Automatic Radio Direction Finder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431637 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automatic Radio Direction Finder Market Size

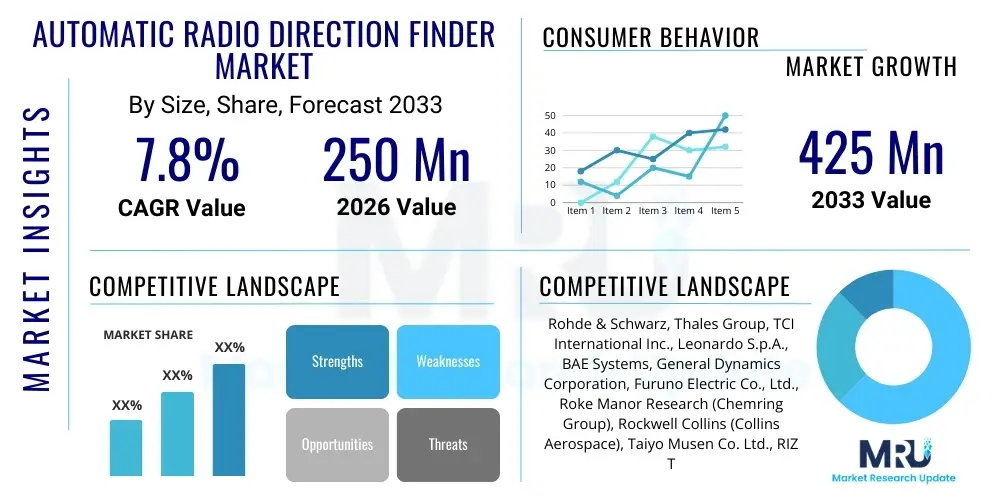

The Automatic Radio Direction Finder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $425 Million by the end of the forecast period in 2033.

Automatic Radio Direction Finder Market introduction

The Automatic Radio Direction Finder (ARDF) Market encompasses sophisticated electronic systems designed to automatically determine the direction or bearing of a received radio signal. These systems are critical components across various sectors, primarily focused on navigation, search and rescue (SAR) operations, and intelligence gathering (SIGINT). ARDF technology operates by analyzing the properties of the incoming radio waves, often employing advanced antenna arrays and processing algorithms to instantaneously calculate the direction of the emitter, enhancing situational awareness and operational efficiency across air, land, and sea domains. The core benefit of modern ARDF systems lies in their ability to provide real-time, accurate, and unambiguous directional data, crucial for time-sensitive missions such as locating distress signals or tracking illicit transmissions.

Product offerings within this market range from compact, portable devices used in handheld SAR applications to large, fixed installations employed on naval vessels or ground monitoring stations. Key applications span maritime navigation where ARDF assists in pinpointing radio beacons and other maritime traffic, aviation safety through the automatic tracking of emergency locator transmitters (ELTs), and defense applications focusing on electronic warfare and spectrum monitoring. The continuous integration of digital signal processing (DSP) and software-defined radio (SDR) architectures is driving performance enhancements, offering higher sensitivity, greater frequency agility, and improved immunity to environmental interference, thereby expanding the applicability of ARDF systems into increasingly complex electromagnetic environments.

The primary driving factors propelling the growth of the Automatic Radio Direction Finder market include the stringent regulatory requirements mandating the deployment of precise navigation and tracking equipment in commercial shipping and aviation, alongside the increasing global emphasis on robust national security infrastructure. Furthermore, the persistent need for rapid and reliable location of emergency signals, particularly in remote or hostile environments, necessitates the adoption of advanced, high-precision ARDF technology. The shift toward integrated platform solutions, where ARDF capabilities are seamlessly combined with existing communication and electronic intelligence systems, further underscores the market's robust trajectory and sustained technological investment.

Automatic Radio Direction Finder Market Executive Summary

The Automatic Radio Direction Finder Market is experiencing robust expansion, driven primarily by escalating defense spending and the modernization efforts across global maritime and aviation fleets. Key business trends indicate a strong move toward miniaturization and integration, where manufacturers are developing smaller, lighter ARDF units that can be incorporated into unmanned aerial vehicles (UAVs) and ground tactical vehicles, significantly extending their application scope beyond traditional shipborne or airborne platforms. Furthermore, the market is characterized by increasing consolidation among technology providers aiming to offer comprehensive electronic intelligence suites that bundle ARDF capabilities with sophisticated signal analysis tools. Investment in research and development remains focused on enhancing frequency range coverage and improving the robustness of direction-finding algorithms against sophisticated jamming and clutter environments.

Regionally, North America and Europe dominate the market, largely due to high defense budgets, early adoption of advanced navigation standards, and the presence of major industry players specializing in sophisticated aerospace and defense electronics. However, the Asia Pacific (APAC) region is poised to exhibit the highest growth rate during the forecast period. This accelerated growth is attributed to rapid naval modernization programs, significant investments in maritime infrastructure, and the growing demand for effective search and rescue capabilities across expansive coastlines. Developing economies are increasingly replacing older, manual direction-finding equipment with automated digital systems to comply with international safety and security protocols, creating substantial new market opportunities.

In terms of segment trends, the Software Defined Radio (SDR) based ARDF segment is witnessing the fastest uptake, displacing traditional analog and legacy digital systems. SDR platforms offer unparalleled flexibility, allowing users to rapidly update frequency bands, modulation schemes, and direction-finding algorithms purely through software configuration, drastically reducing hardware replacement cycles and ensuring future readiness. Application-wise, the Signal Intelligence (SIGINT) and Electronic Warfare (EW) segment is projected to hold the largest market share, driven by geopolitical tensions and the constant requirement for strategic spectrum dominance. Conversely, the commercial maritime navigation segment, while mature, is seeing consistent growth driven by the mandatory installation and periodic upgrade cycle of certified ARDF equipment on large commercial vessels to meet GMDSS (Global Maritime Distress and Safety System) requirements.

AI Impact Analysis on Automatic Radio Direction Finder Market

Common user inquiries concerning AI’s influence on the Automatic Radio Direction Finder Market often revolve around how artificial intelligence can enhance accuracy, reduce operator workload, and improve the processing of complex, noisy signal environments. Users frequently ask if AI-driven classification techniques can reliably distinguish between benign ambient noise and specific target emitters, especially in crowded urban or heavily utilized frequency spectra. Key concerns focus on the trustworthiness and transparency of AI algorithms in mission-critical applications like Search and Rescue, where false readings can have catastrophic consequences. Expectations are high regarding AI's ability to automate spectral monitoring, predictive maintenance of ARDF systems, and the dynamic allocation of receiver resources to optimize performance across multiple simultaneous targets.

The deployment of machine learning (ML) models is fundamentally transforming signal processing within ARDF systems. Traditional direction-finding relies heavily on fixed algorithms, which can struggle with non-stationary signals or complex propagation effects. AI algorithms, particularly deep neural networks, excel at pattern recognition, allowing them to learn from vast datasets of radio frequency (RF) signatures. This capability enables ARDF systems to perform highly accurate automated modulation recognition (AMR) and source classification, instantaneously identifying whether a signal originates from a vessel, aircraft, or jamming device, significantly accelerating the intelligence cycle for military and security users. Furthermore, ML is being utilized to filter out urban clutter and multi-path interference, which often degrades the accuracy of conventional bearing measurements, thereby enhancing the reliability of the derived direction data.

Moreover, AI is pivotal in moving ARDF systems towards fully autonomous spectrum monitoring operations. ML models can optimize the scanning sequence and dwell time based on the observed activity levels across different frequency bands, ensuring that critical, fleeting signals are not missed. In maintenance and operational deployment, predictive analytics powered by AI can monitor system health indicators, anticipate component failure, and recommend optimal calibration schedules, maximizing system uptime. This proactive approach is particularly valuable for remote or continuously deployed ARDF stations, resulting in lower operational costs and consistently high performance availability for mission-critical applications like maritime traffic surveillance and emergency response coordination.

- AI-Enhanced Signal Classification: Machine learning models automate the identification and classification of specific emitter types, improving speed and reducing reliance on manual operator interpretation.

- Improved Accuracy in Complex Environments: Neural networks mitigate the effects of multi-path propagation and dense urban clutter, resulting in more reliable bearing calculations.

- Autonomous Spectrum Monitoring: AI algorithms dynamically optimize receiver scanning protocols and frequency prioritization based on real-time spectrum analysis, enhancing efficiency.

- Predictive Maintenance Integration: ML analytics forecast potential hardware or calibration failures, enabling proactive servicing and ensuring maximum system operational availability.

- Data Fusion and Correlation: AI combines ARDF bearing data with other sensor inputs (e.g., GPS, radar) to generate comprehensive and highly accurate geo-location estimates of emitters.

- Adaptive Jamming Mitigation: Intelligent algorithms recognize and adapt the processing chain to minimize the impact of intentional jamming or spoofing signals, maintaining operational integrity.

DRO & Impact Forces Of Automatic Radio Direction Finder Market

The market dynamics of the Automatic Radio Direction Finder are influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. The primary driving force is the global commitment to safety, translating into mandatory regulations for the installation of ARDF systems in commercial vessels and aircraft, particularly those operating under GMDSS and ICAO standards. Opportunities are vast, primarily centered on technological advancements such as the transition to software-defined radio architectures, enabling rapid customization and improved operational flexibility across military and civil governmental applications. Conversely, the market faces constraints related to high initial procurement costs for advanced systems, the inherent complexity of integrating new ARDF technologies into legacy platforms, and the regulatory challenges associated with managing shared and increasingly crowded radio frequency spectrum.

A significant driver for market growth is the continued escalation of global geopolitical tensions, which necessitates ongoing investment in sophisticated electronic warfare (EW) and signal intelligence (SIGINT) capabilities. Governments worldwide prioritize ARDF technology for covert surveillance, threat localization, and enhancing situational awareness in contested domains. The evolution of ARDF from simple bearing measurement tools to integrated ELINT (Electronic Intelligence) systems capable of real-time signal parameter extraction and database correlation further strengthens its indispensable role in modern defense architectures. Additionally, the proliferation of unmanned systems—both aerial (UAVs) and maritime (USVs)—requires highly precise, low-SWaP (Size, Weight, and Power) ARDF systems for beyond visual line of sight (BVLOS) operations, tracking, and compliance monitoring, significantly boosting demand across specialized tactical markets.

However, the market's expansion is tempered by critical restraints, most notably the high research and development expenditures required to keep pace with rapidly evolving communication technologies and countermeasures designed to defeat direction-finding systems. Furthermore, the operational performance of ARDF systems is inherently susceptible to environmental factors, including atmospheric interference, terrain masking, and urban canyons, which necessitate sophisticated, and often costly, compensatory algorithms. The impact forces show that while technology push (SDR, AI integration) provides significant upward momentum (Opportunity), the regulatory compliance burden and the lengthy procurement cycles typical of defense and large commercial maritime sectors exert a stabilizing, sometimes restraining, influence on rapid market penetration.

Segmentation Analysis

The Automatic Radio Direction Finder Market is highly segmented based on technology, platform, application, and frequency range, reflecting the diverse operational requirements across its end-use sectors. Understanding these segments is crucial for market participants to tailor their offerings and focus their strategic investments. The segmentation by technology highlights the shift from traditional analog systems, which are increasingly being phased out, towards modern, digital processing solutions, particularly those built on Software Defined Radio (SDR) principles. Segmentation by platform—airborne, shipborne, ground-based, and man-portable—demonstrates the versatility and adaptability of ARDF systems to various operational environments, with shipborne systems currently dominating revenue due to mandatory navigation requirements.

Key segments driving market innovation include the application segments of Signal Intelligence (SIGINT) and Electronic Warfare (EW), which demand the highest level of performance, frequency coverage, and processing speed. These high-end governmental applications represent the most lucrative segment in terms of per-unit value. Concurrently, the Search and Rescue (SAR) application segment, driven by international safety regulations (Cospas-Sarsat), mandates reliable, high-sensitivity ARDF capabilities capable of quickly locating emergency beacons (ELTs, EPIRBs). The frequency range segmentation, spanning from HF (High Frequency) to UHF/VHF (Ultra High Frequency/Very High Frequency), reflects the distinct propagation characteristics and target types; for instance, VHF/UHF is critical for civil aviation and short-range tactical communications tracking, while HF is vital for long-range maritime and military communications intercept.

Geographically, market segmentation provides crucial insights into regional demand patterns, with established markets in North America and Europe primarily focused on upgrading existing sophisticated defense platforms, whereas emerging economies in the APAC region are driving demand for new installations across rapidly expanding naval and commercial fleets. The competitive dynamics within these segments are defined by specialization; certain companies excel in ruggedized military platforms, while others focus on highly certified, integrated solutions for the commercial maritime sector, ensuring a differentiated competitive landscape based on core competence and regulatory compliance expertise.

- By Platform Type:

- Shipborne ARDF Systems

- Airborne ARDF Systems

- Ground-based / Fixed Site ARDF Systems

- Man-portable and Vehicle-mounted Systems

- By Technology:

- Software Defined Radio (SDR) Based ARDF

- Digital Signal Processing (DSP) Based ARDF

- Superheterodyne / Analog ARDF (Legacy)

- By Application:

- Signal Intelligence (SIGINT) and Electronic Warfare (EW)

- Search and Rescue (SAR)

- Maritime Navigation and Surveillance

- Aviation Traffic Monitoring

- Regulatory Spectrum Management

- By Frequency Range:

- HF (High Frequency) ARDF

- VHF/UHF (Very/Ultra High Frequency) ARDF

- SHF/EHF (Super/Extremely High Frequency) ARDF

Value Chain Analysis For Automatic Radio Direction Finder Market

The value chain of the Automatic Radio Direction Finder Market is multifaceted, starting with upstream suppliers providing critical raw materials and components, moving through complex manufacturing and integration processes, and culminating in delivery and post-sales support to specialized end-users. Upstream analysis focuses on the sourcing of high-precision components such as specialized antenna elements (e.g., phased arrays, crossed loop antennas), high-speed Analog-to-Digital Converters (ADCs), specialized RF front-ends, and advanced Field-Programmable Gate Arrays (FPGAs) or Digital Signal Processors (DSPs). Key suppliers in this stage are semiconductor companies and specialized component manufacturers. The quality and reliability of these upstream components directly dictate the ARDF system's final performance, sensitivity, and accuracy, making supplier selection a critical competitive advantage.

The manufacturing and system integration stage involves the assembly of these components, the development and embedding of proprietary direction-finding algorithms, and extensive system testing and calibration to meet stringent performance and environmental standards (e.g., MIL-STD, marine certifications). This stage adds the most significant value, transforming disparate hardware into a cohesive, high-performance tactical or navigation system. Manufacturers often possess deep intellectual property concerning array calibration techniques, error correction, and signal processing methods. The distribution channel is often bifurcated: Direct distribution is typical for high-value defense contracts, where original equipment manufacturers (OEMs) work directly with government bodies or prime defense contractors. This channel involves complex security clearances, customized product specifications, and comprehensive service level agreements.

Indirect distribution, involving specialized maritime or aerospace system integrators and value-added resellers (VARs), is common for commercial markets like civil aviation and commercial shipping. These intermediaries play a crucial downstream role by providing regional installation expertise, integrating the ARDF system with the vessel's or aircraft's existing bridge or cockpit systems, and offering localized maintenance and technical support. Downstream analysis emphasizes the role of these integrators in ensuring compliance with local regulatory bodies (e.g., FCC, European directives) and providing training to end-users. The ultimate value delivery is realized through post-sales support, including software updates (critical for SDR systems), periodic calibration, and hardware upgrades, ensuring the long-term operational viability of the mission-critical ARDF equipment.

Automatic Radio Direction Finder Market Potential Customers

The primary customers for Automatic Radio Direction Finder systems are large organizational entities requiring high-reliability location and tracking capabilities for safety, security, or strategic advantage. The most significant segment of end-users comprises governmental and defense organizations, including naval forces, air forces, coast guards, border patrol agencies, and federal law enforcement. These entities utilize ARDF systems for signal intelligence (SIGINT), electronic warfare (EW), maritime domain awareness, drug interdiction, and locating unauthorized transmitters. The procurement cycle within this segment is typically lengthy, characterized by competitive tendering processes, strict performance requirements (often military specification compliant), and a focus on long-term maintainability and interoperability with existing command and control infrastructure.

Another major customer base includes commercial aviation and maritime companies. In the maritime sector, shipping companies, ferry operators, and commercial fishing fleets are mandated by international conventions (SOLAS, GMDSS) to install and maintain reliable ARDF equipment to assist in navigating, avoiding hazards, and quickly responding to distress signals (EPIRBs). Similarly, in the aviation sector, commercial airlines and general aviation operators rely on airborne ARDF systems to locate Emergency Locator Transmitters (ELTs) or navigational aids. These commercial buyers prioritize certified equipment that offers ease of integration, low total cost of ownership, and compliance with stringent international safety standards such as those set by the International Civil Aviation Organization (ICAO).

Furthermore, specialized governmental agencies focused on spectrum management and telecommunications regulation, such as the FCC in the US or Ofcom in the UK, represent a growing customer segment. These agencies deploy sophisticated, fixed-site and mobile ARDF systems to monitor frequency usage, locate sources of interference, enforce spectrum allocation regulations, and ensure the integrity of critical communication networks. Finally, private sector entities involved in oil and gas exploration (offshore platforms), offshore wind farm maintenance, and private security detail (PSD) operations also constitute niche but high-value customers, demanding ruggedized and highly accurate ARDF solutions for asset protection and emergency response within complex offshore environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $425 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rohde & Schwarz, Thales Group, TCI International Inc., Leonardo S.p.A., BAE Systems, General Dynamics Corporation, Furuno Electric Co., Ltd., Roke Manor Research (Chemring Group), Rockwell Collins (Collins Aerospace), Taiyo Musen Co. Ltd., RIZ Transmitters, Safran S.A., ThinkRF Corp., Southern Avionics Company, Koden Electronics Co., Ltd., Icom Inc., SRT Marine Systems, Raytheon Technologies, Curtiss-Wright Corporation, Cobham plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Radio Direction Finder Market Key Technology Landscape

The Automatic Radio Direction Finder market is undergoing a significant technological transformation, driven primarily by the adoption of Software Defined Radio (SDR) and advanced digital signal processing (DSP) techniques. SDR technology offers unparalleled flexibility, enabling manufacturers to build highly adaptable ARDF receivers where essential functions like modulation, filtering, and direction-finding algorithms are implemented in software rather than dedicated hardware. This paradigm shift allows for rapid configuration changes to track new frequency hopping patterns, adapt to diverse communication protocols, and instantly integrate upgraded processing capabilities, crucial for electronic warfare and modern spectrum management applications. The modularity of SDR architectures also simplifies maintenance and ensures longevity, as systems can be updated over their lifetime to counter emerging threats or comply with new regulatory standards without costly hardware overhauls.

Another dominant technology trend involves the sophisticated use of antenna arrays and interferometer techniques. Phased array antennas, combined with advanced correlative interferometry, are becoming standard, particularly for high-end systems requiring high angular accuracy and fast processing speeds. These techniques involve simultaneously sampling the signal across multiple antenna elements and using the phase and amplitude differences to determine the angle of arrival (AoA). Modern systems often utilize highly integrated, compact antenna designs (e.g., circular arrays) that maintain performance while meeting the stringent Size, Weight, and Power (SWaP) constraints required for deployment on small platforms like UAVs and tactical vehicles. The ability of these arrays to operate over extremely wideband frequency ranges is a key differentiator, catering to the need for comprehensive spectrum coverage from HF to SHF bands.

Furthermore, the integration of Artificial Intelligence and Machine Learning (AI/ML) is rapidly becoming a fundamental technology layer. AI algorithms are used extensively for automated signal classification, distinguishing between various types of emitters (e.g., radar, voice communication, data links) in complex electromagnetic environments. ML models are also critical for advanced interference cancellation and mitigating the effects of multi-path signals, which can severely degrade direction-finding accuracy. By learning and adapting to specific propagation environments and noise profiles, AI-enhanced ARDF systems provide significantly more reliable and actionable intelligence compared to deterministic legacy systems. This convergence of high-speed DSP, flexible SDR, and intelligent AI processing defines the technological cutting edge and sets the performance benchmarks for competitive offerings in the ARDF market, ensuring greater operational effectiveness across both strategic and tactical applications.

Additionally, the evolution toward networked and distributed direction-finding systems is crucial. Instead of relying solely on a single platform's data, modern ARDF technology involves multiple, geographically dispersed receivers linked via high-speed data networks. This configuration allows for highly accurate geo-location of an emitter through triangulation or multilateration (TDOA – Time Difference of Arrival) techniques, providing a precise fix that is often more reliable than a single bearing measurement. The core technology enabling this includes precise time synchronization (often using GPS disciplined oscillators or atomic clocks) across all receiver nodes and advanced network fusion software that processes the decentralized data in near real-time. This distributed architecture is especially vital in military applications for targeting and electronic surveillance across vast operational theaters, and in civil applications for monitoring large maritime zones or tracking atmospheric phenomena emitters. This integration of networked nodes leverages the collective strength of multiple systems to overcome individual platform limitations, significantly enhancing the coverage area and the reliability of location fixes, particularly against low-probability-of-intercept (LPI) signals.

Regional Highlights

The Automatic Radio Direction Finder Market exhibits pronounced regional variations in demand, technological maturity, and application focus. North America holds a dominant position, primarily driven by substantial and sustained defense spending by the United States and Canada. The region is home to major aerospace and defense primes that specialize in developing cutting-edge ARDF systems for electronic warfare, national security surveillance, and integrated intelligence platforms. Compliance with Federal Aviation Administration (FAA) and U.S. Coast Guard regulations also mandates the continuous upgrade and installation of ARDF technology in civil infrastructure. The demand here is largely characterized by a requirement for highly sophisticated, customized, and networked systems that incorporate the latest advancements in AI and SDR technology, catering to complex signal intelligence and tactical targeting missions.

Europe represents another mature and substantial market, propelled by mandatory safety regulations (e.g., GMDSS for maritime, EASA for aviation) and the ongoing need for continental border security and monitoring. European naval and air forces are actively modernizing their fleets, incorporating advanced ARDF systems as part of broader electronic support measures (ESM) suites. Countries such as the UK, France, and Germany are leaders in developing highly precise direction-finding solutions, focusing heavily on integrating these capabilities into naval platforms and coastal surveillance networks. Furthermore, the region’s active participation in joint European defense initiatives and maritime safety efforts ensures steady demand for interoperable and standardized ARDF equipment, emphasizing high reliability and conformity to stringent quality certifications.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This rapid expansion is fueled by the significant naval expansion and fleet modernization programs underway in nations like China, India, Japan, and South Korea, coupled with exponential growth in commercial shipping and aviation traffic. As regional geopolitical tensions rise, investments in signal intelligence and electronic surveillance capabilities are soaring, creating high demand for advanced ARDF solutions. Unlike the predominantly upgrade-focused markets of North America and Europe, APAC often involves procuring entirely new systems for newly constructed ships and aircraft. Market growth in this region is also supported by increasing regulatory enforcement concerning illegal fishing and maritime boundary disputes, requiring enhanced surveillance and tracking technologies.

- North America: Market leader driven by high U.S. defense procurement, technological superiority in EW and SIGINT systems, and stringent regulatory requirements for aviation safety.

- Europe: Strong demand supported by GMDSS compliance, naval modernization efforts, and established defense technology manufacturing bases (e.g., Thales, Leonardo).

- Asia Pacific (APAC): Highest CAGR potential, driven by rapid military expansion, booming commercial maritime sector, and escalating need for domain awareness capabilities.

- Latin America: Growing demand primarily linked to border security, counter-narcotics operations, and basic maritime patrol requirements, favoring cost-effective, ruggedized systems.

- Middle East and Africa (MEA): Significant investment in advanced ARDF for critical infrastructure protection, oil and gas security, and enhanced military surveillance capabilities, often relying on imports from North American and European suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Radio Direction Finder Market.- Rohde & Schwarz

- Thales Group

- TCI International Inc.

- Leonardo S.p.A.

- BAE Systems

- General Dynamics Corporation

- Furuno Electric Co., Ltd.

- Roke Manor Research (Chemring Group)

- Rockwell Collins (Collins Aerospace)

- Taiyo Musen Co. Ltd.

- RIZ Transmitters

- Safran S.A.

- ThinkRF Corp.

- Southern Avionics Company

- Koden Electronics Co., Ltd.

- Icom Inc.

- SRT Marine Systems

- Raytheon Technologies

- Curtiss-Wright Corporation

- Cobham plc

Frequently Asked Questions

Analyze common user questions about the Automatic Radio Direction Finder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Automatic Radio Direction Finder (ARDF) system?

The primary function of an Automatic Radio Direction Finder (ARDF) is to automatically and accurately determine the line of bearing or direction of a specific radio frequency emitter. This capability is crucial for maritime and aerial navigation, identifying distress signals (Search and Rescue), and conducting sophisticated signal intelligence operations.

Which technological trends are driving innovation in the ARDF Market?

The key technological innovations include the widespread adoption of Software Defined Radio (SDR) architectures, which provide unprecedented flexibility and frequency agility, and the integration of Artificial Intelligence and Machine Learning (AI/ML) for advanced signal classification, interference mitigation, and enhanced accuracy in complex environments.

How does the segmentation of ARDF by platform influence procurement decisions?

Segmentation by platform (Shipborne, Airborne, Ground-based) dictates critical factors such as Size, Weight, and Power (SWaP) constraints, environmental ruggedization standards (e.g., marine corrosion resistance), and required angular accuracy. Shipborne systems, for instance, must meet stringent GMDSS regulatory compliance for safety and navigation.

What are the main market restraints impacting the growth of the ARDF sector?

Major restraints include the high initial procurement cost associated with advanced, high-precision military-grade systems, the technical complexity of integrating ARDF hardware and software into legacy military or commercial platforms, and the inherent performance degradation caused by environmental interference and multi-path effects.

Which geographical region is expected to demonstrate the highest growth rate for ARDF systems?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by extensive military modernization programs, particularly in naval fleets, and the massive expansion of the commercial shipping industry demanding mandatory GMDSS-compliant navigation and safety equipment upgrades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager