Automatic Overwrapping Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434639 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automatic Overwrapping Machine Market Size

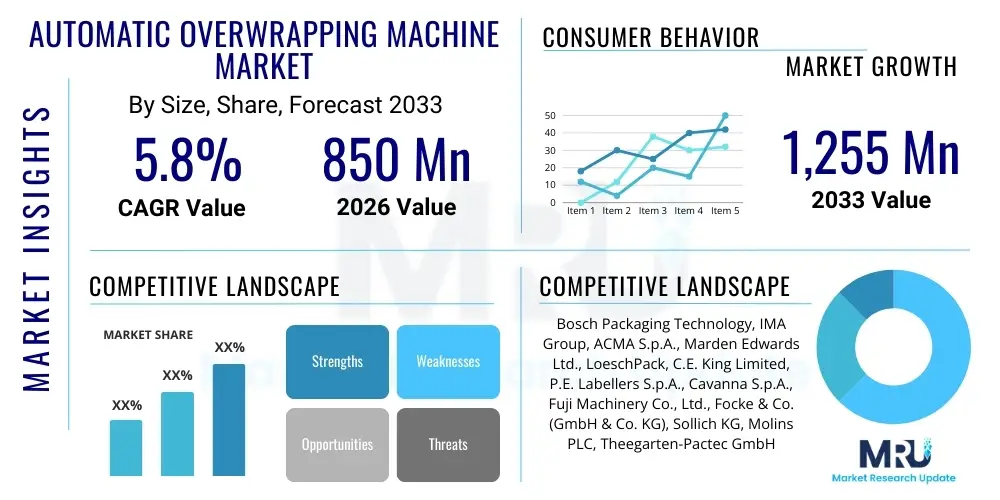

The Automatic Overwrapping Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,255 Million by the end of the forecast period in 2033.

Automatic Overwrapping Machine Market introduction

The Automatic Overwrapping Machine Market encompasses equipment designed for high-speed, precision application of film around products, commonly utilizing heat-sealable films such as BOPP (Biaxially Oriented Polypropylene) or cellophane. These machines are crucial for achieving a premium, professional finish, enhancing product aesthetics, and providing tamper-evident protection. They operate entirely without manual intervention during the wrapping process, handling everything from feeding and cutting the film to folding, sealing, and final discharge. Their application is widespread across industries requiring aesthetic secondary packaging, particularly where product integrity and presentation are paramount, such as cosmetics, perfumes, pharmaceuticals, confectionery, and tobacco.

The core functionality of these sophisticated systems involves using mechanical precision coupled with advanced thermal control to ensure tight, wrinkle-free wrapping at extremely high throughput rates. Key advantages include consistent quality assurance, reduced labor costs, and significant efficiency improvements compared to semi-automatic or manual methods. Furthermore, modern automatic overwrapping machines are designed for quick format changeovers, accommodating a diverse range of product sizes and shapes, thereby increasing operational flexibility for manufacturers handling multiple SKUs. The adoption is heavily driven by increasing consumer demand for hygienically packaged and visually appealing products, coupled with stringent regulatory requirements in sectors like pharmaceuticals.

The major driving factors contributing to market expansion include the globalization of supply chains demanding consistent packaging standards, the proliferation of unit-dose and multi-pack consumer goods, and the persistent need for brand protection against counterfeiting. As automation becomes non-negotiable for large-scale production, particularly in emerging economies seeing rapid industrialization, the demand for high-performance, integrated overwrapping solutions that seamlessly interface with upstream and downstream packaging equipment continues to accelerate. Manufacturers are focusing on developing more energy-efficient models capable of handling sustainable, thinner films without compromising structural integrity or speed.

Automatic Overwrapping Machine Market Executive Summary

The Automatic Overwrapping Machine Market is characterized by robust growth, primarily fueled by global expansion in the pharmaceutical and Fast-Moving Consumer Goods (FMCG) sectors, particularly the booming demand for premium and secure product packaging. Business trends indicate a strong shift towards flexible machinery capable of utilizing sustainable and recyclable packaging films, aligning with global environmental, social, and governance (ESG) mandates. Key manufacturers are aggressively investing in modular designs, integrating advanced servo technology and Human-Machine Interface (HMI) systems to simplify operation and maintenance, thereby offering a competitive edge based on total cost of ownership (TCO) rather than just initial capital outlay. Strategic acquisitions and partnerships are common as companies seek to expand their geographic reach and integrate specialized technologies, such as advanced vision inspection systems for quality control.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, driven by rapid industrialization, expanding domestic consumption bases (especially in China and India), and the establishment of large-scale manufacturing hubs for cosmetics and pharmaceuticals. North America and Europe, while mature, maintain significant market share due to stringent regulatory environments (mandating high-quality, tamper-evident packaging) and the early adoption of highly automated, high-throughput equipment. Latin America and the Middle East & Africa (MEA) are emerging markets, showing significant investment in packaging infrastructure supported by foreign direct investment and localized manufacturing initiatives aimed at reducing import dependency.

Segment trends reveal that the pharmaceutical application segment is growing at a superior rate, largely attributed to the necessity for blister packs, individual medicine boxes, and medical devices to be securely overwrapped for sterility and traceability. From a machinery perspective, fully automatic, high-speed models, particularly those featuring continuous motion capabilities, account for the largest revenue share, reflecting the industry's sustained focus on maximizing operational throughput. Furthermore, the material segment shows increasing preference for eco-friendly films like bioplastics and thinner gauge BOPP, compelling machine designers to innovate sealing and cutting mechanisms to handle these delicate materials effectively while maintaining high cycle speeds.

AI Impact Analysis on Automatic Overwrapping Machine Market

User inquiries regarding AI's influence on the Automatic Overwrapping Machine Market primarily focus on operational efficiency, quality assurance, and predictive maintenance capabilities. Common questions center around how AI-driven vision systems can detect minute packaging flaws (like minor wrinkles or sealing inconsistencies) undetectable by human operators or traditional sensors, the feasibility of using machine learning to optimize film consumption and reduce waste, and the potential for AI algorithms to predict equipment failures hours or days in advance. Users are keen to understand the return on investment for retrofitting existing machinery with AI modules and how autonomous adjustments facilitated by AI can lead to higher overall equipment effectiveness (OEE). The overarching theme is the transition from reactive maintenance and manual quality checks to fully proactive, data-driven, self-optimizing overwrapping processes.

- AI-powered Predictive Maintenance: Algorithms analyze sensor data (temperature, vibration, motor load) to forecast component failure, drastically reducing unplanned downtime and maintenance costs.

- Enhanced Quality Control (QC): High-resolution AI vision systems utilize deep learning to inspect overwrapping quality, identifying subtle defects (creases, misalignment, inadequate sealing) in real-time at high speeds, improving product aesthetics and compliance.

- Optimized Film Usage: Machine learning models calculate the precise minimum film tension and cut length required for various product geometries, minimizing material waste and achieving significant operational savings.

- Autonomous Parameter Adjustment: AI enables the machine to self-adjust critical wrapping parameters (e.g., heating element temperature, pressure, folding timing) dynamically based on environmental conditions and film batch variations, ensuring consistent output quality without manual intervention.

- Throughput Optimization: AI models analyze bottlenecks within the entire packaging line, providing actionable insights to optimize the synchronization between the overwrapper and upstream/downstream equipment, maximizing overall line efficiency.

DRO & Impact Forces Of Automatic Overwrapping Machine Market

The market trajectory is significantly shaped by a confluence of driving forces such as rapid urbanization and increased spending on packaged consumer goods, particularly in emerging markets, necessitating scalable and reliable packaging solutions. Simultaneously, the persistent push toward achieving superior product presentation for premiumization and ensuring tamper evidence, especially for high-value items like perfumes and specialized pharmaceuticals, drives the adoption of automatic overwrapping technology. However, the market faces constraints primarily related to the high initial capital investment required for these complex machines and the specialized skillset needed for their sophisticated maintenance and operation. The environmental scrutiny regarding plastic packaging materials also acts as a restraint, although this concurrently creates an opportunity for manufacturers developing machines capable of processing sustainable, thinner, and biodegradable films.

Opportunities are abundant in the customization and integration of overwrapping solutions for niche market segments, such as personalized subscription boxes or unique product geometries requiring specialized handling systems. Furthermore, the development of Industry 4.0 compliant machines that offer comprehensive connectivity, remote monitoring, and diagnostic capabilities presents a major growth avenue, appealing to multinational corporations seeking centralized control over distributed manufacturing sites. The primary impact force influencing the market is the substitution threat, where alternative technologies like stretch banding or shrink wrapping may be utilized for certain applications; however, overwrapping maintains its unique position for aesthetic, high-barrier, tamper-evident packaging.

The competitive landscape is characterized by intense focus on innovation related to speed, precision, and film material flexibility. Companies that successfully integrate AI and machine vision into their standard offerings to provide 'zero-defect' packaging solutions are poised to capture increased market share. The regulatory environment, particularly concerning pharmaceutical serialization and anti-counterfeiting measures, acts as a powerful external force compelling rapid technological adoption in this segment. Overall, the market dynamics suggest continuous technological refinement will mitigate restraints, while demographic and industrial growth sustains the primary drivers.

Segmentation Analysis

The Automatic Overwrapping Machine Market is comprehensively segmented based on machine type, application (end-user industry), and the type of wrapping film utilized. Machine segmentation determines the level of automation and speed, ranging from semi-automatic models, typically used by smaller enterprises or for low-volume specialty runs, to fully automatic, high-speed, continuous motion systems prevalent in large-scale pharmaceutical and tobacco production. The application segmentation highlights the varying operational requirements, where the food industry prioritizes hygiene and rapid cycle times, while the pharmaceutical sector emphasizes precision, sterility, and compliance with anti-counterfeiting requirements. Analyzing these segments provides strategic insights into which sectors are driving current demand and where future technological investment will be focused, particularly toward modularity and high-speed processing capabilities.

- By Type

- Semi-Automatic Overwrapping Machines

- Automatic Overwrapping Machines

- High-Speed Continuous Motion Overwrapping Machines

- By Application (End-User Industry)

- Pharmaceuticals

- Cosmetics & Personal Care

- Confectionery & Food

- Tobacco

- Others (e.g., Stationery, Multimedia)

- By Film Material

- BOPP (Biaxially Oriented Polypropylene)

- PVC (Polyvinyl Chloride)

- Cellophane (Regenerated Cellulose)

- PE (Polyethylene)

- Sustainable & Biodegradable Films

Value Chain Analysis For Automatic Overwrapping Machine Market

The value chain for the Automatic Overwrapping Machine Market begins with the upstream suppliers responsible for providing critical components and raw materials. This includes specialized sensor manufacturers, precision mechanics and servo motor providers, electronic control system manufacturers (PLCs, HMIs), and the basic metal and frame suppliers. The quality and reliability of these upstream inputs directly dictate the performance, speed, and durability of the final overwrapping equipment. Strong relationships with technologically advanced component suppliers are crucial, especially as machines become more reliant on advanced digitalization and connectivity features (IoT capabilities). Cost optimization at this stage is vital, yet component quality cannot be compromised given the demanding 24/7 operating cycles of these industrial machines.

The core segment of the value chain involves the machine manufacturers (Original Equipment Manufacturers, OEMs) who handle design, engineering, assembly, integration, and rigorous testing. This stage requires significant intellectual property related to film handling, thermal sealing processes, and mechanical synchronization. The distribution channel subsequently moves the finished equipment to the end-users. Direct distribution is common for large, customized, or highly complex systems, where OEMs maintain direct sales teams, offer specialized commissioning, and provide long-term maintenance contracts. This ensures the correct installation and integration into the customer's existing packaging line. Indirect distribution utilizes regional agents, distributors, and system integrators who specialize in specific geographic markets or industry sectors, often providing localized support and faster response times for standard models.

Downstream analysis centers on the end-user industries (e.g., pharmaceutical giants, large FMCG corporations). After-sales service, including training, spare parts supply, and ongoing maintenance contracts, represents a significant and high-margin portion of the value chain. As machines are critical to production lines, minimizing downtime is paramount, making reliable and efficient service a key differentiator. Furthermore, the final stage involves film material converters and suppliers who provide the consumables (BOPP, PVC films), working closely with machine manufacturers to ensure compatibility, especially as new sustainable film types are introduced, thus creating a circular relationship between equipment capability and consumable material innovation.

Automatic Overwrapping Machine Market Potential Customers

The primary customers for automatic overwrapping machines are high-volume manufacturers across sectors where product presentation, security, and tamper evidence are indispensable requirements for market viability and regulatory compliance. Pharmaceutical companies constitute a significant customer base, utilizing these machines to package individual medicine cartons, blister packs, and vials, ensuring sterility and compliance with track-and-trace regulations. The confectionery and food sector, particularly premium chocolate and gum manufacturers, rely on overwrapping for its aesthetic appeal and preservation qualities, ensuring products maintain freshness and exhibit a luxurious finish demanded by consumers.

Beyond these core industries, cosmetic and personal care producers are heavy users, applying overwrapping to high-end perfumes, makeup palettes, and creams to signal authenticity and luxury while preventing tampering prior to purchase. The tobacco industry, despite global regulatory pressures, remains a crucial buyer, requiring extremely high-speed, reliable overwrapping systems for cigarette cartons and tobacco pouches. These customers prioritize machines offering rapid format changeovers, exceptional speed, and integration capabilities with existing primary packaging lines, as their production volumes necessitate minimal disruption and maximum OEE.

Potential buyers are continually seeking equipment that not only meets current production demands but also offers future-proofing, such as compatibility with various film thicknesses and the integration of advanced digitalization features like IoT connectivity and remote diagnostics. Small to Medium Enterprises (SMEs) are increasingly adopting semi-automatic or modular automatic machines as they scale up operations, seeking the efficiency benefits of automation without the massive capital outlay associated with ultra-high-speed continuous systems. Therefore, the customer base is diverse, ranging from small, specialized packaging houses to multinational manufacturing conglomerates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,255 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Packaging Technology, IMA Group, ACMA S.p.A., Marden Edwards Ltd., LoeschPack, C.E. King Limited, P.E. Labellers S.p.A., Cavanna S.p.A., Fuji Machinery Co., Ltd., Focke & Co. (GmbH & Co. KG), Sollich KG, Molins PLC, Theegarten-Pactec GmbH & Co. KG, Syntegon Technology GmbH, Shemesh Automation, Betti s.r.l., Tenchi Sangyo Co., Ltd., Wrapade Packaging Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Overwrapping Machine Market Key Technology Landscape

The technological landscape of the automatic overwrapping machine market is defined by precision engineering, advanced robotics, and digitalization necessary to handle films consistently at exceptionally high speeds. Central to modern equipment is the adoption of multi-axis servo drive technology, which provides precise, independent control over various machine sections—such as film feeding, cutting, folding, and sealing—allowing for rapid, repeatable motions and synchronization. This transition away from purely mechanical linkages enables faster format changeovers via HMI recipe selection, drastically reducing setup time and maximizing productivity. Furthermore, the development of specialized thermal sealing mechanisms, including ultrasonic and impulse sealing, is crucial for effectively handling diverse, thin-gauge, or temperature-sensitive sustainable film materials without melting or wrinkling the product.

A significant trend is the mandatory integration of Industry 4.0 elements, transforming these mechanical systems into smart assets. This includes the deployment of numerous sensors across critical points to monitor temperature stability, tension control, and mechanical wear, feeding data into integrated supervisory control systems. These systems enable comprehensive remote diagnostics, performance monitoring (OEE tracking), and preventive maintenance alerts, minimizing costly production stops. OEMs are also incorporating advanced vision systems using high-speed cameras and AI algorithms to perform real-time, non-contact quality inspection, ensuring that every package meets stringent aesthetic and structural criteria, particularly vital for pharmaceutical and high-end cosmetic applications where brand integrity is crucial.

The ongoing challenge of sustainable packaging drives innovation in film handling technology. Modern machines must be flexible enough to transition between traditional BOPP and emerging biodegradable or thinner recyclable barrier films. This requires sophisticated tensioning systems and adaptive folding heads that minimize static buildup and tearing, ensuring a perfect finish regardless of the film's properties. Additionally, the increasing demand for integrated, end-to-end packaging solutions pushes overwrapper manufacturers to design machines that communicate flawlessly with upstream cartoners and downstream case packers and palletizers, often requiring the use of common communication protocols and standardized modular interfaces to achieve seamless, high-speed automated production lines.

Regional Highlights

- Asia Pacific (APAC): Dominance and Rapid Growth Hub. APAC holds the largest market share and is projected to register the highest CAGR, primarily driven by China, India, and Southeast Asian nations. This growth is attributable to massive investments in manufacturing expansion, burgeoning middle-class consumption increasing demand for packaged FMCG and pharmaceutical products, and the establishment of sophisticated export-oriented packaging facilities. Localized competition and government initiatives supporting manufacturing automation further boost the demand for cost-effective and high-speed overwrapping solutions.

- North America: Automation and Regulatory Compliance Focus. The North American market is mature, characterized by high adoption rates of fully automatic and continuous motion machines. Growth is sustained by the stringent regulatory landscape in the pharmaceutical sector (e.g., serialization requirements) and the consumer preference for premium, high-quality packaging in the cosmetic and tobacco industries. Investment is concentrated on integrating AI-driven systems for predictive maintenance and advanced quality assurance to maximize operational efficiency and reduce labor reliance.

- Europe: Sustainability and Precision Engineering Leadership. Europe maintains a significant market position, driven by Germany, Italy, and the UK, which are major centers for packaging machinery manufacturing and sophisticated end-user industries. The region is leading the charge in sustainable packaging, necessitating demand for overwrapping machines capable of handling new eco-friendly films efficiently. European manufacturers focus on precision, modular design, and energy efficiency, adhering to strict EU environmental directives and consumer expectations for minimal packaging waste.

- Latin America (LATAM): Industrialization and Modernization. The LATAM market, led by Brazil and Mexico, is experiencing steady growth as local manufacturers modernize existing infrastructure to meet regional and international standards. Increased foreign direct investment in the food and beverage sector drives the need for faster, more reliable overwrapping systems. The market is increasingly shifting away from semi-automatic methods toward fully automated solutions to improve output consistency and control costs.

- Middle East & Africa (MEA): Infrastructure Development and Import Substitution. The MEA region is an emerging market with substantial potential, fueled by ambitious industrialization projects and efforts to achieve self-sufficiency in manufacturing (import substitution). Demand for automatic overwrappers is accelerating, particularly in the UAE, Saudi Arabia, and South Africa, supporting the growth of local pharmaceutical, cosmetic, and tobacco processing industries. Investment is focused on acquiring flexible machinery that can adapt to varying local market needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Overwrapping Machine Market.- Syntegon Technology GmbH (formerly Bosch Packaging Technology)

- IMA Group

- ACMA S.p.A. (Coesia Group)

- Marden Edwards Ltd.

- LoeschPack (part of the Labthink Group)

- Cavanna S.p.A.

- Focke & Co. (GmbH & Co. KG)

- Theegarten-Pactec GmbH & Co. KG

- Sollich KG

- Molins PLC

- Fuji Machinery Co., Ltd.

- P.E. Labellers S.p.A.

- C.E. King Limited

- Wrapade Packaging Systems

- Shemesh Automation

- Betti s.r.l.

- Tenchi Sangyo Co., Ltd.

- Pro Mach, Inc. (Various Subsidiaries)

- Serac Group

- CME S.p.A.

Frequently Asked Questions

Analyze common user questions about the Automatic Overwrapping Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-speed automatic overwrapping machines?

The primary driver is the need for increased production throughput coupled with stringent consumer and regulatory demands for tamper-evident, aesthetically appealing, and consistently packaged products, particularly in the high-volume pharmaceutical and premium FMCG sectors.

How is the adoption of sustainable packaging films impacting overwrapping machine design?

The shift to thinner, biodegradable, and recyclable films requires manufacturers to invest heavily in specialized machine features such as optimized tension control systems, precision cutting mechanisms, and advanced thermal/ultrasonic sealing technologies to prevent tearing and ensure strong, consistent seals at high speeds.

What role does Industry 4.0 play in modern automatic overwrapping equipment?

Industry 4.0 integration, encompassing IoT connectivity, HMI interfaces, and advanced sensors, enables critical functionalities like remote monitoring, centralized performance tracking (OEE), and AI-driven predictive maintenance, which drastically reduces unplanned downtime and optimizes operational efficiency.

Which end-user segment dominates the market revenue for automatic overwrappers?

The Pharmaceutical industry segment typically dominates revenue, due to the high regulatory requirements mandating precise, consistent, and tamper-evident secondary packaging for medical devices and prescription drugs, necessitating investment in high-precision, validated automatic systems.

What are the key technical differences between continuous motion and intermittent motion overwrapping machines?

Continuous motion machines offer significantly higher production speeds by processing products non-stop, requiring complex synchronization and precise servo control. Intermittent motion machines, while slower, offer greater flexibility for handling unusual or irregularly shaped products, stopping momentarily during the folding and sealing cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager