Automotive Adaptive Variable Suspension System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434787 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Adaptive Variable Suspension System Market Size

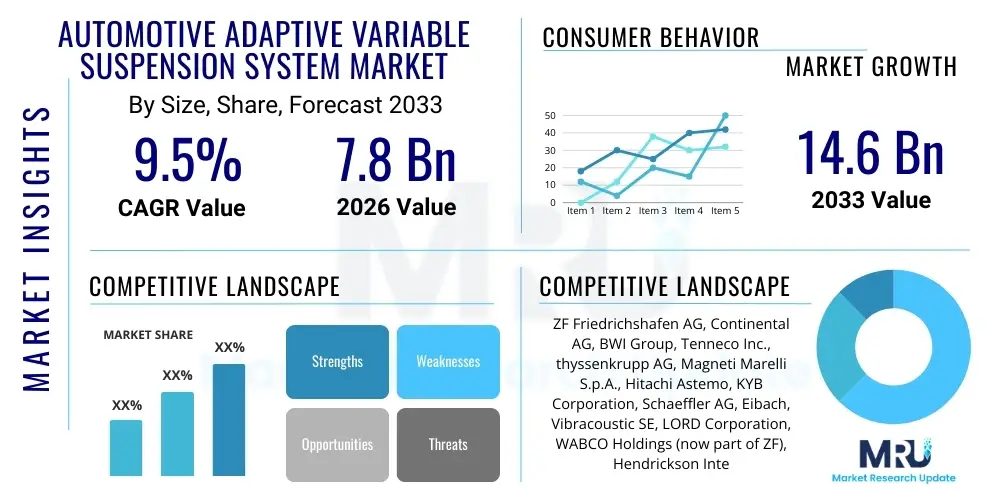

The Automotive Adaptive Variable Suspension System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $7.8 Billion in 2026 and is projected to reach $14.6 Billion by the end of the forecast period in 2033.

Automotive Adaptive Variable Suspension System Market introduction

The Automotive Adaptive Variable Suspension System Market encompasses advanced vehicular technologies designed to dynamically adjust the vehicle's ride characteristics, damping rates, and spring stiffness in real-time. This sophisticated technology moves beyond traditional passive suspension systems by utilizing sensors, electronic control units (ECUs), and actuators to monitor road conditions, driver inputs, and vehicle load, thereby optimizing performance, safety, and comfort simultaneously. These systems are crucial for maintaining optimal tire contact with the road surface, reducing body roll during cornering, and absorbing vibrations efficiently, offering a customized driving experience tailored to different environments, ranging from smooth highways to rugged off-road terrains. The core mechanism involves instant adjustments to shock absorber fluid flow or air spring pressure, ensuring immediate responsiveness to dynamic operational requirements.

Product description centers on systems like Continuous Damping Control (CDC), Adaptive Air Suspension (AAS), and Magnetic Ride Control (MRC). CDC systems continuously adjust the damping force based on vehicular movement inputs, optimizing wheel control and stability. AAS uses air springs and compressors instead of traditional coil springs, allowing for height adjustments and variable spring rates, highly valued in luxury and electric vehicle segments for load leveling and aerodynamic advantages. Major applications span high-performance sports cars, premium luxury sedans, and increasingly, high-end Sport Utility Vehicles (SUVs) and commercial vehicles where improved handling and stability are paramount. The integration of these systems is a key differentiator for Original Equipment Manufacturers (OEMs) aiming to enhance brand perception through superior driving dynamics.

The primary benefits of adopting these systems include significantly enhanced ride comfort by minimizing disruptive road inputs, improved vehicle handling and safety through superior traction control, and reduced vehicle body fatigue over the long term. Driving factors fueling market expansion include the stringent global safety regulations mandating better vehicle stability features, increasing consumer demand for premium vehicle features and luxury amenities, and the rapid electrification trend in the automotive industry. Electric Vehicles (EVs) benefit immensely from adaptive suspension as it aids in battery protection, load management, and aerodynamic optimization, directly extending driving range. Furthermore, advancements in sensor technology and computing power are making these complex systems more cost-effective and reliable for integration into mid-range vehicle segments.

Automotive Adaptive Variable Suspension System Market Executive Summary

The Automotive Adaptive Variable Suspension System Market is undergoing robust expansion, driven primarily by technological convergence and evolving consumer expectations for comfort and safety. Key business trends indicate a strong push towards semi-active systems, particularly those incorporating electronically controlled damping, owing to their balanced cost-to-performance ratio compared to fully active systems. OEMs are increasingly standardizing these features in their higher trims to justify premium pricing and differentiate themselves in highly competitive markets. Strategic partnerships between suspension suppliers and software developers are becoming common to enhance predictive capabilities using artificial intelligence and machine learning algorithms, allowing the suspension to anticipate road anomalies rather than merely reacting to them. Furthermore, the trend toward autonomous vehicles necessitates highly responsive and reliable suspension systems to ensure passenger comfort and sensor stability, positioning this technology as fundamental to future mobility solutions.

Segment trends reveal that the Passenger Car segment retains the largest market share, specifically the luxury and premium vehicle sub-segments, which were early adopters of adaptive suspension technology. However, the Commercial Vehicle segment, particularly heavy-duty trucks and buses, is demonstrating the highest growth trajectory, fueled by the need to protect sensitive cargo and improve driver well-being during long hauls, alongside compliance with stricter road damage minimization standards. By component, the Electronic Control Unit (ECU) segment is witnessing significant innovation, shifting towards highly integrated, multi-domain controllers that manage not only suspension but also steering and braking functions. Geographically, Asia Pacific (APAC) is emerging as the fastest-growing region, propelled by surging automotive production, rising disposable incomes in countries like China and India, and increasing penetration of electric vehicles that prioritize sophisticated chassis management systems.

Regional trends highlight that North America and Europe currently dominate the market revenue share due to the high adoption rate of advanced driver assistance systems (ADAS) and the prevalent culture of high-performance vehicle ownership. European regulations, particularly concerning vehicle handling and occupant protection, strongly favor the incorporation of adaptive suspension. The market structure remains moderately concentrated, with key players investing heavily in miniaturization, material science (to reduce weight), and software optimization. The immediate future suggests a competitive landscape focused on developing cost-effective solutions for mass-market vehicles and further integrating suspension data with vehicle-to-infrastructure (V2I) communication systems for true predictive suspension control. The market’s resilience is underpinned by its critical role in the transition toward electric and autonomous mobility platforms.

AI Impact Analysis on Automotive Adaptive Variable Suspension System Market

User queries regarding the impact of AI on adaptive suspension frequently center on how machine learning enhances prediction accuracy, the transition from reactive to proactive damping, the role of deep learning in optimizing comfort profiles based on individual driving habits, and concerns about the cybersecurity implications of highly connected suspension ECUs. Users are keen to understand if AI can genuinely personalize the ride experience across various road types and if it can efficiently handle unprecedented dynamic events. The consensus expectation is that AI will move these systems from merely adaptive (adjusting based on current state) to truly intelligent and prescriptive (anticipating future state), drastically reducing response latency and improving energy efficiency, particularly critical for EV applications. Concerns often revolve around the computational resources required and the reliability of sensor fusion when integrating disparate data sources like GPS, camera input, and internal vehicle telemetry to inform suspension decisions.

The infusion of Artificial Intelligence, specifically machine learning algorithms, fundamentally transforms the operational paradigm of adaptive suspension systems. AI enables these systems to move beyond pre-programmed responses and real-time sensor feedback by creating models that can predict the optimal damping force seconds before the vehicle encounters an obstacle. This predictive capability is achieved through continuous analysis of historical driving data, current road conditions identified via vehicle cameras (road preview), and real-time inputs from acceleration and gyroscope sensors. For instance, an AI-powered system can learn the characteristics of a frequently traveled route, identifying areas prone to potholes or speed bumps, and proactively adjust suspension settings, leading to a smoother and safer transit. This level of anticipatory control minimizes vertical acceleration and enhances tire grip far more effectively than traditional reactive electronics.

Furthermore, AI algorithms are instrumental in optimizing the complex control logic required for fully active suspension systems, managing the intricate interplay between various components like hydraulic pumps, actuators, and electronic valves. AI aids in personalized comfort tuning; it can learn the driver’s preferred handling characteristics or passenger comfort requirements and dynamically adjust the suspension stiffness accordingly—a capability often referred to as 'digital twin' control. This personalization aspect is highly valued in the luxury segment. The implementation of AI also facilitates enhanced diagnostics and predictive maintenance. By analyzing subtle variations in sensor data over time, the AI system can detect potential component failures (such as actuator wear or sensor drift) long before they cause operational issues, thereby significantly reducing downtime and maintenance costs for vehicle owners and fleet managers. This shift toward intelligent, self-optimizing suspension is a major catalyst for market growth and technological differentiation.

- AI algorithms facilitate predictive damping control by analyzing road surface topology ahead of the vehicle.

- Machine learning enables real-time personalization of suspension settings based on driver behavior and passenger preferences.

- Deep learning enhances sensor fusion reliability, integrating data from cameras, lidar, GPS, and internal gyroscopes for informed decision- making.

- AI optimizes energy consumption in active suspension systems, critical for extending the range of battery electric vehicles (BEVs).

- Predictive maintenance and diagnostics are improved, minimizing component failure through continuous algorithmic monitoring.

- Enhanced cybersecurity protocols are required for AI-driven ECUs to prevent unauthorized access or system manipulation.

DRO & Impact Forces Of Automotive Adaptive Variable Suspension System Market

The dynamics of the Automotive Adaptive Variable Suspension System Market are shaped by a powerful confluence of drivers related to consumer demand and regulatory pressure, while simultaneously navigating technological and cost-related restraints. The overarching driver is the global emphasis on vehicle safety, performance, and luxurious comfort, particularly in premium vehicle classes where these features are becoming expected rather than optional. The shift towards electrification acts as a significant opportunity, as adaptive suspension is vital for managing the heavy weight and specific dynamics of battery packs in EVs. However, the high initial cost and complexity of integrating these electro-mechanical systems remain the principal restraining factors, limiting their mass-market adoption in lower-segment vehicles. These forces, when balanced, result in an accelerating but strategically competitive market environment where differentiation is key. The impact forces are generally high, reflecting the technology's fundamental importance to future mobility trends, including autonomous driving where stable sensor platforms are non-negotiable.

The primary drivers bolstering market growth include rising consumer demand for improved vehicle stability and superior ride quality across diverse road conditions. Safety regulations, such as those related to Electronic Stability Control (ESC) and rollover prevention, indirectly push OEMs to adopt advanced suspension controls that integrate seamlessly with these safety systems. Moreover, the increasing average age of the vehicle fleet globally necessitates the development of sophisticated aftermarket solutions for suspension upgrades and replacements, offering a secondary growth avenue. Technological advancements, specifically the reduction in sensor and ECU costs coupled with increased processing power, are making these systems more accessible. Opportunities lie heavily in the medium and heavy-duty commercial vehicle sector, where load variation is significant, and adaptive systems offer substantial fuel economy improvements and reduced wear-and-tear on road infrastructure, appealing directly to fleet operators focused on operational efficiency.

Conversely, significant restraints challenge rapid market expansion. The high manufacturing complexity, involving precise electronic and mechanical integration, translates to high component and installation costs, making the technology prohibitive for budget vehicle manufacturers. Furthermore, the reliance on specialized maintenance personnel and diagnostic tools adds to the total cost of ownership for end-users. The market also faces the restraint of consumer awareness; while luxury buyers understand the benefits, mainstream buyers often perceive adaptive suspension as an unnecessary complexity compared to conventional systems. The inherent opportunity to overcome these restraints involves focused research into modular and standardized system architectures, enabling simpler, lower-cost production and maintenance. The ongoing development of cost-effective Magneto-Rheological (MR) fluids and simplified pneumatic systems could unlock significant market potential in the mid-range segment, capitalizing on the underlying demand for safety and comfort enhancement.

Segmentation Analysis

The Automotive Adaptive Variable Suspension System Market is comprehensively segmented based on technology, component type, vehicle application, and sales channel, allowing for granular analysis of market penetration and growth vectors across different domains. The technological segmentation is crucial, differentiating between hydraulic, pneumatic, semi-active, and fully active systems, which dictates both performance capabilities and cost structures. Component analysis focuses on the essential hardware and software elements—ECUs, sensors, and actuators—highlighting areas of high investment and rapid technological turnover. Vehicle application segmentation clarifies where the highest demand originates, primarily distinguishing between the high-volume passenger car sector and the high-growth commercial vehicle segment. These segmentations are vital for suppliers to target their product development and marketing efforts effectively toward the most lucrative and expanding niches within the global automotive industry landscape.

The dominance of semi-active damping systems, particularly Continuous Damping Control (CDC), defines the current market landscape under the technology segment. CDC offers a strong balance between performance gains and system complexity, making it favored by mid-to-high-end vehicle manufacturers. Conversely, fully active systems, though offering unparalleled control and ride quality, are restricted almost entirely to ultra-luxury and high-performance segments due to their prohibitive cost and energy demands. The shift towards electrification strongly influences segmentation, boosting the Pneumatic Suspension segment, as air springs are highly effective for managing the significant weight variations and required ride height adjustments inherent in modern EVs and large SUVs. The increasing sophistication of these systems means that software and ECU development is now outpacing hardware innovation in terms of value creation and competitive differentiation.

The Sales Channel segmentation emphasizes the importance of the OEM channel, which accounts for the vast majority of revenue, driven by vehicle manufacturing volumes. However, the Aftermarket segment is gaining traction, particularly in mature markets like North America and Europe, where consumers seek performance enhancements or replacements for aging factory adaptive systems. This aftermarket growth is supported by standardized interfaces and the emergence of third-party sensor and actuator suppliers capable of providing compatible components. Understanding these segmentation dynamics is critical for forecasting, as it predicts shifts in investment, from initial vehicle manufacturing (OEM) to long-term vehicle maintenance and customization (Aftermarket), and helps track the transition of advanced features from exclusive luxury inclusions to standardized features across broader vehicle types.

- By Technology:

- Semi-Active Suspension System (e.g., CDC)

- Active Suspension System

- Adaptive Air Suspension (AAS)

- Magneto-Rheological (MR) Dampers

- By Component:

- Electronic Control Unit (ECU)

- Sensors (Position, Acceleration, Pressure)

- Actuators/Dampers (Hydraulic, Electric)

- Air Compressor and Storage Tanks

- By Vehicle Type:

- Passenger Cars (Sedan, SUV, Hatchback)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Automotive Adaptive Variable Suspension System Market

The value chain for the Automotive Adaptive Variable Suspension System Market is intricate, starting with highly specialized upstream suppliers and concluding with vehicle distribution and post-sales servicing. Upstream analysis focuses on raw material providers (metals, composites, and specialized fluids) and the manufacturers of core microelectronic components, notably high-precision sensors, microcontrollers for ECUs, and specialized hydraulic or MR fluids. The value added at this stage is significant, driven by intellectual property related to sensor accuracy and the chemical formulation of damping fluids, requiring stringent quality control and proprietary manufacturing processes. Key material suppliers often engage in long-term contracts with Tier 1 component manufacturers, ensuring supply stability for these critical and often bespoke parts. Innovation in lightweight materials and high-speed processing chips directly impacts the downstream performance and cost structure of the final suspension system.

Midstream activities are dominated by Tier 1 suppliers who assemble components into integrated systems. These major players—such as Continental, ZF, and Tenneco—take the raw materials and microelectronics and design, develop, and integrate the complete suspension modules, including the physical dampers, air springs, compressors, and the necessary control software. This stage involves complex research and development cycles, stringent testing, and customization based on specific OEM platform requirements (e.g., vehicle weight, intended ride height, and targeted handling characteristics). The distribution channel between Tier 1 suppliers and OEMs is predominantly direct, characterized by highly collaborative and long-term relationships, with suppliers often co-locating engineering teams near the vehicle manufacturer’s assembly lines to facilitate just-in-time delivery and continuous system optimization throughout the vehicle’s lifecycle. Software integration and calibration are paramount at this stage, representing a growing proportion of the system’s overall value.

Downstream analysis covers the integration of the system into the final vehicle assembly (OEM channel) and subsequent sales through dealership networks, followed by the aftermarket segment. Direct distribution dominates the OEM channel, ensuring systems are integrated seamlessly during manufacturing. Indirect distribution channels, including independent garages, specialized tuning shops, and online parts retailers, become vital in the aftermarket segment, servicing replacement and upgrade demand. The complexity of adaptive suspension necessitates specialized diagnostic tools and training at the dealership and independent service level, creating opportunities for suppliers to offer lucrative training and software licensing services. The final consumer interaction, either through vehicle purchase or system replacement, relies heavily on technical support and the long-term reliability of the system, underscoring the importance of high-quality installation and calibration across all sales and service points.

Automotive Adaptive Variable Suspension System Market Potential Customers

The primary potential customers and end-users of Automotive Adaptive Variable Suspension Systems span several key segments within the automotive ecosystem, driven by diverse requirements related to vehicle performance, operational efficiency, and occupant experience. The largest segment remains Original Equipment Manufacturers (OEMs), particularly those specializing in the luxury, premium, and high-performance vehicle categories, including marques like BMW, Mercedes-Benz, Audi, Porsche, and high-end divisions of volume manufacturers. These companies view adaptive suspension as a non-negotiable differentiator, integral to their brand promise of superior driving dynamics, safety, and comfort. The continuous push by these OEMs to incorporate enhanced chassis control features across a wider range of models ensures a consistent and high-volume demand stream for system suppliers. Furthermore, emerging EV manufacturers are crucial customers, utilizing adaptive suspension to mitigate the adverse effects of heavy battery packs on vehicle handling and to optimize aerodynamics for range extension.

Another significant customer group comprises commercial fleet operators, ranging from long-haul trucking companies to urban public transport providers. For heavy commercial vehicles (HCVs), adaptive air suspension systems are critical for load leveling, protecting sensitive cargo (e.g., electronics, perishables), and reducing wear on tires and chassis components, directly impacting operational costs and regulatory compliance regarding axle load limits. Bus operators increasingly adopt adaptive systems to enhance passenger comfort and stability, particularly in urban environments with frequent braking and turning. The business case for these customers is driven less by luxury and more by efficiency, longevity, safety, and regulatory adherence. The ability of adaptive suspension to minimize costly repairs associated with traditional systems positions the technology as a long-term investment rather than an expense.

Finally, the aftermarket segment represents a diverse customer base, including specialized performance tuning houses, independent garages, and individual vehicle owners seeking upgrades or replacements. Performance tuning companies are keen consumers of advanced dampers and custom ECUs to maximize track performance or aggressive street handling. Individual owners of aging premium vehicles constitute the replacement market, opting for high-quality, specialized adaptive parts when their factory systems require servicing. As adaptive suspension technology permeates older vehicle generations, this segment will grow, driven by the desire to restore or enhance original vehicle specifications. Successful suppliers in the aftermarket segment must offer compatibility with various vehicle protocols and robust technical support for complex installation procedures, catering to a sophisticated and technically minded customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.8 Billion |

| Market Forecast in 2033 | $14.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Continental AG, BWI Group, Tenneco Inc., thyssenkrupp AG, Magneti Marelli S.p.A., Hitachi Astemo, KYB Corporation, Schaeffler AG, Eibach, Vibracoustic SE, LORD Corporation, WABCO Holdings (now part of ZF), Hendrickson International, Mando Corporation, Robert Bosch GmbH, Delphi Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Adaptive Variable Suspension System Market Key Technology Landscape

The technology landscape of the Automotive Adaptive Variable Suspension System Market is characterized by intense competition in software sophistication and control algorithm development, moving rapidly toward integration with advanced vehicle dynamics control systems. Current technologies are predominantly electronic, relying on high-speed data processing. Semi-active systems, particularly those using continuously variable damping (like Tenneco's Continuously Variable Semi-Active Suspension, CVSA), utilize electronically controlled valves to adjust fluid flow within the damper based on sensor input, striking a balance between cost and performance. A significant technological advancement is the integration of high-resolution sensors, including LiDAR and cameras, which feed road surface data directly to the suspension ECU. This "road preview" capability allows the system to preload adjustments for upcoming road irregularities, effectively turning a reactive system into a proactive one, significantly enhancing ride comfort and maintaining stability at high speeds, a critical requirement for next-generation performance vehicles.

Adaptive Air Suspension (AAS) remains a cornerstone technology, especially in high-end SUVs and electric vehicles, due to its ability to manage variable loads and offer adjustable ride height for aerodynamic efficiency. Innovations in AAS are focusing on faster air compression cycles, silent operation, and more resilient air bladder materials capable of withstanding extreme temperatures and pressures over the vehicle's lifespan. Furthermore, the development of Magneto-Rheological (MR) technology continues to be critical, offering near-instantaneous damping adjustment by utilizing fluids whose viscosity changes rapidly when subjected to a magnetic field. While historically expensive, ongoing research aims to reduce the cost of MR fluid components and simplify the overall system architecture, potentially broadening its application beyond ultra-luxury and high-performance sports cars. The efficiency gains delivered by MR systems are particularly attractive for reducing the computational burden on the main vehicle ECU.

Looking ahead, the technological evolution is heavily biased toward fully active suspension systems, though implementation remains complex. These systems utilize dedicated actuators (often hydraulic or electromagnetic) to independently push or pull each wheel, actively counteracting body roll, pitch, and heave. Companies are investing heavily in electromechanical active suspension (EMAS) which uses high-power electric motors instead of hydraulic pumps, offering faster response times, greater energy efficiency, and easier integration into electric vehicle architectures. The ultimate convergence of these technologies involves fully integrated chassis control systems, where steering, braking, and suspension are managed by a single domain controller, utilizing AI to optimize overall vehicle dynamics for safety, performance, and autonomy. Cybersecurity protocols designed specifically for these critical networked components are becoming an essential, integral part of the suspension technology architecture to safeguard against external manipulation.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily driven by substantial growth in vehicle production, particularly in China, Japan, South Korea, and increasingly, India. The region's expanding middle class is driving demand for premium features and SUVs, leading OEMs to integrate adaptive suspension systems in locally manufactured models. China, in particular, is a major growth engine, spurred by high governmental focus on New Energy Vehicles (NEVs) where chassis optimization is critical. Regulatory shifts toward safer and more comfortable public transport also favor the adoption of adaptive air suspension in commercial buses and trucks across the region.

- Europe: Europe holds a dominant position in market revenue, characterized by high adoption rates in premium and luxury automotive segments. Stringent European safety standards and consumer preferences for sophisticated driving dynamics ensure a steady demand for high-performance semi-active and active systems. Germany, the UK, and Italy are key contributors, hosting major Tier 1 suppliers and luxury OEMs. The rapid transition to high-performance Battery Electric Vehicles (BEVs) further cements Europe's leadership, as these vehicles necessitate advanced suspension for optimized handling and range management.

- North America: North America represents a mature yet high-value market, primarily driven by the strong consumer preference for large vehicles, such as SUVs, light trucks, and high-performance muscle cars, which benefit significantly from adaptive damping technology. The region is a key adopter of Magnetic Ride Control (MRC) systems. The market is also fueled by strong aftermarket demand for performance upgrades and specialized commercial vehicle applications (e.g., heavy-duty towing and long-haul transportation), where reliability and variable load management are paramount.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets with growth concentrated in specific economies like Brazil, Mexico, and the UAE. While adoption remains lower than in developed regions, growth is accelerating, particularly within the luxury vehicle imports segment and the increasing localization of commercial vehicle manufacturing. Poor road infrastructure in parts of LATAM and MEA actually drives specific localized demand for highly durable, adaptive systems capable of handling challenging terrains while maintaining passenger comfort.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Adaptive Variable Suspension System Market.- ZF Friedrichshafen AG (Includes WABCO)

- Continental AG

- BWI Group (Beijing West Industries)

- Tenneco Inc. (Monroe Intelligent Suspension)

- thyssenkrupp AG

- Magneti Marelli S.p.A.

- Hitachi Astemo, Ltd.

- KYB Corporation

- Schaeffler AG

- Eibach GmbH

- Vibracoustic SE

- LORD Corporation (now part of Parker Hannifin)

- Mando Corporation

- Robert Bosch GmbH (Control Systems)

- Delphi Technologies (now BorgWarner)

- Hendrickson International

- Porsche Automobil Holding SE (Strategic Investments)

- Haldex AB

Frequently Asked Questions

Analyze common user questions about the Automotive Adaptive Variable Suspension System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of Adaptive Variable Suspension Systems over traditional passive suspension?

The primary benefit is the dynamic, real-time optimization of vehicle handling and ride comfort. Unlike passive systems, adaptive suspension continuously adjusts damping forces or spring stiffness based on road conditions and driving dynamics, significantly improving safety, stability, and personalized comfort across various terrains and speeds. This dynamic capability is essential for modern vehicle performance requirements.

How does the integration of AI enhance Adaptive Suspension Systems for Electric Vehicles (EVs)?

AI integration in EVs is crucial for optimizing range and performance. AI algorithms utilize road preview data to proactively adjust the suspension, minimizing energy expenditure from unnecessary dampening adjustments. Crucially, adaptive systems manage the heavy battery weight efficiently, protecting the battery pack from excessive vibration while optimizing ride height to reduce aerodynamic drag, directly extending the EV's operational range.

Which segment of the Adaptive Suspension Market is showing the fastest growth rate?

The Commercial Vehicle segment, particularly Heavy Commercial Vehicles (HCVs), is exhibiting the fastest growth. This acceleration is driven by the need for better cargo protection, extended component longevity, and improved driver well-being during long-haul transport. Adaptive Air Suspension (AAS) is the key technology enabling this growth by offering superior load leveling and vibration isolation critical for fleet efficiency.

What are the main restraints hindering the mass-market adoption of Adaptive Suspension?

The main restraints are the high initial component cost and the complexity of integration, particularly the specialized sensors, actuators, and the Electronic Control Units (ECUs) required. These factors significantly increase the manufacturing cost, restricting the technology predominantly to mid-range and luxury vehicle segments, while specialized maintenance requirements also add to the long-term cost of ownership.

What is the difference between semi-active and fully active suspension systems?

Semi-active systems (like Continuous Damping Control) can only adjust the resistive force (damping) but cannot introduce external energy into the system. Fully active suspension systems, conversely, use dedicated actuators (e.g., hydraulic pumps or electric motors) to actively push or pull the wheels, generating forces that directly counteract body movements (roll, pitch, heave), offering the highest degree of control but at a significantly higher cost and complexity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager