Automotive Aroma Diffuser Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438149 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Automotive Aroma Diffuser Market Size

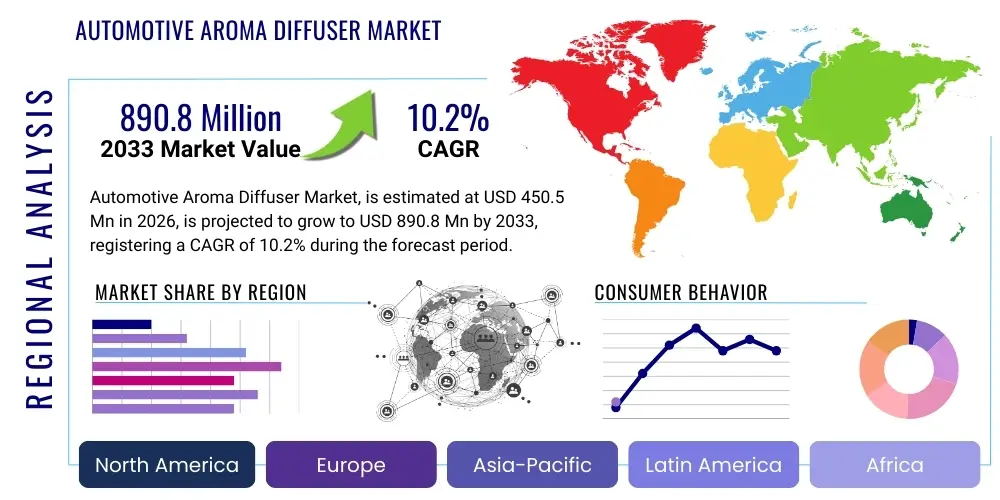

The Automotive Aroma Diffuser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.2% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 890.8 Million by the end of the forecast period in 2033.

Automotive Aroma Diffuser Market introduction

The Automotive Aroma Diffuser Market encompasses devices specifically designed for use within vehicle interiors to disperse essential oils or fragrance blends, enhancing the sensory experience for occupants. These products range from simple passive vents and wick diffusers to sophisticated electronic systems utilizing ultrasonic or nebulizing technology. The primary function is to neutralize unpleasant odors and introduce therapeutic or aesthetically pleasing aromas, contributing significantly to driver well-being, mood alteration, and overall perceived vehicle luxury. Modern automotive diffusers are increasingly integrated with vehicle power systems (USB or cigarette lighter ports) or operate via internal batteries, offering convenience and portability, thereby catering to a broad spectrum of vehicle owners globally who prioritize personalized comfort within their personal mobility spaces.

The core product offering in this market involves the diffuser apparatus itself, paired with consumable scent cartridges or essential oil solutions. Major applications extend beyond basic odor masking to include psychological benefits, such as promoting alertness during long drives (using scents like peppermint or citrus) or inducing relaxation during heavy traffic (using lavender or chamomile). The inherent flexibility of these devices allows for consumer-driven personalization, moving the car cabin from a purely functional space to an extension of the owner's preferred environment. This personalization trend is a significant catalyst, particularly among younger demographics and premium segment buyers who view vehicle interiors as crucial determinants of their driving satisfaction and experience.

Driving factors for sustained market expansion include the exponential increase in global vehicle production and ownership, coupled with a rising consumer awareness regarding the benefits of aromatherapy, particularly in enclosed spaces where air quality and scent profile dramatically impact mood and health. Furthermore, the integration of smart technology, allowing scent control via smartphone applications or voice commands, positions these diffusers as high-value automotive accessories. The market also benefits from consistent product innovation, including dry-diffusion technologies that minimize residue and advanced filtration systems that combine air purification with aroma delivery, thereby addressing health and maintenance concerns simultaneously and broadening the product appeal across diverse climatic and regional conditions.

Automotive Aroma Diffuser Market Executive Summary

The Automotive Aroma Diffuser Market is experiencing robust growth driven by simultaneous shifts in consumer behavior towards vehicle personalization and technological integration within cabin electronics. Key business trends indicate a strong move toward sustainable and natural essential oils, bypassing synthetic fragrances that often contain volatile organic compounds (VOCs). Manufacturers are increasingly focusing on miniaturization, long-lasting scent performance, and seamless aesthetic integration with modern vehicle designs, moving away from bulky aftermarket attachments to sleek, OEM-quality accessories. The competitive landscape is characterized by established household fragrance brands leveraging their expertise alongside specialized automotive accessory manufacturers and tech startups introducing smart, IoT-enabled diffusion solutions, fostering intense competition centered on design, efficacy, and ease of use.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rapid urbanization, increasing disposable incomes, and the strong cultural acceptance of wellness and aromatherapy practices in countries like China, Japan, and South Korea. North America and Europe, while mature markets, demonstrate high adoption rates for premium and technologically advanced diffusers, where consumers are willing to invest in high-end, brand-specific scent libraries and features like automatic scent intensity adjustment based on cabin conditions. Regulatory standardization concerning battery safety and fragrance ingredient transparency, particularly in the EU and North America, is influencing product development, pushing brands toward certified, non-toxic formulations, subsequently driving innovation in natural and organically sourced aroma compounds.

Segment trends highlight the dominance of the aftermarket distribution channel, particularly online sales platforms, providing consumers with unparalleled variety and competitive pricing options for both device purchase and recurrent consumable refills. Within the product technology segment, ultrasonic and nebulizing diffusers are gaining significant traction over traditional evaporative and wick-based models due to their ability to deliver a more intense and consistent scent output without the use of heat or water, thereby offering better therapeutic properties and cleaner operation. Furthermore, the increasing integration of these systems into luxury and mid-range passenger vehicles at the Original Equipment Manufacturer (OEM) level signifies a major segmental shift, transforming the aroma diffuser from a simple accessory into a fundamental vehicle comfort feature, necessitating supply chain collaboration between automotive tier 1 suppliers and fragrance specialists.

AI Impact Analysis on Automotive Aroma Diffuser Market

Common user questions surrounding the impact of Artificial Intelligence on the Automotive Aroma Diffuser Market center on how AI can transition scent delivery from a static setting to a dynamic, responsive experience. Key concerns revolve around AI's ability to personalize scent based on real-time driver data, such as mood, fatigue levels, driving conditions, and environmental factors like air quality. Users are intensely interested in integration capabilities—specifically, whether AI algorithms can link the vehicle's navigation system (e.g., triggering alertness scents during long highway stretches) or biometric sensors (e.g., releasing calming scents during stressful traffic jams). The prevailing expectation is that AI will move the market beyond simple diffusion toward sophisticated, predictive wellness systems that proactively manage the in-cabin atmosphere, thereby enhancing safety and comfort significantly.

The deployment of AI and machine learning (ML) algorithms is poised to revolutionize the personalization and functionality of automotive aroma diffusers. AI systems can analyze input data streams—including cabin temperature, humidity, external pollution indices, and even driver behavior patterns extracted from steering input or infotainment usage—to automatically determine the optimal time, intensity, and type of aroma to release. This level of environmental and behavioral responsiveness transcends manual settings, offering a seamless and highly individualized experience. For manufacturers, AI analysis of scent preference over time allows for hyper-targeted marketing of consumable refills and the development of new, highly specific fragrance libraries tailored to micro-segments of the driving population based on demographic, geographic, and temporal preferences.

Furthermore, AI-driven predictive maintenance and consumption monitoring represent a critical operational impact. ML models can accurately forecast when a scent cartridge will deplete based on historical usage patterns and recommend or automatically order replacements, ensuring uninterrupted service for the vehicle owner and establishing a lucrative subscription model for vendors. This shift from one-time product sales to a recurring service model, underpinned by smart inventory management and personalized recommendations, enhances customer loyalty and stabilizes revenue streams. Ultimately, AI transforms the aroma diffuser from a basic luxury item into a proactive, integral component of the vehicle's broader health, safety, and comfort ecosystem, dramatically increasing its value proposition in the connected car environment.

- AI enables dynamic scent delivery based on real-time biometric and environmental data.

- Predictive algorithms optimize scent intensity relative to cabin air quality and driving mode.

- Machine learning facilitates personalized aroma libraries and automated refill ordering services.

- AI systems integrate scent diffusion with navigation and advanced driver-assistance systems (ADAS) for safety enhancement.

- Improved diagnostic capabilities detect and report device malfunctions or consumption rates accurately.

DRO & Impact Forces Of Automotive Aroma Diffuser Market

The automotive aroma diffuser market is primarily propelled by significant cultural and technological drivers, yet simultaneously faces considerable headwinds related to regulatory compliance and competitive volatility. The pervasive driver is the increasing consumer desire for personalized in-vehicle experiences, moving beyond standard amenities to encompass holistic wellness and sensory customization. This trend is strongly supported by technological opportunities, such as the integration of IoT and Bluetooth capabilities, allowing diffusers to connect with vehicle infotainment systems and external smart devices, which dramatically enhances user convenience and functionality. However, the market faces structural restraints, chiefly the stringent regulations governing volatile organic compound (VOC) emissions and the increasing scrutiny of synthetic fragrance components, forcing manufacturers to invest heavily in R&D for natural and certified non-toxic alternatives, which often carry higher production costs and complexity.

A major impact force driving market expansion is the increasing OEM adoption in luxury and high-end vehicle segments. When manufacturers like Mercedes-Benz and BMW incorporate proprietary scent systems directly into their vehicle architecture, it legitimizes the product category, sets a high standard for quality, and trickles down consumer expectation to mass-market vehicle owners, boosting aftermarket sales. The primary opportunity lies in the burgeoning electric vehicle (EV) segment, where the absence of engine noise amplifies the importance of the internal sensory environment, making sophisticated aroma management a critical differentiator for EV manufacturers seeking to enhance cabin comfort and mask potential material odors common in new synthetic interiors. Exploiting this EV transition offers unparalleled growth potential, provided diffusers can be optimized for low power consumption and seamless electrical integration.

Conversely, significant restraints include the high fragmentation of the fragrance component supply chain and the associated instability in the pricing and availability of high-quality essential oils, which can impact profitability and consistent product quality. Another restraint is consumer confusion and skepticism surrounding the efficacy and safety of lower-end, non-certified products flooding the market, which can dilute brand equity and erode consumer trust in the overall category. To overcome these forces, companies must focus on establishing transparent certifications, ensuring product durability within the harsh automotive environment (extreme temperature fluctuations), and leveraging strategic partnerships with established aromatherapy and essential oil suppliers to secure stable, verifiable source materials, thereby managing both quality and regulatory risks effectively.

Segmentation Analysis

Segmentation within the Automotive Aroma Diffuser Market is crucial for understanding specific consumer preferences, technological maturity, and effective distribution strategies. The market is fundamentally segmented based on the device's mechanism of diffusion (Type), the technological sophistication of control (Technology), the point of sale (Distribution Channel), and the class of vehicle they are designed for (Vehicle Type). This layered segmentation allows manufacturers to tailor product features—such as size, power source, and connectivity—to meet the distinct demands of luxury car owners seeking fully integrated OEM solutions versus budget-conscious consumers purchasing simple, clip-on aftermarket accessories through e-commerce channels. Understanding the interplay between these segments is vital for developing differentiated product lines and maximizing market penetration across varied income brackets and regional tastes.

The Type segmentation, covering ultrasonic, nebulizing, heat, and evaporative methods, differentiates products based on scent intensity, oil consumption efficiency, and the need for water or heat, directly impacting the quality of the aromatherapy experience. Concurrently, the Distribution Channel segment dictates market access, with OEM integration representing high-value, long-term contracts, while the Aftermarket (split into online and offline retail) offers high-volume, rapid turnover. The online channel has demonstrated superior growth due to the ease of accessing a wide array of refills and niche essential oil brands. Technological segmentation, distinguishing between standard and smart (App/Bluetooth controlled) systems, reflects the digital transformation within vehicles, catering to tech-savvy consumers who expect seamless control and customization of their cabin environment via integrated interfaces.

- Type:

- Ultrasonic Diffusers

- Heat Diffusers (Pad/Wick)

- Nebulizing Diffusers

- Evaporative Diffusers (Vent Clips)

- Technology:

- Standard/Manual Control

- Bluetooth/App Controlled (Smart Diffusers)

- Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Online and Offline Retail)

- Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Vans, Buses)

Value Chain Analysis For Automotive Aroma Diffuser Market

The value chain for the Automotive Aroma Diffuser Market begins with upstream activities centered on the procurement and processing of raw materials. This stage involves securing high-grade essential oils (sourced from agriculture and extraction specialists) and sophisticated electronic components (microprocessors, ultrasonic plates, and polymer casings) necessary for device manufacturing. Upstream suppliers face pressures related to ethical sourcing, purity verification of oils, and managing the global semiconductor supply chain volatility for smart devices. Efficiency and cost optimization at this stage depend heavily on establishing long-term contracts with certified material suppliers to ensure the consistent quality required for products marketed for health and wellness applications, minimizing risks associated with counterfeit or low-grade input materials that could compromise performance and safety standards.

Midstream activities involve core manufacturing, assembly, and quality control. Diffuser manufacturers focus on design aesthetics, durability (especially thermal resistance), and integrating power supply mechanisms suitable for vehicle environments. For OEM sales, this stage also involves rigorous testing and certification processes to meet automotive industry standards (e.g., vibration resistance, electromagnetic compatibility). Simultaneously, fragrance blending and cartridge manufacturing occur, requiring specialized knowledge to create stable, effective, and safe scent profiles. Successful midstream players leverage advanced robotics and lean manufacturing principles to handle high-volume production while maintaining strict regulatory compliance regarding VOCs and REACH directives, especially for units sold in European markets.

Downstream analysis focuses on distribution channels, which are bifurcated into direct (OEM supply chains) and indirect (aftermarket). The direct channel requires specialized logistics for just-in-time delivery to assembly plants, forming long-term relationships with Tier 1 and Tier 2 automotive suppliers. The indirect channel relies heavily on large e-commerce platforms (Amazon, eBay) and specialty automotive retail stores. Online distribution is crucial as it allows for efficient inventory management of high-turnover consumables (scent refills) and provides extensive reach to individual consumers globally. Effective downstream success hinges on robust digital marketing, consumer education regarding the health benefits of aromatherapy, and optimized logistics for both bulky diffuser units and small, high-value oil cartridges, ensuring product availability and prompt delivery across diverse geographical regions.

Automotive Aroma Diffuser Market Potential Customers

The primary customers for the Automotive Aroma Diffuser Market fall into two distinct but overlapping segments: Automotive OEMs and individual vehicle owners purchasing through the aftermarket. OEMs, particularly those in the luxury and premium vehicle segments, represent high-value potential customers who integrate proprietary scent systems directly into their new vehicles. These customers prioritize reliability, aesthetic integration, and long-term supply stability. Their purchasing decisions are driven by the desire to elevate the vehicle's interior experience and justify premium pricing, viewing the integrated aroma system as a core feature rather than a simple accessory. Success with OEM buyers requires adherence to rigorous automotive safety standards, high-volume production capability, and extensive collaboration during the vehicle design cycle.

The second and largest segment comprises individual consumers who purchase diffusers and refills via the aftermarket. These buyers are further segmented based on motivation: the 'Wellness Enthusiast' who seeks therapeutic benefits (stress reduction, focus enhancement) and is willing to pay a premium for certified essential oils and advanced nebulizing technology; and the 'Aesthetic Enhancer' who primarily desires odor elimination and personalized fragrance, favoring aesthetically pleasing designs and often purchasing cheaper evaporative or vent-clip models. This diverse customer base demands a wide range of products across varying price points and technical complexity, making online retail a crucial touchpoint for personalized recommendations and refill subscriptions.

Furthermore, a growing niche potential customer segment includes fleet operators and commercial vehicle owners (taxis, ride-sharing services, corporate shuttles). For these professional users, aroma diffusers serve a dual purpose: improving driver alertness during extended shifts and enhancing passenger satisfaction, which directly impacts service ratings and repeat business. These commercial buyers typically prioritize robust, durable, and low-maintenance devices that can operate continuously and mask common commercial odors effectively. Targeting this segment requires specialized B2B sales strategies emphasizing durability, cost-effectiveness, and compliance with commercial vehicle interior standards, often necessitating bulk purchasing programs and dedicated commercial-grade fragrance formulations resistant to heavy use environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 890.8 Million |

| Growth Rate | 10.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pura Car, Yankee Candle, AirWick, Scent Air, Godrej Aer, CARMATE, Xiaomi, Muji, Bath & Body Works, Febreze, Dr. Vranjes, Jo Malone, Diptyque, Rituals, Kringle Candle, Scentered, InnoGear, Young Living, doTerra, Grove Collaborative |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Aroma Diffuser Market Key Technology Landscape

The technological evolution within the automotive aroma diffuser market is primarily focused on enhancing efficiency, improving scent quality, and maximizing integration capability within modern vehicle electronics. The shift from passive evaporation methods (like vent clips and fiber wicks) to active, electronic diffusion technologies represents the most significant trend. Ultrasonic technology, which utilizes high-frequency vibrations to disperse a fine mist of oil and water, is highly favored due to its silent operation, effective humidification properties, and preservation of the therapeutic integrity of essential oils without the use of heat. However, it requires periodic cleaning and water refills, introducing a minor maintenance requirement. Conversely, nebulizing technology, which uses an air pump to atomize pure essential oil into a micro-fine vapor without water, is gaining ground in the premium segment as it offers the most potent and concentrated aroma delivery, ideal for therapeutic applications and larger cabin spaces, despite potentially higher oil consumption rates.

The second major technological thrust is centered around smart integration and connectivity, driven by the proliferation of the Internet of Things (IoT) in automotive interiors. Modern diffusers are increasingly equipped with Bluetooth or Wi-Fi connectivity, allowing drivers to control diffusion settings, intensity levels, timers, and switch between multiple fragrance cartridges via smartphone applications or the vehicle's integrated infotainment system. This connectivity extends to utilizing Artificial Intelligence (AI) and machine learning to create adaptive scent profiles that respond to internal and external environmental cues, such as automatically increasing fragrance intensity during heavy traffic or switching to an 'alertness' blend if the vehicle's monitoring system detects signs of driver fatigue. Power management is also a key technological focus, with advancements in energy-efficient components allowing longer battery life for portable models and optimized drawing of power from the vehicle's USB ports without draining the main electrical system.

Furthermore, material science and cartridge design play a critical role in minimizing contamination and maximizing ease of use. Dry-diffusion and nano-dispersion technologies are being researched to offer residue-free operation, addressing concerns about oil buildup on vehicle surfaces and air vents. Cartridge technology is moving toward hermetically sealed, long-life, interchangeable systems that prevent scent mixing and degradation. Moreover, the integration of air quality monitoring sensors (like VOC and PM2.5 detectors) directly into the diffuser unit allows the device to function as a combined air purifier and aroma delivery system, positioning it as a sophisticated cabin environment manager. This technological convergence increases the device's utility, transitioning it from a simple scent accessory to an integral component of the vehicle's health and wellness apparatus, justifying a higher price point and enhancing OEM appeal.

Regional Highlights

- Asia Pacific (APAC): APAC represents the highest growth potential for the Automotive Aroma Diffuser Market. The region is characterized by rapid urbanization, increasing vehicle sales, and a deeply embedded culture of aromatherapy and traditional wellness practices, particularly in China, Japan, and India. High population density and resulting traffic congestion in mega-cities increase the consumer need for stress-reducing and purifying in-car environments. Moreover, the strong presence of electronics manufacturing hubs in the region facilitates the rapid production and adoption of affordable, technology-driven diffusers. South Korea and Japan show high demand for premium, aesthetically integrated, and brand-specific aroma solutions, often favoring high-efficiency nebulizers and elegant design.

- North America (NA): North America is a mature market distinguished by high purchasing power and strong consumer preference for smart, connected devices. Demand is concentrated on high-quality, certified organic essential oils and diffusers featuring Bluetooth and app control capabilities. The prevalence of long-distance commuting and a strong focus on self-care and wellness drive the adoption of therapeutic-grade diffusers designed to promote focus or relaxation. The aftermarket dominates distribution, but OEM integration is rapidly gaining traction, particularly in the premium truck and SUV segments, requiring adherence to stringent federal safety and material standards.

- Europe: The European market is highly regulated, prioritizing product safety, environmental sustainability, and ingredient transparency (e.g., adherence to REACH regulations concerning chemical substances). This environment fosters demand for diffusers that use ethically sourced, natural, and low-VOC fragrances. Western European consumers, especially in Germany, France, and the UK, lean towards subtle, sophisticated scent profiles and devices that offer silent operation and seamless integration with high-end vehicle interiors. Electric vehicles (EVs) are a key growth driver, with manufacturers seeking to differentiate the cabin experience through superior sensory management.

- Latin America (LATAM): LATAM is an emerging market segment where growth is tied to rising disposable incomes and increasing motorization rates, particularly in Brazil and Mexico. The market is highly price-sensitive, initially favoring basic, cost-effective evaporative and vent-clip diffusers. However, as awareness of wellness benefits grows, there is a gradual shift towards electronic, USB-powered diffusers. Distribution often relies on local specialty automotive accessory stores and general merchandise retail chains, presenting opportunities for brands that can effectively manage import duties and offer regionally appropriate scent blends.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, represents a niche but highly lucrative market for luxury and high-performance diffusers. Consumers in the GCC often purchase high-end vehicles and require sophisticated, long-lasting aroma systems that can counteract intense regional heat and dust, necessitating robust, powerful diffusion technology. Demand often centers on opulent, traditional Arabic and Oud-based fragrances. Africa remains largely untapped, with opportunity centered on urban centers and affordable, durable device options catering to lower-to-mid-range vehicle owners.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Aroma Diffuser Market.- Pura Car

- Yankee Candle

- AirWick

- Scent Air

- Godrej Aer

- CARMATE

- Xiaomi

- Muji

- Bath & Body Works

- Febreze

- Dr. Vranjes

- Jo Malone

- Diptyque

- Rituals

- Kringle Candle

- Scentered

- InnoGear

- Young Living

- doTerra

- Grove Collaborative

Frequently Asked Questions

Analyze common user questions about the Automotive Aroma Diffuser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between ultrasonic and nebulizing automotive diffusers?

Ultrasonic diffusers utilize water and high-frequency vibrations to create a fine, scented mist, often doubling as a humidifier. Nebulizing diffusers, conversely, use pure essential oil atomized by air pressure, resulting in a much more potent and concentrated scent release without requiring water, making them ideal for therapeutic applications but potentially consuming oil faster.

Are smart (Bluetooth/App controlled) automotive diffusers worth the investment over standard models?

Yes, smart diffusers offer significant advantages, including precise scheduling, intensity control, remote operation, and often integration with vehicle systems or AI-driven environmental sensing. This level of customization enhances both convenience and the overall therapeutic efficacy of the product, justifying the higher initial cost for tech-savvy consumers.

Which factors are restraining the growth of the Automotive Aroma Diffuser Market?

Key restraints include the stringent regulatory environment surrounding Volatile Organic Compounds (VOCs) and synthetic fragrance ingredients, supply chain volatility for high-purity essential oils, and the competitive challenge posed by low-quality, non-certified products that can erode consumer trust in product safety and performance.

How is the electric vehicle (EV) segment influencing diffuser technology?

The EV segment is driving demand for highly efficient, silent, and aesthetically integrated diffusers. The quiet nature of EV cabins emphasizes the sensory experience, necessitating advanced diffusion technologies that seamlessly manage air quality and aroma without contributing to noise or consuming excessive battery power, transforming the diffuser into a premium feature.

What is the dominant distribution channel for automotive aroma diffusers?

The Aftermarket channel, particularly through online e-commerce platforms, is currently the dominant distribution channel. This channel allows consumers access to a vast array of brands, competitive pricing, and efficient recurring subscriptions for essential oil refills, outpacing traditional brick-and-mortar automotive retailers and initial OEM installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager