Automotive ADAS Sensors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432358 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive ADAS Sensors Market Size

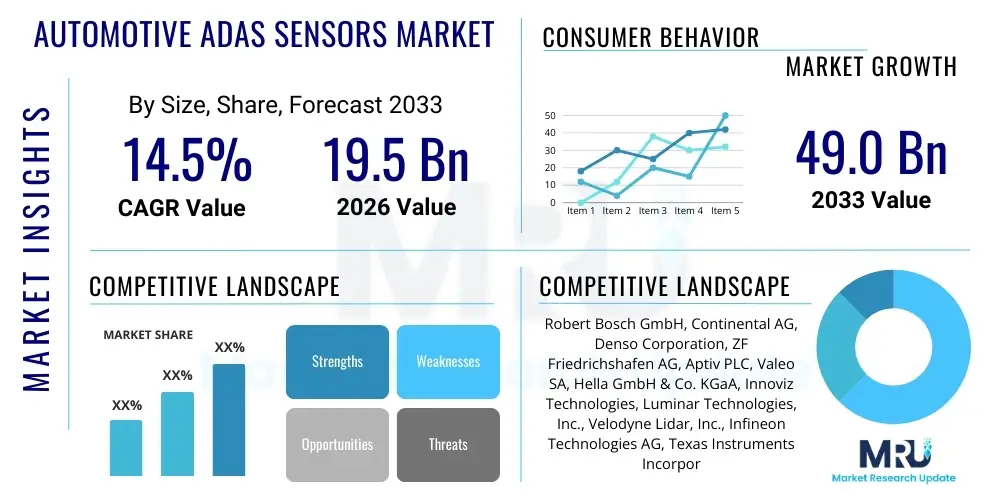

The Automotive ADAS Sensors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 49.0 Billion by the end of the forecast period in 2033. This significant expansion is driven by stringent global safety regulations, increasing consumer demand for enhanced vehicle security features, and the rapid technological evolution towards higher levels of autonomous driving capability (Level 3 and above).

Automotive ADAS Sensors Market introduction

The Automotive Advanced Driver Assistance Systems (ADAS) Sensors Market encompasses a diverse range of hardware components critical for enabling advanced safety and automation functions in modern vehicles. These sensors, including cameras, radar, lidar, and ultrasonic sensors, serve as the primary inputs for ADAS systems, allowing vehicles to perceive their surrounding environment, detect obstacles, measure distances, and track movement. The integration of these sophisticated sensory inputs is fundamental to the operation of features such as Adaptive Cruise Control (ACC), Lane Keep Assist (LKA), Automatic Emergency Braking (AEB), and parking assistance systems. The push towards zero-accident mobility and the development of Software-Defined Vehicles (SDVs) are rapidly increasing the sensor count per vehicle, thereby propelling market growth globally.

Product differentiation within the market is primarily characterized by sensor modality and performance metrics, particularly in terms of range, resolution, reliability under varied weather conditions, and integration complexity. Radar sensors, operating primarily in the 24 GHz and 77 GHz bands, offer robust long-range detection and speed measurement, critical for ACC and AEB functions. Camera systems, often utilizing sophisticated image processing and computer vision algorithms, provide high-resolution visual data essential for lane recognition, traffic sign identification, and pedestrian detection. Lidar, while still gaining commercial traction in mass-market vehicles due to cost constraints, offers unparalleled 3D point cloud data, which is indispensable for Level 3 and Level 4 autonomous driving stacks requiring high-fidelity mapping and precise localization. The market structure reflects strong competition among traditional automotive suppliers and specialized sensor technology companies.

Major applications of these sensors span all vehicle segments, from entry-level passenger cars mandated to include basic safety features like AEB, to high-end luxury and commercial vehicles deploying fully integrated Level 2+ and Level 3 autonomy solutions. The benefits derived from these systems are substantial, centering on enhanced road safety by mitigating human error, reducing accident severity, and improving overall driving comfort and efficiency. Driving factors for market expansion include evolving regulatory mandates—such as the Euro NCAP safety ratings and pending regulations in the US and Asia—requiring the mandatory fitment of certain ADAS features. Furthermore, the rising investment by Original Equipment Manufacturers (OEMs) and Tier 1 suppliers in next-generation sensor fusion architectures, which combine data from multiple sensor types for superior performance and redundancy, further stimulates technological adoption and volume production.

Automotive ADAS Sensors Market Executive Summary

The Automotive ADAS Sensors Market is experiencing robust expansion, fundamentally driven by the global imperative for enhanced vehicle safety and the escalating industry focus on autonomous driving capabilities. Current business trends indicate a critical shift towards high-resolution, solid-state sensing technologies, particularly in the lidar and imaging radar segments, aimed at overcoming the limitations of traditional sensor configurations. Tier 1 suppliers are heavily investing in advanced sensor fusion platforms and centralized Electronic Control Units (ECUs) capable of processing immense volumes of real-time sensor data, moving away from decentralized domain architectures. Furthermore, standardization efforts across major automotive consortia are influencing design choices, pushing manufacturers to adopt modular and scalable sensor solutions that can serve various vehicle platforms, reducing costs and accelerating time-to-market. Competitive strategy is increasingly focusing on software capabilities, as sensor data interpretation and decision-making algorithms become key differentiators in overall ADAS performance.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by the massive automotive production capacity and rapidly increasing ADAS adoption rates in China and South Korea, often supported by governmental roadmaps for intelligent vehicles. Europe remains a critical mature market, characterized by stringent existing and forthcoming safety mandates (e.g., General Safety Regulation 2, requiring mandatory installation of features like Intelligent Speed Assistance and reversing cameras), ensuring sustained demand for standard-fit radar and camera systems. North America continues to be a crucial hub for technological innovation and early deployment of advanced Level 3 features, particularly within premium vehicle segments and emerging robo-taxi services, thereby driving demand for high-performance, high-cost lidar solutions.

In terms of segments, camera sensors currently hold the largest market share by volume due to their relatively low cost and versatility in applications such as viewing, recognition, and parking assistance, making them ubiquitous across all vehicle classes. However, radar sensors, specifically 77 GHz radar used for long-range object detection, are expected to demonstrate the highest value growth, driven by their critical role in Level 2+ and Level 3 systems that require reliable performance in challenging weather conditions. Lidar technology, although representing a smaller segment presently, is projected to achieve the highest CAGR over the forecast period as technological advancements reduce manufacturing costs and improve integration complexity, making high-resolution 3D sensing viable for mass production towards the end of the decade. The shift towards sensor redundancy, requiring multiple sensor types (a minimum of 8-12 sensors) per vehicle for higher automation levels, underpins the positive outlook across all sensor modalities.

AI Impact Analysis on Automotive ADAS Sensors Market

Users frequently inquire about how Artificial Intelligence (AI) fundamentally transforms sensor data processing, reliability, and ultimately, the safety performance of ADAS. Key themes revolve around AI's ability to handle ambiguous edge cases, the transition from classical computer vision to deep learning networks for perception, and the computational requirements placed on in-vehicle hardware. Consumers and industry experts are keen to understand if AI can significantly reduce false positives and false negatives—critical concerns in ADAS reliability—and how machine learning models trained on vast datasets enhance object classification and prediction capabilities beyond traditional algorithmic methods. Concerns often center on the explainability (XAI) and validation process for these complex AI systems, as regulatory bodies demand verifiable safety standards before approving widespread deployment of Level 3 and above functionalities. Expectations are high that AI will be the ultimate enabler for seamless sensor fusion, translating fragmented sensor inputs into a singular, coherent, and highly accurate model of the vehicle's environment.

The core influence of AI lies in optimizing the perception stack, moving beyond simple signal processing to complex semantic understanding of the driving scene. Deep Neural Networks (DNNs), particularly Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs), are now standard for processing camera data, enabling accurate real-time classification of objects such as pedestrians, cyclists, road debris, and lane markings, even under low-visibility or cluttered conditions. This enhanced perception capability increases the reliance on high-quality camera and lidar sensors that can feed the necessary data complexity to the AI models. Furthermore, AI is central to sensor fusion, where algorithms dynamically weigh the confidence scores from radar, camera, and lidar to generate a robust and redundant environmental model, thereby significantly improving system reliability and minimizing decision latency, which is paramount for safety applications.

The impact of AI extends into the optimization of the sensor hardware itself. For instance, edge AI processing is being integrated directly into smart sensors (like smart cameras or processing-intensive lidar units) to perform initial data filtering and inference, reducing the bandwidth requirements on the central ECU. This distributed processing approach allows for faster reaction times and facilitates the adoption of more complex, data-rich sensor outputs. Additionally, AI is utilized in the development and validation cycle, employing simulation environments and synthetic data generation to train and test ADAS algorithms against millions of scenarios, far exceeding what is possible through real-world road testing alone. This application of AI is instrumental in accelerating the development of highly reliable and safe ADAS solutions, thereby increasing the market demand for sensors compatible with these high-performance AI architectures.

- AI enables robust, real-time object classification and semantic segmentation using deep learning models on camera data.

- Deep Neural Networks (DNNs) improve sensor fusion by dynamically assessing and integrating inputs from diverse sensor modalities (radar, lidar, camera).

- Edge AI processing is increasingly embedded within smart sensors, reducing latency and bandwidth demands on central processing units.

- AI algorithms are critical for predictive path planning and behavioral modeling in Level 3 and Level 4 autonomous systems.

- Machine learning accelerates the validation and testing cycle through extensive simulation and synthetic data generation, enhancing system reliability.

DRO & Impact Forces Of Automotive ADAS Sensors Market

The trajectory of the Automotive ADAS Sensors market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant market impact forces. Key drivers include mandatory regulatory requirements, such as the European Union’s General Safety Regulation II (GSR II), which necessitates the inclusion of advanced safety features, thereby guaranteeing a baseline demand for camera and radar sensors across new vehicle fleets. Furthermore, increasing consumer awareness and willingness to pay for vehicles with high safety ratings (driven by programs like Euro NCAP and NHTSA) serve as powerful market accelerators. Technological opportunities, such as the maturation of solid-state lidar technology, the integration of 4D imaging radar offering improved elevation data, and the deployment of high-resolution CMOS image sensors, promise superior performance and cost reduction, opening new avenues for mass-market adoption. These factors collectively push the market towards higher automation levels, demanding greater sensor redundancy and sophistication.

Conversely, significant restraints hinder growth and scalability. The high initial cost associated with advanced sensor technologies, particularly high-performance lidar, remains a substantial barrier to entry for lower-end vehicle segments. Integrating these diverse sensor modalities necessitates complex sensor fusion software, which presents significant technical challenges related to data synchronization, computational overhead, and resolving conflicting inputs—issues that directly impact the reliability and safety certification process. Cybersecurity vulnerabilities associated with complex, interconnected electronic architectures represent another critical restraint; ensuring the integrity and authenticity of sensor data is paramount. Furthermore, performance degradation under adverse weather conditions (heavy rain, snow, dense fog) remains a persistent technological hurdle for optical sensors (camera and lidar), necessitating redundancy and specialized heating/cleaning solutions which add cost and complexity.

The primary impact force shaping the market is the regulatory environment coupled with the aggressive pursuit of autonomous driving (AD). Regulations set the floor for ADAS sensor demand, while the AD race among OEMs and tech giants (Waymo, Cruise, etc.) sets the ceiling for technological capability and investment. This dynamic interaction creates strong downward pressure on sensor component pricing (due to volume scaling) while simultaneously increasing demand for innovative, high-performance units suitable for Level 3 and 4 deployment. Strategic opportunities lie in developing integrated system-on-chips (SoCs) that combine sensor signal processing and AI perception algorithms, providing streamlined, energy-efficient solutions. Companies focusing on resilient sensor fusion architectures, predictive maintenance driven by sensor data analytics, and standardized, automotive-grade cybersecurity solutions are optimally positioned to capitalize on these enduring market forces.

Segmentation Analysis

The Automotive ADAS Sensors Market is highly diversified and is primarily segmented based on the type of sensor technology, the vehicle type in which they are deployed, the level of autonomy supported, and their geographical distribution. The segmentation based on sensor type—which includes Radar, Camera, Lidar, and Ultrasonic sensors—is crucial as it defines performance characteristics, cost structures, and applicability to specific ADAS functions. The trend is moving towards multi-modal sensor configurations, where no single sensor type is relied upon, driving simultaneous growth across all technological segments but with varying growth rates influenced by cost optimization and performance requirements for increasing automation levels. Understanding these segmentation nuances is key for stakeholders formulating manufacturing and R&D strategies.

Further segmentation by application highlights the shift from mere warning systems (e.g., Forward Collision Warning) to active control systems (e.g., Automatic Emergency Braking and Lane Centering Assist). This shift dictates the demand for higher data integrity and reliability, favoring high-resolution radar and sophisticated camera systems over basic ultrasonic sensors used mainly for parking. Vehicle type segmentation—covering passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs)—shows that passenger cars currently account for the bulk of sensor volume, driven by high production numbers and increasing consumer adoption of safety packs. However, commercial vehicles are expected to show accelerated growth as regulations concerning driver fatigue monitoring and platooning technologies necessitate specialized, high-durability sensor arrays designed for heavy-duty operational environments.

The segmentation by autonomy level (Level 1 through Level 5, as defined by SAE) offers a forward-looking perspective, where Level 2+ systems currently dominate the market, requiring a minimum of three to five sensor modalities. The impending transition to Level 3 (Conditional Automation) is the primary engine driving demand for lidar, high-definition mapping cameras, and highly redundant systems. Sensor demand volume dramatically increases as vehicles progress up the autonomy scale; Level 4 and 5 vehicles may utilize 15 or more sensors, including specialized short-range radar and high-frequency communication modules, transforming the sensor market dynamics entirely. Geographically, markets are segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, reflecting differing regulatory speeds and consumer adoption rates globally.

- By Sensor Type:

- Camera Sensors (CMOS Image Sensors, Thermal Cameras)

- Radar Sensors (24 GHz, 77 GHz/79 GHz, Imaging Radar)

- Lidar Sensors (Mechanical Lidar, Solid-State Lidar, Micro-Electro-Mechanical Systems (MEMS) Lidar)

- Ultrasonic Sensors

- By Application:

- Adaptive Cruise Control (ACC)

- Automatic Emergency Braking (AEB)

- Lane Departure Warning (LDW) / Lane Keep Assist (LKA)

- Parking Assist Systems (PAS)

- Blind Spot Detection (BSD)

- Traffic Sign Recognition (TSR)

- By Vehicle Type:

- Passenger Vehicles (PHEV, BEV, ICE)

- Commercial Vehicles (Light, Heavy)

- By Autonomy Level (SAE):

- L1 (Driver Assistance)

- L2/L2+ (Partial Automation)

- L3 (Conditional Automation)

- L4/L5 (High/Full Automation)

Value Chain Analysis For Automotive ADAS Sensors Market

The Automotive ADAS Sensors market value chain is extensive and begins with upstream raw material and component suppliers, moves through specialized technology developers, reaches the sensor manufacturers, and finally integrates into the automotive ecosystem through Tier 1 suppliers and Original Equipment Manufacturers (OEMs). Upstream analysis reveals reliance on semiconductor manufacturing for ASIC/FPGA components (crucial for sensor processing), specialized lens and mirror components for optical systems, and high-frequency components for radar modules. Key materials include gallium arsenide (GaAs) or silicon germanium (SiGe) for high-frequency circuits, and high-resolution CMOS sensors for camera units. Manufacturers must secure reliable sourcing agreements, given the current volatility and complexity of the global semiconductor supply chain, which directly impacts sensor production volume and cost. Strategic partnerships with foundries are essential for guaranteeing supply stability and facilitating custom chip development necessary for advanced sensing algorithms.

The core manufacturing and integration phase involves Tier 2 specialized sensor providers (e.g., chip designers, lidar developers) who produce the sensor modules, and Tier 1 suppliers (e.g., Bosch, Continental, Denso) who integrate these modules into complete ADAS domain controllers and sensor fusion systems. Tier 1 suppliers serve as the critical intermediary, managing the interface between sensor technology and the vehicle architecture, ensuring software compatibility, system calibration, and functional safety compliance (ISO 26262). Downstream analysis focuses on the OEMs, who integrate the final ADAS package into the vehicle assembly line and bear the ultimate responsibility for system performance and consumer safety. The distribution channel is predominantly indirect, moving from Tier 2 sensor specialists to Tier 1 integrators, and then sold directly to the OEMs via long-term supply contracts. The aftermarket for ADAS sensors and replacement parts remains a smaller, though growing, segment.

Direct engagement, though less common for high-volume hardware components, is observed when specialized sensor startups (particularly lidar or software companies) partner directly with major OEMs for early-stage development and customized integration of Level 3/4 systems, bypassing traditional Tier 1 channels initially. However, standard production volumes invariably rely on the established indirect distribution channel managed by global Tier 1 suppliers, who possess the logistical capacity, manufacturing scale, and quality control systems required by the automotive industry. Optimization of this value chain hinges on vertical integration strategies adopted by major players, focusing on bringing software and perception algorithm development in-house to reduce reliance on third-party integration, thereby controlling performance and cost from silicon level design up to the final vehicle application.

Automotive ADAS Sensors Market Potential Customers

The primary customers and end-users of Automotive ADAS Sensors are predominantly the global Original Equipment Manufacturers (OEMs) and their associated manufacturing arms responsible for vehicle production across all major regions. These OEMs, including industry leaders such as General Motors, Volkswagen Group, Toyota, Ford, and various emerging electric vehicle manufacturers like Tesla and Rivian, purchase sensors in large quantities, dictated by production volumes and vehicle platform specifications. Their purchasing decisions are heavily influenced by regulatory mandates, consumer safety preferences, and their internal strategic roadmaps for achieving higher levels of vehicle automation. Given the long product life cycles and stringent quality requirements in the automotive industry, OEMs prioritize suppliers offering proven reliability, scalability, functional safety certification, and long-term support for component supply.

Beyond the traditional automotive manufacturers, the burgeoning sector of dedicated mobility service providers and technology companies focused on autonomous vehicle deployment represents a rapidly growing segment of potential customers. This group includes specialized autonomous driving developers (e.g., Waymo, Cruise, Argo AI before acquisition), mapping companies, and logistics fleets testing autonomous trucking and last-mile delivery solutions. These customers typically demand high-performance, often customized, and highly redundant sensor arrays, particularly high-resolution lidar and imaging radar systems, to meet the exacting requirements of Level 4 operation in defined operational design domains (ODDs). Their purchasing cycle is driven by the deployment timeline of their technology stacks and the need for early access to cutting-edge sensor technology that can provide superior environmental perception.

A third crucial customer segment comprises Tier 1 automotive systems integrators, who act as intermediaries but are, in essence, the largest volume buyers of individual sensor components. Companies like Continental, Aptiv, ZF, and Magna procure sensor hardware from specialized Tier 2 manufacturers, integrate them with ECUs, processing software, and wiring harnesses, and then supply the complete, validated ADAS module to the OEMs. While not the final end-user, their procurement decisions shape the market specifications and technology winners, making them essential customers for sensor component manufacturers. Their requirements revolve around sensor compatibility, data interface standardization, and the ability to source components globally at competitive prices while maintaining strict automotive quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 49.0 Billion |

| Growth Rate | CAGR 14.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Aptiv PLC, Valeo SA, Hella GmbH & Co. KGaA, Innoviz Technologies, Luminar Technologies, Inc., Velodyne Lidar, Inc., Infineon Technologies AG, Texas Instruments Incorporated, ON Semiconductor, Autoliv Inc., Magna International Inc., Mobileye (Intel Corp.), Renesas Electronics Corporation, Ambarella, Inc., LeddarTech, STMicroelectronics N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive ADAS Sensors Market Key Technology Landscape

The technological landscape of the Automotive ADAS Sensors market is defined by rapid innovation focused on improving detection range, angular resolution, reliability, and cost-efficiency. Currently, the dominant technologies include high-frequency 77 GHz radar systems, which offer superior long-range performance and environmental resilience compared to older 24 GHz systems, and high-resolution CMOS image sensors, which benefit from continuous advancements in pixel size, dynamic range, and low-light performance. The critical trend shaping the future is the transition to solid-state sensing methodologies across all major modalities. For radar, this involves moving towards 4D imaging radar that provides elevation data, effectively creating a high-resolution point cloud similar to lidar, but with the robustness of radio frequency technology. For cameras, technology development centers on integrating AI processing directly onto the sensor chip (edge AI) for immediate data analysis and optimized bandwidth usage.

Lidar technology represents the most disruptive area of current development, shifting away from bulky, expensive mechanical spinning units to compact, scalable solid-state designs utilizing technologies like Micro-Electro-Mechanical Systems (MEMS), Flash Lidar, or Optical Phased Arrays (OPA). Solid-state lidar promises the requisite high angular resolution (necessary for discriminating small objects at distance) while significantly lowering manufacturing costs, paving the way for mass adoption in Level 3 and Level 4 vehicles. Furthermore, the industry is witnessing intense development in sensor fusion architectures, moving beyond simple data merging to sophisticated, centralized domain controllers. These controllers utilize high-performance automotive-grade processors (like NVIDIA DRIVE or Qualcomm Snapdragon Ride) capable of simultaneously processing petabytes of sensor data from 10 to 20 different inputs, ensuring redundancy and consistency in the environmental model derived from the fused data streams.

Another pivotal technological area is the deployment of Vehicle-to-Everything (V2X) communication, which complements ADAS sensors by providing contextual data beyond the line of sight. While not strictly a sensor, V2X, utilizing technologies such as Dedicated Short-Range Communications (DSRC) or Cellular V2X (C-V2X), expands the perceived environment of the vehicle, allowing it to anticipate hazards or traffic flow changes that on-board sensors cannot yet detect. The convergence of highly accurate internal sensing (radar, lidar, camera) with external situational awareness (V2X and high-definition maps) defines the current technological frontier. Ongoing research also includes thermal sensing to enhance pedestrian detection in low-visibility situations and specialized short-range ultra-wideband (UWB) sensors for precise positioning within parking scenarios and cabin monitoring, showcasing a comprehensive strategy to cover all sensing requirements from bumper-to-bumper and exterior-to-interior.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate due to rapid industrialization, the world's largest automotive production base (led by China and India), and governmental initiatives promoting smart infrastructure and New Energy Vehicles (NEVs). China, in particular, is aggressively pushing domestic OEMs to achieve Level 3 autonomy swiftly, creating immense demand for advanced sensor packages, especially domestically manufactured lidar and high-end camera systems. Consumer demand for safety features in emerging middle-class populations further drives volume. Japan and South Korea remain key markets for technological early adopters, focusing on refined sensor integration and functional safety standards.

- Europe: Europe is a mature but highly influential market, largely dictated by stringent regulatory frameworks, notably the implementation of the General Safety Regulation II (GSR II), which standardizes and mandates several key ADAS features like AEB and LKA. This regulatory push ensures high penetration rates of standard-fit radar and camera systems across all new vehicles. The region is a hub for Tier 1 innovation, focusing heavily on developing robust sensor fusion systems compliant with the highest levels of functional safety (ASIL D), driving demand for premium, highly reliable sensor components.

- North America: The North American market is characterized by high demand for Level 2+ premium features and serves as the primary testing ground for Level 3 and Level 4 autonomous technology, particularly in fleet-based applications and robo-taxis. The market penetration of lidar technology is highest here, driven by high R&D investments from both OEMs and technology startups. While regulations are fragmented across states, consumer preference for large vehicles equipped with extensive convenience and safety features sustains strong demand for both long-range radar and high-definition camera arrays.

- Latin America, Middle East, and Africa (LAMEA): LAMEA currently represents a smaller share of the global market, primarily adopting basic ADAS features (L0/L1) due to cost sensitivity. However, growing infrastructure investments in the Middle East, particularly for smart city projects and logistics modernization, are beginning to stimulate demand for commercial vehicle ADAS sensors. South Africa and Brazil lead the region in safety adoption, driven by regional NCAP programs, gradually increasing the baseline requirements for camera and ultrasonic sensors in locally assembled vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive ADAS Sensors Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Aptiv PLC

- Valeo SA

- Hella GmbH & Co. KGaA

- Innoviz Technologies

- Luminar Technologies, Inc.

- Velodyne Lidar, Inc.

- Infineon Technologies AG

- Texas Instruments Incorporated

- ON Semiconductor

- Autoliv Inc.

- Magna International Inc.

- Mobileye (Intel Corp.)

- Renesas Electronics Corporation

- Ambarella, Inc.

- LeddarTech

- STMicroelectronics N.V.

Frequently Asked Questions

Analyze common user questions about the Automotive ADAS Sensors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption rate of Automotive ADAS Sensors?

The primary factor driving ADAS sensor adoption is stringent global safety regulations, such as the EU's General Safety Regulation (GSR) and the influence of high safety ratings from NCAP programs. These mandates compel OEMs to install features like Automatic Emergency Braking (AEB) and Lane Keep Assist (LKA) as standard, guaranteeing baseline market growth.

How is Lidar technology influencing the future segmentation of the ADAS sensor market?

Lidar technology, particularly the shift to cost-effective, high-resolution solid-state variants, is fundamentally influencing the market by enabling reliable Level 3 and Level 4 autonomy. It creates a high-value niche segment necessary for robust 3D mapping and object perception beyond the capabilities of radar and cameras alone.

Which sensor type currently holds the largest market share by volume and why?

Camera sensors currently hold the largest market share by volume due to their versatility, relatively low cost, and requirement for numerous mandatory ADAS features like Traffic Sign Recognition (TSR), Lane Detection, and basic viewing systems, making them standard equipment across most vehicle classes, including entry-level models.

What major challenges restrict the widespread integration of advanced ADAS systems?

Major restraints include the high total system cost of integrating redundant, high-performance sensor suites (especially Lidar), complex technical challenges in achieving seamless sensor fusion software, and ensuring reliable performance and data integrity under severe or adverse weather conditions.

What role does Artificial Intelligence (AI) play in enhancing ADAS sensor performance?

AI, through deep learning algorithms, transforms sensor data processing by enabling highly accurate real-time object classification and semantic environmental understanding, significantly improving the reliability of perception. AI is also critical for dynamic sensor fusion and enhancing system validation through simulation and synthetic data training.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager