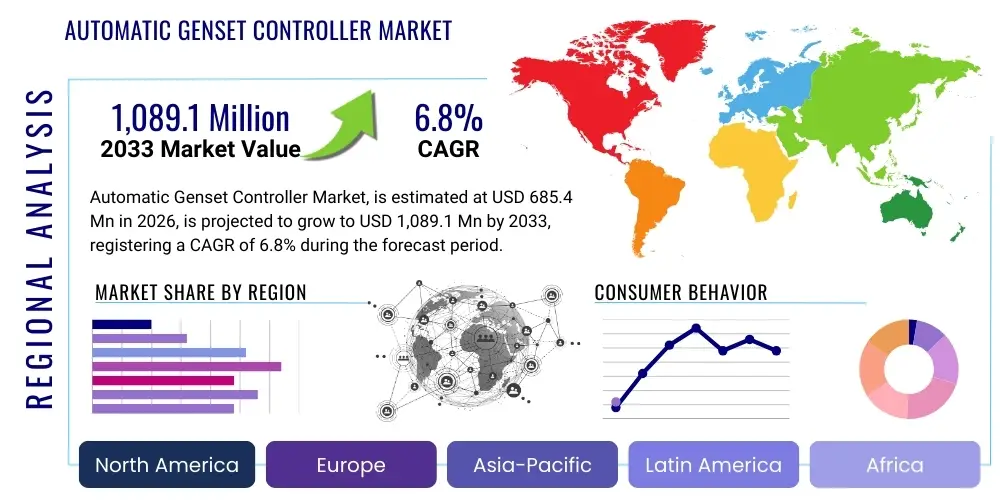

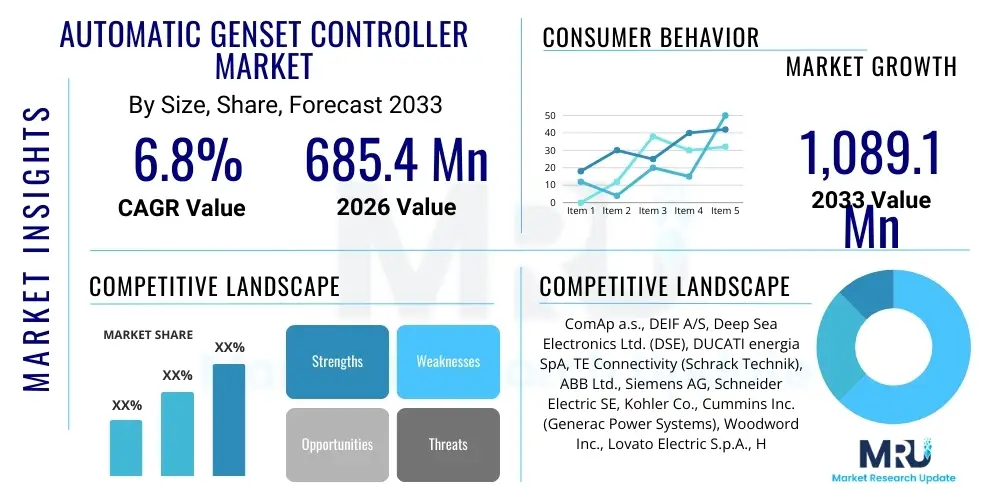

Automatic Genset Controller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436636 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automatic Genset Controller Market Size

The Automatic Genset Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 685.4 million in 2026 and is projected to reach USD 1,089.1 million by the end of the forecast period in 2033.

Automatic Genset Controller Market introduction

The Automatic Genset Controller (AGC) market encompasses advanced electronic devices designed to monitor, protect, and control diesel or gas generator sets automatically. These systems are critical components in ensuring reliable backup power supply, managing load transfer, and optimizing generator performance, especially in applications requiring continuous and uninterrupted electrical energy. AGCs integrate sophisticated microprocessors and communication capabilities, allowing them to interface with various mechanical and electrical parameters of the generator, the grid, and external load requirements. The core function involves initiating startup/shutdown sequences, synchronizing multiple gensets, managing load sharing, and executing protective functions against faults such as over-speed, high temperature, or low oil pressure. The increasing demand for reliable energy infrastructure, particularly in developing economies and critical sectors like healthcare, data centers, and telecommunications, serves as a foundational driver for market expansion.

The product scope of AGCs extends beyond basic control functionalities to include complex features such as remote monitoring, telemetry, integration with SCADA and Building Management Systems (BMS), and adherence to stringent environmental and safety regulations. Major applications span industrial manufacturing, commercial infrastructure (high-rise buildings, retail complexes), public utilities, and residential complexes that rely on standby power. The key benefit derived from AGC implementation is enhanced operational efficiency, reduced human intervention, minimized downtime, and prolonged lifespan of the genset machinery through precise monitoring and proactive fault detection. Furthermore, AGCs facilitate seamless transitions between utility power and backup power sources, which is paramount for sensitive electronic equipment and processes.

Driving factors propelling the market include the accelerating pace of industrialization and urbanization globally, leading to higher electricity consumption and subsequent strain on existing grid infrastructure, necessitating robust backup solutions. The proliferation of data centers, driven by cloud computing and digitalization trends, presents a massive requirement for zero-downtime power systems, heavily relying on advanced genset controls. Regulatory mandates concerning power quality and environmental emissions also incentivize the adoption of advanced AGCs capable of optimizing fuel consumption and managing emission outputs. The shift toward renewable energy sources, which often requires hybridization with conventional diesel generators for stable supply, further fuels the complexity and demand for smart, automatic control systems.

Automatic Genset Controller Market Executive Summary

The Automatic Genset Controller market exhibits robust growth driven by rapid global infrastructure development and the increasing necessity for reliable, uninterrupted power supply across critical sectors. Key business trends indicate a strong move toward digitalization and integration, where AGCs are transitioning from standalone control units to connected devices supporting IoT frameworks, remote diagnostics, and predictive maintenance. Manufacturers are focusing heavily on developing controllers compatible with diverse fuel types (natural gas, hydrogen, diesel) and advanced synchronization capabilities crucial for microgrid applications and grid-parallel operations. Strategic partnerships between controller manufacturers and genset OEMs are becoming common to ensure integrated product offerings and streamline deployment processes, optimizing the total cost of ownership for end-users. Geographical expansion into emerging markets, particularly in Asia Pacific and the Middle East, is a primary growth strategy due to high government investments in power generation and infrastructure projects.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure projects in China, India, and Southeast Asia, coupled with high frequency of power outages necessitating reliable backup power solutions. North America and Europe, characterized by established grids and rigorous safety standards, show stable demand driven by the replacement cycle of legacy equipment and the adoption of high-end controllers for complex parallel operations and grid stability applications. Latin America and MEA are exhibiting substantial growth spurred by expansions in the oil and gas sector, data center construction, and mining activities, which inherently require rugged and reliable automatic power control systems. The regional demand profiles are also influenced by local regulatory frameworks pertaining to emissions and grid interconnection requirements, driving specialized product development.

Segment trends underscore the dominance of the standalone controller type, although the demand for parallel and synchronization controllers is growing rapidly, reflecting the complexity of modern power systems involving multiple gensets or grid interconnection. In terms of end-use, the industrial segment, including heavy manufacturing and oil and gas, remains the largest consumer due to the high power requirements and severe financial consequences of downtime. However, the commercial and institutional segment, led by the exponential growth of the data center industry and the sustained expansion of the healthcare sector, is projected to witness the highest incremental growth over the forecast period. Technology-wise, the trend favors controllers equipped with advanced features such as CAN bus communication, graphical display interfaces, and enhanced cyber-security protocols to protect essential infrastructure assets.

AI Impact Analysis on Automatic Genset Controller Market

User inquiries regarding AI's influence on the Automatic Genset Controller market primarily revolve around predictive maintenance capabilities, optimal load management, and improving energy efficiency. Users are keenly interested in how AI can move AGC systems beyond reactive monitoring to proactive fault prediction, minimizing costly unplanned outages. Common concerns include the complexity of integrating AI algorithms into existing hardware, the reliability of machine learning models in dynamic operational environments, and the cyber-security implications of connecting these critical systems to AI-driven analytical platforms. Expectations are high for AI to revolutionize fuel consumption optimization, enable highly sophisticated load sequencing in complex microgrids, and automate decision-making processes regarding grid synchronization and load shedding, ultimately increasing operational uptime and reducing lifetime operational expenditure.

- AI enables predictive failure detection for engine components, reducing unexpected downtime.

- Machine learning algorithms optimize fuel consumption based on real-time load profiles and historical data.

- Advanced AI systems facilitate dynamic load shedding and sequencing in complex multi-genset environments.

- AI integration enhances cybersecurity protocols through anomaly detection in operational parameters.

- Automated diagnostics and remote troubleshooting capabilities are significantly improved via AI analysis.

- AI drives the creation of self-learning control systems adaptable to changing grid conditions and load demands.

- Improved synchronization accuracy and speed for grid-parallel operations using predictive modeling.

- Data-driven insights from AI platforms enhance overall fleet management and maintenance planning.

DRO & Impact Forces Of Automatic Genset Controller Market

The Automatic Genset Controller Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces shaping its trajectory. The primary driver is the global need for power reliability, exacerbated by aging grid infrastructure and frequent extreme weather events. This is coupled with the burgeoning data center industry which demands extremely stable and continuous power supply, thereby mandating the use of advanced AGCs. However, the market faces restraints such as the high initial investment cost associated with advanced controllers and the increasing global focus on renewable energy sources, which, while sometimes requiring hybrid genset systems, fundamentally aim to reduce reliance on fossil fuel generators in the long term. Opportunities abound in the development of smart grid-compatible controllers and the integration of IoT and AI for sophisticated energy management, allowing AGCs to play a central role in decentralized power generation architecture.

Impact forces are heavily skewed toward technological advancements and regulatory shifts. Increasing sophistication in controller hardware, focusing on modularity, communication protocols (like Modbus, CANbus, and proprietary internet-based protocols), and user interface design (HMI integration) acts as a powerful accelerating force. Conversely, the scarcity of skilled technicians capable of installing, commissioning, and maintaining these complex digital control systems acts as a friction point, slowing adoption rates in certain regions. The rising stringency of environmental regulations regarding emissions (e.g., Tier 4 final standards) necessitates continuous innovation in AGCs to ensure compliant engine operation, pushing manufacturers toward more complex and feature-rich products. The ongoing geopolitical instability also sporadically drives short-term demand for portable and robust control solutions in conflict and disaster-prone zones.

The market’s future is predominantly defined by the capability of AGCs to facilitate the energy transition. The shift toward microgrids and decentralized power generation mandates controllers that can seamlessly manage synchronization, load sharing, and power quality across heterogeneous sources (solar, battery storage, gensets). This requirement creates a substantial opportunity for manufacturers investing in advanced software features and communication standards. Furthermore, the persistent infrastructure deficit in emerging economies ensures a sustained baseline demand for standby power solutions. Manufacturers that successfully address the dual challenges of cost-effectiveness and high-level digitalization are poised to capture dominant market share, utilizing these impact forces to their strategic advantage.

Segmentation Analysis

The Automatic Genset Controller market is strategically segmented based on product type, technology, fuel type, power rating, and end-user application to provide a granular understanding of demand dynamics and growth pockets. Product type segmentation distinguishes between controllers utilized for standalone applications (single genset operation) and those designed for complex parallel operations, including synchronization and load sharing among multiple generators or with the main utility grid. Technological differentiation is critical, separating basic analog controls from highly advanced digital and microprocessor-based systems. End-user categorization identifies key demand drivers across vital sectors such as industrial, commercial, residential, and institutional segments, each exhibiting unique requirements regarding control complexity and reliability demands. This multidimensional segmentation allows stakeholders to tailor product development and market penetration strategies effectively.

- By Product Type:

- Single Genset Controller

- Parallel/Synchronization Controller

- By Technology:

- Analog

- Digital/Microprocessor-based

- By Fuel Type:

- Diesel Gensets

- Gas Gensets (Natural Gas, LPG)

- Bi-fuel/Hybrid Gensets

- By Power Rating:

- Low Power (Below 100 kVA)

- Medium Power (100 kVA – 500 kVA)

- High Power (Above 500 kVA)

- By End-User:

- Industrial (Manufacturing, Oil & Gas, Mining)

- Commercial (Data Centers, Retail, Hospitality)

- Residential

- Institutional (Hospitals, Government Buildings, Educational Facilities)

Value Chain Analysis For Automatic Genset Controller Market

The value chain for the Automatic Genset Controller market initiates with upstream activities involving the sourcing of raw materials, particularly high-grade electronic components such as microprocessors, integrated circuits, sensors, communication modules, and display screens. Key challenges in the upstream segment include ensuring the reliability and quality of semiconductors and managing global supply chain volatility, which directly impacts production costs and lead times. Manufacturers invest heavily in R&D and design to create reliable, compliant, and feature-rich control software and hardware architectures. Efficient inventory management and strategic procurement are essential for maintaining competitive pricing and timely delivery within this segment.

The core manufacturing and assembly stage involves integrating software, programming microcontrollers, and rigorous testing for environmental resilience and functional accuracy. Midstream activities are dominated by specialized AGC manufacturers who either sell directly to Original Equipment Manufacturers (OEMs) of gensets or to system integrators and distributors. Downstream analysis focuses on the distribution channel, which is bifurcated into direct sales to large industrial end-users (especially for high-power, customized solutions) and indirect channels through a network of specialized electrical distributors, genset dealers, and certified service partners. The service and aftermarket segment, including installation, commissioning, maintenance contracts, and software updates, represents a crucial revenue stream and a determinant of customer satisfaction.

Direct distribution channels are preferred for high-value contracts involving large-scale industrial projects or data center installations where technical complexity necessitates direct manufacturer support and customization. Indirect channels, primarily comprising authorized local distributors, efficiently serve the mass market, particularly the low and medium power segments, leveraging local inventory and quicker turnaround times. The effectiveness of the value chain is highly dependent on the synergy between the controller manufacturer and the genset OEM, as seamless integration is critical for end-product performance. Ensuring comprehensive training and technical support across all distribution tiers is paramount for market penetration and sustaining long-term customer relationships.

Automatic Genset Controller Market Potential Customers

The primary consumers of Automatic Genset Controllers are entities requiring high levels of power reliability and automation to manage their backup and prime power generation assets. Critical infrastructure sectors form the largest potential customer base, including data center operators who demand Tier III and Tier IV reliability standards, necessitating sophisticated synchronization and redundancy capabilities offered by advanced AGCs. Healthcare facilities, particularly large hospitals and pharmaceutical manufacturing units, are high-priority customers, as uninterrupted power is essential for life support systems and maintaining product integrity, driving demand for compliant and robust control systems capable of seamless transfer switching.

Further potential customers are drawn from the heavy industrial sector, specifically oil and gas extraction sites, mining operations, and large-scale manufacturing plants, where power outages lead to significant financial losses and operational hazards. These customers typically require high-power rated controllers with rugged designs suitable for harsh environmental conditions and specialized communication protocols for integration with industrial control systems. Additionally, commercial real estate developers of high-rise buildings, large retail centers, and hospitality complexes represent a burgeoning customer segment, seeking automated power solutions to ensure tenant satisfaction and maintain critical services during grid disruptions.

The increasing adoption of microgrids and distributed energy resources (DERs) positions utility companies, independent power producers (IPPs), and rural electrification projects as growing potential buyers. These entities require AGCs capable of sophisticated energy management, bidirectional power flow control, and integrating renewable energy sources alongside conventional gensets. Furthermore, residential communities in areas prone to grid instability or those relying on islanded power systems represent a steady, volume-driven customer base for standard single genset controllers, emphasizing ease of use and cost-effectiveness as key purchase criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685.4 Million |

| Market Forecast in 2033 | USD 1,089.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ComAp a.s., DEIF A/S, Deep Sea Electronics Ltd. (DSE), DUCATI energia SpA, TE Connectivity (Schrack Technik), ABB Ltd., Siemens AG, Schneider Electric SE, Kohler Co., Cummins Inc. (Generac Power Systems), Woodword Inc., Lovato Electric S.p.A., Himoinsa S.L., KUTAI Electronics Industry Co. Ltd., Marathon Equipment Inc., Selco A/S, Smartgen Technology Co., Ltd., Eltek Power, Zenith Controls, Kirloskar Oil Engines Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Genset Controller Market Key Technology Landscape

The technology landscape of the Automatic Genset Controller market is characterized by a rapid transition toward digital, microprocessor-based platforms that prioritize connectivity, computational power, and advanced diagnostic capabilities. Modern AGCs rely heavily on high-performance microcontrollers to execute complex algorithms for functions such as synchronization, load sharing, power factor correction, and protection relaying in real-time. The integration of various standardized communication protocols, most notably CAN bus (Controller Area Network) for engine ECU (Engine Control Unit) communication and Modbus TCP/IP or Ethernet for remote monitoring and integration with higher-level Supervisory Control and Data Acquisition (SCADA) or Building Management Systems (BMS), is now standard practice across leading product lines.

A significant technological focus is placed on enhancing Human-Machine Interface (HMI) through the use of high-resolution graphical displays and intuitive touch interfaces, simplifying complex monitoring and configuration tasks for field operators. Furthermore, remote monitoring technology, enabled by cellular (4G/5G) or satellite communication modules, allows users to manage and diagnose genset performance from anywhere, supporting fleet management across wide geographical areas and enabling predictive maintenance strategies. The development of proprietary software tools for programming, simulation, and firmware updates is also a core competitive differentiator, ensuring ease of maintenance and longevity of the installed systems.

Future technological advancements are centered around incorporating edge computing capabilities and robust cyber-security measures directly within the AGC hardware. This allows for faster, localized decision-making, particularly crucial in microgrid applications where latency can compromise stability. The increasing demand for controllers compatible with multiple fuel sources (e.g., biogas, hydrogen blends) and capable of managing battery storage integration (Hybrid Genset Controllers) requires continuous software development and calibration. Adoption of standardized functional safety protocols (e.g., IEC 61508) is also becoming increasingly important, particularly for controllers used in critical industrial environments.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the market in terms of volume growth, driven by massive infrastructure spending, rapid industrialization, and high levels of energy demand due to urbanization in China, India, and Southeast Asian nations. Frequent power quality issues and reliance on standby power generation in manufacturing hubs fuel demand for robust, cost-effective AGCs.

- North America: Characterized by high technological adoption and stringent regulatory standards, North America is a key market for high-end, complex parallel synchronization controllers, particularly driven by the exponential growth of hyperscale data centers and the need for reliable backup power in critical infrastructure like hospitals and telecommunication networks.

- Europe: The European market is mature and focuses heavily on the replacement market and the integration of gensets into decentralized energy systems (microgrids). Demand is strong for controllers that comply with strict emission regulations (Stage V) and are capable of complex grid-parallel operations and optimized fuel consumption.

- Middle East and Africa (MEA): This region is experiencing significant market acceleration, primarily due to large investments in oil and gas infrastructure, tourism, and governmental diversification projects. The demand is concentrated on rugged, reliable controllers capable of operating under high temperatures and remote conditions, especially for telecommunication tower sites and isolated mining operations.

- Latin America: Growth in Latin America is driven by modernization projects in industrial sectors (e.g., mining, agriculture) and ongoing efforts to improve grid stability. Economic volatility often encourages businesses to invest in reliable self-generation capabilities, fostering steady demand for AGC solutions across various power ratings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Genset Controller Market.- ComAp a.s.

- DEIF A/S

- Deep Sea Electronics Ltd. (DSE)

- DUCATI energia SpA

- TE Connectivity (Schrack Technik)

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Kohler Co.

- Cummins Inc. (Generac Power Systems)

- Woodword Inc.

- Lovato Electric S.p.A.

- Himoinsa S.L.

- KUTAI Electronics Industry Co. Ltd.

- Marathon Equipment Inc.

- Selco A/S

- Smartgen Technology Co., Ltd.

- Eltek Power

- Zenith Controls

- Kirloskar Oil Engines Ltd.

- PCC Power Control Center

- Nuvation Energy

- Eaton Corporation plc

Frequently Asked Questions

Analyze common user questions about the Automatic Genset Controller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Automatic Genset Controller (AGC)?

The primary function of an AGC is to automatically monitor the status of the main power supply (utility grid), initiate the generator startup sequence upon power failure, seamlessly transfer the electrical load to the generator, monitor engine performance, and safely shut down the generator and return the load to the utility once power is restored, ensuring uninterrupted critical operations.

How does the integration of IoT technology impact AGC market growth?

IoT integration significantly boosts market growth by enabling advanced remote monitoring, real-time diagnostics, and predictive maintenance scheduling. Connected AGCs transmit operational data to centralized platforms, allowing fleet managers to optimize fuel efficiency, minimize unplanned downtime, and reduce operational costs across geographically dispersed generator fleets.

Which end-user segment drives the highest demand for advanced parallel controllers?

The commercial segment, specifically the data center industry and large institutional facilities (hospitals), drives the highest demand for advanced parallel and synchronization controllers. These applications require multiple gensets to run simultaneously for redundancy (N+1) or increased capacity, demanding precise load sharing and complex grid synchronization capabilities.

What are the main technical differentiators between analog and digital genset controllers?

Analog controllers use basic electrical circuits and relays, offering limited functionality, while digital (microprocessor-based) controllers use advanced programming and computational power to provide superior accuracy, real-time data logging, complex protective functions, and communication interfaces for external system integration and remote control.

How are environmental regulations affecting the development of new Automatic Genset Controllers?

Environmental regulations, such as EU Stage V and EPA Tier 4 standards, force controller manufacturers to develop more sophisticated control software to manage engine emissions by precisely controlling injection timing, managing aftertreatment systems (e.g., DPF/SCR), and optimizing engine performance to comply with stringent limits, increasing the demand for highly digital solutions.

Advanced Genset Controller Capabilities and Market Sophistication

Modern Automatic Genset Controllers are evolving into sophisticated energy management hubs, moving beyond simple transfer switch operations. The shift is driven by the complexity inherent in integrating multiple energy assets. AGCs are increasingly required to manage battery energy storage systems (BESS) alongside traditional combustion engines, necessitating advanced bidirectional power flow control and state-of-charge management algorithms. This hybrid control capability is critical for optimizing fuel consumption and minimizing carbon footprint in applications like remote telecom sites or islanded microgrids. Furthermore, leading controllers incorporate enhanced cyber-security features, addressing the growing vulnerability of interconnected industrial control systems. These features include encrypted communication channels, role-based access control, and robust logging capabilities to ensure system integrity against unauthorized access or manipulation, particularly vital for critical infrastructure installations.

The market for parallel synchronization controllers is experiencing disproportionately high growth compared to standalone units. This trend reflects a broader industry shift towards power redundancy and capacity scaling. In industrial settings, high-power applications often require paralleling two or more smaller gensets instead of relying on a single, massive unit. This modular approach enhances reliability, facilitates easier maintenance scheduling (allowing one unit to be serviced while others run), and improves operational efficiency by running gensets at their most efficient load point. The core technology enabling this is high-speed peer-to-peer communication between controllers, ensuring instantaneous voltage matching, frequency synchronization, and seamless load sharing algorithms, often utilizing protocols like Isochronous Load Sharing (ILS) to maintain precise power balance.

Technology adoption varies significantly by region and end-user profile. Developed markets in North America and Europe predominantly demand controllers with high feature sets, focusing on regulatory compliance (emissions, grid codes), complex communication integration, and user-friendly diagnostics. These markets are driven by total cost of ownership (TCO) optimization achieved through superior fuel management and predictive maintenance. Conversely, emerging markets, while rapidly adopting digital controllers, often prioritize ruggedness, durability, and essential protective functions over the most advanced communication features, though the demand for remote monitoring is rapidly increasing due to geographical dispersion of assets. The future competitive edge in this market will lie in software customization and the ability to seamlessly integrate controllers with proprietary engine management systems and cloud-based analytical tools.

Market Dynamics: Regulations, Technology, and Competitive Landscape

Regulatory frameworks are a potent catalyst for technological innovation within the AGC market. For instance, grid codes in various jurisdictions are becoming increasingly stringent regarding the quality of power injected back into the grid, requiring gensets operating in parallel to meet specific requirements for harmonic distortion, reactive power support, and fast frequency response. AGC manufacturers must continuously update their software and hardware to ensure compliance, effectively creating a barrier to entry for smaller players and driving consolidation among those capable of massive R&D investment. Similarly, safety standards, particularly the adherence to standards like UL and CE marking, dictate the physical design and electronic architecture of controllers, ensuring reliable performance under fault conditions.

The competitive landscape is characterized by a few global dominant players (like ComAp, DEIF, and Deep Sea Electronics) who specialize exclusively in control solutions, alongside major genset manufacturers (like Cummins and Kohler) who often integrate their proprietary controllers into their own equipment packages. Specialization tends to allow independent control manufacturers to offer more flexible, fuel-agnostic solutions compatible with a wider range of engine brands, whereas proprietary controllers often offer deeper integration but limited universality. The ongoing competition centers on features such as ease of configuration (reducing commissioning time), durability (IP ratings for ingress protection), and the robustness of their remote telematics platforms.

A key strategic development is the shift toward modular design architectures. Manufacturers are offering core control modules supplemented by optional expansion modules for inputs/outputs (I/O), communication interfaces, and specific protective relays. This modularity allows customers to tailor the controller precisely to their application needs, minimizing complexity and unnecessary cost, and facilitating future upgrades without replacing the entire unit. This flexibility is particularly valued by system integrators who customize power solutions for diverse clients, from small commercial operations to massive industrial plants. Furthermore, the accessibility of programming tools and quality of global technical support remain critical factors influencing long-term procurement decisions by major OEMs and end-users.

Geographical Analysis: Deep Dive into Regional Consumption Patterns

The consumption pattern in North America is highly influenced by disaster preparedness and the regulatory environment governing data center operations. Following significant power outages caused by hurricanes, wildfires, and extreme cold snaps, reliability standards for backup power have intensified. This drives demand for high-reliability, dual-redundant AGC systems capable of handling rapid load step changes and performing rigorous self-tests. Moreover, the integration of energy storage systems is more advanced in this region, leading to higher adoption rates for hybrid controllers that optimize the dispatch sequence between gensets and batteries to minimize run hours and emissions.

In the European market, the push for decarbonization significantly shapes the demand for AGCs. While the base installation volume is lower than in APAC, the complexity of control systems required for decentralized energy schemes is much higher. European regulations favor controllers that enable gensets to participate actively in grid stability services (e.g., frequency response markets), necessitating highly responsive synchronization and export limitation functionalities. The widespread use of combined heat and power (CHP) installations also necessitates specialized AGCs capable of optimizing both electrical and thermal outputs, driving premium pricing for highly customized, energy-efficient solutions.

Asia Pacific’s dominance stems from volume manufacturing and a massive infrastructure deficit. India and China, in particular, are deploying vast numbers of gensets across telecommunications, manufacturing, and commercial real estate sectors to mitigate frequent power shedding. The competitive focus here is often on robust baseline functionality, cost efficiency, and quick scalability. However, as major APAC economies mature, there is an increasing shift toward the higher-end digital controllers, especially in advanced manufacturing sectors (e.g., semiconductor fabrication) and international data center clusters, mirroring the technological sophistication seen in Western markets. Local manufacturers are increasingly capturing market share by offering cost-effective, regionally specific solutions.

Future Outlook: Decentralization and Software Focus

The future trajectory of the Automatic Genset Controller market is intrinsically tied to the global energy transition toward decentralization. Gensets are evolving from isolated backup units to integral components of complex microgrid ecosystems. AGCs are thus transforming into sophisticated energy resource management systems (ERMS). They must seamlessly coordinate generation assets (gensets), storage assets (batteries), and intermittent renewables (solar/wind), prioritizing economic operation, power quality, and environmental compliance simultaneously. This requires significant investment in advanced software capable of predictive optimization based on weather forecasts, utility tariff structures, and instantaneous load fluctuations.

The competitive battleground will increasingly shift from hardware features to software capabilities, including user interface excellence, interoperability, and the robustness of cloud-based fleet management solutions. Manufacturers offering open Application Programming Interfaces (APIs) and flexible communication architectures will gain a strategic advantage by enabling easier integration with diverse third-party energy management platforms and enterprise resource planning (ERP) systems. Service revenue generated from software subscriptions for predictive maintenance, remote monitoring, and firmware updates is expected to grow substantially, reshaping the business model from product sales to value-added services.

Finally, sustainability mandates will drive demand for controllers optimized for alternative fuels. AGCs must be able to manage the transient performance and control characteristics of gas, hydrogen, and bi-fuel engines, which inherently have different stability and load acceptance profiles than traditional diesel engines. This requires specialized tuning and protective schemes implemented within the controller logic. The emphasis on minimizing generator runtime and maximizing the use of cleaner power sources will cement the AGC’s role as the intelligent orchestrator of reliable, sustainable, decentralized power solutions globally, ensuring its sustained market relevance despite the broader push toward electrification.

The technological advancement in sensors and data processing capabilities directly enhances the quality of input data fed into the AGC, leading to more precise control actions. High-accuracy sensors monitor engine vitals, fuel levels, exhaust emissions, and alternator performance, providing a comprehensive operational picture. The implementation of vibration and acoustic sensors, when paired with AI processing on the edge, allows the AGC to detect subtle anomalies that signal impending mechanical failure long before standard protective relays would trip, facilitating condition-based maintenance. This shift significantly reduces the frequency of unnecessary scheduled maintenance, maximizing operational availability.

Another crucial element of the evolving technology landscape is the focus on interoperability across diverse brands and components. As system integrators increasingly source components from various specialized suppliers (e.g., engines from one vendor, alternators from another, and controls from a third), the AGC must function as the universal translator. Standardization of protocols and open architectures are crucial to avoid vendor lock-in. This emphasis on open standards supports the growth of complex, multi-vendor microgrid projects, which are becoming the norm in industrial and institutional power installations requiring high levels of resilience and customization. Leading manufacturers are investing in robust protocol stacks and gateway functionality within the AGC itself to manage this interoperability challenge effectively.

The robust market expansion is further reinforced by global initiatives aimed at improving electricity access in underserved regions. Government and NGO projects in Sub-Saharan Africa and parts of Southeast Asia rely heavily on robust, low-maintenance power generation solutions. AGCs designed for extreme environments, featuring enhanced temperature tolerance and dust/moisture protection (higher IP ratings), are essential for these deployments. While initial cost remains a barrier, the long-term reliability and reduced maintenance burden offered by digital AGCs over manual or basic analog systems provide a compelling lifecycle cost advantage, thereby accelerating the replacement cycle in these regions.

The convergence of power electronics and digital control is driving the AGC market toward greater efficiency and integration. The capability of modern controllers to communicate effectively with electronic fuel injection (EFI) engines and advanced voltage regulators allows for dynamic adjustments that optimize engine performance under varying load conditions. This fine-tuning capability results in substantial fuel savings over the generator's operating lifespan, making the adoption of sophisticated AGCs a strategic financial decision for large fleet operators. Moreover, the detailed logging and event recording features inherent in digital controllers provide invaluable data for forensic analysis following system disturbances or outages, improving overall system resilience and future design choices.

The competitive differentiation is increasingly centered on the user experience. Manufacturers are developing mobile applications and secure web portals that mirror the functionality of the physical controller display, allowing operators to monitor key parameters, acknowledge alarms, and even initiate remote start/stop sequences via smartphones or tablets. This accessibility dramatically improves response times to critical events and allows for effective management by non-specialized personnel. The focus on intuitive graphical interfaces and streamlined configuration workflows minimizes the specialized training required, thereby lowering the operational barriers for adopting these complex technologies in emerging markets.

Finally, the growing complexity of emissions control systems, particularly for larger industrial engines, necessitates a tightly integrated AGC. These controllers must precisely manage parameters related to Exhaust Gas Recirculation (EGR), Selective Catalytic Reduction (SCR), and Diesel Particulate Filters (DPF) to ensure regulatory compliance without compromising engine performance. The AGC acts as the central brain, coordinating engine operation and emission reduction strategies simultaneously. This critical role ensures that the generator set remains environmentally compliant throughout its operational life, securing the long-term viability of the equipment in environmentally sensitive markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager