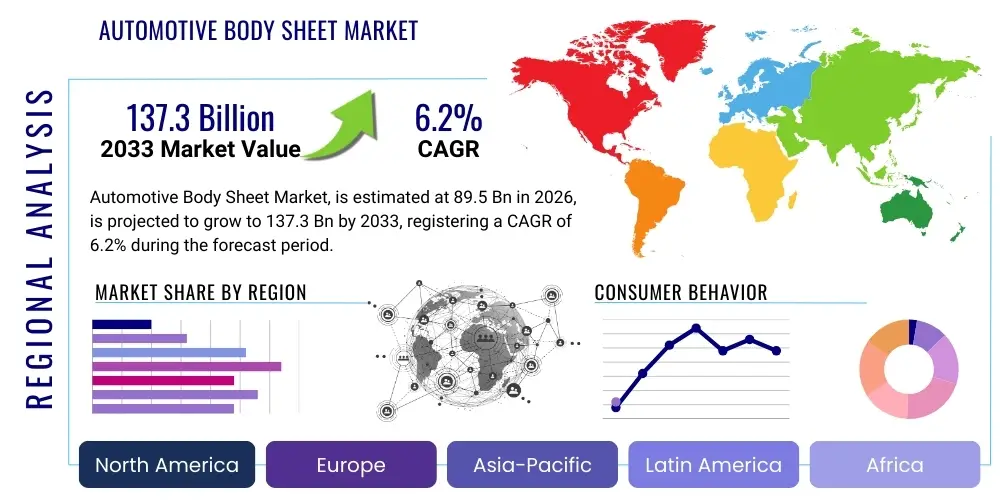

Automotive Body Sheet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439777 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Body Sheet Market Size

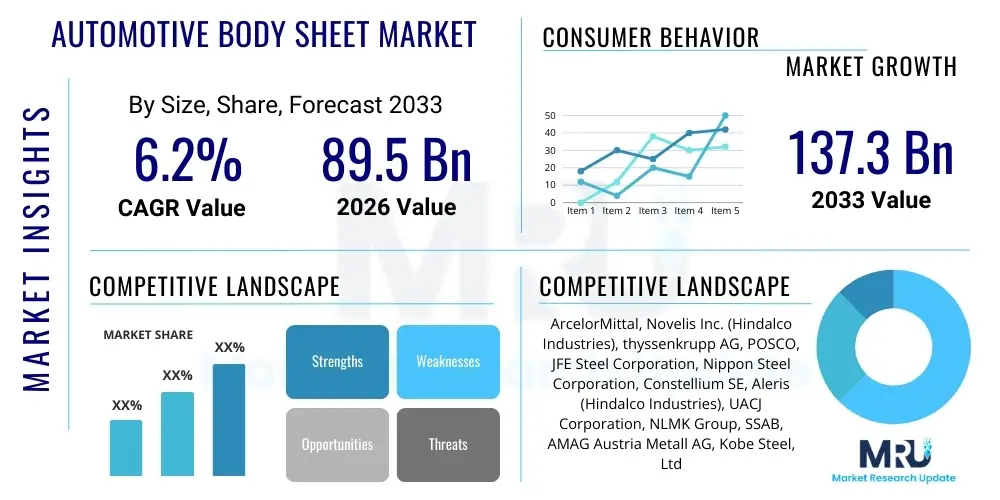

The Automotive Body Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 89.5 Billion in 2026 and is projected to reach USD 137.3 Billion by the end of the forecast period in 2033.

Automotive Body Sheet Market introduction

The automotive industry is undergoing a transformative period, profoundly influenced by stringent emission regulations, the accelerating transition to electric vehicles (EVs), and an unyielding demand for enhanced safety and fuel efficiency. These megatrends collectively position the automotive body sheet market as a pivotal sector, providing foundational materials critical for vehicle construction. Automotive body sheets encompass a diverse range of metallic and non-metallic materials engineered to form the primary structural components and exterior panels of a vehicle, including the body-in-white (BIW), doors, hoods, trunk lids, fenders, and roof panels. The selection of these materials is a complex interplay of performance requirements, manufacturing feasibility, and cost considerations, directly impacting a vehicle's crashworthiness, aesthetic appeal, and overall environmental footprint.

The product scope of automotive body sheets primarily includes various grades of steel (mild steel, high-strength low-alloy (HSLA) steel, advanced high-strength steel (AHSS), ultra-high-strength steel (UHSS)), aluminum alloys, and an increasing array of composite materials such as carbon fiber reinforced polymers (CFRPs) and glass fiber reinforced polymers (GFRPs). Major applications span across passenger cars, commercial vehicles, and electric vehicles, where these sheets are crucial for ensuring structural integrity, occupant safety, and aerodynamic efficiency. The inherent benefits derived from advanced body sheets include significant vehicle lightweighting, which directly translates to improved fuel economy for internal combustion engine (ICE) vehicles and extended range for EVs. Furthermore, these materials contribute to superior crash energy absorption, enhanced durability, and improved noise, vibration, and harshness (NVH) characteristics, elevating overall vehicle comfort and performance. Driving factors for this market's robust growth include global mandates for CO2 emission reductions, evolving consumer preferences for safer and more sustainable vehicles, continuous advancements in material science, and the widespread adoption of multi-material vehicle architectures.

The imperative for automotive manufacturers to reduce vehicle weight to meet stringent fuel efficiency and emission targets, particularly with the proliferation of electric vehicles (EVs), stands as a primary catalyst for innovation in the automotive body sheet market. EVs, burdened by heavy battery packs, rely heavily on lightweight body structures to maximize range and performance. Beyond weight reduction, safety regulations worldwide are continuously tightening, demanding materials that offer superior crash energy management without compromising vehicle aesthetics or structural rigidity. This drives the adoption of AHSS and aluminum, which provide high strength-to-weight ratios. Moreover, advancements in manufacturing technologies, such as hot stamping, laser welding, and hydroforming, enable the intricate shaping and joining of these advanced materials, pushing the boundaries of design and engineering. The market is also benefiting from a growing focus on material circularity and sustainable production processes, compelling manufacturers to invest in solutions that offer high recyclability and lower environmental impact throughout their lifecycle.

Automotive Body Sheet Market Executive Summary

The Automotive Body Sheet Market is experiencing dynamic shifts, driven by a confluence of evolving industry trends, regional specificities, and material segment transformations. Business trends are largely characterized by an intensifying focus on lightweighting strategies across the automotive sector, propelled by the urgent need to comply with global emission standards and to enhance the performance and range of electric vehicles (EVs). This has led to a notable shift from conventional mild steel to advanced high-strength steels (AHSS), aluminum alloys, and increasingly, multi-material constructions incorporating composites. Automotive manufacturers are actively engaging in strategic partnerships with material suppliers and technology providers to co-develop innovative solutions that balance strength, ductility, formability, and cost-effectiveness. Furthermore, the market is witnessing significant investments in advanced manufacturing processes such as hot stamping, tailor-welded blanks, and sophisticated joining technologies, which are essential for processing these new generation body sheet materials efficiently and effectively.

Regional trends exhibit distinct patterns influenced by regulatory landscapes, consumer preferences, and manufacturing capabilities. Asia-Pacific, particularly China and India, represents the largest and fastest-growing market due to robust automotive production volumes, burgeoning middle-class populations, and escalating demand for both passenger and commercial vehicles. European markets are characterized by a strong emphasis on premium vehicles and accelerated EV adoption, driving demand for high-performance and lightweight materials. North America demonstrates a significant uptake of AHSS and aluminum, especially in light trucks and SUVs, alongside a growing pivot towards EV production. Emerging economies in Latin America, the Middle East, and Africa are gradually increasing their adoption of advanced body sheets as their automotive industries mature and local regulations become more stringent, albeit often with a focus on cost-efficient solutions.

Segment trends highlight a pronounced shift in material composition. The steel segment, while dominant, is progressively migrating from mild steel to various grades of AHSS and UHSS, which offer superior strength-to-weight ratios and enhanced crash performance. This evolution allows for thinner gauges without compromising safety. The aluminum segment is experiencing robust growth, particularly in premium vehicles and EVs, owing to its exceptional lightweighting capabilities and corrosion resistance, though often at a higher cost. Composite materials, including carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP), though still niche due to their higher cost and complex manufacturing, are gaining traction in high-performance and luxury vehicles where extreme weight savings are paramount. The market is increasingly moving towards a multi-material approach, where different materials are strategically combined within a single vehicle structure to optimize specific performance attributes such as safety, weight, and cost, presenting both challenges and opportunities for material suppliers and vehicle designers alike.

AI Impact Analysis on Automotive Body Sheet Market

User inquiries surrounding the impact of Artificial Intelligence (AI) on the automotive body sheet market frequently revolve around themes of efficiency, material innovation, cost reduction, and quality control. Common questions explore how AI can optimize the design and manufacturing of advanced body sheets, predict material performance under various conditions, enhance the precision of stamping and joining processes, and improve supply chain resilience. Users are keen to understand AI's role in accelerating the development of new alloys and composites, minimizing material waste, detecting defects proactively, and ultimately, contributing to the overall cost-effectiveness and sustainability of automotive production. There's also significant interest in AI's potential to integrate complex multi-material solutions more seamlessly, ensuring structural integrity and safety standards are met while pushing the boundaries of lightweighting and vehicle performance.

- AI-driven material design and optimization: Accelerating the discovery and formulation of new alloys and composite structures with tailored properties (e.g., strength, formability, crash absorption).

- Predictive modeling for material performance: Simulating how different body sheet materials will behave under various stress conditions, impacting crashworthiness and durability, reducing physical prototyping.

- Enhanced manufacturing process control: AI algorithms optimize stamping, forming, welding, and bonding processes, reducing defects, improving consistency, and increasing production line efficiency.

- Automated quality inspection: AI-powered vision systems detect microscopic flaws and anomalies in body sheets or formed components with greater accuracy and speed than human inspectors.

- Supply chain optimization: AI predicts demand fluctuations, optimizes inventory levels, identifies potential disruptions, and streamlines logistics for raw materials and finished body sheets.

- Cost reduction through material utilization: AI algorithms minimize scrap rates during cutting and stamping by optimizing nesting patterns and material flow.

- Robotics and automation integration: AI enables more intelligent and adaptive robots in stamping plants and assembly lines, improving flexibility and precision in handling diverse body sheet materials.

- Digital twin creation for production lines: AI contributes to real-time monitoring and predictive maintenance of machinery involved in body sheet production and assembly, minimizing downtime.

DRO & Impact Forces Of Automotive Body Sheet Market

The Automotive Body Sheet Market is shaped by a powerful interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the relentless pursuit of vehicle lightweighting, critically important for both enhancing fuel efficiency in internal combustion engine (ICE) vehicles and extending the range of electric vehicles (EVs) without compromising safety. Stringent global emission regulations, such as those imposed by the EU, EPA, and CAFE standards, directly necessitate lighter vehicle architectures. Simultaneously, ever-evolving automotive safety standards (e.g., NCAP ratings) compel manufacturers to adopt advanced materials that offer superior crash energy absorption and occupant protection. Innovations in material science, leading to the development of advanced high-strength steels (AHSS), aluminum alloys, and composite materials, provide the technological backbone for these advancements, offering optimal strength-to-weight ratios and formability.

Despite these strong drivers, the market faces significant restraints. The higher material cost associated with advanced body sheets like AHSS, aluminum, and composites can substantially increase vehicle production costs, which then needs to be balanced against consumer price sensitivity. Furthermore, the complexity involved in processing and joining dissimilar materials (e.g., steel to aluminum or composites) in multi-material vehicle architectures presents manufacturing challenges, requiring specialized equipment, advanced welding techniques, and skilled labor. Supply chain volatility, particularly in raw material prices (iron ore, bauxite, carbon fiber precursors), can also introduce instability and impact profit margins for manufacturers. The capital-intensive nature of research and development for new materials and production processes acts as another barrier, especially for smaller market players, requiring substantial investment in infrastructure and expertise.

Opportunities for growth are abundant within this dynamic landscape. The accelerating global transition to electric vehicles offers a significant growth avenue, as EVs uniquely benefit from lightweighting to optimize battery range and performance. The continuous development of advanced composites, potentially incorporating sustainable or recycled content, promises further weight reduction and performance enhancements. Emerging markets in Asia-Pacific, Latin America, and Africa present untapped potential as vehicle ownership increases and local automotive industries mature, driving demand for more advanced and safer vehicles. Furthermore, the integration of 3D printing for specialized or complex body sheet components, coupled with advancements in smart materials that offer adaptive properties, could revolutionize vehicle design and production processes. The increasing focus on circular economy principles also drives opportunities for developing highly recyclable body sheet materials and closed-loop manufacturing processes, aligning with broader sustainability goals and potentially reducing long-term material costs and environmental impact.

Segmentation Analysis

The Automotive Body Sheet Market is broadly segmented by Material Type, Application, and Vehicle Type, each delineating distinct trends and growth trajectories within the industry. This comprehensive segmentation provides a granular view of the market's structure, allowing for precise analysis of market dynamics, competitive landscapes, and future growth opportunities. The diverse material landscape, ranging from traditional steel to advanced composites, caters to varying performance requirements and cost considerations across different vehicle segments and end-use applications. Understanding these segmentations is critical for stakeholders to identify key growth areas, tailor product development strategies, and optimize market penetration efforts in a rapidly evolving automotive ecosystem.

- By Material Type:

- Steel:

- Mild Steel

- High-Strength Low-Alloy (HSLA) Steel

- Advanced High-Strength Steel (AHSS)

- Ultra-High-Strength Steel (UHSS)

- Aluminum Alloys:

- 5xxx series (Al-Mg)

- 6xxx series (Al-Mg-Si)

- 7xxx series (Al-Zn)

- Composites:

- Carbon Fiber Reinforced Polymer (CFRP)

- Glass Fiber Reinforced Polymer (GFRP)

- Natural Fiber Composites

- Other Materials (e.g., Magnesium Alloys, Thermoplastics)

- Steel:

- By Application:

- Body-in-White (BIW)

- Exterior Panels (Doors, Hoods, Trunk Lids, Fenders, Roof Panels)

- Chassis Components

- Structural Components

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- Electric Vehicles (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles)

Value Chain Analysis For Automotive Body Sheet Market

The value chain for the Automotive Body Sheet Market is a multi-tiered and complex network, beginning with the extraction and processing of raw materials and culminating in the final integration into a finished vehicle. Upstream analysis involves key players such as mining companies extracting iron ore and bauxite, followed by primary metal producers like steel mills (e.g., integrated steelmakers, mini-mills) and aluminum smelters. These entities are responsible for transforming raw materials into various grades of steel coils, aluminum ingots, or composite precursors (e.g., carbon fiber filaments, resin systems). Their operations are highly capital-intensive and energy-intensive, with a strong focus on optimizing material properties to meet stringent automotive specifications for strength, formability, and weldability. The quality and cost of these foundational materials significantly dictate the downstream manufacturing processes and the ultimate performance of the automotive body sheet.

Moving downstream, the value chain encompasses sheet metal manufacturers and fabricators who process these primary metals and composites into the specific dimensions, thicknesses, and forms required by the automotive industry. This includes hot rolling, cold rolling, annealing, and surface treatment processes for metals, and preforming/curing for composites. Further down the chain are stamping and forming companies (often Tier-1 suppliers) that transform these sheets into complex body panels, structural components, and body-in-white (BIW) sub-assemblies through processes like deep drawing, hydroforming, and hot stamping. These components are then supplied directly to Automotive Original Equipment Manufacturers (OEMs) for final vehicle assembly. The distribution channels for automotive body sheets are predominantly direct, where large-volume contracts are established between sheet manufacturers or Tier-1 suppliers and OEMs. However, indirect channels also exist, serving smaller niche manufacturers, aftermarket repair segments, or specialized vehicle builders, often through metal service centers or distributors who provide cut-to-size sheets and smaller batch orders. The efficiency and synchronization across this entire value chain are critical for meeting the just-in-time delivery requirements of the automotive sector and managing the inherent complexities of multi-material vehicle architectures.

The intricate nature of the automotive body sheet market's value chain necessitates close collaboration and integration among its various participants. Direct channels involve long-term supply agreements between major material producers (steel, aluminum, composites) and large automotive OEMs or their primary Tier-1 body component suppliers. This ensures consistent quality, optimized material specifications, and streamlined logistics for high-volume production. These relationships often involve joint research and development efforts to innovate new materials and manufacturing processes. Indirect channels typically cater to the aftermarket, smaller specialty vehicle manufacturers, or prototyping stages, where material distributors or service centers play a crucial role in providing diverse material types in smaller quantities with faster turnaround times. This dual distribution strategy allows the market to serve both the mass production needs of the global automotive industry and the specialized requirements of niche segments, while also managing fluctuating demand and supply complexities. Ensuring transparency and resilience across both direct and indirect channels is paramount for mitigating risks related to raw material shortages, price volatility, and geopolitical disruptions, thereby safeguarding the continuous flow of essential body sheet materials to vehicle production lines worldwide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 89.5 Billion |

| Market Forecast in 2033 | USD 137.3 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Novelis Inc. (Hindalco Industries), thyssenkrupp AG, POSCO, JFE Steel Corporation, Nippon Steel Corporation, Constellium SE, Aleris (Hindalco Industries), UACJ Corporation, NLMK Group, SSAB, AMAG Austria Metall AG, Kobe Steel, Ltd., China Baowu Steel Group Corp., Ltd., Hyundai Steel Company, Hydro Extruded Solutions, AMG Advanced Metallurgical Group N.V., Tata Steel, Sumitomo Metal Industries, Hexcel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Body Sheet Market Key Technology Landscape

The technological landscape of the Automotive Body Sheet Market is characterized by continuous innovation aimed at improving material properties, optimizing manufacturing efficiency, and enabling the seamless integration of diverse materials into complex vehicle structures. A pivotal technology is Advanced High-Strength Steel (AHSS) production, encompassing techniques like hot stamping and tailor-rolled blanks. Hot stamping allows for the creation of ultra-high-strength components with complex geometries, while tailor-rolled blanks enable varying thickness within a single sheet, optimizing weight and strength where needed. These advancements in steel processing significantly contribute to lightweighting and enhanced crash performance without sacrificing design flexibility. Similarly, sophisticated aluminum processing techniques, such as continuous casting, rolling, and advanced heat treatments, are crucial for producing high-formability and high-strength aluminum alloys, particularly for exterior panels and structural components where surface quality and dent resistance are paramount.

Beyond material production, the market is heavily reliant on cutting-edge joining and forming technologies. Multi-material vehicle architectures demand advanced joining methods capable of bonding dissimilar materials effectively and reliably, such as laser welding, friction stir welding, resistance spot welding for compatible metals, and a growing reliance on structural adhesives and self-piercing rivets for multi-material junctions (e.g., steel to aluminum or composites). Hydroforming, another key technology, utilizes high-pressure fluid to shape complex tubular and sheet metal parts, reducing weight and improving structural integrity by consolidating multiple pieces into a single component. Digital simulation and virtual prototyping tools are also indispensable, allowing engineers to predict material behavior, optimize designs for manufacturing, and simulate crash scenarios before physical prototypes are built, thereby accelerating development cycles and reducing costs. Furthermore, non-destructive testing (NDT) techniques, including ultrasonic testing and eddy current inspection, are vital for ensuring the quality and integrity of welded joints and formed components, guaranteeing safety and durability in the final vehicle.

The evolution towards more sustainable and efficient production also drives technological advancements. Techniques such as roll forming offer continuous production of uniform cross-section parts, often with less material waste than traditional stamping. Surface treatment technologies, including advanced coating systems and pre-treatments, enhance the corrosion resistance and paint adhesion of body sheets, extending vehicle lifespan and maintaining aesthetic quality. The integration of Industry 4.0 principles, including IoT sensors, real-time data analytics, and AI-driven process control, is transforming body sheet manufacturing lines into smarter, more adaptive, and highly efficient operations. These technologies enable predictive maintenance, optimized material flow, and dynamic adjustments to production parameters, significantly improving output quality and reducing operational costs. The continuous development of specialized tooling and dies, leveraging advanced material science and precision engineering, is also critical for manufacturing complex body sheet parts with tight tolerances and exceptional surface finishes, directly supporting the automotive industry's push for innovative designs and superior vehicle performance.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market due to high vehicle production volumes in countries like China, India, Japan, and South Korea. Rapid industrialization, increasing disposable incomes, and the swift adoption of electric vehicles are key drivers. China, in particular, leads in both conventional and EV production, driving immense demand for advanced body sheet materials. Significant investments in manufacturing infrastructure and R&D for lightweight materials are also characteristic of this region.

- Europe: A mature market characterized by stringent emission regulations and a strong emphasis on premium and luxury vehicles. This drives the demand for high-performance AHSS, aluminum, and composites to achieve lightweighting and meet advanced safety standards. Countries like Germany, France, and the UK are at the forefront of EV adoption, further accelerating the shift towards advanced body sheet materials. Innovation in material science and advanced manufacturing techniques is a continuous focus.

- North America: Exhibits substantial demand for automotive body sheets, particularly in the production of light trucks, SUVs, and an accelerating shift towards electric vehicles. The region is a significant adopter of aluminum and AHSS due to fuel efficiency mandates and consumer preferences for larger, safer vehicles. The United States and Canada are witnessing increased investment in EV battery and vehicle manufacturing, which directly impacts the demand for lightweight body structures.

- Latin America: An emerging market with growing automotive production, primarily in Brazil and Mexico. Demand for body sheets is steadily increasing, with a gradual shift towards more advanced materials as local manufacturing capabilities improve and environmental regulations become more stringent. Cost-effectiveness remains a crucial factor in material selection within this region.

- Middle East and Africa (MEA): A developing market for automotive body sheets, driven by increasing vehicle sales and nascent manufacturing bases in countries like South Africa and Turkey. The market is influenced by imports and a rising demand for both passenger and commercial vehicles. Adoption of advanced materials is slower compared to developed regions but is expected to grow with urbanization and economic development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Body Sheet Market.- ArcelorMittal

- Novelis Inc. (Hindalco Industries)

- thyssenkrupp AG

- POSCO

- JFE Steel Corporation

- Nippon Steel Corporation

- Constellium SE

- Aleris (Hindalco Industries)

- UACJ Corporation

- NLMK Group

- SSAB

- AMAG Austria Metall AG

- Kobe Steel, Ltd.

- China Baowu Steel Group Corp., Ltd.

- Hyundai Steel Company

- Hydro Extruded Solutions

- AMG Advanced Metallurgical Group N.V.

- Tata Steel

- Sumitomo Metal Industries

- Hexcel Corporation

Frequently Asked Questions

What is the primary driver for growth in the Automotive Body Sheet Market?

The primary driver for growth in the Automotive Body Sheet Market is the increasing global demand for vehicle lightweighting, which is crucial for improving fuel efficiency in internal combustion engine vehicles and extending the range of electric vehicles, alongside stringent environmental regulations and enhanced safety standards.

Which material types are gaining prominence in the automotive body sheet market?

Advanced High-Strength Steels (AHSS), various aluminum alloys (e.g., 5xxx, 6xxx, 7xxx series), and composite materials (like Carbon Fiber Reinforced Polymers - CFRP) are gaining significant prominence due to their superior strength-to-weight ratios, corrosion resistance, and ability to meet evolving crash safety requirements.

How is the rise of Electric Vehicles (EVs) impacting the demand for automotive body sheets?

The rise of EVs is profoundly impacting demand by accelerating the shift towards lightweight body sheet materials. EVs require lighter structures to offset the weight of heavy battery packs, thereby maximizing range and performance, leading to increased adoption of aluminum and AHSS.

What are the key manufacturing technologies used for automotive body sheets?

Key manufacturing technologies include hot stamping for AHSS, advanced hydroforming, laser welding, friction stir welding, structural adhesive bonding for multi-material structures, and sophisticated forming techniques that enable complex geometries and precise material utilization.

Which region currently holds the largest share in the Automotive Body Sheet Market and why?

The Asia Pacific (APAC) region currently holds the largest market share, primarily driven by high automotive production volumes in countries such as China, India, Japan, and South Korea, coupled with rapid urbanization, rising disposable incomes, and significant investment in EV manufacturing within the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager