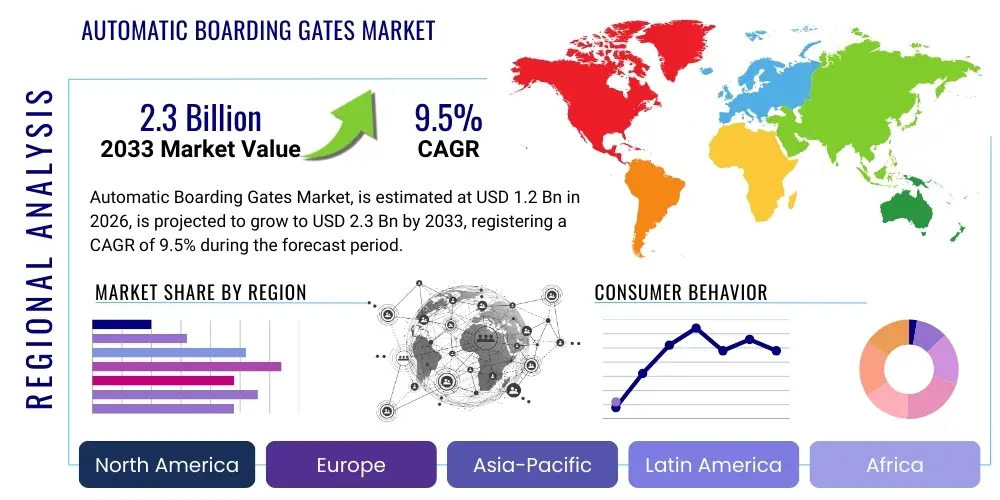

Automatic Boarding Gates Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434506 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automatic Boarding Gates Market Size

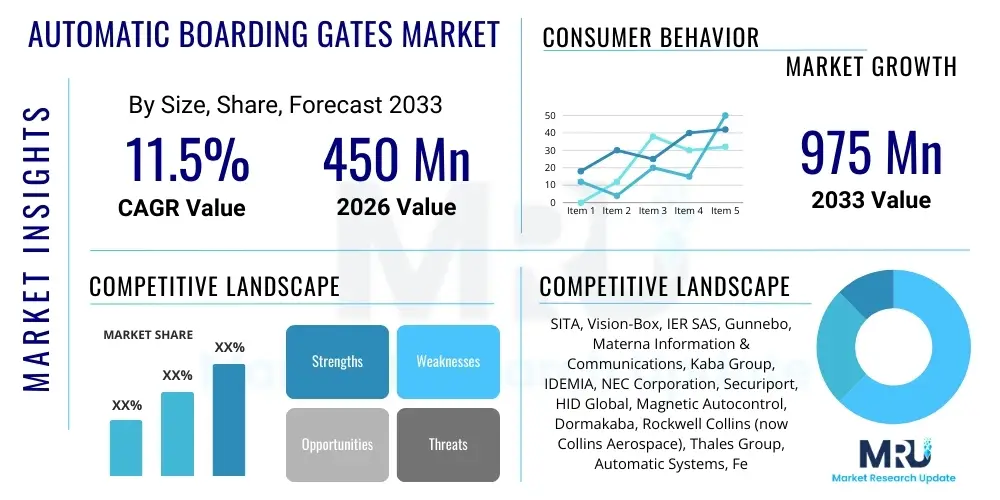

The Automatic Boarding Gates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $975 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for streamlined, secure, and efficient passenger processing solutions in major international airports globally, where managing high-volume traffic while adhering to stringent security protocols is paramount.

Automatic Boarding Gates Market introduction

The Automatic Boarding Gates Market encompasses the deployment of automated systems designed to verify passenger identity and eligibility for flight access, replacing traditional manual checks. These sophisticated systems integrate various technologies, including biometric scanners (primarily facial recognition and fingerprint), document readers (passport and boarding pass), and sophisticated software platforms linked to the airline's Departure Control System (DCS) and Airport Collaborative Decision Making (A-CDM) systems. The primary product offering includes hardware infrastructure, sensors, proprietary software, and integration services necessary for seamless operation within the airport ecosystem. The evolution of these gates is centered on reducing human error, enhancing security measures, and drastically cutting down passenger queuing times during peak operational periods.

Major applications of automatic boarding gates are concentrated in international air travel hubs, where they are utilized at various checkpoints, including pre-security, border control, and most critically, at the gate for final boarding verification. Key benefits realized by adopting this technology include significant improvements in operational efficiency, enhanced passenger satisfaction due to reduced bottlenecks, and a superior level of security assurance provided by multi-factor authentication methods. Furthermore, these automated processes allow airport and airline staff to focus on complex tasks or passenger assistance rather than routine document verification, optimizing human resource allocation. The technological reliability and speed of processing offered by automated systems are increasingly essential for airlines maintaining tight turnaround schedules.

Driving factors for market growth are numerous, primarily centering on global security mandates following international regulations that necessitate higher scrutiny of travelers. The transition towards touchless travel, greatly accelerated by public health crises, has cemented biometric and automated solutions as foundational infrastructure for modern air travel. Investment in smart airport initiatives, particularly in highly congested regions such as Asia Pacific and Europe, further accelerates deployment. The declining cost of biometric sensors, coupled with rising passenger volumes worldwide, creates a compelling economic argument for airports to invest in high-throughput automation solutions, ensuring long-term operational sustainability and competitiveness in the global aviation sector.

Automatic Boarding Gates Market Executive Summary

The Automatic Boarding Gates Market is characterized by robust technological innovation, competitive pricing pressures, and strong governmental backing through regulatory mandates emphasizing security and efficiency. Business trends highlight a pronounced shift towards software-as-a-service (SaaS) models for the management and maintenance of these gates, moving away from purely capital expenditure purchases towards operational leasing and subscription services for biometric databases and verification algorithms. Furthermore, key market players are focusing heavily on strategic partnerships with airlines and global system integrators to offer bundled solutions that cover the entire passenger journey—from check-in kiosks to baggage drop and final boarding—creating seamless, integrated automation experiences. The market exhibits high fragmentation in terms of integrators but consolidation among core biometric technology providers, seeking to standardize identification protocols across different jurisdictions.

Regional trends indicate that mature markets, such as North America and Western Europe, are focused on upgrading legacy automated gates to incorporate advanced facial recognition capabilities and predictive analytics for optimizing boarding procedures (e.g., zone-based priority boarding management). In contrast, emerging markets, particularly in the Middle East and parts of Asia Pacific (APAC), are undertaking greenfield airport projects, providing fertile ground for large-scale, comprehensive installation of the latest generation of fully integrated biometric gates. APAC, driven by significant infrastructure investments in China and India to manage rapidly increasing domestic and international traffic, is projected to be the fastest-growing region, simultaneously driving technological advancements specific to high-density environments. Standardization challenges remain a regional hurdle, particularly concerning data privacy laws that differ vastly across continents, influencing the specific biometric modalities deployed.

Segmentation trends show that the Biometric Technology segment, specifically facial recognition, dominates the market due to its non-intrusive nature, speed, and proven accuracy rates. Within the Application segment, international airport terminals remain the largest end-user, though there is increasing penetration into smaller regional airports seeking to leverage automation for cost reduction and service level parity. Component analysis suggests that the software and integration services segment is expanding at a faster rate than the pure hardware segment, reflecting the increasing complexity of integrating these gates with legacy airport IT systems, airline reservation systems, and global security watchlists. The drive toward future-proof solutions mandates flexible, modular software architectures capable of accommodating future identity verification methods, such as mobile ID credentials, without necessitating complete hardware replacement.

AI Impact Analysis on Automatic Boarding Gates Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Automatic Boarding Gates Market frequently center on its role in enhancing security beyond simple identity matching, its capacity for predictive maintenance to ensure system uptime, and its potential for personalizing the passenger experience. Users are keen to understand how AI-driven analytics can optimize the entire boarding process, addressing concerns about throughput limitations and false rejection rates (FRR) common in first-generation systems. The analysis reveals a clear expectation that AI will transition the gates from being merely verification points to intelligent nodes within the airport ecosystem, capable of real-time adaptation, fraud detection, and integration with broader security and operational intelligence platforms. Key themes revolve around the accuracy enhancements provided by deep learning algorithms in facial recognition under various lighting and angle conditions, and the application of machine learning for preemptively identifying and resolving equipment failures before they cause operational delays.

- AI algorithms significantly improve the speed and accuracy of biometric matching, reducing false positives and negatives, crucial for high-speed passenger flow.

- Machine learning models enable predictive maintenance by analyzing sensor data and operational patterns, minimizing gate downtime and increasing system reliability.

- AI enhances security by analyzing gait, behavior, and physiological cues in real time, providing an additional layer of security beyond passive identity verification.

- Deep learning facilitates real-time data integration with various airport systems (Baggage Handling, Flight Information Display Systems) to provide dynamic boarding instructions.

- Natural Language Processing (NLP) integration aids in sophisticated troubleshooting and provides multi-lingual, voice-activated assistance features at the gate interface.

- AI-driven optimization software uses historical and real-time data to adjust boarding sequences, maximizing aircraft turnaround time and minimizing passenger congestion.

DRO & Impact Forces Of Automatic Boarding Gates Market

The Automatic Boarding Gates Market is shaped by a powerful confluence of drivers related to efficiency, security, and global standardization efforts, counterbalanced by significant technological and regulatory restraints. Key drivers include the overwhelming pressure on airports to manage soaring passenger traffic volumes efficiently, regulatory mandates from international bodies like ICAO and IATA promoting standardized digital identity protocols, and the increasing acceptance and integration of biometric technologies globally. The primary opportunity lies in the transition toward "seamless travel" initiatives, where the boarding gate is simply one component of an end-to-end biometric passenger journey. The integration of mobile boarding credentials and blockchain-secured identity management systems presents a massive growth avenue for technology providers who can navigate complex data security requirements, transforming the gate experience from transactional to experiential and secure.

Restraints primarily revolve around the initial high capital investment required for deploying integrated, highly secure boarding gate systems, particularly for smaller regional airports with constrained budgets. Furthermore, the complexities associated with integrating new automated gates with disparate, often decades-old legacy IT infrastructure (DCS, check-in systems) pose significant technical and financial hurdles. A critical restraint that heavily impacts global deployment is the evolving landscape of data privacy regulations, such as GDPR in Europe, which necessitate robust data anonymization and strict consent management for biometric data usage. The public perception of biometric surveillance and the potential for data breaches also requires continuous transparent communication and stringent security protocols from vendors and airport authorities to maintain public trust in automation technologies.

Impact forces in the market are overwhelmingly positive, driven by the compelling operational benefits that automation delivers. The desire for reduced operational expenditure (OPEX) through decreased staffing needs at manual checkpoints and the critical need to improve on-time performance (OTP) metrics for airlines solidify the business case for investment. The impact of security mandates and the pursuit of competitive advantage by offering a superior, faster passenger experience are forcing adoption across all tiers of global aviation. The ability of automated gates to handle unexpected scenarios, such as last-minute flight changes or passenger document issues, utilizing real-time decision-making systems, further underscores their importance as essential, mission-critical infrastructure rather than optional enhancements, thereby ensuring sustained market momentum and technological evolution throughout the forecast period.

Segmentation Analysis

The Automatic Boarding Gates Market is comprehensively segmented based on three primary categories: Component, Technology, and Application. Analyzing these segments provides strategic insights into investment trends, regional adoption patterns, and technological preferences. The Component segmentation typically divides the market into Hardware (gate structures, sensors, scanners, controllers), Software (biometric matching engine, integration platform, system management tools), and Services (installation, maintenance, and consulting). The increasing complexity of the software required for real-time integration and advanced facial recognition algorithms means the Software and Services segments are expected to capture a progressively larger share of the market value, shifting the focus from physical gate hardware to sophisticated digital capabilities and long-term support contracts.

Technology segmentation is perhaps the most dynamic area, primarily covering Biometrics (Facial Recognition, Iris/Retina Scanning, Fingerprint/Palm Vein) and Document Readers (Barcode/QR Code Scanners, NFC/RFID readers). Facial recognition technology has become the dominant modality due to its high speed, throughput, and completely touchless interaction, aligning perfectly with modern hygiene standards and passenger preference for minimal effort. While fingerprint and iris scans offer extremely high accuracy, their deployment is often reserved for high-security applications or border control points rather than high-volume boarding gates, emphasizing the speed-security trade-off in design choices. Furthermore, the convergence of multiple technologies—such as using an NFC reader for a mobile boarding pass followed by a quick facial scan—is becoming standard practice to ensure both convenience and robust security verification.

Application segmentation differentiates deployment based on the size and scope of the airport facility, usually categorized into International Airports and Regional Airports, or based on the specific function, such as Domestic Gates versus International Gates (where passport/visa verification is integrated). International airports remain the predominant revenue driver, necessitating extensive installations across multiple terminals and incorporating sophisticated integration with government border control systems. However, regional airports are increasingly adopting lower-cost, modular automatic gates to improve efficiency and maintain service standards equivalent to major hubs, fueling growth in the mid-tier market segment. The trend towards self-service processes across all airport touchpoints ensures that automatic boarding gates are now considered essential for maintaining competitive passenger service levels globally.

- By Component:

- Hardware (Gate Structures, Sensors, Controllers)

- Software (Biometric Matching Engine, System Management, Integration Platforms)

- Services (Installation, Maintenance, Consulting, Upgrades)

- By Technology:

- Biometrics (Facial Recognition, Iris Recognition, Fingerprint Recognition, Vein Scanning)

- Document & Barcode Readers (NFC, QR Code, RFID)

- By Application/End-User:

- International Airports

- Regional and Domestic Airports

- Private Aviation Terminals

Value Chain Analysis For Automatic Boarding Gates Market

The value chain for the Automatic Boarding Gates Market begins with the upstream suppliers responsible for providing essential components such as high-resolution cameras and biometric sensors (e.g., CMOS sensors, specialized infrared optics), microprocessors, and sophisticated embedded software modules. These suppliers form the foundational layer, providing specialized hardware and computing power necessary for real-time identification and decision-making within the gate mechanism. Following this, the core manufacturers and system integrators acquire these components to design and assemble the physical gate structures and develop the proprietary verification software. This manufacturing stage involves precision engineering to create robust, vandal-resistant, and aesthetically appropriate gate solutions that comply with diverse airport architectural and operational requirements. Successful integrators focus heavily on modular design to facilitate ease of maintenance and future technological upgrades.

The downstream segment of the value chain involves the crucial role of system integrators and distributors. These entities are responsible for the complex task of installation, which often requires significant civil works modifications within existing terminal infrastructure. More importantly, system integrators link the newly deployed automatic gates to the airport's central IT systems—including the Airport Operational Database (AODB), the airline's Departure Control System (DCS), and national border control databases. The effectiveness of the automated gates is entirely dependent on the quality and stability of this integration layer. Distribution channels are varied; direct sales channels are common for large, multi-year contracts with major international airport authorities, ensuring customized solutions and direct accountability. Indirect channels, involving specialized aviation technology resellers or regional contractors, handle deployments in smaller, localized markets and are crucial for providing localized support and rapid response maintenance services.

The service component, which sits at the very end of the value chain, is increasingly valuable. This involves providing continuous maintenance, software updates, calibration of biometric sensors, and ensuring compliance with evolving security standards. Many vendors offer performance-based contracts, where maintenance fees are tied to uptime guarantees and throughput metrics. The shift towards cloud-based management platforms facilitates remote diagnostics and faster software deployment, minimizing physical intervention time. This robust service structure ensures the high availability of the mission-critical boarding gates. Ultimately, the successful delivery of value requires close collaboration between the gate manufacturer, the airport authority, and the operating airlines to ensure that the integrated solution enhances both security performance and passenger experience seamlessly.

Automatic Boarding Gates Market Potential Customers

The primary customers for automatic boarding gate solutions are airport operators and governing bodies, spanning a wide spectrum from massive international aviation hubs to smaller regional facilities managed by local authorities. Large international hubs, characterized by high traffic volume (over 40 million passengers annually) and complex flight schedules, represent the highest potential customer segment. These facilities prioritize maximum throughput, stringent security compliance, and robust integration capabilities with global border management systems. Their purchasing decisions are often driven by long-term strategic plans for terminal modernization and the adoption of "smart airport" technology frameworks, necessitating large-scale, multi-phase deployment contracts for hundreds of gates designed for high reliability and 24/7 operational capability.

Secondary potential customers include regional airports and specialized flight facilities, such as those catering predominantly to domestic or low-cost carriers. While their budgets might be smaller, their need for automation is growing rapidly due to increasing pressure to handle traffic spikes efficiently and reduce operational costs associated with manual staffing. These customers typically seek modular, scalable, and potentially less customized solutions that offer strong return on investment (ROI) within shorter timeframes. The key buying criteria for this segment often focus on ease of installation into existing infrastructure and simplified management interfaces, avoiding the need for highly specialized IT teams to maintain the complex systems.

Furthermore, airlines themselves, particularly those heavily invested in digital transformation and proprietary passenger experience initiatives, are also key influencers and sometimes direct purchasers, especially when integrating gates with their own proprietary check-in and loyalty systems. Government and border control agencies are indirect but significant customers, as their mandates and technological requirements (e.g., specifications for biometric matching against national databases) directly dictate the necessary technical capabilities and security standards that the automatic boarding gate systems must adhere to, fundamentally shaping product development and regional market penetration strategies. This triangular relationship—between airport, airline, and government—defines the final solution deployment landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $975 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SITA, Vision-Box, IER SAS, Gunnebo, Materna Information & Communications, Kaba Group, IDEMIA, NEC Corporation, Securiport, HID Global, Magnetic Autocontrol, Dormakaba, Rockwell Collins (now Collins Aerospace), Thales Group, Automatic Systems, Fentura Group, T-Systems International, Beijing Topsec Technologies, PFlow Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Boarding Gates Market Key Technology Landscape

The technological landscape of the Automatic Boarding Gates Market is defined by the convergence of advanced biometric identification methods, robust sensor technologies, and highly scalable software integration platforms. Facial recognition stands as the prevailing technology, relying on sophisticated 3D cameras and machine learning algorithms (often utilizing deep convolutional neural networks) to map unique facial features against a passenger's pre-registered biometric template or their stored passport photograph. This technology is continually being refined to address challenges like varying lighting conditions, aging, wearing of accessories (glasses, hats), and identity spoofing attempts. The shift toward passive, 'walk-through' identification systems, minimizing the need for passengers to stop or align themselves precisely, is a key focus area for vendors, driving up gate processing speeds significantly.

Beyond biometrics, the hardware architecture incorporates high-speed document readers capable of scanning multiple formats, including traditional magnetic strips, 2D barcodes, and NFC/RFID chips embedded in mobile devices or e-passports. Sensor arrays are critical for passenger safety and flow management, utilizing infrared, ultrasonic, and LiDAR technologies to detect movement, prevent tailgating, and ensure the physical gate barrier operates safely and efficiently. Integration platforms form the intellectual core of the system; these middleware solutions are responsible for securely connecting the physical gates to disparate airport systems (like A-CDM for slot management) and airline data repositories (DCS for eligibility checks) while maintaining strict adherence to data encryption and security protocols like ISO 27001. The interoperability between these systems is crucial for maintaining seamless airport operations across different carriers and governmental bodies.

A significant emerging area is the implementation of decentralized identity management utilizing blockchain technology. While still in nascent stages, using distributed ledger technology (DLT) offers the potential for passengers to securely manage their own digital identity credentials, allowing for verified, yet privacy-preserving, access across multiple airport touchpoints without relying on a single, centralized database. Furthermore, the adoption of edge computing is vital, allowing for initial biometric matching and data processing to occur directly at the gate, reducing latency and the reliance on continuous, high-bandwidth connections to central servers. This technological evolution toward localized processing ensures higher resilience and quicker response times, which are essential for critical operational infrastructure in high-traffic, time-sensitive environments like major international airports.

Regional Highlights

Regional dynamics heavily influence the adoption and maturity level of the Automatic Boarding Gates Market, driven by factors such as infrastructure investment, regulatory harmonization, and existing passenger volumes. North America, encompassing the United States and Canada, represents a highly mature market characterized by significant government investment in biometric border control and a strong push toward fully integrated "Curb-to-Gate" seamless travel programs, particularly spearheaded by the Transportation Security Administration (TSA) and Customs and Border Protection (CBP). While installation rates are high, the focus is shifting from new deployments to comprehensive upgrades of existing hardware with advanced AI-driven facial recognition systems. The rigorous security standards and the presence of major technology vendors fuel innovation, establishing North America as a primary market for large-scale, enterprise-level automated solutions designed for maximum security integrity.

Europe holds a distinct position, propelled by stringent Schengen Area mandates for efficient internal border management and high commitment to passenger privacy regulations (GDPR). The European market is mature in terms of automation, but adoption is highly nuanced; deployments must meticulously balance the need for high-speed throughput with robust compliance concerning biometric data handling and storage. Central and Western European airports are focusing on optimizing operational efficiency through A-CDM integration, utilizing automatic gates not just for security but as sophisticated tools for managing passenger flow and flight departure timelines. The regulatory complexity, however, necessitates solutions that are highly adaptable and often modular, allowing countries to customize the data processing flow according to specific national legal frameworks while maintaining regional interoperability.

The Asia Pacific (APAC) region is poised for the most rapid growth during the forecast period. This growth is predominantly fueled by unprecedented infrastructure development, specifically the construction of massive new international airports and the expansion of existing facilities in countries like China, India, and Southeast Asia, aimed at accommodating the explosive rise in middle-class air travel. These greenfield projects offer unique opportunities for vendors to install the newest generation of fully integrated biometric gates from the outset, without the restraints of legacy systems. The acceptance of biometric data is generally higher in several APAC nations, allowing for aggressive deployment strategies focusing on speed and volume handling. The Middle East and Africa (MEA) region, particularly the major hubs in the UAE, Qatar, and Saudi Arabia, are significant investors, leveraging automatic gates to cement their status as global super-connector hubs that prioritize luxury, efficiency, and cutting-edge passenger technology to attract premium travel traffic.

- North America: High maturity, focus on technology upgrades (AI/Facial Recognition), and deep integration with federal border security systems (CBP, TSA) for "Seamless Flow" initiatives.

- Europe: Driven by Schengen border management and strict GDPR compliance; strong market for highly integrated, privacy-focused biometric solutions and operational efficiency improvements via A-CDM.

- Asia Pacific (APAC): Fastest-growing region, boosted by massive new airport infrastructure projects (greenfield sites), high traffic volume management, and high public acceptance of biometrics.

- Middle East & Africa (MEA): Significant investment in luxury and high-tech solutions, aimed at positioning key hubs as global transit leaders, prioritizing speed, efficiency, and passenger experience.

- Latin America: Emerging market characterized by selective deployment, primarily in major capital airports, driven by security modernization and efforts to streamline international travel processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Boarding Gates Market.- SITA

- Vision-Box

- IER SAS (part of the Blue&Co Group)

- Gunnebo AB

- Materna Information & Communications SE

- IDEMIA

- NEC Corporation

- Securiport LLC

- HID Global Corporation

- Dormakaba Holding AG

- Magnetic Autocontrol GmbH

- Automatic Systems (Bollore Group)

- Collins Aerospace (formerly Rockwell Collins)

- Thales Group

- Access IS (JADAK)

- Fentura Group

- T-Systems International GmbH

- Desko GmbH

- Paragon Identification SAS

- Beijing Topsec Technologies Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automatic Boarding Gates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key technological driver propelling the growth of automatic boarding gates?

The key technological driver is the maturation and widespread adoption of facial recognition biometrics. This technology offers high throughput rates, enhanced security, and a touchless passenger experience, aligning perfectly with modern requirements for efficient airport operations and public health safety standards.

How do automatic boarding gates ensure compliance with passenger data privacy regulations like GDPR?

Compliance is ensured through the implementation of robust data minimization techniques, secure encryption protocols for biometric templates, and decentralized storage architectures. Gates are designed to process and verify identity locally or against highly secured, consented databases, adhering strictly to regional data retention and usage policies.

What is the projected ROI for airports implementing automated boarding gates?

The projected Return on Investment (ROI) is primarily achieved through significant reduction in airline and airport staff requirements at the gate, minimized flight delays (improving On-Time Performance), and increased security efficiency, which reduces the costs associated with security breaches and manual verification errors. ROI is typically realized over a three-to-five-year period.

Are automatic boarding gates suitable for both domestic and international flights?

Yes, automatic boarding gates are highly versatile. For domestic flights, they verify boarding pass validity and passenger identity. For international flights, they integrate additional capabilities, such as automated passport and visa verification, linking in real time with governmental border control databases for rigorous security checks.

What are the primary challenges in deploying automatic boarding gate systems globally?

The primary challenges involve the high initial capital expenditure required for large-scale deployment, complex integration with often-outdated legacy airport and airline IT systems (DCS), and navigating the widely varying international and national regulations concerning the capture, storage, and usage of sensitive biometric data.

The comprehensive market analysis presented here demonstrates that the Automatic Boarding Gates Market is evolving rapidly, shifting from simple automation to intelligent, integrated systems powered by AI and advanced biometrics. The demand for seamless, secure, and efficient passenger processing is non-negotiable for modern air travel, solidifying the market's trajectory toward high growth and continuous technological innovation throughout the forecast period. Global airports are recognizing these systems not as optional upgrades but as fundamental, mission-critical infrastructure components essential for maximizing throughput and maintaining competitive passenger service levels. Future development will focus heavily on mobile identity integration and highly resilient, decentralized data architecture, ensuring both security and passenger autonomy.

The geographical expansion, particularly in high-growth regions like APAC and MEA, will continue to drive economies of scale, making these advanced solutions more accessible to a broader range of airports, including regional facilities seeking efficiency improvements. Furthermore, the role of systems integrators, who bridge the gap between sophisticated hardware and complex airport IT ecosystems, will become increasingly pivotal, emphasizing the market's reliance on specialized services and robust, long-term maintenance contracts. This dependence on expert integration and post-installation support means the software and services segment will likely outpace hardware growth, defining the financial structure of the industry in the coming years and influencing strategic partnerships among leading market players.

In conclusion, the market's fundamental health is robust, underpinned by enduring macro trends: escalating global travel demand, rising security threats requiring advanced verification, and the pervasive industry mandate for digital transformation to enhance operational efficiency. While regulatory hurdles related to data privacy pose an ongoing challenge, continuous advancements in AI and secure biometric technology are providing viable pathways for compliance and deployment. Strategic success for vendors will hinge on offering modular, scalable solutions that ensure future-proof investments for airport operators facing high-pressure operational environments and demanding passenger expectations for frictionless, personalized travel experiences.

The transition toward open standards and collaborative platforms, such as those promoted by IATA's One ID initiative, also signifies a major shift, encouraging interoperability across vendor systems and various airport touchpoints. This standardization effort is essential for breaking down silos between check-in, security screening, border control, and the final boarding gate, allowing the automatic gate to function as part of a continuous, secure biometric corridor. Consequently, competitive differentiation will increasingly rely on the sophistication of the backend analytics provided, allowing airports to leverage real-time data from the gates to make informed decisions about resource allocation, passenger routing, and queue management, transforming the gate from a simple checkpoint into a source of valuable operational intelligence.

The focus on sustainability and environmental efficiency is also subtly influencing product design, driving demand for gates built with highly efficient, low-power components and materials that maximize durability while minimizing ecological footprint. While perhaps not the primary purchasing driver, this consideration is becoming increasingly important for major airport authorities committed to global environmental targets. This combination of security, efficiency, technological sophistication, and evolving regulatory compliance defines the complex but highly lucrative landscape of the Automatic Boarding Gates Market, ensuring its continued expansion well into the next decade as global air traffic recovery and subsequent growth solidify its market standing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager