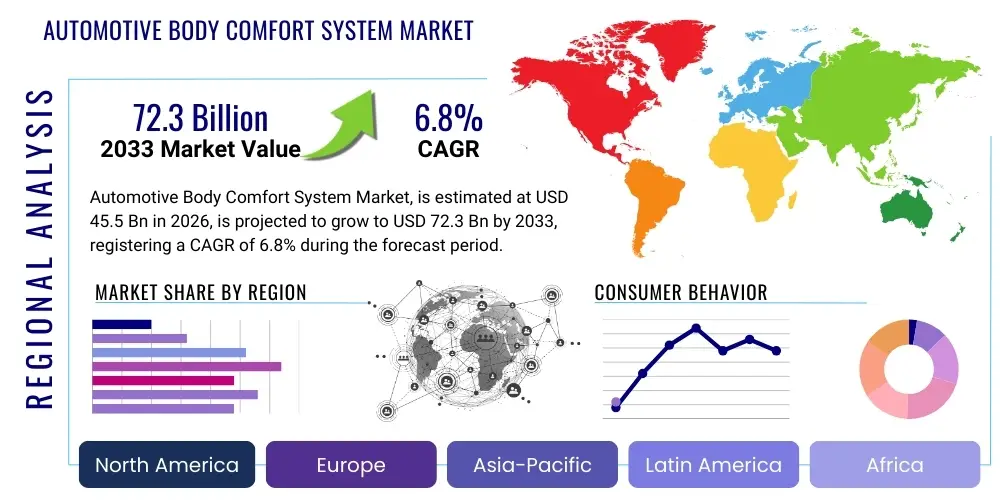

Automotive Body Comfort System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438082 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Automotive Body Comfort System Market Size

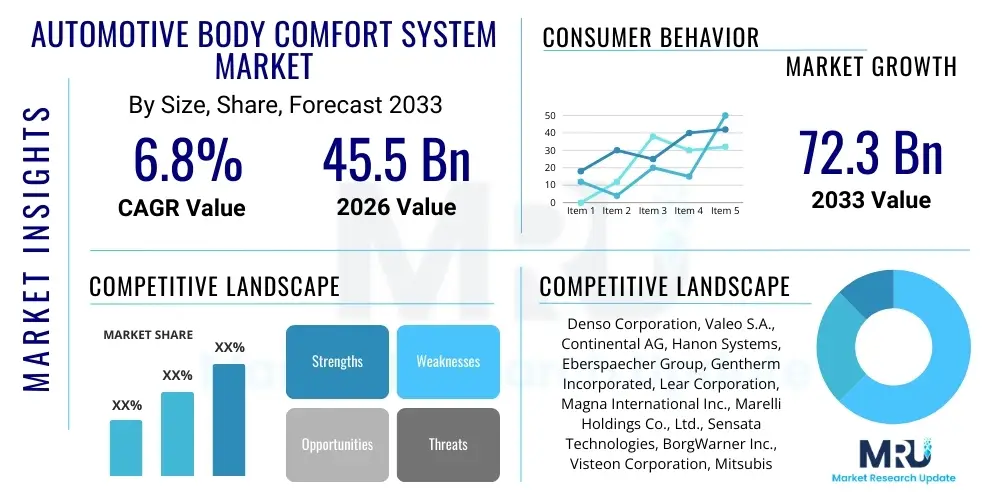

The Automotive Body Comfort System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 72.3 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing consumer demand for premium vehicle features, coupled with stringent regulatory standards related to interior air quality and thermal management across global automotive markets. The continuous integration of sophisticated sensors and electronic control units (ECUs) is enabling greater personalization and efficiency in comfort delivery, solidifying the market's expansion.

Automotive Body Comfort System Market introduction

The Automotive Body Comfort System Market encompasses a comprehensive range of technologies and components designed to optimize the thermal, tactile, and acoustic environment within a vehicle cabin, thereby enhancing occupant well-being and driving experience. These systems primarily include Heating, Ventilation, and Air Conditioning (HVAC), seat comfort systems (heating, ventilation, massage), steering wheel heating, automatic climate control modules, and sophisticated passive systems like noise cancellation and optimized interior lighting. The primary objective is to maintain a consistent and personalized microclimate, independent of external weather conditions, contributing significantly to passenger safety and comfort during long journeys.

Product complexity is rapidly increasing due to the shift toward electric vehicles (EVs) and autonomous driving, requiring more energy-efficient and highly localized comfort solutions. Major applications span across passenger vehicles (sedans, SUVs, luxury cars) and commercial vehicles, with luxury and premium segments acting as early adopters of advanced features such as multi-zone climate control and haptic feedback seating. The core benefits delivered include improved thermal efficiency, reduced driver fatigue, enhanced interior aesthetics through advanced lighting concepts, and overall elevated brand perception for automakers incorporating these high-end technologies.

Key driving factors supporting market momentum include rising disposable incomes in emerging economies, leading to higher vehicle penetration and demand for feature-rich cars, along with the technological evolution enabling seamless connectivity and predictive comfort adjustments. Moreover, the necessity for efficient thermal management in electric vehicles, where cabin comfort directly impacts battery range, is forcing rapid innovation in high-efficiency heat pumps and radiant heating elements, thus sustaining market growth throughout the forecast period. The convergence of comfort features with in-vehicle infotainment systems further simplifies user interaction and increases perceived value.

Automotive Body Comfort System Market Executive Summary

The Automotive Body Comfort System Market is positioned for significant growth, driven by key business trends emphasizing electrification, advanced sensor integration, and user-centric design. Business trends show a strong shift towards modular and integrated solutions that minimize space and weight, critical factors particularly in Battery Electric Vehicles (BEVs). Strategic collaborations between component suppliers and OEMs are accelerating the development of energy-optimized HVAC systems, utilizing heat pump technology extensively to reclaim waste heat and improve cabin efficiency without compromising battery performance. Furthermore, customization and personalized zone control represent major investment areas, moving beyond standard multi-zone climate control to highly individual occupant thermal management.

Regionally, Asia Pacific (APAC) continues to dominate the market growth trajectory, fueled by large-scale vehicle production in China and India, coupled with increasing consumer demand for premium features in mid-range vehicles. Europe and North America exhibit high adoption rates of advanced comfort systems, spurred by stringent safety regulations, a focus on luxury segment growth, and aggressive transition plans toward electric mobility requiring specialized thermal comfort solutions. These mature markets are leading in the integration of AI-powered predictive comfort features and advanced haptic interfaces within seating systems. Latin America and Middle East & Africa (MEA) are emerging markets showing gradual but steady demand, often driven by the import of modern, feature-equipped vehicles.

Segment trends highlight the dominance of the HVAC systems segment due to its foundational necessity and high cost contribution, though the seat comfort systems segment (ventilation, massage, dynamic posture support) is projected to exhibit the fastest CAGR, reflecting luxury feature penetration into mass-market vehicles. Technology segmentation favors active noise cancellation and smart climate algorithms utilizing complex data inputs from internal and external environments. The shift from traditional fluid-based systems to electric and radiant heating elements is a primary segmentation driver, catering directly to the needs of the growing EV fleet and enhancing system responsiveness and energy conservation.

AI Impact Analysis on Automotive Body Comfort System Market

User queries regarding the impact of Artificial Intelligence (AI) on Automotive Body Comfort Systems frequently revolve around predictive personalization, energy consumption optimization, and integration with autonomous driving functions. Common themes include how AI can anticipate occupant thermal needs before they are explicitly expressed, whether machine learning algorithms can significantly improve the efficiency of thermal loops in EVs to extend range, and the role of AI in creating highly localized microclimates for individual passengers. Users are concerned about the complexity of integrating diverse sensor data (physiological, environmental, vehicular status) and ensuring the AI systems are unobtrusive, learning preferences smoothly over time without extensive manual calibration. The expectation is that AI will transform comfort systems from reactive controls into proactive, invisible environmental managers.

AI’s influence is shifting comfort system design from fixed logic control to adaptive, data-driven optimization. Machine learning algorithms analyze vast datasets, including driving patterns, solar load, geographical location, outside temperature history, and individual user profiles (including physiological inputs gathered via wearable or embedded sensors). By synthesizing this information, AI can initiate pre-cooling or pre-heating sequences, modulate air flow direction, and adjust seat temperature settings predictively, ensuring optimal comfort upon vehicle entry or during critical driving phases. This predictive capability is crucial for maximizing passenger satisfaction while minimizing the energy draw, a key challenge in high-voltage EV architectures.

Furthermore, AI is instrumental in integrating different comfort components—HVAC, acoustic systems (ANC), and ambient lighting—into a cohesive, harmonized experience. For instance, AI can correlate high noise levels with driver stress and automatically adjust acoustic damping, simultaneously activating a calming ambient lighting scenario and slightly increasing seat ventilation. This holistic approach, managed by central AI domain controllers, ensures that the ‘body comfort experience’ is more than the sum of its parts. The development of deep learning models for noise and vibration prediction allows for highly effective active noise cancellation (ANC), tailoring anti-noise signals in real-time based on road surface quality and vehicle speed, representing a paradigm shift in cabin quietness.

- AI enables predictive thermal management by analyzing occupant physiological data and external environmental factors.

- Machine Learning (ML) optimizes HVAC energy consumption in EVs, maximizing battery range without sacrificing cabin comfort.

- Deep learning algorithms enhance Active Noise Cancellation (ANC) by real-time prediction and mitigation of cabin noise and vibration.

- AI facilitates hyper-personalized zone control, adjusting localized temperature, airflow, and haptic feedback for each occupant.

- Integration of AI centralizes control over lighting, acoustics, seating, and thermal systems for a harmonized holistic cabin experience.

- AI supports adaptive ventilation strategies based on air quality monitoring (e.g., detecting pollen or pollutants and automatically switching to recirculation).

DRO & Impact Forces Of Automotive Body Comfort System Market

The Automotive Body Comfort System Market is subject to a complex interplay of Drivers, Restraints, and Opportunities, shaping its growth trajectory and competitive landscape. The primary drivers include the accelerated global shift towards electric and autonomous vehicles, which necessitate highly efficient and sophisticated thermal management systems to preserve battery life and accommodate passengers who spend more time engaged in non-driving activities. Coupled with these technological pushes are consumer demands for luxury features, personalization, and seamless integration of comfort controls with vehicle infotainment systems, particularly in rapidly urbanizing and wealth-generating regions like APAC. These market forces collectively push OEMs to prioritize advanced comfort systems as a core differentiator.

However, significant restraints temper the market’s expansion. The chief constraint is the high complexity and cost associated with integrating advanced multi-sensor, AI-driven comfort systems, leading to increased manufacturing costs and potential technical challenges in ensuring interoperability across different vehicle platforms. Moreover, the energy penalty imposed by comfort systems, especially HVAC, remains a critical restraint in EVs, demanding substantial R&D investment to develop ultra-efficient components, which often face material and regulatory hurdles. The integration of complex wiring harnesses and control units also adds weight and structural complexity, counteracting vehicle light-weighting initiatives crucial for fuel economy and EV performance.

Opportunities for exponential market growth lie in the development of modular, scalable comfort solutions utilizing sustainable materials and highly localized heating/cooling methods (e.g., radiant panels, thermoelectric modules) that bypass energy-intensive air convection systems. The rise of Mobility-as-a-Service (MaaS) and shared autonomous fleets creates a necessity for robust, rapidly adjustable, and hygienic comfort systems that can quickly adapt to successive occupants with diverse profiles. Furthermore, regulatory mandates concerning interior air quality (IAQ) and thermal runaway prevention in battery packs present opportunities for suppliers specializing in advanced filtration, humidity control, and precise thermal monitoring components, ensuring sustained innovation and market penetration. These forces define the strategic choices for market players moving forward.

Segmentation Analysis

The Automotive Body Comfort System Market is highly diversified, segmented primarily by system type, technology, vehicle type, and distribution channel. Segmentation analysis provides a granular view of market dynamics, revealing varying growth rates and adoption patterns across different product categories. System Type segmentation highlights the dominance of core functions like HVAC systems, which are mandatory across all vehicle classes, contrasting with faster-growing niche areas such as seat comfort systems (massage, dynamic cushioning) and advanced acoustic management (ANC/Engine Sound Enhancement). Technology segmentation is critical, showing the rapid shift towards electric compressors, heat pumps, and solid-state cooling elements over traditional mechanical systems, reflecting the industry's focus on energy efficiency and space optimization driven by EV architecture.

Vehicle type segmentation confirms that Premium/Luxury vehicles are the primary testbeds and earliest adopters of advanced, high-cost comfort systems, while the SUV/Truck segment drives volume due to its popularity and larger cabin size requiring robust thermal solutions. The light commercial vehicle segment is increasingly adopting features previously exclusive to passenger cars to improve driver retention and comfort for long-haul operations. Geographic segmentation remains crucial, showing pronounced differences in demand based on climate—high demand for sophisticated AC systems in equatorial regions and comprehensive heating solutions in temperate zones. The detailed segmentation helps stakeholders tailor R&D investments and go-to-market strategies effectively across diverse global needs.

- By System Type:

- Heating, Ventilation, and Air Conditioning (HVAC) System

- Seat Comfort System (Heating, Cooling, Ventilation, Massage, Posture Adjustment)

- Steering Wheel Heating System

- Interior Lighting Systems (Ambient/Dynamic Lighting)

- Acoustic Management Systems (Active Noise Cancellation, Sound Enhancers)

- By Technology:

- Conventional Systems (Mechanical Compressors, Resistance Heating)

- Advanced Electric Systems (Electric Compressors, Heat Pumps, Thermoelectric Coolers)

- Sensor and Control Modules (Smart Climate Control Units, Thermal Sensors)

- By Vehicle Type:

- Passenger Vehicles (Sedans, Hatchbacks, SUVs)

- Commercial Vehicles (Light Commercial Vehicles, Heavy-Duty Trucks)

- Electric Vehicles (BEV, PHEV, HEV)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Component:

- Compressors (Electric and Mechanical)

- Condensers and Evaporators

- Climate Control Modules and ECUs

- Fans and Blowers

- Sensors and Actuators

Value Chain Analysis For Automotive Body Comfort System Market

The value chain for the Automotive Body Comfort System Market begins upstream with raw material suppliers, encompassing manufacturers of specialized metals (aluminum, copper), plastics, semiconductors, and specialized refrigerants (increasingly low-GWP refrigerants like R1234yf). This stage requires rigorous quality control and adherence to environmental standards, especially regarding material provenance and toxicity. The subsequent stage involves Tier 2 component manufacturers who process these raw materials into critical sub-components like motors, sensors, filters, control valves, and electronic boards (PCBs). Efficiency and miniaturization are key requirements at the Tier 2 level, particularly for sensor arrays and micro-actuators that enable precise comfort control.

Moving downstream, Tier 1 suppliers such as major automotive system integrators (e.g., Denso, Continental, Valeo) play a pivotal role. They assemble, integrate, and validate entire comfort modules—HVAC units, complete seating systems, or centralized domain controllers—before delivery to the Original Equipment Manufacturers (OEMs). Tier 1 companies invest heavily in R&D to meet increasingly stringent OEM specifications regarding system performance, weight reduction, and seamless electronic integration into the vehicle’s communication network (CAN/LIN). Direct distribution to OEMs is the predominant channel for new vehicles, governed by long-term contracts and highly specific customization requirements.

The final stages involve the OEMs, who integrate the comfort systems into the vehicle architecture, and the downstream distribution channels, which primarily focus on the aftermarket. The aftermarket includes independent service operators and authorized dealers responsible for maintenance, repair, and replacement of comfort components (e.g., compressors, filters, blowers). While OEM distribution is primary, the aftermarket provides steady revenue streams, particularly for replacement parts requiring specialized diagnostics and certified components to maintain system efficiency and warranty compliance. The distribution channels are highly regulated, ensuring consumer safety and adherence to specific regional environmental guidelines regarding refrigerant handling and disposal.

Automotive Body Comfort System Market Potential Customers

The primary potential customers and end-users of Automotive Body Comfort Systems are highly diverse but can be broadly categorized into Original Equipment Manufacturers (OEMs), fleet operators, and direct vehicle owners purchasing aftermarket upgrades or replacements. OEMs constitute the largest customer segment, driven by the necessity to incorporate advanced comfort features across their entire model portfolio to remain competitive and meet evolving regulatory requirements regarding cabin safety and passenger well-being. Luxury vehicle manufacturers, in particular, demand the highest complexity and level of technological sophistication, driving innovation in areas like biometric sensing and thermal seating.

Fleet operators, including ride-sharing companies (MaaS providers), taxi services, and commercial transport companies, represent a rapidly growing customer base. For these customers, durability, low maintenance, rapid cooling/heating cycles, and energy efficiency are paramount, as system downtime directly impacts profitability. Autonomous shuttle providers are also key buyers, requiring next-generation comfort systems that are highly adaptable and hygienic for constant passenger turnover in a driverless environment. These buyers prioritize cost-effectiveness over absolute luxury, seeking robust, standardized, and easily serviceable systems.

Finally, individual vehicle owners act as customers for the aftermarket segment. These buyers typically seek replacement parts (filters, compressors), upgrades (e.g., installing heated seats in base models), or customization features. Driven by factors such as vehicle longevity, increased personal comfort during ownership, or climate-specific needs, this segment relies heavily on the availability and quality assurance provided by reputable aftermarket distributors and authorized service centers, focusing on compatibility and ease of installation for older vehicle models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 72.3 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Denso Corporation, Valeo S.A., Continental AG, Hanon Systems, Eberspaecher Group, Gentherm Incorporated, Lear Corporation, Magna International Inc., Marelli Holdings Co., Ltd., Sensata Technologies, BorgWarner Inc., Visteon Corporation, Mitsubishi Electric Corporation, Johnson Electric Holdings Limited, Panasonic Corporation, Webasto Group, Bosch, Trelleborg AB, Calsonic Kansei, and Faurecia. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Body Comfort System Market Key Technology Landscape

The technological landscape of the Automotive Body Comfort System Market is undergoing rapid transformation, primarily driven by the mandate for energy efficiency in electric vehicles and the requirement for highly personalized occupant experiences. A pivotal technological shift involves the mass adoption of electric compressors and heat pump technology, replacing traditional belt-driven systems. Heat pumps, which can efficiently move heat into or out of the cabin depending on requirements, are essential for EVs as they drastically reduce reliance on resistive heating, thereby conserving battery power and extending range. Furthermore, advanced thermal energy storage (TES) systems are being integrated to manage peak loads and ensure thermal stability without continuous high energy draw, improving system responsiveness and overall energy management efficiency within the vehicle architecture.

Another crucial area is the rise of solid-state thermal management solutions, particularly thermoelectric (TE) modules used in localized cooling and heating applications, such as ventilated seats and small, personal cooling zones. While TE modules traditionally face efficiency challenges, continuous material science improvements are making them viable for highly localized comfort delivery, reducing the need to condition the entire cabin volume. Alongside hardware advancements, the sensor and software landscape is defining the next generation of comfort systems. This includes sophisticated infrared and physiological sensors (monitoring skin temperature, heart rate variability) that feed data into AI-driven climate control ECUs, enabling truly proactive and non-intrusive system adjustments based on occupant stress or fatigue levels, rather than simple temperature set-points.

The integration of advanced acoustic management is also fundamental. Active Noise Cancellation (ANC) utilizes the vehicle’s audio system to generate anti-phase sound waves, canceling low-frequency road and engine noise, creating a quieter cabin environment crucial for autonomous vehicles where occupants seek distraction or rest. Complementing ANC is Engine Sound Enhancement (ESE) technology, which synthesizes desired engine sounds for performance vehicles, maintaining the emotional connection to driving in electrified models. Looking ahead, keyless entry and access systems are converging with comfort features; for example, biometric identification systems (facial recognition or fingerprint) not only unlock the car but also automatically load pre-set personalized comfort profiles, adjusting seating, mirrors, climate zones, and ambient lighting before the driver is seated, representing the epitome of seamless human-machine interaction and predictive comfort delivery.

Regional Highlights

The Automotive Body Comfort System Market exhibits diverse regional dynamics shaped by climate, regulatory environment, and consumer purchasing power. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily due to high vehicle production volumes in China, India, Japan, and South Korea. China, in particular, drives demand for advanced features like heated/ventilated seating and multi-zone climate control, reflecting the rapid growth of the domestic luxury and EV segments. The region’s diverse climatic conditions, from extreme cold to severe heat and high humidity, necessitate the incorporation of robust and highly adaptable HVAC systems, coupled with advanced air filtration technologies to combat high levels of urban air pollution, making cabin air quality a significant market driver.

Europe represents a mature market characterized by a strong emphasis on thermal efficiency, light-weighting, and regulatory compliance, especially regarding the phase-out of high Global Warming Potential (GWP) refrigerants. European OEMs prioritize sophisticated systems that enhance the driving experience in high-end and performance vehicles, leading to higher penetration of advanced seating comfort features (massage, dynamic side bolster support) and advanced acoustic management systems (ANC). The aggressive push for electrification across major European nations is driving specialized demand for high-performance heat pumps and efficient thermal management of battery packs, which is inextricably linked to cabin comfort performance. Regulatory frameworks promoting safety and ergonomics further solidify the demand for high-quality, integrated comfort solutions.

North America is a key market, particularly driven by high consumer preference for large vehicles (SUVs and trucks) which require powerful and durable HVAC units. Demand in North America focuses heavily on convenience and integration, including systems that seamlessly interact with smart home devices and mobile applications for remote climate pre-conditioning. The market here is highly receptive to innovative technologies, such as advanced material usage in seats for better cooling and heating distribution, and the incorporation of robust connectivity features within comfort controls. Meanwhile, Latin America and the Middle East & Africa (MEA) are characterized by strong demand for robust, reliable AC systems to handle extreme heat, with market growth gradually increasing as disposable income rises and newer, imported vehicle models become more accessible, stimulating interest in basic and mid-range comfort amenities.

- Asia Pacific (APAC): Highest volume market, driven by China’s massive EV production and demand for advanced air filtration due to pollution concerns. Focus on robust HVAC and high adoption in the emerging middle class.

- Europe: Focus on efficiency, low-GWP refrigerants, and luxury features. Leading adoption of specialized heat pumps and advanced acoustic solutions driven by stringent environmental standards and premium vehicle segment growth.

- North America: Strong demand concentrated in large vehicles (SUVs/Trucks). High uptake of connectivity features, remote start/climate control, and integrated comfort systems for extreme thermal variability.

- Latin America: Gradual adoption of modern comfort systems; primary need is reliable air conditioning; growth constrained by economic volatility but showing steady trajectory for basic features.

- Middle East & Africa (MEA): Critical demand for high-performance cooling systems due to severe climate conditions; emerging adoption of advanced features in luxury segments of the GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Body Comfort System Market.- Denso Corporation

- Valeo S.A.

- Continental AG

- Hanon Systems

- Eberspaecher Group

- Gentherm Incorporated

- Lear Corporation

- Magna International Inc.

- Marelli Holdings Co., Ltd.

- Sensata Technologies

- BorgWarner Inc.

- Visteon Corporation

- Mitsubishi Electric Corporation

- Johnson Electric Holdings Limited

- Panasonic Corporation

- Webasto Group

- Bosch

- Trelleborg AB

- Calsonic Kansei (now part of Marelli)

- Faurecia (now part of Forvia)

Frequently Asked Questions

Analyze common user questions about the Automotive Body Comfort System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most energy-efficient comfort technology being adopted in electric vehicles (EVs)?

The most energy-efficient technology widely adopted in EVs is the heat pump system. Heat pumps utilize thermal energy exchange rather than electrical resistance to heat the cabin, significantly reducing the energy load on the battery compared to traditional HVAC systems and thereby improving the overall driving range.

How does AI contribute to the future of automotive body comfort systems?

AI, leveraging machine learning and sensor fusion, enables predictive and highly personalized comfort systems. It analyzes occupant physiological data, external conditions, and historical preferences to proactively adjust temperature, airflow, seating, and acoustics, ensuring optimal comfort without direct user input while simultaneously optimizing energy consumption.

Which market segment is expected to show the fastest growth rate?

The Seat Comfort System segment, specifically encompassing ventilation, massage functionality, and dynamic posture support, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This growth is driven by the rapid penetration of these premium features from the luxury segment into mass-market SUVs and mid-range passenger vehicles globally.

What role do Active Noise Cancellation (ANC) systems play in vehicle comfort?

ANC systems enhance vehicle comfort by using microphones to detect unwanted low-frequency noises (road, tire, engine) and generating opposing sound waves through the audio speakers to neutralize them. This technology is critical in autonomous and electric vehicles, creating a quieter, less fatiguing environment for passengers and supporting enhanced communications and entertainment.

What are the primary restraints affecting the market growth?

The primary restraints include the high initial cost associated with complex, multi-sensor integrated systems, the weight and complexity added by advanced components (impacting vehicle light-weighting goals), and the substantial energy penalty that high-power comfort systems still place on the battery capacity and range of electric vehicles.

The extensive demand for customization in cabin environment control, particularly among high-end consumers and fleet operators utilizing Mobility-as-a-Service (MaaS) models, continues to drive intense competition among Tier 1 suppliers. These suppliers are now investing heavily in advanced materials research, focusing on lighter, more efficient components like micro-channel heat exchangers and composite materials for seating structures, ensuring compliance with strict weight reduction mandates from OEMs. Furthermore, the integration of health and wellness features, such as air purification systems that actively monitor particulate matter and volatile organic compounds (VOCs), is becoming a standard expectation, particularly in densely populated urban centers. These systems utilize advanced filtration media and chemical sensors linked to the vehicle's ECU to automatically manage air intake and recirculation, guaranteeing a healthier cabin environment. The transition to advanced low-GWP refrigerants (e.g., R1234yf) is another crucial element mandated by environmental regulations, influencing component material choices and design tolerances across the HVAC supply chain, particularly in Europe and North America.

The convergence of comfort systems with Advanced Driver Assistance Systems (ADAS) and autonomous driving platforms represents a major technological challenge and opportunity. As vehicles assume control, occupant alertness and comfort become paramount for seamless transition and overall passenger experience. For instance, integrated comfort systems can monitor driver drowsiness via sensor data (e.g., thermal mapping of the face or steering wheel grip) and automatically trigger stimulating actions like increasing cold air circulation, adjusting lumbar support, or providing haptic feedback through the steering wheel. This transition requires comfort system ECUs to communicate reliably and redundantly with the centralized domain controllers managing vehicle autonomy, raising the bar for cybersecurity and functional safety standards (ISO 26262) within the comfort domain. The sheer complexity of these interconnected systems mandates sophisticated software over-the-air (OTA) update capabilities, allowing OEMs to refine comfort algorithms and address potential vulnerabilities post-sale, reflecting the growing software-defined vehicle paradigm.

Looking specifically at component evolution, the fan and blower segment is seeing innovation focused on reducing noise and increasing efficiency through optimized aerodynamics and brushless DC (BLDC) motor technology. These quieter, more powerful fans are essential for effective thermal distribution and are designed to function seamlessly alongside active noise cancellation technology. Similarly, actuator technology—used for controlling air dampers, vents, and seat adjustments—is moving toward smaller, higher-precision micro-actuators that offer granular control over localized comfort zones. This drive for precision and miniaturization is necessary to support the multi-zone, hyper-personalized environment demanded by luxury and next-generation electric vehicles. The long-term trend suggests a move away from large centralized air ducts toward distributed thermal management modules embedded within the floor, roof, and trim, optimizing cabin space and increasing thermal uniformity for all passengers.

The influence of digitalization extends beyond simple control to encompass the entire ownership experience. Digital twins and simulation tools are now essential in the R&D process, allowing suppliers and OEMs to accurately model complex thermal dynamics and acoustic performance under various real-world conditions before physical prototyping. This accelerates development cycles and improves the first-time quality of integrated comfort systems. The aftermarket landscape is also digitalizing, with diagnostic tools offering high precision in identifying faults within complex networked comfort systems, replacing trial-and-error repair methodologies. Furthermore, consumers increasingly access comfort settings and vehicle pre-conditioning functions through smartphone applications, requiring robust telematics and cloud connectivity, further integrating the comfort system into the broader Internet of Vehicles (IoV) ecosystem and demanding high levels of data security and privacy for personalized profiles and physiological data.

The regional market differences also heavily dictate material application. For instance, in regions with extremely high solar load, specialized glass coatings and interior materials designed for low thermal emissivity are critical components that support the efficiency of the active cooling systems. In contrast, colder climates emphasize rapid heating and insulation properties. This geographical variability necessitates a highly flexible supply chain capable of producing region-specific component variants efficiently. The regulatory landscape around material flammability and volatile organic compound (VOC) emissions from interior components is also tightening globally, pushing manufacturers toward advanced, low-emission polymers and textiles for seats, headliners, and dashboard components that directly interact with the cabin environment, impacting both air quality and thermal characteristics of the overall comfort system.

The investment flow into startups specializing in niche thermal technologies, such as plasma-based air purification or advanced radiant heating foils, signals the market's trajectory towards highly distributed, non-invasive comfort solutions. These emerging technologies offer the potential to deliver instant, localized comfort with minimal energy draw, which is the holy grail for high-range EVs and autonomous shuttles. Venture capital funding is focusing on optimizing the human-machine interface (HMI) for comfort systems, integrating multimodal inputs (voice control, gesture recognition, haptic feedback) to make control intuitive and effortless. This shift reflects a broader industry movement: moving comfort control out of traditional buttons and dials and into the centralized, intelligent digital cockpit, managed by sophisticated software architectures that prioritize user experience and system efficiency above all else.

The concept of 'well-being cabins' is gaining traction, transforming the vehicle interior from a mere transportation space into a dynamic, restorative environment. This involves integrating comfort systems with other wellness technologies, such as therapeutic lighting sequences, custom aromatherapy diffusion, and sophisticated soundscapes designed to reduce stress or enhance concentration. The market is moving towards selling 'experiences' rather than just components. Suppliers are responding by developing integrated modules that combine thermal, acoustic, light, and scent elements into pre-programmed wellness modes (e.g., 'Energize Mode,' 'Relax Mode'). This trend emphasizes the importance of multidisciplinary engineering and collaborative design across traditional automotive supply silos, linking thermal engineers with software developers, industrial designers, and neuroscientists to create truly innovative and comprehensive body comfort systems that cater to the physical and psychological needs of the modern occupant.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager