Automatic Spray Guns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437962 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automatic Spray Guns Market Size

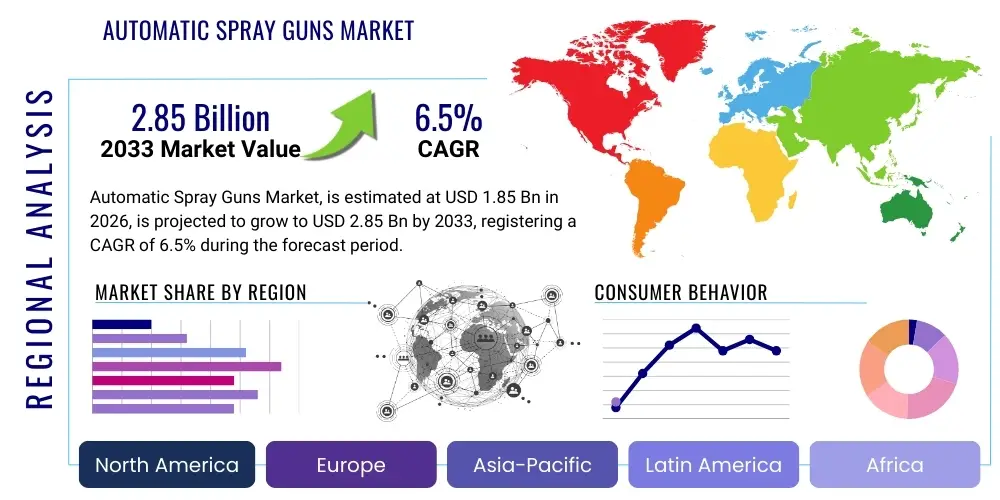

The Automatic Spray Guns Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.85 Billion by the end of the forecast period in 2033.

Automatic Spray Guns Market introduction

The Automatic Spray Guns Market encompasses sophisticated coating and finishing equipment designed for high-volume industrial applications, replacing manual processes with automated precision systems. These devices are critical components in production lines requiring uniform material deposition, whether utilizing paint, adhesives, powder coatings, or sealants. The core product offering includes various technologies such as High Volume Low Pressure (HVLP), Airless, Air-Assisted Airless, and increasingly, electrostatic systems, which maximize material transfer efficiency and minimize overspray. The primary motivation for adopting these systems across industries is the consistent, repeatable quality they deliver, which is often unattainable through manual operations. Furthermore, the integration of these systems into robotic arms allows for seamless operation in hazardous environments and complex geometric applications.

Major applications of automatic spray guns span the automotive, aerospace, heavy machinery, consumer goods, and wood finishing industries. The automotive sector, in particular, represents a significant demand driver, utilizing these guns extensively for primer, basecoat, and clear coat applications on vehicle bodies, where flawless surface finish is paramount to brand perception and product longevity. Benefits derived from utilizing automatic spray guns include substantial material savings due to high transfer efficiency, reduced volatile organic compound (VOC) emissions meeting stringent environmental regulations, increased production throughput, and enhanced worker safety by minimizing exposure to hazardous chemicals. These systems are essential for manufacturers seeking to achieve Industry 4.0 objectives, integrating sophisticated sensing and control mechanisms for real-time process adjustments.

Key driving factors accelerating the market growth include the global trend toward factory automation, rising labor costs coupled with a shortage of skilled manual applicators, and the stringent quality standards mandated by end-user industries, particularly in high-value manufacturing like aerospace and luxury goods. Manufacturers are continually investing in research and development to enhance atomization quality, improve equipment durability, and integrate smart features such as pattern recognition and adaptive coating thicknesses. This technological evolution ensures that automatic spray guns remain indispensable tools for modern, highly efficient manufacturing environments, contributing significantly to both cost reduction and product quality improvement.

Automatic Spray Guns Market Executive Summary

The automatic spray guns market is characterized by robust business trends centered on digitization and sustainable manufacturing practices. Key business trends include the pervasive adoption of robotic integration, where automatic spray guns are mounted on advanced multi-axis robots to handle complex geometries and ensure superior coating uniformity, thereby dramatically improving line efficiency. Another critical trend is the shift towards advanced monitoring systems incorporating IoT sensors, allowing manufacturers to gather crucial operational data on flow rates, pressure, and temperature for predictive maintenance and real-time quality control. Furthermore, intense competition among key players is driving innovation in electrostatic coating technology, aiming for higher transfer efficiency rates, which directly translates to lower material consumption and a smaller environmental footprint, aligning with global corporate sustainability goals and regulatory compliance.

Regional trends indicate that the Asia Pacific (APAC) region is experiencing the most rapid growth, fueled by massive expansion in the automotive manufacturing base, particularly in China, India, and Southeast Asian countries, coupled with increasing investments in general industrial fabrication and electronics production. North America and Europe, while mature markets, maintain dominance in adopting high-end, technologically sophisticated systems, driven by stringent environmental protection agency (EPA) standards demanding extremely low VOC coatings and maximum transfer efficiency. These regions are prioritizing retrofitting existing facilities with smart, connected spray gun systems to optimize current operational expenditures rather than building entirely new lines, focusing on efficiency gains derived from connectivity and data analytics.

Segment trends highlight the technological preference toward electrostatic spray guns, especially in powder coating applications and liquid finishing where conductivity allows for superior wrap-around effect, ensuring comprehensive coverage of complex parts. The component segment, specifically nozzles and fluid tips, is seeing development focused on durable materials resistant to abrasive coatings and optimized for micro-atomization, enhancing finish quality. Furthermore, the end-user market is showing strong growth in the Tier 1 automotive supplier segment, as they rapidly expand capacity to meet global OEM demands, requiring high-throughput, reliable automatic finishing systems for internal and external components. This consolidation of demand across multiple manufacturing tiers reinforces the need for highly reliable and interoperable automatic spraying solutions.

AI Impact Analysis on Automatic Spray Guns Market

User queries regarding the impact of Artificial Intelligence (AI) on the Automatic Spray Guns Market frequently revolve around optimizing coating processes, enhancing predictive maintenance capabilities, and addressing the challenges associated with complex pattern recognition and quality assurance. Users are keen to understand how AI-driven algorithms can move beyond simple automation to achieve adaptive coating thickness based on real-time material viscosity changes, or how machine learning models can minimize defects by correlating environmental factors (humidity, temperature) with final product quality data. A key concern often raised is the cost and complexity of integrating sophisticated neural networks with legacy spraying equipment, especially in smaller manufacturing operations. The consensus expectation is that AI will transform automatic spraying from a programmed sequence into a highly intelligent, self-optimizing process, significantly reducing rework rates and material wastage while ensuring unprecedented consistency across massive production batches.

The implementation of AI algorithms fundamentally alters the operational paradigm of automatic spray gun systems by introducing predictive and prescriptive capabilities. AI-powered vision systems, utilizing deep learning, can analyze the surface topography of components in real-time, instantly adjusting spray patterns, pressure, and fluid flow to maintain a perfect, uniform coating thickness even on complex or moving conveyor lines. This eliminates human subjectivity and the need for frequent manual calibrations. Furthermore, AI enhances equipment reliability; by analyzing vibration, temperature, and fluid dynamic data collected through IoT sensors, machine learning models can accurately predict component failures (such as nozzle wear or pump degradation) far in advance, enabling preventative maintenance scheduling, which drastically minimizes unplanned downtime and optimizes operational expenditure (OPEX).

This integration of AI is driving the creation of 'smart spray booths' where every environmental and operational variable is constantly monitored and adjusted autonomously. For instance, in powder coating, AI can optimize the charging voltage and powder flow to maximize the electrostatic effect, thus improving transfer efficiency beyond standard programmed limits. The long-term implication is a substantial reduction in the environmental impact of coating operations, as material utilization approaches theoretical maximums. Manufacturers adopting these AI-enabled systems are positioned to achieve unparalleled production consistency, a significant competitive advantage in industries where minute quality variances can determine product acceptance, such as aerospace and high-end electronics assembly.

- AI optimizes real-time fluid dynamics and atomization based on viscosity and temperature fluctuations.

- Machine learning algorithms predict nozzle wear and equipment failure, enabling precise predictive maintenance scheduling.

- AI-powered vision systems provide instantaneous, automated quality control by detecting microscopic coating defects or inconsistencies.

- Adaptive spray pattern generation tailored automatically for complex or irregular part geometries.

- Optimization of powder coating electrostatic parameters (voltage, flow) to maximize transfer efficiency and minimize material waste.

DRO & Impact Forces Of Automatic Spray Guns Market

The market dynamics are defined by a strong confluence of drivers rooted in industrial efficiency and environmental compliance, balanced against significant cost-related restraints and expansive technological opportunities. The primary market driver is the pervasive adoption of automation across global manufacturing sectors, fueled by escalating labor costs and the criticality of precise, repeatable coating quality required for modern composite materials and specialized finishes. Furthermore, stringent global environmental regulations, particularly regarding the reduction of Volatile Organic Compound (VOC) emissions, push manufacturers toward highly efficient application technologies like electrostatic and HVLP systems, which automatic spray guns predominantly utilize. These systems not only comply with regulatory frameworks but also offer substantial long-term material cost savings, compelling investment despite high initial capital outlay. Regulatory pressure and the inherent desire for operational excellence create a forceful positive impact on market growth.

However, the market expansion is moderately restrained by the substantial initial investment required to install automated spray gun systems, including the cost of associated robotic arms, sophisticated controllers, and the necessary infrastructure modifications to existing production lines. This high capital expenditure can be prohibitive for small and medium-sized enterprises (SMEs), particularly in developing regions. Another restraint involves the complexity of maintenance and the requirement for highly specialized technical personnel to program, troubleshoot, and maintain these advanced systems, posing a workforce training challenge. These initial cost hurdles and specialized labor needs act as a braking mechanism, especially during economic downturns, affecting the rapid penetration of high-end automated solutions across fragmented industrial landscapes.

Opportunities for market players are primarily concentrated in emerging economies, where rapid industrialization and the establishment of new manufacturing hubs (especially automotive and appliance) create greenfield investment potential for complete automated finishing solutions. Technological opportunities revolve around the integration of smart factory concepts, including advanced sensors, IoT connectivity, and machine learning, offering new pathways for enhanced precision, material tracking, and remote diagnostics. The development of specialized automatic guns for niche markets, such as additive manufacturing post-processing or advanced composite coatings in aerospace, also presents lucrative avenues. The combined impact forces suggest a market trajectory tilted toward strong, sustained growth, driven by technological necessity and amplified by the global mandate for efficiency and sustainability, overriding the short-term resistance posed by high initial costs.

Segmentation Analysis

The Automatic Spray Guns Market is comprehensively segmented based on technology, the type of coating material handled, the specific component of the system, and the primary end-user industry. Analyzing these segments provides strategic insights into areas of rapid growth and specific technological preferences across the industrial landscape. The segmentation based on technology, specifically differentiating between electrostatic, HVLP, and airless systems, reveals the critical role of material transfer efficiency in modern purchasing decisions, with electrostatic methods dominating high-volume, quality-critical applications due to superior material utilization rates. Segmentation by end-user highlights the disproportionate influence of the automotive sector, which sets the benchmark for technological adoption and throughput requirements, alongside steady growth in the general industrial segment fueled by diverse coating needs across various fabrication processes. Understanding this matrix allows vendors to tailor product portfolios and marketing strategies effectively.

Segmentation by coating type, distinguishing between liquid coating applications (paints, lacquers) and powder coating applications, illustrates the divergence in equipment requirements and complexity. Powder coating systems demand specialized equipment for charging and recovery, representing a distinct market segment characterized by high capital investment and stringent environmental benefits. Conversely, liquid coating systems focus heavily on precise atomization and rapid color change capabilities, catering to complex product lines like consumer electronics or specialized vehicles. The component segmentation, focusing on fluid delivery systems, nozzles/tips, and controllers, allows for an analysis of aftermarket revenue streams and the technological evolution of consumables, which must withstand increasing pressures and abrasive materials inherent in industrial coatings.

- By Technology:

- Electrostatic Automatic Spray Guns

- High Volume Low Pressure (HVLP) Automatic Spray Guns

- Air-Assisted Automatic Spray Guns

- Airless Automatic Spray Guns

- By Coating Type:

- Liquid Coating (Solvent-borne, Water-borne)

- Powder Coating

- By Component:

- Gun Body and Air Cap

- Nozzles and Fluid Tips

- Fluid Delivery Systems (Pumps, Regulators)

- Control Systems and Robotics Integration

- By End-use Industry:

- Automotive (OEMs and Tier Suppliers)

- General Industrial (Machinery, Fabrication)

- Aerospace and Defense

- Heavy Machinery and Construction Equipment

- Wood Finishing and Furniture

- Consumer Goods and Appliances

Value Chain Analysis For Automatic Spray Guns Market

The value chain for the Automatic Spray Guns Market begins with upstream activities centered around the procurement of specialized raw materials and complex electronic components. This phase involves sourcing high-grade alloys (stainless steel, aluminum) for the gun bodies and fluid sections, which must resist corrosive and abrasive coating materials, alongside precision electronic components for controllers, sensors, and power supplies necessary for electrostatic charging. Key upstream suppliers include specialty metal manufacturers, polymer/plastic component suppliers for handles and non-contact parts, and advanced sensor manufacturers. Efficiency at this stage is crucial, as the quality and durability of the finished spray gun heavily rely on the resilience of these primary materials, influencing the overall longevity and performance guarantees offered by manufacturers.

Midstream activities involve the core manufacturing and assembly processes. This encompasses precision machining of fluid passages and air caps to ensure optimal atomization quality, the integration of complex electrical components for charging mechanisms, and rigorous quality testing. Manufacturers often invest heavily in clean-room assembly environments and advanced calibration equipment to guarantee the consistency of spray patterns and transfer efficiency across every unit. Distribution channels then move the finished products from manufacturers to end-users. Direct distribution channels are highly favored for complex, integrated robotic systems, where manufacturers provide installation, calibration, and ongoing service contracts directly to large Automotive OEMs or Tier 1 suppliers. This direct relationship ensures seamless integration and continuous performance optimization.

Indirect distribution involves specialized industrial equipment distributors and integrators who cater primarily to smaller industrial fabricators, providing easier access to standalone or less complex systems like manual HVLP guns or retrofit kits. Downstream analysis focuses on the end-user adoption and integration of these spray guns into their production environments. This often requires significant expenditure on ancillary equipment such as ventilation systems, curing ovens, and filtration units, creating a symbiotic relationship with other capital equipment providers. Furthermore, the downstream includes the substantial aftermarket segment, covering consumables (nozzles, tips, filters) and maintenance services, which represent a crucial and consistent revenue stream for both manufacturers and specialized service providers, ensuring the long-term operational viability of the installed base.

Automatic Spray Guns Market Potential Customers

Potential customers for automatic spray guns represent organizations requiring high-precision, high-throughput surface finishing capabilities where coating consistency and material efficiency are non-negotiable operational requirements. The primary and most demanding segment includes Automotive Original Equipment Manufacturers (OEMs), who utilize these guns across vast paint shops for applying electrophoretic deposition (e-coat), primers, basecoats, and clear coats on vehicle bodies and component parts. These buyers require fully integrated, robot-mounted systems capable of rapid color change and high transfer efficiency, often entering into long-term strategic partnerships with spray gun manufacturers that include dedicated service and parts agreements. The sheer volume and quality standards of the automotive industry make this group the most critical driver of technological innovation and market demand.

The second major group comprises Tier 1 and Tier 2 Automotive Suppliers, focused on coating specific interior components, wheels, plastic parts, and engine components. While their scale may be smaller than the OEMs, their need for consistency to meet OEM specifications is equally stringent. This customer base often seeks versatile systems that can handle a variety of substrates and coating materials, ranging from specialized high-heat ceramic coatings to decorative finishes. Outside of the automotive sector, General Industrial fabricators represent a substantial and highly fragmented customer base, encompassing manufacturers of white goods (appliances), industrial machinery, electrical enclosures, and metal furniture. These customers prioritize robustness, ease of integration into existing lines, and systems capable of handling heavy-duty, often abrasive, industrial coatings and protective layers.

Further specialized buyers include aerospace and defense contractors, who require systems certified for applying specialized functional coatings, such as anti-corrosion, stealth, or high-temperature barriers, where failure tolerances are extremely low and documentation is critical. Similarly, manufacturers in the electronics sector utilize micro-automatic spray guns for applying precise conformal coatings onto circuit boards and sensitive components for protection against moisture and dust. These diverse end-users share the core need for automation to combat rising labor costs and achieve consistent quality, reinforcing the broad applicability and continued growth potential across the industrialized global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Graco Inc., Nordson Corporation, Sames Kremlin, Anest Iwata Corporation, Carlisle Fluid Technologies, SATA GmbH & Co. KG, Wagner Group, EXEL Industries (SAMES KREMLIN), Larius S.p.A., Gema Switzerland GmbH (Graco Inc.), PNR Italia, 3M Company, Fuji Spray, C.A. Technologies, Spraying Systems Co., ECCO Finish Solutions, Ransburg Industrial Coating Equipment, Taiho Kogyo Co., Ltd., Binks Manufacturing Company, AccuSpray. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Spray Guns Market Key Technology Landscape

The technological landscape of the automatic spray guns market is rapidly evolving, driven primarily by the pursuit of ultra-high transfer efficiency and seamless integration into fully automated production environments. Electrostatic charging technology remains a foundational technology, particularly for conductive substrates and powder coating applications, where the charged particles are magnetically attracted to the grounded workpiece, minimizing overspray and maximizing material utilization. Innovations within this segment focus on developing intelligent power supplies that can dynamically adjust voltage and current based on the distance to the part and the material's resistivity, ensuring consistent coating quality regardless of minor variations in the process. Furthermore, the development of lightweight and durable materials for gun construction is essential, particularly for robot-mounted systems where reduced mass enhances the robotic arm's agility and cycle time.

A critical shift involves the integration of advanced sensing and control systems, aligning the technology with Industry 4.0 standards. Modern automatic spray guns are equipped with integrated flow meters, pressure transducers, and temperature sensors that feed real-time data into a central PLC or manufacturing execution system (MES). This IoT connectivity facilitates real-time performance monitoring, remote diagnostics, and the crucial capability for closed-loop control, allowing the system to automatically compensate for viscosity changes caused by ambient temperature fluctuations, a common cause of coating defects. High-Definition Vision Systems, often powered by AI, are also becoming integral, mapping the part surface geometry precisely and instructing the robot and gun controls to adjust the spray trajectory and atomization pattern millisecond by millisecond, ensuring comprehensive coverage of complex recessed areas.

In terms of atomization methods, the market sees continued differentiation between High Volume Low Pressure (HVLP) and Airless technologies. HVLP remains essential where environmental regulations demand lower air pressure and superior transfer efficiency for liquid coatings, focusing on precision and reduced turbulence. Conversely, Airless systems are favored for high-build coatings and viscous materials, prioritizing speed and high delivery rates, often seen in protective coatings for heavy machinery or infrastructure. The latest advancements in fluid tip and air cap design, often achieved through advanced computational fluid dynamics (CFD) modeling, aim to strike an optimal balance between atomization finesse (critical for gloss and smooth finish) and efficiency, pushing the boundaries of material savings and defect reduction in both liquid and powder coating applications.

Regional Highlights

The regional market dynamics for automatic spray guns are heavily influenced by the concentration of manufacturing industries, the maturity of automation infrastructure, and the stringency of environmental mandates across different geographical areas. North America and Europe currently represent mature markets characterized by a high adoption rate of sophisticated, high-efficiency electrostatic systems and a strong focus on retrofitting existing facilities with smart, IoT-enabled spray solutions. In these regions, the emphasis is heavily placed on maximizing material transfer efficiency (MTE) to comply with rigorous EPA and EU REACH regulations concerning VOC reduction. Growth here is primarily driven by the replacement cycle, demand for specialized aerospace and defense coatings, and the transition toward automated electric vehicle (EV) manufacturing lines that require unique battery pack coatings.

Asia Pacific (APAC) is positioned as the fastest-growing market globally, primarily due to the rapid expansion of the manufacturing sectors in China, India, and Southeast Asia. The region is witnessing a massive influx of foreign direct investment in automotive manufacturing, consumer electronics, and appliance production, leading to the establishment of numerous greenfield production facilities that mandate the installation of modern, fully automated spray gun systems from the outset. While initial cost remains a consideration, the necessity of meeting global export quality standards drives the adoption of advanced robotic spraying solutions. Government initiatives supporting industrial automation and the local production of complex machinery further stimulate this explosive market expansion across the major industrial hubs within APAC.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets with high potential, although currently characterized by lower market penetration compared to developed regions. Growth in LATAM is closely tied to automotive assembly operations and the local production of heavy equipment, showing a gradual shift from manual processes to semi-automatic and fully automatic systems to improve output quality. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is investing heavily in diversification away from oil, fueling growth in construction, infrastructure, and domestic manufacturing, which requires professional surface finishing equipment. However, market growth in these regions is subject to greater variability based on commodity price fluctuations and local economic stability, typically prioritizing robust and reliable systems over the absolute latest high-end technological innovations, though high-transfer efficiency remains a long-term goal for sustainability reasons.

- Asia Pacific (APAC): Highest growth trajectory, driven by massive expansion in automotive and general industrial sectors in China and India; focus on new automated line installations.

- North America: Mature market characterized by high technology penetration, stringent environmental compliance (HVLP/Electrostatic focus), and investment in aerospace coatings and EV production.

- Europe: Strong emphasis on sustainable manufacturing, robotics integration, and high-precision systems; driven by high labor costs and adherence to demanding EU safety and environmental directives.

- Latin America (LATAM): Gradual adoption of automation, largely influenced by the presence of global automotive OEMs and heavy equipment manufacturing; cost sensitivity dictates adoption pace.

- Middle East & Africa (MEA): Emerging market growth tied to infrastructure development and industrial diversification; demand for protective and robust coating applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Spray Guns Market.- Graco Inc.

- Nordson Corporation

- Sames Kremlin

- Anest Iwata Corporation

- Carlisle Fluid Technologies

- SATA GmbH & Co. KG

- Wagner Group (J. Wagner GmbH)

- EXEL Industries (SAMES KREMLIN)

- Larius S.p.A.

- Gema Switzerland GmbH (A part of Graco Inc.)

- PNR Italia

- 3M Company

- Fuji Spray

- C.A. Technologies

- Spraying Systems Co.

- ECCO Finish Solutions

- Ransburg Industrial Coating Equipment

- Taiho Kogyo Co., Ltd.

- Binks Manufacturing Company

- AccuSpray

Frequently Asked Questions

Analyze common user questions about the Automatic Spray Guns market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current adoption of automatic spray guns in the automotive industry?

The primary driver is the necessity for consistent, high-quality surface finishes at high production volumes, coupled with stringent environmental regulations requiring high material transfer efficiency (MTE) to minimize VOC emissions and material waste, which is best achieved through automated electrostatic and robotic systems.

How does AI technology specifically enhance the performance of automatic spray gun systems?

AI enhances performance through predictive maintenance by analyzing sensor data to prevent failures and through closed-loop control systems that use machine vision and algorithms to automatically adjust parameters (flow, pressure, pattern) in real-time, ensuring optimal coating thickness and zero defects.

Which geographical region exhibits the fastest growth potential for automatic spray guns?

The Asia Pacific (APAC) region, driven by rapid industrialization, massive investments in automotive manufacturing (especially electric vehicles), and increasing adoption of automation technology in countries like China, India, and South Korea, is projected to experience the fastest market expansion.

What are the main technological differences between HVLP and Electrostatic automatic spray guns?

HVLP (High Volume Low Pressure) guns focus on reducing overspray and maximizing transfer efficiency by using lower air pressure. Electrostatic guns, conversely, apply an electrical charge to the paint particles, magnetically attracting them to the grounded workpiece, achieving superior wrap-around effect and material utilization, making them ideal for conductive materials.

What is the most significant restraint challenging the growth of the automatic spray guns market?

The most significant restraint is the high initial capital investment required for implementing fully automated, robotic spray systems and the associated infrastructure upgrades, making the technology less accessible for smaller manufacturing operations despite the long-term operational savings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager