Automotive Alternator Slip Ring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435042 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Automotive Alternator Slip Ring Market Size

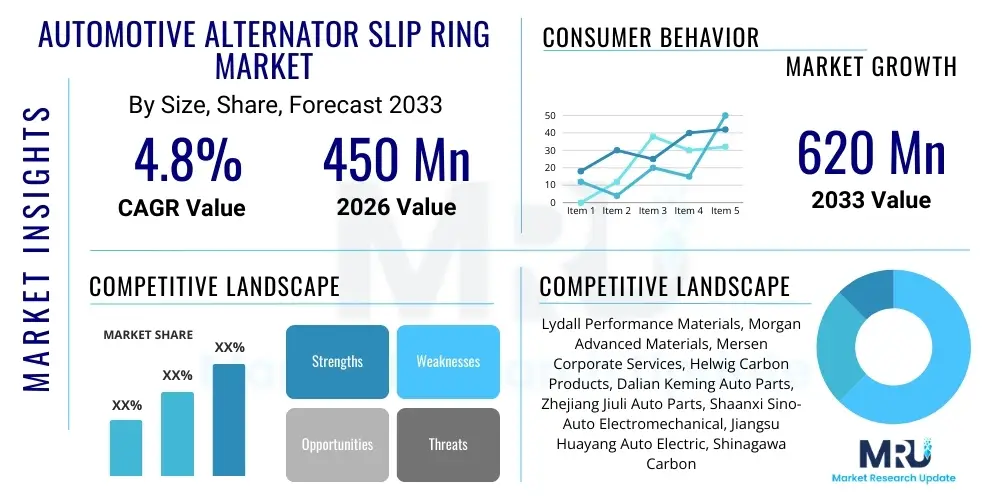

The Automotive Alternator Slip Ring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the sustained growth in global vehicle production, coupled with the increasing integration of complex electronic systems in modern automobiles, which necessitate reliable and high-performance power generation components. The continuous demand for vehicle efficiency and the need for durable replacement parts in the large existing vehicle fleet further stabilize this growth trajectory.

Automotive Alternator Slip Ring Market introduction

The Automotive Alternator Slip Ring Market encompasses the production, distribution, and sale of specialized conductive rings used within automotive alternators. These components are critical electromechanical interfaces designed to transfer electrical power from the stationary wiring harness to the rotating rotor coils, thereby enabling the generation of electrical energy necessary to charge the battery and power the vehicle’s electrical systems. Slip rings must exhibit exceptionally low friction, high conductivity, and robust wear resistance to ensure the long-term reliability of the alternator, often operating under severe thermal and vibrational stress within the engine bay environment.

The primary function of the slip ring assembly is intrinsically linked to the operational efficiency of the alternator, making it a vital component for both internal combustion engine (ICE) vehicles and mild hybrid systems (MHEVs). Major applications span across passenger vehicles, commercial trucks, and off-road heavy equipment. Benefits derived from high-quality slip rings include improved alternator lifespan, minimized energy loss, and reduced maintenance frequency. The trend toward increased vehicle electrification, requiring higher electrical loads for sophisticated infotainment, safety, and driver-assistance systems (ADAS), significantly drives the demand for technically advanced slip rings capable of handling greater current densities and achieving superior durability.

Key driving factors include the global expansion of the automotive manufacturing sector, particularly in emerging economies, the rising average age of vehicles on the road driving aftermarket demand for replacements, and ongoing technological advancements in material science focused on optimizing conductivity and wear characteristics. Furthermore, stringent regulatory requirements across regions regarding fuel efficiency and CO2 emissions push manufacturers to adopt highly efficient electrical systems, indirectly boosting the market for precision-engineered slip rings that minimize internal resistance and maximize alternator output.

Automotive Alternator Slip Ring Market Executive Summary

The global Automotive Alternator Slip Ring market is characterized by steady evolutionary business trends centered on material innovation, miniaturization, and enhanced operational longevity. A significant business trend involves the shift towards silver-graphite and advanced composite brush materials interacting with highly polished copper or brass rings, aiming to reduce electrical noise and wear rate, crucial for modern, noise-sensitive electronic architectures. Geographically, the market exhibits strong bifurcation, with Asia Pacific (APAC) serving as the predominant manufacturing hub and consumer market due to high vehicle production volumes, while North America and Europe lead in the adoption of high-performance, specialized slip rings for premium and electric vehicle applications.

Regional trends indicate that regulatory pushes in Europe toward higher efficiency standards are compelling suppliers to focus on precision manufacturing and zero-defect components. Simultaneously, the rapid expansion of the aftermarket in Latin America and the Middle East highlights strong demand for cost-effective and reliable replacement slip rings. Business expansion strategies are increasingly focusing on vertical integration, where slip ring manufacturers seek closer partnerships with Tier 1 alternator suppliers (e.g., Denso, Bosch, Valeo) to influence design specifications early in the development cycle, ensuring product compatibility with next-generation high-output alternators designed for 48V systems.

Segmentation trends highlight the increasing prominence of the OEM segment due to the tightening of quality requirements, although the aftermarket segment remains vital, capitalizing on the high frequency of alternator repair and overhaul cycles. By vehicle type, the passenger vehicle segment commands the largest share, but the commercial vehicle segment, driven by the need for heavy-duty, long-life components in trucking and transportation, exhibits stable growth. Furthermore, the material-based segmentation shows a gradual transition toward proprietary alloy combinations and surface treatments, offering superior environmental protection and extended service intervals, responding directly to consumer demand for reduced cost of ownership.

AI Impact Analysis on Automotive Alternator Slip Ring Market

Common user questions regarding AI's impact on the Automotive Alternator Slip Ring Market primarily revolve around predictive maintenance, optimized manufacturing processes, and quality control automation. Users are highly interested in how machine learning algorithms can analyze vibration, temperature, and electrical load data captured from alternators in real-time to predict slip ring wear and scheduled replacements, moving maintenance from reactive to proactive strategies. Another key concern centers on the integration of AI-driven vision systems in high-speed production lines to detect microscopic defects in slip ring surface finish, ensuring zero-defect rates crucial for high-performance alternators. The overriding expectation is that AI will enhance product quality, drastically reduce manufacturing waste, and extend the functional lifespan of the component through intelligent system monitoring, thereby optimizing the total cost of ownership for vehicle fleets and individual consumers.

- AI-powered Predictive Maintenance: Utilization of sensor data analytics to estimate slip ring remaining useful life (RUL) and schedule proactive component replacement.

- Optimized Manufacturing Parameters: Machine learning models adjusting plating thickness, surface roughness, and pressing force in real-time during production to maximize product consistency.

- Automated Quality Inspection: Deployment of AI vision systems for non-contact measurement and detection of microscopic defects or surface contamination on the slip ring track.

- Supply Chain Optimization: Use of AI to forecast fluctuations in raw material prices (copper, silver) and manage inventory based on dynamic global automotive production schedules.

- Design Optimization: Application of generative design techniques influenced by AI simulations to create lighter and more thermally efficient slip ring geometries.

DRO & Impact Forces Of Automotive Alternator Slip Ring Market

The market dynamics for Automotive Alternator Slip Rings are complex, driven by simultaneous pressure for high performance and cost reduction, creating distinct drivers, restraints, and opportunities. Primary drivers include the global increase in vehicle electronic content, demanding higher amperage output from alternators, requiring more durable and efficient slip ring assemblies, and the robust demand from the secondary replacement market fueled by the component’s limited wear life. However, restraints such as the initial high cost associated with advanced material compositions (like silver-plated rings), intense pressure from OEMs for price reduction, and the potential long-term technological shift towards brushless alternator designs (where slip rings are eliminated) pose significant hurdles to sustained volume growth.

Opportunities for market players are largely concentrated in the electric vehicle (EV) maintenance ecosystem, particularly for 48V mild hybrid systems which often rely on advanced belt starter-generators utilizing high-power slip rings. Furthermore, the development of proprietary polymer composites and self-lubricating brush materials presents a pathway for differentiated, high-margin products that offer superior longevity in extreme environments. Navigating these forces requires manufacturers to invest heavily in R&D to maintain a competitive edge in material science and precision engineering, moving away from commoditized production toward specialized solutions.

The key impact forces acting upon this market include competitive intensity, technological obsolescence risk, and regulatory mandates. Competitive rivalry is high, particularly in the APAC region where numerous domestic suppliers offer cost-effective alternatives, pressuring pricing structures globally. Technological impact is exerted by the constant pursuit of greater efficiency and reduction of friction losses, making the adoption of cutting-edge coating technologies mandatory for market survival. Lastly, environmental regulations indirectly impact the market by encouraging lightweight vehicle components and systems that reduce parasitic losses, pushing for slip ring designs that are both compact and highly efficient, thereby necessitating continuous innovation in materials and manufacturing tolerances.

Segmentation Analysis

The Automotive Alternator Slip Ring market is comprehensively segmented based on several critical parameters including the type of contact mechanism, the materials utilized in construction, the application in different vehicle types, and the sales channel through which the product is distributed. Analyzing these segments provides a granular view of market demand heterogeneity and identifies key areas of growth, particularly within the aftermarket space where product durability and cost-effectiveness are primary purchasing criteria. Segmentation helps manufacturers tailor their product portfolio, focusing on high-growth areas such as specialized rings for high-output alternators required in performance vehicles or the robust, long-life rings demanded by the heavy-duty commercial sector, balancing high volume production with precision niche offerings.

- By Product Type:

- Solid Slip Ring

- Split/Segmented Slip Ring

- Sleeve Type Slip Ring

- By Material Type:

- Copper Alloys (Standard)

- Silver-Plated Copper (High Performance)

- Brass

- Proprietary Alloys and Coatings

- By Vehicle Type:

- Passenger Vehicles (PVs)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement/Maintenance)

- By Alternator Output Capacity:

- Standard Output (70A - 150A)

- High Output (150A - 250A)

Value Chain Analysis For Automotive Alternator Slip Ring Market

The value chain for the Automotive Alternator Slip Ring Market begins intensely in the upstream segment, dominated by suppliers of high-purity raw materials such as copper, brass, and increasingly, precious metals like silver, which is used for plating to enhance conductivity and wear life. The quality and stable supply of these basic materials are paramount, as slight variations in alloy composition or surface finish directly impact the final product's performance and longevity. Upstream operations are sensitive to global commodity pricing and geopolitical stability, compelling manufacturers to implement robust sourcing strategies, often involving dual-sourcing from geographically diverse regions to mitigate supply chain risk and price volatility.

The midstream phase, involving manufacturing and assembly, is characterized by high precision engineering. This stage includes processes such as cold forming, machining, surface treatment (e.g., electroplating with silver or gold alloys), and the critical assembly of the slip ring onto its insulating core. Companies in this segment focus heavily on maintaining extremely tight tolerances for run-out and concentricity to ensure minimal brush wear and noise generation during operation. Investment in specialized machinery, such as automated multi-spindle lathes and advanced electroplating baths, is necessary to achieve the required scale and quality for Tier 1 automotive suppliers. Quality control, often incorporating advanced metrology and non-destructive testing, adds significant value at this stage.

The downstream distribution channel involves two main routes: direct and indirect. The direct channel primarily serves Original Equipment Manufacturers (OEMs) and major Tier 1 suppliers (e.g., Bosch, Denso, Valeo), where slip rings are sold in large volumes under long-term contracts for integration into new alternators. The indirect channel caters extensively to the global aftermarket, utilizing networks of authorized distributors, independent garages, and online retail platforms. This channel is crucial for servicing the large global fleet of vehicles requiring replacement parts. Success in the aftermarket depends heavily on logistical efficiency, brand reputation for durability, and competitive pricing, often requiring specialized packaging and cataloging to ensure correct fitment across various vehicle models and generations.

Automotive Alternator Slip Ring Market Potential Customers

The primary potential customers and end-users of Automotive Alternator Slip Rings are multi-layered, beginning with large-scale global component manufacturers. Tier 1 automotive suppliers specializing in electrical components, such as manufacturers of complete alternator assemblies (e.g., Denso, Bosch, Valeo, Mitsubishi Electric), represent the largest and most demanding customer segment in terms of volume and technical specifications. These customers require high-volume, defect-free components that adhere strictly to automotive quality standards (e.g., IATF 16949) and often require custom designs optimized for their proprietary alternator architectures, necessitating close collaborative relationships between the slip ring producer and the Tier 1 firm.

The second major customer group comprises vehicle Original Equipment Manufacturers (OEMs) themselves, although they typically purchase alternators as complete units from Tier 1 suppliers. However, OEMs exert significant influence over the selection and specification of components, ensuring that the slip rings utilized meet their rigorous vehicle-level performance and longevity standards. Furthermore, heavy-duty and specialized vehicle manufacturers (e.g., agricultural, construction, marine) represent a critical niche market, demanding slip rings engineered for extreme environments, higher current loads, and exceptional resistance to contaminants like dust, moisture, and elevated temperatures.

Finally, the vast global aftermarket constitutes a persistently growing segment of potential customers, encompassing independent parts distributors, specialized automotive rebuilders, and maintenance workshops. These customers prioritize affordability, immediate availability, and reliability, stocking a wide array of slip ring models compatible with various older and current vehicle platforms. Online retailers and large automotive parts chains also play an increasing role in direct-to-consumer sales for DIY mechanics or smaller repair shops, making catalog integration and detailed product information key to serving this diverse and fragmented customer base effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lydall Performance Materials, Morgan Advanced Materials, Mersen Corporate Services, Helwig Carbon Products, Dalian Keming Auto Parts, Zhejiang Jiuli Auto Parts, Shaanxi Sino-Auto Electromechanical, Jiangsu Huayang Auto Electric, Shinagawa Carbon, Gopher Manufacturing, Rotek, United Equipment Accessories, Hangzhou Fusheng Electrical, Kanthal, Schunk Carbon Technology, Electro-Nite, Tsubaki Nakashima, Toyo Carbon, Wabtec Corporation, SGL Carbon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Alternator Slip Ring Market Key Technology Landscape

The technological landscape of the Automotive Alternator Slip Ring Market is characterized by a relentless pursuit of miniaturization, improved thermal management, and enhanced material durability. A critical focus area involves advanced surface engineering, including the use of Physical Vapor Deposition (PVD) or Chemical Vapor Deposition (CVD) techniques to apply ultra-thin, highly conductive, and exceptionally hard coatings, typically based on silver or proprietary carbide alloys, onto the slip ring surface. These coatings significantly reduce the contact resistance and friction coefficient, directly translating into higher alternator efficiency and markedly extending the component's operational life, which is a major selling point for OEM and high-end aftermarket applications.

Another pivotal technological trend is the development of specialized brush materials designed to complement the advanced slip ring surfaces. Traditional carbon brushes are increasingly being replaced or augmented by advanced composites incorporating metallic powders, graphitic compounds, and polymer binders. These proprietary brush formulations are optimized for low wear rates under high current density and wide operating temperatures, simultaneously minimizing electrical noise—a vital factor in vehicles equipped with sensitive digital communication systems. Furthermore, slip ring designs are evolving to accommodate the increasing current demand of 48V mild hybrid systems, leading to the introduction of multi-track or sleeve-type rings with increased surface area and optimized thermal dissipation pathways.

Integration technology, focusing on the assembly method of the slip ring unit within the alternator rotor, is also advancing. Precision injection molding techniques are being employed to ensure highly accurate seating and insulation of the conductive rings, providing superior resistance to vibration and thermal shock. Innovations in mounting methodologies aim to reduce overall alternator weight and complexity, supporting the automotive industry's pervasive lightweighting goals. Overall, the technological trajectory points toward highly customized, integrated slip ring and brush systems designed as a cohesive unit, rather than standalone parts, demanding closer collaboration between material scientists, electrical engineers, and alternator manufacturers to push the boundaries of power transfer efficiency.

Regional Highlights

The global Automotive Alternator Slip Ring Market exhibits distinct regional consumption and manufacturing patterns, heavily influenced by local vehicle production volumes, regulatory frameworks, and market maturity. Asia Pacific (APAC), led by China, India, Japan, and South Korea, dominates the market both in terms of manufacturing capacity and consumption volume. The region benefits from high-volume domestic vehicle production and a rapidly expanding middle class driving new car sales, creating sustained demand for OEM components and fueling a massive, low-cost replacement market. APAC manufacturers often leverage economies of scale, making the region a global hub for standard and mid-range slip ring components.

Europe represents a highly specialized market segment, characterized by stringent environmental regulations and a strong emphasis on premium vehicle performance and efficiency. European OEMs demand high-specification slip rings, particularly those designed for 48V systems and high-output performance alternators. This drives technology adoption focused on advanced materials, minimal friction, and exceptionally long service lives. The replacement market in Europe is also mature, supporting premium aftermarket brands that emphasize component quality and longevity over bare cost considerations, often linked to the high labor costs associated with vehicle repair.

North America maintains a robust market, driven by stable new vehicle sales and a significant demand from the heavy-duty commercial vehicle (HCV) sector, where alternators require extremely durable slip rings capable of handling high loads over extended operating periods. The US aftermarket is particularly strong, characterized by consumer willingness to invest in reliable, branded replacement parts. Latin America and the Middle East & Africa (MEA) are emerging growth regions, primarily fueled by the increasing vehicular population and the corresponding surge in demand for affordable replacement parts, often relying on imported components from APAC or established European and American aftermarket brands.

- Asia Pacific (APAC): Highest growth and manufacturing volume; dominance driven by China and India's mass production of passenger and commercial vehicles; focus on cost-efficiency and high-volume supply.

- Europe: Demand concentrated on high-performance and efficiency-optimized slip rings, particularly for 48V systems and premium automotive brands; strict quality standards and technological leadership.

- North America: Stable OEM market and robust aftermarket; strong demand from the heavy-duty vehicle sector requiring exceptional durability and load capacity.

- Latin America (LATAM): Growing aftermarket presence driven by an aging vehicle fleet and improving economic conditions; increasing reliance on replacement components.

- Middle East & Africa (MEA): Emerging market characterized by demand for robust components capable of withstanding harsh environmental conditions (heat, dust); growing distribution networks for aftermarket products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Alternator Slip Ring Market.- Lydall Performance Materials (now part of Solvay)

- Morgan Advanced Materials

- Mersen Corporate Services

- Helwig Carbon Products

- Dalian Keming Auto Parts Co., Ltd.

- Zhejiang Jiuli Auto Parts Manufacturing Co., Ltd.

- Shaanxi Sino-Auto Electromechanical Co., Ltd.

- Jiangsu Huayang Auto Electric Co., Ltd.

- Shinagawa Carbon Co., Ltd.

- Gopher Manufacturing Inc.

- Rotek, Inc.

- United Equipment Accessories (UEA)

- Hangzhou Fusheng Electrical Co., Ltd.

- Kanthal (Sandvik Group)

- Schunk Carbon Technology

- Electro-Nite (A metallurgical analysis company, relevant for material sourcing)

- Tsubaki Nakashima Co., Ltd.

- Toyo Carbon Co., Ltd.

- Wabtec Corporation (Focusing on heavy-duty/rail applications but relevant technology)

- SGL Carbon SE

Frequently Asked Questions

Analyze common user questions about the Automotive Alternator Slip Ring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a slip ring in an automotive alternator?

The primary function of the slip ring assembly is to conduct electrical current from the stationary brush contacts to the rotating field winding (rotor) of the alternator. This current energizes the rotor, creating a magnetic field necessary for electricity generation, ensuring reliable power supply to the vehicle's electrical systems and battery charging.

How do 48V mild hybrid systems affect the demand for alternator slip rings?

48V mild hybrid systems (MHEVs) often rely on high-output belt starter-generators (BSGs) which place significantly higher thermal and electrical loads on the slip rings than traditional 12V alternators. This drives increased demand for specialized, high-performance slip rings made from advanced materials like silver alloys to handle higher current density and ensure extended durability.

What are the key differences between OEM and Aftermarket slip rings?

OEM slip rings are manufactured to precise, often proprietary specifications set by the vehicle manufacturer or Tier 1 supplier, focusing on zero defects and maximum longevity within new vehicle assemblies. Aftermarket slip rings, while meeting functional standards, generally focus on cost-effectiveness and broad compatibility, serving the replacement and repair market where component lifespan is often balanced against pricing considerations.

What materials are commonly used in high-performance alternator slip rings?

High-performance alternator slip rings typically use copper or brass base materials plated with precious metals such as silver or proprietary silver-graphite alloys. These advanced coatings significantly enhance conductivity, reduce contact resistance, minimize friction, and provide superior resistance to wear and oxidation compared to standard unplated rings.

Is the market threatened by the shift toward Brushless DC motors in automotive systems?

While the long-term trend towards full electrification (BEVs) reduces demand for traditional alternators, and some newer systems adopt brushless designs, the current market for conventional and mild-hybrid vehicles remains robust. Slip rings are essential for the vast existing fleet and most MHEV 48V systems. The threat is moderate and long-term, mitigated by ongoing demand for replacement parts and the slow transition period for mass adoption of purely brushless architectures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager