Automotive Active Purge Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433767 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Active Purge Pumps Market Size

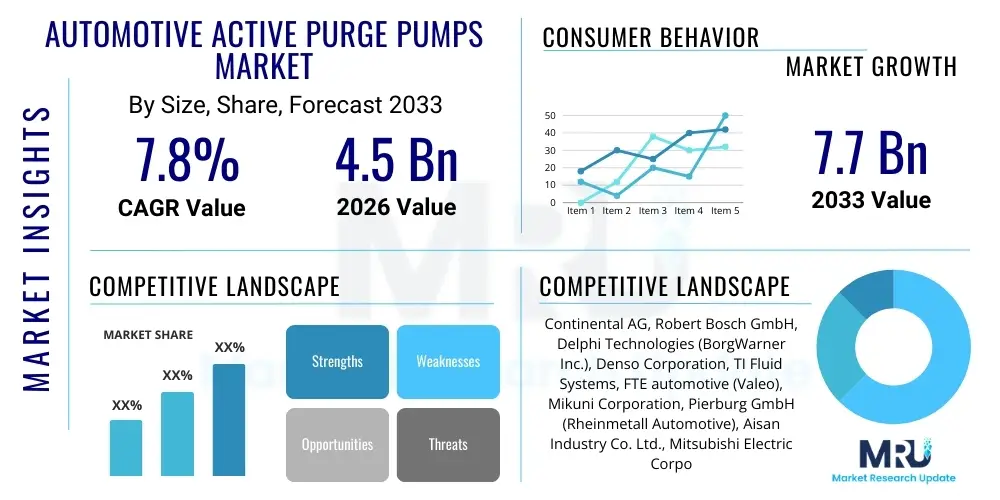

The Automotive Active Purge Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Automotive Active Purge Pumps Market introduction

The Automotive Active Purge Pumps Market encompasses the design, manufacturing, and distribution of electro-mechanical devices integral to the Evaporative Emission Control System (EVAP) in modern vehicles. These pumps, often mandated by strict governmental emission standards globally, actively manage the flow of fuel vapors stored in the carbon canister back into the engine intake manifold for combustion. Unlike passive purge systems that rely solely on engine vacuum, active purge pumps utilize sophisticated electronic control units (ECUs) and sensors to regulate vapor flow precisely, optimizing fuel efficiency and significantly reducing harmful hydrocarbon (HC) emissions released into the atmosphere, a critical requirement under regulations like Euro 6d and LEV III. The primary product is a compact, high-efficiency electrical pump assembly that incorporates integrated valves and diagnostic capabilities.

Major applications of these active systems are concentrated within gasoline-powered passenger vehicles and light commercial vehicles, particularly those equipped with modern powertrain technologies such as direct injection and turbocharging, where manifold vacuum is often insufficient or highly variable. The pumps ensure that the EVAP system operates effectively across all engine loads and ambient temperatures, preventing canister saturation and subsequent vapor leakage. Key benefits derived from the implementation of active purge pumps include enhanced compliance with mandated evaporative emission thresholds, improved vehicle fuel economy through vapor recycling, and superior diagnostic capabilities that aid in real-time monitoring and reporting to the On-Board Diagnostics (OBD) system, which is crucial for maintaining vehicle reliability and regulatory compliance over its operational lifespan.

The market growth is fundamentally driven by the continuous tightening of global evaporative emission standards, compelling Original Equipment Manufacturers (OEMs) across all major regions—North America, Europe, and Asia Pacific—to upgrade their EVAP infrastructure from passive to active systems. Furthermore, the rising production volumes of gasoline vehicles in developing economies and the increasing complexity of vehicle architectures, which necessitate precise vapor control independent of engine load, act as powerful driving factors. The shift toward hybrid vehicles (HEVs and PHEVs), which experience frequent engine cycling, also bolsters demand, as active purge systems are essential for maintaining emission control during stop-start and electric-only driving phases.

Automotive Active Purge Pumps Market Executive Summary

The Automotive Active Purge Pumps Market is characterized by robust growth underpinned by stringent global environmental regulations focused on reducing hydrocarbon emissions, particularly from gasoline vehicles. Business trends indicate a strategic focus among Tier 1 suppliers toward miniaturization, integration of smart sensors, and the development of pumps capable of handling varied vapor compositions and flow rates, essential for compatibility with flex-fuel and mild-hybrid vehicle platforms. The market is moderately concentrated, with key players investing heavily in proprietary motor control technologies and diagnostic software to offer highly reliable and durable components to OEMs globally. A significant trend involves the optimization of pump energy consumption, addressing concerns related to the overall electrical load, especially in battery-electric and plug-in hybrid vehicles (PHEVs) where system efficiency is paramount. The long-term business trajectory suggests that system integration, moving from separate components to complete, optimized EVAP modules, will be a critical competitive differentiator.

Regionally, Asia Pacific (APAC), particularly China and India, presents the highest growth opportunities due to escalating vehicle production and the rapid adoption of Euro 6/China 6 equivalent emission standards, forcing a massive market conversion from older passive systems. Europe remains a stable market, driven by continuous adherence to rigorous WLTP (Worldwide Harmonized Light Vehicles Test Procedure) testing protocols that emphasize real-world driving emissions, necessitating robust active controls. North America, governed by stringent EPA and CARB regulations (e.g., LEV III), maintains high demand for active purge systems, particularly in large pickup trucks and SUVs which dominate the light-duty fleet. Future regional expansion is intrinsically linked to emerging automotive hubs in Southeast Asia and Latin America as these jurisdictions phase in equivalent advanced emission control mandates.

Segmentation trends highlight that the Passenger Car segment, particularly sedans and SUVs, remains the largest application base, owing to sheer production volume and regulatory focus on this category. From a component perspective, electronically controlled valve mechanisms and high-efficiency Brushless Direct Current (BLDC) motors are witnessing rapid technological advancement, commanding higher unit prices and driving value growth. The OEM segment accounts for the overwhelming majority of sales, reflecting the critical nature of these components in initial vehicle design and assembly. However, the aftermarket segment is projected to show accelerated growth as the global vehicle parc ages, requiring replacement of EVAP components over their 8-15 year mandated life cycles, thereby ensuring long-term stable revenue streams beyond initial vehicle production cycles.

AI Impact Analysis on Automotive Active Purge Pumps Market

Common user questions regarding AI's impact on the Automotive Active Purge Pumps Market frequently revolve around predictive maintenance, optimization of system efficiency, and how AI might aid in compliance and warranty claim reduction. Users are concerned about whether AI integration will significantly increase component complexity and cost, or if it will primarily serve as a diagnostic tool. Key themes emerging from these inquiries include the expectation that AI-driven analytics, leveraging data from the ECU and EVAP sensors, could forecast potential pump failures before they occur, optimizing vehicle uptime and reducing costly warranty repairs for OEMs. There is also a strong interest in using machine learning algorithms to refine the purge strategy in real-time, adapting vapor flow rates dynamically based on driving patterns, fuel level, ambient conditions, and engine health, thereby ensuring compliance and maximizing fuel efficiency under non-standard operating conditions that traditional lookup tables struggle to address.

While the physical design and mechanical functionality of the active purge pump remain hardware-intensive, AI’s influence is predominantly felt in the intelligent control and diagnostics layer. AI/ML algorithms can ingest vast datasets generated by fleets (telematics data) to identify correlations between environmental factors, driver behavior, and system degradation patterns specific to the purge pump assembly, leading to significant improvements in reliability design iterations. This predictive capability moves beyond simple threshold monitoring, enabling the pump’s control software to proactively adjust its operation to mitigate potential stress points, ensuring the component lasts the full regulatory-mandated lifespan (often 150,000 miles or more) without failure, a major concern for automakers facing stringent emissions performance durability requirements.

Furthermore, AI-enhanced diagnostic systems embedded within the vehicle’s OBD system can precisely isolate the root cause of EVAP malfunction codes (DTCs), distinguishing between a failed pump, a leak in the vapor line, or a fault in the canister itself. This precision dramatically reduces 'No Fault Found' returns during service and accelerates repair times, improving the customer experience and lowering service costs for dealerships. The adoption of AI-driven optimization loops allows component manufacturers to validate their products against complex real-world driving cycles much faster than conventional testing, leading to accelerated product development cycles for newer, more efficient active purge pump generations tailored for varying global emission landscapes.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast potential pump failures, minimizing warranty claims and maximizing vehicle uptime.

- Real-time Purge Strategy Optimization: Machine learning algorithms adjust vapor flow and pump duty cycles dynamically based on driving conditions and environmental variables for optimal emission compliance.

- Enhanced On-Board Diagnostics (OBD): AI improves fault isolation accuracy within the complex EVAP system, reducing diagnostic time and service costs.

- Accelerated Design Validation: ML models speed up the simulation and testing of pump durability against stringent regulatory lifespan requirements.

- Supply Chain Forecasting: AI aids manufacturers in predicting demand fluctuations based on regional emission policy changes and OEM production schedules.

DRO & Impact Forces Of Automotive Active Purge Pumps Market

The market for Automotive Active Purge Pumps is principally shaped by the interplay of regulatory imperatives (Drivers) and technical complexities (Restraints), with significant long-term growth predicated on evolving propulsion technologies (Opportunities). The dominant driver is the unrelenting global push toward zero and near-zero evaporative emissions, requiring vehicles to maintain compliance even during non-running periods or extreme temperature variations, a task uniquely suited for active, electrically-driven systems. The primary restraint stems from the added complexity, cost, and energy draw introduced by active components compared to traditional passive systems. However, the largest opportunities lie in the rapidly expanding hybrid vehicle segment and the development of standardized, integrated EVAP modules that simplify assembly and maintenance for OEMs, mitigating the historical restraints associated with component integration.

Drivers: The global adoption of stricter emission standards such as China 6, Euro 6d, and U.S. LEV III mandates a significant reduction in evaporative hydrocarbon emissions (HC). Active purge pumps offer the precise, electronically controlled vapor management necessary to meet these challenging targets, particularly when the engine vacuum is low (e.g., turbocharged, direct injection, or hybrid vehicles). Furthermore, increasing consumer demand for fuel-efficient vehicles indirectly drives the adoption of active systems, as the controlled recycling of fuel vapors contributes positively to overall vehicle fuel economy, thereby justifying the higher component cost. The standardization of enhanced OBD monitoring globally necessitates components capable of providing continuous, accurate feedback on their status, a feature inherently built into electronically controlled active purge pumps.

Restraints: The most significant restraint is the higher manufacturing and procurement cost associated with active electromechanical pumps compared to simple vacuum valves. This added cost places pressure on OEM profit margins, particularly in the highly competitive entry-level and mass-market vehicle segments. Technical challenges, including managing noise, vibration, and harshness (NVH) produced by the electric pump and ensuring long-term durability against corrosive fuel vapors and temperature extremes, also pose developmental hurdles. Additionally, the proliferation of Battery Electric Vehicles (BEVs), which do not require EVAP systems, represents a long-term existential threat, gradually reducing the overall serviceable market size, though this shift is slow and regionally varied.

Opportunities: Opportunities abound in the burgeoning market for Plug-in Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs). These architectures require specialized EVAP systems because the internal combustion engine cycles on and off frequently, demanding rapid and reliable purging when the engine is running—a function optimized by active pumps. Additionally, market expansion into advanced, integrated EVAP modules, combining the canister, pump, and leak detection elements into a single, pre-validated unit, offers efficiency gains and reduces OEM integration complexity. The aftermarket also presents a robust opportunity driven by the mandatory replacement cycle of these critical emission components over the vehicle's prolonged regulatory lifespan.

Segmentation Analysis

The Automotive Active Purge Pumps Market is systematically segmented based on criteria that reflect both application requirements and technological composition. Key segmentation variables include the component type (defining the technology used), the vehicle type (defining the application environment and volume), the sales channel (defining the market path), and the propulsion type (defining the specific technological need). This granular analysis enables manufacturers and suppliers to strategically target resources toward segments exhibiting the highest growth potential, such as the PHEV and Passenger Car segments, which are heavily influenced by the latest emission regulations. Understanding these segments is crucial for aligning production capabilities with OEM demand trends, especially concerning the shift towards highly integrated, compact pump modules.

The segmentation by Component Type is crucial as it dictates manufacturing complexity and unit cost. It separates standard pumps from those incorporating advanced features like integrated leak detection sensors or sophisticated solenoid valve systems for finer flow control. The Vehicle Type segmentation highlights the dominance of Passenger Cars, where the overwhelming majority of EVAP systems are installed due to stringent regulations and high production volumes, contrasting with the smaller, though still critical, Commercial Vehicle segment. Furthermore, the segmentation by Sales Channel reinforces the market's structure, dominated by OEM sales but increasingly supported by a stable and growing aftermarket focused on regulatory compliance and maintenance.

- By Component Type:

- Pump Module (including motor and housing)

- Integrated Valve and Sensor Assembly

- Control Electronics and Diagnostics

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Light Commercial Vehicles (LCVs)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Propulsion Type:

- Gasoline Internal Combustion Engine (ICE)

- Hybrid Electric Vehicles (HEV/PHEV)

Value Chain Analysis For Automotive Active Purge Pumps Market

The value chain for the Automotive Active Purge Pumps Market begins with Upstream Analysis, focusing heavily on raw material suppliers, specifically specialized plastics (e.g., high-temperature resistant polymers), permanent magnet suppliers (for BLDC motors), and semiconductor component providers (for ECUs and sensors). The quality and cost of these specialized materials, which must withstand harsh under-hood environments and corrosive fuel vapors, are critical determinants of the final product's performance and unit cost. Key suppliers in the upstream segment include specialized chemical companies and microelectronics manufacturers, whose innovation in material science directly impacts the pump's durability and miniaturization capabilities. Maintaining stable sourcing and mitigating supply chain risks, particularly concerning geopolitical disruption in electronics manufacturing, is paramount for profitability in this market segment.

The midstream involves the core manufacturing process, dominated by Tier 1 automotive suppliers. This stage includes precision molding, assembly of the motor and valve mechanism, calibration, and rigorous end-of-line testing for flow rate and leak integrity. Manufacturing is highly automated, leveraging advanced robotics and clean-room environments to ensure the component meets demanding OEM quality standards and regulatory compliance. The distribution channel is predominantly Direct, where Tier 1 suppliers negotiate long-term contracts directly with Original Equipment Manufacturers (OEMs) for integration into new vehicle platforms. The stringent validation process required by OEMs means that once a supplier is selected for a specific platform, the relationship is long-lasting, creating high barriers to entry for new competitors and reinforcing the importance of established supplier relationships.

Downstream Analysis centers on the installation of the pump into the vehicle assembly line and subsequent aftermarket services. The Indirect channel primarily pertains to the aftermarket, where distributors and wholesalers supply replacement pumps to independent repair shops and franchised dealerships. Since the purge pump is a mandatory emission component, failure often triggers a diagnostic trouble code (DTC) requiring immediate replacement to maintain regulatory compliance, ensuring a steady aftermarket demand. The performance of the pump in the field, coupled with data collected via vehicle telematics, feeds back into the upstream R&D cycle, driving continuous product improvement and defining the competitive edge through enhanced reliability and extended service life.

Automotive Active Purge Pumps Market Potential Customers

Potential customers for Automotive Active Purge Pumps are primarily segmented into two distinct groups: Original Equipment Manufacturers (OEMs) and the automotive aftermarket service industry. OEMs represent the largest customer base, requiring high volumes of customized pumps integrated seamlessly into their specific vehicle platforms (e.g., Ford, Volkswagen, Toyota, General Motors). These customers demand highly reliable components that meet specific NVH, packaging, and regulatory requirements (often warrantied for 10-15 years or 150,000 miles). The purchasing criteria for OEMs are deeply technical, focusing on durability validation, precision control mechanisms, and the ability of the supplier to manage complex global logistics and high-volume quality control, necessitating long-term strategic partnerships with Tier 1 component manufacturers.

The second major group comprises the aftermarket segment, including franchised dealerships, large retail auto parts chains, independent garages, and national maintenance centers. These customers purchase replacement units to service vehicles whose original EVAP components have failed, typically after several years of operation. Unlike OEMs, aftermarket buyers prioritize availability, standardization, competitive pricing, and ease of installation, although quality remains non-negotiable due to the emission-critical nature of the component. The growth of the aftermarket segment is directly correlated with the global aging vehicle fleet equipped with these active systems and the strict enforcement of periodic emission testing and maintenance mandates.

Furthermore, specialized engineering firms and regulatory bodies occasionally act as indirect customers by procuring pumps for research, testing, and validation purposes related to new vehicle development and future emission compliance standards. The shift towards global vehicle platforms means that OEMs often source pumps globally but require local technical support and logistics, making suppliers with extensive international manufacturing and distribution footprints the preferred partners across all purchasing tiers and geographical locations. The rise of integrated EVAP modules means that purchasing decisions increasingly favor suppliers who can provide complete, pre-validated systems rather than just discrete pump units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Delphi Technologies (BorgWarner Inc.), Denso Corporation, TI Fluid Systems, FTE automotive (Valeo), Mikuni Corporation, Pierburg GmbH (Rheinmetall Automotive), Aisan Industry Co. Ltd., Mitsubishi Electric Corporation, Standard Motor Products, Inc., Johnson Electric, ACDelco (GM), Vitesco Technologies, Uchiya Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Active Purge Pumps Market Key Technology Landscape

The technological landscape of the Automotive Active Purge Pumps Market is defined by continuous innovation focused on optimizing efficiency, reducing size, and enhancing diagnostic capabilities to meet future regulatory demands. A critical shift involves the widespread adoption of Brushless Direct Current (BLDC) motors over older brushed technologies. BLDC motors offer significantly longer lifespans, higher efficiency, and quieter operation, which is crucial for modern vehicle architectures where NVH performance is highly scrutinized, particularly in electric and hybrid modes. These motors are paired with sophisticated electronic control units (ECUs) that manage pulse width modulation (PWM) to regulate pump speed and flow rate precisely, allowing the system to respond instantly to varying engine and ambient conditions. Miniaturization techniques are also pivotal, enabling the integration of the pump directly onto or into the carbon canister, reducing overall system complexity and simplifying vehicle assembly.

Another major technological advancement is the integration of advanced diagnostic and sensing capabilities. Modern active purge pumps often include pressure sensors, temperature sensors, and sometimes dedicated flow meters to provide real-time data back to the vehicle’s central ECU. This integration supports highly accurate leak detection protocols, mandated by U.S. and European standards, which require the system to detect leaks as small as 0.020 inches. Suppliers are developing "smart pump" modules that incorporate proprietary software algorithms capable of executing complex diagnostic routines independent of the main vehicle computer. This decentralization of processing power enhances system responsiveness and allows for quicker and more precise fault identification, substantially improving OBD compliance rates and reducing false positive trouble codes, which are costly for both consumers and manufacturers.

Furthermore, the material science supporting the technology landscape is evolving rapidly. There is a concerted effort to use enhanced polymer composites that exhibit superior resistance to ethanol (E10, E15, E85) and methanol blends, ensuring longevity and performance integrity under diverse fuel compositions found globally. Packaging optimization focuses on creating highly compact, sealed modules resistant to moisture ingress and extreme under-hood temperatures, which can exceed 100°C. Future technological trends point toward the standardization of smart network interfaces (e.g., CAN bus connectivity for diagnostic communication), allowing the purge pump to function as an integral node within the vehicle's broader control network, facilitating faster communication and over-the-air updates for control algorithms, further solidifying the role of electronics in this electro-mechanical system.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven primarily by China and India. The mandatory adoption of China 6 standards and equivalent stringent regulations across ASEAN nations has created an enormous conversion market, forcing older, passive EVAP technologies out in favor of active purge systems. High volume production of light-duty gasoline vehicles, coupled with government incentives for cleaner vehicles, fuels demand. Japan and South Korea, mature markets, focus heavily on technological innovation, specializing in high-efficiency pumps tailored for hybrid and advanced GDI (Gasoline Direct Injection) engines. The region's competitiveness centers on localizing manufacturing to manage supply chain costs and respond quickly to rapidly evolving regional emissions schedules.

- North America: This region represents a mature, high-value market driven by the stringent mandates of the U.S. Environmental Protection Agency (EPA) and the California Air Resources Board (CARB), particularly the LEV III and future emissions programs. Demand is stable and consistent, influenced heavily by the large proportion of light trucks and SUVs, which often require robust and high-capacity purge pumps. Suppliers focus intensely on durability and regulatory compliance testing, as the warranty periods and regulatory penalties for non-compliance are severe. The market is highly saturated with established Tier 1 suppliers, making technological differentiation in durability and diagnostic performance key competitive advantages.

- Europe: The European market is characterized by a high degree of complexity due to diverse regional fuel standards and the rigorous demands of the WLTP testing cycle, which stresses real-world evaporative emissions control. While the long-term trend leans toward full electrification, the short-to-medium term requirement for highly efficient gasoline, mild-hybrid, and plug-in hybrid engines sustains robust demand for sophisticated active purge pumps. European OEMs prioritize integration complexity and lightweighting, driving suppliers to develop ultra-compact, multi-functional EVAP modules that minimize packaging space under the bonnet and adhere to strict European quality norms.

- Latin America: This region is an emerging market with significant long-term potential. Growth is catalyzed by the gradual phase-in of stricter emission controls, moving away from Euro 4/5 equivalents toward Euro 6 alignment in major economies like Brazil and Mexico. The market is cost-sensitive, often relying on global OEM platforms being localized. As regulatory enforcement tightens, the shift from basic passive systems to active pumps becomes inevitable, creating sustained growth opportunities for suppliers capable of providing reliable technology at competitive price points and managing complex local logistics and regulatory harmonization challenges across the continent.

- Middle East and Africa (MEA): The MEA market is highly heterogeneous. Demand is localized, primarily concentrated in the affluent Gulf Cooperation Council (GCC) states and South Africa, which often follow Euro or U.S. standards through vehicle import mandates. Growth is moderate and tied to vehicle sales volume and the gradual introduction of fuel quality standards. The key technical challenge in this region is ensuring pump reliability under extreme high-temperature and dusty conditions, necessitating specialized housing materials and enhanced sealing mechanisms to ensure long-term functionality, presenting a niche market for high-durability pump designs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Active Purge Pumps Market.- Continental AG

- Robert Bosch GmbH

- Delphi Technologies (BorgWarner Inc.)

- Denso Corporation

- TI Fluid Systems

- FTE automotive (Valeo)

- Mikuni Corporation

- Pierburg GmbH (Rheinmetall Automotive)

- Aisan Industry Co. Ltd.

- Mitsubishi Electric Corporation

- Standard Motor Products, Inc.

- Johnson Electric

- ACDelco (GM)

- Vitesco Technologies

- Uchiya Co., Ltd.

- Magneti Marelli CK Holding (Marelli)

- Kautex Textron GmbH & Co. KG

- Tokai Rika Co., Ltd.

- Hella GmbH & Co. KGaA

- Ningbo Tuopu Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Active Purge Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Automotive Active Purge Pump?

The primary function is to precisely control the flow of fuel vapors stored in the charcoal canister back into the engine intake manifold for combustion. This process, known as purging, is essential for minimizing harmful evaporative hydrocarbon (HC) emissions, ensuring compliance with global environmental regulations like Euro 6 and LEV III, and improving overall fuel efficiency by recycling vapors.

How do active purge pumps differ from older passive EVAP systems?

Passive systems rely solely on engine vacuum, which is unreliable in modern engines (like turbocharged GDI) that often produce low vacuum. Active purge pumps use an electric motor and integrated control electronics to generate the necessary pressure differential and precisely regulate vapor flow independent of engine load, guaranteeing consistent and optimized emission control under all operating conditions, crucial for meeting stringent modern testing protocols.

Which regulatory standards are driving the most significant demand for these pumps?

The most significant demand is driven by the implementation of the U.S. LEV III standards, the European Union's Euro 6d regulations, and the China 6 emission mandates. These regulations require extremely low evaporative emissions and necessitate high-precision active systems capable of accurate leak detection and real-time vapor management throughout the vehicle's lifespan.

How does the growth of Hybrid Electric Vehicles (HEVs) impact the Active Purge Pumps Market?

The growth of HEVs and PHEVs positively impacts the market. These vehicles frequently cycle the internal combustion engine on and off. During engine start-up after an electric drive phase, a precise and immediate purge cycle is required, a function that only high-speed, electronically controlled active purge pumps can reliably execute to prevent emission spikes.

What is the expected long-term impact of Battery Electric Vehicles (BEVs) on this market?

While BEVs do not require EVAP systems, representing a long-term threat to the overall market size, their mass adoption rate is slow and varied geographically. In the short to medium term (2026-2033), the continuing dominance and high production volume of gasoline and hybrid vehicles ensure sustained demand and growth for active purge pumps, delaying the immediate negative impact of full electrification on this specific component market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager