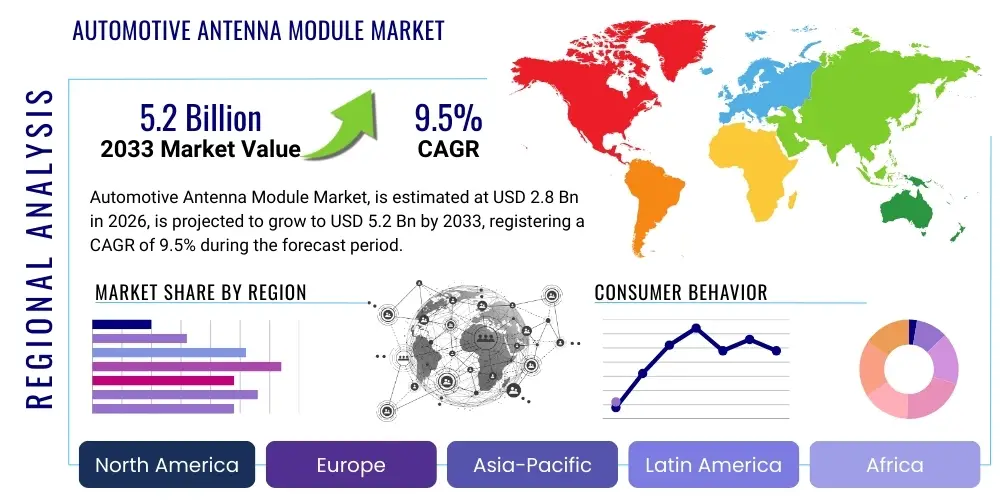

Automotive Antenna Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438682 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Automotive Antenna Module Market Size

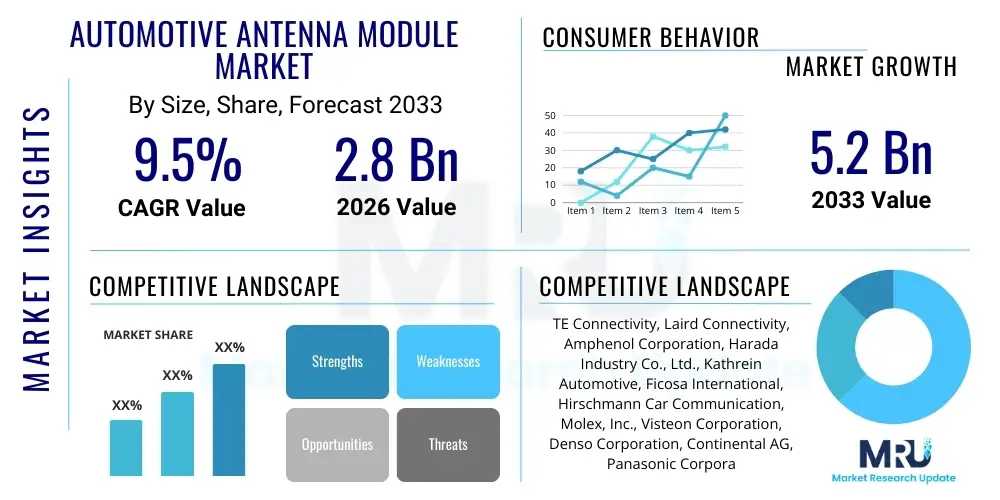

The Automotive Antenna Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $2.8 Billion in 2026 and is projected to reach $5.2 Billion by the end of the forecast period in 2033.

Automotive Antenna Module Market introduction

The Automotive Antenna Module Market encompasses specialized systems designed to facilitate seamless wireless communication within modern vehicles. These modules are crucial for enabling a wide range of functions, including navigation (GNSS/GPS), multimedia reception (AM/FM, SDARS), telematics (eCall, B-Call), and sophisticated vehicle-to-everything (V2X) communication, which is foundational for connected and autonomous driving environments. As vehicles transform into sophisticated mobile data hubs, the demand for highly integrated, multi-functional antenna solutions that minimize electromagnetic interference and maximize bandwidth is intensifying across the global automotive industry. These integrated modules replace multiple discrete antennae, offering aesthetic and aerodynamic advantages.

Antenna modules are complex systems incorporating not only the radiating element but also low-noise amplifiers (LNAs), filters, and multiplexers, often packaged within sleek designs such as the widely adopted shark fin housing or integrated within glass or body panels. Key applications driving market expansion include advanced infotainment systems requiring high-speed data transfer for streaming services, increased penetration of emergency services like eCall mandated in regions like Europe, and the global push towards autonomous driving that relies heavily on precise positioning and reliable V2X communication for safety and operational efficiency. The primary benefit of these modules is the consolidation of connectivity features into a single, robust, and aesthetically pleasing unit.

Major driving factors fueling this market growth include the escalating consumer demand for superior in-vehicle connectivity experiences, stringent government regulations mandating vehicle safety and tracking technologies, and the rapid deployment of 5G infrastructure, which necessitates new antenna designs capable of handling higher frequencies and massive data throughput. Furthermore, the shift towards electric vehicles (EVs) and hybrid vehicles, which require optimized communication channels for battery management and remote diagnostics, is accelerating the integration of these advanced module solutions globally. The structural complexity and material science involved in developing modules compatible with new vehicle body materials (like composites and aluminum) also define the current technological trajectory.

Automotive Antenna Module Market Executive Summary

The global Automotive Antenna Module Market is characterized by robust growth, primarily driven by the paradigm shift toward connected vehicle technologies and autonomous mobility. Business trends indicate a strong move toward platform standardization and modular design, allowing automotive OEMs to efficiently integrate diverse connectivity options—ranging from legacy AM/FM to cutting-edge 5G and C-V2X (Cellular V2X)—using a single supplier base. Strategic collaborations between Tier 1 suppliers and telecommunications providers are becoming common to ensure that antenna modules are optimized for emerging global network standards. Furthermore, the increased focus on cybersecurity within these connected systems necessitates continuous software and hardware integration improvements, pushing manufacturers to develop software-defined antenna arrays that offer flexibility and upgradeability post-sale.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by high volume automotive production in countries like China, Japan, and South Korea, coupled with rapidly increasing adoption of telematics and connected services in mass-market vehicles. Europe remains critical due to its emphasis on premium segment vehicles, strict mandates such as eCall, and early investment in 5G automotive corridors, driving demand for high-performance, complex integrated modules. North America shows sustained growth, primarily spurred by consumer expectations for high-end infotainment features, widespread satellite radio adoption (SDARS), and the early commercialization of autonomous vehicle testing, which requires highly accurate Global Navigation Satellite System (GNSS) antenna arrays.

Segment trends reveal that the Shark Fin antenna module segment continues to dominate due to its optimal placement for signal reception and aesthetic appeal. However, modules integrated into vehicle glass or hidden under body panels are gaining traction, especially in electric vehicles where aerodynamic efficiency is paramount. By application, Telematics and V2X are projected to exhibit the fastest growth rate, surpassing traditional entertainment applications. This shift is a direct result of regulatory pressures regarding safety and the industry's focus on monetization through value-added services enabled by reliable, continuous connectivity. Component suppliers are prioritizing miniaturization and material optimization to handle multi-band, multi-standard requirements within constrained physical spaces.

AI Impact Analysis on Automotive Antenna Module Market

Common user questions regarding AI's influence on the Automotive Antenna Module Market frequently revolve around how artificial intelligence enhances signal integrity, optimizes array performance in dynamic driving conditions, and manages the immense complexity of multi-band, multi-protocol communication. Users are concerned about whether AI can facilitate predictive maintenance for antenna performance degradation, or if it can dynamically steer beams to maintain connectivity in areas with weak or obstructed signals. Furthermore, there is interest in how machine learning algorithms will be used to analyze large datasets generated by V2X communication, allowing for faster processing and decision-making crucial for autonomous functions. The consensus expectation is that AI will transform antenna modules from passive receiving components into active, intelligent communication nodes.

AI’s primary impact is centered on enabling cognitive connectivity. Traditional antenna systems operate based on fixed parameters; however, the increasing density of wireless signals and environmental variability necessitates real-time adaptation. AI algorithms, particularly machine learning, are employed for dynamic antenna management, allowing the system to learn optimal communication paths, dynamically adjust power levels, and perform beam steering in real-time. This capability is vital for maintaining robust 5G and V2X connections required by high-level autonomous driving features. Furthermore, AI contributes significantly to predictive failure analysis, processing data on signal strength, noise levels, and hardware performance to alert drivers or maintenance systems of potential connectivity issues before they lead to service interruption.

The integration of AI also addresses the challenge of designing extremely complex, multi-functional arrays. Generative AI and machine learning optimization tools are being used during the design phase to simulate thousands of scenarios and rapidly iterate on antenna designs that maximize performance across numerous frequency bands simultaneously while adhering to strict space and weight constraints. This accelerates the product development cycle and ensures that newer vehicles are equipped with communication systems that are inherently smarter, more resilient to interference, and capable of adapting to future network evolution without major hardware overhauls. This shift represents a major step towards truly software-defined vehicles.

- AI enables dynamic beam steering and pattern reconfiguration for optimized signal strength.

- Machine learning algorithms enhance noise filtering and interference cancellation in congested spectrums.

- AI facilitates real-time channel estimation and selection for reliable V2X communication.

- Predictive analytics driven by AI monitor antenna health and forecast component failure.

- Generative AI tools accelerate the design and simulation of highly complex multi-band antenna arrays.

DRO & Impact Forces Of Automotive Antenna Module Market

The Automotive Antenna Module Market is shaped by a powerful confluence of Drivers, Restraints, and Opportunities (DRO). The paramount driver is the surging global adoption of connected vehicle ecosystems, necessitating high-speed, reliable data links for infotainment, advanced driver-assistance systems (ADAS), and vehicle-to-infrastructure (V2I) communication. Regulations, such as mandated eCall systems in Europe and increasing demand for stolen vehicle recovery services globally, also exert significant upward pressure on market growth. Simultaneously, the proliferation of 5G networks provides the necessary high-bandwidth backbone, making sophisticated antenna modules indispensable for leveraging these advanced network capabilities within the vehicle environment. These drivers collectively establish a strong foundational demand structure.

Conversely, the market faces notable restraints, primarily concerning complexity and cost. The integration of multi-band, multi-protocol functionality into a single module necessitates complex filtering and shielding, driving up component costs. Furthermore, the stringent space and aesthetic requirements of vehicle manufacturers often conflict with the physical size requirements for optimal antenna performance, leading to complex engineering trade-offs. Signal interference, particularly from internal vehicle electronics and the close proximity of multiple communication systems (Wi-Fi, Bluetooth, Telematics, GNSS), remains a persistent technical challenge that requires sophisticated and costly mitigation techniques, limiting broader adoption in cost-sensitive segments. The lack of standardized global V2X technology also introduces uncertainty for long-term module design.

Significant opportunities exist in the development of flexible and conformal antenna solutions, such as those utilizing advanced materials like liquid crystal polymer (LCP) and metamaterials, which can be seamlessly integrated into vehicle body panels without compromising performance or aerodynamics. The emergence of software-defined radio (SDR) technology promises to future-proof antenna modules, allowing for software updates to accommodate new communication standards (e.g., transitioning from 4G to 5G protocols) without physical replacement. Furthermore, the focus on electric vehicles creates a specific niche opportunity for highly efficient, lightweight antenna designs that minimize power consumption while ensuring critical connectivity for battery monitoring and charging management systems. The integration of security hardware directly into the module represents a high-growth security enhancement opportunity.

- Drivers: Connected Car proliferation (V2X, Telematics), mandatory safety regulations (eCall), high consumer demand for superior in-car infotainment, and 5G network expansion.

- Restraints: High module complexity and integration cost, electromagnetic interference (EMI) challenges, lack of global V2X standardization, and the aesthetic constraints imposed by OEMs.

- Opportunities: Development of flexible, conformal metamaterial antennas, adoption of Software-Defined Radio (SDR) for future-proofing, and specialized solutions for the rapidly growing Electric Vehicle (EV) segment.

- Impact Forces: Rapid technological obsolescence due to evolving wireless standards (e.g., 6G anticipation), increasing power demands from integrated systems, and the imperative for cross-industry collaboration between automotive, telecommunications, and semiconductor sectors.

Segmentation Analysis

The Automotive Antenna Module Market is comprehensively segmented based on several key criteria, including Component, Vehicle Type, Technology, and Application. This structured segmentation is critical for understanding market dynamics, investment patterns, and technological priorities across different industry verticals. The component segment highlights the market reliance on specialized hardware, such such as coaxial cables, connectors, filters, and low-noise amplifiers (LNAs), which often require precision manufacturing and advanced material science. The performance and reliability of the overall module are directly tied to the quality of these underlying components, making component suppliers vital nodes in the value chain. The trend is moving towards highly integrated System-in-Package (SiP) solutions for enhanced miniaturization.

The segmentation by Application provides insight into the functional drivers of demand. While traditional applications like AM/FM and Satellite Digital Audio Radio Service (SDARS) form the mature base of the market, the exponential growth is concentrated in mission-critical applications. Telematics, encompassing mandatory safety systems (e.g., eCall) and tracking services, represents a high-priority segment due to regulatory mandates and fleet management requirements. Similarly, V2X communication, which includes V2V, V2I, and V2P, is the future cornerstone, driving demand for modules capable of extremely low latency and high reliability, irrespective of speed or environment. GNSS integration is another crucial application, supporting both navigation and highly accurate positioning required for ADAS and autonomous features.

Vehicle type segmentation distinguishes demand characteristics between Passenger Vehicles and Commercial Vehicles. Passenger vehicles, particularly those in the premium and luxury segments, drive demand for highly aesthetic (shark fin) and feature-rich modules supporting high-end infotainment, multiple simultaneous connections (multi-MIMO), and personalized services. Conversely, the commercial vehicle segment (heavy trucks, buses, fleet vehicles) focuses on robustness, durability, and reliable telematics for logistics, asset tracking, and regulatory compliance. The emerging electric vehicle (EV) segment, while currently categorized under passenger or commercial, presents unique challenges and opportunities related to electromagnetic compatibility (EMC) and weight constraints, leading to demand for custom-designed, lightweight antenna solutions that minimize power draw.

- By Component:

- Coaxial Cables and Connectors

- Filters and Duplexers

- Low-Noise Amplifiers (LNAs)

- Radiating Elements/Patches

- Housings and Enclosures

- By Application:

- Telematics (Emergency & Diagnostic Services)

- Global Navigation Satellite System (GNSS)/GPS

- Infotainment (AM/FM, SDARS)

- Vehicle-to-Everything (V2X) Communication

- Wi-Fi/Bluetooth Connectivity

- By Vehicle Type:

- Passenger Vehicles (Sedan, SUV, Luxury)

- Commercial Vehicles (Trucks, Buses, Light Commercial Vehicles)

- Electric Vehicles (EVs/Hybrid)

- By Technology:

- Conventional Antennas (Rod/Whip)

- Printed Circuit Board (PCB) Antennas

- Conformal/Hidden Antennas

- Metamaterial/Phased Array Antennas

Value Chain Analysis For Automotive Antenna Module Market

The value chain of the Automotive Antenna Module Market is intricate, spanning from raw material sourcing and specialized component manufacturing to system integration and end-user application. Upstream analysis involves the procurement of highly specialized raw materials, including advanced polymers and plastics for housings, high-frequency PCB laminates, high-purity copper and aluminum for conductive elements, and semiconductor chips for LNAs and processing units. Suppliers in this segment must adhere to strict automotive quality standards (e.g., IATF 16949). The upstream stage is highly competitive and globalized, driven by the need for cost efficiency and technical performance characteristics essential for high-frequency applications (e.g., low dielectric loss materials).

The midstream is dominated by Tier 1 and Tier 2 suppliers responsible for design, assembly, and testing of the final module. Tier 2 suppliers focus on specialized components like connectors, cables, and LNA chips, whereas Tier 1 suppliers (module manufacturers) handle the integration, packaging (e.g., shark fin design), rigorous testing (EMI/EMC compliance, vibration resistance), and direct delivery to Original Equipment Manufacturers (OEMs). Manufacturing processes are technologically sophisticated, involving high-precision surface-mount technology (SMT) and automated assembly lines. Strategic alliances at this stage are crucial, as Tier 1 suppliers often collaborate directly with OEMs during the vehicle design cycle to ensure seamless integration and optimized performance based on vehicle geometry and materials.

Downstream distribution channels are predominantly B2B, characterized by two primary routes: Direct Supply to OEMs and the Aftermarket. The direct channel accounts for the vast majority of sales, involving long-term supply contracts and highly customized production runs synchronized with vehicle manufacturing schedules. This route demands just-in-time delivery and zero-defect quality assurance. The aftermarket, consisting of repair shops, vehicle modification specialists, and independent distributors, handles replacement parts and upgrades, although it represents a smaller, yet growing, segment focused mainly on specialized GNSS or telematics additions for older fleet vehicles. Success in the distribution phase is predicated on maintaining a global logistical footprint and ensuring regional compliance with diverse communication spectrum regulations.

Automotive Antenna Module Market Potential Customers

The primary and largest potential customers in the Automotive Antenna Module Market are Original Equipment Manufacturers (OEMs). These automotive manufacturers, including global giants and emerging EV producers, integrate the antenna modules directly into vehicles during the assembly process. OEMs seek modules that offer maximum functionality, seamless integration with vehicle aesthetics, high durability, and strict compliance with global connectivity standards (e.g., 5G readiness, C-V2X protocols). The purchasing decisions of OEMs are heavily influenced by the ability of suppliers to customize modules for specific vehicle platforms, deliver modules that meet rigorous safety and reliability tests, and provide competitive pricing under high-volume contracts. Long-term supplier relationships based on trust and technological leadership define this customer segment.

The second major segment comprises Fleet Operators and Logistics Companies. These customers are primarily interested in robust, high-performance telematics and GNSS tracking capabilities for their extensive commercial vehicle fleets (trucks, buses, delivery vans). For fleet operators, the antenna module is a critical component for operational efficiency, regulatory compliance (e.g., electronic logging devices, ELDs), route optimization, and predictive maintenance. They often purchase modules separately or as part of integrated aftermarket telematics solutions, prioritizing ruggedness, signal consistency, and compatibility with various third-party fleet management platforms. Cost-effectiveness and ease of installation are significant buying criteria for this segment, favoring standardized and reliable systems.

Finally, Aftermarket Service Providers, including vehicle customization shops, independent garages, and insurance companies offering usage-based insurance (UBI), constitute another key customer base. These entities purchase modules for replacing damaged units, upgrading older vehicles with modern connectivity features (e.g., adding satellite radio, improving GPS reception), or installing specialized tracking devices. While the volume is lower than OEM direct supply, this segment offers higher profit margins and demands a broad range of compatible products suitable for diverse vehicle models and generations. Insurance providers, in particular, drive demand for discreet, tamper-proof telematics antenna solutions enabling accurate data collection on driving behavior.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.8 Billion |

| Market Forecast in 2033 | $5.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Laird Connectivity, Amphenol Corporation, Harada Industry Co., Ltd., Kathrein Automotive, Ficosa International, Hirschmann Car Communication, Molex, Inc., Visteon Corporation, Denso Corporation, Continental AG, Panasonic Corporation, Huawei Technologies Co., Ltd., NXP Semiconductors N.V., Airgain, Inc., Calearo Antenne S.p.A., Global Invacom, Taoglas, TDK Corporation, Yokowo Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Antenna Module Market Key Technology Landscape

The technology landscape of the Automotive Antenna Module Market is rapidly evolving, driven by the need for higher bandwidth, lower latency, and integration of numerous communication standards within a small, non-obtrusive package. A major technological advancement is the widespread adoption of multi-function integrated modules, primarily exemplified by the Shark Fin design, which typically houses GNSS, 4G/5G LTE, Wi-Fi, and SDARS antennas simultaneously. Achieving functional separation and minimizing mutual interference within such proximity necessitates advanced filtering technologies, including ceramic filters and high-performance duplexers, which are designed to isolate adjacent frequency bands effectively. The materials science aspect is also critical, focusing on lightweight, high-dielectric materials that maintain stable performance across varying temperatures and environmental conditions common in automotive use.

A transformative trend involves the development and early adoption of conformal and invisible antenna technologies. These antennas, often based on printed electronics (e.g., Laser Direct Structuring – LDS) or transparent conductive films, are integrated directly into the vehicle's glass, polymer bumpers, or internal roof liners, eliminating the need for external structures and significantly improving vehicle aesthetics and aerodynamics, which is particularly crucial for maximizing the range of electric vehicles. Beyond physical integration, software-defined radio (SDR) principles are beginning to influence module design. SDR allows the antenna processing unit to dynamically change frequency bands, modulation schemes, and power output based on software updates, ensuring that the vehicle’s connectivity stack remains compliant and functional even as network standards evolve globally.

Looking forward, the development of intelligent and active antenna systems, such as phased arrays and those utilizing metamaterials, represents the cutting edge of the market. Phased array technology allows the antenna beam to be electronically steered without physical movement, which is essential for maximizing signal strength in V2X communication, especially at high speeds. Metamaterials, engineered to exhibit properties not found in natural substances, enable the creation of extremely thin, lightweight, and highly efficient antennas optimized for specific frequency ranges (like 5G millimeter wave) while consuming minimal power. These technologies are crucial enablers for fully autonomous driving, where reliability and redundancy in communication links are paramount and demand active, adaptive control over signal transmission and reception.

Regional Highlights

- North America: This region is characterized by high penetration of premium and connected vehicles, making it a key early adopter of advanced multi-band modules, particularly those supporting high-definition infotainment and Satellite Digital Audio Radio Service (SDARS), which is commercially dominant here. Driven by robust R&D spending and the testing/deployment of autonomous vehicles, demand for high-precision GNSS and advanced V2X modules is exceptionally strong. Regulatory push for emergency response systems and the early rollout of 5G infrastructure also solidify North America’s position as a high-value market.

- Europe: Driven heavily by stringent safety regulations, notably the mandatory implementation of the eCall system across the European Union, Europe maintains a high demand for reliable telematics modules. The region emphasizes aesthetic integration, pushing manufacturers towards conformal and discreet antenna solutions in luxury and high-end automotive brands. Europe is also a leader in C-V2X pilot projects and maintains a significant focus on reducing vehicle emissions, which favors lightweight and aerodynamically optimized components.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily due to high volume manufacturing in China, Japan, and South Korea, coupled with rapidly expanding middle-class populations demanding connected features. Government initiatives promoting smart mobility and rapid 5G deployment, particularly in China and South Korea, are accelerating the integration of advanced antenna modules into mass-market vehicles. This region dominates both supply (manufacturing base) and demand (high sales volume), focusing on balancing performance with cost-competitiveness.

- Latin America (LATAM): The LATAM market is growing steadily, primarily fueled by increasing vehicle production and regulatory requirements related to vehicle security and tracking systems (Telematics). While the adoption of advanced 5G-enabled V2X modules is slower compared to North America and Europe, the demand for basic telematics and GPS/GNSS modules for fleet management and insurance applications is rising significantly, especially in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated in technologically advanced economies like the UAE and Saudi Arabia, which are investing heavily in smart city infrastructure and connected mobility projects. The primary demand drivers are luxury vehicle imports requiring high-end infotainment and localized telematics solutions. Challenges related to diverse spectrum allocation and limited infrastructure density in certain African markets restrain overall regional growth, but opportunities exist in fleet and asset tracking for resource industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Antenna Module Market.- TE Connectivity

- Laird Connectivity (acquired by DuPont)

- Amphenol Corporation

- Harada Industry Co., Ltd.

- Kathrein Automotive (acquired by Telegärtner)

- Ficosa International S.A.

- Hirschmann Car Communication GmbH (A TE Connectivity Company)

- Molex, Inc. (A Koch Company)

- Visteon Corporation

- Denso Corporation

- Continental AG

- Panasonic Corporation

- Huawei Technologies Co., Ltd.

- NXP Semiconductors N.V.

- Airgain, Inc.

- Calearo Antenne S.p.A.

- Global Invacom Group Limited

- Taoglas

- TDK Corporation

- Yokowo Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Antenna Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced automotive antenna modules?

The central driver is the pervasive integration of connected car technologies, including Vehicle-to-Everything (V2X) communication, high-speed 5G connectivity, and sophisticated infotainment systems, which require reliable, multi-band antenna arrays to manage increased data throughput and low latency.

How are 5G networks influencing the design and complexity of automotive antenna modules?

5G requires antenna modules to handle much higher frequencies, including millimeter wave (mmWave), necessitating miniaturized, active antenna elements, advanced beamforming capabilities (phased arrays), and highly efficient materials to mitigate transmission losses, significantly increasing module complexity and integration requirements.

What are the main technological challenges in integrating multiple antennas into a single module?

The major challenges involve mitigating Electromagnetic Interference (EMI) between closely spaced antennas operating on different frequencies, ensuring adequate isolation, and designing complex filtering and multiplexing circuitry within confined spaces to prevent signal degradation and maintain optimal performance for all communication standards simultaneously.

Which application segment is expected to show the fastest growth in the antenna module market?

The Vehicle-to-Everything (V2X) communication segment, followed closely by telematics applications related to safety and regulation compliance, is projected to experience the highest growth rate as autonomous driving features and government mandates for road safety become globally standardized and adopted.

How does the shift to electric vehicles (EVs) impact the design requirements for antenna modules?

EVs demand highly integrated, lightweight, and aerodynamically optimized antenna modules to maximize battery range. Furthermore, antenna designs must account for unique electromagnetic compatibility (EMC) challenges posed by high-voltage battery systems and power electronics often found in electric drivetrains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager