Automobile Optical Lens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432151 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automobile Optical Lens Market Size

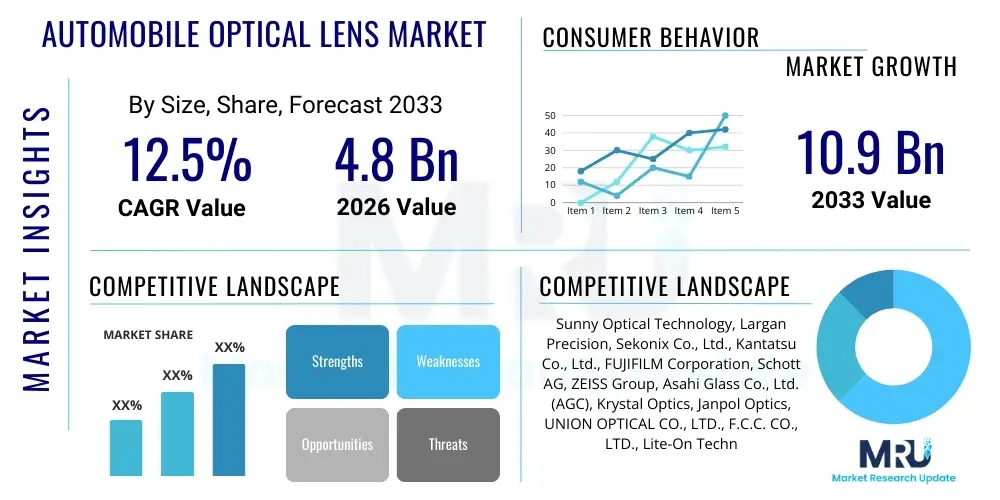

The Automobile Optical Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2033.

Automobile Optical Lens Market introduction

The Automobile Optical Lens Market encompasses the design, manufacturing, and distribution of specialized optical components used across various automotive applications, primarily centered around safety, convenience, and driver assistance systems. These lenses are critical enabling technologies for Advanced Driver Assistance Systems (ADAS), including surround-view camera systems, forward-facing cameras for collision avoidance, parking assistance, and increasingly, high-resolution lenses for integration with Light Detection and Ranging (LiDAR) and Head-Up Displays (HUDs). The core function of these lenses is precise light management—collecting, shaping, and focusing light onto electronic sensors—requiring exceptional performance stability under harsh automotive operating conditions, such as extreme temperature fluctuations, high humidity, and mechanical vibration. The performance of the entire sensing system, including object recognition and distance measurement, is directly dependent on the optical quality and reliability of the lens module.

Optical lenses utilized in the automotive sector range significantly in complexity, from standard spherical glass lenses to highly advanced, multi-element aspherical lenses and complex molded plastic optics engineered for minimal distortion and superior thermal resilience. The growing mandate for functional safety standards, such as ISO 26262, compels manufacturers to utilize high-grade materials like specialized polymers and optical glasses, often incorporating advanced coatings to mitigate glare, reflection, and environmental contamination. Major applications driving demand include exterior cameras for blind-spot monitoring and lane departure warnings, interior cameras for driver monitoring systems (DMS), and illumination optics in sophisticated LED matrix headlights. The stringent requirements for automotive qualification necessitate lengthy validation processes, establishing high barriers to entry for new market participants and favoring established suppliers with proven track records in precision molding and quality control.

Key driving factors for market expansion include the global regulatory push for increased vehicle safety, particularly the mandatory adoption of rearview cameras and certain ADAS features in key markets like North America and Europe. Furthermore, the rapid proliferation of electric vehicles (EVs) and the sustained investment in autonomous driving research escalate the need for redundant and high-fidelity sensor arrays, each requiring sophisticated optical lenses. Benefits realized from these systems include significant reduction in traffic accidents, enhanced driving comfort, and the enablement of future vehicle autonomy levels (Level 3 and above). These lenses transform raw light data into actionable digital information, bridging the physical environment with the vehicle's electronic control unit (ECU) and perception algorithms.

Automobile Optical Lens Market Executive Summary

The Automobile Optical Lens Market is undergoing a fundamental transformation driven by the transition from traditional image capturing towards sophisticated 3D environmental mapping required by L3+ autonomy and sensor fusion technologies. Current business trends indicate a strong move toward hybrid lens systems, combining glass and plastic elements to achieve high resolution, wider fields of view (FoV), and enhanced thermal stability while managing overall cost and size constraints. Suppliers are increasingly focused on developing standardized, scalable lens modules that can be readily integrated by Tier 1 manufacturers into diverse sensor platforms, reducing development time and complexity. Furthermore, the push for miniaturization and integration demands specialized manufacturing processes, such as wafer-level optics (WLO), particularly for small-form-factor cameras deployed ubiquitously throughout the vehicle exterior and interior.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, remains the dominant growth engine, fueled by massive production volumes of both conventional and New Energy Vehicles (NEVs) and aggressive governmental promotion of smart transportation infrastructure. Europe and North America follow closely, characterized by stringent safety regulations that accelerate the adoption of high-performance sensing suites, focusing heavily on LiDAR and high-resolution imaging for robust ADAS performance. Segment trends reveal that the Imaging/Sensing segment, specifically lenses for ADAS cameras and LiDAR systems, is experiencing the fastest growth, significantly outpacing traditional lighting optics, reflecting the automotive industry's pervasive shift towards enhanced perception capabilities. This rapid growth necessitates significant capital expenditure in automated, cleanroom-based manufacturing facilities capable of producing sub-micron tolerance components.

In summary, the market trajectory is defined by the symbiotic relationship between advanced software (AI perception) and high-fidelity hardware (optical lenses). Success hinges on manufacturers' ability to maintain ultra-precision in mass production while optimizing lens design for specific sensor wavelengths (e.g., 905nm for common LiDAR, NIR for DMS). Challenges include managing the complex supply chain for specialized optical materials and mitigating geopolitical trade risks affecting critical component sourcing. The market's structural shift towards specialized optics designed for automated driving functions confirms its vital role as a cornerstone technology for the future of mobility.

AI Impact Analysis on Automobile Optical Lens Market

User inquiries regarding the impact of Artificial Intelligence on the Automobile Optical Lens Market typically revolve around whether AI algorithms can compensate for lower optical quality, what lens specifications are optimized for AI perception, and how real-time data processing influences lens thermal management and stability. Users are particularly concerned about the interplay between computational photography techniques enabled by AI and the need for expensive, high-precision physical optics. The key consensus is that while AI algorithms (like convolutional neural networks) can significantly enhance image processing, correct minor aberrations, and improve object classification accuracy, they cannot fully negate fundamental limitations imposed by poor lens design, such as low light sensitivity, inherent distortion, or chromatic aberration. AI's effectiveness in autonomous driving relies on receiving the highest fidelity input data possible, thus driving demand for optically superior, rather than compromised, lens systems.

The integration of AI perception systems directly influences lens design requirements by demanding higher contrast, minimized stray light, and greater consistency across lens batches, ensuring reliable training data and predictable operational performance. Lenses must be optimized not just for human vision but specifically for machine vision, which involves maximizing performance in the Near-Infrared (NIR) spectrum for nighttime operation and leveraging specific spectral bandwidths for LiDAR. Furthermore, as AI systems require massive amounts of data captured in diverse environmental conditions, the optical lens must maintain structural and performance stability across a wide operational temperature range (-40°C to +85°C), necessitating the use of advanced thermally stable materials and athermalized lens designs to prevent focal shift.

The increasing complexity of AI-driven sensor fusion—where data from multiple cameras, LiDARs, and radars are combined—requires precise calibration and alignment, making lens repeatability and quality consistency paramount. The move towards deep learning models that process raw sensor data (rather than processed images) further emphasizes the need for pristine optical input. Consequently, AI acts as a demanding customer, setting a higher bar for optical performance specifications, driving innovation in anti-reflection coatings, minimizing lens element count (where possible through advanced aspheric molding), and accelerating the adoption of complex optical assemblies suitable for high-speed, accurate perception necessary for L4 and L5 autonomous vehicles.

- AI algorithms necessitate ultra-low distortion optics to ensure accurate spatial measurements and mapping.

- Increased demand for Near-Infrared (NIR) optimized lenses to support AI-driven night vision and Driver Monitoring Systems (DMS).

- AI drives the requirement for precise chromatic aberration control, crucial for effective color-based object recognition and classification.

- Thermal stability optimization (athermalization) in lens modules is critical, ensuring focal plane consistency despite heat generated by adjacent high-performance AI processing units (ECUs).

- Encouragement of hybrid lens designs (glass-plastic) to balance the high optical performance required by AI with cost and weight constraints.

- Acceleration of wafer-level optics (WLO) adoption for miniaturized cameras, supporting the proliferation of sensing nodes required for 360-degree AI coverage.

DRO & Impact Forces Of Automobile Optical Lens Market

The Automobile Optical Lens Market dynamics are characterized by a strong interplay of compelling regulatory drivers and severe technical constraints, balanced by significant opportunities arising from autonomy and electrification. The primary driver is the global implementation of safety mandates, such as the U.S. requirement for rearview cameras (FMVSS 111) and European Union regulations pushing for mandatory ADAS features like Automatic Emergency Braking (AEB) and Lane Keep Assist (LKA), all of which rely fundamentally on high-quality optical input. This regulatory environment creates non-negotiable demand floors for camera and sensor integration. Alongside this, the pervasive technological push towards higher levels of autonomous driving (L3, L4, L5) demands not only more cameras but also increased redundancy and superior resolution, compelling manufacturers to invest heavily in advanced lens materials and molding precision.

However, the market faces significant restraints. The foremost restraint is the extremely long and complex qualification cycle required by automotive OEMs, often taking several years from design to mass production, hindering rapid technology deployment. Furthermore, the necessity for producing lenses with sub-micron tolerances in high volume presents substantial manufacturing cost hurdles, especially for hybrid or full glass assemblies. Price sensitivity remains a constant pressure point; while OEMs demand high performance, they also exert continuous pressure on Tier 1 suppliers to reduce unit costs, leading to intense competition among lens manufacturers and driving innovation towards cost-effective precision molding techniques. Supply chain vulnerability, particularly the sourcing of specialized optical glass and resins, poses an ongoing risk, often exacerbated by geopolitical instability.

Opportunities for exponential growth exist in several specialized areas. The explosive growth of LiDAR systems, requiring specialized, high-transmission optics tailored for near-infrared wavelengths, presents a lucrative new segment distinct from visible light cameras. Similarly, the trend toward immersive in-vehicle experiences is driving demand for advanced optics used in large format Head-Up Displays (HUDs) and augmented reality interfaces. The shift toward electrification minimizes mechanical vibrations and allows for more stable sensor platforms, potentially simplifying some lens stabilization requirements and opening avenues for higher fidelity optics. Impact forces on the market are high, driven by the rapidly evolving semiconductor technology landscape (sensor resolution increases every two years) which mandates corresponding and often challenging upgrades in optical component performance to avoid becoming the limiting factor in the perception chain. Regulatory forces and consumer demand for safety act as persistent, non-cyclical accelerators for market expansion.

Segmentation Analysis

The Automobile Optical Lens Market is comprehensively segmented based on various technical and application criteria, crucial for understanding market dynamics and targeted investment strategies. Key segmentation parameters include the type of material used (glass, plastic, hybrid), the lens type (aspherical, spherical, diffractive), the application area (sensing/imaging, lighting, display), and the vehicle type (passenger vehicles, commercial vehicles). This structured approach allows suppliers to specialize their manufacturing capabilities, focusing on the high-volume plastic molding required for mainstream camera systems or the high-precision glass molding necessary for specialized LiDAR and high-end projector optics.

The Application segment is particularly vital, demonstrating the industry's pivot towards advanced perception. The Imaging and Sensing segment, encompassing ADAS, DMS, and autonomous systems, currently dominates market growth due to the escalating count of required sensors per vehicle. Contrastingly, the Lighting segment, though mature, still drives significant demand, especially with the trend toward complex, adaptive LED matrix headlights that utilize multiple precise lenses for beam shaping and steering. Furthermore, the material segmentation highlights the ongoing technical debate between glass, which offers superior thermal stability and light transmission, and plastic, which provides cost-effectiveness, lighter weight, and flexibility for mass production via injection molding, leading to the rapid adoption of hybrid lens assemblies to capitalize on the benefits of both.

- By Application:

- Imaging/Sensing (ADAS Cameras, LiDAR, DMS)

- Lighting (Headlamps, Taillights, Interior Lighting)

- Display (HUD, Augmented Reality Displays)

- By Lens Type:

- Aspherical Lenses

- Spherical Lenses

- Diffractive Optical Elements (DOEs)

- Hybrid Lenses (Plastic and Glass Combination)

- By Material:

- Glass Lenses

- Plastic Lenses (e.g., Polycarbonate, Acrylic)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Buses, Vans)

Value Chain Analysis For Automobile Optical Lens Market

The value chain for the Automobile Optical Lens Market is highly specialized and sequential, beginning with raw material extraction and culminating in system integration by automotive OEMs. The upstream segment involves the sourcing and preparation of specialized optical materials, including high-ppurity optical glass blanks (requiring minimal internal defects) and optical-grade polymer resins (such as Cyclo Olefin Polymer/Copolymer or specific polycarbonates) necessary for precision molding. Material suppliers must adhere to stringent quality standards, providing traceable materials that meet automotive-grade specifications regarding thermal expansion, refractive index stability, and light absorption characteristics. Key upstream activities include material refining, compounding, and initial pre-forming processes, setting the foundation for the precision required downstream.

The core manufacturing and processing segment involves midstream activities such as ultra-precision injection molding (for plastic lenses), glass press molding, thin-film coating deposition (for anti-reflection, anti-fog, and abrasion resistance), and the assembly of multi-element lens barrels. These manufacturers, often specialized optical component providers, utilize advanced metrology equipment and cleanroom environments to maintain micron-level tolerances and prevent contamination. Finished lens modules are then supplied to Tier 1 automotive suppliers (e.g., Continental, Bosch, Aptiv, Magna), who integrate the optics with image sensors (CMOS/CCD), microprocessors, and housing units to form complete sensor modules (e.g., ADAS cameras, LiDAR units). This integration phase is critical, requiring complex alignment and calibration processes to ensure the sensor system meets the functional requirements of the vehicle.

The downstream distribution channel primarily utilizes an indirect model, where Tier 1 suppliers act as the main customers and integrators, delivering the complete sensing systems directly to Original Equipment Manufacturers (OEMs) like Ford, Toyota, Volkswagen, and Tesla. Direct distribution to OEMs by optical lens manufacturers is rare and usually limited to highly proprietary or specialized optics like those for advanced HUD systems. The aftermarket channel for replacement optics is growing but remains a smaller portion of the total market, predominantly focused on replacement headlamp assemblies and minor camera repairs. The overall chain emphasizes quality assurance and collaborative design (co-development between lens makers and sensor providers) to ensure seamless system performance and meet rigorous automotive reliability standards over the vehicle’s lifespan.

Automobile Optical Lens Market Potential Customers

The primary customers in the Automobile Optical Lens Market are bifurcated into two major categories: Tier 1 Automotive Suppliers and, increasingly, Original Equipment Manufacturers (OEMs) who are developing proprietary autonomous driving stacks. Tier 1 suppliers represent the largest customer base, acting as the system integrators responsible for designing, validating, and supplying complete sensing and lighting modules to car manufacturers. Companies such as ZF, Hella, Bosch, and Magna source vast quantities of individual lens elements and assembled modules to build their branded camera units, LiDAR assemblies, and advanced lighting systems, making them the direct purchasers and specifiers of optical components.

A rapidly growing segment of potential customers includes specialized technology companies and autonomous vehicle developers (e.g., Waymo, Cruise, Mobileye), who often require highly customized, bespoke optical solutions tailored to their specific sensor fusion architectures and perception algorithms. These customers seek highly specialized lens assemblies, particularly for high-end LiDAR and long-range imaging, demanding cutting-edge performance that standard off-the-shelf components might not provide. The purchase decisions of these tech-focused customers are heavily driven by performance metrics such as low stray light, high signal-to-noise ratio, and thermal performance, often prioritizing technological advancement over marginal cost savings.

Finally, automotive OEMs themselves are becoming more direct influencers, and in some cases, direct customers, particularly as they vertically integrate key technology areas. As major car manufacturers seek greater control over their sensor data and perception capabilities, many are establishing internal partnerships or joint ventures for sensor module production. This shift means that lens manufacturers must increasingly engage in co-development initiatives directly with OEM R&D teams, ensuring that optical specifications are optimized precisely for the vehicle platform and the associated processing hardware, thereby moving the purchasing decision point higher up the value chain for strategic components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sunny Optical Technology, Largan Precision, Sekonix Co., Ltd., Kantatsu Co., Ltd., FUJIFILM Corporation, Schott AG, ZEISS Group, Asahi Glass Co., Ltd. (AGC), Krystal Optics, Janpol Optics, UNION OPTICAL CO., LTD., F.C.C. CO., LTD., Lite-On Technology Corporation, Valeo, Continental AG, Hella GmbH & Co. KGaA, Magna International Inc., Lumileds Holding B.V., Nichia Corporation, OSRAM GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automobile Optical Lens Market Key Technology Landscape

The technological landscape of the Automobile Optical Lens Market is dominated by advancements in ultra-precision manufacturing and material science, driven by the need to meet simultaneously higher resolution demands, broader temperature stability, and lower manufacturing costs. A key enabling technology is high-precision injection molding, specifically for plastic and hybrid lenses. This process allows for the mass production of complex aspheric lens shapes with sub-micron surface accuracy, which is essential for correcting aberrations and improving image quality in compact camera modules. Sophisticated molding techniques, often utilizing diamond-turned molds, are required to achieve the geometrical precision necessary for lenses integrated into ADAS systems, ensuring uniform optical performance across millions of units despite the constraints of manufacturing speed and cost efficiency.

Another critical area of innovation is the development and application of specialized coatings. Thin-film deposition technologies are utilized to apply multi-layer anti-reflection (AR) coatings, dramatically reducing light loss and flare, which are critical issues in automotive cameras operating in high-contrast environments (e.g., direct sunlight or tunnel exits). Furthermore, hydrophobic and oleophobic coatings are increasingly applied to exterior lens surfaces to ensure the clear capture of images under adverse weather conditions, providing passive cleaning capabilities. These functional coatings are integrated directly into the manufacturing process, adding complexity but guaranteeing system reliability under environmental stress and contributing significantly to functional safety requirements.

The rise of LiDAR and AR-HUD systems is concurrently pushing the limits of traditional optics into new technological territories. For LiDAR, the focus is on developing high-efficiency, robust optics optimized for specific infrared wavelengths (typically 905nm or 1550nm). This often involves specialized glass materials with superior transmission properties and complex beam-steering mechanisms, including micro-lenses and diffractive optical elements (DOEs). For AR-HUDs, the technology centers on free-form optics and projection lenses that can display vivid, large-field-of-view virtual images onto the windshield, necessitating extremely high precision in lens shaping and mounting to maintain calibration relative to the driver's eye position and external environment. The combination of these demands drives sustained R&D investment in advanced metrology and automated assembly processes.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to maintain the largest market share and exhibit the highest growth rate throughout the forecast period, primarily driven by massive automotive manufacturing volumes, particularly in China, Japan, and South Korea. China, as the world's largest automotive market and a global leader in EV production, mandates significant integration of sensing technologies, fueling demand for low-to-mid-cost camera lenses for mandatory safety features, as well as high-end LiDAR optics for domestic autonomous vehicle initiatives. Government support for smart cities and automated public transport further accelerates the adoption of sophisticated sensing arrays. Japan and South Korea contribute significantly due to established, high-quality OEM bases and leading advancements in autonomous driving research and precision optical manufacturing.

- Europe: Europe represents a highly valuable market segment characterized by stringent regulatory oversight (e.g., General Safety Regulation II mandating advanced safety features) and a strong consumer preference for premium, feature-rich vehicles. Demand is heavily concentrated on high-performance optics, specifically lenses optimized for long-range ADAS capabilities, matrix lighting systems, and integrated sensors for L3/L4 vehicles. German OEMs lead the push for highly specialized, athermalized glass and hybrid lenses that offer superior optical performance under severe climatic variations. The region emphasizes functional safety standards and requires robust validation across the supply chain.

- North America: North America is a critical early adopter market, particularly for camera systems mandated by federal regulations (e.g., rearview cameras). The region is a hotbed for autonomous vehicle development, driven by major technology companies and established automakers, leading to high investment in cutting-edge sensor technology, including complex LiDAR optics and high-resolution sensing lenses. The demand here is dual-focused: meeting baseline regulatory requirements and pushing the technological envelope for fully autonomous test fleets. The market is also heavily influenced by robust aftermarket consumer demand for upgraded sensing and lighting kits.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets, primarily focused on adopting base-level ADAS features and replacing traditional halogen lighting with LED systems. Growth is steady but slower compared to APAC and Europe, driven by increasing vehicle sales and tightening regional safety standards. The market here typically demands cost-effective, durable optical solutions, with initial adoption concentrated in commercial fleets and high-volume passenger vehicles manufactured locally or imported under specific safety guidelines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automobile Optical Lens Market.- Sunny Optical Technology (Group) Company Limited

- Largan Precision Co., Ltd.

- Sekonix Co., Ltd.

- Kantatsu Co., Ltd.

- FUJIFILM Corporation

- Schott AG

- ZEISS Group (Carl Zeiss AG)

- Asahi Glass Co., Ltd. (AGC)

- Krystal Optics

- Janpol Optics

- UNION OPTICAL CO., LTD.

- F.C.C. CO., LTD.

- Lite-On Technology Corporation

- Valeo

- Continental AG

- Hella GmbH & Co. KGaA

- Magna International Inc. (Focusing on module integration)

- Lumileds Holding B.V. (Focusing on lighting optics)

- Nichia Corporation

- OSRAM GmbH

Frequently Asked Questions

Analyze common user questions about the Automobile Optical Lens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for high-resolution automobile optical lenses?

The primary driver is the accelerating trend toward higher levels of vehicle autonomy (L3 and beyond), necessitating multiple redundant high-fidelity sensors (cameras and LiDAR) that require ultra-precision optics to feed accurate, reliable data to AI perception systems.

How do hybrid lens systems compare to traditional glass lenses in automotive applications?

Hybrid lens systems, combining glass and plastic elements, offer a balance between the superior thermal stability and transmission of glass and the cost-efficiency, lightweight, and mass-producibility of plastic, making them ideal for temperature-sensitive ADAS cameras requiring complex, compact designs.

What role does Wafer-Level Optics (WLO) play in the Automobile Optical Lens Market?

WLO is crucial for miniaturization. It enables the mass production of numerous micro-lenses simultaneously on a single wafer, facilitating smaller, thinner camera modules essential for seamless integration into vehicle bodies and supporting the proliferation of discreet sensing nodes for 360-degree coverage.

Are thermal stability and athermalization critical requirements for automotive optical lenses?

Yes, thermal stability is critical. Automotive lenses must operate reliably from extreme cold (-40°C) to intense heat (+85°C). Athermalized designs ensure the optical performance and focal length remain consistent across this range, preventing image degradation and sensor misalignment that could compromise ADAS functionality.

Which segment of the market is expected to demonstrate the highest growth rate?

The Imaging/Sensing segment, specifically optics utilized in LiDAR systems and high-resolution ADAS cameras, is projected to show the highest compound annual growth rate, driven by the shift from basic safety features to complex environmental mapping and perception required for autonomous driving.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager