Automatic Weeding Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432829 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automatic Weeding Robot Market Size

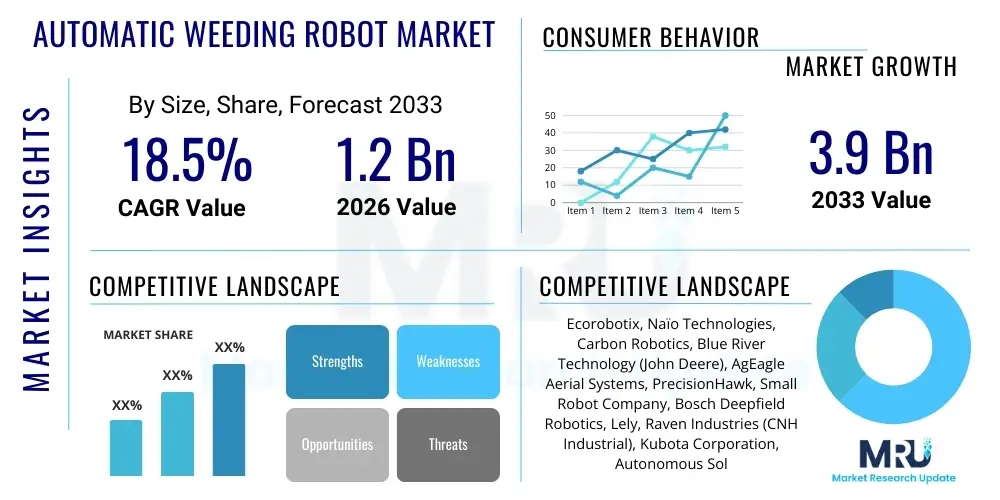

The Automatic Weeding Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.9 Billion by the end of the forecast period in 2033.

Automatic Weeding Robot Market introduction

The Automatic Weeding Robot Market encompasses specialized autonomous machinery designed to identify, target, and eliminate unwanted vegetation (weeds) in agricultural fields, minimizing the need for manual labor and chemical herbicides. These systems utilize advanced navigation technologies, high-resolution cameras, computer vision, and Artificial Intelligence (AI) to differentiate crops from weeds with high precision. The core product is typically a self-propelled unit or a tractor-attached implement capable of non-chemical weed removal, employing methods such as mechanical removal (tillage, cutting), thermal treatment, or micro-dosing of targeted herbicides, greatly enhancing farm sustainability and operational efficiency. The integration of GPS, RTK (Real-Time Kinematic) positioning, and machine learning ensures accurate operation across diverse field conditions and crop types, making these robots indispensable tools in modern precision agriculture.

Major applications of automatic weeding robots span across large-scale commercial farming, specialty crop cultivation (e.g., vineyards, vegetables), and organic farming, where chemical constraints are stringent. They are particularly valuable in row crops like corn, soy, and sugar beets, where early weed competition significantly impacts yield. The primary benefits driving adoption include substantial reduction in herbicide costs and environmental runoff, alleviation of labor shortages in farming sectors, and improved crop health due to less mechanical damage and chemical stress. Furthermore, these robots enable true site-specific weed management, moving beyond blanket applications to treat weeds only where they occur, optimizing resource use and complying with increasingly stringent global environmental regulations.

Key driving factors propelling market growth include the rising global demand for food security coupled with decreasing arable land and a persistent scarcity of skilled agricultural labor, particularly in developed economies. Government initiatives supporting agricultural modernization and the adoption of precision farming techniques further accelerate deployment. Additionally, the growing consumer preference for organic and sustainably grown produce necessitates alternatives to conventional chemical weed control, positioning automated solutions as critical enablers for sustainable farming practices. Technological advancements, particularly in sensor fusion, battery endurance, and real-time data processing, are continually enhancing the efficacy and affordability of these robotic systems, expanding their operational feasibility across varied farm sizes and topographical challenges.

Automatic Weeding Robot Market Executive Summary

The Automatic Weeding Robot Market is characterized by rapid technological iteration and aggressive market entry by specialized AgTech startups, driving competition alongside established agricultural machinery manufacturers. Key business trends indicate a shift towards Robotics-as-a-Service (RaaS) models, lowering the initial capital expenditure barrier for farmers and facilitating faster adoption of expensive, high-precision equipment. Furthermore, strategic partnerships between robot manufacturers and input suppliers (e.g., seed and chemical companies) are emerging to develop integrated solutions optimized for specific cropping systems. The underlying focus across the business landscape remains on enhancing operational autonomy, improving machine learning algorithms for weed identification accuracy, and increasing robot working speed and battery life to maximize field efficiency and coverage.

Regionally, North America and Europe currently dominate the market, driven by high labor costs, robust R&D infrastructure, and proactive government policies promoting sustainable agriculture and smart farming subsidies. Europe, in particular, showcases strong adoption due to rigorous environmental directives limiting herbicide use, creating a favorable regulatory environment for automated, non-chemical solutions. Asia Pacific is emerging as the fastest-growing region, fueled by massive agricultural sectors in countries like China and India, increasing mechanization rates, and rising investments in large-scale commercial farms seeking efficiency gains. Latin America is also showing promise, particularly in commodity crop production, though adoption is currently more concentrated in large agribusiness operations.

Segmentation trends highlight the dominance of mechanical weeding robots (physical removal) due to their non-chemical nature, resonating strongly with organic farming mandates and environmental concerns. However, the targeted spraying segment is projected to grow rapidly, benefiting from advancements in micro-dosing technology that significantly reduce overall chemical use compared to traditional broadcast spraying. In terms of end-user application, row crops and specialty crops remain the major revenue generators, although field vegetables are expected to see the highest proportional growth as robotics becomes essential for managing high-value, high-intensity cultivation methods. The shift is generally towards smaller, lighter, and more swarm-capable robots, moving away from heavy, tractor-scale machinery to minimize soil compaction and maximize application precision.

AI Impact Analysis on Automatic Weeding Robot Market

User inquiries regarding the impact of Artificial Intelligence on the Automatic Weeding Robot Market center primarily on the accuracy and reliability of weed identification, the robot’s decision-making capabilities in complex field scenarios, and the potential for AI to optimize entire farming workflows beyond mere weeding. Users frequently ask about the role of deep learning in classifying novel weed species, the feasibility of real-time adaptation to changing crop growth stages or environmental conditions (e.g., lighting, dust), and how AI integration affects the total cost of ownership (TCO) compared to conventional methods. There is significant expectation that AI will transition these machines from simple automated tools to sophisticated, intelligent agricultural assistants capable of predictive maintenance and holistic crop management, thereby drastically improving yield outputs and reducing operational risks associated with misidentification or damage to cash crops.

The core theme is the perceived shift in value proposition: robots are no longer just tools for mechanical tasks, but platforms for gathering and acting upon high-fidelity, plant-level data. AI, specifically machine vision utilizing convolutional neural networks (CNNs), provides the crucial intelligence layer enabling centimeter-level precision. This precision allows robots to execute targeted removal strategies (mechanical or chemical) that were previously impossible, solving the "last-mile" problem in selective weeding. The continuous collection of field data by these AI-powered systems creates a valuable feedback loop, continually refining the identification models and enhancing the robot's performance over successive farming seasons, accelerating the return on investment for farmers.

- AI facilitates high-precision, real-time differentiation between crops, weeds, and soil irregularities, leading to minimal crop damage.

- Deep learning algorithms enable rapid adaptation to regional weed variations and different crop morphologies throughout the growing cycle.

- Predictive analytics powered by AI optimize robot path planning, battery consumption, and task sequencing for maximum field coverage efficiency.

- AI enhances sensor fusion (combining visual, multispectral, and LiDAR data) to maintain operational accuracy under adverse weather or lighting conditions.

- It allows for targeted micro-dosing of herbicides, drastically reducing chemical use and promoting environmental sustainability.

- AI integration is driving the shift towards autonomous decision-making, allowing robots to identify and prioritize treatment areas without constant human oversight.

DRO & Impact Forces Of Automatic Weeding Robot Market

The Automatic Weeding Robot Market is influenced by a dynamic interplay of factors encompassing technological advancements, economic pressures, regulatory shifts, and environmental necessity. The primary drivers include rising global labor costs in agriculture and persistent skilled worker shortages, which make automation an economic imperative. Coupled with this is the escalating public and regulatory scrutiny on excessive herbicide use, particularly in the EU and North America, necessitating non-chemical alternatives. Opportunities stem from the rapid maturation of AI and sensor technology, which are continually improving robot precision and reliability, alongside the expanding addressable market in specialty and high-value crops where precision weeding offers significant economic returns. However, growth is restrained by the high initial capital investment required for these sophisticated machines, limited operational proficiency in handling diverse, undulating terrains, and the existing necessity for robust network connectivity (RTK signal coverage) to ensure navigation accuracy, posing adoption barriers for smaller farms.

The impact forces are substantial and reshaping conventional agricultural practices. The shift towards precision agriculture, driven by Big Data and IoT integration, places weeding robots at the center of smart farm ecosystems. These robots are key components in the sustainable intensification of agriculture, offering a path to higher yields with lower ecological impact. The regulatory environment acts as a strong external force, pushing innovation towards zero-herbicide solutions. Competitive forces are driving down the long-term operational costs of robotics through RaaS models and economies of scale, making sophisticated technology accessible to a wider farmer base. Overall, the dominant impact force is the necessity to harmonize food security goals with strict environmental mandates, positioning automatic weeding robots as essential tools for future farming viability.

Specific market pressures include competition from alternative technologies such as specialized genetic engineering (e.g., herbicide-tolerant crops) and the ongoing challenge of achieving interoperability standards between different robotic platforms and farm management software systems. While high upfront costs remain a constraint, the total cost of ownership (TCO) calculation increasingly favors automation when factoring in labor savings, reduced chemical inputs, and minimized yield loss from poorly executed conventional weeding. Furthermore, the inherent risk associated with introducing highly complex machinery into harsh, unpredictable outdoor environments (e.g., maintenance, downtime) necessitates continuous improvements in hardware durability and diagnostic software, representing a crucial area of focus for manufacturers to maintain market momentum.

Segmentation Analysis

The Automatic Weeding Robot Market is segmented primarily based on the Type of Robot Technology used (targeting mechanism), the operational Platform type (form factor), the Application or Crop type, and the geographic Region. Understanding these segments is crucial for strategic market positioning, as each segment caters to distinct pain points and regulatory landscapes within the global agricultural sector. The segmentation reflects the diverse needs of modern farming, ranging from large-scale commodity producers requiring high-throughput systems to organic specialty growers prioritizing non-chemical removal methods. This granularity allows manufacturers to tailor solutions concerning precision, speed, and cost-effectiveness, maximizing product-market fit across varied agricultural environments and economic contexts. The dominance of specific segments, such as mechanical weeding, underscores prevailing environmental trends, while the rapid emergence of autonomous platforms highlights technological advancements.

The segmentation by Type reveals a critical strategic choice for farmers between physical removal (mechanical) and resource-intensive application (chemical or thermal). Mechanical weeding, involving micro-tillage or physical cutting, offers a sustainable, chemical-free solution popular in regulated and organic markets, but can be slower and riskier in high-density crops. Conversely, targeted spraying robots offer superior speed and efficiency over broad-acre spraying, significantly cutting chemical volume while maintaining efficacy, which appeals to conventional growers facing regulatory caps on chemical use. Platform segmentation differentiates between autonomous mobile robots (AMRs), which are entirely self-contained, and implement-based systems attached to existing tractors, providing flexibility based on existing farm machinery ownership and infrastructure. The future trajectory suggests a convergence, with specialized, lightweight AMRs dominating high-precision tasks, while tractor-mounted units handle preliminary, broad-stroke weed management.

- By Type:

- Mechanical Weeding Robots

- Targeted Spraying Robots

- Thermal Weeding Robots

- By Platform:

- Fully Autonomous Mobile Robots (AMRs)

- Tractor-Mounted/Implement Robots

- By Application/Crop Type:

- Row Crops (Corn, Soybean, Wheat)

- Specialty Crops (Vegetables, Fruits, Nuts)

- Orchards and Vineyards

- By End-User:

- Commercial Farms

- Research Institutes

- Horticulture and Greenhouse Operations

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Automatic Weeding Robot Market

The value chain for the Automatic Weeding Robot Market starts with upstream suppliers providing critical components, notably high-precision sensors (LiDAR, RGB cameras, multispectral), advanced microprocessors (for AI processing), high-capacity batteries, and complex kinematic systems. This phase is dominated by global technology firms specializing in robotics, electronics, and software development. Upstream analysis focuses on securing reliable, cutting-edge AI chips and precision guidance systems (RTK-GPS) which determine the final machine accuracy and reliability. Strategic alliances with specialized component providers are essential to maintain technological leadership, ensuring access to robust and durable components capable of enduring harsh agricultural environments.

The core midstream involves the robot manufacturers, who undertake integration, platform development, and sophisticated software engineering. This stage encompasses the proprietary development of AI algorithms for weed-crop differentiation, field mapping software, and the final assembly of the robotic units. Distribution channels are varied, including direct sales for large agricultural enterprises, strategic partnerships with established agricultural machinery dealers (who offer extensive service networks), and increasingly, specialized AgTech distributors focused solely on automation and smart farming solutions. The choice of channel often dictates the service level and market penetration speed; traditional dealers provide reach and familiarity, while direct channels allow for closer customer relationship management and feedback loops crucial for iterative product improvement.

Downstream analysis focuses on the end-users—commercial farms, specialty growers, and large cooperatives—who utilize the robots. Key downstream activities involve training, maintenance, data services, and ongoing software updates. The shift towards RaaS models indicates that the value proposition is increasingly moving towards data generated and actionable insights provided by the robot, rather than just the hardware itself. Direct and indirect distribution channels coexist; direct channels are favored for RaaS contracts and customized solutions requiring extensive post-sale support, whereas indirect channels (dealerships) handle standard sales and localized technical support, ensuring broader geographic market access and service availability essential for minimizing costly field downtime.

Automatic Weeding Robot Market Potential Customers

Potential customers for automatic weeding robots are predominantly large-scale commercial agricultural operations and cooperatives specializing in high-density, row crops such as corn, soybeans, sugar beets, and various vegetables. These entities are characterized by significant acreage, high operational costs associated with labor and herbicides, and a critical dependence on minimizing yield loss from early weed competition. Their primary purchase motivations revolve around achieving substantial return on investment (ROI) through labor replacement, chemical savings, and enhanced yield quality stemming from reduced chemical usage and more precise field management. They require robust, high-throughput robots capable of continuous operation across thousands of acres, integrated seamlessly with existing farm management information systems (FMIS).

A rapidly growing segment of potential buyers includes specialty crop growers—particularly vineyards, orchards, and high-value vegetable farms—where manual weeding is disproportionately costly and chemical constraints are severe, especially in organic or certified sustainable production systems. For these customers, the emphasis shifts from sheer speed to unparalleled precision and minimal soil disturbance. They often prefer smaller, articulated robots designed for inter-row operation and delicate crop handling. Furthermore, the rising demand for organic produce globally is creating a significant customer base prioritizing non-chemical, mechanical and thermal weeding solutions, where automation provides the only viable, scalable alternative to manual labor.

Institutional buyers, including agricultural research facilities and governmental extension services, represent another critical, though smaller, customer base. These organizations utilize weeding robots for experimental purposes, testing new varieties, assessing the efficacy of different weed control strategies, and developing localized robotic protocols. Their requirements often focus on data acquisition capabilities, flexibility in operational parameters, and high fidelity in sensor output, driving demand for the most technologically advanced and adaptable platforms available in the market. The adoption patterns confirm that economic scale and environmental necessity are the two primary determinants of customer acquisition globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ecorobotix, Naïo Technologies, Carbon Robotics, Blue River Technology (John Deere), AgEagle Aerial Systems, PrecisionHawk, Small Robot Company, Bosch Deepfield Robotics, Lely, Raven Industries (CNH Industrial), Kubota Corporation, Autonomous Solutions Inc., Harvest Automation, Robotics Plus, Vision Robotics, FarmWise Labs, Steketee (Lemken), Rowbot Systems, Horsch, Tillet & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Weeding Robot Market Key Technology Landscape

The technology landscape for automatic weeding robots is defined by the convergence of agricultural engineering, computer science, and high-precision sensor technology. Core to their operation is the Real-Time Kinematic (RTK) GPS system, which provides centimeter-level positioning accuracy, essential for navigation in fields and precise targeting of individual weeds without harming adjacent crops. This guidance system ensures reliable path planning and repeatability across large areas. The second critical pillar is advanced computer vision and machine learning (ML), utilizing high-resolution RGB and multispectral cameras combined with deep convolutional neural networks (CNNs). These ML models are trained on extensive datasets to accurately distinguish between various crop stages, weed species, and environmental debris, forming the basis for the robot's decision-making process regarding removal action.

Further technological differentiation lies in the implementation of the weed removal mechanisms themselves. Mechanical robots employ highly refined, often proprietary, tools such as micro-tine cultivators, precision knives, or laser ablation systems (as used by some startups) that physically destroy the weed. Targeted spraying robots rely on micro-dosing technologies, often incorporating pulse-width modulation (PWM) nozzles, which allow for the application of minute, highly concentrated doses of herbicide only onto the identified weed, drastically improving efficacy while minimizing overall chemical footprint. The hardware must be ruggedized and modular, incorporating robust suspension systems and advanced power management, typically using high-density lithium-ion batteries, to handle continuous operation in diverse and challenging outdoor environments typical of farming operations.

The future technology trajectory is moving towards enhanced autonomy through sensor fusion—combining data from cameras, LiDAR, and ultrasonic sensors to create a comprehensive 3D map of the operating environment, improving safety and navigation robustness. Edge computing is increasingly vital, allowing the robot to process complex AI algorithms locally in real time, reducing latency and dependence on constant cloud connectivity. Furthermore, the development of swarm robotics—deploying multiple smaller, lighter, and coordinated units—is gaining traction. This approach enhances scalability, reduces the impact of individual machine failure, and minimizes soil compaction, requiring sophisticated inter-robot communication and centralized task allocation algorithms, pushing the limits of current agricultural robotics capabilities.

Regional Highlights

- North America: This region is a primary leader in the automatic weeding robot market, characterized by large farm sizes, high labor costs, and a significant early adopter culture for precision agriculture technologies. The market is primarily driven by the need to maximize efficiency in commodity crops (corn, soy) and increasing investments from major agricultural machinery conglomerates (e.g., John Deere/Blue River Technology). Government subsidies and private VC funding in AgTech startups are robust, accelerating the deployment of autonomous solutions across the Midwest and California’s specialty crop regions.

- Europe: Europe represents a crucial market segment, strongly influenced by the stringent regulatory framework, particularly the European Green Deal and Farm to Fork Strategy, which mandates drastic reductions in chemical pesticide use. This regulatory pressure heavily favors mechanical and non-chemical targeted weeding solutions. Countries like Germany, France, and the Netherlands show high rates of adoption, fueled by targeted subsidies for sustainable farming practices and the necessity to maintain competitiveness in high-value vegetable and specialty crop production.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market. Although currently facing challenges related to smaller average farm sizes and fragmented land holdings in certain areas, rapid mechanization and government support for high-tech farming in large economies like China, Japan, and Australia are driving demand. The need for increased output to feed a massive population, coupled with growing environmental concerns, ensures significant future investment in automated solutions, particularly for rice and vegetable cultivation.

- Latin America (LATAM): The LATAM market, while nascent, is focusing primarily on large-scale commodity production in Brazil and Argentina. Adoption is currently centralized in large agribusinesses that can absorb the high upfront investment and utilize the technology across vast monoculture operations. The driver here is scale efficiency and reducing reliance on migratory labor, with targeted spraying robots often favored for extensive field operations requiring high-speed coverage.

- Middle East and Africa (MEA): This region presents a market with unique challenges related to water scarcity and difficult terrain. Adoption is sporadic, concentrated mainly in high-value, protected environment agriculture (greenhouses) in the Middle East and large, corporate-managed farms in South Africa. The focus is on maximizing yield efficiency under resource-constrained conditions, making precision weeding technology highly valuable for optimizing every input.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Weeding Robot Market.- John Deere (Blue River Technology)

- Ecorobotix

- Naïo Technologies

- Carbon Robotics

- CNH Industrial (Raven Industries)

- Kubota Corporation

- Small Robot Company

- FarmWise Labs

- Bosch Deepfield Robotics

- Lely

- Autonomous Solutions Inc.

- Harvest Automation

- PrecisionHawk

- AgEagle Aerial Systems

- Robotics Plus

- Vision Robotics

- Steketee (Lemken)

- Horsch

- Rowbot Systems

- Tillet & Co.

Frequently Asked Questions

Analyze common user questions about the Automatic Weeding Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary economic benefit of adopting automatic weeding robots?

The primary economic benefit is the significant reduction in operational expenditure derived from minimizing costly manual labor and substantially decreasing the volume of chemical herbicides required, leading to a rapid return on investment (ROI).

How does AI ensure the robot differentiates between a crop and a weed?

AI utilizes sophisticated deep learning models (Convolutional Neural Networks) trained on vast image datasets to analyze plant morphology, color, and texture in real-time via high-resolution cameras, enabling highly accurate, centimeter-level classification and targeted action.

Are automatic weeding robots suitable for small farms or only large commercial operations?

While historically favored by large farms, the introduction of Robotics-as-a-Service (RaaS) models and the development of smaller, more cost-effective robots are making the technology increasingly accessible and economically viable for specialty crop growers and small-to-medium-sized agricultural businesses.

What are the key technological challenges currently restraining market growth?

Major constraints include the high initial capital investment, the current reliance on consistent, high-accuracy RTK-GPS signaling (network connectivity) for navigation precision, and the need for robust AI models that perform reliably across highly diverse weed species and challenging terrains.

Which type of weeding robot technology is favored in highly regulated European markets?

In highly regulated markets like Europe, mechanical weeding robots are heavily favored due to stringent environmental policies restricting chemical herbicide use, offering a sustainable, non-chemical method of effective weed control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager