Automotive Antipinch Power Window Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439595 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Antipinch Power Window Systems Market Size

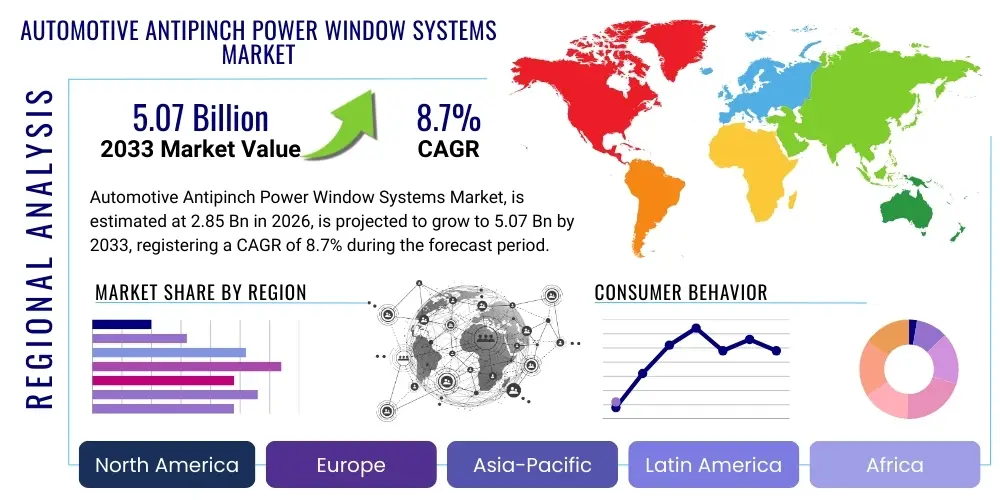

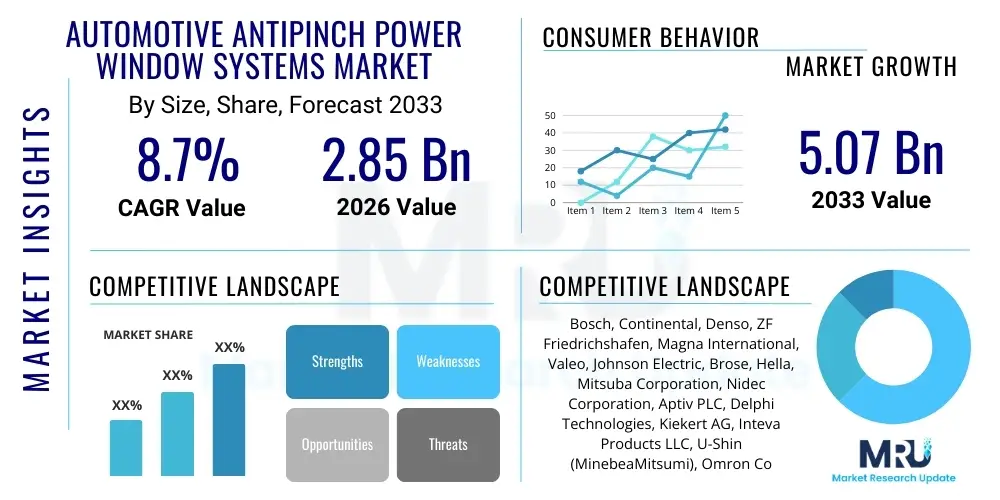

The Automotive Antipinch Power Window Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at $2.85 billion in 2026 and is projected to reach $5.07 billion by the end of the forecast period in 2033.

Automotive Antipinch Power Window Systems Market introduction

The Automotive Antipinch Power Window Systems Market encompasses the design, manufacturing, and integration of safety mechanisms within vehicle power windows that prevent injuries caused by trapping body parts. These systems utilize various sensor technologies and control algorithms to detect obstructions during window closure, automatically reversing or stopping the window movement to avoid pinching. Originally a premium feature, antipinch technology has become a critical safety standard in many regions, driven by evolving regulatory mandates and increasing consumer awareness regarding vehicle safety.

Major applications of these systems are primarily found in passenger cars, including sedans, hatchbacks, SUVs, and luxury vehicles, but are also increasingly adopted in light commercial vehicles. The primary benefit is enhanced occupant safety, particularly for children and pets, by mitigating the risk of serious injury. Beyond safety, these systems contribute to a perception of modern vehicle sophistication and comfort. Key driving factors for market growth include stringent global safety regulations, advancements in sensor technology, increasing disposable incomes in emerging economies leading to higher vehicle ownership, and the ongoing trend towards vehicle automation and enhanced convenience features.

The core product involves an electronic control unit (ECU), electric motor, and an array of sensors—such as Hall-effect sensors, current-sensing systems, or optical sensors—that monitor the window's resistance or position. When an abnormal resistance or obstruction is detected, the system triggers an immediate reversal of the window's direction, effectively preventing an accident. This integration of electromechanical components and intelligent control software ensures a high level of safety and reliability, making antipinch power window systems an indispensable feature in contemporary automotive design, crucial for meeting both regulatory compliance and consumer expectations for safety and advanced vehicle features.

Automotive Antipinch Power Window Systems Market Executive Summary

The Automotive Antipinch Power Window Systems Market is experiencing robust growth fueled by an interplay of evolving safety standards, consumer demand for advanced vehicle features, and continuous technological innovation. Business trends indicate a strong focus on cost-effective yet highly reliable sensor solutions, alongside integration into broader vehicle electrical architectures. Tier 1 suppliers are investing in miniaturization and enhanced software capabilities to provide more sophisticated and responsive systems. The shift towards electric and autonomous vehicles is also influencing product development, as these vehicles often incorporate more advanced human-machine interfaces and require comprehensive safety systems that are seamlessly integrated into the overall vehicle intelligence, pushing the market towards smarter, more connected antipinch solutions.

Regional trends reveal a diverse landscape. Asia Pacific, particularly China and India, is emerging as a significant growth engine due to increasing vehicle production, rising safety awareness, and the implementation of stricter safety regulations. Developed markets such as North America and Europe, which already possess high adoption rates, are focusing on premium features, advanced sensor integration, and enhancing the reliability and responsiveness of existing systems. Latin America, the Middle East, and Africa are showing nascent but steady growth, driven by an expanding automotive sector and a gradual adoption of global safety standards. These regions represent significant future opportunities as vehicle penetration and regulatory frameworks mature.

Segment trends highlight the dominance of current sensing and Hall-effect sensor technologies due to their proven reliability and cost-effectiveness. However, there is a growing interest in more advanced optical and capacitive sensors for enhanced precision and broader detection capabilities, especially in high-end and luxury vehicle segments. Passenger vehicles, particularly SUVs and premium sedans, continue to be the largest application segment, with increasing adoption in light commercial vehicles as well. The aftermarket segment, while smaller, is also seeing gradual development as consumers seek to upgrade older vehicles. The market's overall trajectory is defined by a continuous push towards higher safety standards, technological refinement, and broader market penetration across various vehicle types and geographic regions.

AI Impact Analysis on Automotive Antipinch Power Window Systems Market

User inquiries concerning AI's influence on Automotive Antipinch Power Window Systems frequently revolve around how artificial intelligence can elevate existing safety standards beyond conventional sensor capabilities. Common questions explore AI's potential for predictive analytics to anticipate pinch hazards before they occur, its role in integrating window safety with broader Advanced Driver-Assistance Systems (ADAS), and its capacity to enhance system reliability and responsiveness. Users are keen to understand if AI can reduce false positives, adapt to varying environmental conditions, or offer personalized safety settings. There is also interest in whether AI can contribute to more sophisticated human-machine interfaces where windows could interact intelligently with occupants based on contextual cues, alongside concerns about data privacy and the complexity of AI system validation in safety-critical applications.

- Predictive pinch detection: AI algorithms can analyze real-time data from multiple sensors (force, position, vision) to predict potential obstructions, initiating pre-emptive window reversal or stop actions even before direct contact, thereby reducing impact force and enhancing safety.

- Adaptive sensitivity: AI allows antipinch systems to dynamically adjust sensitivity levels based on environmental factors (e.g., temperature affecting window seal friction), occupant detection (e.g., presence of children), or vehicle speed, minimizing false triggers while maintaining optimal protection.

- Integration with ADAS and vehicle intelligence: AI facilitates seamless communication and coordination between antipinch systems and other vehicle safety features like occupant monitoring systems, blind-spot detection, or autonomous driving sensors, creating a more holistic safety envelope.

- Enhanced reliability and diagnostics: AI-driven diagnostics can monitor sensor performance, motor health, and system integrity in real-time, identifying potential malfunctions or degradation proactively, improving system reliability and reducing maintenance costs.

- Personalized safety profiles: Future AI-powered systems could learn user habits and preferences, allowing for personalized safety settings or automatic adjustments based on specific occupants detected in the vehicle, optimizing comfort and safety simultaneously.

- Over-the-air (OTA) updates and improvements: AI-driven software can be continuously optimized and updated via OTA, enabling manufacturers to deploy performance enhancements, new features, and critical security patches post-sale, ensuring systems remain cutting-edge.

- Contextual awareness: AI can process data from cabin cameras and microphones to understand occupant behavior and context (e.g., child reaching out of window), enabling the system to react more intelligently than simple obstruction detection.

DRO & Impact Forces Of Automotive Antipinch Power Window Systems Market

The Automotive Antipinch Power Window Systems Market is significantly influenced by a combination of driving forces, inherent restraints, and promising opportunities. Drivers primarily include the escalating global demand for enhanced vehicle safety features, stringent regulatory frameworks mandating antipinch functionality in various regions, and increasing consumer awareness regarding occupant protection, especially for children and pets. The continuous technological advancements in sensor design, control electronics, and motor efficiency further propel market expansion by enabling more reliable and cost-effective solutions. Moreover, the integration of these systems into sophisticated vehicle architectures, particularly with the rise of ADAS and autonomous driving technologies, creates a powerful impetus for market growth, positioning them as fundamental components within modern safety ecosystems.

However, several restraints challenge the market's trajectory. The primary impediment is the additional manufacturing cost associated with incorporating these advanced safety systems, which can impact the overall vehicle pricing and potentially deter adoption in budget-sensitive segments. The technical complexity of integrating multiple sensors and control units, coupled with the need for rigorous validation and testing to meet safety standards, can also be a barrier for smaller manufacturers. Furthermore, potential issues such as sensor malfunctions, false positives or negatives, and the increasing vulnerability of interconnected automotive systems to cyber threats represent ongoing concerns that require continuous innovation and robust engineering solutions to overcome, impacting both consumer trust and widespread market acceptance.

Despite these challenges, significant opportunities abound for the Automotive Antipinch Power Window Systems Market. Emerging economies, characterized by rapidly expanding automotive industries and increasing disposable incomes, present fertile ground for new market penetration as safety regulations mature and consumer expectations rise. The ongoing global shift towards electric vehicles (EVs) and autonomous vehicles (AVs) offers a unique avenue for advanced antipinch system integration, where these systems can become a more integral part of intelligent cabin management and comprehensive safety suites. Furthermore, the development of software-defined vehicles allows for greater flexibility, over-the-air updates, and the potential for new revenue streams through enhanced features and predictive maintenance services, fostering continuous innovation and market expansion. The drive for miniaturization and energy efficiency in components also creates opportunities for developing more compact and power-optimized solutions, meeting the evolving design requirements of modern vehicles.

Segmentation Analysis

The Automotive Antipinch Power Window Systems Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation helps in analyzing market trends, identifying key growth areas, and understanding competitive landscapes. The primary segments include categorization by sensor type, reflecting the core technology used for obstruction detection; by vehicle type, indicating the primary application areas; by sales channel, differentiating between original equipment manufacturers and aftermarket sales; and by power window type, specifying the application within the vehicle's window system. Each segment plays a crucial role in shaping the market's overall structure and growth trajectory, driven by factors such as cost-effectiveness, regulatory compliance, and specific vehicle design requirements across various global regions.

- By Sensor Type:

- Hall-Effect Sensors

- Current-Sensing Systems

- Optical Sensors

- Pressure Sensors

- Capacitive Sensors

- By Vehicle Type:

- Passenger Cars

- Hatchbacks

- Sedans

- SUVs/Crossovers

- Luxury Vehicles

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Passenger Cars

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Power Window Type:

- Front Doors

- Rear Doors

- Sunroofs/Panoramic Roofs

- Quarter Windows

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Automotive Antipinch Power Window Systems Market

The value chain for the Automotive Antipinch Power Window Systems Market begins with upstream activities involving the sourcing and manufacturing of fundamental raw materials and electronic components. This includes suppliers of various metals (steel, aluminum), plastics and polymers for window frames and mechanisms, and intricate electronic components such as semiconductors, microcontrollers, capacitors, and resistors that form the basis of the control units. Key players in this stage also encompass specialized manufacturers of sensors (e.g., Hall-effect, optical, pressure sensors) and electric motors, which are the core functional elements of the power window system. These suppliers provide critical inputs that determine the quality, performance, and cost-effectiveness of the final antipinch module, necessitating robust supplier relationships and quality control measures to ensure compliance with stringent automotive standards.

Moving midstream, the value chain involves the assembly and integration of these components by Tier 1 automotive suppliers. These companies specialize in designing, developing, and manufacturing complete power window modules, which include the motor, gear assembly, sensors, and the electronic control unit (ECU) with integrated antipinch software. They act as system integrators, taking raw materials and components from upstream suppliers and transforming them into ready-to-install units for vehicle manufacturers. Their role is critical in ensuring the functionality, reliability, and safety of the entire system through rigorous testing and adherence to automotive industry specifications. These Tier 1 suppliers often collaborate closely with automotive OEMs during the vehicle design phase to optimize integration and performance, often holding intellectual property for system design and control algorithms.

Downstream activities predominantly involve the distribution and sale of these integrated power window systems to automotive Original Equipment Manufacturers (OEMs). OEMs then incorporate these modules into their vehicle assembly lines during the manufacturing process. The primary distribution channel is direct, where Tier 1 suppliers deliver units directly to OEM assembly plants globally. The aftermarket channel, though smaller for complete antipinch systems, involves distributors and retailers providing replacement parts or upgrade kits, often facilitated by a network of authorized service centers and independent repair shops. This complex interplay ensures the seamless flow of components and finished systems from raw material extraction to final vehicle integration, with each stage adding significant value through specialized manufacturing, technological integration, and distribution efficiencies.

Automotive Antipinch Power Window Systems Market Potential Customers

The primary and most significant potential customers for Automotive Antipinch Power Window Systems are Original Equipment Manufacturers (OEMs) within the automotive industry. These include global automotive giants, luxury vehicle manufacturers, and increasingly, emerging electric vehicle (EV) startups. OEMs procure these systems directly from Tier 1 suppliers during the design and production phases of new vehicle models, integrating them into the core architecture of their vehicles. Their purchasing decisions are driven by stringent safety regulations (e.g., UN ECE R21, FMVSS), consumer demand for advanced safety features, brand reputation, and the need to differentiate their product offerings. For OEMs, reliability, cost-effectiveness, and ease of integration are paramount considerations, along with the ability of suppliers to innovate and meet future technological challenges, such as those posed by autonomous driving and software-defined vehicles.

Beyond OEMs, the market also serves a more niche segment of vehicle owners and fleet operators through the aftermarket. While the core antipinch mechanism is typically factory-installed, there is a limited but growing demand for aftermarket components for replacement purposes due to wear and tear, or for upgrading older vehicles that lack these safety features. This segment includes individual car owners seeking to enhance the safety of their existing vehicles, particularly for families with young children or pets. Fleet operators, managing large numbers of vehicles, might also represent potential customers for replacement parts or upgrades to ensure their fleet complies with internal safety standards or to minimize liability risks. However, the aftermarket for full antipinch system installation is less prevalent compared to other automotive components, as it often requires complex integration with vehicle electronics.

Additionally, specialized vehicle manufacturers, such as those producing recreational vehicles (RVs), armored vehicles, or custom-built utility vehicles, also represent potential, albeit smaller, customer bases. These manufacturers require bespoke solutions that cater to their unique design specifications and safety requirements, often demanding highly customized antipinch window systems. Automotive component distributors and retailers also act as intermediaries, particularly within the aftermarket, supplying parts to independent repair shops and consumers. Ultimately, the market is largely defined by the direct relationship between Tier 1 suppliers and major automotive OEMs, underscoring the importance of long-term partnerships and robust technological capabilities to secure a competitive edge in this safety-critical sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.85 billion |

| Market Forecast in 2033 | $5.07 billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces | >|

| Segments Covered | >|

| Key Companies Covered | Bosch, Continental, Denso, ZF Friedrichshafen, Magna International, Valeo, Johnson Electric, Brose, Hella, Mitsuba Corporation, Nidec Corporation, Aptiv PLC, Delphi Technologies, Kiekert AG, Inteva Products LLC, U-Shin (MinebeaMitsumi), Omron Corporation, Alps Alpine Co. Ltd., Gentex Corporation, Autoliv Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Antipinch Power Window Systems Market Key Technology Landscape

The technological landscape of the Automotive Antipinch Power Window Systems Market is characterized by continuous advancements aimed at enhancing safety, reliability, and integration with broader vehicle electronics. At its core, the technology relies on sophisticated sensor systems to detect obstructions. Hall-effect sensors, which monitor the motor's rotational speed, and current-sensing systems, which detect changes in motor current draw due to resistance, are widely adopted due to their cost-effectiveness and proven reliability. More advanced systems are increasingly incorporating optical sensors or pressure sensors embedded in the window seal to provide even more precise and immediate obstruction detection, particularly valuable for nuanced pinch situations. The trend is towards sensor fusion, combining data from multiple sensor types to improve accuracy and reduce false positives, ensuring optimal safety performance across diverse environmental conditions.

Beyond sensing, the control architecture involves powerful microcontrollers and embedded software responsible for processing sensor data, executing algorithms to determine pinch events, and rapidly controlling the window motor's direction. Communication within the vehicle's electrical network is typically managed through automotive-specific protocols like Controller Area Network (CAN) bus or Local Interconnect Network (LIN) bus, ensuring seamless interaction with other vehicle ECUs and safety systems. The ongoing drive for miniaturization and integration allows for these complex electronic components to be housed in compact, robust modules that can withstand harsh automotive environments. Furthermore, advancements in motor technology, including more efficient and quieter DC motors, contribute to overall system performance and passenger comfort, while also supporting precise control for rapid reversal actions.

The emerging technological frontier for antipinch systems includes the adoption of advanced predictive algorithms, often incorporating elements of artificial intelligence and machine learning, to anticipate potential pinch hazards before direct contact occurs. This predictive capability leverages data from various in-cabin sensors and vehicle systems to create a more proactive safety response. Furthermore, connectivity features, such as Over-The-Air (OTA) update capabilities, are gaining traction, allowing manufacturers to deploy software enhancements, security patches, and performance optimizations remotely. The integration of antipinch systems into the broader ecosystem of Advanced Driver-Assistance Systems (ADAS) and autonomous driving platforms is also a key area of innovation, where window safety can be coordinated with comprehensive occupant monitoring and environmental perception systems to create a truly intelligent and adaptive safety solution for the future of mobility.

Regional Highlights

- North America: A mature market with high adoption rates, driven by stringent safety regulations (e.g., FMVSS 118 for power-operated windows) and strong consumer demand for advanced vehicle safety and convenience features. The region is a hub for technological innovation and integration, particularly in premium segments and larger vehicles like SUVs and trucks.

- Europe: Characterized by highly strict safety standards (e.g., UN ECE R21) and a strong emphasis on automotive quality and passenger protection. Europe is a significant market for advanced antipinch technologies, with a focus on precision, reliability, and seamless integration into sophisticated vehicle designs, especially within the luxury and premium car segments.

- Asia Pacific (APAC): The fastest-growing region, propelled by booming automotive production in countries like China, India, Japan, and South Korea. Rapidly increasing disposable incomes, rising consumer awareness regarding vehicle safety, and the gradual implementation of stricter regulatory frameworks are key growth drivers, creating immense opportunities for market expansion.

- Latin America: An emerging market experiencing steady growth, influenced by increasing vehicle sales and a gradual shift towards adopting global safety standards. While still developing, the market here shows significant potential as economic conditions improve and local regulations evolve to align with international safety norms.

- Middle East and Africa (MEA): A nascent but growing market. The expansion of the automotive sector, driven by economic development and urbanization, is fostering a demand for safer and more technologically advanced vehicles. Adoption rates are currently lower but are expected to rise as safety awareness increases and regulatory landscapes mature.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Antipinch Power Window Systems Market.- Bosch

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Magna International Inc.

- Valeo S.A.

- Johnson Electric Holdings Ltd.

- Brose Fahrzeugteile GmbH & Co. KG

- Hella GmbH & Co. KGaA

- Mitsuba Corporation

- Nidec Corporation

- Aptiv PLC

- Delphi Technologies (BorgWarner Inc.)

- Kiekert AG

- Inteva Products LLC

- U-Shin Ltd. (a MinebeaMitsumi Group Company)

- Omron Corporation

- Alps Alpine Co. Ltd.

- Gentex Corporation

- Autoliv Inc.

Frequently Asked Questions

What are automotive antipinch power window systems?

Automotive antipinch power window systems are safety mechanisms integrated into vehicle power windows that automatically detect obstructions during closure and reverse or stop the window's movement to prevent injuries from pinching, particularly to fingers, hands, or other body parts.

How do antipinch power window systems work?

These systems typically use sensors like Hall-effect, current-sensing, optical, or pressure sensors to monitor the window's movement or detect abnormal resistance. When an obstruction is detected, an electronic control unit (ECU) instantaneously commands the electric motor to reverse the window, preventing injury.

Are antipinch power window systems mandatory in all vehicles?

The mandating of antipinch power window systems varies by region and vehicle type. Many developed countries and regions, such as the EU (UN ECE R21) and the US (FMVSS 118), have regulations requiring antipinch functionality for power windows, especially in passenger vehicles, to enhance occupant safety.

What technologies are used for obstruction detection?

Common technologies include Hall-effect sensors (monitoring motor rotation), current-sensing systems (detecting changes in motor load), optical sensors (infrared beams for object detection), and pressure sensors (in the window seal). Advanced systems may integrate multiple sensor types for improved accuracy and reliability.

How does AI impact the future of antipinch power window systems?

AI is expected to enhance antipinch systems by enabling predictive pinch detection, adaptively adjusting sensitivity based on context, integrating with broader vehicle ADAS for holistic safety, and facilitating continuous improvement through over-the-air updates and advanced diagnostics for greater reliability and proactive safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager