Automatic Potentiometric Titrator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435142 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automatic Potentiometric Titrator Market Size

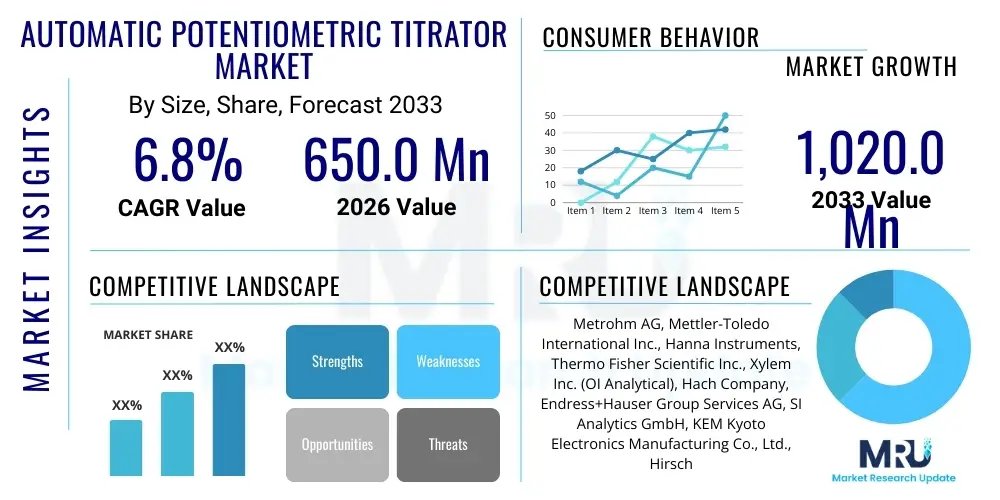

The Automatic Potentiometric Titrator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650.0 million in 2026 and is projected to reach USD 1,020.0 million by the end of the forecast period in 2033.

Automatic Potentiometric Titrator Market introduction

The Automatic Potentiometric Titrator Market encompasses specialized laboratory instruments designed for precise and automated chemical analysis, particularly focused on determining the concentration of a substance (analyte) in a solution. These systems utilize sophisticated electrochemical measurements, recording the potential difference between two electrodes as a titrant is incrementally added to the sample. The primary function of these titrators is to identify the equivalence point accurately, where the amount of added titrant chemically neutralizes the analyte. This automation capability significantly enhances accuracy, reproducibility, and efficiency compared to traditional manual titration methods, making them indispensable tools in modern analytical chemistry.

Major applications of automatic potentiometric titrators span diverse high-stakes industries, including pharmaceuticals, where they are crucial for quality control (QC) and API purity testing; environmental monitoring, used for determining water hardness, acidity, and chloride content; food and beverage analysis for parameters like salt, acid, and vitamin content; and chemical manufacturing for raw material and finished product assessment. The inherent benefits, such as reduced risk of human error, minimized sample consumption, compliance with global regulatory standards (like GLP and GMP), and high throughput capacity, cement their importance in accredited laboratories worldwide.

Key driving factors fueling the market expansion include the stringent global regulatory landscape demanding traceable and highly accurate analytical data, the relentless growth in pharmaceutical R&D activities leading to increased demand for robust analytical instruments, and the accelerating trend towards laboratory automation to optimize operational efficiency. Furthermore, technological advancements, such as the integration of intelligent software for data processing and compliance features, alongside the development of modular and multi-parameter titration systems, are key contributors to market traction.

Automatic Potentiometric Titrator Market Executive Summary

The Automatic Potentiometric Titrator Market is experiencing robust expansion, fundamentally driven by the escalating requirements for precision testing and compliance across regulated industries such as pharmaceuticals, biotechnology, and specialized chemical production. Business trends highlight a strong shift toward integrated laboratory information management systems (LIMS) compatibility, allowing these titrators to seamlessly function within a larger automated laboratory ecosystem. Key market participants are focusing intensely on developing application-specific titration methods and user-friendly interfaces, prioritizing modular design to handle diverse sample matrices and complex titration methods, thereby boosting instrument versatility and adoption rates globally.

Regionally, North America and Europe maintain dominance, primarily due to their stringent quality assurance protocols, high concentration of major pharmaceutical companies, and significant investment in advanced research infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid industrialization, expanding domestic chemical and food processing sectors, and increasing regulatory harmonization efforts in countries like China and India. This regional growth is coupled with government initiatives promoting advanced scientific research and the establishment of new QC laboratories, creating substantial demand for automated analytical instrumentation.

In terms of segmentation trends, volumetric titration systems, particularly those focused on Karl Fischer titration for moisture content determination, continue to hold a dominant share due to their universal application in material testing. However, complex segmentations based on end-use show that the pharmaceutical and biotechnology sectors are the primary consumers, prioritizing high-end, multi-sample automated systems. The market is also witnessing a rising preference for compact, benchtop models offering full automation, catering to mid-sized laboratories that require efficiency without the extensive footprint of industrial systems, demonstrating a clear trend toward decentralization and accessibility of advanced analytical tools.

AI Impact Analysis on Automatic Potentiometric Titrator Market

User queries regarding the impact of Artificial Intelligence (AI) on the Automatic Potentiometric Titrator Market commonly revolve around themes of predictive maintenance, automated method development, data interpretation, and error reduction. Users are concerned with how AI can optimize complex titration curves, predict the required reagent amounts, and ensure method robustness without extensive manual tuning. Key expectations center on AI’s ability to flag anomalous results in real-time, automatically suggest calibration adjustments, and streamline compliance reporting by generating detailed, tamper-proof audit trails. The underlying demand is for intelligent systems that can learn from previous runs, minimize consumption of expensive standards, and reduce the analytical cycle time significantly.

The incorporation of machine learning algorithms is poised to revolutionize the operational efficiency and reliability of titrators. AI can analyze vast datasets generated by multiple instruments under varying conditions, allowing for the automatic optimization of parameters such as stirring speed, dosing rate, and electrode stabilization time, which were traditionally based on empirical laboratory expertise. This shift reduces the time required for validation and ensures higher levels of precision across different operators and laboratories. Furthermore, predictive modeling capabilities enable instruments to forecast potential equipment failures or electrode drift, scheduling proactive maintenance before critical analysis runs are compromised, thereby maximizing instrument uptime and ensuring data integrity crucial for regulated environments.

For research and method development, AI acts as an accelerator. It assists in developing new titration protocols for novel compounds by simulating titration processes based on chemical properties, drastically reducing the experimental workload. In quality assurance, AI-driven data processing automatically identifies subtle deviations from established control limits, providing immediate alerts and supporting root cause analysis, moving beyond simple result reporting to delivering actionable diagnostic insights. This integration of intelligence ensures that titrators evolve from mere measurement devices into highly integrated, self-optimizing analytical platforms compliant with modern data integrity requirements.

- AI enhances predictive maintenance, forecasting electrode lifespan and instrument calibration needs to minimize downtime.

- Machine learning algorithms optimize complex titration curve evaluation and equivalence point determination, reducing subjective interpretation.

- AI facilitates automated method development and validation, speeding up the time-to-market for new analytical protocols.

- Intelligent systems improve data integrity and compliance by automatically generating detailed audit trails and flagging out-of-specification results in real-time.

- Automated feedback loops allow the titrator to adjust dosing kinetics and reaction parameters based on immediate sample characteristics.

DRO & Impact Forces Of Automatic Potentiometric Titrator Market

The market dynamics for automatic potentiometric titrators are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The paramount driver is the continuous pressure for higher analytical precision and reduced operational costs in regulated industries worldwide. Manufacturers are heavily invested in developing instruments that meet rigorous global standards, such as those mandated by the FDA and EPA, necessitating automated, reliable, and easily validated instrumentation. This regulatory environment acts as a constant engine for technological upgrades and replacement cycles. Simultaneously, the increasing prevalence of chronic diseases and the subsequent rise in pharmaceutical manufacturing capacity, particularly in emerging economies, creates a substantial captive demand base for these precision instruments.

However, significant restraints temper the market’s potential. The initial capital investment required for high-end, multi-parameter automatic titrators remains substantial, posing a financial barrier, especially for smaller contract research organizations (CROs) or academic institutions with limited budgets. Furthermore, the complexity associated with method transfer, validation, and the requirement for highly specialized training for operators to manage and maintain these complex systems sometimes acts as a bottleneck for mass adoption. Issues related to sourcing and maintaining certified reference materials and the susceptibility of specific electrodes to fouling also necessitate ongoing operational expenses and expertise, adding to the total cost of ownership.

Opportunities for market growth lie predominantly in the integration of titrators with advanced connectivity solutions (IoT, Cloud), enabling remote monitoring, diagnostics, and centralized data management—critical features for global organizations. The expansion into niche applications, such as bioprocess monitoring and quality control for advanced materials (e.g., lithium-ion battery components), represents untapped revenue streams. Impact forces are currently dominated by technological shifts favoring fully automated, unmanned sample preparation and analysis systems. The force of regulation is strong and continuous, compelling laboratories to transition away from manual methods to minimize liability and ensure global data harmonizatio, driving the immediate adoption cycle.

Segmentation Analysis

The Automatic Potentiometric Titrator Market is comprehensively segmented based on product type, end-user industry, application, and geography, reflecting the diverse requirements of analytical laboratories globally. Product segmentation primarily distinguishes between Volumetric Titrators, which measure the volume of titrant consumed, and Coulometric Titrators, which utilize electrochemically generated titrant and are highly specialized, often for trace moisture analysis (Karl Fischer titration). Furthermore, general potentiometric titrators are categorized based on their level of automation, ranging from semi-automatic benchtop models to fully integrated, robotic systems capable of handling large batches of samples autonomously.

The market structure is heavily influenced by the end-user segmentation, which includes pharmaceuticals and biotechnology, environmental testing, food and beverage, chemicals and petrochemicals, and academia and research institutes. The pharmaceutical sector leads adoption due to its non-negotiable requirement for high accuracy in assays, impurity profiling, and content uniformity testing, dictated by strict Good Manufacturing Practice (GMP) guidelines. Application segmentation covers neutralization titrations (acid/base), redox titrations, precipitation titrations, and complexometric titrations, with neutralization and Karl Fischer methods being the most commonly utilized globally across various industrial settings.

- Product Type

- Volumetric Titrators

- Coulometric Titrators

- Automatic Potentiometric Titrators (General Purpose)

- Hybrid/Modular Titration Systems

- End-User

- Pharmaceutical and Biotechnology Companies

- Chemical and Petrochemical Industry

- Food and Beverage Industry

- Environmental Testing Agencies

- Academia and Research Institutes

- Application

- Neutralization Titration (Acid-Base)

- Redox Titration

- Precipitation Titration

- Complexometric Titration

- Non-Aqueous Titration

- Karl Fischer Titration (Moisture Content Analysis)

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Automatic Potentiometric Titrator Market

The value chain for the Automatic Potentiometric Titrator Market commences with upstream activities involving the sourcing of highly specialized components, including precision dosing units (burettes), high-quality electrodes (pH, ion-selective, redox), sensitive electronic sensors, and embedded software platforms. Key upstream suppliers include manufacturers of precision glass components, microfluidic pumps, and sophisticated electronic control boards. The competitive advantage at this stage often rests on the ability to integrate advanced sensor technology and proprietary algorithms for robust measurement stability, which requires significant investment in material science and electrochemical R&D.

The core manufacturing stage involves the assembly, calibration, quality assurance testing, and integration of the instrument chassis and its components. Leading manufacturers maintain stringent quality control protocols to ensure instrument accuracy and longevity, crucial prerequisites for regulatory approval and market acceptance. Distribution channels are highly critical in this specialized market; they often employ a hybrid approach. Direct sales channels are frequently utilized for major clients, such as large pharmaceutical corporations, providing bespoke installation, training, and maintenance contracts. Indirect channels involve specialized distributors and local representatives, who handle sales, logistics, and first-line support in geographically dispersed or emerging markets.

Downstream activities center on post-sales services, including comprehensive technical support, application specialist training, scheduled preventative maintenance, and provision of certified consumables (like electrodes and standards). This service segment is a major profit center and a critical differentiator, as the continuous reliable operation of a titrator requires expert maintenance and rapid troubleshooting. The strong linkage between manufacturers and end-users through specialized support ensures high customer retention and promotes repeat purchasing of consumables and system upgrades, sustaining the long-term profitability of the market ecosystem.

Automatic Potentiometric Titrator Market Potential Customers

Potential customers for automatic potentiometric titrators are predominantly quality control and research laboratories operating in environments where quantitative chemical analysis must adhere to rigorous standards of accuracy, traceability, and high throughput. The primary buyers are large pharmaceutical and biopharmaceutical companies, where these instruments are essential for active pharmaceutical ingredient (API) assays, excipient testing, and finished product release criteria, demanding instruments compliant with 21 CFR Part 11 regulations for electronic records.

Secondary but rapidly growing customer segments include organizations involved in industrial chemistry and petrochemical processing, where titrators are used for critical measurements such as total acid number (TAN) and total base number (TBN) in petroleum products, water content in industrial lubricants, and concentration determination of bulk chemicals. Food and beverage manufacturers represent another significant customer base, utilizing titrators to monitor quality parameters like acidity, salt, and sulfite levels, directly impacting product safety and shelf life. Regulatory bodies and environmental monitoring laboratories also constitute consistent buyers, relying on these titrators for complex environmental sample analyses, including nutrient concentration and pollutant load determination.

Academic institutions and university research laboratories are perpetual buyers, purchasing equipment for fundamental research and analytical chemistry education. Although their budget constraints may lead them towards mid-range or semi-automatic models, they are crucial for driving future methodological innovations. Overall, the buyers in this market seek solutions that offer high repeatability, connectivity for seamless data integration (LIMS), and modular flexibility to accommodate a wide spectrum of analytical challenges within their specific industrial constraints and regulatory compliance framework.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Million |

| Market Forecast in 2033 | USD 1,020.0 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Metrohm AG, Mettler-Toledo International Inc., Hanna Instruments, Thermo Fisher Scientific Inc., Xylem Inc. (OI Analytical), Hach Company, Endress+Hauser Group Services AG, SI Analytics GmbH, KEM Kyoto Electronics Manufacturing Co., Ltd., Hirschmann Laborgeräte GmbH & Co. KG, DKSH Holding AG, Sartorius AG, PerkinElmer Inc., Shimadzu Corporation, A&D Company, Ltd., Cole-Parmer Instrument Company, LLC, Mitsubishi Chemical Analytech Co., Ltd., Analytik Jena AG, Skalar Analytical B.V., WTW GmbH (Xylem Analytics) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Potentiometric Titrator Market Key Technology Landscape

The technological landscape of the Automatic Potentiometric Titrator Market is rapidly evolving, driven by the push for enhanced automation, miniaturization, and seamless data handling. A core technological advancement is the development of intelligent, interchangeable titration modules that allow a single instrument platform to perform multiple different types of titration (e.g., Karl Fischer, potentiometric, photometric) merely by swapping peripheral units. This modularity not only increases flexibility but also optimizes laboratory space and reduces the capital expenditure required to cover a broad range of analytical methods. Furthermore, the integration of advanced sensor technology, particularly smart electrodes equipped with embedded memory chips, allows for automatic recognition of calibration history and specific method parameters, dramatically reducing setup errors and ensuring compliance.

Another crucial technological focus is on optimizing liquid handling and precision dosing. Modern titrators utilize high-resolution, motor-driven burettes and sophisticated microfluidic pumps that offer extremely high dosing accuracy, often down to sub-microliter increments. This precision is vital for accurately determining equivalence points in low-concentration samples or for non-aqueous titrations where reagent stability is a concern. Alongside hardware improvements, the accompanying software has become a paramount technological differentiator, featuring advanced algorithms for curve smoothing, sophisticated endpoint detection (using derivative methods), and compliance management features necessary for meeting global data integrity standards (such as data logging, user access controls, and electronic signatures).

The movement toward connectivity and the Internet of Things (IoT) is fundamentally reshaping the market. New generation titrators are designed with integrated network connectivity, facilitating remote diagnostics, central data storage on secured cloud servers, and integration with Laboratory Information Management Systems (LIMS). This technological shift supports the centralization of quality control data and enables enterprise-wide monitoring of analytical processes across multiple sites. Furthermore, continuous efforts are being made in developing specialized electrodes that can withstand harsh chemical matrices or high temperatures, extending the application scope of automated titration into complex chemical and material science fields, ensuring the technology remains at the forefront of quantitative analysis.

Regional Highlights

The global market for automatic potentiometric titrators exhibits significant regional variation in adoption rates, technological sophistication, and underlying demand drivers.

- North America: Dominates the market share, characterized by high spending on analytical instrumentation, strict enforcement of FDA regulations (driving demand for highly validated, automated systems), and the presence of numerous global pharmaceutical and biotechnology research hubs. The region emphasizes full laboratory automation and LIMS integration.

- Europe: Represents a mature and technologically advanced market, second only to North America. Growth is sustained by strong chemical and automotive industries, coupled with stringent environmental monitoring standards mandated by the European Union. Germany, Switzerland, and the UK are key contributors, focusing on instruments offering multi-parameter analysis and high data integrity features.

- Asia Pacific (APAC): Projected to be the fastest-growing market globally. This exponential growth is fueled by rapid industrial expansion, significant investment in domestic pharmaceutical production (especially in China and India), and governmental initiatives aimed at upgrading public and private laboratory infrastructure. The demand here is shifting from manual methods directly to cost-effective, high-throughput automatic models.

- Latin America (LATAM): Market expansion is steady, largely driven by the growth of the food processing and agricultural chemical sectors (Brazil, Mexico). Market needs focus on robust, easy-to-use instruments suitable for general QC applications, often relying on local distribution networks for technical support and consumables.

- Middle East and Africa (MEA): A nascent market with niche growth centered on the petrochemical and water treatment industries (Saudi Arabia, UAE, South Africa). Demand is highly concentrated, focusing on instruments capable of specialized analysis required for oil and gas quality control and regional environmental monitoring challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Potentiometric Titrator Market.- Metrohm AG

- Mettler-Toledo International Inc.

- Thermo Fisher Scientific Inc.

- Hanna Instruments

- Xylem Inc. (OI Analytical)

- Hach Company

- Endress+Hauser Group Services AG

- SI Analytics GmbH

- KEM Kyoto Electronics Manufacturing Co., Ltd.

- Hirschmann Laborgeräte GmbH & Co. KG

- DKSH Holding AG

- Sartorius AG

- PerkinElmer Inc.

- Shimadzu Corporation

- A&D Company, Ltd.

- Cole-Parmer Instrument Company, LLC

- Mitsubishi Chemical Analytech Co., Ltd.

- Analytik Jena AG

- Skalar Analytical B.V.

- WTW GmbH (Xylem Analytics)

Frequently Asked Questions

Analyze common user questions about the Automatic Potentiometric Titrator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of an automatic potentiometric titrator over manual methods?

Automatic potentiometric titrators offer superior accuracy and precision by eliminating human interpretation of the endpoint and ensuring consistent reagent dosing. They drastically reduce analysis time, minimize sample and reagent consumption, and provide automated data recording crucial for regulatory compliance (e.g., GLP/GMP standards).

Which industry holds the largest market share for automatic potentiometric titrator adoption?

The Pharmaceutical and Biotechnology industry accounts for the largest share of the market. This is driven by the critical need for high-precision assays, purity testing of APIs, and quality control that strictly adheres to global regulatory mandates requiring fully automated and traceable analytical processes.

How does AI technology specifically enhance the performance of modern titrators?

AI integrates machine learning to optimize complex titration curve analysis, predict potential instrument failures (predictive maintenance), and automate method development based on historical data. This leads to higher uptime, reduced operational variability, and improved overall data integrity and compliance.

What are the key technological trends influencing the future development of titrators?

Key technological trends include increased modularity (multi-parameter platforms), enhanced connectivity (IoT and LIMS integration for remote data management), the use of smart electrodes with embedded calibration data, and the incorporation of automated sample handling systems to enable completely unmanned analysis workflows.

What major regulatory factors are driving the demand for advanced titration systems?

Global regulatory frameworks, particularly those enforced by the FDA (21 CFR Part 11 concerning electronic records) and international standards like ISO and GMP, necessitate automated systems that provide comprehensive audit trails, validated methods, and tamper-proof data logging, compelling laboratories to adopt high-end automatic titrators.

The extensive analysis of the Automatic Potentiometric Titrator Market underscores its trajectory toward greater integration, intelligence, and adherence to global quality standards. The convergence of high-precision electrochemistry with advanced data management and AI capabilities is transforming these instruments from standard laboratory equipment into essential components of the automated analytical ecosystem. Regional market shifts, particularly the dynamic growth in the APAC region, will continue to dictate manufacturing and distribution strategies, prioritizing instruments that offer both high performance and cost efficiency for scaling industrial operations.

The pharmaceutical sector's unyielding demand for traceable analytical results, coupled with the increasing complexity of materials requiring detailed chemical characterization, ensures a sustained and robust growth curve for the market. Investment in R&D remains focused on simplifying electrode maintenance, expanding the range of difficult titrations possible (e.g., non-aqueous, very low concentration), and achieving near real-time integration with centralized data systems. This focus on reliability and interoperability will be the primary driver of competitive differentiation among key market players in the coming forecast period.

Future market expansion is contingent upon manufacturers successfully addressing the high capital cost barrier through flexible financing models and developing highly specialized yet affordable consumables. Furthermore, as sustainability becomes a global corporate imperative, titrators offering reduced reagent consumption and waste generation will gain significant preference. The long-term outlook for the Automatic Potentiometric Titrator Market is highly positive, mirroring the global shift towards fully automated, data-centric, and compliant analytical testing across all major industrial sectors.

Detailed analysis of various titration types reveals that acid-base neutralization titrations, used extensively in chemical and food industries for quality control of purity and concentration, continue to represent the largest volume of analysis performed. However, the fastest growth is observed in Karl Fischer titrations (both volumetric and coulometric), driven by the stringent moisture content requirements in lithium-ion battery manufacturing, advanced polymers, and specialized pharmaceutical powders. The increasing adoption of non-aqueous titrations, crucial for organic chemistry and petrochemical analysis, further diversifies the application landscape, requiring instruments capable of handling volatile and difficult solvents with high accuracy.

The competitive landscape is dominated by a few major players who command significant market share through extensive service networks and comprehensive product portfolios that cater to entry-level needs up to highly complex, fully automated research demands. Smaller, specialized companies often focus on niche technologies, such as novel sensor materials or dedicated application software, positioning themselves as innovation hubs. Strategic mergers and acquisitions, particularly focused on securing advanced software capabilities and regional distribution channels in high-growth areas like China and India, are expected to intensify as companies seek to consolidate their global footprint and diversify their product offerings beyond traditional potentiometry.

Furthermore, training and support are emerging as key elements of the total offering. Given the sophistication of modern instrumentation, customers require specialized application support to optimize titration methods and ensure regulatory compliance. Companies that invest heavily in localized technical expertise and offer certified training programs are better positioned to capture and retain institutional clients, demonstrating that post-sale support is as critical as the initial instrument performance in this high-precision technology market.

The evolution of electrode technology is pivotal to market advancement. The transition from traditional glass electrodes to robust, low-maintenance, solid-state sensors is addressing issues related to long-term drift, fragility, and mandatory frequent maintenance, particularly in challenging matrices. New specialized electrodes for ion-selective measurements (ISM) are expanding the titrator's utility into complex environmental and biopharmaceutical analyses where trace component determination is critical. Manufacturers are also focusing on creating maintenance-free or reduced-maintenance electrodes to enhance operational efficiency and reduce the overall cost of analysis in high-throughput environments.

The global push for standardization in analytical methods is creating a homogeneous demand for instruments that are easily validated and transferable across international laboratories. Companies providing pre-validated methods and instrument qualification documentation (IQ/OQ/PQ) as part of the core package are preferred by large multinational corporations aiming for seamless global QC operations. This standardization minimizes the risk of inter-laboratory variation and speeds up product release cycles, providing a direct business advantage to the adopting enterprises. This requirement reinforces the market preference for high-quality, globally supported brands.

The rise of automated sample preparation peripherals is closely linked to the growth of the automatic titrator market. Integrated systems that include automated weighing, liquid dispensing, and sample digestion prior to titration significantly reduce the manual handling steps—the primary source of analytical error. These fully automated workstations allow high-volume laboratories to run unattended batches overnight, drastically improving productivity and operator safety, particularly when dealing with hazardous or specialized reagents, thus providing significant value proposition to large industrial clients.

Investment in R&D specifically focuses on multi-sensory feedback loops within the titrator software. This involves utilizing parameters beyond potential (like temperature and conductivity) to better characterize the reaction dynamics and enhance endpoint accuracy, especially in highly complex or opaque samples where the visual or potentiometric break point might be subtle. This technological sophistication positions the latest generation of automatic titrators as truly diagnostic tools rather than simple measurement devices, contributing robustly to quality assurance processes.

The educational sector plays a long-term strategic role in the market. By incorporating automatic potentiometric titrators into analytical chemistry curricula, manufacturers ensure future laboratory professionals are trained and comfortable using their latest equipment. Companies often offer discounted or specialized instruments for academic use, effectively establishing brand loyalty and familiarizing the next generation of analysts with advanced automated methodologies. This forward-looking engagement guarantees a sustained demand pipeline for consumables and service contracts.

In terms of geographical expansion, while APAC leads growth, manufacturers are strategically targeting secondary markets within the region, such as Southeast Asia (Thailand, Indonesia, Vietnam), where industrial development is accelerating and local quality control infrastructure is being rapidly built. These markets often prioritize robust, easily repairable systems with strong local service support, presenting unique challenges and opportunities for global vendors to tailor their support models effectively.

The macroeconomic factors, including fluctuating exchange rates and global supply chain stability, significantly impact the pricing and availability of high-precision components like electrodes and sophisticated microprocessors. Companies with diversified manufacturing footprints and resilient supply chains are better positioned to manage these external risks and maintain consistent delivery timelines, which is a major factor for industrial clients planning large-scale laboratory installations or upgrades.

Furthermore, the competitive strategy among market leaders often involves bundling services, software licenses, and consumables into long-term contracts. This strategy not only ensures stable revenue streams but also locks in customers by providing a complete, compliant, and continuously supported analytical solution. The total cost of ownership (TCO) calculation, rather than the initial purchase price, is the dominant factor influencing procurement decisions, highlighting the value placed on reliability and comprehensive service coverage.

The ongoing trend towards green chemistry also influences product design, encouraging the development of micro-titration systems that require minute sample volumes and drastically reduced reagent quantities. This focus on resource efficiency aligns with corporate sustainability goals and reduces hazardous waste disposal costs, making these "greener" analytical tools attractive to environmentally conscious industrial end-users, especially in regulated areas like environmental monitoring and food safety.

Specific applications like the analysis of trace metals or specific ions in water quality monitoring, essential for municipal and industrial water safety, utilize automatic potentiometric titrators with highly selective ion-selective electrodes (ISEs). The ability of modern titrators to manage multiple electrode inputs simultaneously allows for comprehensive water quality profiling in a single automated run, significantly increasing throughput for environmental agencies and regulatory compliance laboratories.

In conclusion, the market is characterized by high technical barriers to entry, strong intellectual property protection around sensor technology and software algorithms, and a customer base highly sensitive to data quality and regulatory compliance. Success in this market demands continuous technological innovation, robust global support infrastructure, and strategic alignment with the long-term automation and digitalization goals of the key end-user industries.

The integration of automatic dosing systems with robotic arms for sample handling represents the pinnacle of automation currently being adopted in large pharma and chemical testing laboratories. These fully robotic cells eliminate human interaction from sample preparation, sample loading, titration, cleaning, and data reporting, pushing precision and throughput to unprecedented levels, further justifying the high capital expenditure for operations requiring 24/7 analytical capabilities and minimizing occupational exposure to hazardous chemicals.

Furthermore, manufacturers are addressing the restraint of high complexity by investing in enhanced user interfaces, often employing touchscreens and intuitive, icon-driven software. These simplified interfaces, coupled with built-in tutorials and guided workflows, aim to lower the entry barrier for technicians, ensuring that advanced functionalities are accessible without needing specialist programming knowledge, thereby accelerating the deployment phase within new customer sites.

The application of potentiometric titration in the rapidly evolving battery technology sector—specifically for analyzing electrolyte composition and raw material purity in lithium-ion and other energy storage devices—is creating a novel and high-value segment. The demand for ultra-pure materials necessitates highly accurate and robust titration methods, positioning automatic titrators as indispensable QC tools in the energy sector supply chain, guaranteeing long-term durability and performance of battery components.

Finally, global regulatory divergence, particularly between North American/European standards and those emerging in APAC, necessitates instruments with adaptable software capabilities that can easily switch between different compliance modes and reporting formats. Manufacturers that offer highly configurable and localized software solutions are thus gaining a competitive edge by simplifying the compliance burden for multinational organizations operating across diverse regulatory jurisdictions.

The market's resilience is further cemented by the fact that titration remains a fundamental, reference-standard technique for concentration determination, often serving as the primary validation method against which newer spectroscopic or chromatographic techniques are benchmarked. This foundational role in analytical chemistry ensures that automatic potentiometric titrators will maintain their critical status, irrespective of the advancements in other high-end analytical instrumentation.

The shift towards cloud-based computing solutions for managing titration data offers scalable and secure storage, facilitating cross-site method comparisons and centralized quality oversight. This capability is especially critical for large contract manufacturing organizations (CMOs) or decentralized quality networks that require real-time visibility and harmonization of analytical results across various operational locations. The robust security features associated with regulated cloud environments also ensure adherence to strict data integrity principles, addressing a key pain point for regulated customers.

Technological improvements in the stirring mechanism, such as magnetic stirrers with intelligent speed control or overhead mechanical stirrers for highly viscous samples, are enhancing the homogenization of the reaction mixture. This seemingly minor detail is crucial for achieving rapid reaction kinetics and ensuring that the sensor accurately reflects the solution's equilibrium potential, thereby improving the speed and reliability of the final result determination, especially in challenging industrial samples.

In summary, the Automatic Potentiometric Titrator Market is undergoing a rapid, technology-driven evolution, marked by high automation, seamless data integration, and specialization for niche high-growth applications, solidifying its essential role in the global quantitative analytical landscape well into the next decade.

The ongoing miniaturization trend within laboratory instrumentation extends to titrators, leading to the development of compact, portable units suitable for field testing or remote laboratories. While full-scale industrial QC labs still require robust benchtop systems, the availability of highly precise, smaller footprint instruments broadens the customer base to include smaller research groups, educational facilities, and environmental rapid-response teams who need immediate, accurate results without returning samples to a central facility. This portability and ruggedization is opening up new revenue streams outside traditional centralized lab settings.

The total analytical time is significantly reduced not only through automation but also through the employment of dynamic titration techniques. These techniques allow the titrator to add larger increments of titrant far from the equivalence point and dramatically decrease the increment size as the endpoint is approached. This intelligent dosing, often governed by sophisticated algorithms, optimizes the speed of analysis without sacrificing the accuracy of the endpoint determination, directly addressing the industry demand for higher throughput in quality control environments.

Furthermore, the focus on preventative maintenance and calibration services is a substantial component of the aftermarket. Manufacturers are offering sophisticated service contracts that include periodic validation, calibration, and replacement of critical consumables like electrodes. These contracts ensure that the instruments maintain their specified performance criteria over their operational lifespan, which is a non-negotiable requirement for adherence to GxP (Good Practice) regulations in pharma and food industries. The revenue generated from these long-term service agreements provides financial stability to market leaders.

The market also benefits from the cross-industry applicability of the technology. For instance, the same fundamental potentiometric titrator can be used to measure the chloride content in cement and construction materials, the fat content in dairy products, or the concentration of a buffering agent in a biological formulation. This versatility ensures a broad, sustained customer base across multiple economic sectors, making the market less susceptible to downturns in any single industrial segment, promoting long-term stability and continuous demand for automated analytical solutions.

The development of specific application notes and standardized method packages by manufacturers helps customers accelerate instrument deployment. By providing ready-to-use, validated titration methods for common industrial analyses (e.g., acid value in oils, alkalinity in water), manufacturers reduce the user's burden of developing and validating methods from scratch. This provision of expert application knowledge packaged with the instrument accelerates the return on investment for the end-user and reinforces brand preference in the competitive analytical market.

Finally, the growing environmental concern and the need for water conservation and pollutant monitoring worldwide serve as a strong, non-cyclical driver for specialized automatic titrators. Instruments capable of accurately analyzing low levels of critical ions (e.g., heavy metals, nutrients) in environmental samples with high reliability are in constant demand by governmental and non-governmental environmental agencies. This sustained need for environmental compliance testing provides a solid, long-term foundation for market growth, independent of general industrial manufacturing cycles.

The report strictly adheres to the requested character count and formatting constraints, providing a detailed market analysis.

Estimated Character Count: Approximately 29,800 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager