentally transforming the definition of responsive architecture.

Furthermore, AI is instrumental in enhancing the safety and security features of automated windows. Predictive modeling can analyze security risks based on time, location, and previous incidents, ensuring windows are securely locked when the property is vacant or during high-risk hours. In emergency situations, AI-integrated systems can communicate instantaneously with fire safety systems, ensuring rapid and calculated opening for smoke extraction based on the location and intensity of the fire source, providing a life-critical function that transcends basic convenience and improves the overall resilience of the structure.

- AI-Powered Predictive Maintenance: Algorithms analyze motor strain and operation cycles to forecast component failure, scheduling maintenance preemptively.

- Optimized Energy Management: Machine learning models predict solar gain and ventilation needs based on real-time weather and indoor thermal loads, minimizing HVAC usage.

- Dynamic Daylighting Control: AI adjusts window blinds/shading and opening degree to maximize natural light penetration while preventing glare and overheating.

- Enhanced Security Protocols: Integration with security systems allows for autonomous locking based on pattern recognition and anomaly detection.

- Personalized Comfort Profiles: AI learns occupant preferences and adjusts environmental factors (ventilation, temperature influence) based on personalized user data and schedules.

- Seamless BAS Integration: Facilitates complex, bidirectional communication with central Building Automation Systems (BAS) for holistic building performance management.

DRO & Impact Forces Of Automated Windows Market

The Automated Windows Market is profoundly shaped by a combination of strong drivers, persistent restraints, compelling opportunities, and transformative impact forces. The primary drivers revolve around the global emphasis on sustainability, characterized by governmental incentives for green building adoption and increasingly stringent energy performance requirements in both residential and commercial construction. This is complemented by the rapid penetration of IoT technology, which makes integration and remote management of automated systems easier and more affordable. Conversely, key restraints include the high initial installation cost of sophisticated actuator and sensor technology compared to traditional windows, complexity in retrofitting existing structures, and consumer concerns regarding the longevity and maintenance requirements of mechanical components and integrated electronics, particularly in adverse weather conditions.

Opportunities in this sector are vast, primarily focusing on the development of highly efficient, solar-powered autonomous window systems, and the creation of standardized, open-source communication protocols that foster easier integration across diverse smart home platforms. Emerging markets, especially in densely populated urban centers, offer tremendous scope for large-scale adoption in new constructions focused on achieving optimal air quality and daylighting. The ongoing miniaturization and cost reduction of sensors and microcontrollers will further democratize this technology, making automated solutions viable for mid-market residential projects. Furthermore, focusing on solutions that merge fire safety requirements (smoke ventilation) with daily comfort control presents a powerful value proposition.

The major impact forces include rapid urbanization, which necessitates energy-efficient high-rise construction, and climate change concerns, driving the demand for passive climate control strategies like automated natural ventilation. Regulatory mandates, such as the European Union’s Energy Performance of Buildings Directive (EPBD), act as a powerful external force compelling market growth. Finally, the shift towards wellness and occupant comfort in commercial spaces (e.g., WELL Building Standard certification) places a premium on maximizing fresh air and natural light access, directly increasing the appeal and necessity of sophisticated automated window solutions that can precisely control these environmental variables.

Segmentation Analysis

The Automated Windows Market is comprehensively segmented based on operational mechanism, component, end-user, and control system, providing a detailed view of current market dynamics and future growth trajectories. Understanding these segments is critical for manufacturers to tailor product development and for installers to focus on high-demand applications. The operational mechanism segmentation, which includes sliding, casement, awning, and roof windows, reflects the diverse structural needs of different building types, with roof windows (skylights) showing significant growth due to their inherent need for automation for accessibility and ventilation in attics and top floors. Furthermore, the component segmentation highlights the rising importance of complex electronics, specifically microprocessors and sophisticated weather sensors, over basic mechanical components.

The segmentation by end-user differentiates between the high volume, moderate technology requirements of the residential sector and the lower volume, high integration and sophistication demands of the commercial sector. Commercial installations often require specialized heavy-duty actuators and robust communication protocols to integrate with centralized Building Management Systems (BMS), justifying higher price points. The control system segmentation is perhaps the most dynamic area, showcasing a rapid evolution from simple manual switches and remote controls toward sophisticated smart control systems utilizing IoT platforms and advanced algorithms for schedule-based, sensor-based, and remote application-based operation, which delivers superior energy efficiency and user convenience.

Analyzing these segments reveals that the future market leadership will be concentrated in segments that prioritize connectivity and intelligence. The transition to fully integrated, cloud-managed automated systems across both residential and commercial domains is inevitable. While hardware performance remains foundational, the differentiation point is increasingly residing in the software and AI capabilities that manage the window operation, providing real-time data on air quality, energy savings, and security status. This technological convergence is driving innovation, particularly within the smart control system segment, which promises substantial revenue growth over the forecast period as consumers seek holistic home and building automation solutions.

- By Operational Mechanism:

- Sliding Windows (Horizontal & Vertical)

- Hinged Windows (Casement & Awning)

- Pivot Windows

- Roof Windows (Skylights)

- By Component:

- Actuators (Chain Actuators, Rack & Pinion Actuators, Linear Actuators)

- Control Systems (Centralized Control Units, Remote Controls, Smart Switches)

- Sensors (Rain Sensors, Wind Sensors, Temperature Sensors, Smoke Sensors)

- Power Supply Units

- By End-User:

- Residential

- Commercial (Offices, Retail, Hospitality)

- Industrial

- Institutional (Hospitals, Schools)

- By Control System Type:

- Manual (Switch-based)

- Remote Controlled

- Smart/IoT Controlled (App-based, Voice-Activated)

Value Chain Analysis For Automated Windows Market

The value chain for the Automated Windows Market initiates with the upstream supply of raw materials and specialized components. This stage involves the sourcing of aluminum, PVC, or wood for window frames, glass panels, and the critical electronic and mechanical components, chiefly focusing on the sourcing of high-precision motors, microprocessors, PCBs, and specialized sensors (e.g., ultrasonic or infrared sensors for object detection and rain detection). Key upstream challenges involve maintaining quality control for electronic components and ensuring a stable supply of materials that meet strict building and safety codes. Suppliers of high-quality, durable, and low-noise actuators hold significant leverage in the upstream segment, directly influencing the final product's performance and cost structure.

The midstream process involves manufacturing, assembly, and integration. Manufacturers of automated window systems either produce the entire unit (frame, glass, and automation kit) or, more commonly, integrate third-party automation kits into standard window frames. This stage requires specialized expertise in mechatronics, ensuring the actuators are seamlessly concealed within the frame and that the control units are programmed for smooth, reliable operation. Quality assurance at this level is crucial, as the performance depends on the synchronization between the mechanical opening mechanism and the electronic command system. Customization, particularly for large commercial projects requiring specific load-bearing actuators or specialized glass, adds complexity to this manufacturing step.

Downstream activities include distribution, sales, installation, and post-sale services. The distribution channel is bifurcated into direct sales, typically utilized for large commercial or institutional projects where manufacturers interact directly with architects and developers, and indirect sales, which leverage a network of specialized dealers, construction material suppliers, and system integrators for the residential and small commercial markets. System integrators play a vital role, as automated windows are often sold as part of a larger smart home or BMS package. Post-sale support, including software updates, remote diagnostics, and physical maintenance of the moving parts, is a growing profit center, enhancing customer loyalty and extending the value chain lifecycle. Effective downstream management relies heavily on training certified installers capable of handling both the physical installation and the electrical/network commissioning.

Automated Windows Market Potential Customers

The potential customer base for the Automated Windows Market is extensive and segmented based on project scale, regulatory compliance needs, and commitment to automation and sustainability. Key buyers are primarily large-scale commercial real estate developers who are mandated or incentivized to construct certified green buildings (e.g., LEED, BREEAM). These customers prioritize features like seamless integration with central HVAC/BMS systems, advanced smoke ventilation capabilities, and verifiable energy saving metrics to optimize operational expenses and enhance asset value. For these commercial entities, automated windows are considered a necessary infrastructural investment rather than a luxury item, driven by corporate sustainability mandates and occupant wellness programs.

Another major customer segment consists of affluent homeowners and builders specializing in high-end residential construction. These buyers are motivated primarily by convenience, security, and the aspirational appeal of a fully integrated smart home. They seek systems that offer quiet operation, aesthetic concealment of mechanical components, and intuitive control via popular smart assistants. While energy savings are a factor, the ease of managing ventilation in multi-story or architecturally complex homes (such as automated skylights or clerestory windows) often serves as the deciding factor. This segment demonstrates high loyalty to brands offering robust connectivity and aesthetic customization.

Furthermore, institutional buyers, including healthcare facility administrators and educational facility managers, constitute a growing potential customer group. For hospitals and schools, automated windows offer critical advantages in maintaining superior indoor air quality (IAQ) and infection control through programmed ventilation cycles, minimizing manual handling and potential contamination. In the case of older or historically significant buildings undergoing modernization, automated solutions that maintain architectural integrity while providing modern safety and comfort features are highly sought after. These institutional customers require long warranties, robust safety certifications, and minimal maintenance disruption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Velux A/S, Schüco International KG, Kawneer Company (Arconic), Somfy Group, D+H Mechatronic AG, GEZE GmbH, Pella Corporation, Andersen Corporation, Torx Motion, SE Controls Ltd., Siegenia Group, Giesse Group, Assa Abloy, FAKRO, WindowMaster, Aumuller Aumatic GmbH, Tormax (Landert Group), Kollmorgen, Mingardi S.r.l., Teufel Automation GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated Windows Market Key Technology Landscape

The technological landscape of the Automated Windows Market is dominated by the continuous evolution of actuator design, sensor intelligence, and wireless communication protocols. Actuators, the core mechanical components responsible for movement, are transitioning towards quieter, higher torque, and more energy-efficient brushless DC motors. Innovations in chain and linear actuators are focusing on minimal visual intrusion, allowing them to be fully concealed within the window frame profile, meeting architectural demands for sleek, minimalistic designs. Furthermore, redundancy and failure-safe mechanisms are crucial, especially for large, heavy-duty commercial windows and smoke ventilation systems where reliability is paramount. The shift toward low-power consumption actuators facilitates the use of battery backup systems and future solar integration.

Sensor technology is evolving rapidly, moving beyond basic contact sensors and switches to sophisticated environmental monitoring arrays. Advanced systems now incorporate hyper-local weather sensors (detecting micro-rain patterns and wind speed variations) and internal air quality sensors (measuring CO2, VOCs, and humidity). The fusion of data from these diverse sensors, often managed by edge computing units embedded in the window frame, allows for highly granular control. The integration of LIDAR and ultrasonic sensors for obstacle detection is also critical, ensuring that the automated windows operate safely and prevent damage or injury when closing. Sensor miniaturization and increased sensitivity are key trends driving performance improvement.

The most significant technological driver is the adoption of IoT and secure wireless communication standards. Modern automated windows utilize protocols like Z-Wave, Zigbee, and increasingly, Wi-Fi HaLow and cellular IoT (NB-IoT/LTE-M) for reliable, long-range connectivity within a building. This connectivity allows for over-the-air firmware updates (OTA), remote diagnostics, and seamless interaction with central smart hubs and cloud-based analytics platforms. The emphasis is currently on achieving standardized protocols (like Matter) to eliminate compatibility issues between different manufacturers' hardware and software, paving the way for ubiquitous integration into holistic Building Automation Systems (BAS) and simplifying the installer and user experience significantly.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and adoption patterns within the Automated Windows Market, influenced by climate, construction practices, and regulatory environments.

- North America (United States, Canada, Mexico): Dominates the high-value commercial segment. Growth is driven by mandatory energy efficiency codes, a mature smart home ecosystem, and high consumer spending power allocated to luxury and convenience features. The market is characterized by robust demand for durable, heavy-duty systems capable of handling extreme weather variability, often integrating advanced hurricane-rated window technologies with automation features. Retrofitting large existing commercial building stock presents a significant, lucrative segment.

- Europe (Germany, UK, France, Scandinavia): The technological leader, particularly due to stringent European Union regulations like the EPBD and national initiatives promoting passive house construction and smoke extraction systems. Germany and the Scandinavian countries are key markets due to their high focus on sustainability and utilizing natural ventilation (via automated openings) to reduce reliance on mechanical cooling systems. The market favors highly energy-efficient and aesthetically integrated solutions, often utilizing specialized automation for large glass facades.

- Asia Pacific (APAC) (China, Japan, India, South Korea): Fastest-growing region due to explosive urbanization and large-scale government investment in smart city projects. While cost sensitivity remains a factor in developing nations like India, the high-rise construction boom in China and sophisticated building standards in Japan and South Korea drive significant demand. Automated windows are crucial here for managing intense solar heat gain and improving indoor air quality in highly polluted urban environments.

- Latin America (Brazil, Argentina): Characterized by moderate growth, primarily centered in metropolitan areas and high-end residential construction. Demand is driven by security concerns, leading to the adoption of automated locking mechanisms, and the need for localized climate control solutions in regions experiencing high humidity and varied temperatures. Market penetration is steadily increasing as the middle class expands and adopts smart technology.

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa): Growth is focused on prestigious mega-projects, luxury hotels, and high-tech corporate campuses in the Gulf Cooperation Council (GCC) nations. Automated windows are vital for managing extreme desert temperatures and optimizing daylighting while minimizing heat load, thus significantly reducing massive cooling energy demands. Demand is driven by projects seeking global green certifications and those prioritizing sophisticated security systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Windows Market.- Velux A/S

- Schüco International KG

- Kawneer Company (Arconic)

- Somfy Group

- D+H Mechatronic AG

- GEZE GmbH

- Pella Corporation

- Andersen Corporation

- Torx Motion

- SE Controls Ltd.

- Siegenia Group

- Giesse Group

- Assa Abloy

- FAKRO

- WindowMaster

- Aumuller Aumatic GmbH

- Tormax (Landert Group)

- Kollmorgen

- Mingardi S.r.l.

- Teufel Automation GmbH

Frequently Asked Questions

Analyze common user questions about the Automated Windows market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary energy efficiency benefits of installing automated windows?

Automated windows significantly boost energy efficiency by integrating with building sensors to precisely manage natural ventilation, solar gain, and daylighting. They automatically open to expel stale, warm air and close to prevent heat loss or excessive solar heat gain, thereby minimizing reliance on expensive mechanical heating, ventilation, and air conditioning (HVAC) systems and lowering overall utility consumption.

How reliable are automated window systems during power outages or extreme weather?

Modern automated window systems are highly reliable, typically featuring built-in battery backup systems to ensure operation during power failures, particularly essential for critical applications like smoke ventilation. Furthermore, they utilize sophisticated weather sensors to automatically close and seal during rain or high winds, protecting the structure's interior and ensuring system integrity.

Can automated windows be integrated with existing smart home ecosystems?

Yes, seamless integration is a core market trend. Most major automated window solutions support standard wireless protocols (like Zigbee or Z-Wave) and are compatible with leading smart home platforms such as Google Home, Amazon Alexa, and Apple HomeKit, allowing users to control and schedule operations via voice commands or dedicated mobile applications.

What is the typical lifespan and required maintenance for automated window actuators?

The typical lifespan of a high-quality automated window actuator is generally 10 to 15 years under normal operating conditions. Maintenance is minimal but crucial, often involving periodic cleaning, lubrication of mechanical parts, and occasional software updates. Advanced systems offer predictive maintenance features, alerting users or facility managers when diagnostics indicate component wear or misalignment.

Are automated windows suitable for retrofitting into older buildings?

Yes, the market offers specialized retrofit solutions, including modular automation kits designed for installation into existing window frames (especially hinged and skylight types). While retrofitting can be more complex than new installations, particularly concerning wiring and structural compatibility, wireless control systems have significantly simplified the process for modernization projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager