Automotive Brake Wear Sensors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434526 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Brake Wear Sensors Market Size

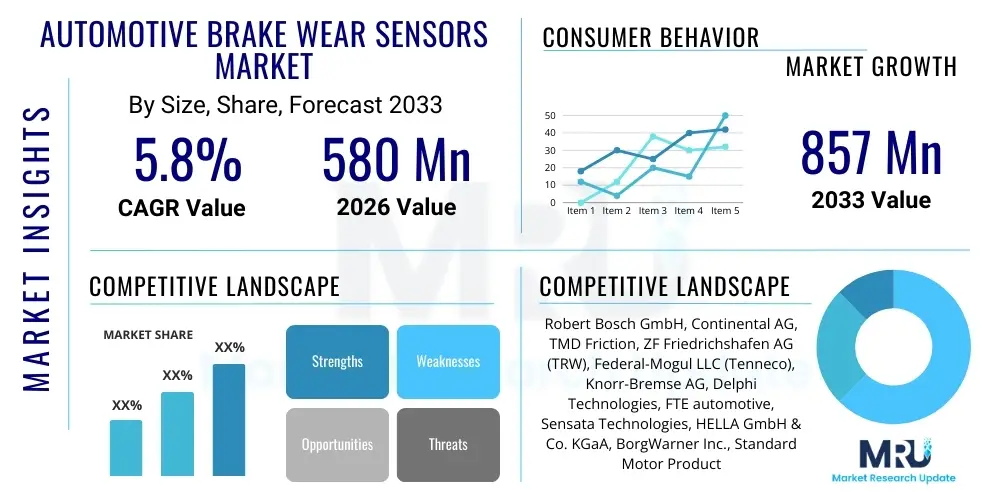

The Automotive Brake Wear Sensors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 857 Million by the end of the forecast period in 2033.

Automotive Brake Wear Sensors Market introduction

The Automotive Brake Wear Sensors Market is driven by increasing global mandates regarding vehicle safety, combined with the rising complexity of modern braking systems such as Anti-lock Braking Systems (ABS) and Electronic Stability Control (ESC). These sensors are crucial components designed to monitor the friction material thickness of brake pads, providing timely alerts to the driver when replacement is necessary. This proactive maintenance capability is vital for ensuring optimal braking performance, preventing costly damage to rotors, and significantly enhancing overall vehicle safety standards. The integration of these sensors is becoming standard practice, especially in premium and mid-segment vehicles, reflecting consumer demand for higher safety features and reliability.

Brake wear sensors fall primarily into two categories: electrical and electronic (or intelligent) sensors. Electrical sensors operate on a simple principle where an embedded contact loop is broken once the brake pad reaches its minimum thickness, triggering a warning light. Electronic sensors, often integrated into advanced diagnostic systems, provide continuous measurement data, allowing for predictive maintenance scheduling. The primary applications span across passenger vehicles (sedans, SUVs) and commercial vehicles (trucks, buses), with the passenger vehicle segment holding the dominant market share due to high production volumes and stringent regulatory compliance requirements in major global economies.

Key driving factors accelerating market growth include rapid advancements in vehicle technology, such as the adoption of connected car features and sophisticated vehicle health monitoring systems. Furthermore, the growing average age of vehicles globally necessitates regular maintenance and replacement of wear parts, sustaining the aftermarket segment. The push towards electrification also plays a role, as Electric Vehicles (EVs) require specialized or more resilient brake wear sensors, even though regenerative braking reduces overall mechanical brake usage, demanding high-precision monitoring during critical braking events to meet safety protocols.

Automotive Brake Wear Sensors Market Executive Summary

The Automotive Brake Wear Sensors Market is characterized by robust growth, propelled primarily by escalating governmental safety regulations, particularly in North America and Europe, mandating preventative maintenance systems. Business trends indicate a strong focus on developing integrated, high-precision electronic sensors that can communicate seamlessly with the vehicle’s central electronic control units (ECUs). Major suppliers are engaging in strategic partnerships with leading original equipment manufacturers (OEMs) to secure long-term supply agreements and standardize sensor integration across new vehicle platforms. The competitive landscape is leaning towards suppliers who can offer miniaturized, durable, and highly reliable sensor solutions capable of withstanding extreme thermal and mechanical stresses encountered in high-performance braking environments.

Regionally, Asia Pacific (APAC), led by China and India, is emerging as the fastest-growing market due to soaring vehicle production, especially in the mid-range and luxury segments, coupled with improving road safety consciousness among consumers. North America and Europe maintain their dominance in terms of technology adoption and revenue contribution, driven by stringent vehicle inspection protocols and high consumer willingness to pay for safety features. A noticeable trend across all regions is the increasing replacement rate in the aftermarket segment, which accounts for a substantial portion of the overall market revenue, fueled by the cyclical nature of brake component wear and replacement schedules.

Segment trends reveal that the electronic sensor type is gaining significant traction over the traditional electrical type, offering enhanced diagnostics and integration capabilities required for advanced driver-assistance systems (ADAS). In terms of sales channels, the OEM segment currently holds the largest share, benefiting from high volumes in new vehicle production. However, the aftermarket segment is critical for sustained profitability and is witnessing innovation in sensor design focused on ease of installation and compatibility across various vehicle models. Furthermore, the light-duty vehicle application segment continues to dominate due to sheer volume, although the heavy-duty commercial vehicle segment shows consistent growth owing to regulatory requirements for reliable brake monitoring in long-haul transport.

AI Impact Analysis on Automotive Brake Wear Sensors Market

Common user questions regarding AI's impact on brake wear sensors center on predictive maintenance accuracy, the obsolescence of physical sensors, and the integration of sensor data into broader vehicle health management (VHM) platforms. Users frequently inquire about how machine learning models can process raw sensor data—like temperature fluctuations, vibration profiles, and subtle resistance changes—to determine wear rates with greater precision than traditional logic-based alerts. A primary concern is whether AI could eventually render simple physical contact sensors obsolete by accurately estimating wear based purely on driving style, mileage, and environment, although the consensus among industry experts highlights that AI will primarily enhance, not replace, the underlying sensing hardware, focusing instead on optimizing replacement timing and reducing false positives.

The key themes circulating around AI integration involve the creation of smart, interconnected braking systems. AI algorithms are crucial for analyzing vast datasets generated by electronic brake wear sensors, correlating wear patterns with specific operational parameters such as average speed, frequency of hard braking events, and geographical driving conditions. This predictive capability shifts maintenance from reactive (triggered by a broken circuit) or calendar-based to truly condition-based monitoring (CBM), leading to maximized component lifecycle utility. Furthermore, AI helps in calibrating sensor inputs to account for manufacturing variances and environmental noise, thereby significantly improving the reliability and precision of the wear assessment warnings provided to both the driver and fleet managers.

AI's role extends into supply chain optimization and inventory management for replacement parts. By accurately forecasting when specific vehicle fleets or individual vehicles will require new brake pads, manufacturers and dealerships can optimize stocking levels, reducing obsolescence and improving service efficiency. This integration transforms brake maintenance into a seamless, digitized service experience, aligning with the broader trend of subscription-based, predictive automotive care. While the physical sensor remains essential, the actionable intelligence derived from the data via AI is the transformative element, driving efficiency and enhancing safety beyond the traditional warning light system.

- AI enhances predictive maintenance modeling by correlating sensor data with driving behavior and environmental factors.

- Machine learning optimizes sensor calibration, minimizing false positive wear alerts and improving overall accuracy.

- AI facilitates integration of wear data into comprehensive Vehicle Health Management (VHM) systems.

- Data analysis drives improved inventory forecasting for brake pad replacement in service centers.

- Development of virtual sensing techniques, utilizing existing vehicle data (e.g., brake pedal pressure, distance traveled) alongside physical sensor inputs.

DRO & Impact Forces Of Automotive Brake Wear Sensors Market

The Automotive Brake Wear Sensors Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, resulting in significant impact forces across the value chain. Key drivers include stringent regulatory compliance regarding vehicle safety in developed nations and the high volume demand originating from continuous growth in global vehicle production, especially in emerging economies. However, the market faces restraints suchised by high sensitivity to raw material costs and intense price competition, particularly in the aftermarket segment where standardization is high. Opportunities lie predominantly in the development of non-contact (e.g., ultrasonic or eddy current) sensing technologies, offering greater durability and precision than current electrical systems, and leveraging the rapid expansion of electric vehicle platforms requiring specialized monitoring solutions.

Impact Forces: The market is under moderate to high impact from regulatory standardization and OEM integration trends. Regulatory bodies continuously push for safer vehicles, making advanced monitoring systems, including brake wear sensors, a non-negotiable feature for achieving high NCAP ratings. This regulatory force acts as a major market driver, compelling manufacturers to adopt integrated solutions early in the design cycle. Concurrently, the bargaining power of major automotive OEMs remains high, influencing pricing structures and demanding continuous technological innovation from sensor suppliers to meet increasingly restrictive integration parameters and higher durability standards.

The threat of substitutes, historically low, is evolving with advancements in software-based wear estimation utilizing complex algorithms and existing vehicle telemetry (such as wheel speed sensors and temperature monitoring). While software cannot entirely replace hardware, it influences the required complexity and features of the physical sensor. The intensity of competition among existing players is high, characterized by ongoing intellectual property battles and a need for strong strategic alliances to maintain market share. Suppliers must consistently focus on miniaturization, cost reduction through efficient manufacturing, and providing comprehensive diagnostic data packages, moving beyond simple wear alerts to maintain a competitive edge.

Segmentation Analysis

The Automotive Brake Wear Sensors Market is comprehensively segmented based on Sensor Type, Sales Channel, Vehicle Type, and Application (which typically aligns with axle position or braking system type). Understanding these segments is crucial for market participants to tailor their product offerings and strategic focus. The market is increasingly polarizing between low-cost, high-volume electrical sensors dominating the basic aftermarket and sophisticated, higher-margin electronic sensors standard in premium OEM installations. This segmentation reflects the varied safety standards and performance expectations across different vehicle classes and regional mandates. The rise of hybrid and electric vehicles introduces a distinct sub-segment within vehicle types, demanding sensors optimized for infrequent but intense mechanical braking cycles.

Analysis by Sales Channel highlights the persistent dichotomy between the Original Equipment Manufacturer (OEM) segment and the Aftermarket (OES/Independent Aftermarket). The OEM channel provides high volume stability but typically requires extensive validation and integration support, often with multi-year contracts. Conversely, the Aftermarket segment, while fragmented, offers higher profit margins on individual units and is less susceptible to annual fluctuations in new vehicle production, providing a crucial revenue stream driven by the natural replacement cycle of brake components, usually every 30,000 to 70,000 miles depending on driving conditions.

Further granularity exists within the Vehicle Type segment, which divides the market into Passenger Vehicles (PV) and Commercial Vehicles (CV). PVs, particularly the sedan and SUV categories, constitute the largest segment due to global production scale. The CV segment, encompassing heavy trucks and buses, requires highly ruggedized and durable sensors capable of extended operation under heavy loads and high thermal stress, driving demand for specialized, high-reliability electronic sensors that integrate with fleet telematics systems for preventative maintenance scheduling and regulatory compliance monitoring (e.g., brake inspection requirements for commercial transport).

- Sensor Type

- Electrical Brake Wear Sensors (Contact Type)

- Electronic Brake Wear Sensors (Non-Contact / Intelligent)

- Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket (Independent Aftermarket and OES)

- Vehicle Type

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Electric Vehicles (EV)

- Application/Position

- Front Axle

- Rear Axle

- Drum Brakes

- Disc Brakes

Value Chain Analysis For Automotive Brake Wear Sensors Market

The value chain for the Automotive Brake Wear Sensors Market starts with upstream activities involving raw material procurement, primarily focused on polymers, copper wire, and metallic contacts. The cost and quality of specialized insulating materials and durable plastics significantly impact the final product's performance and longevity, especially given the harsh operating environment (heat, moisture, road debris). Key upstream suppliers are focused on providing customized, heat-resistant components that meet strict automotive-grade specifications. Efficiency in this stage is critical, as raw material costs exert substantial pressure on overall manufacturing profitability, particularly for high-volume electrical sensors where cost reduction is paramount.

The manufacturing and assembly stage involves high-precision processes, including injection molding, wire harness assembly, and rigorous testing for continuity and resistance. Companies specializing in sensor technology invest heavily in automated assembly lines to ensure consistency and minimize defects, which are unacceptable in critical safety components. Direct sales channels, especially to major Tier 1 suppliers or OEMs, emphasize complex contractual relationships, just-in-time delivery systems, and long-term quality control adherence. Indirect distribution channels primarily cater to the independent aftermarket, utilizing specialized automotive parts distributors and wholesale networks, necessitating robust packaging and branding strategies to compete effectively.

Downstream activities center on integration into the vehicle's braking system (primarily conducted by Tier 1 brake system suppliers) and subsequent distribution to end-users for replacement. For the OEM segment, the sensor supplier works closely with the vehicle manufacturer during the design phase to ensure seamless integration with the electronic control unit (ECU). In the aftermarket, distributors and retailers play a vital role in educating technicians and consumers about the benefits and correct installation procedures. The complexity of electronic sensors requires specialized diagnostic tools and training at the service center level, creating a niche market for service support and technical documentation, completing the value chain loop from material extraction to final vehicle maintenance.

Automotive Brake Wear Sensors Market Potential Customers

The primary potential customers and buyers in the Automotive Brake Wear Sensors Market fall into distinct categories defined by the sales channel: Original Equipment Manufacturers (OEMs) and the vast network of aftermarket stakeholders. OEMs, including major global automotive groups like Volkswagen Group, Toyota, General Motors, and their respective brake system suppliers (Tier 1), represent the highest volume buyers. These customers prioritize long-term contractual relationships, superior quality standards, competitive pricing for mass production, and advanced R&D capabilities to meet future vehicle specifications, especially those related to electrification and autonomous driving systems.

The second major customer base comprises the independent aftermarket, which includes large national automotive parts distributors (e.g., AutoZone, O’Reilly), wholesale parts suppliers, and regional maintenance garages and independent service operators (ISOs). These customers demand product variety (covering numerous vehicle makes and models), reliability, quick availability, and cost-effectiveness. For this segment, ease of installation and comprehensive cataloging are essential purchasing criteria, ensuring that replacement parts are accessible and identifiable across a diverse vehicle fleet requiring service.

A growing segment of buyers includes fleet operators and logistics companies, particularly those running large fleets of commercial vehicles (trucks, buses). These entities are increasingly adopting telematics and fleet management systems that rely heavily on accurate brake wear data provided by electronic sensors. Their purchasing decisions are influenced not just by component cost, but by the overall system reliability, longevity, and the sensor’s ability to minimize vehicle downtime through highly accurate predictive maintenance alerts, contributing directly to operational efficiency and regulatory compliance in transport services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 857 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, TMD Friction, ZF Friedrichshafen AG (TRW), Federal-Mogul LLC (Tenneco), Knorr-Bremse AG, Delphi Technologies, FTE automotive, Sensata Technologies, HELLA GmbH & Co. KGaA, BorgWarner Inc., Standard Motor Products, ATE (Continental), AISIN Corporation, Mando Corporation, Brembo S.p.A., Hitachi Astemo, Ningbo Foryou Group, Wenzhou Dongjun Automobile Parts Co., Ltd., Wuxi Jihong Electrical Equipment Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Brake Wear Sensors Market Key Technology Landscape

The technology landscape of the Automotive Brake Wear Sensors Market is primarily bifurcated into established electrical contact systems and emerging electronic non-contact systems. Electrical sensors rely on a simple mechanism involving a conductive wire loop embedded within the brake pad material. Once the pad wears down to a critical level, the rotor contact breaks the circuit, illuminating a dashboard warning light. This technology is mature, highly cost-effective, and forms the bedrock of the standard aftermarket segment. However, its limitation lies in providing only a single, binary warning (worn/not worn), lacking the precision required for advanced diagnostics or predictive maintenance scheduling.

The shift towards intelligent braking systems and ADAS necessitates the adoption of electronic sensors. These sensors often use capacitance, inductance, or Hall effect principles to measure the remaining friction material thickness continuously and non-invasively. Non-contact technologies, such as eddy current sensing or ultrasonic sensors, are gaining traction as they eliminate physical wear on the sensor itself, improving reliability and lifetime. These electronic systems deliver analog or digital signals directly to the vehicle's ECU, providing real-time data on wear rates, temperature, and usage patterns, which is critical for fleet management and predictive analytics applications utilizing AI and machine learning algorithms.

Furthermore, technology development is focused on enhancing sensor resilience against extreme conditions, including high operating temperatures characteristic of performance vehicles and commercial transport. Innovations include the use of advanced polymer encapsulation materials and shielded cable harnesses to resist chemical degradation and physical damage. Miniaturization and standardization of connectors (e.g., utilizing established automotive connector formats) are also key trends, easing integration into complex vehicle architectures and simplifying replacement procedures in the aftermarket. The long-term trajectory involves sensor fusion, where wear data is correlated with data from other vehicle sensors (e.g., vibration, heat) to provide a holistic and highly reliable assessment of braking system health.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate due to escalating vehicle production, especially in high-volume markets like China, India, and Southeast Asia. The region is seeing rapid urbanization and increasing consumer awareness regarding vehicle safety standards, driving the adoption of standardized brake wear sensors in domestically manufactured vehicles. Furthermore, the massive proliferation of two-wheelers and light commercial vehicles in developing APAC countries necessitates localized sensor solutions tailored for specific regional vehicle platforms and road conditions.

- Europe: Europe represents a mature market characterized by stringent environmental and safety regulations (e.g., EU regulations on roadworthiness), which strongly mandate the use of reliable brake monitoring systems. The region leads in the adoption of advanced electronic brake wear sensors due to the high market penetration of premium and luxury vehicles. Germany, France, and the UK are key contributors, driven by high R&D spending on braking system technologies and the rapid transition toward electric and hybrid vehicle platforms, necessitating advanced sensor integration.

- North America: North America holds a substantial market share, driven by high vehicle ownership rates and a robust aftermarket industry. The demand here is shaped by consumer expectations for high performance and sophisticated vehicle safety features. Replacement cycles are frequent due to extensive mileage covered by personal and commercial vehicles. The US market, in particular, showcases a strong preference for high-quality, durable electronic sensors integrated with comprehensive vehicle diagnostics systems required by the large population of light trucks and SUVs.

- Latin America & Middle East and Africa (LAMEA): These regions show steady, albeit slower, growth. Market development is primarily dependent on vehicle import volumes and evolving regional safety standards. The Middle East benefits from high-end vehicle imports, driving demand for premium sensor solutions, while Latin America and Africa focus predominantly on cost-effective, durable electrical sensors for their dominant light and heavy commercial vehicle fleets. Investment in localized manufacturing and distribution infrastructure is the key to unlocking significant future market potential in LAMEA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Brake Wear Sensors Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG (TRW)

- TMD Friction

- Federal-Mogul LLC (Tenneco)

- Knorr-Bremse AG

- Delphi Technologies

- FTE automotive

- Sensata Technologies

- HELLA GmbH & Co. KGaA

- BorgWarner Inc.

- Standard Motor Products

- ATE (Continental)

- AISIN Corporation

- Mando Corporation

- Brembo S.p.A.

- Hitachi Astemo

- Ningbo Foryou Group

- Wenzhou Dongjun Automobile Parts Co., Ltd.

- Wuxi Jihong Electrical Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Brake Wear Sensors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and necessity of an Automotive Brake Wear Sensor?

The primary function of an automotive brake wear sensor is to monitor the remaining thickness of the brake pad friction material. Its necessity stems from providing a timely warning to the driver, enabling proactive brake pad replacement to prevent catastrophic brake failure, avoid costly rotor damage, and maintain optimal vehicle safety performance as mandated by global safety standards.

How do Electronic Brake Wear Sensors differ fundamentally from traditional Electrical Brake Wear Sensors?

Electrical sensors are simple contact-based systems that provide a binary alert (on/off) only when the pad reaches its critical minimum thickness and the circuit is broken. Electronic or intelligent sensors, utilizing non-contact technologies like Hall effect or eddy currents, provide continuous, measurable data on the wear rate, allowing for precise predictive maintenance scheduling and seamless integration with complex vehicle diagnostic systems.

How is the growing adoption of Electric Vehicles (EVs) impacting the demand for brake wear sensors?

While EVs utilize regenerative braking, which significantly reduces mechanical brake usage and extends pad life, the demand for high-reliability brake wear sensors remains critical. EVs require specialized sensors that can accurately monitor mechanical wear during high-stress emergency braking events, ensuring compliance with strict safety protocols, thus driving innovation toward more durable and resilient electronic sensor types.

Which sales channel contributes most significantly to the Automotive Brake Wear Sensors Market revenue?

The Original Equipment Manufacturer (OEM) sales channel currently holds the largest volume share of the market, driven by mass production integration into new vehicles. However, the Aftermarket segment, consisting of replacement components sold through independent distributors and repair shops, offers high-profit margins and provides sustained, cyclical revenue based on the mandatory replacement schedule of wear parts.

What role does Artificial Intelligence (AI) play in the future development of brake wear monitoring?

AI's future role is to analyze large datasets from electronic sensors, correlating wear rates with dynamic factors (driving behavior, environment) to move maintenance from scheduled or reactive to truly condition-based predictive modeling. This optimizes the lifespan of the brake pads, minimizes unexpected vehicle downtime, and improves the overall efficiency and safety of fleet operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager