Automatic Blaster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432717 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automatic Blaster Market Size

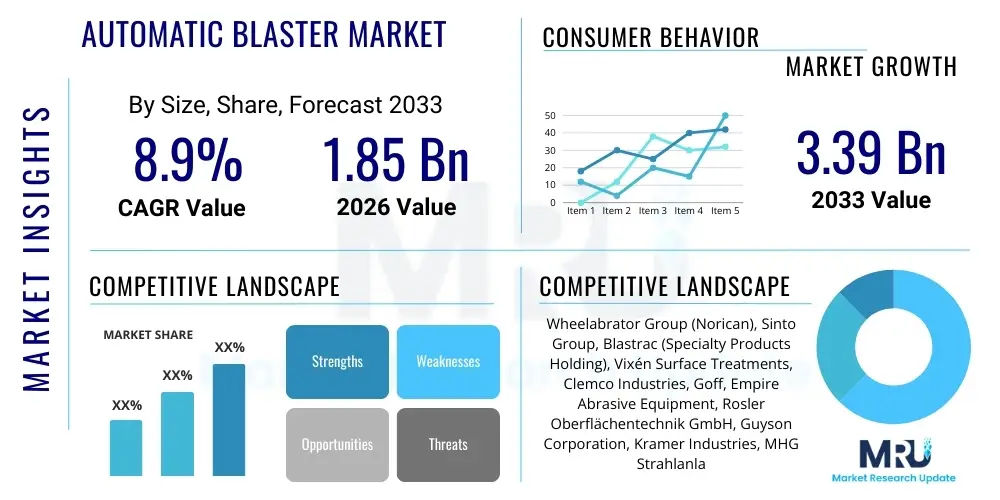

The Automatic Blaster Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.39 Billion by the end of the forecast period in 2033.

Automatic Blaster Market introduction

The Automatic Blaster Market encompasses the advanced technology systems utilized for automated surface preparation, cleaning, finishing, and component treatment across various heavy industries. These systems, which include robotic blast chambers, automated wheel blast equipment, and pressure-fed air blast cabinets, are designed to significantly enhance operational efficiency, ensure consistent quality control, and improve worker safety compared to manual blasting methods. The primary function of automatic blasters is to precisely propel abrasive media (such as sand, grit, shot, or specialized beads) onto a workpiece surface to achieve specific texture, clean contaminants, or provide necessary stress relief (like shot peening). Adoption is fundamentally driven by the stringent quality requirements in high-value manufacturing sectors and the increasing global focus on workplace environment regulations that favor enclosed, automated processes.

Major applications of automatic blasters are widespread and critical to the integrity of manufactured goods, spanning sectors such as automotive manufacturing for component finishing, aerospace for fatigue life enhancement (peening), infrastructure for rust and coating removal, and metal fabrication for weld preparation. These systems offer significant advantages, including high throughput capabilities, reduced labor costs, and superior repeatability, which are paramount in serial production environments. Furthermore, modern automatic blasters often incorporate advanced features like dust collection systems, media reclamation, and integrated monitoring sensors, contributing to a lower environmental footprint and optimized material usage.

The core driving factors propelling the growth of this market include the global trend toward industrial automation (Industry 4.0), escalating demand for high-performance surface finishes in critical components (e.g., turbine blades, orthopedic implants), and the tightening of health and safety standards which make enclosed, automated blasting systems mandatory in many jurisdictions. The continuous innovation in abrasive media types and nozzle technology further allows automatic blasters to address complex surface geometry and specific material handling requirements, broadening their applicability from traditional steel cleaning to sensitive composite and alloy treatments.

Automatic Blaster Market Executive Summary

The Automatic Blaster Market is experiencing robust expansion, characterized by a significant shift towards fully integrated, smart blasting solutions that leverage sensor technology and predictive maintenance capabilities. Key business trends indicate intensified merger and acquisition activities among equipment manufacturers aiming to consolidate technological expertise, particularly in robotics and software integration for complex process control. The market’s competitive landscape is defined by the necessity for customization, as end-users require tailor-made solutions for specific component sizes, material types, and desired surface roughness parameters. Investment in R&D is focused on developing environmentally friendly blasting media alternatives and closed-loop systems that minimize waste generation, aligning with global sustainability initiatives and providing a strong competitive edge to early adopters.

Regionally, the market dynamics are highly influenced by industrialization rates and infrastructure spending. Asia Pacific (APAC) leads in market size and growth, fueled by massive expansion in automotive production, heavy manufacturing, and rapidly developing construction sectors in countries like China, India, and South Korea. North America and Europe, while mature markets, emphasize technological upgrades, replacing older machinery with sophisticated, energy-efficient robotic systems compliant with strict occupational safety regulations. The adoption in emerging markets is primarily driven by the need to scale up production capacity while meeting international quality standards, pushing demand for cost-effective yet reliable automatic solutions.

Segment trends reveal that the robotic blasting segment is outpacing traditional mechanical blasting systems due to its unparalleled flexibility and precision in handling complex geometries characteristic of aerospace and high-end energy components. Based on end-use, the automotive segment remains the largest consumer, utilizing blasters for engine parts, chassis preparation, and coating adhesion enhancement. Furthermore, there is a pronounced growth in demand for specialized automatic blasters in the medical device manufacturing industry, where stringent surface integrity and biocompatibility requirements necessitate highly controlled and repeatable blasting processes, often involving non-contaminating abrasive media like glass beads or specialized plastic shots. The move toward automation is universally recognized across all segments as the primary method to mitigate human error and ensure process stability.

AI Impact Analysis on Automatic Blaster Market

User queries regarding AI's impact on the Automatic Blaster Market center heavily on how artificial intelligence can move these systems beyond simple automation toward true cognitive optimization. Common questions revolve around the use of machine learning for process parameter self-adjustment, ensuring consistent surface finish regardless of material variations or equipment wear. Users are highly interested in predictive maintenance facilitated by AI, aiming to eliminate unplanned downtime which is costly in high-throughput manufacturing environments. Furthermore, there is significant inquiry into how AI-driven vision systems can improve quality inspection by autonomously recognizing defects, foreign materials, or non-uniform blasting patterns in real-time, thereby reducing the reliance on post-blasting manual quality checks and guaranteeing zero-defect output. The underlying expectation is that AI integration will transform automatic blasting from a defined mechanical process into a dynamically adaptive, self-optimizing system capable of achieving unprecedented levels of precision and efficiency.

The primary concern among industry professionals often relates to the complexity and cost of integrating sophisticated AI algorithms and sensor arrays into existing blaster infrastructure, particularly for small and medium enterprises (SMEs). Calibration and training of AI models using highly variable industrial data pose significant challenges, requiring specialized expertise that is often scarce. However, the perceived long-term benefits—namely, maximizing media utilization efficiency, minimizing energy consumption by optimizing blast cycles, and extending the lifespan of critical components (like nozzles and turbine wheels) through predictive failure analysis—strongly outweigh these initial implementation hurdles. AI is seen as crucial for scaling customized blasting operations, where batch sizes are small but quality requirements are exceptionally high, requiring rapid reconfiguration and validation.

The current phase of AI adoption focuses on integrating advanced algorithms for pattern recognition and anomaly detection within the blasting chamber. Future advancements will likely involve reinforcement learning models that can iteratively refine the blasting parameters (pressure, media flow rate, angle of impact, dwell time) based on continuous feedback loops from integrated sensors (acoustic, visual, thermal, and force sensors). This development is critical for specialized applications like aerospace component shot peening, where minute variations in surface compression can dramatically affect component fatigue life. AI will ensure that automatic blasters deliver functional performance improvements rather than merely aesthetic surface modification, solidifying the transition to smart factory environments characterized by autonomous and self-correcting machinery.

- AI-driven optimization of blasting parameters (pressure, speed, media flow) for real-time consistency.

- Predictive maintenance analytics to forecast component failure and schedule proactive repairs, minimizing operational downtime.

- Integration of machine vision and deep learning for automated, high-speed surface quality inspection and defect classification.

- Enhanced process repeatability and traceability by logging and analyzing every blasting cycle data point.

- Optimization of energy consumption and abrasive media usage through smart resource allocation algorithms.

- Autonomous calibration and changeover management for varying material types and part geometries.

DRO & Impact Forces Of Automatic Blaster Market

The Automatic Blaster Market is significantly propelled by several robust drivers, primarily the undeniable imperative for industrial automation across global manufacturing sectors striving for Industry 4.0 standards. The need to reduce reliance on manual labor, which is often hazardous in blasting environments, alongside the consistent demand for high-quality, repeatable surface treatments in high-value industries like aerospace and medical devices, provides constant momentum. Furthermore, increasingly stringent environmental and occupational safety regulations globally necessitate the use of closed-loop, automated blasting systems that minimize dust exposure and manage spent media effectively. These factors combine to create a compelling financial justification for capital investment in automated machinery, particularly as labor costs continue to rise across developed economies.

However, the market faces significant restraints, principally the high initial capital investment required for purchasing and installing sophisticated robotic and automatic blasting equipment. This high entry cost often creates a barrier for smaller manufacturers or those operating in developing economies with limited access to capital. Additionally, the complexity of maintaining and programming these highly technical systems demands a workforce possessing specialized skills in robotics, automation control, and material science, leading to a recognized skills gap in many regions. Downtime associated with complex troubleshooting, coupled with the reliance on proprietary software and components from key vendors, also restricts immediate adoption flexibility.

Opportunities for expansion are abundant, particularly in integrating advanced sensor technologies and Internet of Things (IoT) capabilities for remote monitoring and diagnostics, which enhances service offerings and operational transparency. A major opportunity lies in the rapid expansion of niche applications, such as the use of automatic micro-blasting for semiconductor manufacturing or the surface preparation of additively manufactured (3D printed) components, where extreme precision is non-negotiable. The impact forces driving market change include disruptive innovations in abrasive media, such as high-performance ceramic or biodegradable options, which address environmental concerns, alongside the pervasive influence of globalization demanding universally high quality standards, compelling manufacturers worldwide to upgrade their surface finishing processes to automated systems.

Segmentation Analysis

The Automatic Blaster Market is meticulously segmented based on several critical parameters, including the type of system technology employed, the media utilized, the operational mode (air vs. wheel blast), and the specific end-use industry being served. This detailed segmentation allows market players to accurately target their product development and marketing strategies towards sectors with the highest growth potential and specific technical requirements. The systems are fundamentally categorized by their mechanism of media propulsion—either utilizing compressed air (air blasting) for precision control or centrifugal force (wheel blasting) for high-volume, high-speed operations. This technological distinction is crucial as it determines the suitability of the equipment for different component sizes and required surface finish specifications.

Further granularity in segmentation involves classifying the market based on the degree of automation, ranging from semi-automatic systems requiring operator loading to fully robotic, closed-loop cells integrated into assembly lines. The choice of abrasive media forms another vital segment, including traditional steel shot and grit, specialized glass beads, aluminum oxide, and emerging non-abrasive options like dry ice or plastic beads, each serving distinct functional purposes from heavy rust removal to delicate peening for fatigue resistance. Understanding these media preferences is key, as they directly influence equipment design, especially material recovery and dust collection systems, which are essential compliance features.

The largest segments driving revenue currently are the heavy manufacturing and automotive sectors due to their massive scale of operations requiring continuous, efficient surface treatment of parts. However, the fastest growth is observed in the aerospace, medical, and electronics segments, which mandate extremely tight tolerances and flawless component integrity, favoring highly sophisticated, computer-controlled robotic blasting systems. This dynamic suggests a market shift toward precision and customization, moving away from large, general-purpose machinery toward specialized, high-tech automated cells capable of intricate work.

- Technology Type:

- Air Blasting Systems (Suction Feed, Pressure Feed)

- Wheel Blasting Systems (Tumblast, Rotary Table, Spinner Hanger)

- Robotic Blasting Cells

- Micro-Blasting Equipment

- Operational Mode:

- Fully Automatic (Integrated and PLC Controlled)

- Semi-Automatic (Load/Unload Required)

- Abrasive Media Used:

- Metallic Media (Steel Shot, Steel Grit)

- Mineral/Natural Media (Sand, Garnet, Aluminum Oxide)

- Non-Metallic Media (Glass Beads, Plastic Media, Walnut Shells)

- Specialized Media (Ceramic Beads, Dry Ice)

- End-Use Industry:

- Automotive

- Aerospace and Defense

- Heavy Manufacturing and Foundries

- Construction and Infrastructure

- Marine and Shipbuilding

- Medical Devices and Implants

- Energy (Oil & Gas, Wind Turbines)

- Application:

- Surface Preparation (Coating/Painting Prep)

- Shot Peening (Fatigue Life Improvement)

- Descaling and Rust Removal

- Deflashing and Deburring

- Aesthetic Finishing

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Automatic Blaster Market

The value chain for the Automatic Blaster Market begins with upstream activities involving the sourcing and processing of raw materials, primarily steel (for machine fabrication and wheel blast components), specialized alloys (for high-wear parts like turbines and nozzles), and the production of abrasive media (steel shot, ceramics, glass beads). Upstream suppliers are characterized by the need for high-quality, durable materials that can withstand extreme wear and tear inherent in the blasting process, making material consistency a critical determinant of system longevity and performance. Innovation at this stage, particularly in developing wear-resistant materials and specialized media formulations, directly influences the efficiency and operating cost of the downstream blasting equipment, establishing a foundational requirement for market competitiveness.

The core of the value chain involves the design, manufacturing, and assembly of the automatic blasting systems by Original Equipment Manufacturers (OEMs). This stage includes significant R&D investment focused on automation technologies, integrating robotics, developing sophisticated dust extraction and media recovery systems, and designing proprietary software for process control and diagnostics. The distribution channel is bifurcated: large, complex, custom-built robotic cells are typically sold through direct sales and engineering teams due to the requirement for extensive consultation and site integration. Smaller, standardized automatic cabinets or semi-automatic wheel blasters often utilize a network of specialized industrial distributors or authorized third-party system integrators who can offer localized installation, maintenance, and spare parts support, facilitating broader market penetration.

Downstream activities center on installation, commissioning, after-sales service, and the supply of consumable spare parts and abrasive media. The operational success of automatic blasters is highly dependent on continuous maintenance and timely access to replacement parts, such as blast wheels, liners, hoses, and filters. Therefore, the long-term profitability for OEMs is increasingly tied to lucrative service contracts and media supply agreements. End-users, who represent the final link, rely on these systems to meet their production throughput, quality control, and safety compliance goals. The feedback loop from end-users regarding equipment wear rates, media consumption, and software functionality is vital for OEMs to drive continuous product improvement and retain market share, particularly in highly regulated industries like aerospace.

Automatic Blaster Market Potential Customers

Potential customers for automatic blasting systems represent a diverse group of heavy industries and precision manufacturers whose production processes necessitate consistent, high-quality surface treatment for functional integrity or preparatory steps before coating or assembly. The primary buyers are large-scale automotive component suppliers (Tier 1 and OEMs) and foundry operations that require rapid, high-volume cleaning and surface hardening of engine blocks, transmissions, and structural components. These customers prioritize high throughput, minimal operational cost per part, and robust reliability to support continuous, assembly-line manufacturing schedules. Their purchasing decisions are heavily influenced by the equipment's integration capability within existing automated manufacturing cells and its ability to consistently meet stringent industry standards like ISO and specific manufacturer specifications for surface roughness.

A rapidly growing segment of potential customers includes specialized manufacturers in the aerospace and energy sectors, focusing on high-stress components such as turbine blades, landing gear, and oilfield equipment. For these buyers, the application often involves critical processes like controlled shot peening to enhance fatigue life and reduce susceptibility to stress corrosion cracking. These customers demand the highest level of precision, typically requiring advanced robotic blasters with multiple axes of motion and sophisticated process monitoring software for complete traceability and validation of every blast cycle. The financial justification for these purchases is centered not on labor reduction, but on the profound implications of surface integrity for component safety and lifespan in extreme operating environments.

Furthermore, infrastructure and construction companies that handle significant volumes of fabricated steel and structural components constitute another major customer base, particularly those involved in bridge construction, railway maintenance, and pipeline coatings. These customers typically favor large-scale, powerful wheel blast systems capable of rapidly descaling and preparing massive structural elements for protective coatings, often operating semi-continuously. Additionally, a niche but high-value customer group includes medical device manufacturers specializing in orthopedic and dental implants, which utilize micro-blasting techniques to create specific surface textures for enhanced osseointegration or aesthetic appeal. Their requirement is absolute process purity and exceptional control over extremely delicate surface modifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.39 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wheelabrator Group (Norican), Sinto Group, Blastrac (Specialty Products Holding), Vixén Surface Treatments, Clemco Industries, Goff, Empire Abrasive Equipment, Rosler Oberflächentechnik GmbH, Guyson Corporation, Kramer Industries, MHG Strahlanlagen GmbH, Airblast B.V., Surface Preparation Technology (SPT), Pangborn Group, SBM Surface Finishing Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Blaster Market Key Technology Landscape

The Automatic Blaster Market technology landscape is rapidly evolving, driven by the need for increased precision, reduced energy consumption, and seamless integration into smart factory ecosystems. Central to this evolution is the deployment of multi-axis robotics and articulated arms specifically designed for handling complex component geometries, ensuring consistent stand-off distance and angle of attack for the blast stream. These robotic systems are powered by sophisticated Programmable Logic Controllers (PLCs) and HMI interfaces that allow for recipe management, defining parameters based on material, component weight, and desired surface finish, thereby achieving unparalleled process repeatability compared to legacy automated equipment. Furthermore, advancements in blast wheel technology, including specialized materials and impeller designs, are maximizing abrasive velocity and distribution efficiency, which translates directly into higher production rates and lower operational expenditure.

Another crucial technological development involves the integration of advanced sensor technology, fundamentally transforming automatic blasters into data-generating assets. High-definition cameras, laser profilers, acoustic sensors, and pressure transducers are used to monitor the blasting process in real-time, detecting variations in media flow, nozzle wear, or surface uniformity. This real-time feedback loop is essential for maintaining process control, especially in critical applications like aerospace shot peening where compliance requires validating the intensity and coverage of the blast. The incorporation of IoT connectivity facilitates remote diagnostics, performance tracking, and over-the-air software updates, enabling preventative maintenance strategies based on usage data rather than fixed schedules, significantly boosting overall equipment effectiveness (OEE).

Furthermore, significant technological attention is directed towards auxiliary systems, particularly media recovery and dust collection. High-efficiency cyclonic separators and magnetic media reclaimers ensure the purity of the abrasive media, which is critical for preventing surface contamination and maintaining process efficacy. The adoption of advanced filtration technologies, such as cartridge filter systems with pulsed cleaning, ensures regulatory compliance regarding airborne particulate matter and enhances the sustainability profile of the equipment. These systems are moving towards closed-loop environments that minimize media loss and maximize reuse, making the overall blasting process cleaner, safer, and substantially more cost-efficient over the long term, cementing the market’s technological trajectory towards precision-driven, data-centric automation.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the Automatic Blaster Market both in terms of production and consumption, driven primarily by the colossal manufacturing bases in China, India, Japan, and South Korea. Rapid urbanization and infrastructure development, particularly the expansion of heavy industries, foundries, and automotive manufacturing, create sustained, high-volume demand for reliable wheel blast systems for initial surface preparation. The region is witnessing a swift transition from semi-automatic to fully robotic systems, particularly in precision electronics and high-end automotive component production, fueled by favorable government policies promoting industrial automation and smart manufacturing initiatives (e.g., Made in China 2025). The regional market is characterized by intense price competition and growing localization of advanced equipment manufacturing to reduce import costs and lead times.

- North America: North America represents a mature, high-value market focused primarily on technological upgrades and specialized, high-precision applications. Demand is exceptionally strong within the aerospace and defense sectors, where the need for advanced shot peening technology in critical components (e.g., airframe parts, turbine blades) drives the adoption of sophisticated, robotic blasting cells and micro-blasting equipment. The stringent regulatory environment concerning worker safety and environmental protection mandates the use of enclosed, highly controlled automatic systems. Market growth is sustained by replacement cycles of older equipment and continuous investment in digitalization, with manufacturers seeking systems fully integrated with MES and ERP platforms for seamless data management and operational transparency, justifying the higher upfront cost for superior process control.

- Europe: The European market is defined by its strong emphasis on quality, energy efficiency, and environmental sustainability, particularly driven by directives like REACH and stricter emissions standards. Germany, Italy, and France are key consumers, predominantly in the luxury automotive, industrial machinery, and precision component manufacturing segments. European demand leans towards modular, flexible automatic systems that can be rapidly reconfigured for varied batch sizes (common in specialized manufacturing) and those utilizing sustainable, non-metallic abrasive media. OEMs here focus heavily on R&D to deliver systems that minimize noise pollution and media waste, often integrating state-of-the-art filtration and dust handling capabilities. The presence of numerous global blast equipment leaders also fosters continuous innovation and strong service infrastructure across the continent.

- Latin America (LATAM): The LATAM region, led by Brazil and Mexico, demonstrates growth driven by increasing foreign direct investment in manufacturing, particularly in automotive assembly and heavy machinery production. While cost sensitivity is higher here, the need to comply with export quality standards imposed by North American and European partners necessitates investment in reliable automatic blasting equipment, particularly for surface preparation prior to coating. The market typically favors robust, easy-to-maintain wheel blast and pressure-fed systems suitable for high-volume basic cleaning operations, with localized service and affordable spare parts being crucial competitive factors for market penetration.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, heavily influenced by large-scale oil and gas infrastructure projects, shipbuilding, and industrial construction. The primary applications involve the preparation of pipelines, structural steel, and marine components for highly protective anti-corrosion coatings required in harsh environments. Demand is steady for large, automated air blasting and customized chamber systems capable of handling massive components. Investment is often cyclical, directly linked to major government infrastructure spending and fluctuations in the global energy commodity markets, prioritizing durability and resistance to challenging operational conditions (e.g., heat, dust).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Blaster Market.- Wheelabrator Group (Norican Technology Group)

- Sinto Group (Sintokogio, Ltd.)

- Blastrac (Specialty Products Holding, LLC)

- Vixen Surface Treatments

- Clemco Industries Corp.

- Goff, Inc.

- Empire Abrasive Equipment Corp.

- Rosler Oberflächentechnik GmbH

- Guyson Corporation of U.S.A.

- Kramer Industries, Inc.

- MHG Strahlanlagen GmbH

- Airblast B.V.

- Surface Preparation Technology (SPT)

- Pangborn Group

- SBM Surface Finishing Technology Co., Ltd.

- AGSCO Corporation

- Blastline International

- Schlick Technology

- Kranzle GmbH

- Finch Manufacturing

Frequently Asked Questions

Analyze common user questions about the Automatic Blaster market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high adoption rate of robotic automatic blasters?

The primary driver is the stringent requirement for enhanced precision and repeatability, particularly in aerospace shot peening and complex automotive part finishing, where traditional methods cannot guarantee consistent surface integrity and required tolerances. Robotic systems eliminate human error and provide full process control and traceability.

How does AI contribute to optimizing the performance of modern automatic blasting equipment?

AI significantly optimizes performance by utilizing machine learning algorithms for predictive maintenance, anticipating component wear and minimizing unplanned downtime. Furthermore, AI-driven vision systems enable real-time quality control by automatically adjusting parameters to maintain a precise and uniform surface finish across varied materials.

Which end-use industry holds the largest market share for automatic blasting equipment?

The automotive manufacturing industry currently holds the largest market share, driven by high-volume demands for surface preparation, cleaning, and stress relief (peening) of engine components, transmission parts, and structural chassis elements to meet durability and aesthetic standards efficiently.

What are the key differences between air blasting and wheel blasting systems in the automatic market?

Air blasting systems use compressed air for highly targeted, precise operations, often favored for delicate or complex geometries and specialized media. Wheel blasting systems use centrifugal force via a rotating wheel to propel media, making them ideal for high-volume, high-speed cleaning of large, sturdy components common in foundries and heavy construction.

What is the biggest restraint impacting the widespread adoption of advanced automatic blasters in emerging markets?

The biggest restraint is the significant initial capital expenditure required for purchasing fully integrated, sophisticated automatic and robotic blasting systems. This high upfront cost, coupled with the complexity of maintenance and the need for specialized technical expertise, limits adoption among smaller enterprises in cost-sensitive emerging regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager