Automatic Charging Relay Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438620 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automatic Charging Relay Market Size

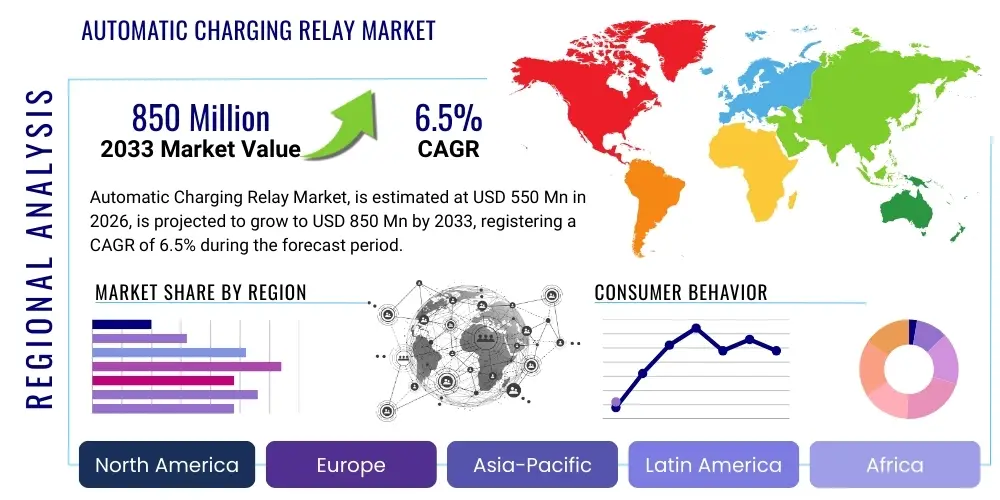

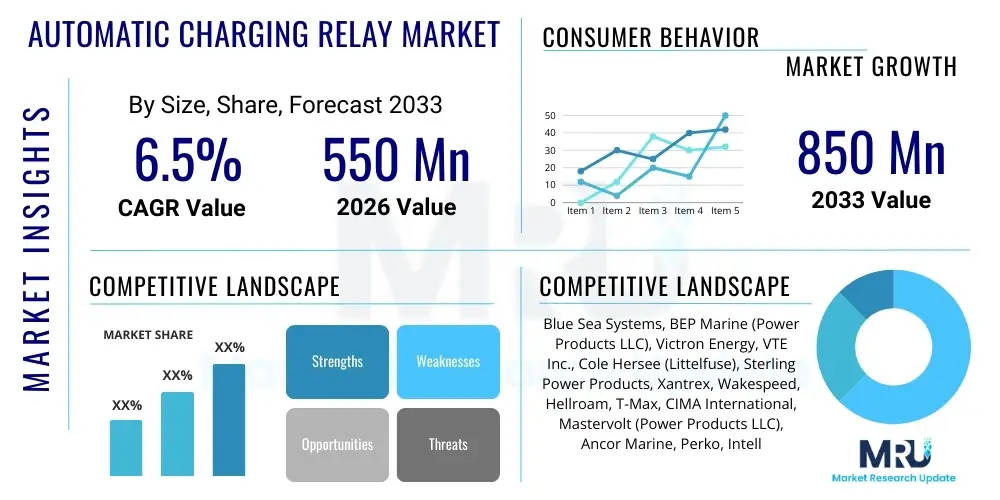

The Automatic Charging Relay Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 550 million in 2026 and is projected to reach USD 850 million by the end of the forecast period in 2033. This consistent growth is primarily fueled by the increasing production and adoption of recreational vehicles (RVs), marine vessels, and specialty vehicles which fundamentally rely on robust, multi-battery management systems for reliable auxiliary power supply and efficient charging management.

Automatic Charging Relay Market introduction

The Automatic Charging Relay (ACR), often referred to as a battery combiner or voltage sensitive relay (VSR), is a critical component designed to automatically manage the charging of two or more battery banks from a single charging source, such as an alternator or battery charger. ACRs ensure that when the charging source is active and the voltage reaches a specified threshold, the auxiliary battery is connected to the primary battery to receive charge. This prevents the primary battery (typically the starting battery) from being drained by auxiliary loads, ensuring dedicated power for essential functions.

Major applications of ACRs span across the recreational, commercial, and utility sectors, including marine leisure craft, heavy-duty trucks, emergency response vehicles (ambulances, fire trucks), and various off-grid solar or mobile power installations. The underlying principle is enhanced power reliability and system longevity. By intelligently isolating and combining battery banks based on real-time voltage sensing, ACRs eliminate the manual switching complexities associated with traditional battery selector switches, thereby reducing the risk of human error and optimizing power delivery efficiency across demanding operational environments.

Key benefits driving the adoption of ACRs include improved battery life due to optimized charging cycles, guaranteed starting power protection, simplified wiring configurations, and compliance with modern safety standards requiring distinct battery systems. Driving factors encompass the global expansion of the leisure boating industry, increasing demand for sophisticated power management in specialty transportation, and technological advancements leading to more durable, high-amperage, and microprocessor-controlled relay designs capable of handling diverse charging chemistries like Lithium-ion batteries.

Automatic Charging Relay Market Executive Summary

The Automatic Charging Relay market is characterized by robust growth, driven primarily by strong business trends in marine and RV manufacturing sectors globally, coupled with advancements in battery technology necessitating precise charging coordination. Technological evolution is favoring solid-state and microprocessor-controlled ACRs over traditional solenoid-based models, offering faster response times, higher efficiency, and compatibility with diverse battery chemisties, including high-density Lithium iron phosphate (LiFePO4) batteries. Strategic collaborations between relay manufacturers and major vehicle original equipment manufacturers (OEMs) are crucial for market penetration, focusing on integrated system solutions for complex electrical architectures found in modern vehicles and vessels.

Regionally, North America maintains market dominance due to high per capita ownership of RVs and marine craft, coupled with rigorous safety and electrical standards demanding certified battery isolation devices. The Asia Pacific region, however, is projected to exhibit the highest growth rate, fueled by rapid urbanization, increased investment in utility and emergency vehicle fleets, and growing interest in recreational activities, particularly in countries like Australia and China. European markets show stable demand, driven by stringent environmental regulations encouraging efficient power use and the expansion of the high-end yacht and specialized commercial vessel industries. Demand fluctuation is closely tied to global economic conditions affecting consumer disposable income for recreational purchases.

Segmentation trends highlight the increasing preference for high-amperage ACRs (200A and above) to support larger auxiliary battery banks and higher power draws from sophisticated onboard electronics. Furthermore, voltage segmentation indicates steady demand across 12V and 24V systems, although the integration of these devices into increasingly common 48V mild-hybrid systems is emerging as a niche growth area. The end-user segment remains dominated by the Marine sector, but the RV/Caravan segment is showing accelerated adoption rates, emphasizing the need for compact, thermally resilient, and fully automated battery management solutions.

AI Impact Analysis on Automatic Charging Relay Market

User queries regarding the impact of Artificial Intelligence on the Automatic Charging Relay market frequently center on whether AI will automate power management to the extent that traditional hardware relays become obsolete, or if AI can optimize charging algorithms for predictive battery health management. Key concerns also address the integration cost and reliability of AI-driven systems in harsh environments (marine, heavy-duty applications). The consensus suggests that while AI will not replace the fundamental relay hardware necessary for physical circuit breaking and battery isolation, it is poised to revolutionize the intelligence layer surrounding ACRs. AI’s primary influence will be through advanced Battery Management Systems (BMS) that utilize machine learning to predict load demands, analyze charging efficiency, and dynamically adjust relay engagement thresholds based on environmental factors and historical usage patterns, thereby maximizing battery longevity and system reliability far beyond what current voltage-sensing relays can achieve.

- AI integration enhances predictive maintenance capabilities, forecasting potential battery failure or relay overheating by analyzing historical current and voltage data patterns.

- Machine learning algorithms optimize charge routing and prioritization based on real-time auxiliary load requirements and starting battery health, increasing energy efficiency.

- AI-driven BMS can dynamically adjust cut-in/cut-out voltages of ACRs based on specific battery chemistries (e.g., LiFePO4 vs. AGM) and temperature fluctuations, improving charging precision.

- Increased demand for smart, network-enabled ACRs capable of transmitting performance data to centralized vehicle or vessel management systems for AI processing.

- AI assists in standardizing diagnostic processes for complex multi-bank systems, reducing maintenance time and improving fault isolation accuracy.

- Development of self-learning power distribution modules that incorporate ACR functions, allowing the system to adapt its power strategy to evolving usage profiles without manual reprogramming.

DRO & Impact Forces Of Automatic Charging Relay Market

The dynamics of the Automatic Charging Relay market are shaped by a complex interplay of growth drivers, functional restraints, and significant opportunities, all subjected to macro-environmental impact forces. The core driver is the robust expansion of the global leisure and specialty vehicle industries, particularly marine and RV sectors, which rely intrinsically on multi-battery setups for safe and reliable operation. This is compounded by regulatory mandates in many regions, especially pertaining to commercial vehicles and marine vessels, which require isolated starting circuits and auxiliary power redundancy. Furthermore, the rapid penetration of high-draw electronic accessories, navigation equipment, and sophisticated entertainment systems in these applications necessitates higher amperage ACRs and more intelligent power distribution, consistently pushing the market forward.

However, the market faces significant restraints. One major limitation is the inherent complexity associated with installing and troubleshooting sophisticated multi-bank battery systems, often requiring specialized technicians, which can deter DIY enthusiasts or smaller volume manufacturers. Price sensitivity remains a challenge, particularly in cost-competitive commercial vehicle markets where cheaper, less reliable solenoid-based alternatives might still be favored over advanced, solid-state ACRs. Moreover, the increasing adoption of integrated, highly centralized battery management systems (BMS) in advanced electric and hybrid vehicles could potentially absorb the functions of discrete ACRs, leading to a shift in product design and procurement channels.

Opportunities for growth are concentrated in the transition to advanced battery technologies, specifically Lithium-ion, which require precise voltage monitoring and rapid disengagement capabilities—areas where high-end ACRs excel. The expanding off-grid power sector, including remote telecommunications sites and solar installations, presents a lucrative market for high-current, robust ACRs designed for continuous cycle management. Impact forces such as environmental regulations (e.g., IMO, EPA standards for marine engines) indirectly drive the need for more efficient electrical systems, while ongoing supply chain disruptions, particularly regarding semiconductor components required for solid-state relays, pose continuous operational risks impacting production costs and timelines.

Segmentation Analysis

The Automatic Charging Relay market is meticulously segmented based on key functional and application parameters, providing a clear view of demand dynamics across various industries. Segmentation by Current Rating reveals a dominant share held by low-to-medium amperage relays (under 100A and 100A-200A), traditionally utilized in smaller recreational boats and standard RVs. However, the fastest-growing segment is high-amperage relays (200A and above), driven by the demand for sophisticated, power-intensive applications in large yachts, luxury RVs, and heavy-duty utility vehicles requiring substantial auxiliary power banks to run air conditioning, complex navigation systems, and dedicated onboard amenities.

Voltage segmentation focuses predominantly on 12V and 24V systems, which form the bedrock of automotive and marine electrical standards globally. While 12V systems command the largest volume due to prevalence in standard automotive and small-to-midsize leisure craft, 24V systems maintain strong traction in commercial trucking, heavy machinery, and larger marine vessels where higher voltage reduces current requirements and wiring weight. Emerging market interest is noted in 48V systems, primarily associated with mild-hybrid vehicle architectures and high-capacity off-grid power solutions, indicating a future trend toward higher operational voltages requiring specialized ACR adaptations.

The End-Use application segmentation clearly highlights the Marine sector as the leading consumer, necessitating robust, weather-resistant ACRs for safety and reliability at sea. The RV/Caravan segment is the second largest, experiencing rapid growth alongside the leisure travel trend. Specialty vehicles, encompassing ambulances, utility service trucks, and fire apparatus, represent a high-value, stringent quality requirement segment where power failure is unacceptable, driving demand for top-tier, fail-safe solid-state relays.

- By Current Rating:

- Under 100 Amperes (A)

- 100A – 200A

- Above 200A

- By Operating Voltage:

- 12 Volt Systems

- 24 Volt Systems

- 48 Volt Systems and Above

- By Type:

- Solenoid-Based Relays (Electro-Mechanical)

- Solid-State Relays (SSR)

- Microprocessor-Controlled Relays (VSR)

- By Application/End-Use:

- Marine Vessels (Leisure and Commercial)

- Recreational Vehicles (RVs) and Caravans

- Specialty and Emergency Vehicles

- Utility and Off-Grid Power Systems

Value Chain Analysis For Automatic Charging Relay Market

The value chain for the Automatic Charging Relay market begins with upstream activities, primarily involving the procurement of essential raw materials and electronic components. This includes high-conductivity metals (copper, silver alloys) for contacts in mechanical relays, specialized plastics and resins for housing insulation, and crucially, semiconductor components, microprocessors, and sensor ICs for advanced solid-state and VSR models. Suppliers of these core components, particularly semiconductor vendors, hold significant influence over production costs and lead times. Manufacturing and assembly follow, requiring precision engineering to ensure contact integrity, thermal management, and reliable operation in harsh environments, often involving specialized automated assembly lines and rigorous quality control testing compliant with marine and automotive standards.

Downstream analysis focuses heavily on distribution and market penetration. Given the specialized nature of ACRs, distribution is frequently channeled through specialized marine and RV electrical component distributors, often coupled with direct sales relationships with major Original Equipment Manufacturers (OEMs) in the marine and recreational vehicle sectors. The indirect channel also involves aftermarket parts retailers and online marketplaces catering to the vast global network of vehicle and vessel owners seeking upgrades or replacements. Success in downstream operations relies on efficient logistics, inventory management tailored to seasonal fluctuations in the recreational industry, and effective technical support for complex installations.

Direct sales are prevalent for large volume OEM contracts, ensuring customized specifications and just-in-time delivery integrated into the vehicle assembly process. Indirect channels leverage wholesale distributors who carry diverse product lines, offering accessibility to smaller boat builders, custom vehicle modifiers, and the end-consumer DIY market. The role of technical documentation, compliance certifications (e.g., CE, ABYC, ISO), and robust warranty support are critical checkpoints throughout the value chain, ensuring product reliability and supporting the premium pricing often associated with high-quality, high-amperage ACR solutions.

Automatic Charging Relay Market Potential Customers

Potential customers for Automatic Charging Relays represent diverse segments unified by the need for robust, isolated multi-battery power management. The primary end-users are Original Equipment Manufacturers (OEMs) specializing in vehicle and vessel manufacturing, including builders of fiberglass yachts, aluminum fishing boats, luxury motorhomes, and travel trailers. These customers require high volumes of customized ACRs integrated directly into their electrical schematics during the production phase, prioritizing durability, compact size, and compliance with stringent operational safety standards relevant to their specific industry (e.g., ABYC standards for marine use).

A second major customer group encompasses fleet operators and government agencies utilizing specialty vehicles. This includes municipal fire departments, ambulance services, utility companies operating aerial bucket trucks, and military or law enforcement agencies. For these professional users, the ACR is a mission-critical component ensuring communication systems, lighting, and specialized hydraulic equipment remain functional without risking the vehicle’s starting capability. Their purchasing criteria emphasize long lifespan, maintenance simplicity, and certification for extreme temperature and vibration resistance.

The aftermarket consumer and service industry forms the third critical segment. This group consists of independent marine and automotive repair shops, custom vehicle integrators, and individual consumers (DIY boaters, RV enthusiasts) looking to upgrade existing electrical systems, add auxiliary battery banks for expanded power usage, or replace failed units. These buyers are often influenced by brand reputation, ease of installation, and compatibility with the latest high-performance battery chemistries, driving demand for user-friendly, feature-rich ACR models with integrated diagnostic features and simple wiring interfaces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blue Sea Systems, BEP Marine (Power Products LLC), Victron Energy, VTE Inc., Cole Hersee (Littelfuse), Sterling Power Products, Xantrex, Wakespeed, Hellroam, T-Max, CIMA International, Mastervolt (Power Products LLC), Ancor Marine, Perko, Intellitec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Charging Relay Market Key Technology Landscape

The technological landscape of the Automatic Charging Relay market is undergoing a significant transition from electro-mechanical solenoids towards intelligent, solid-state, and microprocessor-controlled devices. Traditional solenoid-based relays rely on basic electromagnetic activation, offering robust but relatively slow switching capabilities, prone to arc welding under extreme high-current loads, and sensitive to vibration and moisture. While they remain cost-effective and utilized in entry-level applications, their limitations, especially with modern battery chemistries like Lithium-ion which require extremely precise charging windows, are accelerating the shift towards advanced alternatives.

The primary technological advancement is the widespread adoption of Voltage Sensitive Relays (VSRs), which incorporate a microprocessor to monitor battery voltage with superior precision. These VSRs enable accurate, rapid switching based on user-defined or factory-optimized voltage thresholds, ensuring that charging is initiated only when the source battery is fully replenished and disengaged instantly to prevent reverse current flow or equalization issues. Further evolution includes the integration of MOSFET technology to create solid-state ACRs, which offer silent operation, exceptionally fast switching speeds, zero wear and tear due to the absence of mechanical contacts, and superior heat dissipation, making them ideal for high-amperage, continuous duty cycles in demanding marine or commercial environments.

The future technology trajectory involves advanced communication protocols (such as CAN bus integration) within ACRs, allowing them to communicate directly with external Battery Management Systems (BMS), alternators, and charging sources. This integration facilitates holistic system management, where the ACR functions as an intelligent hub rather than a standalone component, enabling real-time diagnostics, load balancing, and remote monitoring capabilities. Furthermore, manufacturers are focusing on miniaturization, enhanced thermal protection, and developing standardized IP ratings (e.g., IP67/IP68) to ensure maximum reliability and longevity when exposed to extreme marine and vehicle conditions.

Regional Highlights

Regional dynamics play a critical role in shaping the Automatic Charging Relay market, reflecting localized demand trends, regulatory environments, and recreational vehicle ownership rates.

- North America: This region holds the largest market share due to the high volume of recreational boating and RV ownership, extensive use of specialty and emergency vehicles, and the presence of major industry players and sophisticated distribution networks. Strict adherence to safety standards, such as those set by the American Boat and Yacht Council (ABYC), mandates the use of reliable battery isolation components, driving consistent high demand, particularly for high-amperage, advanced VSRs and solid-state models.

- Europe: The European market demonstrates steady growth, driven by a strong, luxury yacht manufacturing sector (particularly in countries like Italy and Germany) and a mature commercial transportation market. Demand is highly focused on quality and compliance with CE directives and environmental efficiency standards. Northern European countries also exhibit significant demand for high-end battery combiners used in off-grid cabins and heavy-duty industrial vehicles.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This acceleration is fueled by increasing disposable incomes leading to greater participation in leisure activities (boating, camping), rapid infrastructure development necessitating large specialty vehicle fleets, and growing indigenous manufacturing of RVs and marine craft in countries like China, Japan, and Australia. Market growth here is increasingly focused on finding a balance between cost-effectiveness and reliable performance.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging markets characterized by sporadic demand driven by specialized industrial applications, resource extraction vehicles, and niche marine sectors. Growth is contingent on economic stability and increased investment in infrastructure projects, leading to higher procurement of utility and heavy-duty commercial vehicles which require robust multi-battery systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Charging Relay Market.- Blue Sea Systems

- BEP Marine (Power Products LLC)

- Victron Energy

- VTE Inc.

- Cole Hersee (Littelfuse)

- Sterling Power Products

- Xantrex

- Wakespeed

- Hellroam

- T-Max

- CIMA International

- Mastervolt (Power Products LLC)

- Ancor Marine

- Perko

- Intellitec

- Newmar Power

- Hubbell Marine

- Sure Power Industries (Eaton)

- Kisae Technology

- Samlex America

Frequently Asked Questions

Analyze common user questions about the Automatic Charging Relay market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a VSR and a traditional battery isolator?

A Voltage Sensitive Relay (VSR) automatically connects battery banks for charging based on real-time voltage detection, providing simultaneous charging without manual intervention. Conversely, a traditional diode-based battery isolator uses diodes to prevent backflow but often causes a voltage drop, leading to less efficient charging compared to the near-zero resistance offered by an advanced ACR or VSR.

How are Automatic Charging Relays adapting to the integration of Lithium-ion batteries?

ACRs are adapting through specialized microprocessor controls designed to handle the higher and narrower charging voltage windows of Lithium-ion (LiFePO4) batteries. Advanced ACRs feature programmable voltage set points and rapid disconnection capabilities necessary to prevent overcharging or reverse current flow, which can severely damage sensitive lithium cells, ensuring safer and optimized charging.

What are the key advantages of solid-state ACRs over electro-mechanical solenoid types?

Solid-state ACRs offer significant advantages including zero moving parts, resulting in silent operation, greater lifespan, and immunity to mechanical wear and tear. They provide extremely fast, precise switching and are superior in handling high-amperage continuous duty cycles and harsh vibration environments compared to traditional electro-mechanical solenoids which are susceptible to contact wear and heat generation.

Which end-user segment drives the highest demand for Automatic Charging Relays globally?

The Marine Vessels segment consistently drives the highest demand globally for Automatic Charging Relays (ACRs). This is due to the critical need for isolated starting battery power and robust auxiliary power systems for navigation, safety, and comfort on boats and yachts, often mandated by maritime safety regulations requiring reliable power redundancy.

Will the adoption of centralized Battery Management Systems (BMS) make discrete ACRs obsolete?

While highly integrated BMS units may absorb charging management functions in future electric vehicle platforms, discrete ACRs are unlikely to become obsolete in marine, RV, and specialty vehicle retrofit markets. They remain vital for simpler, retrofit multi-battery installations and as essential, localized, high-current switching hardware for physical circuit isolation, even in smart systems.

The continuous evolution in recreational habits and the increasing power demands of onboard electronics confirm the sustained relevance of high-quality Automatic Charging Relays. Manufacturers are consistently innovating, moving toward highly efficient, durable, and smart solutions that integrate seamlessly with modern vehicle and vessel control systems. The shift towards higher voltage architectures and the necessity for precise charging of advanced battery chemistries present significant market opportunities, particularly within the commercial and utility sectors where system reliability is paramount. The North American market maintains its dominance due to established consumer bases, while Asia Pacific rapidly emerges as a key growth engine, indicating a balanced global demand trajectory.

Further analysis of competitive strategies reveals that differentiation is achieved primarily through technology—focusing on IP ratings, current handling capacity, and specialized software integration rather than purely on price. Companies investing heavily in research and development of robust solid-state technology are positioned to capture greater market share, especially in applications requiring fail-safe performance under extreme conditions. Regulatory alignment, particularly in the marine sector, provides a stable underpinning for mandatory product specifications, ensuring a baseline requirement for certified ACR installation across new vessel construction worldwide. These factors solidify the market's trajectory toward smarter, more reliable, and technologically advanced battery management hardware.

Economic indicators, such as global GDP growth and consumer spending on leisure activities, remain critical variables influencing market size, as the ACR market is closely tied to discretionary purchasing in the marine and RV industries. Despite potential economic slowdowns that might temporarily affect recreational vehicle sales, the essential nature of ACRs in commercial and emergency vehicles provides a degree of resilience. Furthermore, the burgeoning aftermarket for power system upgrades in older fleets offers a sustained revenue stream. Successful market participants must therefore maintain diversified product portfolios catering to both OEM volume contracts and high-margin, specialized aftermarket requirements.

The increasing complexity of power systems necessitates that manufacturers provide not only the hardware but comprehensive installation guides and technical support, leveraging digital platforms for training and diagnostics. This service component is becoming a non-price differentiator, especially as complex solid-state relays require specific configuration based on the type of alternator or battery chemistry used. Addressing this need for specialized knowledge will be crucial for penetrating new segments and ensuring long-term customer satisfaction and brand loyalty in a highly technical niche market.

Finally, sustainability considerations are beginning to impact product development. Manufacturers are exploring the use of recyclable materials and designing ACRs for enhanced energy efficiency, minimizing power draw during idle states. Although not yet a primary purchasing criterion, sustainability will increasingly influence procurement decisions, particularly among large OEMs targeting environmentally conscious consumers. Future regulatory pressures related to electronic waste and material sourcing are expected to further drive innovation in green manufacturing practices within the Automatic Charging Relay sector, shaping long-term product lifecycle management strategies.

The market faces structural challenges related to the global availability and cost stability of crucial semiconductor components, essential for modern VSR and solid-state products. Geopolitical tensions affecting critical supply chains require manufacturers to diversify sourcing strategies and potentially increase localized production capacity, mitigating reliance on single geographical regions. This operational hurdle introduces complexity in cost management and requires forward planning to secure component supply necessary to meet escalating demand from the rapidly expanding specialty vehicle segment.

Investment trends highlight a focus on acquiring or partnering with companies that possess expertise in advanced power electronics and communication protocols. This strategy allows traditional relay manufacturers to rapidly integrate smart features, such as CAN bus integration and wireless monitoring capabilities, positioning their products favorably against integrated BMS solutions. These strategic moves are essential for maintaining competitive edge, especially as vehicle platforms transition towards higher degrees of electrical architecture centralization and require components that can seamlessly interact within a network environment.

In terms of specific product advancements, there is noticeable effort dedicated to improving the thermal management capabilities of high-amperage solid-state relays. As current ratings climb above 300A for large commercial and marine applications, dissipating heat effectively without compromising compact form factors becomes paramount. Innovations in heat sink design, material science for conductive components, and internal sensor placement are critical areas of focus to ensure these high-capacity ACRs maintain their reliability and longevity under continuous peak load conditions, which is a vital requirement for the heavy-duty sector.

Furthermore, consumer education regarding the proper use and sizing of ACRs remains a persistent hurdle. Incorrect sizing—either undersizing the relay capacity relative to the charging source or oversizing, leading to unnecessary cost—is common, especially in the aftermarket segment. Market leaders are addressing this by developing user-friendly selection tools and providing clear, application-specific documentation, leveraging digital channels to deliver technical assistance, thereby reducing installation errors and improving overall system performance and customer satisfaction metrics.

The regulatory environment continues to evolve, especially concerning fire safety and battery standards, particularly in passenger transport and marine environments. Compliance with stringent fire codes often dictates the materials used in ACR housing and the requirement for specific certifications, such as UL or CE marking, to gain access to premium markets. Manufacturers must proactively participate in standards development to ensure their product roadmaps align with future legislative requirements, avoiding costly redesigns and delays in product launch, particularly in the highly regulated European and North American markets.

Market saturation is a concern in mature segments, leading companies to seek growth through geographical expansion into emerging markets, such as Southeast Asia and Eastern Europe, or through diversification into adjacent product categories like integrated power distribution panels that include ACR functionality. This diversification strategy provides OEMs with simplified procurement and installation processes, offering a complete, pre-wired solution rather than individual components, reflecting a trend toward system-level sales over component sales in the high-end vehicle market.

Finally, the growing trend of vehicle electrification, while initially posing a threat due to centralized BMS, also presents an opportunity. As auxiliary 12V or 24V systems persist in hybrid and electric vehicles for powering essential components, specialized, high-reliability ACRs are required to manage the charge from DC-DC converters to the auxiliary battery bank. These highly technical, specialized applications demand the highest levels of accuracy and robustness, potentially creating a lucrative, high-barrier-to-entry niche within the broader electrification movement.

To capitalize on the burgeoning off-grid and renewable energy market, ACR manufacturers are developing specialized products optimized for solar charging systems. These relays need to handle potentially irregular charging patterns from solar controllers and integrate seamlessly with complex energy storage systems. The requirement here is for low quiescent current draw, high cycle life, and precise voltage management, differentiating these ACRs from standard marine or automotive versions, thereby opening up a new substantial vertical market for dedicated power management solutions outside traditional vehicle platforms.

The competitive landscape is characterized by a strong presence of established players known for quality and reliability (e.g., Blue Sea Systems, Victron Energy), which set high industry benchmarks. Smaller competitors often focus on cost leadership or highly niche applications. Innovation pace requires continuous monitoring of emerging battery technologies and developing flexible hardware platforms that can be quickly adapted via firmware updates to accommodate new chemistries or charging profiles, ensuring product relevance in a fast-evolving energy storage sector.

Market penetration in the OEM sector relies heavily on long-term supplier agreements and the ability to meet large-scale production requirements while maintaining stringent quality control standards. For smaller manufacturers, securing OEM partnerships can be challenging due to the high barriers to entry related to certification, liability, and production scale. Consequently, these smaller players often concentrate on the high-margin aftermarket and custom integration segments where brand loyalty and immediate availability often outweigh bulk purchasing criteria.

The digital transformation is also influencing the market through the use of simulation tools in the design phase. Manufacturers use advanced modeling techniques to predict thermal performance and electromagnetic compatibility (EMC) of new ACR designs before physical prototyping, significantly accelerating the product development cycle and ensuring compliance with strict electrical standards required for sensitive onboard electronics, thereby enhancing overall product quality and reducing time-to-market.

Future growth will be significantly impacted by the increasing global demand for emergency medical services (EMS) and disaster response vehicles, particularly in developing economies. These vehicles are intrinsically reliant on dedicated, isolated power systems to operate critical life-support and communication equipment. The procurement of ACRs for these fleets is guided by failure rates and certified reliability, leading to consistent demand for the highest-grade, redundancy-enabled solid-state ACRs, providing a stable, non-cyclical revenue stream distinct from the fluctuating recreational market.

The integration of ACRs with inverter/chargers is becoming a standard offering, streamlining power systems. These integrated solutions simplify installation and communication between charging components, improving the overall efficiency of the energy conversion process. Manufacturers offering such pre-configured, cohesive power systems are gaining traction, particularly among RV and custom vessel builders looking for plug-and-play solutions that minimize labor costs and potential wiring errors during assembly.

The market also witnesses subtle price elasticity across segments. While the high-end marine market tolerates premium pricing for robust, certified ACRs, the light-duty RV aftermarket remains highly competitive, often preferring cost-effective solenoid-based units. This bifurcation requires market players to maintain clear product lines targeted specifically at reliability-sensitive professionals and cost-conscious consumers, necessitating distinct marketing and pricing strategies for successful market navigation and optimization of profitability across the entire product spectrum.

Finally, the market must address the rising concern over electromagnetic interference (EMI) generated by high-current switching devices, particularly in close proximity to sensitive navigation and communication electronics. Advanced ACR designs are incorporating enhanced shielding and filtering technologies to meet increasingly stringent EMI/EMC standards, ensuring operational integrity of connected systems, a critical requirement for military, aviation, and high-end marine applications where signal clarity is non-negotiable for safety.

The emphasis on ruggedization and thermal performance is further amplified by the expansion into extreme climate applications, such as heavy machinery operating in arctic environments or utility vehicles deployed in desert conditions. ACRs designed for these environments must withstand extreme temperature swings and high levels of ingress protection (IP ratings), driving innovation in sealing technologies and material selection to guarantee flawless operation regardless of external environmental severity. This resilience factor becomes a core selling point in industrial and military procurement processes.

Technological advancement is not limited to switching speed; it also includes sophisticated fault detection and isolation capabilities. Modern ACRs are increasingly featuring built-in diagnostics that can communicate fault codes or overheating warnings to the operator via connected displays or mobile applications. This enhanced capability significantly reduces troubleshooting time and improves preventative maintenance schedules, thereby maximizing uptime for both recreational users and commercial fleet managers, adding substantial long-term value beyond the initial hardware function.

The evolving regulatory landscape around battery transportation and usage, including safety protocols for large Lithium battery banks, indirectly boosts the ACR market. Regulations often mandate the physical isolation of auxiliary power sources, thereby ensuring that certified ACRs remain a foundational component for compliance. Manufacturers who can quickly secure and advertise certifications specific to new battery transport and installation standards gain a competitive advantage in a compliance-driven industry.

In summary, the Automatic Charging Relay market is defined by continuous technical refinement, driven by the shift towards high-efficiency battery chemistries and the demand for absolute power system reliability across critical applications. Strategic focus remains on smart integration, thermal resilience, and expanding the product portfolio to cater to the diverging needs of the high-volume recreational sector and the high-specification commercial and specialty vehicle market, securing sustained growth through the forecast period.

The increasing complexity of power systems in modern vessels and vehicles necessitates standardized wiring harnesses and installation templates provided by ACR manufacturers. This effort aims to simplify the process for OEMs and aftermarket installers, reducing the likelihood of incorrect connections that could lead to system failure or compromised safety. Standardization contributes significantly to reducing labor costs and warranty claims, positioning the manufacturers who offer comprehensive system solutions favorably within the competitive environment.

The market for replacement parts and repair services represents a stable segment, given the lifespan of vehicles and vessels often exceeding the operational life of the original electrical components. Offering easily replaceable components, comprehensive service manuals, and robust dealer networks for maintenance ensures continued revenue from the installed base, irrespective of new vehicle sales cycles. This focus on post-sale support enhances brand reputation and customer loyalty, particularly important in the often rugged and remote usage environments of marine and RV applications.

Digitalization in manufacturing processes, including the implementation of Industry 4.0 technologies, allows key players to achieve greater precision in component assembly, especially for sensitive solid-state components. High-precision manufacturing ensures consistency in product quality, minimized defects, and better long-term reliability, which are crucial factors when competing for high-value contracts where performance guarantees are non-negotiable. Investment in advanced robotics and automated testing validates the high operational standards required by military and emergency services buyers.

Finally, the growth of shared mobility and rental services in the RV and marine sectors also contributes to market demand. Rental fleets require highly durable and tamper-proof power systems due to intensive use and varying operator experience. ACRs, by automating the battery management process and protecting the critical starting battery, are essential components in these high-utilization environments, guaranteeing system availability and minimizing operational downtime for fleet owners, thereby confirming a consistent, non-cyclical purchase driver.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager