Automobile Flasher Controller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436652 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automobile Flasher Controller Market Size

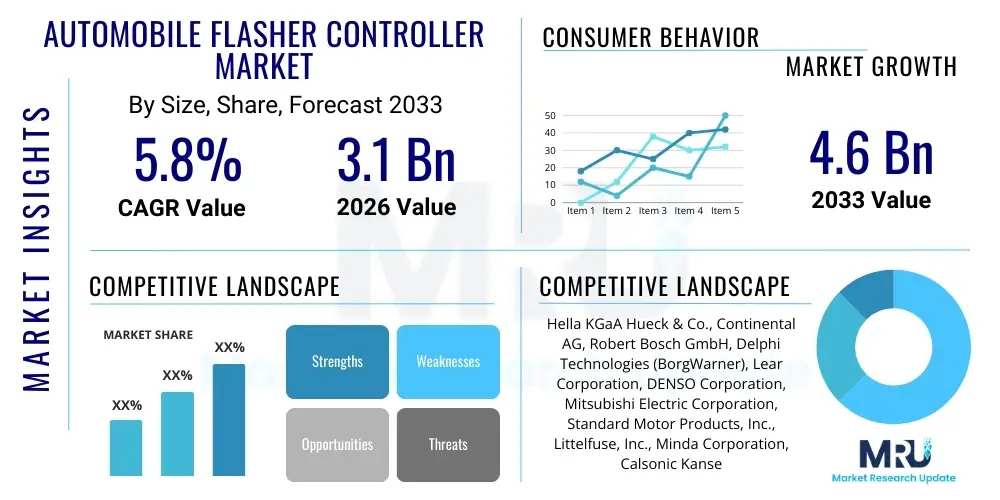

The Automobile Flasher Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.6 Billion by the end of the forecast period in 2033.

Automobile Flasher Controller Market introduction

The Automobile Flasher Controller Market encompasses devices integral to vehicular safety and communication, primarily responsible for regulating the timing and duration of turn signals and hazard lights. These controllers, often integrated into the vehicle's electrical control units (ECUs), manage the intermittent flashing sequence required by regulatory standards globally. Historically based on thermal or electro-mechanical relays, modern controllers are overwhelmingly solid-state, utilizing advanced semiconductor technology and embedded software to ensure precise, reliable, and energy-efficient operation. The increasing complexity of lighting systems, including LED technology and dynamic turn signals, necessitates sophisticated controllers capable of handling variable loads and integrating with CAN bus communication systems for synchronized performance across the vehicle platform.

The product's primary applications span passenger vehicles, commercial trucks, buses, and off-highway machinery, serving the critical function of signaling driver intent and warning other road users during emergencies or maneuvers. Key benefits derived from modern flasher controllers include enhanced reliability, reduced electromagnetic interference (EMI), and the ability to diagnose faults within the lighting circuit, contributing significantly to overall vehicle safety ratings. Furthermore, solid-state controllers offer greater flexibility in configuring flash patterns, which is becoming increasingly relevant for aesthetic features and compliance with differing regional lighting regulations, particularly in complex export markets.

The market is predominantly driven by stringent global automotive safety regulations mandating reliable signaling systems, coupled with the continuous growth in global vehicle production and the accelerating trend of vehicle electrification. The integration of advanced driver-assistance systems (ADAS) also impacts this sector, as flasher controllers must interface seamlessly with parking assistance features and collision avoidance systems that sometimes require automatic activation of hazard lights. As vehicles become more reliant on centralized electronic architecture, the role of the flasher controller evolves from a simple timing device to a highly integrated safety module, ensuring sustained market demand and technological innovation.

Automobile Flasher Controller Market Executive Summary

The Automobile Flasher Controller Market is characterized by a stable but innovative trajectory, fueled primarily by mandatory safety standards and the widespread shift towards solid-state electronic components. Key business trends indicate a consolidation among tier-1 suppliers specializing in automotive electronics, focusing on developing controllers compatible with high-power LED arrays and advanced vehicle communication protocols like FlexRay and Ethernet. The demand for controllers featuring built-in diagnostic capabilities (self-monitoring and fault reporting) is paramount, driven by Original Equipment Manufacturers (OEMs) seeking to minimize warranty claims and enhance system longevity. Furthermore, cost optimization in manufacturing through highly automated production lines remains a crucial competitive differentiator among market participants.

Regional trends highlight Asia Pacific (APAC), particularly China and India, as the dominant growth engines, driven by escalating domestic vehicle production volumes, rising disposable incomes, and improving road safety regulations. North America and Europe maintain high demand for advanced, premium controllers that support intricate lighting features, such as sequential signaling and adaptive lighting functions, often linked to higher average selling prices (ASPs). The Middle East and Latin America are showing steady adoption, primarily driven by regulatory compliance associated with imported vehicles and increasing local manufacturing initiatives. Infrastructure development and fleet modernization programs across all regions further stabilize the market outlook.

Segment-wise, the solid-state electronic flasher controller segment holds the largest market share and is expected to exhibit the fastest growth, effectively replacing older thermal and electro-mechanical types due to superior performance characteristics and packaging flexibility. By vehicle type, the passenger vehicle segment commands the largest revenue share, reflecting the sheer volume of personal automobiles produced globally. However, the commercial vehicle segment is poised for significant adoption of high-durability, ruggedized controllers that meet the demanding operational schedules and environmental conditions inherent to commercial transportation and logistics fleets.

AI Impact Analysis on Automobile Flasher Controller Market

Common user questions regarding AI's impact on the Automobile Flasher Controller Market often revolve around whether artificial intelligence will render dedicated controllers obsolete, how ADAS and autonomous driving systems will influence signaling requirements, and the necessity for predictive maintenance in electrical systems. Users are keenly interested in the integration capabilities of AI-driven ECUs that manage multiple vehicle functions, questioning if the flasher control logic will be subsumed into larger, centralized domain controllers. The general expectation is that while dedicated flasher controllers might remain in lower-end models, high-end vehicles will see flasher control become an embedded, dynamic function within AI-enhanced vehicle operating systems, optimizing signaling based on real-time environmental data and predictive algorithms for proactive safety warnings.

The primary influence of AI and machine learning is not in the physical act of flashing but in the decision-making process that triggers the flash sequence. AI algorithms analyze data from external sensors (Lidar, cameras, radar) and internal vehicle telemetry to determine the optimal timing, duration, and even intensity of signaling lights. This shift allows for adaptive signaling—for instance, automatically activating hazard lights under rapid deceleration before the human driver initiates the action, or adjusting the brightness based on ambient light and weather conditions. This move toward 'smart' signaling enhances driver communication and significantly reduces the probability of human error leading to collisions.

Furthermore, AI facilitates advanced diagnostics and predictive failure analysis within the flasher control circuit. By continuously monitoring current draw, voltage stability, and component temperature, AI can detect subtle degradation in the controller or associated wiring harness long before total failure occurs. This capability supports sophisticated fleet management systems and over-the-air (OTA) update functionalities, ensuring the signaling systems remain compliant and fully operational throughout the vehicle’s lifecycle, moving the market toward highly reliable, software-defined control modules.

- Integration of signaling logic into AI-enhanced centralized domain controllers, reducing the need for discrete units.

- Development of adaptive signaling algorithms that optimize flash patterns and intensity based on real-time external data (weather, traffic density).

- Enhanced predictive maintenance capabilities through machine learning to detect and flag potential electrical failures in lighting systems proactively.

- Facilitation of mandatory signaling requirements for Level 3 and Level 4 autonomous vehicles, ensuring clear communication of vehicle state to surrounding traffic.

- Optimization of power consumption in LED-based lighting systems managed by AI-driven controllers, maximizing energy efficiency, especially in Electric Vehicles (EVs).

DRO & Impact Forces Of Automobile Flasher Controller Market

The Automobile Flasher Controller Market is shaped by a robust interplay of driving forces, significant restraining factors, and emerging opportunities, all contributing to the overall impact landscape. The chief driver remains the global harmonization and enforcement of stringent automotive safety regulations, such as those governed by the UNECE and NHTSA, which necessitate highly reliable and tested signaling equipment in all new vehicles. Coupled with this is the continuous technological shift from conventional incandescent bulbs to energy-efficient and highly configurable LED lighting systems, requiring precise electronic flasher controllers for effective power management and synchronization. Furthermore, the steady rise in global vehicle production, particularly in emerging economies, provides a persistent baseline demand for these essential safety components.

However, the market growth is constrained primarily by intense price competition, especially within the high-volume passenger vehicle segment, forcing manufacturers to operate with narrow profit margins. The high degree of standardization required by OEMs limits differentiation possibilities for many component suppliers. A significant restraint also comes from the increasing functional integration within vehicle electronic architectures; as controllers are subsumed into larger body control modules (BCMs) or centralized domain controllers, the market for standalone flasher controllers may face structural contraction over the long term, requiring component manufacturers to evolve their product offering towards integrated system solutions.

Opportunities for expansion are predominantly found in the rapidly accelerating adoption of Electric Vehicles (EVs) and hybrid vehicles, which demand highly energy-efficient and lightweight electrical components. The advent of dynamic and sequential LED turn signals presents a niche market for advanced, specialized controllers capable of managing complex, time-sensitive illumination patterns. Furthermore, the development of robust, fail-safe controllers for autonomous driving platforms—where communication of vehicle intent is paramount—opens avenues for premium, high-reliability products that command higher ASPs. The collective impact forces suggest a market moving towards specialized, highly integrated, and software-defined solutions, prioritizing performance and reliability over legacy cost structures.

Segmentation Analysis

The Automobile Flasher Controller Market is segmented based on technology type, vehicle type, and distribution channel, providing a granular view of market dynamics and revenue streams. Understanding these segments is crucial for stakeholders to tailor manufacturing strategies, investment decisions, and geographical expansion plans. The technological bifurcation highlights the shift from traditional mechanisms to modern electronic devices, reflecting broader trends in vehicle electrification and safety enhancement. The dominance of electronic flasher controllers underscores the industry's commitment to reliability, precision timing, and compatibility with modern vehicle networking protocols.

In terms of vehicle application, the market is broadly divided between passenger vehicles (PV) and commercial vehicles (CV). While PVs represent the volume driver, reflecting mass production and consumer demand, the CV segment (including heavy trucks and buses) often necessitates more ruggedized and durable controllers capable of withstanding severe vibration, temperature fluctuations, and extended duty cycles. The unique requirements of each segment influence design parameters, material choices, and the complexity of fault diagnostics incorporated into the controller unit.

The distribution channel segmentation distinguishes between the Original Equipment Manufacturer (OEM) channel, which accounts for the vast majority of new vehicle installations, and the Aftermarket, which serves replacement and repair needs throughout the vehicle lifecycle. Growth in the aftermarket is intrinsically linked to the size of the global vehicle parc and the average age of vehicles in operation, while the OEM channel is directly tied to global automotive production forecasts. Strategic presence in both channels is essential for maximizing market penetration and stabilizing revenue streams across economic cycles.

- By Technology Type

- Thermal Flasher Controllers (Decreasing Market Share)

- Electro-Mechanical Flasher Controllers (Legacy Applications)

- Solid-State Electronic Flasher Controllers (Dominant and Growth Segment)

- By Vehicle Type

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement and Upgrades)

Value Chain Analysis For Automobile Flasher Controller Market

The value chain for the Automobile Flasher Controller Market begins with the Upstream Analysis, focusing on the procurement of essential raw materials and components. This stage involves the sourcing of critical semiconductors (microcontrollers, MOSFETs), printed circuit boards (PCBs), passive components (resistors, capacitors), and housing materials (plastics, metals). Suppliers of these electronic components often operate globally, leveraging economies of scale. Price volatility in semiconductor markets and geopolitical supply chain risks have a direct impact on the manufacturing costs of flasher controllers, necessitating robust supplier management and inventory optimization strategies by Tier 2 and Tier 1 players.

The central manufacturing stage involves component assembly, quality testing, and firmware flashing. Tier 1 automotive suppliers are typically responsible for designing, validating, and mass-producing the final flasher controller unit according to stringent OEM specifications and automotive quality standards (e.g., IATF 16949, AEC-Q100). The manufacturing process is highly specialized, requiring cleanroom environments and advanced automated assembly equipment to ensure the reliability and durability demanded by the automotive environment. Significant investment in research and development is required at this stage to integrate advanced features such as CAN bus compatibility, dynamic load management, and enhanced electromagnetic compatibility (EMC).

Downstream analysis focuses on distribution channels and end-user consumption. Direct distribution involves supplying the finished flasher controllers directly to automotive OEMs for integration into new vehicles during the assembly process. This channel requires established logistics, just-in-time (JIT) delivery, and deep collaborative relationships with vehicle manufacturers. Indirect distribution primarily caters to the Aftermarket, utilizing vast networks of authorized distributors, independent retailers, and repair shops globally. The effectiveness of the aftermarket channel relies heavily on product availability, brand reputation, and competitive pricing, providing replacement parts essential for vehicle maintenance and repair operations throughout the vehicle's operational lifespan.

Automobile Flasher Controller Market Potential Customers

The primary customer base for the Automobile Flasher Controller Market consists overwhelmingly of large Original Equipment Manufacturers (OEMs) and their associated Tier 1 suppliers in the global automotive industry. OEMs such as General Motors, Volkswagen Group, Toyota, Ford, and Hyundai-Kia represent the largest buyers, procuring controllers in massive volumes for integration into their new vehicle production lines. For Tier 1 suppliers like Bosch, Continental, and Hella, who often supply complete body electronics or lighting modules, the flasher controller is a mandatory component, dictating the design specifications and reliability requirements across entire vehicle platforms. Maintaining long-term contracts and adherence to stringent quality metrics are critical to serving these customers effectively.

A secondary, yet highly important, customer segment comprises the aftermarket distribution network, which includes wholesalers, independent repair facilities, authorized service centers, and specialized performance tuning shops. These buyers primarily seek reliable replacement controllers for vehicle maintenance and repair needs stemming from failures or accidents, or upgrades for custom lighting solutions. The aftermarket segment is sensitive to pricing and availability but offers manufacturers a reliable revenue stream independent of new vehicle production cycles, serving the vast global fleet of operational vehicles.

Furthermore, specialized potential customers include manufacturers of niche vehicles, such as electric buses, heavy mining equipment, agricultural machinery, and military vehicles. These industries require controllers that often exceed standard specifications, demanding enhanced ruggedization, specialized voltage tolerance, or unique communication interfaces. Catering to these diverse customers requires a product portfolio that balances high-volume, standardized components for the OEM market with durable, customized solutions for specialized industrial and commercial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella KGaA Hueck & Co., Continental AG, Robert Bosch GmbH, Delphi Technologies (BorgWarner), Lear Corporation, DENSO Corporation, Mitsubishi Electric Corporation, Standard Motor Products, Inc., Littelfuse, Inc., Minda Corporation, Calsonic Kansei (Marelli), Texas Instruments, Infineon Technologies AG, NXP Semiconductors, Allegro MicroSystems, Hitachi Astemo, Inc., Omron Corporation, Tungsram, MTA S.p.A., Flasher Control Systems Pvt Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automobile Flasher Controller Market Key Technology Landscape

The technological landscape of the Automobile Flasher Controller Market is rapidly evolving, driven by the shift from legacy mechanical systems to sophisticated solid-state electronics, which offer superior control, diagnostic capabilities, and energy efficiency. Central to this evolution is the utilization of microcontrollers (MCUs) specifically designed for automotive applications. These MCUs, often supplied by companies like NXP and Infineon, provide the processing power necessary to execute complex timing algorithms, manage variable loads associated with LED arrays, and communicate status and fault information via vehicle networking protocols, particularly the Controller Area Network (CAN) bus. The shift to pulse-width modulation (PWM) techniques allows for precise dimming and sequencing of modern lighting systems, a function impossible with older thermal units.

Another crucial technological development involves robust power management and output stage design. Modern controllers utilize high-side or low-side driver integrated circuits (ICs) and highly efficient MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors) to handle the power switching necessary for lighting loads. These components must be extremely durable, capable of resisting high transient voltages, temperature extremes, and short-circuit conditions, adhering strictly to automotive reliability standards (AEC-Q100). Furthermore, the integration of advanced protection features, such as overcurrent protection, thermal shutdown, and voltage monitoring, is now standard practice, ensuring the longevity and safety of the entire lighting system.

The emerging technological focus is on integration and software-defined functionality. Flasher control logic is increasingly embedded within Body Control Modules (BCMs) or Domain Controllers, reducing the part count and simplifying vehicle wiring harnesses. This centralization requires highly sophisticated software architecture that allows for over-the-air (OTA) updates and dynamic reconfiguration of signaling features based on regulatory changes or customer preference. Future controllers are also being designed for integration into 48V mild-hybrid and full-EV architectures, demanding further optimization for ultra-low quiescent current draw and enhanced electromagnetic compatibility (EMC) to avoid interference with sensitive sensor systems crucial for ADAS functionality.

Regional Highlights

The global Automobile Flasher Controller Market exhibits distinct regional dynamics driven by varying rates of vehicle production, regulatory environments, and technological adoption curves. Asia Pacific (APAC) stands out as the most significant market globally, driven by the massive automotive manufacturing hubs in China, Japan, South Korea, and India. China, in particular, dominates the volume aspect, fueled by both domestic demand and substantial export capabilities. The rapid penetration of Electric Vehicles (EVs) and the increasing focus on road safety modernization across APAC are accelerating the adoption of solid-state electronic flasher controllers, driving high growth rates in this region. This region also sees intense competition, often prioritizing cost efficiency alongside reliability.

Europe and North America represent mature markets characterized by stringent safety and environmental regulations, leading to high demand for premium, technologically advanced flasher controllers. European manufacturers lead the trend in incorporating sophisticated dynamic and sequential signaling systems, demanding controllers capable of complex timing and communication over high-speed networks. The focus in these regions is less on volume growth and more on technological refinement, integration into ADAS, and ensuring controllers comply with rigorous electromagnetic interference (EMI) standards essential for modern vehicle electronics. The ongoing electrification push in both regions further necessitates highly efficient componentry.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but are experiencing steady growth supported by infrastructure investments and improving vehicle safety legislation. In LATAM, market growth is often linked to the revival of regional automotive production and importation of modern vehicle platforms that utilize contemporary electronic systems. MEA demand is primarily driven by fleet modernization, commercial vehicle utilization in resource extraction, and compliance with safety standards for imported vehicles. These regions typically adopt tested, reliable technologies before migrating to the cutting-edge features seen in Europe and North America, offering a robust market for standardized electronic flasher modules.

- Asia Pacific (APAC): Highest volume market due to major manufacturing bases (China, India, Japan); fastest adoption of electronic controllers driven by EV manufacturing expansion.

- Europe: Focus on premium controllers supporting dynamic signaling, highly integrated systems within BCMs, and strict adherence to UNECE regulations and high EMC standards.

- North America: Stable demand driven by replacement cycles and mandatory safety features; emphasis on high-reliability components compatible with high-end truck and SUV segments.

- Latin America (LATAM): Steady growth driven by increasing vehicle parc and tightening regulatory frameworks regarding signaling and safety components.

- Middle East and Africa (MEA): Growth tied to commercial vehicle fleet expansion and regulatory enforcement promoting the use of mandatory safety equipment on new vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automobile Flasher Controller Market.- Hella KGaA Hueck & Co.

- Continental AG

- Robert Bosch GmbH

- Delphi Technologies (BorgWarner)

- Lear Corporation

- DENSO Corporation

- Mitsubishi Electric Corporation

- Standard Motor Products, Inc.

- Littelfuse, Inc.

- Minda Corporation

- Calsonic Kansei (Marelli)

- Texas Instruments

- Infineon Technologies AG

- NXP Semiconductors

- Allegro MicroSystems

- Hitachi Astemo, Inc.

- Omron Corporation

- Tungsram

- MTA S.p.A.

- Flasher Control Systems Pvt Ltd.

Frequently Asked Questions

Analyze common user questions about the Automobile Flasher Controller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional thermal and modern solid-state flasher controllers?

Traditional thermal flasher controllers use a bimetallic strip heated by the current flow to create the flash timing, making them sensitive to load changes and less reliable. Modern solid-state controllers use semiconductor switching elements (like MOSFETs) and microcontrollers for precise, consistent timing regardless of load (essential for LED compatibility) and include advanced diagnostic functions.

How is the shift to LED lighting impacting the design of flasher controllers?

The low current draw and directional nature of LEDs necessitate electronic controllers capable of managing low loads, detecting bulb-out conditions electronically (as opposed to thermal units relying on current), and often incorporating Pulse Width Modulation (PWM) for dynamic or sequential signaling effects, requiring much higher technological complexity.

Are Automobile Flasher Controllers being integrated into larger electronic systems like BCMs?

Yes, there is a strong trend, particularly in premium and high-end vehicles, towards integrating flasher control functionality into centralized Body Control Modules (BCMs) or specialized domain controllers. This reduces overall wiring complexity, improves component communication via the CAN bus, and enables software-defined features and Over-The-Air (OTA) updates.

What role do flasher controllers play in the context of Electric Vehicles (EVs)?

For Electric Vehicles, flasher controllers must be highly energy-efficient, minimizing quiescent current draw to preserve battery range. They must also be optimized for robustness in 48V or high-voltage architectures, ensuring stringent electromagnetic compatibility (EMC) standards are met to prevent interference with sensitive EV electronic systems.

Which geographical region offers the most significant growth opportunity for this market?

The Asia Pacific (APAC) region, driven by countries like China and India, offers the most significant growth opportunity. This is attributed to accelerating vehicle production volumes, rapid electrification of the vehicle fleet, and increasing regulatory enforcement of road safety standards demanding modern electronic signaling systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager