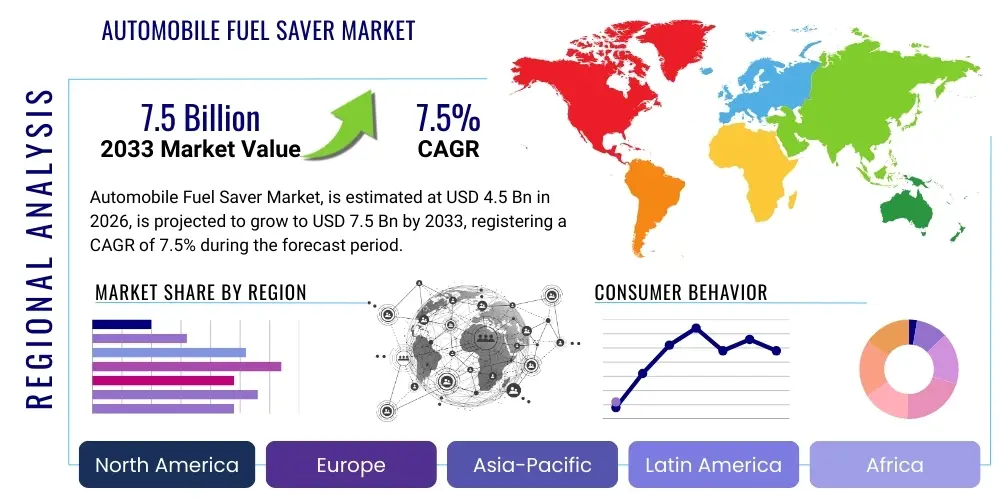

Automobile Fuel Saver Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436775 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Automobile Fuel Saver Market Size

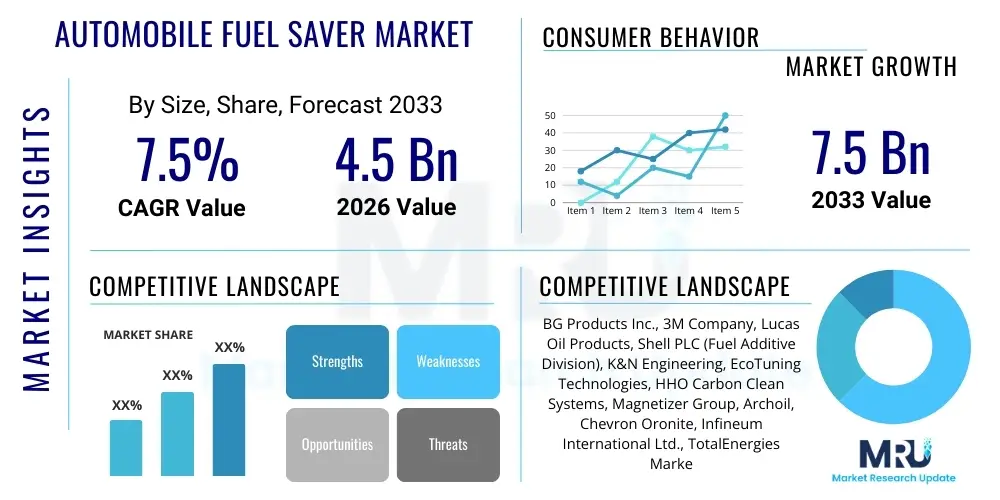

The Automobile Fuel Saver Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at 4.5 Billion USD in 2026 and is projected to reach 7.5 Billion USD by the end of the forecast period in 2033.

Automobile Fuel Saver Market introduction

The Automobile Fuel Saver Market encompasses a diverse array of products and technologies designed to enhance the fuel efficiency of internal combustion engine (ICE) vehicles, thereby reducing operational costs and lowering carbon emissions. These solutions range from mechanical devices, aerodynamic enhancements, and electronic control unit (ECU) optimization software to chemical fuel additives. The core premise driving this market is the persistent need for cost reduction among consumers and commercial fleets, coupled with stringent environmental mandates imposed by global regulatory bodies. As automotive technology transitions towards hybridization and electric powertrains, fuel savers remain highly relevant for the massive existing fleet of gasoline and diesel vehicles worldwide, often positioned as accessible, aftermarket solutions for immediate efficiency gains.

Product categories within this domain include physical devices such as vortex generators, magnetic fuel conditioners, hydrogen-on-demand systems, and advanced air intake modifications. On the chemical front, specialized fuel additives containing detergents, lubricity enhancers, and combustion catalysts are widely utilized to clean engine components and optimize the combustion process, resulting in more complete energy extraction from the fuel. Major applications span across passenger vehicles (sedans, SUVs), light commercial vehicles, and heavy-duty commercial fleets (trucks, buses). Commercial applications are particularly critical, as marginal improvements in fuel economy translate directly into substantial savings for logistics and transportation companies operating large numbers of vehicles over long distances. The integration of sophisticated sensors and telematics further allows for real-time monitoring and validation of these products' effectiveness, bolstering consumer confidence in the aftermarket segment.

The primary benefits driving market adoption are twofold: economic advantage and environmental compliance. Economically, fuel savers mitigate the impact of volatile global petroleum prices by reducing the volume of fuel consumed per mile traveled. Environmentally, they contribute directly to the reduction of greenhouse gas (GHG) emissions, particularly carbon dioxide (CO2), and harmful pollutants like nitrogen oxides (NOx) and particulate matter. Driving factors include tightening fuel economy standards such as CAFE (Corporate Average Fuel Economy) in the US and similar regulations in Europe and Asia Pacific, forcing both OEMs and aftermarket providers to prioritize efficiency enhancements. Furthermore, increasing consumer awareness regarding sustainable practices and the high cost of vehicle ownership significantly contributes to the demand for proven fuel-saving technologies.

Automobile Fuel Saver Market Executive Summary

The Automobile Fuel Saver Market is experiencing robust growth driven by escalating global fuel prices, intensifying environmental regulations, and the expansion of the commercial logistics sector. Current business trends indicate a significant shift towards validated, data-driven solutions, moving away from unproven gimmicks. This includes the proliferation of smart electronic tuning modules and additive formulations backed by certified laboratory testing. Key stakeholders, including specialty chemical producers and automotive component manufacturers, are increasingly investing in R&D to develop synergistic products that integrate seamlessly with modern engine management systems, particularly those incorporating start-stop functionality and turbocharging. Strategic partnerships between fuel saver manufacturers and major fleet operators or dealership networks are emerging as a critical distribution mechanism, ensuring wider market penetration and professional installation services.

Regional trends highlight dynamic expansion in the Asia Pacific (APAC) region, largely fueled by the rapid growth in vehicle parc, urbanization, and the need for cost-effective transportation solutions in developing economies like India and China. While North America and Europe maintain mature markets characterized by stringent regulatory oversight (Euro 6, EPA standards), demand here is dominated by premium, certified products and specialized fleet management solutions that offer verifiable return on investment (ROI). Conversely, Latin America and the Middle East and Africa (MEA) present significant opportunities due to high average fuel consumption rates and volatile geopolitical influences impacting energy costs, making fuel savings an immediate economic imperative for both private and public transportation sectors. Governments in these regions are also starting to incentivize the adoption of efficiency improvements to manage national fuel import bills.

Segment trends reveal that the Chemical Additives segment, particularly performance-enhancing detergents, holds a substantial market share due to ease of use and low initial cost, appealing strongly to the general consumer market. However, the Electronic/ECU Optimization segment is witnessing the fastest CAGR, driven by advancements in software tuning and the ability to customize performance profiles for specific driving conditions (e.g., urban vs. highway driving). For commercial fleets, solutions integrating telematics data analysis with fuel saving adjustments are becoming standard. This trend underscores a broader market movement toward holistic solutions that combine physical or chemical modifications with data analytics to ensure sustained and measurable fuel efficiency improvements over the vehicle’s lifecycle.

AI Impact Analysis on Automobile Fuel Saver Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Automobile Fuel Saver Market primarily revolve around predictive maintenance capabilities, real-time optimization algorithms, and the verification of product efficacy. Users frequently ask if AI can autonomously adjust engine parameters to minimize fuel consumption based on driving patterns, road conditions, and vehicle load, seeking assurance that AI-driven solutions offer verifiable, superior performance compared to conventional methods. There is strong interest in how machine learning models can process vast amounts of telematics data to identify subtle inefficiencies overlooked by human operators and how this technology can personalize fuel-saving strategies for individual drivers or specific fleet routes. The underlying themes are centered on transitioning from static, hardware-based solutions to dynamic, intelligent systems capable of continuous, adaptive optimization, thus maximizing long-term fuel economy and operational sustainability.

- AI-driven Predictive Maintenance: Utilizing ML models to anticipate engine component degradation that affects fuel efficiency (e.g., injector wear, sensor drift), allowing for proactive repairs.

- Real-Time Parameter Optimization: Employing AI algorithms within the ECU or telematics units to dynamically adjust ignition timing, fuel-air mixture, and gear shift points based on instantaneous environmental and operational variables.

- Fleet Management and Route Optimization: Leveraging AI to analyze complex route data, traffic patterns, and driver behavior to recommend the most fuel-efficient paths and minimize idling time.

- Efficacy Validation and Auditing: Using AI to process consumption data, comparing baseline performance with performance post-installation of a fuel saver product, providing irrefutable, data-backed ROI analysis.

- Development of Smart Fuel Additives: Using computational chemistry and AI simulations to rapidly test and optimize molecular structures for maximum combustion efficiency and reduced emissions.

- Driver Behavior Coaching: Providing personalized, AI-generated feedback to drivers on improving their driving style (smooth acceleration, optimal cruising speed) to maximize fuel economy.

DRO & Impact Forces Of Automobile Fuel Saver Market

The Automobile Fuel Saver Market is fundamentally influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively framed by potent external Impact Forces. Key drivers center on the global imperative for climate change mitigation, leading to increasingly stringent government regulations aimed at reducing vehicular emissions (e.g., CO2 targets and particle reduction mandates), which directly stimulate the development and adoption of fuel-saving technologies. Furthermore, the persistent volatility and high cost of global crude oil prices serve as a continuous economic driver, pressuring commercial fleet managers and private vehicle owners alike to seek immediate cost-saving measures. The rapid expansion of e-commerce and logistics services globally also necessitates optimized fleet operations, where fuel consumption efficiency directly impacts profitability and competitive edge, thereby accelerating the deployment of these solutions.

However, significant restraints impede the market’s full potential. The primary challenge remains consumer skepticism, stemming from a history of poorly validated or fraudulent "fuel saving" products that promised unrealistic results, leading to a prevalent distrust, particularly in the aftermarket segment. Furthermore, ensuring the compatibility of aftermarket devices with increasingly complex and integrated OEM vehicle electronics poses a substantial technical restraint, often requiring costly certification and rigorous testing. The higher initial investment required for advanced, proven technologies (such as hydrogen injection systems or complex ECU remaps) compared to lower-cost, less effective solutions also acts as a barrier to mass adoption, particularly in price-sensitive markets. Regulatory hurdles, although generally supportive, sometimes impose complex testing requirements that slow down the introduction of innovative products.

Opportunities for growth are abundant, particularly through technological convergence. The integration of fuel saver technologies into hybrid and even hydrogen fuel cell vehicles presents a unique avenue, optimizing conventional components (like range extender engines) for maximum efficiency. Developing comprehensive, validated fuel management platforms that combine hardware, software, and AI analytics for fleets offers substantial differentiation and premium pricing potential. External impact forces, primarily government policy (tax incentives for efficient vehicles, carbon taxes), have the most profound influence, rapidly altering market dynamics. Moreover, shifting consumer preferences towards sustainability and corporate social responsibility (CSR) initiatives among large corporations increase the demand for demonstrably green logistics operations, acting as a powerful non-economic impact force that compels market participants to invest in verifiable efficiency solutions. Geopolitical instability affecting oil supply chains further strengthens the reliance on fuel savers as a vital tool for economic resilience.

Segmentation Analysis

The Automobile Fuel Saver Market is extensively segmented based on the type of technology employed, the application vehicle type, and the distribution channel utilized. This segmentation reflects the diverse needs of various end-users, ranging from individual consumers seeking chemical additives for routine maintenance to large commercial enterprises requiring complex, integrated mechanical and electronic systems for fleet optimization. Understanding these segments is crucial for manufacturers to tailor their marketing strategies, product development, and pricing models to address specific operational requirements, regulatory environments, and purchasing behaviors across different regions globally. The inherent diversity in engine types (diesel, gasoline), vehicle age, and operational usage necessitates a granular approach to product classification.

- By Technology Type:

- Fuel Additives (Chemical-based)

- Mechanical/Hardware Devices (e.g., Magnetic Fuel Conditioners, Air Intake Enhancers, Aerodynamic Kits)

- Electronic/Software Optimization (ECU Remapping, Advanced Engine Controllers)

- Alternative Combustion Systems (e.g., Water/Hydrogen Injection Systems)

- By Application:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Vehicle Type:

- Gasoline Vehicles

- Diesel Vehicles

- Hybrid Electric Vehicles (HEV)

- By Distribution Channel:

- OEMs (Original Equipment Manufacturers)

- Aftermarket (Retail Stores, E-commerce, Specialty Service Centers)

Value Chain Analysis For Automobile Fuel Saver Market

The value chain for the Automobile Fuel Saver Market begins with highly specialized upstream activities centered around raw material procurement, intensive research and development (R&D), and intellectual property creation. For chemical additives, this involves sourcing base chemicals, specialized detergents, and patented catalysts. For mechanical and electronic devices, the upstream segment includes the procurement of specialized magnetic materials (e.g., rare-earth magnets), high-precision sensors, and semiconductor components. R&D is a critical value-adding step, where manufacturers invest heavily in laboratory testing, computational fluid dynamics (CFD), and engine dynamometer tests to substantiate fuel efficiency claims and ensure regulatory compliance, creating proprietary knowledge and unique selling propositions essential for market differentiation.

The midstream segment involves manufacturing, assembly, and quality control. This stage requires rigorous process management to ensure the consistency and reliability of the final product, especially given the precision demands of modern automotive systems. Production processes often involve specialized chemical blending facilities for additives or precision machining and electronics integration for hardware devices. Certification and validation are key activities here, as third-party endorsements from organizations like TÜV or EPA-recognized labs significantly enhance market credibility and facilitate entry into large commercial and OEM supply chains. Effective inventory management and scalable production capacity are necessary to meet the fluctuating demands of both the OEM and aftermarket sectors.

Downstream analysis focuses on distribution channels and end-user deployment. The market utilizes diverse distribution strategies: direct sales to OEMs for integration during vehicle assembly (often restricted to proven technologies or minor components), and robust aftermarket channels including specialized automotive service centers, large format retail parts stores, and increasingly, direct-to-consumer e-commerce platforms. Specialized service centers are crucial for complex installations, such as ECU tuning or hydrogen assist systems, ensuring professional fitting and calibration. Indirect channels, primarily distributors and wholesalers, play a vital role in reaching vast, geographically dispersed consumer bases, especially for fast-moving chemical consumables. Effective aftermarket support, including installation training, warranty provision, and performance guarantees, is essential to sustain consumer trust and drive repeat purchases in this often-skeptical market environment.

Automobile Fuel Saver Market Potential Customers

Potential customers for Automobile Fuel Saver products fall into three primary categories: commercial fleet operators, individual consumers, and Original Equipment Manufacturers (OEMs). Commercial fleet operators, including logistics companies, public transportation authorities, and delivery services, represent the most critical and high-value segment. These buyers prioritize verifiable ROI and require products that offer long-term durability, minimal maintenance requirements, and comprehensive data logging capabilities to prove the efficiency gains across hundreds or thousands of vehicles. Their purchasing decisions are driven purely by operational economics and environmental compliance targets, favoring sophisticated solutions such as telematics-integrated fuel optimization software and advanced chemical additives that protect diesel particulate filters (DPFs).

Individual vehicle owners constitute the largest volume segment, characterized by diverse needs and varying levels of technical knowledge. This consumer base generally prefers easily accessible, low-cost solutions, primarily chemical fuel additives (for routine engine cleaning and performance) and simple, DIY-installable devices (like specialized air filters or low-friction oil treatments). Price sensitivity is high, and purchasing is often influenced by retail promotions, anecdotal evidence, and general media trends. While they seek economic savings, they are also highly susceptible to marketing claims, necessitating transparent and easy-to-understand product validation to foster loyalty and confidence. E-commerce platforms are the primary purchasing route for this demographic, demanding robust logistics and clear installation instructions.

Original Equipment Manufacturers (OEMs) are crucial buyers, although they often integrate proprietary fuel efficiency technologies during the manufacturing phase rather than purchasing third-party aftermarket solutions directly. However, OEMs act as major customers for high-specification components, such as specialized engine sensors, low-friction coatings, and advanced lubricant technology incorporated into new vehicle designs. Suppliers targeting OEMs must meet extraordinarily high standards of quality, safety, and supply chain reliability, undergoing lengthy certification processes. Furthermore, OEMs often engage with fuel saver technology providers through licensing agreements or joint ventures to incorporate proven, validated efficiency enhancements into mid-cycle vehicle updates, thereby addressing consumer demand for lower running costs directly at the point of sale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 4.5 Billion USD |

| Market Forecast in 2033 | 7.5 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BG Products Inc., 3M Company, Lucas Oil Products, Shell PLC (Fuel Additive Division), K&N Engineering, EcoTuning Technologies, HHO Carbon Clean Systems, Magnetizer Group, Archoil, Chevron Oronite, Infineum International Ltd., TotalEnergies Marketing, AMSOIL Inc., Wynn's (ITW), Pro-Tec Deutschland, Fuel Efficiency Technologies, Optimize Fuel, DPF Cleaner Systems, Ecotek Canada, Quantum Fuel Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automobile Fuel Saver Market Key Technology Landscape

The Automobile Fuel Saver Market is defined by a rapidly evolving technological landscape, shifting away from simple mechanical fixes towards sophisticated electronic and chemical engineering solutions. A key technology is the use of advanced combustion catalysts within fuel additive formulations. These specialized chemical compounds are designed to lower the activation energy required for combustion, allowing the fuel to burn more completely and efficiently, thereby extracting maximum energy while minimizing unburnt hydrocarbon emissions and soot formation. Furthermore, detergent packages within these additives are crucial for cleaning critical engine components, such as fuel injectors and intake valves, maintaining the engine’s factory-intended efficiency over its lifespan. The precision required in synthesizing these additives necessitates substantial investment in high-purity chemical manufacturing and rigorous laboratory analysis to ensure compliance with modern engine tolerances.

Another major technological pillar is Electronic Control Unit (ECU) optimization, often referred to as performance mapping or chipping. Modern ECUs manage hundreds of parameters affecting fuel delivery, timing, and boost pressure. Fuel saver solutions in this domain involve recalibrating the ECU’s software to fine-tune these parameters, optimizing the engine’s operational map for specific outcomes like maximum efficiency under standard load conditions, often achieved by slightly adjusting the air-fuel ratio or ignition timing advance. This technology requires deep expertise in powertrain engineering and is increasingly leveraging real-time data from vehicle sensors (O2 sensors, mass airflow sensors) to make dynamic, adaptive adjustments, moving beyond static map changes. The security and encryption protocols surrounding OEM software pose a significant technological challenge that developers must continuously overcome.

Furthermore, mechanical and aerodynamic solutions continue to play a vital role, especially in the Heavy Commercial Vehicle (HCV) segment. Aerodynamic fuel savers, such as trailer side skirts, boat tails, and customized fairings, reduce aerodynamic drag—a major determinant of fuel consumption at highway speeds. Simultaneously, internal mechanical devices, like specialized air filters or low-resistance oil additives, reduce parasitic losses within the engine and drivetrain. Emerging technologies include Hydrogen-on-Demand (HOD) or brown gas systems, which generate small amounts of hydrogen gas (HHO) through electrolysis on board the vehicle, mixing it with the incoming air charge to enhance combustion speed and efficiency. Although controversial due to varying validation results, these systems represent a segment focused on maximizing the thermal efficiency of the existing combustion process through chemical enhancement.

Regional Highlights

- Asia Pacific (APAC): This region is poised for the fastest growth, driven by massive urbanization, rapidly increasing vehicle density, and the strong presence of price-sensitive consumers and fleets seeking immediate operational cost savings. Governments, particularly in China and India, are aggressively implementing stricter emission standards, creating a mandatory market for efficiency solutions. The aftermarket sector thrives here due to the high volume of older vehicles and the prevalence of local, independent repair shops.

- North America (NA): Characterized by long travel distances and a high reliance on large light-duty trucks and heavy-duty commercial vehicles, the market is highly focused on sophisticated, certified solutions for fleet management. CAFE standards drive OEM investment, while volatile gasoline prices stimulate consumer demand for high-quality chemical additives and proven electronic tuning devices. Validation through EPA or industry recognized testing is a critical success factor.

- Europe: The European market is dominated by stringent environmental regulations (Euro 6/7) and high fuel taxation, prioritizing low-emission solutions alongside fuel economy. Diesel fuel savers, targeting DPF maintenance and NOx reduction, are particularly strong. The mature market favors established brands and highly specialized technical solutions (like advanced low-viscosity lubricants and precision ECU calibration services) often backed by robust regulatory frameworks and consumer protection laws.

- Latin America (LATAM): Growth is primarily fueled by economic necessity due to high fuel costs and less strict vehicle retirement protocols, leading to a large parc of older, less efficient vehicles. The demand is strong for foundational fuel savers, including robust chemical additives and simple mechanical enhancements, offering accessible entry points for reducing immediate operating expenses across diverse vehicle types.

- Middle East and Africa (MEA): Despite varying degrees of governmental fuel subsidies, the necessity for efficient fleet operations, especially in mining, construction, and oil & gas sectors, drives market demand. The market size is smaller but focused on heavy-duty applications where harsh operating conditions necessitate specialized chemical treatments and high-durability mechanical devices to maintain engine efficiency. Political efforts toward diversification and reducing energy consumption also contribute to market traction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automobile Fuel Saver Market.- BG Products Inc.

- Lucas Oil Products

- 3M Company

- Shell PLC (Fuel Additive Division)

- Chevron Oronite

- K&N Engineering

- A.R.E. Accessories (Aerodynamic Solutions)

- EcoTuning Technologies

- HHO Carbon Clean Systems

- Magnetizer Group

- Archoil

- Infineum International Ltd.

- TotalEnergies Marketing

- AMSOIL Inc.

- Wynn's (ITW)

- Pro-Tec Deutschland

- Fuel Efficiency Technologies

- Optimize Fuel

- DPF Cleaner Systems

- Quantum Fuel Systems

Frequently Asked Questions

Analyze common user questions about the Automobile Fuel Saver market and generate a concise list of summarized FAQs reflecting key topics and concerns.Are aftermarket fuel saver devices compatible with modern vehicle warranties and complex ECU systems?

Compatibility varies significantly by product type. While high-quality chemical additives are generally safe, electronic tuning devices or invasive mechanical modifications can potentially void OEM warranties if they interfere with manufacturer-specified performance parameters. Consumers should prioritize solutions that are non-invasive, validated, and specifically designed to work harmoniously with modern electronic control units (ECUs) without triggering diagnostic codes.

How can commercial fleets verify the actual Return on Investment (ROI) from installing fuel saver technology?

Commercial fleets rely heavily on integrated telematics systems and verifiable data. ROI is typically measured by conducting pilot programs, comparing baseline fuel consumption data (miles per gallon or liters per 100 km) with post-installation data, factoring in the device cost, and utilizing AI-driven analytics to isolate fuel savings from other variables like driver behavior or route changes. Only data-backed, third-party validated results are accepted in the commercial sector.

Which technology type, additives or electronic optimization, offers the highest potential fuel savings?

Electronic/Software Optimization (ECU tuning) often yields the highest percentage increase in efficiency because it modifies the engine’s core operational logic to suit specific geographical or driving needs. However, this must be complemented by high-quality Fuel Additives, which maintain the engine's internal health (cleaning injectors, reducing friction) to ensure that the electronic optimizations can operate effectively and sustainably over time.

What impact do global emission regulations, such as Euro 7, have on the demand for fuel saver products?

Global emission regulations exponentially increase the demand for fuel saver products. Mandates like Euro 7 require significant reductions not only in CO2 (fuel consumption) but also in NOx and particulate matter (PM). Fuel saver technologies, particularly advanced chemical additives and precise electronic controls, are crucial for existing and new vehicles to meet these tightening standards while avoiding costly hardware upgrades, making them necessary compliance tools.

Is the Automobile Fuel Saver Market relevant given the accelerating shift towards Electric Vehicles (EVs) and Hybrid Vehicles?

Yes, the market remains highly relevant. While EV adoption grows, the global fleet of internal combustion engine (ICE) and Hybrid Electric Vehicles (HEVs) will dominate for decades. Fuel saver technologies are essential for optimizing the efficiency of the millions of existing ICE vehicles and the gasoline/diesel engines used as range extenders in HEVs, ensuring cost control and reduced environmental impact during the long energy transition phase.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager