Automatic Climbing System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440003 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Automatic Climbing System Market Size

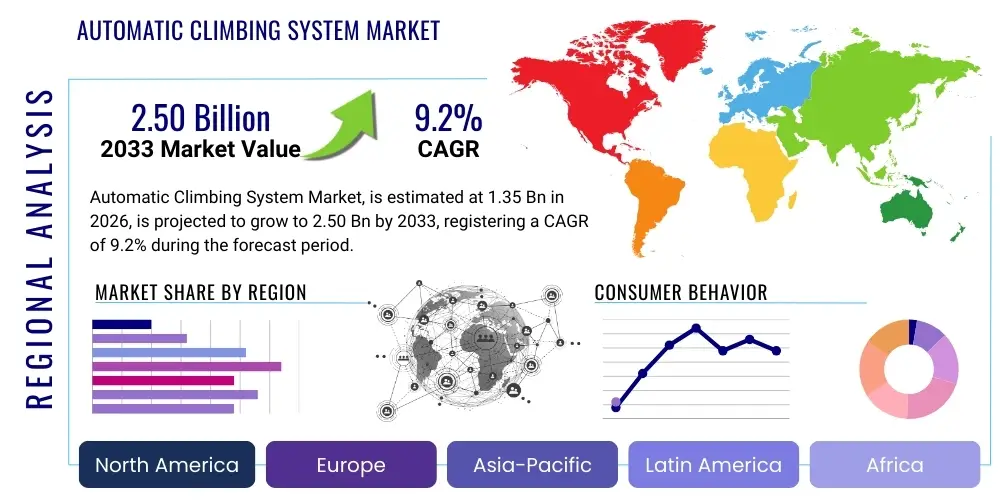

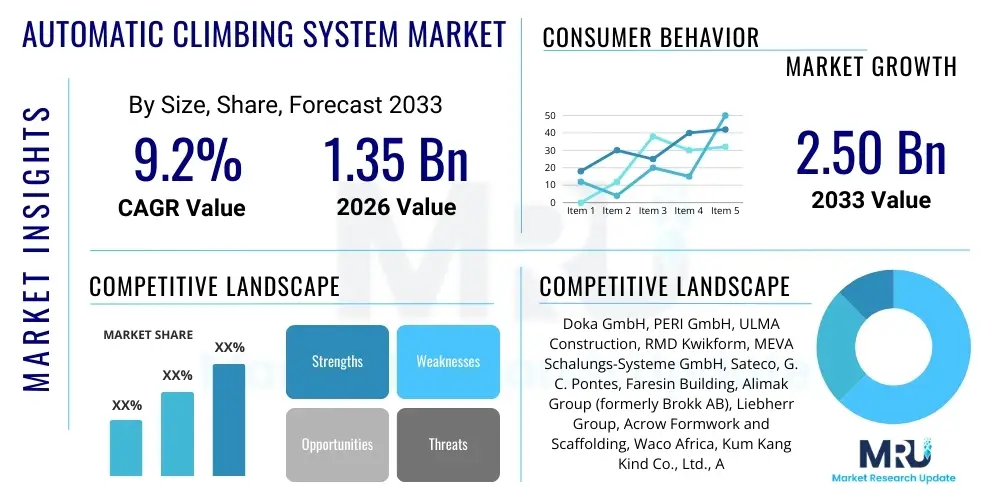

The Automatic Climbing System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.50 Billion by the end of the forecast period in 2033.

Automatic Climbing System Market introduction

The Automatic Climbing System Market encompasses advanced technological solutions designed to enhance safety, efficiency, and speed in high-rise construction and infrastructure projects. These systems provide a self-contained, integrated platform that climbs independently, eliminating the need for cranes to reposition formwork, scaffolding, or protection screens during the construction of tall structures. By automating the vertical movement of these essential construction elements, automatic climbing systems significantly reduce project timelines, mitigate labor costs, and improve worker safety by offering enclosed working environments and stable platforms at elevated heights. They represent a critical evolution in modern construction methodologies, moving away from traditional, labor-intensive manual handling processes towards more streamlined and technologically driven operations.

Product descriptions within this market typically include hydraulic climbing systems, rail-guided systems, and cable-based solutions, each tailored for specific structural requirements and project complexities. Hydraulic systems, for instance, utilize powerful cylinders to lift entire sections of formwork, while rail-guided systems offer precision and stability for vertical concrete pours. Major applications span a wide spectrum, from residential skyscrapers and commercial high-rises to complex industrial facilities, bridges, and dam construction. The versatility of these systems allows them to adapt to varying building geometries and construction sequences, making them indispensable for large-scale urban development and critical infrastructure projects worldwide.

The primary benefits derived from the adoption of automatic climbing systems are multifaceted. They include substantial improvements in construction site safety by reducing exposure to falls and other hazards associated with manual crane operations, enhanced operational efficiency through faster cycle times and reduced reliance on external lifting equipment, and superior concrete quality due to consistent pouring conditions. Furthermore, these systems contribute to cost savings by optimizing labor deployment and accelerating project completion, thereby reducing overall project expenditures. Driving factors for market growth are largely attributed to the global boom in high-rise construction, stringent safety regulations mandating safer working practices, increasing demand for faster project delivery, and the continuous technological advancements in automation and material science within the construction industry. The imperative to build higher, faster, and safer structures is propelling the widespread acceptance and integration of automatic climbing systems.

Automatic Climbing System Market Executive Summary

The Automatic Climbing System Market is experiencing robust growth, primarily driven by transformative business trends within the global construction sector. A significant trend involves the increasing adoption of modular and prefabrication techniques, which seamlessly integrate with automatic climbing systems to streamline construction processes and enhance overall project efficiency. Furthermore, the market is witnessing a strong shift towards digitalization, with Building Information Modeling (BIM) and digital twin technologies being increasingly employed to design, plan, and execute projects utilizing these systems, optimizing material usage, resource allocation, and real-time progress monitoring. Environmental sustainability is also emerging as a key business imperative, pushing developers and contractors to invest in systems that reduce waste, optimize energy consumption, and minimize environmental footprint, areas where advanced climbing systems can contribute through efficiency gains.

Regionally, the market exhibits varied growth dynamics. Asia Pacific, particularly China and India, stands out as a dominant force due to rapid urbanization, extensive infrastructure development projects, and a surge in high-rise building construction. North America and Europe demonstrate a mature yet consistently growing market, driven by stringent safety standards, a focus on labor efficiency, and continuous investment in innovative construction technologies for both new builds and retrofitting projects. Latin America, the Middle East, and Africa are showing promising potential, fueled by ambitious urban development plans, economic diversification initiatives, and increasing foreign direct investment in large-scale construction ventures. Each region presents unique opportunities and challenges, requiring tailored market entry strategies and localized product offerings to cater to specific regulatory environments and construction practices.

In terms of segment trends, the market is broadly segmented by type, system component, application, and end-use. The hydraulic climbing system segment continues to hold a substantial share due to its proven reliability and adaptability across diverse construction projects. However, cable-based and rail-guided systems are gaining traction for specialized applications requiring high precision and speed. The self-climbing formwork and self-climbing scaffolding segments are pivotal, driven by the core necessity for efficient concrete pouring and safe access solutions at height. Application-wise, commercial and residential high-rise buildings remain primary drivers, with significant growth observed in infrastructure projects such as bridges, tunnels, and dams. The convergence of these trends underscores a market that is not only expanding in volume but also evolving in sophistication and technological integration, catering to the multifaceted demands of modern construction.

AI Impact Analysis on Automatic Climbing System Market

The integration of Artificial Intelligence (AI) within the Automatic Climbing System Market is a topic of significant user interest, primarily centered around its potential to revolutionize operational efficiency, safety protocols, and predictive maintenance. Common questions revolve around how AI can enhance the autonomy of these systems, whether it can optimize climbing sequences for faster project completion, and its role in real-time structural monitoring to prevent failures. Users are particularly keen to understand AI's capability in processing vast amounts of sensor data to anticipate maintenance needs, detect anomalies, and adapt to changing environmental conditions, thereby minimizing downtime and extending equipment lifespan. There is also considerable expectation regarding AI's contribution to risk management through advanced predictive analytics, simulating various construction scenarios, and providing data-driven insights to mitigate potential hazards before they occur. The overarching theme is a desire for more intelligent, self-optimizing climbing solutions that reduce human intervention and elevate overall project safety and productivity.

- Enhanced predictive maintenance: AI algorithms analyze sensor data from climbing systems to forecast potential mechanical failures, allowing for proactive maintenance and reducing unexpected downtime.

- Optimized operational efficiency: AI-powered scheduling and path planning can determine the most efficient climbing sequences, minimizing cycle times and accelerating construction progress.

- Real-time safety monitoring: AI vision systems and sensor fusion can monitor working conditions, detect unsafe practices, and identify structural integrity issues in real-time, alerting operators to potential hazards.

- Autonomous system control: Future systems could leverage AI for more autonomous operations, where the climbing system makes intelligent decisions based on site conditions, weather, and construction progress.

- Improved resource management: AI can optimize the allocation of materials and labor by integrating climbing system data with overall project management software, ensuring resources are available precisely when needed.

- Adaptive system performance: AI enables climbing systems to adapt their performance parameters, such as climbing speed and hydraulic pressure, dynamically based on real-time load, wind conditions, and concrete curing rates.

- Data-driven design and customization: AI can analyze historical project data to inform the design of more robust, efficient, and customized climbing solutions for future projects, catering to specific architectural and engineering requirements.

DRO & Impact Forces Of Automatic Climbing System Market

The Automatic Climbing System Market is profoundly shaped by a confluence of drivers, restraints, opportunities, and inherent impact forces. Key drivers include the escalating global demand for high-rise buildings and complex infrastructure, fueled by rapid urbanization and population growth, particularly in developing economies. The pervasive need for faster construction cycles to meet project deadlines, coupled with the rising cost of manual labor and the imperative to enhance on-site safety, further propels the adoption of these automated systems. Stringent government regulations mandating advanced safety protocols and the continuous innovation in construction techniques and materials also act as significant accelerators. These factors collectively push construction firms towards more efficient, safe, and technologically advanced solutions, making automatic climbing systems an indispensable tool for modern construction.

Despite these robust drivers, the market faces several restraining factors. The high initial capital investment required for purchasing and implementing automatic climbing systems presents a considerable barrier, especially for smaller construction companies or those with limited access to financing. The complexity of operating and maintaining these sophisticated systems necessitates a highly skilled workforce, which can be a challenge in regions with labor shortages or insufficient technical training infrastructure. Furthermore, the limited flexibility of some systems to adapt to highly irregular building geometries or smaller-scale projects can restrict their broader application. Concerns regarding downtime during system setup and dismantling, as well as the potential for unforeseen technical glitches, also contribute to market hesitancy.

Opportunities within the market are abundant and promising. The ongoing digital transformation in construction, including the integration of Building Information Modeling (BIM), IoT, and AI, offers avenues for creating smarter, more integrated climbing systems with enhanced capabilities for predictive maintenance and autonomous operation. The expansion into emerging markets, particularly in Africa and Southeast Asia, presents untapped potential as these regions embark on ambitious urbanization and infrastructure development projects. Furthermore, the development of lightweight, modular, and more adaptable climbing systems, alongside the provision of comprehensive rental and leasing options, can address the cost and flexibility concerns of potential users. The growing emphasis on sustainable construction practices and green building certifications also creates opportunities for systems that can contribute to reduced waste and optimized resource utilization, solidifying their long-term market relevance.

Segmentation Analysis

The Automatic Climbing System Market is meticulously segmented across various parameters to provide a comprehensive understanding of its dynamics, addressable markets, and growth trajectories. These segmentations are crucial for stakeholders to identify niche opportunities, tailor product offerings, and formulate effective market strategies. The market can be broadly categorized by type of climbing mechanism, specific system components, end-use applications, and the vertical sectors they serve, each revealing distinct adoption patterns and growth drivers. Understanding these divisions helps in dissecting the market's complexities and predicting future trends, allowing for targeted development and competitive positioning within the diverse landscape of modern construction and infrastructure projects.

- By Type

- Hydraulic Climbing System

- Crane-Independent Climbing System

- Rail-Guided Climbing System

- Cable-Based Climbing System

- Self-Climbing Core Systems

- By System Component

- Self-Climbing Formwork (SCF)

- Self-Climbing Scaffolding (SCS)

- Climbing Protection Screens (CPS)

- Automatic Climbing Platforms

- Climbing Work Platforms

- By Application

- Residential Buildings

- Commercial Buildings (Office Towers, Hotels, Shopping Malls)

- Industrial Structures (Power Plants, Silos)

- Infrastructure Projects (Bridges, Dams, Tunnels, Wind Turbines)

- By End-Use

- Building & Construction

- Energy & Power

- Oil & Gas

- Mining

- Other Heavy Industries

Value Chain Analysis For Automatic Climbing System Market

The value chain for the Automatic Climbing System Market is intricate, beginning with the upstream activities of raw material procurement and component manufacturing. This initial stage involves sourcing high-grade steel, hydraulic components, electrical systems, and advanced control electronics from a network of specialized suppliers. Manufacturers in this segment focus on precision engineering, quality control, and often engage in R&D to develop lightweight yet robust materials and more efficient hydraulic or mechanical systems. Key relationships here are with steel mills, specialized electronics manufacturers, and hydraulic component suppliers, ensuring the foundational quality and performance of the climbing systems. Efficiency in this upstream segment directly impacts the cost-effectiveness and reliability of the final product.

Moving downstream, the value chain encompasses the design, assembly, testing, and distribution of the automatic climbing systems. System integrators and original equipment manufacturers (OEMs) play a crucial role in combining diverse components into a cohesive, functional climbing system. This stage involves sophisticated engineering, software development for automation and control, and rigorous testing to ensure safety and operational compliance. Distribution channels are varied, including direct sales to large construction companies, a network of specialized equipment rental firms, and third-party distributors who provide localized sales, technical support, and after-sales services. The choice of distribution strategy often depends on the manufacturer's global footprint, the specific market demands, and the logistical complexities associated with heavy equipment. Direct sales are common for major projects, while rental fleets cater to smaller or temporary project needs.

The downstream activities extend to the end-users – construction companies, infrastructure developers, and specialized contractors – who acquire and utilize these systems on their project sites. This phase also includes installation, commissioning, operator training, maintenance, and ongoing technical support. Both direct and indirect distribution channels are prevalent. Direct channels involve manufacturers selling directly to end-users, offering customized solutions and comprehensive support packages. Indirect channels involve distributors or rental companies acting as intermediaries, providing a broader reach and often bundling services like logistics, maintenance, and training. The effectiveness of the value chain is ultimately determined by the seamless collaboration between all stakeholders, ensuring that high-quality, reliable, and well-supported automatic climbing systems are delivered to projects, maximizing their benefits in terms of safety, speed, and cost efficiency. After-sales support and ongoing technical assistance are critical for maintaining customer satisfaction and fostering long-term relationships.

Automatic Climbing System Market Potential Customers

Potential customers for the Automatic Climbing System Market primarily comprise entities deeply involved in large-scale construction, infrastructure development, and specialized heavy industrial projects. These end-users are typically characterized by their need for efficient, safe, and accelerated construction methodologies for high-rise or complex structures. Major general contractors and construction companies that undertake ambitious urban development projects, including commercial skyscrapers, luxury residential towers, and mixed-use complexes, represent a core customer base. Their continuous demand for innovative solutions to manage complex concrete pouring schedules and ensure worker safety at extreme heights positions them as primary buyers. These companies often seek to minimize reliance on external lifting equipment, reduce project timelines, and optimize labor resources, making automatic climbing systems a highly attractive investment.

Beyond traditional building construction, significant potential lies within specialized infrastructure developers and engineering procurement and construction (EPC) firms. These customers are engaged in constructing critical infrastructure such as long-span bridges, hydroelectric dams, large industrial silos, power plant structures, and wind turbine towers. For such projects, the ability of automatic climbing systems to manage large-scale concrete pours, provide stable working platforms in challenging environments, and adhere to rigorous safety standards is paramount. The unique demands of these projects, often involving significant heights, complex geometries, and prolonged construction phases, necessitate the precision and reliability offered by these automated systems, positioning them as essential tools for achieving project milestones efficiently and safely.

Furthermore, government agencies and public-sector enterprises involved in urban renewal, public housing initiatives, and national infrastructure programs also emerge as crucial potential customers, either directly or through their contracted partners. As these entities prioritize safety, efficiency, and timely completion of public works, they indirectly drive the demand for advanced construction technologies. Rental companies specializing in heavy construction equipment also constitute a vital segment of potential customers, as they acquire and maintain fleets of automatic climbing systems to lease to a broader range of contractors, including those who may not justify outright purchase. This diversified customer base underscores the widespread applicability and growing importance of automatic climbing systems across various facets of the global construction and engineering landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.50 Billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Doka GmbH, PERI GmbH, ULMA Construction, RMD Kwikform, MEVA Schalungs-Systeme GmbH, Sateco, G. C. Pontes, Faresin Building, Alimak Group (formerly Brokk AB), Liebherr Group, Acrow Formwork and Scaffolding, Waco Africa, Kum Kang Kind Co., Ltd., Alsina Formwork, Zulin Formwork & Scaffolding, Beijing Climb Tech Co., Ltd., JFE Engineering Corporation, Shandong Daming Construction Machinery Co., Ltd., Changli Xiongli Construction Machine Co., Ltd., Peiner Umformtechnik GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Climbing System Market Key Technology Landscape

The Automatic Climbing System Market is characterized by a dynamic and evolving technology landscape, driven by continuous innovation aimed at improving safety, efficiency, and versatility. At the core are advanced hydraulic and mechanical systems, which enable the powerful and precise lifting of heavy formwork, scaffolding, and protection screens. These systems incorporate sophisticated hydraulic pumps, cylinders, and control valves that allow for synchronized and controlled climbing movements, ensuring structural stability and worker safety. Developments in material science have led to the use of high-strength, lightweight steel alloys and composite materials in the construction of climbing frames, reducing the overall weight of the system while maintaining structural integrity and enhancing operational speed.

Furthermore, the integration of advanced sensor technology and sophisticated control electronics is a pivotal aspect of the current technological landscape. Modern automatic climbing systems are equipped with an array of sensors, including inclinometers, load cells, anemometers, and proximity sensors, which provide real-time data on the system's position, load distribution, wind conditions, and surrounding environment. This sensor data is processed by programmable logic controllers (PLCs) or industrial PCs, which execute complex control algorithms to ensure safe and precise climbing operations. The adoption of wireless communication technologies allows for remote monitoring and control, providing operators with critical information and enabling rapid response to any anomalies or changing site conditions, thereby significantly enhancing operational oversight and safety protocols.

Looking ahead, the market is increasingly influenced by the pervasive trend of digitalization and automation. Building Information Modeling (BIM) is widely utilized during the planning and design phases to simulate climbing sequences, optimize system configurations, and detect potential clashes, thereby streamlining the entire construction process. The advent of IoT (Internet of Things) enables seamless connectivity between climbing systems and central monitoring platforms, facilitating data collection for predictive maintenance, performance analysis, and asset management. The burgeoning field of Artificial Intelligence (AI) and machine learning (ML) holds immense promise for developing more autonomous and adaptive climbing systems that can optimize their operations based on real-time site conditions, learn from historical data, and even anticipate maintenance needs, further enhancing efficiency, safety, and reducing human intervention. These technological advancements collectively shape a future where automatic climbing systems are not just automated tools but intelligent partners in modern construction.

Regional Highlights

- North America: A mature market characterized by stringent safety regulations, high labor costs, and a strong emphasis on automation and technological adoption. The United States and Canada are leading in the construction of commercial high-rises and critical infrastructure, driving consistent demand for advanced climbing systems. Focus on reducing project timelines and enhancing worker safety remains paramount.

- Europe: Similar to North America, Europe exhibits a mature market with a high adoption rate of sophisticated climbing technologies, particularly in Germany, the UK, and France. Emphasis on sustainability, energy efficiency in buildings, and strict construction standards fosters innovation. Renovation and retrofitting of existing tall structures also contribute to market demand.

- Asia Pacific (APAC): The fastest-growing region, propelled by rapid urbanization, massive infrastructure development, and a booming construction sector in countries like China, India, and Southeast Asian nations. This region is witnessing an unprecedented scale of high-rise residential and commercial building construction, making it a pivotal market for automatic climbing systems. Lower labor costs in some areas are offset by the sheer volume and speed requirements of projects.

- Latin America: An emerging market with significant growth potential, driven by increasing foreign direct investment in urban development and infrastructure projects, particularly in Brazil, Mexico, and Chile. The region is progressively adopting modern construction techniques to improve efficiency and safety standards, presenting new opportunities for market expansion.

- Middle East and Africa (MEA): Characterized by ambitious mega-projects and rapid urban expansion, especially in the GCC countries (UAE, Saudi Arabia, Qatar) and parts of Africa. Investments in iconic skyscrapers, smart cities, and large-scale commercial developments are substantial. There's a strong focus on advanced construction technologies to achieve architectural marvels and stringent project deadlines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Climbing System Market.- Doka GmbH

- PERI GmbH

- ULMA Construction

- RMD Kwikform

- MEVA Schalungs-Systeme GmbH

- Sateco

- G. C. Pontes

- Faresin Building

- Alimak Group (formerly Brokk AB)

- Liebherr Group

- Acrow Formwork and Scaffolding

- Waco Africa

- Kum Kang Kind Co., Ltd.

- Alsina Formwork

- Zulin Formwork & Scaffolding

- Beijing Climb Tech Co., Ltd.

- JFE Engineering Corporation

- Shandong Daming Construction Machinery Co., Ltd.

- Changli Xiongli Construction Machine Co., Ltd.

- Peiner Umformtechnik GmbH

Frequently Asked Questions

What are the primary benefits of using automatic climbing systems in construction?

Automatic climbing systems offer significant benefits, including enhanced worker safety by reducing exposure to falls, increased construction speed due to faster cycle times and crane independence, and substantial cost savings through optimized labor and accelerated project completion. They also improve concrete quality by providing stable pouring conditions.

How do automatic climbing systems contribute to project efficiency?

These systems boost efficiency by eliminating the need for external cranes to move formwork or scaffolding, allowing for continuous and uninterrupted vertical construction. Their automated nature reduces manual labor requirements and accelerates concrete pouring cycles, leading to faster overall project delivery and better resource utilization.

What types of construction projects commonly utilize automatic climbing systems?

Automatic climbing systems are predominantly used in high-rise construction, including residential towers, commercial skyscrapers, and mixed-use buildings. They are also critical for large-scale infrastructure projects such as bridges, dams, industrial structures (e.g., power plants, silos), and wind turbine towers, where significant vertical construction is required.

What is the role of AI and digitalization in the future of automatic climbing systems?

AI and digitalization are set to revolutionize these systems by enabling predictive maintenance, optimizing climbing sequences, enhancing real-time safety monitoring, and facilitating autonomous operation. Integration with BIM and IoT will lead to smarter, more efficient, and safer construction processes with reduced human intervention and improved decision-making.

What are the main challenges faced by the automatic climbing system market?

Key challenges include the high initial capital investment required for these sophisticated systems, the need for a highly skilled workforce for operation and maintenance, and limitations in adapting to highly complex or irregular building geometries. Additionally, the setup and dismantling times can be a concern for some projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager