Automatic Speech Recognition (ASR) Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435838 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automatic Speech Recognition (ASR) Software Market Size

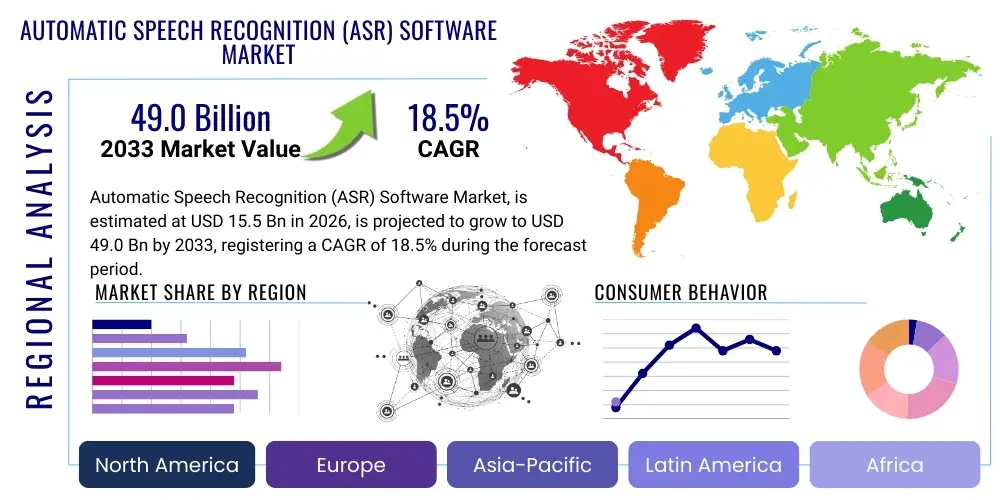

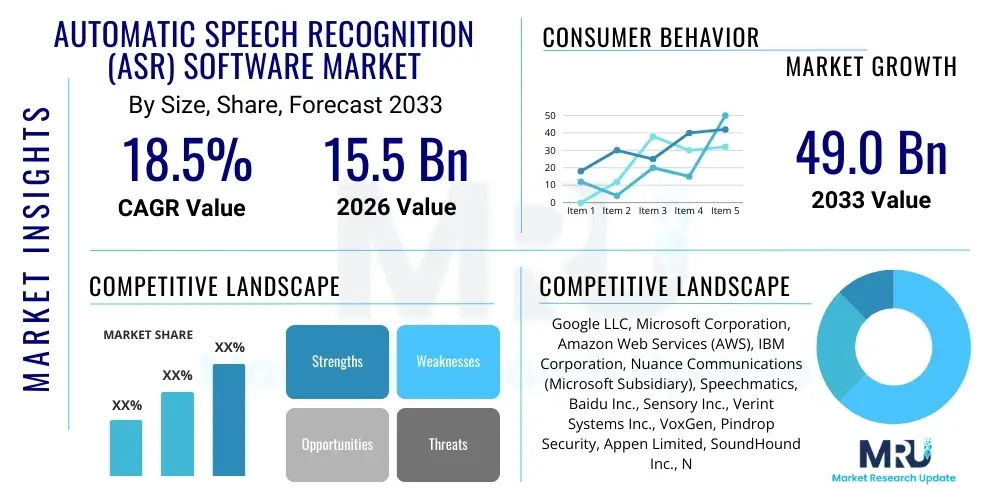

The Automatic Speech Recognition (ASR) Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 49.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating integration of voice-enabled technologies across diverse consumer and enterprise platforms, necessitating sophisticated and highly accurate speech-to-text conversion capabilities. The adoption of ASR solutions is accelerating significantly within sectors such as automotive, healthcare, and customer service, where efficiency gains from automated transcription and command processing are paramount to digital transformation initiatives. Furthermore, continuous technological advancements, particularly in deep learning algorithms and neural network architectures, are enhancing recognition accuracy and reducing latency, thereby broadening the practical applicability of ASR software in complex, real-world environments, securing its trajectory toward becoming a critical component of modern computing interfaces.

Automatic Speech Recognition (ASR) Software Market introduction

The Automatic Speech Recognition (ASR) Software Market encompasses technologies and solutions designed to convert spoken language into textual format. These systems leverage complex computational linguistics, acoustic modeling, and machine learning techniques, predominantly deep neural networks, to accurately interpret human speech, regardless of variations in accent, pitch, speed, or vocabulary. ASR software is a foundational element for numerous modern applications, ranging from virtual assistants and hands-free computing to advanced contact center automation and medical dictation services, driving significant improvements in accessibility and operational efficiency across the global digital ecosystem. The fundamental product includes core recognition engines, specialized language models, APIs for integration, and deployment platforms that facilitate seamless interaction between users and machines, often forming the primary interface layer for intelligent systems.

Major applications of ASR software span critical business processes and consumer interactions. In the enterprise domain, ASR is vital for enhancing customer relationship management (CRM) through voice analytics, providing real-time transcription for compliance requirements, and powering interactive voice response (IVR) systems. Consumer applications prominently include mobile device control, smart home automation, and transcription services for video content. Key benefits derived from adopting ASR software include reduced manual data entry time, improved efficiency in call centers, enhanced accessibility for users with disabilities, and the capability to quickly process and derive insights from vast amounts of unstructured voice data, leading to better business intelligence and decision-making capabilities.

The market is primarily driven by the exponential growth in demand for intelligent virtual assistants (IVAs) and natural language understanding (NLU) capabilities integrated into mainstream devices. Furthermore, the pervasive spread of high-speed internet infrastructure and the increasing affordability of high-performance computing resources, particularly cloud-based processing power, enable complex ASR models to operate effectively at scale. Regulatory pressures requiring better accessibility features in digital products and the shift toward omnichannel communication strategies by businesses further solidify the essential role of ASR software, acting as a crucial bridge between human communication and automated digital workflows across all major industrial sectors.

Automatic Speech Recognition (ASR) Software Market Executive Summary

The Automatic Speech Recognition (ASR) Software Market is characterized by intense technological evolution and robust adoption rates across multiple industry verticals. Business trends indicate a strong movement toward cloud-based deployment models, driven by the scalability, flexibility, and reduced capital expenditure offered by Software as a Service (SaaS) solutions. There is a heightened competitive focus among major technology providers on developing domain-specific ASR models, specifically tailored for nuanced vocabularies found in medical, legal, or technical fields, thereby significantly improving accuracy and utility in professional settings. Strategic partnerships between hardware manufacturers and software developers are increasingly common, aimed at embedding ASR capabilities directly into consumer electronics, automobiles, and industrial equipment, accelerating market penetration and establishing voice as a primary interaction modality. Furthermore, the incorporation of advanced security and privacy features is becoming a critical differentiating factor, responding to growing regulatory requirements and user concerns regarding voice data handling.

Regionally, North America maintains the dominant market share, attributed to the early adoption of advanced digital technologies, the presence of major technological innovation hubs, and high consumer acceptance of virtual assistants and smart devices. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by massive investments in digital infrastructure, the burgeoning adoption of mobile internet services, and supportive government initiatives promoting digitalization in countries like China and India. Europe also represents a significant market, primarily driven by strict data protection regulations necessitating highly secure, local ASR solutions, and the strong presence of the automotive industry demanding sophisticated in-car voice control systems. Emerging markets in Latin America and MEA are seeing substantial growth, spurred by the need for localized language models and automation solutions in rapidly developing service sectors.

Segment trends highlight the dominance of the Solution component, particularly software platforms leveraging deep learning and NLP for enhanced accuracy. Within the deployment segment, the Cloud model is rapidly overtaking on-premise solutions due to its scalability and continuous update capabilities. End-use segmentation confirms that the BFSI (Banking, Financial Services, and Insurance) and IT & Telecom sectors are the largest consumers, utilizing ASR extensively for fraud detection, customer authentication, and call center automation. Concurrently, the Healthcare sector is experiencing the fastest growth, primarily adopting ASR for clinical documentation, electronic health record (EHR) updates, and surgical transcription, demonstrating the software's profound impact on clinical workflow efficiency and reducing administrative burdens on medical professionals.

AI Impact Analysis on Automatic Speech Recognition (ASR) Software Market

User queries regarding AI's influence on ASR software frequently revolve around the expected improvements in transcription accuracy, handling of noisy environments, and the capability to understand nuanced, context-dependent language (Natural Language Understanding or NLU). There is significant consumer interest concerning how generative AI and large language models (LLMs) will shift ASR from a purely transcription tool into a contextual understanding and response system, particularly in customer service and medical applications. Key concerns often center on data privacy implications related to deep learning models requiring vast datasets, the computational cost associated with running state-of-the-art AI models, and the potential for bias propagation within trained algorithms that might affect specific accents or demographic groups. Businesses are primarily focused on the return on investment (ROI) derived from AI-powered ASR, seeking quantifiable improvements in automation rates, reduction in error margins, and seamless integration with existing enterprise resource planning (ERP) systems.

The integration of advanced Artificial Intelligence techniques, such as transformer models and self-supervised learning, has been transformative for the ASR market. These AI advancements have propelled recognition accuracy metrics closer to human parity, drastically improving performance in complex scenarios involving multiple speakers, background noise, or highly technical vocabulary. Modern AI-driven ASR systems are increasingly moving beyond simple text conversion to include sentiment analysis and speaker identification capabilities, offering richer metadata insights from voice interactions. This shift enables applications like proactive customer intervention in call centers or automated monitoring of meeting compliance. The continual refinement of AI models ensures that ASR software remains at the forefront of human-computer interaction, driving demand for high-capacity, AI-optimized cloud infrastructure.

Moreover, the rise of edge AI processing is fundamentally changing deployment strategies. By allowing smaller, efficient ASR models to run directly on devices (such as smartphones or smart speakers), AI reduces latency and enhances privacy by minimizing reliance on continuous cloud connectivity. Generative AI components, specifically LLMs, are now being paired with ASR engines to instantly summarize transcribed conversations, generate automated follow-up actions, or refine transcription accuracy using contextual coherence checks, thereby creating end-to-end intelligent voice solutions rather than discrete software components. This synthesis of ASR and Generative AI marks the evolution toward truly intuitive conversational AI platforms, solidifying AI as the indispensable core technology of the market.

- AI drives near-human-level transcription accuracy through deep neural networks (DNNs) and deep learning algorithms.

- Integration of Large Language Models (LLMs) enables contextual understanding and automated summarization of transcribed data.

- Advancements in acoustic modeling significantly enhance performance in noisy environments and for varied accents.

- Edge AI processing facilitates low-latency, privacy-preserving ASR execution directly on endpoint devices.

- AI enables real-time speaker diarization, distinguishing and labeling multiple voices in a single interaction.

- Use of transfer learning and self-supervised training reduces the data requirements for building highly specialized ASR models.

- AI algorithms are core to sentiment analysis and emotion detection layered onto transcribed voice data for enhanced business intelligence.

- Facilitation of complex multi-turn conversational AI systems, moving beyond simple command-and-control functions.

DRO & Impact Forces Of Automatic Speech Recognition (ASR) Software Market

The Automatic Speech Recognition (ASR) Software Market is shaped by a powerful confluence of drivers necessitating rapid adoption, significant restraints limiting universal implementation, and abundant opportunities for technological differentiation and market expansion. The primary driver is the accelerating proliferation of smart devices and IoT ecosystems, which rely heavily on voice interfaces for interaction and control. This trend is amplified by the business imperative across industries like contact centers and healthcare to automate routine tasks and improve workflow efficiency through precise documentation. However, the market faces constraints, most notably the persistent challenges related to achieving 100% accuracy in complex auditory environments, such as heavy background noise or overlapping speech, alongside profound user and regulatory concerns regarding data privacy, security, and the storage of sensitive voice biometrics. Despite these restraints, substantial growth opportunities exist in developing highly localized, multilingual models for emerging markets and integrating ASR with augmented and virtual reality (AR/VR) technologies, positioning the market for sustained high growth.

Impact forces within the market are predominantly technological and competitive. High bargaining power of buyers, especially large enterprise customers, drives continuous pressure on vendors to lower prices while simultaneously increasing accuracy and offering specialized vocabulary support. The threat of substitution remains moderate but is primarily focused on alternative input methods, though voice remains the most efficient for many mobile and hands-free contexts. Supplier power is high for specialized component providers, such particularly those supplying advanced GPU computing hardware and pre-trained foundational AI models necessary for deep learning processes. Regulatory forces, particularly GDPR in Europe and HIPAA in the US, impose strict requirements on data handling, acting as both a restraint (due to compliance costs) and an opportunity (for providers offering secure, compliant ASR solutions).

The long-term impact of these forces suggests a market trajectory dominated by niche specialization and platform consolidation. Providers who successfully address the accuracy limitations through innovative noise reduction and context-aware modeling, while also demonstrating robust data security frameworks, will capture the greatest market share. The democratization of advanced AI algorithms, however, lowers barriers to entry for specialized startups, fueling a dynamic competitive environment focused on specific language pairs or industry applications. Ultimately, ASR software is becoming an essential utility, making its adoption irreversible, with growth modulated only by the speed at which infrastructural and ethical concerns related to data handling can be effectively addressed by the industry leaders.

Segmentation Analysis

The Automatic Speech Recognition (ASR) Software Market is systematically segmented based on technological implementation, operational characteristics, deployment architecture, and the specific application needs of various end-user industries. This segmentation provides a critical framework for market participants to tailor their offerings, addressing distinct requirements regarding scalability, security, and linguistic specialization. The primary segmentation revolves around the components (solutions vs. services), the underlying technology utilized (NLP, Deep Learning), the deployment model (cloud vs. on-premise, reflecting enterprise IT preferences), and the end-use industry, where application-specific models are necessary to handle unique terminologies and acoustic environments. Analyzing these segments is essential for understanding regional market maturity, competitive dynamics, and future investment opportunities in high-growth niches.

- By Component:

- Solution (Software, Platform, Core Engine)

- Services (Consulting, Integration and Deployment, Training and Support, Managed Services)

- By Technology:

- Natural Language Processing (NLP)

- Deep Learning

- Hidden Markov Model (HMM)

- Neural Networks (Recurrent Neural Networks, Convolutional Neural Networks, Transformer Models)

- By Deployment Model:

- Cloud-Based

- On-Premise

- Hybrid Deployment

- Edge-Based Deployment

- By Application:

- Voice Search and Recognition

- Customer Authentication

- Call Center Automation and Management

- Interactive Voice Response (IVR) Systems

- Medical Transcription and Documentation

- Virtual Assistants and Smart Speakers

- By End-Use Industry:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Healthcare and Life Sciences

- Automotive

- Retail and E-commerce

- Government and Public Sector

- Media and Entertainment

- Education

Value Chain Analysis For Automatic Speech Recognition (ASR) Software Market

The value chain for the Automatic Speech Recognition (ASR) software market is highly complex, beginning with foundational research and computational linguistics, and extending through software development, system integration, and end-user support. The upstream analysis is dominated by core technology providers, including academic institutions and major tech firms focused on developing advanced acoustic models, large language models (LLMs), and training datasets. This stage requires immense investment in high-performance computing (HPC) infrastructure and specialized data scientists. The primary value addition at this initial stage is the creation of highly accurate, low-latency, and linguistically diverse recognition engines that serve as the foundation for commercial products. Access to high-quality, ethically sourced audio data is a non-negotiable upstream requirement, significantly influencing the quality and performance ceiling of the final ASR output.

The middle segment of the value chain involves ASR platform development and integration. Software vendors take the core recognition engine and package it into accessible formats, such as APIs or modular platforms, often integrating sophisticated features like diarization, noise reduction, and security protocols. Distribution channels are varied, including direct sales to large enterprises requiring customized, on-premise solutions, and indirect channels relying heavily on cloud marketplaces (e.g., AWS, Azure) and system integrators (SIs) who embed ASR capabilities into broader enterprise applications like CRM or EHR systems. The efficiency of this middle layer is critical for rapid deployment and ensuring compatibility across disparate operating environments and existing IT stacks, thereby driving market reach and scalability for ASR providers.

Downstream analysis focuses on deployment, customer service, and feedback loops. End-users receive the software either as a standalone solution (e.g., dictation software) or, more commonly, integrated into a consumer device or enterprise application (e.g., call center software). Post-sales activities, including maintenance, iterative model retraining using real-world data, and technical support, are essential for maximizing the value of ASR systems. The performance data generated downstream—including error rates, latency metrics, and user satisfaction—flows back to the upstream providers to refine acoustic and language models, completing the cycle of continuous improvement. Direct channels often prioritize bespoke solutions and dedicated support, while indirect channels leverage channel partners for broader geographical reach and industry-specific expertise, ensuring that ASR technology adapts dynamically to evolving user needs and technological standards.

Automatic Speech Recognition (ASR) Software Market Potential Customers

Potential customers for Automatic Speech Recognition (ASR) software are exceptionally diverse, spanning virtually every sector that handles high volumes of verbal communication or requires hands-free interaction with technology. The most significant end-users are large enterprises in highly regulated industries, such as BFSI, which utilizes ASR for enhanced security through voice biometrics, regulatory compliance monitoring of agent interactions, and sophisticated fraud prevention. Another key buyer segment is the Healthcare sector, where physicians and clinicians are primary users, relying on ASR for efficient documentation, reducing the burden of manual charting, and updating Electronic Health Records (EHRs) directly through dictation, which directly impacts patient care quality and operational overhead.

Beyond highly regulated industries, the IT and Telecom sector, along with Retail and E-commerce, represent massive consumption bases. Telecommunication companies deploy ASR extensively in automated call centers and Interactive Voice Response (IVR) systems to handle high customer query volumes efficiently, thereby reducing operational costs. Retailers utilize ASR for personalized voice search on e-commerce platforms and for inventory management in warehouses, demonstrating its utility in both customer-facing and back-end logistical operations. Furthermore, the Automotive industry is a crucial segment, integrating ASR deeply into vehicle infotainment and control systems to enhance driver safety and user experience by enabling completely hands-free control over navigation, media, and communication functions.

A rapidly growing segment includes SMEs (Small and Medium-sized Enterprises) across various industries, utilizing flexible, cloud-based ASR solutions as affordable tools for meeting transcription, customer service automation, and enhancing internal collaboration. Government agencies and defense organizations are also major customers, employing ASR for intelligence gathering, large-scale media monitoring, and secure, high-stakes communication transcription. The common thread across all potential customers is the need to efficiently process spoken data, integrate voice as a primary input mechanism, and leverage the resulting transcripts for generating actionable business intelligence or improving operational velocity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 49.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google LLC, Microsoft Corporation, Amazon Web Services (AWS), IBM Corporation, Nuance Communications (Microsoft Subsidiary), Speechmatics, Baidu Inc., Sensory Inc., Verint Systems Inc., VoxGen, Pindrop Security, Appen Limited, SoundHound Inc., NVIDIA Corporation, Deepgram, Twilio Inc., Meta Platforms Inc., Apple Inc., Cognigy GmbH, AI-Media |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Speech Recognition (ASR) Software Market Key Technology Landscape

The Automatic Speech Recognition (ASR) Software Market is defined by a dynamic technological landscape where innovation in artificial intelligence (AI) and machine learning (ML) is paramount. The foundational technology relies heavily on acoustic modeling and language modeling, increasingly utilizing sophisticated deep learning architectures such as Recurrent Neural Networks (RNNs), Convolutional Neural Networks (CNNs), and, most recently, transformer models. Transformer architecture, particularly prominent through its use in large language models (LLMs), has significantly improved the ability of ASR systems to understand context and handle long-form speech, moving beyond the capabilities of older Hidden Markov Model (HMM) and Gaussian Mixture Model (GMM) approaches. This shift has facilitated unparalleled accuracy, even in complex, conversational settings, by improving phoneme recognition and linguistic coherence checks, pushing the market standard toward AI-native solutions that require significant computational power for both training and inference processes.

A critical technology trend is the rise of end-to-end deep learning ASR systems. Unlike traditional systems that required separate components for acoustic modeling, pronunciation modeling, and language modeling, end-to-end approaches simplify the pipeline, often leading to better performance, faster deployment, and easier model updates. This methodology is often coupled with transfer learning, where models trained on vast, general datasets are fine-tuned rapidly for highly specific domains (e.g., legal jargon or financial terminology), drastically reducing the time and data required for specialization. Furthermore, advancements in specialized hardware, such as Graphics Processing Units (GPUs) and Tensor Processing Units (TPUs) provided by companies like NVIDIA and Google, are essential, enabling the high-speed parallel processing required to run these complex models in real time, especially for high-volume applications like live captioning or large contact centers.

The convergence of ASR with Natural Language Understanding (NLU) and Natural Language Generation (NLG) is shaping the future product roadmap, transforming simple speech recognition software into comprehensive conversational AI platforms. Key areas of development include multi-channel and multi-modal ASR, which integrates visual and other sensory inputs to enhance contextual accuracy, and highly secure, encrypted voice processing capabilities necessary for sensitive sectors like defense and finance. Furthermore, the push for multilingual support and low-resource language modeling remains a major technological focus, utilizing techniques like phonetic mapping and synthetic data generation to extend ASR capabilities into diverse global markets that previously lacked the required volume of training data. Ultimately, the technological landscape is moving toward personalized, robust, and omnipresent ASR systems that seamlessly integrate into the daily operational fabric of both consumer and enterprise environments.

Regional Highlights

- North America: This region maintains the largest market share, driven by early and widespread adoption across the corporate sector and a high consumer penetration rate of smart speakers and virtual assistants. The presence of leading technology providers (Google, Microsoft, AWS, IBM) and robust R&D spending on AI and machine learning infrastructure ensures continuous innovation. Strict regulatory requirements, particularly in healthcare (HIPAA) and finance, necessitate advanced, highly secure ASR systems for compliance and documentation. The market here is mature but continues high growth, primarily through specialized vertical applications and the integration of generative AI into existing ASR workflows.

- Europe: Europe represents a strong and steadily growing market, heavily influenced by GDPR, which mandates high standards for data privacy and local processing. This environment drives demand for hybrid and on-premise deployment solutions. Key growth is concentrated in the automotive sector, particularly in Germany and France, where advanced in-car ASR for multi-language control is a priority. The diverse linguistic landscape necessitates strong investment in multilingual ASR engines, making linguistic diversity a critical competitive advantage for regional vendors.

- Asia Pacific (APAC): Projected to be the fastest-growing region globally, APAC benefits from rapid urbanization, massive government investment in digital infrastructure (e.g., smart city initiatives), and the world’s largest mobile subscriber base. Countries like China, India, Japan, and South Korea are huge markets, demanding ASR solutions capable of handling complex tonal languages, varied dialects, and low-resource languages. The adoption in IT, BPO (Business Process Outsourcing), and consumer electronics manufacturing is fueling exponential growth rates.

- Latin America (LATAM): This region exhibits high potential driven by the rapid modernization of customer service infrastructure and the increasing digital literacy rates. The demand is strong for bilingual (Spanish-Portuguese) ASR solutions for telecommunications and banking sectors aiming to improve operational efficiency and scale their contact center capabilities across the region. Economic instability often favors flexible, cloud-based ASR models requiring minimal upfront investment.

- Middle East and Africa (MEA): Growth in MEA is spurred by significant governmental digitalization initiatives (such as Saudi Vision 2030 and UAE's AI strategy) and the necessity for ASR tailored to handle specific Arabic dialects and other regional languages. The adoption is concentrated initially in the BFSI and government sectors for security and monitoring purposes, with increasing penetration expected in mobile and retail services as digital infrastructure matures across the Gulf Cooperation Council (GCC) countries and parts of sub-Saharan Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Speech Recognition (ASR) Software Market.- Google LLC

- Microsoft Corporation

- Amazon Web Services (AWS)

- IBM Corporation

- Nuance Communications (Microsoft Subsidiary)

- Speechmatics

- Baidu Inc.

- Sensory Inc.

- Verint Systems Inc.

- VoxGen

- Pindrop Security

- Appen Limited

- SoundHound Inc.

- NVIDIA Corporation

- Deepgram

- Twilio Inc.

- Meta Platforms Inc.

- Apple Inc.

- Cognigy GmbH

- AI-Media

Frequently Asked Questions

Analyze common user questions about the Automatic Speech Recognition (ASR) Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the ASR Software Market?

The market is primarily driven by the massive proliferation of smart devices and IoT ecosystems, which rely fundamentally on accurate, hands-free voice interfaces for seamless user interaction and control, alongside the widespread enterprise need for automation in customer service and documentation.

How is Deep Learning impacting ASR accuracy and performance?

Deep Learning, particularly through the implementation of advanced neural network architectures like transformers, has enabled ASR systems to achieve near-human parity accuracy, significantly enhancing their ability to handle background noise, accents, and complex conversational context in real-time, thereby expanding practical application scope.

Which deployment model holds the highest growth potential in ASR?

The Cloud-Based deployment model exhibits the highest growth potential, offering superior scalability, lower infrastructure costs, easy integration via APIs, and continuous access to the latest AI model updates, making it the preferred choice for both large enterprises and flexible start-ups.

What are the key restraint challenges facing ASR adoption?

Key restraints include the persistent challenge of maintaining 100% accuracy in highly noisy or multi-speaker environments, significant concerns regarding the data privacy and security of transcribed voice biometrics, and the high initial cost and complexity associated with integrating specialized ASR models into legacy IT infrastructures.

Which end-use industry is expected to show the fastest adoption rate?

The Healthcare sector is projected to show the fastest adoption rate, utilizing ASR software extensively for clinical documentation, medical transcription, and updating Electronic Health Records (EHRs), driven by the crucial need to reduce administrative burdens on medical professionals and improve data capture efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager