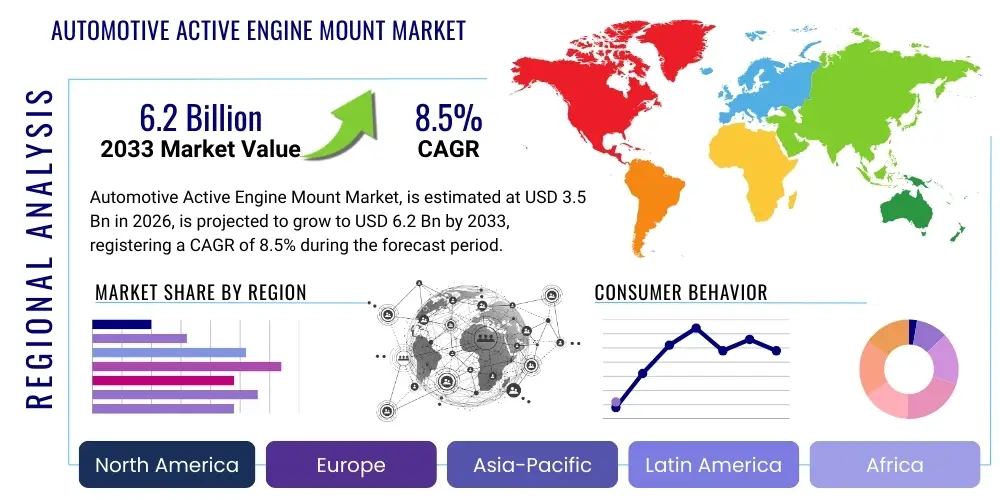

Automotive Active Engine Mount Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437676 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Automotive Active Engine Mount Market Size

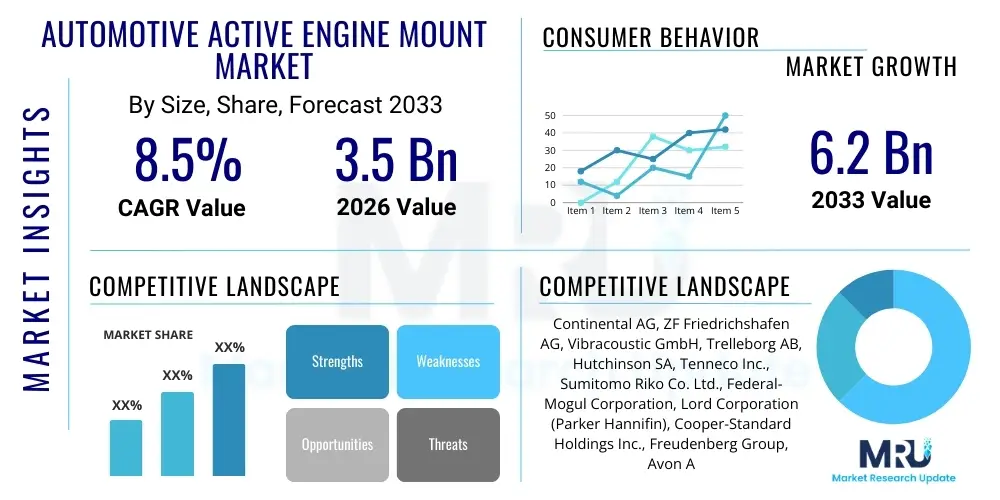

The Automotive Active Engine Mount Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Automotive Active Engine Mount Market introduction

The Automotive Active Engine Mount Market encompasses advanced vibration isolation systems designed to minimize the transfer of engine vibrations and noise to the vehicle chassis, thereby significantly enhancing Noise, Vibration, and Harshness (NVH) characteristics. Unlike passive mounts, active mounts utilize sensors, electronic control units (ECUs), and actuators (often electromagnetic or hydraulic with variable stiffness) to generate counteracting forces in real-time. These systems are crucial for modern vehicles, particularly those equipped with start-stop functionality or cylinder deactivation technologies, where inherent engine vibrations at low frequencies or during transient conditions are exacerbated. The primary product description focuses on a highly sophisticated mechatronic component that replaces traditional rubber or hydraulic passive mounts, offering adaptive damping tailored to specific engine operating parameters such as speed, torque, and vehicle dynamics.

Major applications of Active Engine Mounts (AEMs) span across various automotive segments, prominently in premium and luxury passenger vehicles, sports cars, and increasingly, high-performance SUVs and battery electric vehicles (BEVs) where the absence of internal combustion engine (ICE) noise makes other mechanical vibrations more noticeable. The benefits derived from AEM adoption include superior ride comfort, reduced driver fatigue on long journeys, and compliance with increasingly stringent internal and external noise regulations. Furthermore, AEMs allow engineers greater flexibility in engine design and calibration, enabling fuel efficiency improvements through aggressive engine operating strategies that might otherwise generate excessive vibrations.

Driving factors propelling this market include the global consumer demand for luxury features and enhanced in-cabin comfort, stringent regulatory mandates regarding vehicle noise emissions, and the rapid technological evolution in powertrain systems, necessitating more effective vibration isolation solutions. The continuous trend toward vehicle lightweighting and engine downsizing, which inherently increases vibration susceptibility, further fuels the adoption of active mounting solutions. The integration of advanced sensor technology and sophisticated control algorithms is making these systems more cost-effective and reliable for mid-range vehicle segments as well, moving them from niche luxury features to standard equipment in modern platforms.

Automotive Active Engine Mount Market Executive Summary

The Automotive Active Engine Mount Market is characterized by robust growth driven primarily by escalating consumer expectations for NVH performance and the proliferation of advanced powertrain architectures, particularly those involving hybridization and mandatory stop-start systems. Business trends indicate a strong focus on strategic partnerships between Tier 1 suppliers and specialized sensor and software developers to enhance control algorithms and reduce system integration complexity for OEMs. Key business opportunities are emerging within the electric vehicle (EV) sector, where active mounts must address different vibration frequencies associated with electric motors and road inputs, distinct from traditional ICE vibrations, demanding specialized product development in areas like active motor mounts.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily due to the rapid expansion of automotive manufacturing bases in China, India, and South Korea, coupled with rising disposable incomes leading to higher demand for premium vehicle features. North America and Europe maintain dominant market shares, representing established markets with high penetration of luxury and high-performance vehicles where AEM technology is already standard. European regulatory frameworks emphasizing NVH standards further solidify the region's strong adoption rates, while North American consumers prioritize luxury and driving comfort, sustaining high demand for these sophisticated damping systems.

Segmental trends reveal that the Electromagnetic Active Mount segment is experiencing the highest growth trajectory, favored for its superior responsiveness, precision, and lower energy consumption compared to traditional fluid-filled hydraulic active mounts. Based on vehicle type, the Passenger Car segment remains the largest volume driver, although the Electric Vehicle segment is poised for explosive growth as manufacturers seek bespoke NVH solutions for quiet, high-torque electric powertrains. The Original Equipment Manufacturer (OEM) sales channel dominates the market, reflecting the complex integration required during the vehicle assembly process, making the aftermarket penetration relatively low, although aftermarket service and replacement component demand is slowly increasing.

AI Impact Analysis on Automotive Active Engine Mount Market

Common user questions regarding AI's influence on the Automotive Active Engine Mount Market revolve around the feasibility of autonomous NVH optimization, the development of self-learning control systems, and the potential for predictive failure diagnostics. Users frequently inquire whether AI can dynamically adjust mount stiffness based on anticipated road conditions or driver behavior, moving beyond pre-programmed maps. The core themes center on AI enabling real-time, highly granular vibration cancellation tailored to instantaneous driving conditions, minimizing energy usage by the active system, and fundamentally reducing reliance on complex manual calibration efforts by engineers during the vehicle development phase. Concerns often touch upon the cybersecurity risks associated with integrating AI-driven ECUs that manage critical vehicle stability components.

The summarized expectation is that Artificial Intelligence, particularly Machine Learning (ML) algorithms, will transition active engine mounts from reactive or semi-active systems to fully adaptive, predictive systems. AI analyzes massive streams of sensor data—engine speed, acceleration, road texture, steering input—to predict vibration modes milliseconds before they occur. This predictive capacity allows the actuator to apply counter-phase forces proactively, achieving unprecedented levels of NVH mitigation. Furthermore, AI facilitates automated calibration and tuning, significantly reducing the time-to-market for new vehicle platforms utilizing AEM technology, making high-performance vibration control accessible across a wider range of vehicles.

The implementation of AI/ML models is also pivotal in enhancing the durability and longevity of active mounts. By continuously monitoring the performance parameters and internal state of the mount, AI systems can detect subtle deviations indicating impending wear or component degradation. This capability is integrated into the vehicle’s diagnostic system, providing drivers and service centers with predictive maintenance alerts. Such diagnostics not only improve safety and reliability but also reduce warranty claims for OEMs, establishing a critical competitive advantage for suppliers who can integrate sophisticated health monitoring features driven by deep learning algorithms.

- AI-driven control algorithms enable predictive NVH cancellation based on instantaneous sensor data.

- Machine Learning optimizes actuator response time and energy efficiency in real-time operation.

- AI facilitates automated, adaptive tuning of mount characteristics across diverse engine loads and road conditions.

- Deep learning models support predictive maintenance by identifying subtle degradation indicators in mount components.

- Enhanced cybersecurity measures are required for AI-integrated AEM control units to prevent system interference.

DRO & Impact Forces Of Automotive Active Engine Mount Market

The market for Automotive Active Engine Mounts is powerfully influenced by a combination of key drivers, inherent restraints, and compelling opportunities that shape its trajectory. The primary driver is the pervasive demand for superior Noise, Vibration, and Harshness (NVH) performance, especially in premium vehicles and electric vehicles where high levels of quietness are expected. This is complemented by regulatory pressures enforcing lower vehicle external noise limits. Conversely, restraints predominantly center on the high component cost associated with the complex mechatronic assembly, including sophisticated sensors, actuators, and dedicated ECUs, which limits broad adoption in economy and entry-level vehicle segments. Furthermore, the complexity involved in integrating and calibrating these systems with specific powertrain characteristics presents a significant technical hurdle for smaller OEMs.

Opportunities in the market are prominently linked to the proliferation of electric and hybrid vehicles. Although EVs eliminate ICE vibration, they introduce new challenges related to high-frequency motor noise and structure-borne road noise, demanding specialized active isolation techniques. The shift towards autonomous driving also creates opportunities, as passengers in self-driving cars will prioritize maximum comfort and silence, driving demand for advanced NVH solutions. Impact forces acting upon this market include the rapid pace of sensor technology miniaturization, which lowers system weight and cost, and the competitive landscape characterized by constant innovation in electromagnetic actuation technology, striving for faster response and higher damping efficiency to manage engine transients effectively.

The dynamic interplay between market drivers and technological advancements dictates market growth. While the high initial cost restrains mass-market penetration, the long-term industry shift toward mandatory acoustic performance standards and electrification acts as a sustained powerful driver. Suppliers are actively investing in R&D to develop standardized, modular active mounting systems that can be adapted across multiple vehicle platforms, effectively mitigating the complexity restraint. The macroeconomic environment, including raw material price volatility for components like rare-earth magnets used in actuators and specialized elastomers, also represents an external impact force influencing overall profitability and sourcing strategy within the value chain.

Segmentation Analysis

The Automotive Active Engine Mount Market is segmented based on critical factors including the Technology utilized, the type of Vehicle employing the mounts, the Sales Channel, and the Application Type (e.g., ICE, Hybrid, EV). This segmentation provides a granular view of market dynamics, revealing where investment is flowing and which product types are gaining traction due to technological superiority or suitability for emerging vehicle platforms. The technological segmentation is particularly crucial, differentiating between hydraulic-based active systems and the increasingly favored electromagnetic systems, while vehicle segmentation shows the gradual transition of AEMs from luxury sedans into high-volume SUV and crossover models, reflecting widening market acceptance driven by cost reduction and integration simplification.

- Technology Type:

- Active Hydraulic Mounts

- Active Electromagnetic Mounts

- Semi-Active Hydraulic Mounts

- Vehicle Type:

- Passenger Cars (Sedans, Hatchbacks, SUVs)

- Commercial Vehicles (Light Commercial Vehicles only)

- Electric Vehicles (BEVs, PHEVs)

- Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- Application:

- Internal Combustion Engine (ICE) Vehicles

- Hybrid Vehicles

- Pure Electric Vehicles (EV)

Value Chain Analysis For Automotive Active Engine Mount Market

The value chain for the Automotive Active Engine Mount Market begins with the upstream segment, which involves the sourcing and production of critical raw materials and specialized components. This includes the supply of high-grade elastomers (rubber compounds) optimized for fatigue resistance and specific stiffness characteristics, metals for brackets and housings, and, critically, sophisticated electronic components such as sensors (accelerometers, position sensors), rare-earth magnets for electromagnetic actuators, and microprocessors for the dedicated Electronic Control Units (ECUs). Suppliers in the upstream segment must meet rigorous automotive quality standards (e.g., IATF 16949) and often face challenges related to the volatile pricing of raw commodities and ensuring a stable supply of high-precision electronic parts necessary for active systems.

The core manufacturing and assembly stage involves specialized Tier 1 suppliers who integrate these components into the final active engine mount system. This midstream segment is highly technologically intensive, requiring expertise in fluid dynamics for hydraulic mounts or electromagnetism and precision machining for electromagnetic systems. Tier 1 manufacturers not only assemble the physical mounts but also develop and calibrate the proprietary control software and algorithms housed within the ECU. Distribution channels are predominantly direct (OEMs), characterized by long-term contracts and stringent requirements for Just-in-Time (JIT) delivery, reflecting the critical nature of these components in vehicle assembly lines.

The downstream segment primarily consists of the automotive OEMs, who integrate the active mount systems into specific vehicle platforms. Successful integration requires close collaboration between the mount supplier and the OEM's powertrain and chassis engineering teams to fine-tune the mount's performance to the engine's unique vibration signature and the vehicle's structural characteristics. Indirect distribution (aftermarket) is nascent but growing, mainly focusing on replacement components that require specialized diagnostic tools for recalibration upon installation. The complexity of AEMs ensures that the direct OEM channel remains dominant, providing better control over quality and system performance throughout the vehicle's life cycle, emphasizing the reliance on specialized servicing and high barrier to entry for independent aftermarket distributors.

Automotive Active Engine Mount Market Potential Customers

The primary potential customers and end-users of Automotive Active Engine Mount systems are Original Equipment Manufacturers (OEMs) across the globe, especially those operating within the premium, luxury, and high-performance vehicle segments. These OEMs, including key players in Germany, the United States, and Japan, require AEMs to meet high consumer demands for ride quality and to manage the complex NVH challenges posed by advanced powertrain designs such as downsized turbocharged engines and mandatory start-stop systems. The decision-makers within these organizations are typically powertrain engineers, NVH specialists, and platform purchasing managers who prioritize component reliability, integration feasibility, and the supplier's capability to co-develop custom control algorithms tailored to specific vehicle models.

A rapidly expanding customer base is the Electric Vehicle (EV) manufacturer segment, including established automakers transitioning to electric platforms and emerging pure-play EV companies. While EVs do not suffer from ICE vibrations, they require active mounts to isolate high-frequency motor whine and structure-borne road noise effectively, especially given the increased prominence of acoustic anomalies in the quiet EV cabin. These customers are seeking next-generation mounts that are lightweight, highly responsive, and capable of operating effectively over a wide range of frequencies, demanding specialized electromagnetic solutions optimized for motor isolation rather than engine isolation.

Secondary potential customers include specialized vehicle manufacturers, such as those producing high-end sports cars, large commercial fleet operators (focusing on operator comfort in high-mileage light commercial vehicles), and the professional independent aftermarket repair garages and dealership service centers. Although the aftermarket is smaller, it represents an important segment for high-margin replacement parts and diagnostics services necessary when the complex electronic components of an active mount fail. The purchasing criteria for these secondary customers revolve around ease of installation, availability of calibration software, and component durability comparable to the original OEM specification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, ZF Friedrichshafen AG, Vibracoustic GmbH, Trelleborg AB, Hutchinson SA, Tenneco Inc., Sumitomo Riko Co. Ltd., Federal-Mogul Corporation, Lord Corporation (Parker Hannifin), Cooper-Standard Holdings Inc., Freudenberg Group, Avon Automotive, Delphi Technologies, Showa Corporation, Boge Rubber & Plastics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Active Engine Mount Market Key Technology Landscape

The technological landscape of the Automotive Active Engine Mount Market is defined by the continual advancement in sensor fusion, control systems, and actuation mechanisms aimed at maximizing vibration isolation efficiency across a dynamic range of frequencies. The core technology centers on developing highly responsive actuators—primarily electromagnetic solenoids or sophisticated fluid-filled hydraulic chambers with controllable orifices—that can generate counter-vibrations precisely out of phase with the engine's inherent vibrations. A major focus area is the miniaturization and cost reduction of the Electronic Control Units (ECUs) and associated wiring harnesses, enabling seamless integration into diverse vehicle platforms without adding excessive weight or complexity, thus moving the technology beyond just the ultra-luxury segment.

A significant trend is the increasing reliance on advanced control algorithms, moving from lookup-table-based reactive systems to adaptive and predictive control strategies. Modern AEMs utilize proprietary software based on H-infinity control theory or adaptive filtering (like Least Mean Squares) to learn the vehicle's specific vibration characteristics in real-time and adjust the damping profile accordingly. Furthermore, the integration of high-speed sensors, such as high-g accelerometers and magnetostrictive sensors, allows for near-instantaneous measurement of vibration input, crucial for managing extremely transient conditions like engine start-up or sudden torque changes, which are the most challenging scenarios for NVH control.

The advent of electric vehicles is spurring research into new materials and designs. For EV applications, the technology emphasis shifts to isolating high-frequency noise generated by electric motors and gears, requiring stiffer materials with optimized acoustic properties. Suppliers are exploring piezoelectric actuation technologies, which offer extremely fast response times and high force density, suitable for canceling high-frequency motor whine. Furthermore, the development of semi-active mounts, which use variable damping without requiring a continuous power source for counter-force generation, represents a crucial midpoint technology, offering better performance than passive mounts at a reduced cost and complexity compared to fully active systems, catering to the large mid-market segment.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, fueled by robust automotive production, particularly in China and India. The increasing affluence across the region is driving higher consumer expectations for luxury features and ride comfort, promoting AEM adoption in locally manufactured premium vehicles. Government emphasis on lowering environmental noise pollution also acts as a regulatory driver, compelling OEMs to adopt advanced NVH solutions.

- Europe: Europe holds a significant market share, characterized by high penetration of high-end passenger cars and strict noise emission standards (e.g., EU noise limits). The strong presence of global luxury brands (German OEMs) that prioritize NVH performance ensures sustained demand. The rapid shift toward hybridization and EV production in this region necessitates sophisticated active mounts optimized for electric powertrain characteristics.

- North America: North America remains a dominant market, largely driven by strong consumer demand for large, comfortable SUVs and luxury vehicles, where AEMs are often standard equipment. High average vehicle transaction prices enable faster integration of expensive technologies. The region focuses heavily on technological advancements in control systems and reliability to withstand diverse temperature and road conditions.

- Latin America (LATAM): LATAM is an emerging market, currently characterized by lower penetration due to cost constraints, but showing potential growth, particularly in Brazil and Mexico, as local manufacturing scales up and exports of higher-specification vehicles increase. Adoption is currently concentrated in locally assembled premium models and imported luxury vehicles.

- Middle East and Africa (MEA): The MEA region is primarily driven by the import of luxury vehicles, with demand concentrated in wealthy Gulf Cooperation Council (GCC) countries. Limited local R&D capacity means the market heavily relies on imported technologies, often seeking the highest-specification AEM systems available globally to meet discerning luxury consumer preferences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Active Engine Mount Market.- Continental AG

- ZF Friedrichshafen AG

- Vibracoustic GmbH

- Trelleborg AB

- Hutchinson SA

- Tenneco Inc.

- Sumitomo Riko Co. Ltd.

- Federal-Mogul Corporation

- Lord Corporation (Parker Hannifin)

- Cooper-Standard Holdings Inc.

- Freudenberg Group

- Avon Automotive

- Delphi Technologies

- Showa Corporation

- Boge Rubber & Plastics

- Polytec Holding AG

- Tokai Rubber Industries, Ltd.

- Sichuan Chengdu Bus Co., Ltd.

- Toyo Tire Corporation

Frequently Asked Questions

Analyze common user questions about the Automotive Active Engine Mount market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Active and Passive Engine Mounts?

Passive mounts use static material stiffness (rubber or hydraulic fluid) to dampen vibrations, offering fixed performance. Active mounts, conversely, use sensors and electronic actuators controlled by an ECU to generate dynamic, counteracting forces in real-time, optimizing vibration cancellation across variable engine speeds and loads, significantly enhancing Noise, Vibration, and Harshness (NVH) characteristics.

How do Active Engine Mounts benefit electric vehicles (EVs)?

For EVs, active mounts are essential for isolating high-frequency motor whine, gear noise, and structure-borne road inputs that become prominent due to the absence of combustion engine noise. They use specialized tuning and actuation mechanisms to manage these unique, higher-frequency vibrations, maintaining a silent and premium cabin experience.

Which technology segment is expected to show the highest growth in the AEM market?

The Active Electromagnetic Mount segment is projected to experience the highest growth rate. Electromagnetic systems offer superior speed, precision, and energy efficiency compared to traditional active hydraulic systems, making them highly suitable for advanced powertrain management, particularly in high-performance and future electric vehicle platforms.

What are the main restraints hindering the mass adoption of AEMs?

The primary restraints are the high complexity and associated cost of the system, including specialized sensors, actuators, and dedicated electronic control units (ECUs). This high cost limits their adoption primarily to the luxury and premium vehicle segments, presenting a challenge for integration into mass-market economy cars.

How does AI contribute to the future performance of Active Engine Mounts?

AI, through machine learning algorithms, enables active mounts to transition to predictive systems. AI analyzes real-time sensor data (road conditions, acceleration, engine output) to anticipate vibration events and proactively apply counter-forces, optimizing NVH suppression and also facilitating predictive maintenance monitoring.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager