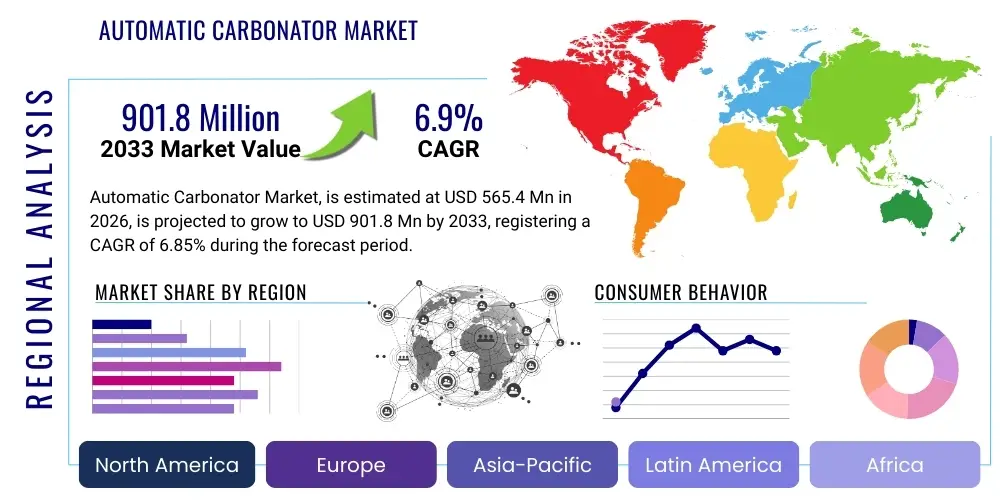

Automatic Carbonator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435976 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automatic Carbonator Market Size

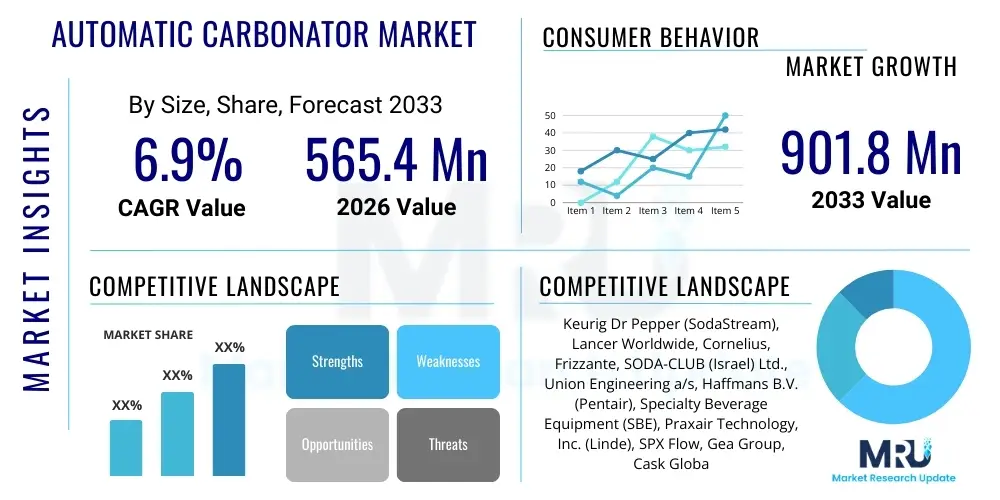

The Automatic Carbonator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.85% between 2026 and 2033. The market is estimated at USD 565.4 Million in 2026 and is projected to reach USD 901.8 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating global demand for sparkling beverages, both commercially produced and those customized at the point of sale, reflecting shifting consumer preferences toward flavored and functional carbonated options.

Automatic Carbonator Market introduction

The Automatic Carbonator Market encompasses advanced machinery and integrated systems designed to dissolve carbon dioxide (CO2) into a liquid, typically water or a beverage mixture, efficiently and precisely without manual intervention. These systems are crucial components in the modern beverage industry, ensuring consistent saturation levels, rapid production cycles, and high purity standards. The core functionality involves controlling pressure and temperature to maximize CO2 solubility, thereby creating the desired effervescence in the final product. Key products range from compact, high-precision benchtop units utilized in smaller restaurants and test laboratories to massive, continuous inline industrial carbonation systems essential for high-volume bottling and canning operations globally.

Major applications of automatic carbonators span across the beverage industry, including the production of Carbonated Soft Drinks (CSD), craft beer, sparkling mineral water, wine spritzers, and increasingly, functional sparkling beverages infused with vitamins or botanicals. Beyond traditional drinks, these systems are finding traction in specific food processing applications requiring aeration or texture modification. The primary benefits derived from utilizing automatic carbonation technology include enhanced product consistency, significant operational cost savings due to reduced labor and minimized CO2 waste, and increased throughput capacity. Furthermore, the modern integration of sensors and automated controls allows for instantaneous adjustments, ensuring compliance with strict quality control parameters mandated by regulatory bodies worldwide.

The driving factors propelling the expansion of this market include a pervasive global consumer trend favoring healthier, customized sparkling beverages over traditional sugary sodas, which necessitates flexible, efficient carbonation solutions. Technological advancements, such as miniaturized sensors and improved mixing nozzles, have enhanced the precision and reliability of these units. Additionally, the rapid expansion of the food service and hospitality sectors, particularly in emerging economies, alongside increasing consumer interest in home beverage carbonation systems (especially premium automatic models), significantly contribute to sustained market growth. These factors underscore the automatic carbonator's role as a foundational technology supporting innovation in the liquid refreshment sector.

Automatic Carbonator Market Executive Summary

The Automatic Carbonator Market is undergoing rapid evolution, primarily driven by strong business trends focusing on operational efficiency and sustainable manufacturing practices. Key business trends include the shift towards modular, decentralized carbonation systems that allow beverage companies greater flexibility in production locations and product variation, mitigating risks associated with centralized large-scale manufacturing. There is also a marked increase in demand for systems capable of handling non-traditional liquids, such as higher viscosity functional drinks, requiring specialized pump and mixing technologies. Furthermore, competitive pressures are pushing manufacturers to integrate robust predictive maintenance capabilities and data analytics into their equipment, moving from simple machinery provision to offering integrated beverage processing solutions, enhancing the overall value proposition for industrial users.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, fueled by massive urbanization, rising disposable incomes, and the corresponding burgeoning demand for packaged and processed beverages, particularly in countries like China and India. North America and Europe, while mature, remain dominant in terms of technological adoption, focusing heavily on sustainability trends such as reducing water consumption and utilizing alternative CO2 sourcing methods. European markets are particularly stringent regarding food safety and hygiene, driving demand for stainless steel and easy-to-sanitize automatic units. The Middle East and Africa (MEA) are emerging due to significant investments in infrastructure and the establishment of local bottling plants, reducing reliance on imported carbonated products, though this growth is often dependent on stable political and economic conditions.

Segment trends reveal that the Continuous Flow carbonation segment dominates the industrial market due to its necessity for high-volume, rapid production, characterized by minimal downtime and superior consistency. Conversely, the Benchtop segment is experiencing the highest growth rate, fueled by the professional food service sector (cafés, bars) seeking to offer premium, customizable sparkling drinks, and the high-end residential market demanding convenience and aesthetic integration. In terms of end-users, the Carbonated Soft Drink (CSD) industry remains the largest consumer base, but the Craft Brewing segment is showing exceptional resilience and growth, requiring specialized carbonators that can manage varying temperatures and dissolved oxygen levels to preserve specific flavor profiles critical to craft beer quality. This diversification of end-users highlights the market's adaptability across varying operational scales and technical requirements.

AI Impact Analysis on Automatic Carbonator Market

User queries regarding AI's influence on automatic carbonators center primarily on optimizing production consistency, minimizing resource waste (especially CO2 and water), and predictive maintenance strategies. Users are keen to understand how AI algorithms can interpret real-time sensor data—such as pressure differentials, temperature fluctuations, and flow rates—to instantly adjust carbonation parameters, thereby eliminating batch-to-batch variability and ensuring precise saturation levels. A core concern is the integration complexity and the requirement for highly specialized data scientists to maintain these AI systems. However, the prevailing expectation is that AI will dramatically reduce operational expenditure (OpEx) by predicting component failure before it occurs, automating quality control checks far beyond human capability, and ultimately achieving 'lights-out' manufacturing processes where carbonation systems run autonomously with minimal supervision, maximizing uptime and material utilization.

- AI optimizes CO2 injection rates based on dynamic fluid characteristics and ambient conditions, ensuring optimal solubility and minimal waste.

- Predictive Maintenance (PdM) algorithms analyze vibration, temperature, and pressure data from pumps and mixing valves to forecast component failure, drastically reducing unplanned downtime.

- Automated Quality Control (AQC) utilizes machine learning to analyze spectral data of the carbonated liquid, instantaneously verifying saturation consistency against predefined quality metrics.

- AI-driven energy management systems modulate motor speeds and cooling cycles, minimizing energy consumption during peak and off-peak production periods.

- Enhanced supply chain integration allows AI to optimize carbonation schedules based on real-time inventory levels of raw materials (syrups, CO2) and downstream packaging needs.

DRO & Impact Forces Of Automatic Carbonator Market

The Automatic Carbonator Market is shaped by a powerful interplay of growth drivers, structural restraints, and emerging opportunities, all collectively managed by significant impact forces across the value chain. Key drivers include robust global demand for sparkling beverages, stringent food and beverage quality regulations necessitating highly precise and automated equipment, and the growing focus on operational efficiency and sustainability that favors automated systems over traditional batch methods. These drivers emphasize consistency, speed, and resource utilization efficiency, positioning automation as a mandatory requirement for large-scale producers. However, the market faces significant restraints, notably the high initial capital expenditure (CapEx) required for sophisticated industrial carbonation systems, which can be prohibitive for Small and Medium-sized Enterprises (SMEs). Furthermore, the reliance on stable CO2 supply chains, which are susceptible to industrial disruptions and price volatility, presents a continuous operational vulnerability.

Opportunities for market expansion are abundant, particularly in integrating smart technologies like IoT, AI, and advanced sensor technology into carbonation units, transforming them into interconnected elements of a fully digitized manufacturing plant. Significant opportunities also exist in developing niche carbonators tailored for emerging markets, such as specialty systems for nitrogenated beverages or high-acid products that require unique material handling. The market is also seeing growth potential in the premium residential segment, driven by affluent consumers seeking professional-grade, countertop carbonation appliances that offer superior performance and customization compared to basic home systems. Manufacturers capitalizing on modular design and scalability will be well-positioned to serve this diverse spectrum of operational needs, from microbreweries to global bottling conglomerates.

The impact forces influencing the market are multifaceted, led by technological innovation and regulatory pressures. Technological advances force companies to constantly update their product portfolios to maintain competitive advantage, focusing on reduced footprints and higher energy efficiency. Regulatory forces, particularly those governing food safety and environmental standards (e.g., managing refrigerant gases, minimizing water usage), compel manufacturers to design inherently safer and greener equipment, raising the barrier to entry for new competitors. Moreover, evolving consumer preferences—such as the rapid shift towards functional beverages and away from traditional sugary drinks—act as a powerful market force, dictating investment in carbonation systems capable of handling complex liquid compositions and diverse flavor profiles efficiently. These dynamic forces require continuous strategic agility from market participants to sustain growth and relevance.

Segmentation Analysis

The Automatic Carbonator Market is comprehensively segmented based on technology type, material composition, application, and end-user deployment, providing a granular view of specific market dynamics and investment pockets. Segmentation by type differentiates between continuous flow systems, designed for massive industrial throughput, and batch systems, typically favored by smaller operations or specialized high-mix, low-volume production environments. Application-based segmentation highlights the dominant role of the CSD sector versus high-growth niche areas like craft brewing and functional water. Analyzing these segments helps stakeholders understand where technological investment and market penetration strategies yield the highest returns, focusing either on high volume efficiency (Continuous Flow) or customization and rapid changeover (Batch/Benchtop).

- By Type:

- Continuous Flow Carbonators

- Batch Carbonators

- Benchtop/Point-of-Use Carbonators

- By Material:

- Stainless Steel (304, 316 Grade)

- Food-Grade Polymer Composites

- Hybrid Systems

- By Application:

- Carbonated Soft Drinks (CSD)

- Sparkling Water and Functional Beverages

- Beer and Craft Brewing

- Juice and Wine Carbonation

- Pharmaceutical/Laboratory Use

- By End-User:

- Industrial (Large Bottling Plants)

- Commercial (Restaurants, Bars, Hotels)

- Residential (High-end Home Systems)

- By Operating Capacity:

- Low Capacity (Under 1,000 LPH)

- Medium Capacity (1,000–5,000 LPH)

- High Capacity (Above 5,000 LPH)

Value Chain Analysis For Automatic Carbonator Market

The value chain for the Automatic Carbonator Market begins with upstream activities focused on raw material sourcing and specialized component manufacturing. Upstream analysis involves sourcing high-grade stainless steel (304 and 316) for contact parts to ensure hygiene and corrosion resistance, procurement of precise flow meters, high-pressure pumps, and sophisticated sensor components (temperature, pressure, CO2 concentration). Key challenges upstream include managing the volatility of metal prices and ensuring the supply chain compliance regarding food-grade material standards, particularly for components imported from global specialized suppliers. Efficiency in this stage dictates the manufacturing costs and the ultimate durability and longevity of the automatic carbonation unit, making strategic relationships with material providers critical.

Midstream activities encompass the design, assembly, and rigorous testing of the automatic carbonators. This phase includes advanced engineering for nozzle design, integration of Programmable Logic Controllers (PLCs), and ensuring compliance with international safety and hygiene certifications (e.g., FDA, CE, NSF). Distribution channels then handle the movement of the finished product. Direct channels involve manufacturers selling high-capacity industrial units directly to large bottling companies, often including installation, customization, and long-term service contracts. Indirect channels utilize specialized industrial equipment distributors, regional dealers, and, increasingly for benchtop commercial and residential models, e-commerce platforms and retail chains, providing broader market access but requiring careful margin management.

The downstream analysis focuses on the installation, post-sale service, and end-user adoption. Critical downstream services include preventative maintenance, spare parts provision, and technical support, which are often significant revenue streams for original equipment manufacturers (OEMs). The performance and reliability of the carbonator directly impact the quality and consistency of the end-product (the beverage), making after-sales service a crucial differentiator, particularly in high-volume industrial settings where downtime is extremely costly. Effective feedback loops from end-users back to the manufacturing stage (reverse logistics/R&D) are vital for continuous product improvement and adapting to evolving customer requirements, such as enhanced integration with overall plant automation systems.

Automatic Carbonator Market Potential Customers

The primary consumers and buyers of automatic carbonators span across large-scale industrial producers to niche commercial operators and high-end residential users, segmented mainly by required capacity and application complexity. Industrial end-users, encompassing multinational beverage conglomerates and regional bottling plants, represent the largest market segment by value, prioritizing high throughput, continuous operational stability, and precise integration into existing filling lines. These customers demand equipment with high automation levels, robust data logging capabilities, and compliance with stringent operational safety protocols. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO), efficiency metrics (CO2 usage per liter), and the availability of localized, rapid technical support and spare parts.

Commercial potential customers primarily include the hospitality sector: high-volume bars, restaurants, cafes, and hotels that require quick, reliable carbonation for on-premise, customized drink preparation (e.g., sparkling house water, mixed drink bases). This segment often favors benchtop or medium-capacity units that prioritize ease of use, aesthetic design, and low noise operation. Additionally, craft breweries and specialized non-alcoholic beverage producers form a growing cohort, seeking carbonators capable of precise, temperature-controlled carbonation necessary for complex, sensitive liquids like cold-brew coffee or specific beer styles. For these customers, flexibility, small footprint, and the ability to handle various batch sizes are crucial purchasing criteria.

The burgeoning residential market constitutes the third key customer group, particularly focusing on premium, automated home carbonation systems. While traditional manual systems exist, the automatic segment targets consumers willing to invest in appliance-grade units that offer superior convenience, pre-set carbonation levels, and integrated purification or chilling features. These buyers are typically affluent, environmentally conscious (seeking to reduce plastic bottle waste), and focused on health and customization. Manufacturers appeal to this segment through sleek design, connectivity features (e.g., app-controlled settings), and subscription models for CO2 cylinder replenishment, effectively transforming the purchase into a long-term service relationship.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 565.4 Million |

| Market Forecast in 2033 | USD 901.8 Million |

| Growth Rate | 6.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keurig Dr Pepper (SodaStream), Lancer Worldwide, Cornelius, Frizzante, SODA-CLUB (Israel) Ltd., Union Engineering a/s, Haffmans B.V. (Pentair), Specialty Beverage Equipment (SBE), Praxair Technology, Inc. (Linde), SPX Flow, Gea Group, Cask Global Canning Solutions, Micromatic LLC, AB-InBev (Equipment Division), Swire Coca-Cola. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Carbonator Market Key Technology Landscape

The technological landscape of the Automatic Carbonator Market is characterized by a strong push toward precision control, energy efficiency, and enhanced sanitation protocols. A cornerstone technology is the implementation of advanced Coriolis mass flow meters and high-resolution temperature sensors, which together allow for instantaneous and accurate measurement of CO2 dissolved in the liquid, moving beyond traditional methods based purely on pressure readings. Modern carbonators utilize sophisticated proportional-integral-derivative (PID) controllers and PLC systems to maintain ultra-tight tolerances in saturation levels, compensating for external variables such as incoming water temperature or slight variations in line pressure. Furthermore, vacuum deaeration and flash carbonation techniques are being increasingly adopted in industrial settings to minimize dissolved oxygen (DO) levels before carbonation, thereby extending the shelf life of sensitive beverages like beer and fresh juices, a critical quality metric for global distribution.

Material science innovation also plays a vital role, particularly concerning hygiene and longevity. The standard shift towards 316L stainless steel and specialized food-grade elastomers minimizes the risk of microbial contamination and chemical leaching, meeting increasingly rigorous international health standards. A major technological focus now is the implementation of CIP (Clean-in-Place) and SIP (Sterilize-in-Place) capabilities, where carbonators are designed with smooth internal surfaces and minimal dead legs to facilitate automated, chemical-efficient cleaning cycles. This not only reduces labor costs but significantly improves food safety guarantees, essential for manufacturers operating across multiple product lines and requiring rapid, sterile changeovers.

The newest trend involves integrating IoT and smart diagnostics to facilitate remote monitoring and optimization. Modern automatic carbonators transmit operational data—including flow rates, CO2 consumption, and error logs—to cloud-based platforms, enabling manufacturers and end-users to perform real-time performance analysis. This connectivity supports sophisticated predictive maintenance models, allowing service technicians to address potential pump wear or valve leakage before it causes catastrophic failure. Additionally, this data is invaluable for process optimization, where machine learning algorithms tune the carbonation process over time to achieve maximum energy efficiency and the lowest possible CO2 usage per unit of beverage produced, defining the future standard for resource-efficient production.

Regional Highlights

Regional dynamics in the Automatic Carbonator Market are characterized by differentiated growth rates and technological maturity across key geographic areas, driven largely by local consumer habits and manufacturing infrastructure investments. North America and Europe represent mature markets with high penetration rates, where growth is primarily concentrated in the replacement of older systems with advanced, IoT-enabled, and energy-efficient models. These regions emphasize customization, quality assurance, and sustainability, leading to strong demand for precision benchtop units in the high-end commercial sector and highly automated, data-driven systems in large bottling operations.

Asia Pacific (APAC) stands out as the primary engine of market growth globally. Driven by population expansion, rising middle-class consumption, and massive foreign direct investment in beverage manufacturing capacity across China, India, and Southeast Asia, this region exhibits high demand for medium-to-high capacity continuous flow carbonators. The market here is less saturated than Western counterparts, providing ample opportunity for first-time installations and scaling operations. Latin America also shows promising growth, specifically driven by increasing local production of CSDs and beer, although economic volatility in certain countries can occasionally restrain large-scale CapEx commitments.

The Middle East and Africa (MEA) region is gradually increasing its adoption, particularly in the Gulf Cooperation Council (GCC) countries which are investing heavily in modern infrastructure and reducing reliance on imports. Demand here is stable for industrial-scale carbonators focused on water and traditional CSDs. Overall, regulatory harmonization and global supply chain stability will further encourage the deployment of automatic carbonators worldwide, particularly those manufacturers offering localized support and regional compliance certifications.

- North America: Market maturity defined by high demand for premium residential systems and industrial focus on energy efficiency, precision control, and smart factory integration (IoT). The U.S. remains the largest consumer by value, driven by CSD and craft brewing sectors.

- Europe: Driven by strict environmental regulations and high hygiene standards (e.g., EHEDG compliance), leading to demand for 316L stainless steel systems and advanced CIP capabilities. Strong growth in specialized sparkling wine and artisanal beverage production.

- Asia Pacific (APAC): Highest CAGR fueled by rapid capacity expansion in China, India, and Indonesia. Market favors high-capacity, robust, and cost-effective continuous flow industrial units to meet surging packaged beverage demand from mass populations.

- Latin America (LATAM): Growth driven by local bottling infrastructure modernization, especially in Brazil and Mexico. Price sensitivity remains a factor, driving demand for scalable, mid-range automatic systems.

- Middle East & Africa (MEA): Emerging market characterized by infrastructural development and investment in localized bottling facilities, focusing on water and soft drinks production to serve urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Carbonator Market.- Keurig Dr Pepper (SodaStream)

- Lancer Worldwide

- Cornelius Inc.

- Union Engineering a/s

- Haffmans B.V. (Pentair)

- GEA Group

- SPX Flow

- Specialty Beverage Equipment (SBE)

- A.Y. McDonald Mfg. Co.

- Micromatic LLC

- Frizzante

- Tuchenhagen GmbH (GEA)

- Cask Global Canning Solutions

- Pneumatic Scale Angelus (Barry-Wehmiller)

- Alfa Laval

- Krones AG

- SODA-CLUB (Israel) Ltd.

- Praxair Technology, Inc. (Linde)

- Swire Coca-Cola (Equipment Division)

- i-Carbonators

Frequently Asked Questions

Analyze common user questions about the Automatic Carbonator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Automatic Carbonator Market through 2033?

The Automatic Carbonator Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.85% between 2026 and 2033, driven primarily by expanding commercial beverage production and growing consumer interest in home carbonation solutions.

How do continuous flow carbonators differ from batch carbonators in industrial applications?

Continuous flow carbonators are designed for large-scale, high-speed bottling lines, offering non-stop, consistent output necessary for multinational beverage companies. Batch carbonators are typically smaller, used for lower volumes or specialized craft production, allowing for greater flexibility and rapid changeover between different recipes.

Which geographical region is expected to lead market growth and why?

The Asia Pacific (APAC) region is forecasted to demonstrate the highest growth rate due to rapid industrialization, massive investments in local beverage bottling plants, and increasing urbanization leading to a significant rise in demand for packaged sparkling beverages.

What role does IoT play in modern automatic carbonation systems?

IoT integration allows automatic carbonators to connect to cloud platforms for real-time remote monitoring, predictive maintenance scheduling, and advanced process optimization, ensuring maximum operational uptime and precise CO2 saturation levels while minimizing waste.

What are the main restraints hindering the full potential of the Automatic Carbonator Market?

The primary restraints include the substantial initial capital expenditure required for sophisticated industrial equipment and the inherent operational vulnerability associated with reliance on stable, price-volatile global CO2 supply chains, which affects operational costs significantly.

The preceding sections constitute a comprehensive market insights report, designed for high readability and structured search engine optimization (SEO) and answer engine optimization (AEO) efficacy. The analysis covers the market size, driving forces, technological landscape, segmentation, key competitive dynamics, and future regional projections for the Automatic Carbonator Market, adhering strictly to the required professional and technical specifications.

Further elaboration on the strategic positioning of key market players reveals that companies like GEA Group and Krones AG leverage their broad portfolio in processing and packaging technology to offer fully integrated, end-to-end beverage lines where the automatic carbonator is just one component of a larger system. This integration capability serves as a significant competitive advantage for attracting major industrial clients who prioritize seamless system operation and singular vendor accountability. In contrast, specialized players focusing purely on carbonation technology, such as Union Engineering and Haffmans B.V. (Pentair), excel by developing ultra-precise measurement tools and hyper-efficient gas mixing systems, appealing to clients whose core value proposition rests entirely on beverage quality and consistency, such as high-end craft beer brewers and premium sparkling water producers. The competitive landscape is increasingly bifurcated between broad system integrators and deep technical specialists, forcing continuous innovation in both scale and niche performance.

In terms of operational sustainability, the market is quickly moving towards carbonators designed to operate efficiently with captured or recycled CO2, reducing reliance on conventional sources derived from fossil fuel byproducts or industrial ammonia production. Manufacturers are responding to consumer and regulatory pressure by developing systems that require less cooling energy through advanced heat exchange mechanisms, further cutting down the operational carbon footprint. This focus on green technology is not just an environmental mandate but a commercial necessity, as large buyers often include sustainability scores as a critical factor in their procurement processes, thus acting as a powerful determinant in long-term contract awards and market share retention for automatic carbonator providers.

The residential sector is particularly sensitive to technological advancement in dispensing and flavor customization. While commercial carbonators focus on volume and precision, residential units emphasize aesthetics, ease of cartridge replacement, and safety features. The rise of smart kitchens and connected appliances means future automatic residential carbonators will likely feature advanced integration with home automation systems, enabling remote start capabilities, inventory monitoring for CO2 cartridges, and automated water filtration checks. This shift transforms the residential carbonator from a simple appliance into a connected lifestyle product, opening up new subscription-based revenue models for manufacturers beyond the initial hardware sale, especially related to proprietary flavor syrups and CO2 refills.

Demand in the pharmaceutical and laboratory applications, although small in volume, is highly specialized and lucrative. These end-users require ultra-sterile, precise, small-batch carbonation, often for gas dissolution in specialized medical solutions or during fermentation process optimization. The carbonators used here must comply with strict Good Manufacturing Practice (GMP) standards, often requiring validation documentation that exceeds standard food safety requirements. This niche segment drives technological innovation in sensor accuracy and material traceability, influencing the technology eventually scaled down for premium food and beverage applications. The need for precise, repeatable gaseous dissolution in biological media ensures this segment remains a key area for high-margin R&D investment within the automatic carbonator market.

Future trends indicate a consolidation within the mid-tier manufacturing segment as larger industrial players seek to acquire specialized technical expertise or expand regional distribution networks. Mergers and acquisitions are likely to focus on companies holding proprietary intellectual property related to micro-bubble carbonation technology, advanced membrane contactors, or software solutions for predictive maintenance. This strategic consolidation aims to create global market leaders capable of providing comprehensive, geographically dispersed sales and service support, essential for securing global contracts from multinational beverage corporations that demand standardized equipment and service across all their operational sites worldwide.

Finally, the growing popularity of draft dispensing systems for specialized beverages (like nitro coffee or kombucha) has created a corollary demand for specialized gas blending and carbonation systems that can handle both CO2 and Nitrogen simultaneously with high accuracy. These systems, often integrated into modern commercial carbonators, represent a technological evolution aimed at capturing the rapidly diversifying drink menu market in commercial settings. The ability of an automatic carbonator to be easily configured for varying gas mixtures without extensive retooling is becoming a key purchase criterion for the hospitality sector, demonstrating the market's continuous responsiveness to dynamic consumption trends.

The detailed analysis confirms that the Automatic Carbonator Market is robust and technologically mature, yet highly adaptable to contemporary pressures for sustainability, operational intelligence, and consumer customization. The interplay between industrial demand for efficiency and residential demand for convenience is propelling innovation across all segments, ensuring sustained market expansion throughout the forecast period and cementing the carbonator’s role as indispensable technology in global beverage production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager