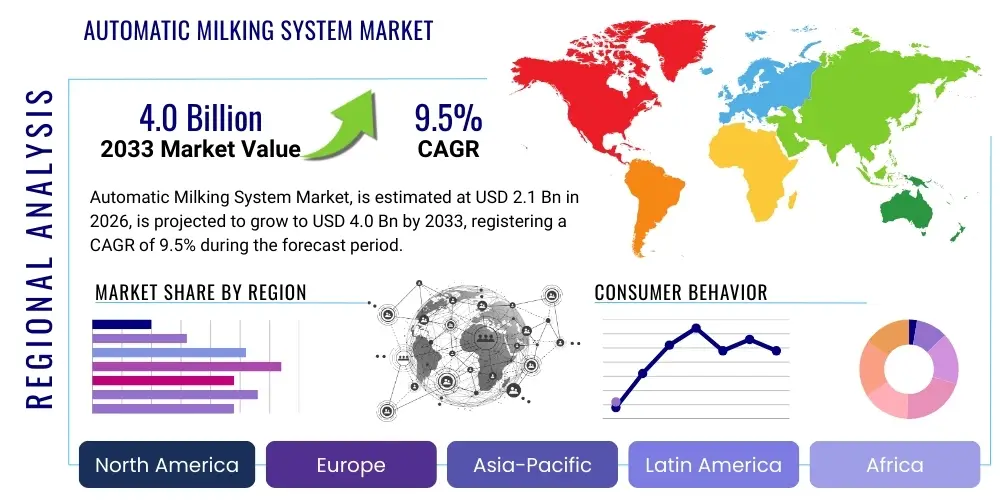

Automatic Milking System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439040 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automatic Milking System Market Size

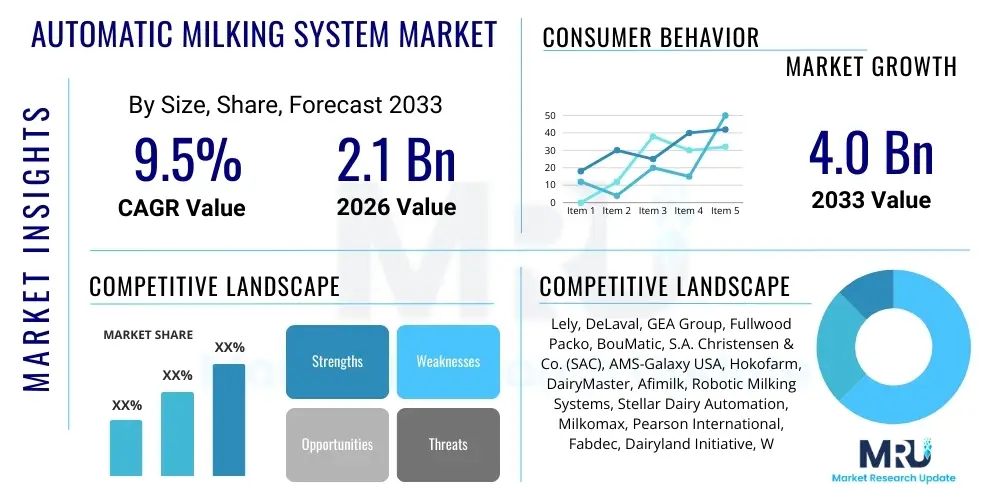

The Automatic Milking System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Automatic Milking System Market introduction

The Automatic Milking System (AMS) market encompasses advanced robotic technologies designed to fully automate the process of harvesting milk from dairy livestock, primarily cattle. These sophisticated installations utilize integrated sensory arrays, precision robotic arms, and complex machine vision systems to manage the entire milking cycle autonomously. Key functions performed by an AMS include automatic cow identification via transponders, preparatory udder cleaning, highly accurate teat cup attachment and detachment, precise yield measurement, and post-milking disinfection. The core value proposition of AMS lies in its ability to enable free cow traffic and voluntary milking, significantly deviating from the traditional fixed-schedule parlor milking, thereby optimizing milk production frequency and volume while enhancing animal welfare metrics.

The technological sophistication inherent in modern AMS platforms extends beyond mechanical execution; they serve as critical data collection hubs within the smart farm ecosystem. Each unit is equipped with conductivity sensors, temperature probes, and milk composition analyzers that provide real-time, cow-specific data on health and productivity. This continuous monitoring capability allows dairy producers to gain granular insights into individual animal performance, reproductive status, and the immediate onset of potential pathologies like mastitis, enabling preventative intervention rather than reactive treatment. The integration of AMS data with overall herd management software platforms facilitates optimized feeding strategies and labor allocation, contributing directly to increased operational profitability and efficiency across the farm enterprise.

Market growth is predominantly driven by the critical socio-economic imperatives affecting global agriculture. Persistent challenges related to the availability and escalating cost of reliable, skilled farm labor compel dairy producers in developed economies to seek highly efficient automation solutions. Furthermore, increasing consumer demand for ethically sourced and highly traceable dairy products, coupled with stringent national and supranational regulatory mandates concerning milk hygiene and animal handling, solidifies the business case for investment in robotics. AMS deployment represents a strategic move towards sustainable intensification, where maximizing output per resource unit (labor, feed, land) is paramount to long-term farm viability and competitiveness in the global dairy commodity market.

Automatic Milking System Market Executive Summary

The Automatic Milking System market is experiencing dynamic growth, characterized by convergence between heavy machinery manufacturing and advanced information technology sectors. Major business trends include a structural shift from selling standalone hardware units to offering comprehensive, integrated system solutions under software-as-a-service (SaaS) or long-term operational lease agreements. This model reduces the initial capital burden for farmers while ensuring consistent revenue streams through ongoing maintenance and software upgrades for manufacturers. Strategic partnerships focused on integrating AMS platforms with complementary technologies, such as automated feeding systems and precision manure handling, are crucial, enabling dairy farms to transition towards fully autonomous, closed-loop operational environments designed for maximum resource efficiency.

Geographically, the market leadership remains concentrated in Europe, where governmental policies and socio-economic factors, notably high labor opportunity costs, have fostered a mature adoption environment. Countries like Germany and the Netherlands continue to drive innovation and penetration rates. However, the most significant growth vector is the Asia Pacific region, specifically China and Australia, where rapid industrialization of dairy farming and increasing foreign direct investment in large-scale corporate operations are creating substantial demand for high-throughput robotic systems. North American growth is stable, primarily focused on scaling existing installations and integrating AI for predictive farm intelligence across vast, commercialized herd environments.

Segment analysis reveals that the multi-stall and rotary AMS segments are capturing the majority of new installation value, particularly appealing to operations managing 200 or more cows where throughput capacity is the primary efficiency determinant. Technologically, the component segment focusing on advanced sensors (e.g., optical spectroscopy for detailed milk composition analysis) and dedicated herd management software is exhibiting the fastest innovation and revenue growth. This trend underscores the market’s evolution: systems are increasingly valued not just for their ability to replace manual labor, but for their capacity to generate, process, and utilize actionable data to drive smarter management decisions and optimize biological processes across the dairy herd.

AI Impact Analysis on Automatic Milking System Market

User inquiries concerning AI's role in the Automatic Milking System Market primarily center on predictive maintenance, enhanced herd health diagnostics, and optimizing milking routines based on individual cow behavioral patterns. Common questions address how AI algorithms can predict equipment failure before it occurs, thereby minimizing costly downtime, and the capability of machine learning models to identify early signs of illness (like mastitis or lameness) from sensor data (milk flow rate, conductivity, temperature) faster than human inspection. Furthermore, users frequently seek clarification on AI's ability to personalize milking frequency and attachment pressure, optimizing yield while ensuring animal comfort. The overarching theme is the expectation that AI will transform AMS from an automated tool into a truly intelligent farm management system capable of autonomous decision-making, significantly boosting productivity and reducing human error.

- Enhanced Predictive Maintenance: AI algorithms analyze continuous operational data streams (vibration, motor performance, cycle times) to preemptively identify potential hardware malfunctions (e.g., faulty valves or robot arm drift), minimizing system downtime and service costs.

- Advanced Disease Detection: Machine Learning models correlate sensor readings (milk conductivity, temperature, color spectrum, somatic cell count proxies) with cow behavior to detect and flag subclinical infections (mastitis, ketosis) significantly earlier than human or basic algorithmic methods.

- Optimized Milking Protocols: AI dynamically adjusts milking parameters—including attachment angle, vacuum pressure, and pulsation settings—in real-time based on individual cow milking history and physiological response, ensuring maximal yield and udder health.

- Automated Behavioral and Mobility Scoring: Computer vision combined with AI analyzes cow movement patterns, feeding durations, and lying behavior within the barn, providing autonomous mobility and stress scoring that alerts farmers to potential lameness or discomfort.

- Refined Resource Allocation: AI optimizes the application of cleaning chemicals, water consumption, and energy usage based on real-time hygiene needs and operational cycles, contributing to sustainable farming practices.

- Integrated Decision Support Systems: AI serves as the core intelligence layer, fusing data from AMS with external sources (weather, feed quality, genetics) to offer high-level strategic recommendations on feed formulation, breeding cycles, and parlor configuration management.

DRO & Impact Forces Of Automatic Milking System Market

The market for Automatic Milking Systems is propelled by powerful macro-economic drivers, primarily the deepening crisis of agricultural labor availability and the rising global demand for higher milk productivity under stricter sustainability guidelines. The increasing age of the farming population in developed markets, coupled with stricter immigration policies affecting seasonal labor, solidifies automation as a non-negotiable factor for continuity. Furthermore, governmental initiatives, notably in the EU and North America, offering direct subsidies, tax credits, or favorable loan structures for farm technology adoption significantly de-risk the investment for dairy producers, accelerating the market penetration rate across various herd size segments. The proven ability of AMS to increase milking frequency, thereby boosting per-cow yield by 10% to 20%, establishes a clear, quantifiable economic driver for technology adoption.

However, significant market restraints persist, most notably the high initial capital investment required, which can range from $150,000 to over $300,000 per robotic stall, making the technology prohibitive for many smaller, financially constrained family farms. Moreover, successful AMS implementation often mandates substantial barn redesign and infrastructure modifications to accommodate optimal cow traffic flow and system placement, incurring additional non-equipment costs. Another critical restraint is the technical complexity and reliance on specialized maintenance expertise. Any system failure leads to immediate milk loss, placing immense pressure on manufacturers and dealers to provide highly responsive, 24/7 technical support, which is often challenging to scale geographically.

Opportunities for future expansion are rooted in technological refinement and geographic market expansion. Integrating AMS with nascent smart agricultural technologies, such as advanced IoT platforms, decentralized data architectures, and enhanced AI-driven diagnostics, represents a significant growth pathway, transforming raw data into predictive, prescriptive management recommendations. Geographically, the opportunity to penetrate rapidly industrializing dairy sectors in Asia (e.g., Vietnam, Indonesia) and Eastern Europe, where labor costs are currently lower but expected to rise sharply, offers new large-scale markets. The dominant impact force remains the technological push driven by competition among key manufacturers to enhance the reliability, affordability, and ease-of-use of systems, simultaneously improving the efficiency of teat cup attachment (the most complex robotic action) and minimizing electricity and water consumption per liter of milk produced. Stringent global food safety regulations act as a secondary, yet powerful, external force demanding the high levels of hygiene and traceability inherently provided by automated systems.

Segmentation Analysis

The Automatic Milking System market is differentiated across multiple dimensions to cater to the diverse needs of the global dairy industry, varying significantly based on farm scale, capital availability, and operational philosophy. The System Type segmentation is crucial, determining the farm's ability to manage cow traffic and throughput, ranging from highly flexible single-stall units for focused production to high-capacity rotary systems optimized for massive commercial operations. Analyzing the market by Component is equally important, reflecting the growing technological value shift from purely mechanical hardware towards specialized software, sensors, and ongoing maintenance services that constitute the recurring revenue base and provide intellectual property differentiation for manufacturers.

- By System Type:

- Single-Stall Unit (Box System): Ideal for small to mid-sized herds (up to 70 cows per unit).

- Multi-Stall Unit (Multi-Box System): Configurable clusters for larger herds, balancing flexibility with increased capacity.

- Rotary (Automatic Milking Rotary): High-throughput, continuous flow systems designed for large-scale industrial dairy operations (500+ cows).

- By Component:

- Hardware: Robotic Arm Mechanics, Vacuum Systems, Pumps, Gates, Teat Cups, and Stall Infrastructure.

- Sensors and Cameras: 3D Vision Systems, Laser Guidance, In-line Milk Quality Analyzers (Conductivity, Temperature, SCC), RFID readers.

- Software and Services: Cloud-based Herd Management Platforms, Data Analytics Modules (AI/ML), Predictive Maintenance Services, Farmer Training and Support Contracts.

- By Herd Size:

- Small Farms (Under 70 cows): Focus on single-box system efficiency and low maintenance.

- Medium Farms (70 to 200 cows): Use multi-box systems for scaling capacity incrementally.

- Large Commercial Farms (Above 200 cows): Primarily utilize high-density multi-box clusters or rotary systems.

- By Application:

- Dairy Cows (Dominant Market Segment)

- Goats and Sheep (Niche Market requiring specialized attachment mechanics)

Value Chain Analysis For Automatic Milking System Market

The Automated Milking System value chain begins with highly specialized upstream sourcing, where manufacturers rely heavily on suppliers of precision industrial robotics, complex electronic control units (ECUs), and advanced sensor technologies crucial for milk analysis and accurate robotic movement. This phase is characterized by stringent quality checks and long lead times for highly customized components, often sourced from specialized robotics and medical device technology providers to meet the high hygiene standards of the food processing industry. Manufacturers must establish resilient supply chains for components like high-speed cameras, hygienic stainless steel, and specialized rubberware used for teat cups, ensuring component durability and adherence to international dairy equipment safety standards (e.g., ISO and FDA requirements).

The subsequent midstream manufacturing and assembly phase involves highly automated production lines where core robotic units and milking equipment are integrated. Leading AMS vendors differentiate themselves here through proprietary software development, integrating the operating system and herd management interface seamlessly into the hardware. This integration capacity is a major source of competitive advantage. The distribution network then takes over, which is predominantly indirect, utilizing a globally dispersed network of highly skilled, certified dealer partners. These partners are crucial as they manage the complex logistics, installation planning (often requiring farm-specific layouts), and the initial training of farm staff, transferring specialized operational knowledge that is vital for the successful adoption and high utilization rates of the AMS.

Downstream market engagement is centered on long-term support and service provision. Due to the high criticality of AMS uptime, manufacturers and dealers earn substantial recurring revenue through comprehensive service level agreements (SLAs), offering preventative maintenance, rapid repair response, and continuous software updates. Direct channels are increasingly used by manufacturers for providing high-level data analysis consulting and strategic herd management advice to their largest corporate clients, facilitating a shift towards a data-driven partnership model. The value chain is constantly being optimized to reduce installation complexity and enhance remote diagnostic capabilities, minimizing the need for physical technician visits and thereby improving the overall lifetime total cost of ownership (TCO) for the dairy producer.

Automatic Milking System Market Potential Customers

The core demographic of potential customers for Automatic Milking Systems includes established commercial dairy operations facing acute labor shortages and possessing the requisite financial infrastructure or access to capital financing. These end-users are often characterized by a strong commitment to technological integration and a focus on maximizing production per employee hour. Primary buyers are increasingly large cooperative farms and corporate dairy enterprises in regions like the US Midwest, Northern Europe, and Oceania, where scalability and quantifiable efficiency gains are the foremost business objectives. These entities prioritize fully integrated, multi-box or rotary systems capable of handling high volumes with minimal human supervision.

A rapidly expanding customer segment comprises medium-sized family farms (typically 50 to 200 cows) in high-cost environments who are utilizing AMS as a strategy for succession planning and labor retention. For these buyers, the ability to improve work-life balance, reduce physically demanding labor, and maintain profitability without increasing herd size substantially makes the investment justifiable. They often seek modular, single-stall systems that allow for gradual implementation and lower initial structural upheaval. Furthermore, niche customers include specialized dairy operations focusing on high-value, organic, or specialty milk production, where the detailed, real-time data provided by AMS sensors helps validate milk quality claims and ensure compliance with premium market standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lely, DeLaval, GEA Group, Fullwood Packo, BouMatic, S.A. Christensen & Co. (SAC), AMS-Galaxy USA, Hokofarm, DairyMaster, Afimilk, Robotic Milking Systems, Stellar Dairy Automation, Milkomax, Pearson International, Fabdec, Dairyland Initiative, Waikato Milking Systems, Konedata, VDL Agrotech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Milking System Market Key Technology Landscape

The foundational technology for Automatic Milking Systems centers on sophisticated mechatronics, merging high-precision industrial robotics with customized dairy equipment requirements. The central robotic arm is engineered for rapid, flexible movement and high reliability, utilizing advanced servo control systems to navigate precisely to the cow's udder, even in variable conditions. This operation is underpinned by advanced computer vision technology, involving 3D mapping and laser profiling of the teat area to ensure exact cup alignment and gentle attachment, minimizing errors and maximizing cow comfort. The continuous development in robotic actuator speed and sensor integration has drastically reduced the attachment failure rate, significantly boosting the operational efficiency and acceptance of the technology by both farmers and livestock.

The critical evolution lies in the sensory and analytical capabilities integrated directly into the milking line. Modern AMS units incorporate specialized inline sensors capable of non-invasively measuring critical milk parameters, including conductivity (for early mastitis detection), temperature, and often utilizing near-infrared (NIR) or optical spectroscopy to estimate fat, protein, and lactose levels. This instant, cow-specific data provides immediate feedback for farm management, allowing for automatic diversion of abnormal milk and personalized feed adjustments. Furthermore, highly reliable radio-frequency identification (RFID) tags and biometric identification systems (e.g., neck transponders or visual recognition software) ensure that every unit of data collected is correctly attributed to the individual cow, forming the bedrock of precision livestock farming.

The ongoing digital transformation of AMS is powered by robust software ecosystems and cloud-based platforms designed for data aggregation and predictive analytics. These platforms utilize IoT protocols to communicate seamlessly with sensors, robotic arms, and external farm systems. The adoption of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is the cutting edge, applied both to optimize cow traffic flow within the barn (determining when a cow should be prompted for milking based on previous production cycles) and to provide advanced diagnostics. AI models improve the accuracy of disease prediction by correlating subtle shifts in milk parameters with behavioral data, transforming passive data collection into an active decision-support tool, thereby ensuring the longevity and sustained high performance of the robotic investment.

Regional Highlights

- Europe: The global leader in AMS installations, characterized by the highest market penetration driven by high labor costs and a strong governmental commitment to ecological and animal welfare standards. The Netherlands, Sweden, and Germany are hubs of innovation and adoption. The market is mature, emphasizing technological upgrades and high utilization rates of installed bases.

- North America: A significant and consistent market where growth is concentrated among large industrial dairies focused on maximizing herd size efficiency. Key drivers are labor mitigation and large-scale data integration. The trend here is toward replacing older parlor technologies with automated rotary and multi-box systems to achieve maximum throughput.

- Asia Pacific (APAC): The fastest-growing regional market, propelled by massive corporate investment in modern dairy infrastructure in China and the rapid modernization of traditional farming in Australia and New Zealand to enhance global export competitiveness. Government policies support the import and adoption of foreign agricultural technology, creating fertile ground for high-value robotic installations.

- Latin America (LATAM): Exhibits accelerating adoption, particularly in dairy export powerhouses like Brazil and Argentina. Market entry often requires localized financing models and systems capable of operating reliably in diverse climatic conditions. The focus is on improving milk safety standards and efficiency to compete in international markets.

- Middle East and Africa (MEA): A high-value, but niche market largely restricted to large, climate-controlled mega-farms in the Gulf Cooperation Council (GCC) states. These operations depend heavily on sophisticated AMS technology to manage extremely large herds in challenging desert environments, utilizing automation to completely bypass domestic labor availability constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Milking System Market.- Lely

- DeLaval

- GEA Group

- Fullwood Packo

- BouMatic

- S.A. Christensen & Co. (SAC)

- AMS-Galaxy USA

- Hokofarm

- DairyMaster

- Afimilk

- Robotic Milking Systems

- Stellar Dairy Automation

- Milkomax

- Pearson International

- Fabdec

- Dairyland Initiative

- Waikato Milking Systems

- Konedata

- VDL Agrotech

Frequently Asked Questions

Analyze common user questions about the Automatic Milking System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical Return on Investment (ROI) period for installing an Automatic Milking System?

The ROI period typically ranges between four and seven years, primarily contingent on the magnitude of labor cost savings achieved, the percentage increase in milk yield due to optimal frequency, and the availability of governmental subsidies. Efficient herd management and high system utilization are crucial accelerators for realizing the investment return.

How does Automatic Milking System technology specifically improve animal welfare on dairy farms?

AMS promotes superior animal welfare by facilitating voluntary, cow-driven milking, which reduces stress and improves comfort. Integrated sensors provide continuous, non-invasive health monitoring, allowing for extremely early detection of pathological conditions like mastitis or lameness, leading to timely and targeted intervention.

What are the primary operational challenges faced by farmers adopting robotic milking?

Key operational challenges include the mandatory restructuring of barn layouts to ensure efficient cow flow, the required steep learning curve for mastering complex data management software, and the critical need for immediate, specialized technical support to maintain high system uptime and minimize catastrophic milk loss during failures.

Are Automatic Milking Systems suitable for all sizes of dairy farms?

Yes, while historically targeting large operations, the market now offers versatile solutions. Single-stall units are economically viable for small-to-mid-sized farms (under 100 cows), whereas large commercial operations (200+ cows) typically utilize high-capacity multi-box clusters or sophisticated automated rotary systems to manage throughput.

Which geographic region currently leads the global adoption of Automatic Milking Systems?

Europe maintains global leadership in AMS adoption, driven by extremely high agricultural labor costs, proactive government support through subsidies for farm technology, and strict animal welfare standards that favor the voluntary nature of robotic milking systems over traditional fixed schedules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager