Automatic Laser Tube Cutting Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431932 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Automatic Laser Tube Cutting Machine Market Size

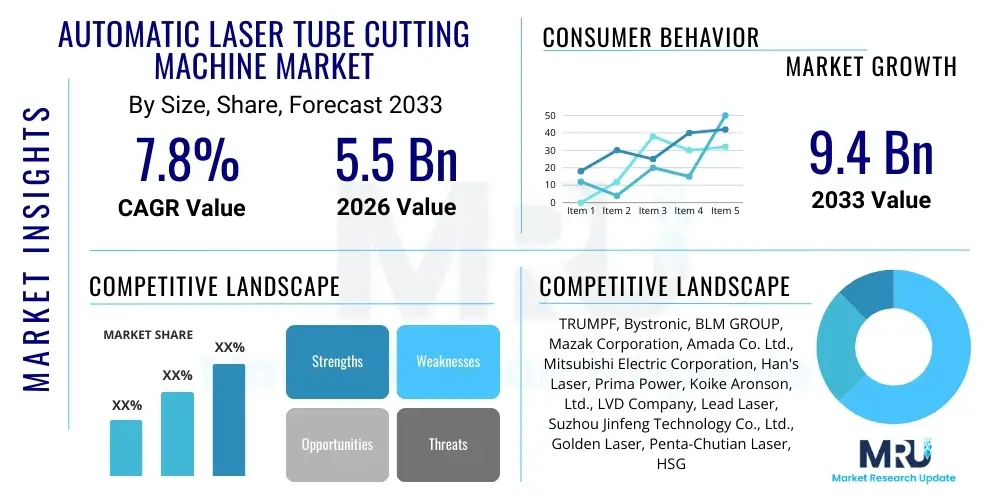

The Automatic Laser Tube Cutting Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 5.5 Billion in 2026 and is projected to reach USD 9.4 Billion by the end of the forecast period in 2033.

Automatic Laser Tube Cutting Machine Market introduction

The Automatic Laser Tube Cutting Machine Market encompasses advanced industrial equipment designed for high-precision, automated processing of metal tubes and pipes using laser technology. These sophisticated machines integrate computer numerical control (CNC) systems, high-power fiber or CO2 lasers, and sophisticated material handling mechanisms to perform complex cuts, holes, and geometries without manual intervention. This automation ensures high throughput, superior quality edge finish, and minimal material wastage, positioning these systems as critical assets in modern manufacturing environments requiring stringent accuracy and efficiency globally.

Major applications span across several demanding industries, including automotive manufacturing for chassis components and exhaust systems, construction for structural framework, furniture production requiring intricate designs, and the oil and gas sector for pipeline fabrication. The primary benefit derived from these machines is the dramatic reduction in processing time and the capacity to handle diverse materials like stainless steel, carbon steel, aluminum, and copper with exceptional repeatability. Furthermore, the inherent non-contact nature of laser cutting eliminates tool wear, further contributing to operational cost efficiency and long-term sustainability and providing superior edge quality compared to traditional abrasive cutting methods.

Driving factors fueling the market growth include the escalating global demand for lightweight and durable components, particularly in the electric vehicle (EV) sector and aerospace industries, which rely on complex tubular structures. The continuous push toward Industry 4.0 and smart factory integration mandates the adoption of fully automated systems that can communicate and adapt within integrated manufacturing chains. Additionally, advancements in fiber laser technology, offering higher energy efficiency and lower maintenance requirements compared to traditional CO2 lasers, are significantly accelerating the replacement cycle of older machinery and expanding the addressable market for automated tube cutting solutions globally, thus driving the market size growth.

Automatic Laser Tube Cutting Machine Market Executive Summary

The global Automatic Laser Tube Cutting Machine Market demonstrates robust expansion driven by increasing industrial automation and the proliferation of complex fabrication requirements across key sectors such as automotive, construction, and HVAC. Current business trends indicate a strong shift towards higher power fiber laser systems (10kW and above) to achieve faster cutting speeds on thicker walled tubes, substantially reducing cycle times and increasing overall manufacturing capacity. There is also a pronounced focus on integrating advanced software solutions that enable dynamic nesting, automatic parameter setting, and real-time diagnostics, enhancing the overall intelligence and efficiency of the cutting process. Competitive differentiation is increasingly achieved through offering comprehensive service packages, including remote maintenance and predictive failure analysis to maximize customer uptime globally.

Regionally, the Asia Pacific (APAC) market, particularly China and India, commands the largest share due to massive investments in infrastructure development and the rapid expansion of domestic manufacturing capabilities, coupled with favorable government policies supporting industrial automation adoption. North America and Europe, while mature, are characterized by high demand for premium, multi-functional machines capable of processing high-strength, specialized alloys required for aerospace and medical devices. These regions prioritize sophisticated automation features, stringent safety standards compliance, and superior energy efficiency, driving innovation in high-end machine design and advanced component sourcing, reflecting a strong preference for total cost of ownership (TCO) over initial acquisition cost.

Segment trends highlight the dominance of systems catering to medium to high tube diameter ranges (100mm to 300mm), reflecting widespread use in structural and heavy machinery applications. Fiber laser technology remains the technological standard bearer, consistently outpacing CO2 lasers due to superior beam quality and energy efficiency, accounting for the largest share by technology. The software and services segment, encompassing control systems, simulation tools, and aftermarket support, is projected to register the fastest growth, underscoring the market's transition from selling hardware to providing comprehensive fabrication solutions that maximize machine uptime, optimize operational yield, and ensure data-driven manufacturing execution for end-users globally.

AI Impact Analysis on Automatic Laser Tube Cutting Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Automatic Laser Tube Cutting Machine Market frequently center on themes of operational intelligence, predictive maintenance capabilities, and enhanced cutting quality optimization. Users are keen to understand how AI can move beyond standard CNC automation to create truly adaptive systems that compensate for material imperfections (such as tube deformation or inconsistent material properties) in real-time, significantly reducing manual adjustments and minimizing scrap. Expectations are high for AI-driven systems that can autonomously manage scheduling, optimize complex tool paths for dynamic nesting configurations, and improve first-pass yield rates by learning from previous cutting outcomes and automatically fine-tuning complex laser parameters such as focal position and power output based on material feedback, ensuring consistency across diverse batches.

The integration of AI transforms the laser tube cutting machine from a programmed tool into an intelligent system capable of self-optimization and predictive functionality. Machine learning algorithms, trained on vast datasets of cutting parameters, material types, and resulting quality metrics, allow the equipment to anticipate potential defects before they occur, automatically adjusting variables like cutting speed, assist gas pressure, and laser intensity to maintain peak performance even under varying environmental or material conditions. This level of autonomy minimizes the reliance on highly specialized human operators for minute adjustments and ensures consistent output quality across long production runs, which is crucial for industries with zero-tolerance for defects, such as medical device manufacturing and aerospace component production, thereby elevating the machine's overall reliability and precision performance globally.

Furthermore, AI significantly enhances the efficiency of maintenance and operational planning within the sector. Predictive maintenance systems, powered by AI, analyze sensor data (vibration, temperature, power consumption) to forecast component failure probabilities, allowing manufacturers to schedule maintenance precisely when needed, rather than relying on fixed time intervals, maximizing machine availability. For fabrication shops handling high-mix, low-volume orders, AI-driven scheduling and nesting optimization tools can rapidly analyze incoming job specifications and determine the most efficient sequence and layout for tube utilization, maximizing material recovery, sometimes by over 5%, and minimizing scrap rates. This directly impacts the manufacturer's bottom line and improves overall supply chain sustainability metrics by reducing material waste significantly.

- AI enables real-time parameter self-adjustment based on material feedback, optimizing cut quality and dynamic speed.

- Predictive maintenance algorithms drastically reduce unexpected machine downtime by forecasting component failure probabilities.

- Machine learning optimizes complex nesting patterns rapidly, maximizing material utilization and minimizing costly scrap generation.

- AI-driven vision systems can detect tube deformation or inconsistencies and dynamically compensate for dimensional variations.

- Automated fault diagnosis speeds up troubleshooting and minimizes the need for high-cost expert technical intervention.

- Enhanced process monitoring through deep learning models ensures real-time adherence to stringent quality control and tolerance standards.

- Autonomous machine learning enhances power efficiency by optimizing laser source usage based on immediate job requirements.

DRO & Impact Forces Of Automatic Laser Tube Cutting Machine Market

The Automatic Laser Tube Cutting Machine Market is primarily driven by the imperative for industrial modernization and the increasing global complexity of designs requiring intricate tubular components, particularly across the automotive, construction, and HVAC sectors demanding higher precision and speed. Key restraints include the substantial initial capital investment required for high-powered, fully automated laser systems, making adoption challenging for small and medium enterprises (SMEs), especially in price-sensitive emerging economies. Significant opportunities lie in the development of highly specialized, compact systems tailored for niche applications (e.g., small-diameter medical components) and the integration of advanced automation features like robotic loading/unloading and real-time quality inspection to create integrated, end-to-end fabrication cells. These factors exert considerable impact forces, driving manufacturers toward developing more energy-efficient and scalable solutions while necessitating strategic financing and leasing models to overcome cost barriers and facilitate broader market penetration globally.

Drivers: The dominant driver remains the persistent shift towards high-precision and high-speed processing in metal fabrication, essential for meeting demanding industry standards and tightening lead times required by modern Just-In-Time (JIT) manufacturing protocols. The rapid expansion of the Electric Vehicle (EV) industry, requiring complex, lightweight tubular battery frames and chassis components made from high-strength steel or aluminum, acts as a massive stimulus for increased laser tube cutting capacity. Furthermore, the global infrastructure boom, particularly in Asia Pacific, necessitates efficient production of structural steel tubes, accelerating demand for high-throughput, large-format cutting machines. Technological advancements in fiber laser sources, which provide superior electrical efficiency and lower operational costs compared to legacy systems, further motivate large-scale industrial adoption and machinery replacement cycles globally, promoting faster ROI.

Restraints: The primary impediment to widespread market growth is the high acquisition cost associated with automated laser tube cutting machines, which includes the significant expense of the high-power laser source, sophisticated CNC controls, and integrated material handling systems. This high barrier to entry limits uptake among smaller fabricators who might opt for traditional, less accurate cutting methods. Additionally, the required operational skill set to program, maintain, and troubleshoot these sophisticated machines is highly specialized, leading to a persistent shortage of qualified technicians in several key manufacturing regions. Economic volatility, global supply chain disruptions, and trade uncertainties also influence capital expenditure decisions, leading to deferred investment in new high-value industrial machinery, impacting short-term sales cycles within the sector and creating procurement bottlenecks.

Opportunities: Opportunities abound in expanding the application scope to new material types and cross-market integrations. Developing compact, high-flexibility machines capable of efficiently processing highly reflective materials like pure copper and brass opens lucrative doors in the electronics, HVAC, and power transmission sectors. The greatest long-term potential lies in integrating laser cutting machines into fully automated, lights-out manufacturing environments through advanced robotic arms and centralized monitoring systems, realizing the full potential of Industry 4.0 principles. Furthermore, expanding service revenue streams through subscription-based software updates (for nesting and optimization) and advanced remote diagnostics presents a profitable long-term strategy for key market players, shifting the focus from transactional product sales to comprehensive solution provision and recurring revenue generation.

Segmentation Analysis

The Automatic Laser Tube Cutting Machine Market is comprehensively segmented based on technology type, laser power, tube diameter capacity, and end-user industry. This segmentation provides a granular view of the market dynamics, revealing specific demand patterns, technological preferences, and growth trajectories across different industrial applications globally. The market analysis confirms Fiber Laser technology's dominance due to its operational advantages. Power classification directly dictates the machine's material processing capabilities and is a critical factor influencing purchasing decisions, while tube diameter capacity defines the machine's primary target market segment, differentiating light fabrication from heavy structural work. The segmentation helps stakeholders strategically focus R&D and marketing efforts on the most promising high-growth segments globally.

- By Technology: Fiber Laser, CO2 Laser, Others (e.g., Disk Laser).

- By Laser Power: Low Power (<= 1kW, primarily for thin materials), Medium Power (1kW - 3kW, general purpose), High Power (> 3kW, heavy duty/high speed).

- By Tube Diameter Capacity: Small Diameter (<= 100 mm, complex small parts/furniture), Medium Diameter (101 mm - 300 mm, automotive/structural), Large Diameter (> 300 mm, oil & gas/heavy construction).

- By End-User Industry: Automotive (largest share), Construction & Infrastructure, Aerospace & Defense, HVAC & Energy, Furniture & Consumer Goods, Others (e.g., Medical Devices, Shipbuilding, Agricultural Equipment).

Value Chain Analysis For Automatic Laser Tube Cutting Machine Market

The value chain for the Automatic Laser Tube Cutting Machine Market is complex and capital-intensive, starting with the upstream suppliers of core components such as highly specialized laser resonators, precision optical systems, and highly sophisticated CNC controls. These upstream activities are highly concentrated, often involving a few globally dominant technology providers (e.g., IPG Photonics for fiber lasers, specialized German/Japanese firms for CNC systems). The core manufacturing stage involves systems integrators and Original Equipment Manufacturers (OEMs) who bear the responsibility for machine design, assembly, rigorous calibration, and customization. Downstream analysis focuses heavily on efficient distribution channels, including direct sales teams for large industrial clients (offering specialized configuration and installation) and indirect channels utilizing regional distributors or agents, particularly in developing markets, who manage localized sales, ongoing service, and critical spare parts inventory to ensure rapid regional support.

The upstream segment is characterized by rapid technological innovation, particularly concerning the efficiency, beam quality, and power output of the fiber laser source. Suppliers of high-precision motion control systems (linear motors, high-precision rotary drives) and specialized software modules also play a critical role in determining the final machine performance, reliability, and accuracy. Manufacturers focus on optimizing machine design for thermal stability, vibration damping, and stringent international safety compliance, adding significant proprietary value through mechanical engineering and integrated control software development. Strategic long-term partnerships with critical component suppliers are essential to ensuring a stable, resilient supply chain and incorporating the latest technological breakthroughs quickly and efficiently into new product lines globally.

The downstream flow is dominated by after-sales service and comprehensive, expert customer training, which is vital due to the inherent complexity and high cost of the equipment. Direct sales channels are consistently preferred for high-value, bespoke contracts with major automotive Tier 1 suppliers or construction giants, ensuring tailored deployment, sophisticated application engineering support, and detailed maintenance contracts based on guaranteed uptime metrics. Indirect distribution channels, particularly prevalent in rapidly growing markets across Asia Pacific and Latin America, leverage local expertise for faster market penetration and localized support. Success in the downstream market relies heavily on providing rapid response times for technical issues and ensuring the immediate availability of critical spare parts, thereby maximizing customer uptime and generating reliable, recurring revenue through long-term service agreements and advanced technical support, often incorporating secure, remote diagnostic capabilities for enhanced efficiency.

Automatic Laser Tube Cutting Machine Market Potential Customers

The primary potential customers and end-users of Automatic Laser Tube Cutting Machines are high-volume metal fabrication shops and specialized manufacturing entities across all industries requiring precise, complex tubular components. Key buyers include global automotive manufacturers and their Tier 1 and Tier 2 suppliers, who utilize these machines extensively for producing lightweight chassis frames, high-strength safety cages, and intricate exhaust systems, demanding extremely high consistency and throughput speed. Additionally, large-scale construction and infrastructure companies purchasing machines for precise processing of structural steel and complex pipework represent strategically significant market segments.

The furniture industry, especially high-end manufacturers requiring intricate tubular designs, lightweight materials, and high aesthetic quality, is a rapidly growing consumer, alongside the highly critical aerospace and defense sectors needing exceptional precision for specialized alloy tubing used in hydraulic lines, engine components, and structural systems, where quality assurance standards are extremely stringent and mandated by regulatory bodies. Other important segments include manufacturers of agricultural machinery, specialized medical equipment (e.g., orthopedic implants), and HVAC system producers, all seeking increased automation and superior cut quality to remain competitive and meet increasingly strict performance standards globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 9.4 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TRUMPF, Bystronic, BLM GROUP, Mazak Corporation, Amada Co. Ltd., Mitsubishi Electric Corporation, Han's Laser, Prima Power, Koike Aronson, Ltd., LVD Company, Lead Laser, Suzhou Jinfeng Technology Co., Ltd., Golden Laser, Penta-Chutian Laser, HSG Laser, HGTECH, Unity Laser, G. Weike Laser, Sintec Co., Ltd., Tianjin Golden Wheel Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Laser Tube Cutting Machine Market Key Technology Landscape

The core technology landscape of the Automatic Laser Tube Cutting Machine Market is predominantly shaped by the rapid evolution of fiber laser technology, which has significantly displaced traditional CO2 laser systems over the last decade due to its superior energy conversion efficiency, substantially reduced maintenance requirements, and inherent ability to effectively process highly reflective materials like aluminum and copper. Modern high-end machines integrate high-power fiber resonators (often ranging from 6kW to 15kW) capable of cutting thick walls at unprecedented speeds, paired with advanced dynamic focusing systems that automatically optimize the laser beam profile instantaneously for different materials and wall thicknesses, ensuring optimal cutting quality across diverse material stocks.

A second crucial technological area involves sophisticated Computer Numerical Control (CNC) and proprietary Machine Control Systems. These systems are now highly specialized, utilizing advanced predictive algorithms for collision avoidance during complex 3D cutting paths and dynamically optimizing material yield through advanced nesting software that minimizes scrap and maximizes tube utilization. The integration of high-speed, high-precision linear motor drives, rather than traditional rack-and-pinion systems, ensures maximum geometric accuracy and dynamic acceleration, which is particularly vital for high-volume automotive component production where extremely tight tolerances and speed are mandatory. Furthermore, real-time sensor fusion technology is deployed to monitor cutting conditions, temperature, and assist gas pressure, ensuring consistent quality throughout the entire cutting process, which enhances the overall reliability and output quality of the automated machine globally.

Furthermore, the implementation of highly efficient automated material handling systems defines the 'Automatic' aspect of the market. This includes robotic loading systems capable of managing long, heavy tubes up to 12 meters in length and automated scrap removal, along with finished part sorting systems designed to efficiently handle high-volume output. Advanced features like five-axis bevel cutting heads, integrated tapping and drilling capabilities, and welding preparation functions (e.g., complex edge preparations) are increasingly being bundled, transforming the laser cutter from a simple cutting tool into a versatile, multi-functional fabrication center. The growing adoption of secure cloud connectivity for remote diagnostics, over-the-air software updates, and overall production monitoring aligns the technology within the broader framework of Industry 4.0, facilitating smarter manufacturing execution systems globally and providing critical data insights for process optimization to operators.

Regional Highlights

The global demand for Automatic Laser Tube Cutting Machines exhibits distinct regional characteristics influenced by manufacturing base maturity, local investment levels in automation, and specific industrial focus areas, creating varied growth profiles and competitive landscapes across continents.- Asia Pacific (APAC): APAC is the dominant market in terms of volume and is projected to maintain the highest growth rate, primarily driven by China and India. This rapid growth is fueled by massive government investments in infrastructure, the aggressive expansion of domestic automotive manufacturing (including leadership in EVs), and the continued favorable trend of global manufacturing capacity migration into the region. The high volume of structural steel fabrication and general fabrication work necessitates constant investment in high-throughput, medium-to-large capacity laser tube cutting equipment. Price sensitivity remains a key factor, leading to intense competition among domestic and established international suppliers focusing on achieving superior price-to-performance ratios.

- North America: This region is characterized by high demand for specialized, high-precision, and highly integrated machinery tailored for stringent applications in aerospace, medical devices, and high-quality construction. North American fabricators consistently prioritize advanced operational features such as multi-axis cutting, integrated robotic handling, and robust software integration (seamless MES/ERP connectivity). The market focuses heavily on replacing older, less efficient CO2 technology with modern, high-power fiber laser systems to enhance operational sustainability, reduce energy consumption, and meet increasingly stringent quality requirements across complex alloy processing applications.

- Europe: Europe represents a mature market with a strong emphasis on continuous technological innovation, strict environmental compliance, and advanced worker safety standards. Countries like Germany, Italy, and Switzerland lead in both machine manufacturing and advanced adoption, focusing intensely on systems that offer maximum automation, superior energy efficiency, and extreme flexibility necessary for handling small batch sizes in high-mix, low-volume production environments. The premium automotive sector and specialized machinery manufacturing industries drive demand for sophisticated cutting capabilities optimized for high-strength steel and complex aluminum alloys used in crucial lightweighting initiatives.

- Latin America (LATAM): Growth in LATAM is steady, driven mainly by the domestic automotive assembly, mining sectors (requiring heavy-duty pipework), and construction activities. Market adoption historically favored cost-effective solutions, though there is accelerating recognition of the long-term total cost of ownership benefits associated with advanced fiber laser technology. This recognition is slowly driving technological modernization efforts in industrial hubs such as Brazil and Mexico, focusing on improving local fabrication quality and throughput capabilities.

- Middle East and Africa (MEA): This region's demand is heavily concentrated in the massive construction, large-scale oil and gas, and rapidly expanding energy sectors, requiring robust, large-diameter, and thick-walled pipe cutting capabilities. Major infrastructure development projects in the Gulf Cooperation Council (GCC) countries are the primary consumers, prioritizing machine robustness, reliability, and high serviceability under challenging high-temperature operational conditions prevalent across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Laser Tube Cutting Machine Market.- TRUMPF

- Bystronic

- BLM GROUP

- Mazak Corporation

- Amada Co. Ltd.

- Mitsubishi Electric Corporation

- Han's Laser

- Prima Power

- Koike Aronson, Ltd.

- LVD Company

- Lead Laser

- Suzhou Jinfeng Technology Co., Ltd.

- Golden Laser

- Penta-Chutian Laser

- HSG Laser

- HGTECH

- Unity Laser

- G. Weike Laser

- Sintec Co., Ltd.

- Tianjin Golden Wheel Group

Frequently Asked Questions

Analyze common user questions about the Automatic Laser Tube Cutting Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Automatic Laser Tube Cutting Machine Market?

The market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven primarily by the global industrial shift towards high-speed automation and the widespread adoption of efficient fiber laser technology across key manufacturing sectors such as automotive and construction.

Which technology dominates the Automatic Laser Tube Cutting Machine Market?

Fiber laser technology overwhelmingly dominates the market due to its superior energy efficiency, significantly higher processing speed, lower maintenance requirements, and ability to reliably cut a broader and more diverse range of materials, including highly reflective metals, compared to legacy CO2 laser systems.

How does AI influence the operational efficiency of tube cutting machines?

AI significantly enhances operational efficiency by enabling intelligent predictive maintenance, automatically adjusting complex laser parameters in real-time to precisely compensate for material variations, and optimizing nesting algorithms to maximize material yield and substantially reduce scrap, thereby minimizing human intervention and maximizing production consistency.

Which end-user industry is the largest consumer of these machines?

The Automotive industry, encompassing traditional vehicle manufacturing and the rapidly accelerating Electric Vehicle (EV) sector, is the largest consumer, utilizing these machines for producing complex, lightweight tubular components such as exhaust systems, intricate chassis frames, and structural battery structures with guaranteed high precision and speed.

What are the primary restraints affecting market growth?

The primary restraints include the high initial capital investment required for purchasing sophisticated automated laser systems, coupled with a persistent global shortage of specialized skilled labor capable of programming, operating, and maintaining these high-tech machines effectively, alongside fluctuating global economic uncertainty impacting capital expenditure decisions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager