Automotive 48V System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432876 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive 48V System Market Size

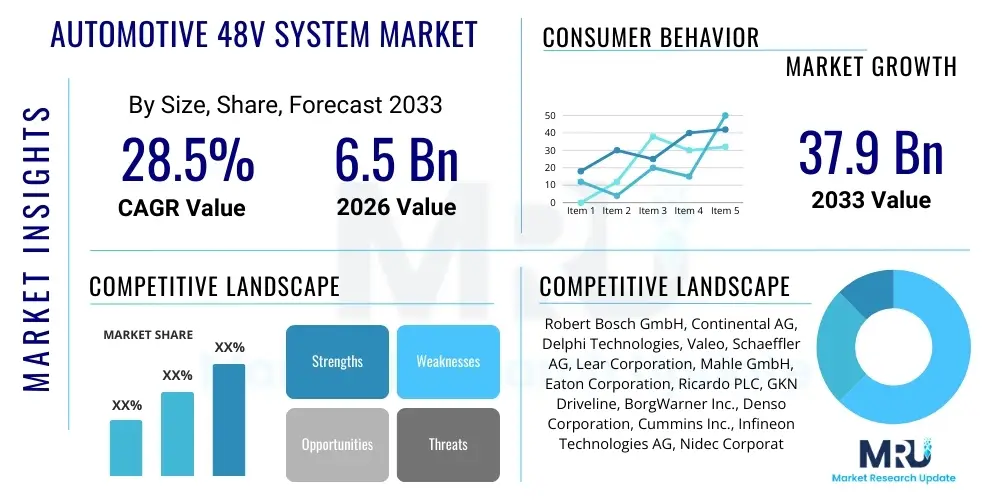

The Automotive 48V System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 37.9 Billion by the end of the forecast period in 2033. This exponential growth trajectory is fundamentally driven by stringent global emission regulations, particularly Euro 7 standards and equivalent mandates in North America and Asia Pacific, necessitating cost-effective electrification solutions that 48V architectures provide.

Automotive 48V System Market introduction

The Automotive 48V System Market encompasses innovative electrical architectures designed to bridge the functional gap between conventional 12V systems and high-voltage full electric or plug-in hybrid systems. These systems utilize a secondary 48V battery coupled with power electronics, such as DC/DC converters and Belt-Driven Starter Generators (BSG) or Integrated Starter Generators (ISG), to support energy-intensive functions like enhanced start-stop, regenerative braking, electric boosting, and mild hybridization. The primary product is the Mild Hybrid Electric Vehicle (MHEV), which leverages the 48V infrastructure to significantly improve fuel efficiency (up to 15%) and reduce CO2 emissions without the extensive engineering complexity or cost associated with high-voltage electrification.

Major applications of 48V technology are centered around powertrain electrification and enhanced vehicle performance. Beyond core functionality, 48V systems power high-demand components such as electric turbochargers (e-turbos), electric compressors, active suspension systems, and advanced climate control systems, which require greater power than traditional 12V networks can reliably supply. The benefits include reduced strain on the internal combustion engine, smoother operation during start-stop cycles, substantial gains in torque assist through e-boosting, and critically, a much lower total cost of ownership compared to full hybrid vehicles. Market driving factors include consumer demand for performance combined with efficiency, governmental mandates pushing CO2 reduction targets, and the increasing feasibility of integrating high-power auxiliary components.

Furthermore, the 48V architecture is viewed by Original Equipment Manufacturers (OEMs) as a crucial stepping stone towards mass electrification. It provides a readily scalable solution that can be integrated into existing vehicle platforms with minimal redesign, making it exceptionally attractive for medium-sized vehicles and entry-level luxury segments. The technological evolution focusing on optimizing the size and efficiency of key components, such as the power inverter and the 48V lithium-ion battery pack, continues to propel market adoption across all major automotive producing regions, solidifying the system's role as the de facto standard for mild hybridization.

Automotive 48V System Market Executive Summary

The Automotive 48V System Market is characterized by rapid technological assimilation and aggressive deployment across global fleets, primarily driven by the urgent need to meet stringent climate objectives without excessive cost escalation for consumers. Business trends indicate a strong move towards vertical integration, where Tier 1 suppliers are increasingly acquiring or partnering with power electronics specialists to offer complete, optimized 48V subsystems to OEMs. Strategic alliances between major German, Japanese, and American automotive conglomerates underscore the standardized approach being adopted for component specifications, aiming for greater economies of scale and faster market penetration. The competitive landscape is intensely focused on reducing the size and improving the thermal management capabilities of the motor-generator units and DC/DC converters, which are crucial for integration flexibility across various chassis architectures.

Regional trends highlight Asia Pacific, particularly China, as the dominant growth engine due to favorable governmental policies promoting MHEVs and high volume manufacturing capabilities. Europe remains a critical adoption region, necessitated by the immediate pressure of CO2 reduction penalties imposed by the European Union, making 48V systems a necessity for fleet average compliance. North America is experiencing accelerated growth, spurred by consumer preference shifting towards vehicles offering improved mileage and performance enhancements derived from mild hybridization. Segment trends show that the Belt-Driven Starter Generator (BSG) segment currently leads due to its lower cost and easier integration into conventional engines, although the Integrated Starter Generator (ISG) segment, offering higher torque and efficiency, is projected to gain significant market share as platforms are specifically designed for electrification from the ground up.

Overall, the market trajectory is highly positive, bolstered by continued investment in specialized battery technology, optimized software control units, and advanced thermal management solutions tailored for 48V operation. The widespread adoption of MHEVs, coupled with the application of 48V architecture in non-powertrain functions such as chassis control and comfort systems, guarantees sustained demand. The market is transitioning from a nascent stage, focused solely on fuel economy, to a mature stage where 48V technology is integral to performance, vehicle dynamics, and advanced safety features, ensuring its indispensable role in the near-to-mid-term future of automotive manufacturing before mass transition to pure battery electric vehicles (BEVs).

AI Impact Analysis on Automotive 48V System Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and 48V systems often revolve around optimizing energy management, predictive maintenance, and enhancing system efficiency. Users frequently ask: How can AI algorithms improve the regenerative braking performance of 48V MHEVs? What role does machine learning play in optimizing the power distribution between the 48V and 12V rails? And how can AI predict component failure in high-stress components like the MGU or DC/DC converter? The key themes summarizing user expectations center on utilizing AI for sophisticated predictive thermal management, dynamic power routing based on real-time driving conditions, and extending the lifespan of the relatively new and complex 48V battery systems. Users anticipate that AI will move the 48V system beyond basic mild hybridization to a fully optimized, smart energy recovery and distribution network.

The impact of AI on 48V systems is predominantly seen in the realm of smart energy management algorithms. Machine learning models are being developed to analyze driver behavior, topographical data, and traffic patterns to predict future power demands. This predictive capability allows the system to optimize charging and discharging cycles of the 48V battery, ensuring maximum energy recapture during regenerative braking opportunities and providing precise torque assist when acceleration is anticipated, thus maximizing fuel economy gains far beyond what rule-based control systems can achieve. Furthermore, AI contributes significantly to noise, vibration, and harshness (NVH) mitigation by ensuring seamless transitions between engine-off and engine-on states during the start-stop process, enhancing overall vehicle refinement.

Advanced AI diagnostics are also revolutionizing the maintenance protocols for 48V components. By continuously monitoring subtle shifts in component performance, such as current leakage in the DC/DC converter or temperature anomalies in the MGU, AI can preemptively identify potential failures long before they become critical. This shift from reactive to predictive maintenance significantly reduces warranty costs for OEMs and improves vehicle uptime for consumers. The integration of AI-driven battery management systems (BMS) ensures optimal health and longevity for the expensive lithium-ion batteries, precisely managing cell balancing and temperature regulation based on historical usage data and immediate operational needs, thereby consolidating the value proposition of 48V technology.

- AI optimizes regenerative braking energy capture based on predictive traffic and topography analysis.

- Machine learning improves thermal management efficiency for the MGU and power electronics, preventing overheating.

- Predictive maintenance algorithms reduce component failure rates and improve system reliability.

- AI-driven control units ensure smoother, quieter transitions during start-stop and torque assist phases.

- Enhanced Battery Management Systems (BMS) use AI to maximize 48V battery lifespan and performance consistency.

DRO & Impact Forces Of Automotive 48V System Market

The market for Automotive 48V Systems is primarily driven by rigorous global regulatory pressures demanding lower carbon dioxide emissions and higher fuel efficiency, notably the implementation of Euro 7 and CAFE standards, making mild hybridization an immediate and cost-effective compliance strategy. Restraints include the initial high cost associated with integrating the complex power electronics and the specialized lithium-ion battery packs, alongside the technical challenge of managing two distinct voltage architectures (12V and 48V) simultaneously within a confined vehicle space. Opportunities are vast, extending beyond fuel economy into performance enhancements, such as electric supercharging and integration with advanced chassis control systems, paving the way for further functional differentiation. The combined impact forces suggest that regulatory compliance is the strongest immediate catalyst, while technological maturity and cost reduction will be the dominant forces shaping long-term adoption rates, ensuring strong market momentum despite initial integration hurdles.

A key driver is the architectural flexibility offered by the 48V system. Unlike full hybrids which require significant redesign of the vehicle platform and powertrain, 48V systems can be relatively easily bolted onto existing conventional engine architectures, accelerating time-to-market for MHEV models. This ease of implementation, coupled with substantial government subsidies and tax incentives offered in many countries for low-emission vehicles, creates a powerful incentive for mass adoption across high-volume passenger car segments. Furthermore, the 48V system uniquely caters to the increasing power demands of modern in-car electronics, supporting energy-intensive features like electric steering, active stabilizer bars, and enhanced sensor arrays required for Level 2 and Level 3 autonomous driving functionalities, which conventional 12V systems struggle to manage.

However, the market faces significant restraints related to standardization and supply chain maturity. As different OEMs adopt proprietary approaches to MGU design and DC/DC conversion protocols, achieving global standardization remains challenging, potentially slowing down component cost optimization through scale. Moreover, the long-term reliability and serviceability of the 48V battery and associated electronics in extreme operating environments (temperature fluctuations, vibration) still require extensive validation and data collection, raising concerns among consumers about maintenance costs post-warranty. Despite these restraints, the opportunity to integrate 48V technology into heavy-duty commercial vehicles and off-road machinery is opening up new revenue streams, significantly expanding the addressable market and promising further technological refinement that will eventually drive down component prices across all vehicle classes.

Segmentation Analysis

The Automotive 48V System Market is strategically segmented based on system type, component, vehicle type, and application, reflecting the diverse ways this technology is deployed across the automotive spectrum. The segmentation allows for a precise analysis of technological maturity and adoption rates within specific market niches. System type delineation distinguishes between architectures based on where the motor-generator is placed relative to the drivetrain, directly impacting efficiency and cost. Component segmentation highlights the critical technologies driving innovation and supply chain value. Vehicle type segmentation defines the target end-user base, dominated by passenger vehicles. Finally, application analysis illustrates the functional benefits and specific use cases that OEMs prioritize when implementing 48V systems, spanning from basic start-stop functionality to advanced chassis controls.

The analysis of the component segment shows that the DC/DC converter and the Battery segment are critical areas of investment. The DC/DC converter is essential for ensuring robust power flow between the 48V and 12V domains, and advancements in wide-bandgap semiconductors like Silicon Carbide (SiC) are improving converter efficiency and reducing heat loss. Simultaneously, the 48V battery segment, predominantly composed of lithium-ion technology, requires continuous development in energy density and thermal resilience to meet the demanding load cycles of regenerative braking and e-boosting. The interplay between these components is central to system performance, and ongoing optimization is key to achieving lower system weight and overall vehicle integration flexibility, which are critical metrics for OEM competitiveness in the MHEV space.

Furthermore, the segmentation by application underscores the expanding role of 48V technology beyond simple hybridization. While the Mild Hybrid Electric Vehicle (MHEV) application accounts for the largest market share, driven by fuel economy mandates, the growth in advanced applications such as electric boosting and integrated chassis systems is notable. Electric boosting, employing electric compressors or e-turbos powered by 48V, addresses turbo lag and enhances engine responsiveness, directly contributing to superior driving dynamics. This diversification of use cases confirms that 48V systems are not merely compliance tools but essential enablers of next-generation performance and comfort features, appealing strongly to the premium and performance segments globally.

- System Type: Belt-Driven Starter Generator (BSG), Integrated Starter Generator (ISG), Others (e.g., Crankshaft Mounted Starter Generator - CSM).

- Component: DC/DC Converter, 48V Battery (Li-ion), Motor Generator Unit (MGU), Power Electronics (Inverters, Control Units), Wiring Harness.

- Vehicle Type: Passenger Vehicle (Sedans, SUVs, Hatchbacks), Commercial Vehicle (Light Commercial Vehicles - LCVs).

- Application: Mild Hybrid Electric Vehicle (MHEV), Start/Stop System Enhancement, Regenerative Braking System, Electric Boosting/Turbocharging, Electric Chassis Components.

Value Chain Analysis For Automotive 48V System Market

The value chain for the Automotive 48V System Market is highly complex, involving specialized material suppliers, component manufacturers, Tier 1 system integrators, and ultimately, the OEMs and end-users. The upstream analysis is dominated by the sourcing of critical raw materials, specifically lithium, cobalt, and nickel for battery manufacturing, alongside specialized semiconductors (SiC, GaN) essential for high-efficiency power electronics like DC/DC converters and inverters. Component specialization occurs among manufacturers focusing on the MGU, the heart of the system, and battery suppliers. Intense competition among raw material providers and semiconductor fabrication plants dictates the upstream cost structure and supply stability, crucial elements given global supply chain sensitivities.

The middle segment of the value chain is commanded by large Tier 1 suppliers such as Bosch, Continental, and Valeo, who act as system integrators. These entities procure specialized components, integrate them into complete 48V architectures (BSG or ISG systems), and validate their performance before delivery to OEMs. Their role involves complex software development for control units (ECUs) to manage the dual voltage system, ensuring seamless interaction with the existing 12V network and the engine management system. Direct distribution channels are prevalent here, as Tier 1s negotiate long-term supply contracts directly with OEMs for specific vehicle platforms, necessitating strong collaborative relationships for co-development and integration support.

Downstream analysis involves the direct integration of these subsystems into the vehicle assembly lines of OEMs (e.g., VW Group, Daimler, Ford). The final distribution to the consumer often happens through indirect channels, primarily franchised dealerships globally. The aftermarket for 48V systems is nascent but growing, primarily focused on replacement batteries and specialized diagnostic tools. The nature of the technology, which is deeply embedded in the powertrain, limits independent repair and favors manufacturer-approved service centers. Indirect distribution via the extensive dealership network ensures that the finished MHEVs reach the global consumer base efficiently, supported by robust warranty and service structures maintained by the OEMs.

Automotive 48V System Market Potential Customers

The primary potential customers for Automotive 48V Systems are vehicle manufacturers, particularly Original Equipment Manufacturers (OEMs) focused on meeting mandatory fleet-wide emission reduction targets and seeking cost-effective electrification alternatives. OEMs producing high volumes of conventional gasoline and diesel engines constitute the largest buyer base, as 48V systems offer the quickest path to achieving significant CO2 savings without migrating entirely to expensive full BEV platforms in the near term. Specifically, manufacturers catering to the compact, mid-size sedan, and entry-level SUV segments globally are aggressively integrating 48V technology, viewing it as a standard feature necessary for maintaining competitiveness and complying with regulations in European and Asian markets.

A secondary, yet rapidly growing, customer segment includes manufacturers of heavy-duty commercial vehicles and specialized industrial equipment. While the initial focus was on passenger cars, the benefits of 48V systems—such as powering high-demand auxiliary functions (e.g., hydraulic pumps, active stabilization) and improving transient efficiency—are increasingly being recognized in trucking and construction industries. For these segments, 48V technology offers reduced engine idling time and supports the integration of advanced safety and telematics systems, contributing to lower operating costs and improved vehicle dynamics under heavy loads, driving procurement decisions based on total cost of ownership (TCO) improvements.

Furthermore, specialized engineering and performance tuning companies represent a niche customer segment. These buyers utilize 48V components, particularly e-turbos and high-power MGU units, for performance enhancement and vehicle customization, seeking to leverage the immediate torque delivery capabilities of the electrical system to augment internal combustion engine performance. While small in volume, this segment drives high-specification demand and contributes to accelerated innovation in power density and control software, often influencing the subsequent design choices made by mainstream OEMs seeking to integrate performance features derived from 48V technology into their standard product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 37.9 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Delphi Technologies, Valeo, Schaeffler AG, Lear Corporation, Mahle GmbH, Eaton Corporation, Ricardo PLC, GKN Driveline, BorgWarner Inc., Denso Corporation, Cummins Inc., Infineon Technologies AG, Nidec Corporation, Aptiv PLC, LG Chem, Samsung SDI, Vitesco Technologies, Marelli Holdings Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive 48V System Market Key Technology Landscape

The technological landscape of the Automotive 48V System Market is characterized by intense innovation focused on miniaturization, thermal management, and enhanced power density, specifically targeting the core components of the MHEV system. A central technology is the evolution of the Motor Generator Unit (MGU), transitioning from less efficient belt-driven configurations (BSG) to highly integrated, coaxial designs (ISG) or dedicated crank-mounted systems (CSM), which provide superior torque output and smoother power delivery. Parallel advancements in liquid cooling technologies and advanced packaging materials are essential for managing the heat generated by these high-power components, especially under high regenerative braking loads, ensuring reliability and maximizing efficiency within increasingly restricted engine bay spaces.

Another crucial technological development involves the DC/DC converter, which facilitates the bidirectional power flow between the 48V and 12V networks. The shift from traditional silicon-based semiconductors to wide-bandgap materials, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN), is revolutionizing converter design. These advanced materials enable significantly higher switching frequencies, leading to smaller, lighter, and more efficient converters with reduced parasitic losses. This technological leap not only improves overall system efficiency but also reduces the physical footprint and material requirements, directly contributing to cost reduction in high-volume applications and bolstering the system's viability for smaller vehicle platforms where space is a premium concern.

Furthermore, battery technology specific to 48V applications continues to advance, moving away from repurposed 12V battery components towards specialized, compact lithium-ion solutions optimized for high-power, short-duration cycling. These batteries are engineered for high C-rates (charge and discharge performance) required during instantaneous e-boost and rapid energy recapture during deceleration. Coupled with sophisticated, AI-enhanced Battery Management Systems (BMS), these batteries are achieving extended life cycles and greater thermal stability, addressing historical concerns regarding longevity and safety. The ongoing optimization of the overall system architecture, including high-voltage wiring harnesses optimized for weight and electromagnetic compatibility (EMC), is cementing 48V systems as a robust, scalable solution for future vehicle architectures.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth Drivers: APAC represents the largest and fastest-growing market for Automotive 48V Systems, primarily fueled by the massive automotive production base in China and the rapid adoption of MHEVs in South Korea and Japan. China’s New Energy Vehicle (NEV) mandate, while heavily focused on BEVs, also incentivizes technologies that reduce conventional engine emissions, placing 48V systems in a sweet spot for compliance and market volume. OEMs in this region benefit from low manufacturing costs and a highly developed local supply chain for power electronics and batteries. The demand is strong across the entire vehicle spectrum, from domestic budget models integrating BSG systems for basic efficiency gains to premium imported models featuring ISG and e-turbo configurations.

- European Market Necessity and Regulatory Pressure: Europe was an early adopter of 48V technology, driven by the severe financial penalties associated with failing to meet the EU's fleet-average CO2 targets. The European market, particularly Germany, France, and Italy, views the 48V system as a mandatory stop-gap solution necessary to bridge the gap until full BEV adoption stabilizes. The market penetration is exceptionally high in premium and high-performance segments, where 48V supports not only fuel economy but also complex features like active roll stabilization and electric power steering. The move towards Euro 7 standards ensures continuous high demand for 48V systems that deliver measurable, immediate emission reductions across the vehicle fleet.

- North American Market Acceleration and Performance Focus: The North American market, historically slower to adopt MHEV technology compared to Europe and China, is now accelerating rapidly, spurred by increasing CAFE standards and strong consumer acceptance of vehicles offering a blend of performance and efficiency. Unlike other regions, North American adoption often integrates 48V systems primarily for performance enhancement, such as supporting powerful e-boosters in light trucks and large SUVs, segments that dominate the regional sales landscape. Key states adopting stricter zero-emission vehicle (ZEV) mandates further compel manufacturers to deploy 48V systems across gasoline powertrains to improve overall fleet emissions metrics while maintaining desired vehicle size and utility.

- Latin America Market Penetration Challenges and Opportunities: The Latin American market presents a unique set of challenges, including price sensitivity and less stringent local emission standards in some countries compared to global benchmarks. However, the 48V system offers a valuable opportunity to modernize older engine platforms cost-effectively. Adoption is concentrated in major economies like Brazil and Mexico, where global OEMs have manufacturing operations. The gradual tightening of regional fuel economy standards, driven partly by international trade agreements, is expected to slowly increase the implementation rate of BSG-type 48V systems in locally produced passenger vehicles over the forecast period, focusing mainly on the lowest cost of entry hybridization.

- Middle East and Africa (MEA) Emerging Adoption: The MEA market, while currently small in terms of 48V system deployment, shows emerging potential, particularly in the Middle Eastern Gulf states where high-end vehicle imports are common. Here, adoption is driven by luxury features and high-performance applications, using 48V systems to power sophisticated comfort and chassis controls rather than solely focusing on fuel efficiency, given the historically low fuel prices. In parts of Africa, the focus remains on robust, conventional platforms, but the introduction of imported MHEVs from major European and Asian manufacturers is beginning to establish the technology, particularly in urban areas with developing infrastructure and nascent emission controls.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive 48V System Market.- Robert Bosch GmbH

- Continental AG

- Delphi Technologies

- Valeo

- Schaeffler AG

- Lear Corporation

- Mahle GmbH

- Eaton Corporation

- Ricardo PLC

- GKN Driveline

- BorgWarner Inc.

- Denso Corporation

- Cummins Inc.

- Infineon Technologies AG

- Nidec Corporation

- Aptiv PLC

- LG Chem

- Samsung SDI

- Vitesco Technologies

- Marelli Holdings Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive 48V System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between a 48V MHEV system and a traditional 12V system?

The fundamental difference lies in voltage capacity and functionality. A traditional 12V system is primarily designed for low-power auxiliary functions like lighting, infotainment, and ignition. A 48V Mild Hybrid Electric Vehicle (MHEV) system introduces a secondary, high-power 48V network capable of supporting energy-intensive functions such as regenerative braking, electric torque assist (e-boosting), and enhanced start-stop capabilities. The 48V system uses specialized components, including a high-efficiency Motor Generator Unit (MGU) and a DC/DC converter, to significantly improve fuel economy (typically 10-15%) and reduce CO2 emissions, functions beyond the capability of the older 12V architecture. This dual-voltage setup is crucial for meeting modern emission standards while maintaining high performance demands in the vehicle.

How do 48V systems contribute to meeting stringent global emission regulations like Euro 7?

48V systems are critical for compliance with rigorous emission regulations, such as the upcoming Euro 7 standard, by enabling mandatory fuel efficiency improvements. The system's MGU rapidly recoups kinetic energy during deceleration through regenerative braking, which is then stored in the 48V battery and reused to provide electric torque assist during acceleration (e-boost). This reduces the workload on the internal combustion engine (ICE), particularly during transient conditions and engine start-up, thereby lowering fuel consumption and tailpipe CO2 emissions directly. Additionally, 48V power can run high-draw components like electric pumps and electric compressors, allowing the engine to be shut off more frequently and for longer durations during idling or coasting, maximizing efficiency gains necessary for fleet-wide regulatory compliance.

What are the primary components of an Automotive 48V system and what role does each play?

The primary components of an Automotive 48V system include the Motor Generator Unit (MGU), the 48V Lithium-ion Battery, the DC/DC Converter, and the Power Electronics Control Unit. The MGU (either BSG or ISG) is the core electro-mechanical component, acting as both a generator to capture energy and an electric motor to provide torque assist and quick engine restarts. The 48V Battery stores the high-power electrical energy captured by the MGU, optimized for rapid charge/discharge cycles. The DC/DC Converter manages the bidirectional power flow, stepping down 48V power to charge the traditional 12V system and sometimes boosting the 12V power to prime the 48V network. Finally, the Power Electronics Control Unit (inverter/controller) manages the complex energy flow and communication between all components, orchestrating seamless operation with the vehicle’s main powertrain control modules, ensuring optimal performance and safety.

Are 48V mild hybrid systems expected to replace full hybrid or battery electric vehicles (BEVs)?

No, 48V mild hybrid systems are generally not expected to replace full hybrid electric vehicles (FHEVs) or pure Battery Electric Vehicles (BEVs); rather, they complement them within the electrification spectrum. 48V systems offer a highly cost-effective, low-complexity path to electrification for high-volume gasoline and diesel engines, serving as a critical transitional technology. FHEVs offer superior pure electric driving range and larger fuel savings due to higher voltage (typically 200V+) systems, while BEVs offer zero tailpipe emissions and much longer electric ranges. The 48V MHEV niche is defined by its ability to deliver significant emission reductions and performance enhancements at a minimal incremental cost compared to FHEVs or BEVs, making it an ideal solution for mass-market compliance and incremental vehicle refinement in the immediate future, particularly in markets where infrastructure for full BEVs is still developing.

What are the ongoing technological challenges in the 48V market regarding component integration?

The primary ongoing technological challenges center around thermal management and spatial integration, particularly for the Motor Generator Unit (MGU) and the power electronics. MGUs operate under significant heat stress due to high current flow and high rotational speeds, necessitating sophisticated liquid cooling systems that must be packaged within already crowded engine compartments. Furthermore, integrating the additional 48V battery and the DC/DC converter requires significant engineering effort to maintain vehicle safety standards, minimize weight, and ensure electromagnetic compatibility (EMC) between the two voltage domains. Miniaturization of the SiC-based power electronics is crucial for overcoming these spatial constraints, while developing standardized interfaces between Tier 1 supplier components and OEM engine platforms remains an industrial challenge impacting cost reduction and standardization efforts across the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager