Automotive Belt Tensioner Pulleys Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434483 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Belt Tensioner Pulleys Market Size

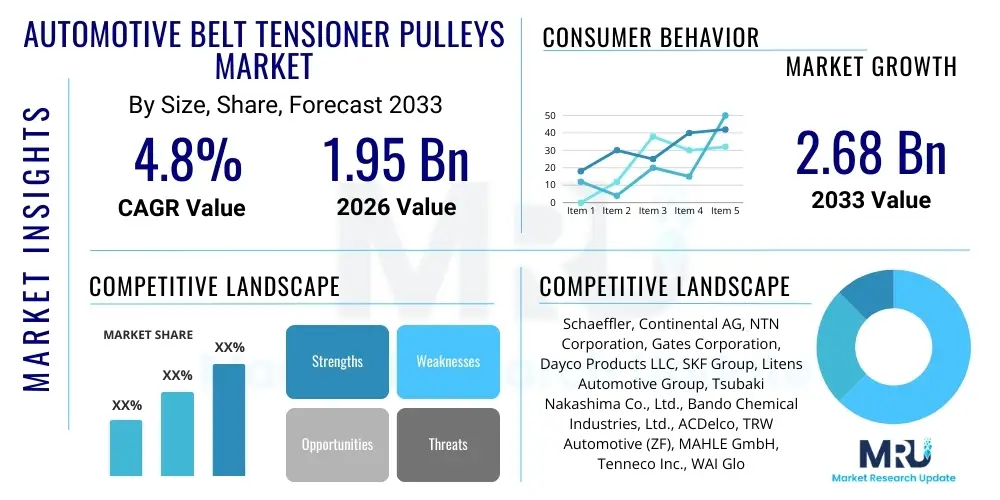

The Automotive Belt Tensioner Pulleys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.68 Billion by the end of the forecast period in 2033.

Automotive Belt Tensioner Pulleys Market introduction

The Automotive Belt Tensioner Pulleys Market constitutes a critical segment within the broader automotive components industry, specializing in components essential for maintaining optimal tension in engine accessory drive belts and timing systems. These pulley systems are indispensable for the efficient and synchronized operation of auxiliary components such as the alternator, water pump, air conditioning compressor, and power steering pump. The primary function of the tensioner pulley assembly is to compensate for belt stretch, thermal expansion, and vibration, thereby preventing slippage, minimizing noise, and maximizing the operational lifespan of both the belt and the connected engine accessories. Product variations largely depend on the mechanism employed, encompassing hydraulic, mechanical, and automatic tensioners, each suited for specific engine architectures and performance requirements, ranging from standard passenger vehicles to high-performance heavy commercial vehicles.

Key applications of these components are universal across Internal Combustion Engine (ICE) vehicles, ensuring reliable power transmission from the crankshaft to peripheral systems. The benefits derived from high-quality belt tensioner pulleys include enhanced fuel efficiency through reduced parasitic drag, superior engine reliability by preventing component failure due to belt slack or overtightening, and significantly lower maintenance costs over the vehicle's lifecycle. Modern tensioner pulleys are increasingly incorporating advanced materials, such as specialized composites and high-strength aluminum alloys, to achieve weight reduction without compromising durability, aligning with stringent automotive lightweighting targets aimed at improving overall vehicle performance and reducing emissions. This shift towards sophisticated materials is driving innovation in bearing design and sealing technologies, which are crucial for operating efficiently in harsh under-hood environments characterized by extreme temperature fluctuations and high operational stress.

Driving factors underpinning the market growth include the robust, albeit geographically shifting, global production of new ICE vehicles, particularly in emerging economies where vehicle parc density continues to increase rapidly. Furthermore, the growing average age of vehicles in mature markets necessitates higher demand for aftermarket replacement parts, as tensioner pulleys and related components are subject to wear and require periodic maintenance. Regulatory frameworks enforcing stricter emission norms indirectly bolster the demand for precise engine timing and ancillary component operation, pushing OEMs to adopt higher-precision tensioning systems. The increasing complexity of modern engines, which utilize multiple accessory belts and high-load systems, further mandates the use of reliable and sophisticated belt tensioner pulley assemblies, thereby ensuring sustained demand across both the Original Equipment Manufacturer (OEM) and the independent aftermarket (IAM) channels.

Automotive Belt Tensioner Pulleys Market Executive Summary

The global Automotive Belt Tensioner Pulleys Market is exhibiting resilient growth, primarily driven by the consistent volume of global vehicle manufacturing and the extensive operational requirement for vehicle maintenance and repair in the established aftermarket sector. Current business trends indicate a significant push towards developing hydraulic and automatic tensioner pulley systems, which offer superior performance characteristics, self-adjustment capabilities, and enhanced dampening of vibrational forces compared to traditional mechanical systems. Furthermore, there is a pronounced supply chain trend focused on regionalization and localization of manufacturing, particularly in Asia Pacific, to mitigate geopolitical risks and optimize logistics costs, while simultaneously complying with increasingly complex global automotive quality standards. Strategic collaborations between material suppliers, bearing specialists, and tensioner manufacturers are defining the competitive landscape, emphasizing the integration of smart monitoring capabilities within pulley systems to provide predictive maintenance alerts.

Regionally, the Asia Pacific (APAC) region continues to dominate the market in terms of volume, attributed to China and India's status as major production hubs for both passenger and commercial vehicles, coupled with rapidly expanding vehicle ownership. North America and Europe, characterized by mature vehicle fleets and stringent safety standards, represent highly lucrative markets for high-performance and premium-priced tensioner pulley assemblies, particularly within the aftermarket segment where consumers prioritize durability and quality. However, the regulatory pivot towards electric mobility in these regions poses a long-term structural challenge, influencing long-range investment strategies for components specifically designed for ICE powertrains. Latin America and the Middle East and Africa (MEA) are emerging as high-growth potential areas, driven by infrastructure development projects boosting commercial vehicle sales and increasing foreign direct investment in localized assembly operations.

Segment trends reveal that the Passenger Vehicle (PV) segment holds the largest market share due to sheer production volume, but the Heavy Commercial Vehicle (HCV) segment demonstrates higher profitability and steady growth owing to the demanding operational conditions requiring more robust and durable tensioner solutions. The transition toward composite and high-grade aluminum materials is accelerating across all vehicle types, shifting the material segment market share away from traditional steel components, particularly within OEM applications focused on achieving stricter CAFE standards and equivalent regulatory mandates globally. The aftermarket segment, supported by the growing mean age of vehicles globally, remains a stable anchor for the market, characterized by intense price competition but consistently high demand for replacement components across all technological levels, including legacy mechanical tensioners.

AI Impact Analysis on Automotive Belt Tensioner Pulleys Market

User queries regarding AI's impact on the Automotive Belt Tensioner Pulleys Market primarily revolve around predictive maintenance integration, optimization of manufacturing processes, and the role of AI in quality control systems. Users frequently ask if AI will lead to the development of "smart" pulleys that communicate real-time health data, and how machine learning algorithms can enhance the durability and design of existing components. Concerns also center on the future relevance of belt-driven systems in an electrified world, and whether AI-driven design optimization can extend the relevance of these ancillary systems by dramatically increasing their efficiency and lifespan. The core expectation is that AI will transform these components from passive mechanical parts into actively monitored, intelligent sub-systems, crucial for zero-downtime operations in commercial fleets and sophisticated monitoring in luxury vehicles.

The integration of Artificial Intelligence primarily affects the upstream manufacturing and supply chain aspects of belt tensioner pulleys, focusing on efficiency gains and defect reduction. AI-powered visual inspection systems and quality control frameworks, utilizing high-speed cameras and deep learning algorithms, are increasingly deployed on production lines to detect minute surface flaws, material inconsistencies, and assembly errors with precision far exceeding human capability. Furthermore, generative design techniques, driven by AI, are being employed during the R&D phase to optimize the geometry and material distribution of tensioner arms and pulley bodies. This allows manufacturers to achieve targeted weight reductions and improved stress resistance simultaneously, leading to lighter components that perform optimally under specific load cycles, tailored precisely to engine specifications.

In the downstream market, particularly the commercial fleet sector, AI facilitates advanced predictive maintenance protocols. By analyzing vibrational data, temperature fluctuations, and operational patterns transmitted from IoT sensors embedded near critical engine components, AI models can accurately predict the remaining useful life (RUL) of the tensioner pulley and its associated bearing before catastrophic failure occurs. This capability shifts maintenance strategies from reactive or time-based schedules to condition-based interventions, maximizing vehicle uptime and reducing overall operational costs. Although the physical pulley itself remains a mechanical device, its reliability and integration into the vehicle's overall health monitoring network are fundamentally enhanced by AI-driven diagnostics and data analytics, providing substantial value to large fleet operators and maintenance service providers.

- AI enhances manufacturing precision through deep learning-based visual inspection for defect detection.

- Generative design algorithms optimize pulley geometry for maximum strength-to-weight ratio.

- Predictive maintenance systems utilize AI to analyze real-time sensor data, forecasting tensioner bearing failure.

- Supply chain logistics for raw materials and finished pulleys are optimized using AI for demand forecasting and inventory management.

- AI-driven simulation tools accelerate the R&D cycle for new high-durability tensioner materials.

DRO & Impact Forces Of Automotive Belt Tensioner Pulleys Market

The Automotive Belt Tensioner Pulleys Market is currently navigating complex dynamics shaped by sustained demand in ICE vehicle maintenance, juxtaposed against the long-term strategic shift towards electrification. The primary market drivers include the continuous increase in global vehicle production, particularly robust growth in Asian automotive manufacturing centers, which generates consistent OEM demand. Simultaneously, the longevity of vehicle fleets in developed economies ensures a high volume requirement for reliable replacement components in the aftermarket. Restraints, however, are significant, most notably the accelerating global transition to Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs), which inherently eliminate the need for traditional belt-driven ancillary systems, posing a structural threat to the long-term ICE component ecosystem. Furthermore, volatility in the pricing of essential raw materials like steel, aluminum, and specialized polymers directly impacts manufacturing costs and profit margins, creating supply chain instability.

Opportunities for growth are concentrated in innovation areas such as the development of lightweight components using advanced composite materials and reinforced plastics, which address the industry-wide goal of reducing vehicle mass to meet strict efficiency regulations. Specialized product development catering to high-performance engines and commercial heavy-duty vehicles, which demand highly durable, complex hydraulic or automatic tensioning systems, presents a profitable niche. Additionally, the expansion of the organized independent aftermarket in developing regions, coupled with initiatives by major global suppliers to combat counterfeit products, offers avenues for established players to capture greater market share and build consumer trust through certified distribution channels. The focus on improving the service interval and maximizing the durability of bearings—the most failure-prone component—through advanced lubrication and sealing technology is also a major area of competitive differentiation and potential market expansion.

The impact forces currently exerting pressure on the market are substantial. The intensity of competition is high, driven by numerous global and regional players competing fiercely on price and quality, particularly in the commoditized aftermarket segment. Substitute components, while not immediately prevalent within the ICE structure, are represented by alternative powertrain architectures (EVs) that serve as a strong external impact force pushing component manufacturers to diversify their product portfolios into non-ICE related parts. The bargaining power of major OEM purchasers remains high due to their scale and rigorous quality requirements, forcing suppliers to maintain high efficiency and lean manufacturing processes. Overall, the market remains cyclical, heavily tied to global automotive production volumes and the macroeconomic stability influencing consumer purchasing power for vehicle maintenance and new vehicle acquisitions.

Segmentation Analysis

The Automotive Belt Tensioner Pulleys Market is meticulously segmented based on mechanism type, material composition, vehicle application, and end-use channel to provide a granular view of market dynamics and profitability across various niches. This segmentation helps stakeholders understand where technological investment is most crucial and which end-user categories offer the most stable or rapidly expanding demand. The market is primarily categorized by the design of the tensioning system—manual, mechanical, hydraulic, or automatic—with automatic tensioners gaining dominance in new vehicle production due to their superior ability to maintain constant, precise belt tension under varying operational conditions, thereby enhancing the performance of auxiliary systems and reducing noise, vibration, and harshness (NVH) characteristics.

Segmentation by material is crucial, reflecting the industry's push for lightweighting and durability. While traditional steel tensioners remain prevalent in cost-sensitive segments and high-stress commercial applications, the adoption of aluminum and advanced thermoplastic composites is steadily increasing, particularly among premium OEMs seeking to minimize engine mass. Furthermore, the segmentation by vehicle type highlights the difference in component requirements; passenger vehicles drive volume, demanding quieter and more compact systems, whereas heavy commercial vehicles require larger, robust tensioners designed to handle extreme operational loads and extended duty cycles, often necessitating hydraulic assistance for dampening. These differing needs dictate material choice, manufacturing process, and final product pricing across segments.

The end-use channel segmentation, split between OEM and Aftermarket (IAM), defines the sales and distribution strategies. The OEM channel demands the highest quality standards, zero-defect tolerance, and long-term supply contracts, operating on high volume but lower margin profiles. Conversely, the aftermarket segment, characterized by millions of periodic replacement cycles globally, is highly fragmented and price-sensitive, offering substantial opportunities for quick market penetration and brand visibility, often focusing on reliability and broad compatibility with aging vehicle models. Understanding the precise requirements and purchasing criteria within each segment is paramount for market players aiming to optimize their product offerings and distribution networks efficiently.

- By Type

- Mechanical Tensioners

- Hydraulic Tensioners

- Automatic/Dynamic Tensioners

- By Material

- Steel

- Aluminum Alloys

- Nylon and Reinforced Composites

- By Vehicle Type

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By End-Use Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (IAM/OES)

- By Component

- Tensioner Arm/Body

- Idler Pulley/Bearing Assembly

- Mounting Bracket and Hardware

Value Chain Analysis For Automotive Belt Tensioner Pulleys Market

The value chain for the Automotive Belt Tensioner Pulleys Market begins with the upstream procurement of essential raw materials, primarily high-grade steels (for arms and brackets), aluminum billets (for lightweight tensioner bodies), and specialized bearing steels and lubricants. Key upstream suppliers include steel mills, aluminum foundries, and advanced elastomer and polymer producers for seals and composite pulleys. Efficiency and cost optimization at this stage are crucial, as raw material costs represent a significant portion of the final product price. Material specifications must adhere strictly to international automotive standards regarding fatigue resistance, thermal stability, and corrosion protection, necessitating close collaboration between component manufacturers and raw material providers to ensure quality consistency and traceability across large production batches, particularly given global volatility in commodity prices.

The middle segment of the value chain involves the manufacturing, assembly, and testing processes. This phase includes precision machining, forging, and casting of the tensioner body and arm, followed by the integration of the central bearing unit and the pulley wheel. High-precision manufacturing is essential, particularly for the bearing element, which determines the pulley’s longevity and noise characteristics. Direct manufacturing involves integrated suppliers like Schaeffler and Continental who handle most processes in-house, while smaller players often rely on specialized sub-component suppliers for bearings and castings. Rigorous quality control, including noise testing, dynamic load testing, and vibration analysis, must be conducted before the product moves downstream, adhering to the demanding defect rates mandated by OEMs.

The downstream segment focuses on distribution and sales, segmented into two distinct channels: OEM and Aftermarket. The OEM channel involves direct sales, often executed through long-term supply agreements and Just-in-Time (JIT) logistics, delivering large volumes directly to vehicle assembly plants worldwide. The indirect channel dominates the aftermarket, relying heavily on a sophisticated network comprising authorized distributors, wholesalers, independent parts retailers, and professional repair garages. Effective distribution in the aftermarket requires robust inventory management, extensive product cataloging, and quick delivery capabilities to service global vehicle parc demands for replacement parts. Successful players leverage both direct OEM relationships and comprehensive, well-supported indirect aftermarket channels to maximize market reach and maintain brand visibility among end-users and mechanics.

Automotive Belt Tensioner Pulleys Market Potential Customers

The primary customer base for Automotive Belt Tensioner Pulleys is broadly segmented into two major categories: Original Equipment Manufacturers (OEMs) and the extensive network of aftermarket buyers, which include wholesalers, parts distributors, independent service garages, and ultimately, vehicle owners. OEMs represent the largest volume purchasers, procuring tensioner pulleys for integration into new vehicle production lines across passenger cars, LCVs, and HCVs globally. These customers prioritize components that offer superior quality assurance, extensive validation testing documentation, high reliability for the vehicle's warranty period, and capability for high-volume, lean supply chain management. Establishing long-term relationships with global automotive giants like Toyota, Volkswagen Group, Ford, and General Motors is critical for success in the OEM segment, requiring immense operational scale and technological congruence.

The aftermarket customers constitute the core consumer base for replacement and maintenance components. This segment is driven primarily by the need for repairs arising from component wear, typically occurring after 60,000 to 100,000 miles, depending on the operational environment. Aftermarket buyers include major national and regional parts distributors (e.g., AutoZone, O'Reilly in North America, or local equivalents globally) who require wide product coverage spanning various vehicle makes and models, competitive pricing, and efficient logistics. Independent service garages and franchised dealerships, who perform the actual installation, are influenced by ease of installation, availability of technical support, and component durability, directly impacting their labor warranty exposure.

A specialized, rapidly growing customer segment is the fleet operator, particularly those managing large commercial transport, logistics, and mining vehicles (HCVs). For these customers, component reliability and longevity are paramount, as unscheduled vehicle downtime translates directly into significant financial losses. Fleet operators often purchase directly from specialized distributors or Original Equipment Service (OES) divisions, demanding robust, heavy-duty tensioners, often hydraulic or highly advanced mechanical units designed for harsh environments and extremely high utilization rates. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO) analyses, favoring components that minimize maintenance frequency and maximize operational uptime, justifying a premium price for superior durability and integrated diagnostic readiness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.68 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schaeffler, Continental AG, NTN Corporation, Gates Corporation, Dayco Products LLC, SKF Group, Litens Automotive Group, Tsubaki Nakashima Co., Ltd., Bando Chemical Industries, Ltd., ACDelco, TRW Automotive (ZF), MAHLE GmbH, Tenneco Inc., WAI Global, Aisin Seiki Co., Ltd., Bosch (Robert Bosch GmbH), Huchinson SA, Fersa Bearings, PBI Group, Metaldyne Performance Group (MPG) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Belt Tensioner Pulleys Market Key Technology Landscape

The technological landscape of the Automotive Belt Tensioner Pulleys Market is centered on enhancing durability, reducing mass, and integrating advanced dampening capabilities to cope with modern high-power, high-revving engines and start-stop systems. A core technological advancement involves the shift from traditional fixed-position mechanical tensioners to sophisticated automatic tensioning systems, utilizing calibrated springs and internal friction elements to dynamically adjust tension based on engine load and speed, significantly improving system longevity and reducing noise. Furthermore, hydraulic damping technology, primarily used in heavy-duty or high-performance applications, is crucial for mitigating high-frequency torsional vibrations within the belt drive system, which are often exacerbated by modern engine designs, thereby protecting auxiliary components from premature failure and maintaining optimal power transfer efficiency under extreme conditions.

Material innovation represents another critical area of technological focus. The utilization of specialized polymers and reinforced thermoplastic composites for the pulley wheel itself is gaining momentum, offering substantial weight savings (up to 40% compared to metal) while maintaining requisite structural integrity and wear resistance. Concurrently, advancements in bearing technology are paramount; high-efficiency, sealed-for-life deep groove ball bearings incorporating specialized, low-friction synthetic lubricants and advanced sealing systems (such as multi-lip or labyrinth seals) are standard requirements. These bearings must withstand extreme operating temperatures, aggressive chemical exposure from under-hood fluids, and high axial and radial loads for the entire operational life of the vehicle, often exceeding 150,000 miles without maintenance, which requires highly refined metallurgical and surface treatment techniques.

In addition to component-level innovation, the use of advanced simulation and modeling tools is transforming the design process. Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) are extensively employed to predict the structural integrity, thermal behavior, and vibrational response of new tensioner designs under various load profiles, significantly accelerating the R&D cycle and reducing the need for iterative physical prototyping. Furthermore, the burgeoning field of smart components includes the integration of micro-sensors (e.g., accelerometers or strain gauges) within the tensioner assembly. These sensors, combined with integrated circuit chips, allow for real-time monitoring of belt tension, component wear, and vibration severity, providing essential data for AI-driven predictive maintenance systems. This technological pivot toward intelligent components aligns the tensioner market with the broader digitalization trends sweeping across the automotive industry.

Regional Highlights

Global demand and manufacturing prowess in the Automotive Belt Tensioner Pulleys Market are distinctly concentrated across major automotive hubs, though market maturity and growth drivers vary significantly:

- Asia Pacific (APAC): Dominates the global market both in terms of production volume and rapidly increasing consumption. China, India, Japan, and South Korea are manufacturing powerhouses, benefiting from lower labor costs and high domestic vehicle production. The aftermarket in APAC is rapidly formalizing, driven by increasing vehicle parc size and rising disposable incomes leading to higher maintenance standards. This region is the primary driver for high-volume, cost-effective mechanical and automatic tensioner demand.

- North America: A mature market characterized by a large and aging vehicle fleet, ensuring robust and stable demand in the aftermarket segment, which values high-quality, long-lasting replacement parts. OEMs in North America prioritize advanced automatic tensioners and lightweight materials to comply with stringent fuel economy and emission standards. The region exhibits strong demand for performance-oriented components, including specialized parts for large trucks and SUVs.

- Europe: Defined by stringent environmental regulations and a focus on premium and technical excellence. European manufacturers (OEMs) typically demand advanced hydraulic tensioners and highly engineered composite materials to achieve superior NVH characteristics and low mass in vehicles, particularly in performance and luxury segments. The aftermarket is well-organized, with a strong preference for OES parts and high-quality independent supplier brands.

- Latin America (LATAM): Exhibits significant growth potential, tied to recovering automotive production in countries like Brazil and Mexico, which serve as major export and domestic manufacturing hubs. The market is highly price-sensitive, with a balance between new vehicle OEM installations and a substantial, often less-regulated, aftermarket requiring durable but economically priced components.

- Middle East and Africa (MEA): Emerging market where growth is heavily influenced by infrastructural spending boosting HCV sales (commercial vehicles require robust tensioners) and high demand for climate-resilient components. Extreme temperature conditions in many MEA countries necessitate specialized lubricants and sealing technologies for pulley bearings, making durability a key purchasing criterion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Belt Tensioner Pulleys Market.- Schaeffler

- Continental AG

- NTN Corporation

- Gates Corporation

- Dayco Products LLC

- SKF Group

- Litens Automotive Group

- Tsubaki Nakashima Co., Ltd.

- Bando Chemical Industries, Ltd.

- ACDelco

- TRW Automotive (ZF)

- MAHLE GmbH

- Tenneco Inc.

- WAI Global

- Aisin Seiki Co., Ltd.

- Bosch (Robert Bosch GmbH)

- Huchinson SA

- Fersa Bearings

- PBI Group

- Metaldyne Performance Group (MPG)

Frequently Asked Questions

Analyze common user questions about the Automotive Belt Tensioner Pulleys market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is EV adoption impacting the long-term demand for belt tensioner pulleys?

EV adoption presents a long-term structural restraint on the market, as BEV and FCEV powertrains generally eliminate the traditional accessory drive systems that require belt tensioners. While growth remains robust through 2033 due to the existing and continued production of ICE vehicles, manufacturers must diversify into components for electric systems or focus heavily on expanding aftermarket penetration and components for high-value hybrid vehicles to mitigate future risks.

What are the key material trends driving innovation in tensioner pulley manufacturing?

The primary material trend is the transition towards lightweight, high-performance materials such as aluminum alloys and advanced fiber-reinforced thermoplastic composites. These materials are chosen to reduce overall engine weight and rotational inertia, contributing to improved fuel efficiency and reduced emissions, while maintaining the high mechanical strength and thermal resistance required under the hood.

What is the difference between hydraulic and automatic (mechanical spring-based) tensioner systems?

Automatic (mechanical) tensioners use calibrated springs and internal friction dampers to provide static and dynamic tension adjustment, suitable for most passenger vehicles. Hydraulic tensioners, conversely, incorporate a hydraulic cylinder for superior damping capability, offering highly effective control over high-frequency engine vibrations, making them essential for high-performance and heavy-duty commercial vehicle engines.

Which regions hold the largest market share for Automotive Belt Tensioner Pulleys?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly driven by the massive scale of new vehicle production in China and India, alongside the rapidly expanding vehicle parc requiring consistent aftermarket support. North America and Europe, while representing smaller volumes, command premium pricing and demand for technically advanced products.

How does predictive maintenance technology affect the aftermarket for tensioner pulleys?

Predictive maintenance systems, often utilizing AI analysis of vibrational data from engine sensors, transform the aftermarket by shifting from reactive failure-based replacement to proactive condition-based service. This minimizes catastrophic failure risks for fleet operators, potentially reducing the total volume of immediate replacements but increasing the demand for smart, high-quality OES-level replacement parts recommended by vehicle diagnostics systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager