Automatic Fish Counting Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434786 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Automatic Fish Counting Machines Market Size

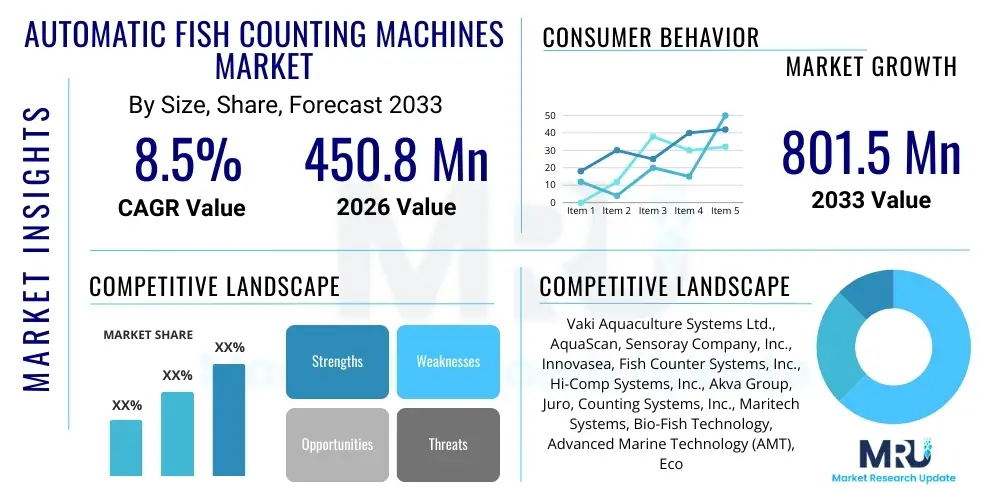

The Automatic Fish Counting Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.8 Million in 2026 and is projected to reach USD 801.5 Million by the end of the forecast period in 2033.

Automatic Fish Counting Machines Market introduction

The Automatic Fish Counting Machines Market encompasses specialized equipment and software systems designed to accurately enumerate fish populations in various controlled and natural environments. These systems are crucial for modern aquaculture, fisheries management, and ecological research, providing non-invasive and high-precision data essential for stock assessment, feeding optimization, and biomass estimation. The technology primarily relies on advanced computer vision, sonar, and acoustic methods, minimizing human error and significantly improving operational efficiency compared to traditional manual counting methods. The core product offering ranges from portable devices used in fish farms for counting smolts and harvest-ready fish to large-scale fixed systems deployed in rivers or hatcheries.

Major applications of automatic fish counting machines include monitoring migrating fish in river systems to ensure conservation and quota adherence, optimizing aquaculture production cycles by accurately calculating stocking density, and facilitating complex research projects focused on aquatic biodiversity and population dynamics. The inherent requirement for precise data in regulatory compliance and sustainable resource management drives the adoption across governmental bodies, private fish farms, and environmental non-governmental organizations. These machines offer substantial benefits, such as reducing labor costs, preventing stress on fish during handling, and providing real-time data streams that integrate seamlessly with broader farm management software systems, thus supporting data-driven decision-making processes.

Key driving factors accelerating the market growth include the global expansion of the aquaculture industry, which demands enhanced productivity and efficiency to meet growing protein consumption. Furthermore, increasing regulatory focus on sustainable fisheries management worldwide necessitates reliable and verifiable methods for estimating wild fish stocks. Technological advancements, particularly in high-definition imaging, deep learning algorithms for species differentiation, and robust underwater sensor technology, have made these counting machines more accurate, reliable, and deployable in challenging environments, cementing their role as indispensable tools for modern aquatic resource management.

Automatic Fish Counting Machines Market Executive Summary

The Automatic Fish Counting Machines Market is undergoing robust expansion, characterized by rapid technological integration and increasing demand from the global aquaculture sector. Key business trends indicate a shift towards systems leveraging Artificial Intelligence (AI) and machine learning to achieve unparalleled accuracy, particularly in distinguishing between species and sizes under suboptimal water conditions. Manufacturers are focusing on developing scalable solutions, ranging from compact, highly portable counters suitable for smaller fish farms to permanently installed, high-throughput systems essential for large hatcheries and research institutions. Strategic partnerships between technology providers and aquaculture consulting firms are emerging as a major competitive factor, aiming to deliver integrated farm management solutions rather than standalone counting devices.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, driven by massive aquaculture operations in countries like China, India, and Vietnam, where the need for efficient stock management is paramount for scaling production. North America and Europe, while possessing mature markets, demonstrate high adoption rates for advanced, regulatory-compliant systems, often mandated by strict environmental monitoring standards for natural fish passages and hatcheries. The focus in these developed markets is heavily skewed towards high-accuracy systems capable of differentiating endangered species or monitoring complex migration patterns, further fueled by government investment in ecological restoration and sustainable fisheries programs.

Segment trends reveal that the machine vision and optical counting systems segment maintains the largest market share due to its high precision in controlled environments like tanks and raceways. However, acoustic and sonar systems are projected to exhibit the highest growth rate, especially for applications in open water environments, river monitoring, and deep-sea research where optical clarity is poor or impractical. In terms of application, the aquaculture segment remains the primary revenue generator, yet the increasing necessity for environmental monitoring and stock assessment driven by global climate change initiatives is significantly boosting the market share of governmental and research application segments. Cloud-based data processing and subscription models for advanced software analytics are also gaining traction, moving the market structure towards a Service (SaaS) oriented approach.

AI Impact Analysis on Automatic Fish Counting Machines Market

Users frequently inquire about how Artificial Intelligence enhances counting accuracy under poor visibility conditions and reduces manual calibration efforts, often comparing the performance gap between traditional computer vision systems and modern deep learning models. Key concerns revolve around the cost implications of implementing AI-powered hardware, data privacy regarding biomass information, and the integration complexity of AI software with existing farm management systems (FMS). There is a high expectation that AI will move beyond simple enumeration to provide predictive analytics—such as forecasting growth rates based on count data and environmental inputs—and facilitate real-time anomaly detection, signaling potential disease outbreaks or unusual fish behavior based on counting pattern deviations. Users anticipate that AI will fundamentally solve the longstanding challenge of reliably counting mixed-species populations or heavily crowded fish in high-flow environments, transforming the data collected from passive counts into actionable, insightful management information.

The integration of deep learning models, particularly Convolutional Neural Networks (CNNs), allows counting machines to recognize individual fish and track their movements even in murky water or low-light situations. These models are trained on vast datasets of fish images, enabling them to classify species, estimate size and weight (biomass), and accurately count objects simultaneously passing through the viewing area, tasks that were historically highly error-prone for non-AI based systems. This sophisticated processing moves the counting function from a reactive measurement tool to a proactive biological intelligence system. Furthermore, AI minimizes the need for extensive human intervention by automatically adjusting parameters for light, debris, and water flow, thereby enhancing the overall reliability and reducing operational costs associated with manual monitoring and system maintenance.

Beyond core counting functionality, AI drives significant improvements in data interpretation and system optimization. Predictive maintenance algorithms monitor the performance of camera lenses, sensors, and lighting components, alerting operators to potential failures before they occur, thus ensuring maximum uptime during critical counting periods, such as fish migration seasons or harvest preparation. Moreover, AI integration allows for cloud-based parallel processing of high-volume video data, making it feasible to analyze data from multiple counting units deployed across vast areas simultaneously, providing a holistic and synchronized view of the aquatic ecosystem or farm. This centralization and smart analysis are critical for compliance reporting and large-scale sustainable management initiatives.

- AI enhances counting accuracy (up to 99%) through deep learning algorithms trained on diverse fish datasets.

- Enables real-time species recognition and size estimation (biomass calculation) in challenging environments.

- Facilitates predictive maintenance of counting hardware, minimizing downtime.

- Supports behavioral analysis by detecting anomalies in movement or counting patterns, indicating stress or disease.

- Reduces operational complexity by automating system calibration and light/flow adjustments.

- Integrates counting data with predictive models for stock growth forecasting and optimized feeding schedules.

- Allows for scalable, centralized processing of high-definition video feeds from numerous deployed units.

DRO & Impact Forces Of Automatic Fish Counting Machines Market

The Automatic Fish Counting Machines Market is significantly influenced by the escalating global necessity for sustainable food production and strict environmental regulation, which serves as a major driver for adoption. The push for greater efficiency in aquaculture, coupled with the need for accurate stock assessment in wild fisheries, mandates the use of reliable counting technology. However, the market faces restraints primarily related to the high initial capital investment required for advanced machine vision and acoustic systems, coupled with the technical expertise needed for their installation, calibration, and maintenance, especially in remote locations or harsh aquatic environments. Opportunities abound in the development of portable, low-cost sensor technologies integrated with cloud platforms, and the expansion into niche markets such as high-value species monitoring and automated farm security systems. These forces collectively shape the market's trajectory, prioritizing innovation that enhances accuracy, durability, and affordability in deployment.

Drivers: The fundamental driver is the global shift toward intensive and super-intensive aquaculture practices, where slight inaccuracies in biomass estimation can lead to significant financial losses due to suboptimal feeding or overcrowding. Regulatory drivers are equally important, particularly in developed economies, where environmental mandates require precise monitoring of fish populations passing through dams or fish ladders for conservation purposes. Technological advancement in sensor technology, coupled with the decreasing cost of high-resolution cameras and computing power, makes these systems more accessible and robust. Additionally, the labor-saving aspect is highly attractive to commercial operators, as automated systems reduce reliance on manual labor, which is often unreliable and stressful for the fish being counted.

Restraints: The primary restraint remains the significant initial capital expenditure associated with purchasing and installing sophisticated counting units, particularly those utilizing advanced AI and sonar capabilities, placing them out of reach for small- to medium-sized fish farming operations globally. Furthermore, the performance of optical systems can be severely compromised by factors inherent in aquaculture environments, such as high turbidity, biofouling of lenses, and inconsistent lighting, requiring frequent, skilled maintenance. There is also a degree of reluctance among traditional fish farmers to adopt complex digital tools, citing a steep learning curve and reliance on specialized technicians for troubleshooting, which limits market penetration in less technologically advanced regions.

Opportunities and Impact Forces: Significant opportunities lie in the miniaturization of counting technology, allowing for the creation of cost-effective, easily deployable sensors compatible with Internet of Things (IoT) infrastructure for integrated smart fish farms. The demand for species-specific counting, especially for commercially valuable species like salmon, shrimp, and tuna, presents a high-margin opportunity for specialized software development. Impact forces are strong, driven by governmental funding into sustainable fisheries research and development of robust counting standards. The competitive landscape is forcing innovation toward integrated hardware-software packages that offer holistic solutions, from counting and sizing to automated sorting and environmental monitoring, maximizing the value proposition for the end-user beyond mere enumeration.

Segmentation Analysis

The Automatic Fish Counting Machines Market is comprehensively segmented based on technology type, application, deployment method, and regional geography, reflecting the diverse operational requirements across the aquatic industry. Technology segmentation differentiates between optical/machine vision systems, which utilize cameras and image processing for counting in clear water, and acoustic/sonar systems, which are preferred for low-visibility, open-water applications, providing foundational differences in system deployment and accuracy parameters. Application segmentation clearly delineates the primary end-user sectors, with aquaculture leading the market due to intensive farming practices, followed by governmental agencies focused on environmental monitoring and resource conservation, and finally, academic and research institutions requiring high-precision data for ecological studies.

Further granularity is achieved through deployment segmentation, which categorizes products into fixed systems, typically installed in migration paths, large raceways, or hatchery conduits, and portable/handheld systems, favored for spot checks, smaller farm tanks, or rapid field assessments. This variation reflects the differing needs for throughput capacity versus flexibility and mobility. The structural organization of these segments provides a clear framework for market players to tailor their product development and marketing strategies, addressing the specific operational challenges and regulatory needs of each distinct segment, whether focusing on high-volume accuracy for large commercial farms or robustness for demanding environmental monitoring projects.

The increasing complexity of aquaculture operations and environmental regulations mandates that segmentation analysis also considers the level of automation and integration capability. Systems that offer seamless integration with existing hatchery automation equipment, automated grading systems, and cloud-based data management platforms are gaining significant competitive advantage. This segmentation highlights the growing trend where customers prioritize holistic solutions that deliver data analytics and operational control alongside raw counting data, pushing the market towards sophisticated, integrated hardware and software platforms rather than simple counting devices.

- Technology Type

- Optical/Machine Vision Systems

- Acoustic/Sonar Systems

- Other Counting Technologies (e.g., Electronic Tagging Systems)

- Application

- Aquaculture (Hatcheries, Grow-out Farms)

- Fisheries Management and Research (Wild Stock Assessment)

- Environmental Monitoring (Fish Passage/Ladder Counting)

- Government and Regulatory Bodies

- Deployment Method

- Fixed Systems

- Portable/Mobile Systems

- End-User

- Commercial Fish Farmers

- Government Agencies

- Academic and Research Institutes

- Component

- Hardware (Sensors, Cameras, Processors)

- Software (Image Processing, AI Algorithms, Data Analytics)

Value Chain Analysis For Automatic Fish Counting Machines Market

The value chain for the Automatic Fish Counting Machines Market begins with the upstream suppliers providing critical components, including high-resolution submerged cameras, advanced sensor arrays (acoustic transducers, flow meters), specialized computing hardware (GPUs/FPGAs for real-time processing), and robust, marine-grade casing materials. Innovation at this stage, particularly in developing energy-efficient and highly durable sensors, directly impacts the performance and operational lifespan of the final counting machine. Key upstream challenges involve maintaining a stable supply chain for specialized electronic components and ensuring high reliability against corrosion and biofouling, which are constant threats in aquatic environments. Strategic alliances with specialized component manufacturers are crucial for maintaining technological edge and cost competitiveness.

The midstream focuses on the Original Equipment Manufacturers (OEMs) and software developers who integrate these components, developing proprietary machine vision algorithms or sonar processing software, often incorporating deep learning for enhanced accuracy and species differentiation. This manufacturing stage involves rigorous calibration and testing procedures to meet specified accuracy levels under varying field conditions. Distribution channels are typically a mix of direct sales to large governmental bodies (due to complex tender requirements) and indirect sales through specialized aquaculture equipment distributors or environmental consulting firms who provide localized installation and maintenance support. The reliance on indirect channels is particularly high for penetrating the fragmented small and medium-sized aquaculture markets globally.

The downstream segment encompasses the end-users—aquaculture farms, governmental fisheries departments, and research institutions—who utilize the systems. Customer value is derived not only from the counting accuracy but significantly from the post-installation support, data integration services, and ongoing software updates that ensure the system remains optimized as environmental conditions or monitoring needs change. The complexity of the technology necessitates strong technical support, making service contracts a vital component of the value proposition. Direct distribution offers greater control over technical installation and data security, while indirect distribution through established regional dealers provides quicker market access and local language support, proving essential for market growth in diverse geographic areas like Southeast Asia and Latin America.

Automatic Fish Counting Machines Market Potential Customers

The primary segment of potential customers for automatic fish counting machines includes commercial aquaculture operators, ranging from small-scale hatcheries focused on producing fingerlings to large, integrated grow-out farms managing millions of fish across complex raceway systems or marine cages. These customers are driven by economic necessity: maximizing feed efficiency, optimizing stocking densities to prevent disease, and achieving accurate pre-harvest biomass estimation. Their buying decisions are heavily influenced by return on investment (ROI), system reliability, and seamless compatibility with existing automated feeding and sorting infrastructure, prioritizing accurate data for operational efficiency and profitability.

A second major customer segment consists of governmental and regulatory bodies, including national and state fisheries departments, water management authorities, and environmental protection agencies. These customers utilize counting machines primarily for non-commercial purposes, such as monitoring migratory species (e.g., salmon, eels) in rivers and fish passages, assessing the impact of dams or environmental changes on wild stocks, and ensuring compliance with conservation quotas. Their requirements prioritize extreme durability, high accuracy across varying flow rates, and the ability to integrate with complex, long-term scientific databases. Procurement in this segment is often driven by public funding, specific regulatory mandates, and long-term infrastructure investment planning.

Furthermore, academic and marine research institutions represent a crucial niche market. Researchers require the highest degree of accuracy and flexibility for specialized ecological studies, population modeling, and biodiversity assessments, often needing systems capable of distinguishing subtle differences between non-commercial or endangered species. This segment also includes non-governmental organizations (NGOs) focused on ecological restoration and conservation projects. While procurement volumes are lower compared to commercial aquaculture, these customers often drive demand for bleeding-edge technologies, such as advanced AI-driven species identification and low-impact monitoring methods, influencing the trajectory of technological development across the broader market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 801.5 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vaki Aquaculture Systems Ltd., AquaScan, Sensoray Company, Inc., Innovasea, Fish Counter Systems, Inc., Hi-Comp Systems, Inc., Akva Group, Juro, Counting Systems, Inc., Maritech Systems, Bio-Fish Technology, Advanced Marine Technology (AMT), Ecomeasure, Aquatec Group, Ocean Instruments, Meritech, Blue Robotics, Hydroacoustic Technology, Inc., SENSOTEC, Reel View Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Fish Counting Machines Market Key Technology Landscape

The technological landscape of the Automatic Fish Counting Machines Market is dominated by two primary methodologies: high-speed optical/machine vision and sophisticated hydroacoustic/sonar sensing. Optical systems leverage high-resolution, low-light cameras coupled with specialized lighting techniques (often infrared or pulsed LEDs) to capture images of fish passing through a controlled environment, such as a narrow pipe or channel. The core innovation here lies in the image processing software, which uses computer vision algorithms, increasingly powered by AI and deep learning, to accurately differentiate, track, and count rapidly moving fish while compensating for variations in size, overlapping, and minor water imperfections. This technology is highly accurate in controlled, clear-water settings like hatcheries and processing plants, offering the added benefit of detailed size and species grading.

Conversely, acoustic and sonar systems are critical for monitoring fish populations in environments where optical clarity is impossible to maintain, such as turbid rivers, open ocean environments, or deep-water aquaculture cages. These systems utilize transducers to emit sound pulses and analyze the echoes reflected back by fish. Advanced hydroacoustic software interprets these echoes to determine fish size, count, speed, and trajectory. Modern acoustic technology has moved beyond simple echo counting to employ sophisticated multi-beam and split-beam sonar techniques, providing three-dimensional visualization and significantly improving species identification and accuracy, even in dense schools or high-flow conditions. Integration of real-time hydroacoustic data with geographical information systems (GIS) further enhances their utility for large-scale fisheries management.

A significant emerging technological trend involves the convergence of these two methods, often referred to as hybrid counting systems, which deploy both optical and acoustic sensors to maximize accuracy and operational range. Furthermore, the reliance on edge computing and cloud integration is transforming the industry. Edge devices embedded in the counting machines preprocess the vast amounts of video or acoustic data locally, reducing latency and bandwidth requirements, before transmitting summarized, actionable insights to cloud platforms. These cloud platforms then perform higher-level analytics, trend forecasting, and provide user interfaces accessible globally, allowing for remote monitoring and management of widely dispersed counting units, positioning the market at the forefront of the Industrial Internet of Things (IIoT) in aquaculture.

Regional Highlights

The global deployment of Automatic Fish Counting Machines exhibits distinct regional characteristics driven by local aquaculture intensity, regulatory frameworks, and technological maturity. The Asia Pacific (APAC) region stands as the undisputed leader in market demand, fueled by the sheer scale of commercial aquaculture operations, particularly in marine and freshwater finfish farming across nations like China, Vietnam, Indonesia, and India. The rapid adoption in APAC is primarily motivated by the need to optimize high-volume production and enhance operational efficiency within increasingly crowded farming environments. While cost sensitivity remains a factor, the shift toward intensive farming methods necessitates the reliability offered by automated counting, driving significant investment in both locally produced and imported advanced systems, particularly those focused on shrimp and high-value finfish species.

North America and Europe represent mature markets characterized by stringent environmental regulations and a strong focus on sustainable fisheries management, leading to high-value purchases of sophisticated counting technology. In North America, substantial market activity centers around governmental mandates for monitoring wild salmon and trout populations in river systems, often requiring high-end sonar and fixed optical systems integrated into fish ladders and bypass facilities. European growth is similarly driven by environmental compliance, alongside innovation in recirculating aquaculture systems (RAS) and offshore aquaculture, where counting accuracy is non-negotiable for efficient closed-loop operations. These regions emphasize systems that offer maximum species differentiation, data traceability, and robust integration with governmental reporting standards.

Latin America (LATAM) and the Middle East and Africa (MEA) regions are emerging markets showing significant potential. LATAM, particularly driven by salmon farming in Chile and shrimp production in Ecuador, is adopting automated counters to manage rapid industry expansion, focusing initially on cost-effective, durable optical systems for hatcheries. The MEA region is experiencing growth through government-led initiatives to diversify food sources through large-scale aquaculture projects, often implemented through international partnerships that integrate modern technology from the outset. While market penetration is currently lower, the high growth potential in these regions is underpinned by increasing foreign direct investment and a strategic governmental commitment to developing robust food security infrastructure.

- Asia Pacific (APAC): Dominates the market due to large-scale, intensive aquaculture production, demanding high-throughput optical systems for mass counting of fish and shrimp in countries like China and Vietnam. Focus is on efficiency and biomass estimation in commercial settings.

- North America: Driven by strict environmental regulations and conservation mandates, leading to high adoption of advanced fixed sonar and optical systems for monitoring wild migratory species (e.g., salmon) in US and Canadian river systems.

- Europe: Focuses on high-tech solutions for Recirculating Aquaculture Systems (RAS) and compliance with EU environmental directives. High adoption of integrated systems for counting, grading, and automated sorting in countries like Norway (salmon) and Scotland.

- Latin America (LATAM): Emerging market driven by the expanding aquaculture industry in Chile (salmon) and Ecuador (shrimp). Market growth hinges on balancing cost with necessary ruggedness for deployment in challenging environmental conditions.

- Middle East and Africa (MEA): Growth is primarily project-based, supported by government investment in large-scale food security and aquaculture development programs. Demand is rising for durable, easy-to-maintain counting hardware suitable for hot climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Fish Counting Machines Market.- Vaki Aquaculture Systems Ltd.

- AquaScan

- Innovasea (formerly known as Sensoray)

- Fish Counter Systems, Inc.

- Akva Group

- Juro (counting systems division)

- Counting Systems, Inc.

- Maritech Systems

- Bio-Fish Technology

- Advanced Marine Technology (AMT)

- Ecomeasure

- Hydroacoustic Technology, Inc. (HTI)

- Blue Robotics

- Ocean Instruments

- SENSOTEC

- Meritech Systems

- Hi-Comp Systems, Inc.

- Reel View Systems

- Aquatec Group

- Fish Pass Systems

Frequently Asked Questions

Analyze common user questions about the Automatic Fish Counting Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between optical and acoustic fish counting systems?

Optical systems utilize high-resolution cameras and computer vision (often AI-enhanced) and are highly accurate in clear, controlled environments like hatcheries. Acoustic (sonar) systems use sound waves to detect and count fish and are preferred for large-scale, turbid, or open-water environments where optical clarity is impractical, such as rivers or marine cages.

How does AI impact the accuracy and functionality of modern fish counters?

AI, specifically deep learning, significantly boosts accuracy (often exceeding 98-99%) by enabling real-time species differentiation, accurate size/biomass estimation, and the ability to maintain counting precision in adverse conditions (low light, partial blockage) that traditionally challenge standard computer vision systems.

What are the major challenges restraining the growth of the Automatic Fish Counting Machines Market?

The principal restraints include the high initial capital expenditure required for sophisticated, high-throughput systems, the necessity for specialized technical expertise for installation and maintenance, and limitations in system performance when faced with extreme water turbidity or severe biofouling in open-water deployment scenarios.

Which application segment holds the largest market share for these counting machines?

The Aquaculture segment (including commercial hatcheries and grow-out farms) holds the largest market share. This dominance is driven by the industry's continuous need for precise, real-time biomass data essential for optimizing feed conversion rates, managing stocking density, and planning efficient harvests to ensure profitability.

What is the projected Compound Annual Growth Rate (CAGR) for the Automatic Fish Counting Machines Market?

The Automatic Fish Counting Machines Market is projected to exhibit a robust CAGR of 8.5% between the years 2026 and 2033, driven by advancements in sensor technology, increased global investment in aquaculture sustainability, and stricter governmental mandates for environmental fisheries monitoring.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager