Automatic Bleeding Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432479 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automatic Bleeding Valves Market Size

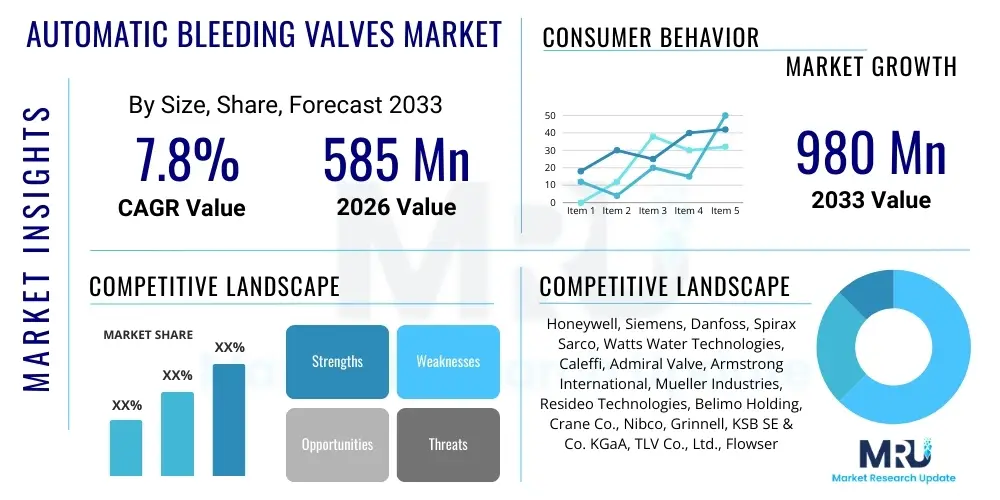

The Automatic Bleeding Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $585 Million in 2026 and is projected to reach $980 Million by the end of the forecast period in 2033.

Automatic Bleeding Valves Market introduction

The Automatic Bleeding Valves Market encompasses specialized components designed to automatically vent trapped air or gases from liquid-filled systems, predominantly utilized in HVAC, plumbing, and industrial fluid transfer circuits. These valves are critical for maintaining system efficiency, preventing corrosion, and mitigating operational noise caused by air pockets, thereby ensuring optimal performance in heating and cooling applications, particularly in hydronic systems. The core product functions by utilizing hydrostatic pressure changes or temperature shifts to release air without manual intervention, significantly reducing maintenance requirements and improving system longevity. Major applications span residential and commercial heating systems, large-scale industrial fluid pipelines, and automotive cooling circuits where reliable air elimination is paramount for safety and efficiency. The primary benefits include energy savings due to enhanced heat transfer efficiency, reduced risk of pump cavitation, and minimized downtime associated with manual bleeding procedures. The market growth is fundamentally driven by the global imperative for energy-efficient building infrastructure, stringent regulatory standards promoting automated climate control solutions, and the increasing complexity of modern hydronic heating and cooling systems that necessitate precise air management.

Automatic Bleeding Valves Market Executive Summary

The Automatic Bleeding Valves Market is characterized by robust growth, propelled by sustained business trends emphasizing automation in fluid control systems and a strong focus on minimizing operational energy consumption across the built environment. Key business trends include the convergence of automatic bleeding technology with smart building management systems (BMS), leading to higher-specification, digitally enabled valves that offer predictive maintenance capabilities and remote diagnostics. Geographically, the market exhibits dynamic regional trends: North America and Europe continue to dominate due to mature infrastructure and high adoption rates of sophisticated HVAC technologies, while the Asia Pacific region is demonstrating the fastest growth trajectory, fueled by rapid urbanization, massive infrastructure investment in commercial and residential construction, and increasing awareness regarding system efficiency in developing economies. Segment trends reveal a significant shift towards stainless steel and high-durability plastic materials, particularly for applications requiring corrosion resistance or high chemical compatibility, while the HVAC application segment remains the foundational driver, constantly demanding valves capable of handling higher pressures and temperatures associated with modern high-efficiency boilers and heat pumps. Furthermore, the industrial sector is increasingly adopting these automated solutions to safeguard high-value process equipment against air-induced failures, reinforcing the market's stability and growth projections across all material and application segments.

AI Impact Analysis on Automatic Bleeding Valves Market

User inquiries regarding AI's influence in the automatic bleeding valves domain frequently center on how machine learning can enhance predictive maintenance, optimize bleeding schedules based on real-time system conditions, and integrate these valves seamlessly into larger smart building ecosystems. Users are concerned about the necessary upfront investment for AI-enabled hardware versus the long-term operational savings, and they seek clarity on the reliability and cybersecurity protocols of these newly digitized components. The collective expectation is that AI will transform automatic bleeding valves from purely mechanical components into smart nodes within the HVAC infrastructure, capable of self-diagnosis, anomaly detection, and highly optimized performance management. This shift is anticipated to move the industry beyond simple temperature and pressure triggers towards algorithms that analyze historical operational data, weather patterns, and occupant load to preemptively manage air accumulation, thereby achieving unprecedented levels of energy efficiency and system uptime, fundamentally redefining the competitive landscape for manufacturers focusing on intelligent fluid control solutions.

- AI-driven Predictive Maintenance: Utilizing sensor data from valves and surrounding systems (e.g., pressure, temperature fluctuations, pump cycles) to predict air accumulation events before they cause operational failures, shifting maintenance from reactive to proactive.

- Optimized System Integration: Machine learning algorithms enhance the integration of automatic bleeding valves within Building Management Systems (BMS) and Energy Management Systems (EMS), allowing for centralized control and optimization of hydronic circuits based on real-time performance indicators.

- Anomaly Detection and Diagnostics: AI processes subtle deviations in valve operation or system sound profiles to identify potential mechanical issues, improving component reliability and reducing manual inspection frequency.

- Smart Bleeding Scheduling: Algorithms determine the optimal time and duration for air bleeding, minimizing water loss and maximizing heat transfer efficiency based on learned operational patterns and external environmental variables.

- Design Optimization: AI tools simulate fluid dynamics and thermal performance under various conditions, assisting manufacturers in designing more efficient and reliable valve geometries and material selections.

- Remote Monitoring and Control: Enables manufacturers to offer value-added services such as remote performance monitoring and firmware updates for digitally enabled valves, ensuring continuous peak performance and compliance with changing efficiency standards.

- Supply Chain Efficiency: AI supports demand forecasting for specialized valve components, streamlining manufacturing processes and inventory management for complex automated valve assemblies.

DRO & Impact Forces Of Automatic Bleeding Valves Market

The market trajectory for automatic bleeding valves is governed by a compelling mix of drivers, restraints, and opportunities that collectively exert significant impact forces on industry expansion and technological adoption. Primary drivers center around the global push for reduced energy consumption in buildings, making the elimination of performance-degrading air pockets essential for high-efficiency hydronic systems. Concurrently, increasing labor costs and the skilled labor shortage in maintenance sectors incentivize the adoption of automated, maintenance-free components, directly driving demand for these valves. However, growth is moderately restrained by the relatively higher initial capital expenditure required for installing automated valves compared to simple manual vent alternatives, particularly in retrofitting older infrastructure where economic justification can be challenging. Furthermore, concerns regarding potential valve leakage failure mechanisms, though rare, necessitate robust material quality and rigorous testing standards. Significant opportunities reside in the rapid expansion of smart building technologies, which favor digitally integrated fluid control mechanisms, and the geographical expansion into large, underserved residential and commercial markets across Asia and Latin America, providing new avenues for volume growth. The combined impact forces are net positive, strongly tilting towards widespread adoption due to the critical role these valves play in system longevity and operational efficiency, making them indispensable components in modern heating, ventilation, and air conditioning systems, thus stabilizing market demand irrespective of minor economic fluctuations.

Segmentation Analysis

The Automatic Bleeding Valves Market is broadly segmented based on the material utilized in valve construction, the specific application area, and the end-use industry that deploys the technology. This segmentation is crucial for understanding specific market dynamics, as material selection directly impacts performance metrics such as pressure rating and corrosion resistance, while application focus dictates volume demand and required operational features. The analysis reveals distinct preferences: high-durability metallic alloys (like brass and stainless steel) dominate industrial and high-temperature HVAC applications, whereas residential and lower-pressure plumbing systems often utilize engineered plastics for cost-effectiveness and ease of installation. Geographic segmentation highlights diverse regulatory environments and construction practices that influence which material and application types gain regional traction, guiding manufacturers in targeted product development and distribution strategy optimization.

- By Material Type:

- Brass/Bronze Automatic Bleeding Valves: Known for robustness, corrosion resistance in standard water systems, and high-temperature tolerance, dominating residential and commercial HVAC.

- Stainless Steel Automatic Bleeding Valves: Preferred for high-purity systems, aggressive chemical environments, or applications requiring exceptional hygiene and superior corrosion protection, common in industrial and specialized commercial settings.

- Plastic Automatic Bleeding Valves: Cost-effective, lightweight, and suitable for low-pressure domestic plumbing and certain solar heating systems where cost and non-metallic properties are advantageous.

- Other Materials (e.g., Nickel-Plated Alloys): Used for niche applications demanding specific material properties or specialized coatings.

- By Application:

- HVAC Systems: The largest segment, encompassing boilers, radiators, hydronic manifolds, heat exchangers, and chilled water loops in commercial and residential buildings.

- Industrial Piping Systems: Used in process cooling, closed-loop fluid transfer systems, and machinery cooling circuits where continuous air removal is critical for process stability.

- Solar Heating Systems: Essential for venting air from collector panels and closed-loop solar circuits to maintain thermal efficiency and prevent cavitation in circulation pumps.

- Automotive Cooling Systems: Specialized smaller valves utilized in internal combustion engine and electric vehicle battery cooling loops.

- Plumbing and Domestic Water Systems: Used in centralized hot water supply systems to prevent air locks and water hammer.

- By End-Use Industry:

- Residential: Driven by new housing construction and retrofitting for energy efficiency in single and multi-family units.

- Commercial: Includes offices, retail centers, hospitals, educational institutions, and data centers—high-density applications requiring robust, long-lasting HVAC performance.

- Industrial: Factories, manufacturing plants, power generation facilities, and specialized processing plants utilizing large, complex fluid circulation systems.

Value Chain Analysis For Automatic Bleeding Valves Market

The value chain for the Automatic Bleeding Valves Market begins with upstream activities focused on the procurement and processing of raw materials, primarily specialized alloys such as brass, bronze, stainless steel, and high-grade engineering plastics, alongside precision manufacturing of internal components like floats, seals, and springs. Upstream supplier selection is pivotal, demanding materials that meet stringent regulatory requirements for potable water safety and high thermal endurance standards, leading to significant reliance on specialized metal foundries and polymer compounders capable of delivering materials with exact metallurgical properties and dimensional accuracy. Efficient upstream logistics are necessary to manage material volatility and ensure a stable supply of consistent quality components, directly impacting the final product's reliability and cost structure. Manufacturers then focus intensely on precision machining, assembly, and rigorous quality control testing, including hydrostatic and operational cycle testing, often automating assembly lines to manage complexity and maintain high volume production standards required by global HVAC OEMs.

Midstream activities involve core manufacturing processes, assembly, and branding, where significant intellectual property is often centered on the valve mechanism design—specifically the float linkage, sealing geometry, and vent aperture size, which determine the valve's sensitivity and maximum operational pressure. Manufacturers invest heavily in certifications (e.g., ISO, CE, UL) to validate product performance and compliance, a prerequisite for entry into many developed regional markets, particularly Europe and North America, necessitating substantial investment in robust R&D and testing facilities. Marketing and sales strategies in this segment are often B2B focused, targeting large original equipment manufacturers (OEMs) of boilers, HVAC systems, and industrial machinery, alongside professional wholesalers and distributors who serve the fragmented professional installer base. This B2B relationship requires detailed technical support and strong collaboration during the design integration phase to ensure the valve complements the performance characteristics of the host system.

Downstream distribution channels are segmented into direct and indirect routes. Direct sales are typically reserved for large, volume-based OEM agreements or specialized industrial projects requiring highly customized valve specifications and technical consultation. Indirect distribution is the dominant route for standard products, involving a multilayered network that includes national and regional HVAC/plumbing wholesalers, independent master distributors, and specialized e-commerce platforms catering to contractors and maintenance professionals. The selection of the distribution channel is critical, as installers and maintenance technicians rely on readily available inventory and expert local support; therefore, a strong network of trusted wholesale partners with deep stock levels is essential for market penetration and timely service delivery. Effective downstream management involves continuous training for distributors on product application and installation best practices, ensuring the end-user benefits from correct valve specification and optimal performance.

Automatic Bleeding Valves Market Potential Customers

The primary consumers of automatic bleeding valves are diverse entities spanning the construction, industrial, and infrastructure maintenance sectors, unified by the necessity of managing air and non-condensable gases within closed-loop fluid systems. The largest customer group includes Heating, Ventilation, and Air Conditioning (HVAC) system Original Equipment Manufacturers (OEMs), who integrate these valves as standard components within their high-efficiency boilers, distribution manifolds, heat pumps, and solar thermal systems, considering the automatic air elimination function non-negotiable for warranty purposes and specified energy performance ratings. Furthermore, commercial and residential builders, along with specialized mechanical contractors, represent a massive segment of potential customers, purchasing valves directly through distribution channels for installation and commissioning during new construction projects or major system upgrades and refurbishments. These professionals prioritize ease of installation, proven longevity, and compliance with local building codes, making brand reputation and quality consistency key purchasing criteria.

A secondary, yet rapidly growing customer segment is the facility management and maintenance sector, encompassing managers responsible for the continuous, efficient operation of large commercial buildings, industrial complexes, hospitals, and educational institutions. For these customers, automatic bleeding valves translate directly into reduced operational costs by maximizing thermal efficiency, minimizing emergency maintenance calls related to air locks, and extending the lifespan of expensive system components like circulation pumps and boiler elements. The total cost of ownership (TCO) becomes the pivotal factor in their purchasing decisions, favoring premium valves with extended warranties and proven durability over cheaper alternatives, emphasizing the recurring demand generated by replacement and maintenance cycles across millions of existing installed systems globally. This segment increasingly seeks smart, IoT-enabled valves that provide remote diagnostic feedback, allowing maintenance teams to anticipate issues before system performance degrades noticeably.

Industrial end-users constitute another vital customer base, including petrochemical facilities, food and beverage processing plants, power generation stations, and semiconductor manufacturing sites, all utilizing complex closed-loop cooling and heating systems critical to their core operations. In these environments, process stability and asset protection against corrosion are paramount; thus, the potential customers demand highly specialized automatic bleeding valves made from stainless steel or exotic alloys capable of withstanding aggressive fluid chemistries, high temperatures, and extreme pressures, often requiring certification for explosive atmospheres (ATEX) or specific sanitary standards. These industrial customers typically purchase directly or through specialized industrial supply houses, demanding comprehensive technical specifications, high traceability, and long-term supply agreements, underscoring the market's differentiation based on application severity and required performance robustness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $585 Million |

| Market Forecast in 2033 | $980 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell, Siemens, Danfoss, Spirax Sarco, Watts Water Technologies, Caleffi, Admiral Valve, Armstrong International, Mueller Industries, Resideo Technologies, Belimo Holding, Crane Co., Nibco, Grinnell, KSB SE & Co. KGaA, TLV Co., Ltd., Flowserve Corporation, Alfa Laval, Emerson Electric Co., Valmet |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Bleeding Valves Market Key Technology Landscape

The technological landscape of the Automatic Bleeding Valves Market is defined by the continuous refinement of mechanical principles, increasing integration of digital components, and advancements in materials science aimed at enhancing reliability and operational lifespan. The core mechanism typically relies on a float-operated lever that responds to the difference in density between liquid and gas; recent innovations focus on optimizing float geometry and lever precision to ensure extremely sensitive and consistent operation across wide temperature and pressure ranges, crucial for high-efficiency condensing boilers and low-temperature hydronic loops. Technological progress is evident in the development of anti-fouling designs, incorporating self-cleaning features or specialized internal coatings that mitigate the buildup of sludge, dirt, or mineral deposits that commonly cause operational failures in traditional valves, thereby extending the valve's service interval and maintaining long-term sealing integrity without manual intervention.

Furthermore, the market is witnessing a major technological pivot towards smart, IoT-enabled automatic bleeding valves, which incorporate miniaturized pressure sensors, temperature probes, and communication modules (e.g., wired protocols or low-power wireless standards). These advanced valves move beyond simple mechanical air release by actively monitoring system conditions, logging operational data, and communicating their status to a centralized Building Management System (BMS). This digital capability supports sophisticated functions such as proactive leakage detection, remote performance calibration, and the integration of AI-powered predictive maintenance algorithms. While high-end commercial and industrial applications are the early adopters, the decreasing cost of sensors and connectivity modules suggests that smart capabilities will become standard features even in residential-grade automatic valves within the next few years, transforming maintenance paradigms and maximizing the overall energy performance of HVAC installations across all scales.

Material innovation represents another critical technological vector, driven by the need for superior resistance to corrosion and compatibility with modern system fluids. The increasing use of propylene glycol and specialized inhibitors in hydronic systems necessitates the use of engineered polymers and specialized stainless steel grades (e.g., 316L) in internal components to prevent chemical degradation and ensure long-term sealing performance, particularly crucial in areas utilizing hard water or recycled fluids. Manufacturers are also exploring advanced manufacturing techniques, such as additive manufacturing (3D printing), for prototyping and production of complex, internal flow paths, which allows for the creation of components with optimized hydraulic performance that are impossible to achieve via traditional casting or machining, paving the way for significantly smaller, yet higher-capacity, valve designs that can be more easily integrated into compact modern HVAC units.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, adoption rates, and technological specifications for automatic bleeding valves across the globe. North America, driven by stringent energy efficiency standards and a high prevalence of complex commercial HVAC systems, represents a mature and high-value market segment. The region's focus on system longevity and minimizing labor costs strongly favors premium, robust automatic valves, often integrating advanced materials and smart features compatible with standard American building codes and industrial specifications. Europe exhibits similar maturity, with particularly high adoption in hydronic heating systems driven by ambitious decarbonization targets and regulations such as the EU Energy Performance of Buildings Directive (EPBD), leading to strong demand for highly efficient valves optimized for district heating networks and modern condensing boilers.

The Asia Pacific (APAC) region is currently the fastest-growing market, primarily fueled by explosive growth in urban infrastructure development, commercial construction, and rising disposable incomes leading to increased penetration of centralized air conditioning and heating systems in countries like China, India, and Southeast Asia. While cost sensitivity remains a factor in certain segments, the increasing adoption of global efficiency standards and foreign investment in high-tech manufacturing facilities is rapidly pushing demand towards higher-quality, durable automatic valves. This region presents significant opportunities for volume expansion, requiring tailored distribution strategies to manage fragmented local markets and varying regulatory frameworks. Manufacturers often prioritize establishing local assembly or partnership models to effectively service this high-growth regional demand while managing supply chain logistics.

Latin America and the Middle East & Africa (MEA) represent emerging markets characterized by significant investments in large-scale commercial real estate, tourism infrastructure, and industrial projects, particularly in the Gulf Cooperation Council (GCC) states. Demand in the MEA region is heavily influenced by cooling applications and large centralized chilling plants, necessitating valves designed for extreme temperature resilience and high salinity water conditions. Latin America sees gradual growth driven by urbanization and expanding residential construction, where regulatory modernization is slowly beginning to mandate higher efficiency levels, creating baseline demand for reliable, cost-effective automatic air vent solutions. Strategic emphasis in these emerging regions is placed on robust, temperature-resistant products and the development of reliable local sales support structures.

- North America: High adoption in commercial HVAC, driven by energy efficiency codes (e.g., ASHRAE standards); strong demand for smart, connected valve technology for building automation.

- Europe: Market maturity, high penetration in residential hydronic heating and district energy networks; regulatory pressure for extremely efficient components (e.g., ErP directive compliance).

- Asia Pacific (APAC): Highest growth rate; driven by rapid commercial and residential construction, industrialization, and increasing adoption of international energy standards, particularly in China and India.

- Middle East & Africa (MEA): Strong demand concentrated in large cooling plants and infrastructure projects; preference for high-temperature and corrosion-resistant valves due to climatic conditions.

- Latin America: Gradually increasing demand in residential and commercial sectors; market growth tied to infrastructure spending and modernization of plumbing regulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Bleeding Valves Market.- Honeywell International Inc.

- Siemens AG

- Danfoss A/S

- Spirax Sarco Engineering plc

- Watts Water Technologies, Inc.

- Caleffi S.p.A.

- Admiral Valve, LLC

- Armstrong International, Inc.

- Mueller Industries, Inc.

- Resideo Technologies, Inc.

- Belimo Holding AG

- Crane Co.

- Nibco Inc.

- Grinnell Corporation

- KSB SE & Co. KGaA

- TLV Co., Ltd.

- Flowserve Corporation

- Alfa Laval AB

- Emerson Electric Co.

- Valmet Corporation

Frequently Asked Questions

Analyze common user questions about the Automatic Bleeding Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and benefit of an automatic bleeding valve in an HVAC system?

The primary function of an automatic bleeding valve is to continuously and automatically remove trapped air and non-condensable gases from closed-loop fluid systems, such as hydronic heating or cooling circuits, without requiring manual intervention. The main benefit is sustaining optimal system performance by preventing air locks, reducing noise, minimizing internal corrosion, and maximizing thermal transfer efficiency, which ultimately lowers energy consumption and extends the lifespan of pumps and heat exchangers.

How do automatic bleeding valves differ from manual air vents, and which applications benefit most from automation?

Automatic bleeding valves operate autonomously using a float mechanism or hydrostatic principle to open and close based on the presence of air, whereas manual air vents require human intervention to open and close the valve periodically. Automation is most beneficial in inaccessible locations, large commercial or industrial systems where continuous air removal is critical, and high-efficiency systems where minor air presence significantly impacts energy performance, reducing labor costs associated with maintenance.

What materials are commonly used in automatic bleeding valves, and how does material selection impact performance?

Common materials include brass/bronze, stainless steel, and engineered plastics. Material selection is critical for determining the valve's resistance to corrosion, pressure, and temperature. Stainless steel is preferred for aggressive industrial fluids or high-purity applications, while brass is standard for conventional residential and commercial HVAC due to its robustness and cost efficiency, ensuring compatibility with system fluids and operating conditions.

Which geographical region exhibits the fastest growth rate for the Automatic Bleeding Valves Market, and why?

The Asia Pacific (APAC) region is projected to demonstrate the fastest growth rate. This rapid expansion is attributed to massive ongoing urbanization, significant investment in large-scale infrastructure and commercial construction projects, and increasing regulatory pressure across key economies like China and India to adopt modern, energy-efficient HVAC and fluid management technologies in both new installations and system upgrades.

How is smart technology, such as IoT and AI, influencing the development of the next generation of bleeding valves?

IoT and AI are transforming bleeding valves into smart components by integrating sensors for pressure and temperature monitoring and communication modules. This enables real-time remote diagnostics, predictive maintenance scheduling, and optimized operational control via Building Management Systems (BMS), moving the technology beyond simple mechanical air release towards proactive, data-driven fluid management solutions that maximize system uptime and energy savings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager