Automotive Braking Component Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434709 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Braking Component Market Size

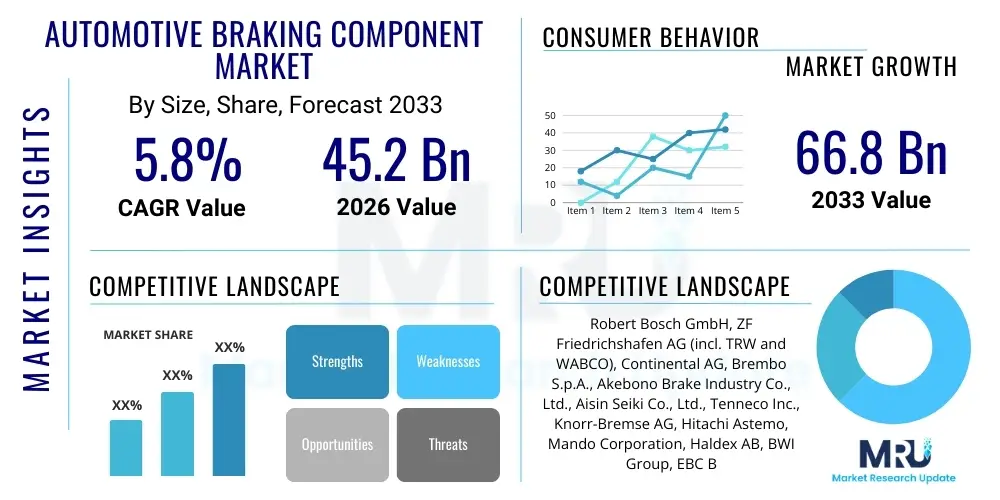

The Automotive Braking Component Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 66.8 Billion by the end of the forecast period in 2033.

Automotive Braking Component Market introduction

The Automotive Braking Component Market encompasses the manufacturing and distribution of parts essential for decelerating and stopping vehicles, including brake pads, rotors, calipers, drums, brake shoes, master cylinders, and advanced electronic braking systems such as ABS and ESC. These components are critical for vehicle safety and performance, making them indispensable elements in all vehicular platforms, ranging from passenger cars and light commercial vehicles (LCVs) to heavy-duty trucks and two-wheelers. The quality and reliability of these components are increasingly scrutinized due to stringent global safety regulations and the integration of sophisticated ADAS (Advanced Driver Assistance Systems).

Major applications of these components are primarily in Original Equipment Manufacturing (OEM) for new vehicle assembly and in the aftermarket for maintenance and replacement purposes. Key benefits derived from modern braking systems include enhanced vehicle control, reduced stopping distances, increased stability during emergency maneuvers, and improved resistance to brake fade under heavy use. Furthermore, advancements in materials science are leading to the adoption of ceramic and low-metallic formulations, addressing concerns related to dust emission, noise, vibration, and harshness (NVH).

The market growth is fundamentally driven by rising global vehicle production, increasing average vehicle age leading to higher replacement rates in the aftermarket, and continuous technological upgrades mandated by safety standards, particularly the pervasive adoption of Electronic Stability Control (ESC) and Anti-lock Braking Systems (ABS) even in emerging economies. The shift towards Electric Vehicles (EVs) also necessitates specialized braking components designed for regenerative braking integration and reduced wear due to lower reliance on friction brakes.

Automotive Braking Component Market Executive Summary

The global Automotive Braking Component Market is experiencing robust expansion fueled by a confluence of stringent governmental safety mandates and rapid technological integration, particularly in active safety systems. Business trends indicate a strong focus on lightweight material adoption, such as aluminum and composite alloys, to improve fuel efficiency and battery range in electric vehicles. Furthermore, the convergence of mechanical and electronic systems is driving innovation towards brake-by-wire technologies, which are anticipated to disrupt traditional hydraulic systems over the long term. Strategic alliances between Tier 1 suppliers and software developers are becoming common to capitalize on the increasing demand for sophisticated brake control units necessary for autonomous driving capabilities.

Regionally, Asia Pacific maintains its dominance, driven by massive vehicle production volumes in China, India, and Japan, coupled with improving safety standards pushing the adoption of advanced systems. North America and Europe, characterized by established automotive industries and high consumer expectations for safety, are the primary markets for premium and high-performance braking components, as well as being leaders in implementing brake-by-wire and integrated braking systems (IBS). Latin America and MEA are seeing substantial growth, largely driven by regulatory pushes making ABS mandatory in vehicle fleets.

Segmentation trends highlight the Electronic Braking Systems segment (ABS, ESC, EBD) as the fastest-growing technology sector, outpacing conventional hydraulic components. Among vehicle types, Passenger Cars remain the largest segment, but Light Commercial Vehicles (LCVs) are showing accelerating demand due to increased logistics and e-commerce activities requiring high-durability braking solutions. The aftermarket segment is resilient and critical, benefiting from deferred replacement cycles and the increasing complexity of components requiring specialized maintenance parts.

AI Impact Analysis on Automotive Braking Component Market

User inquiries regarding AI's influence on the braking component market frequently center around its role in autonomous driving (how AI dictates braking maneuvers), predictive maintenance (using machine learning to anticipate component failure), and system optimization (AI algorithms improving brake force distribution and reaction times). Key user concerns revolve around the reliability and ethical implications of AI-controlled emergency braking, the security of vehicle data used for predictive analytics, and the necessary integration standards required for traditional mechanical suppliers to comply with AI-driven braking architectures. Expectations are high regarding the potential for AI to dramatically enhance safety and significantly extend component lifespan by minimizing unnecessary wear.

AI algorithms are fundamentally changing how braking events are managed in modern vehicles. These algorithms, crucial for ADAS and autonomous vehicles, process massive amounts of real-time sensor data—including lidar, radar, and cameras—to determine precise stopping distance, pressure application, and timing, often far exceeding human reaction capabilities. This transition necessitates that traditional component manufacturers develop highly responsive and finely calibrated mechanical and electronic interfaces capable of executing instantaneous, AI-generated commands, pushing the need for faster solenoid actuation and robust sensor integration within the calipers and rotors themselves.

Moreover, AI is pivotal in manufacturing process optimization and supply chain management. Machine learning models are deployed to analyze quality control data, identifying microscopic flaws in component fabrication, thereby ensuring zero-defect output for safety-critical parts like master cylinders and brake lines. In the aftermarket, AI-powered diagnostics and predictive maintenance platforms analyze vehicle operational data (mileage, driving style, environmental conditions) to alert drivers and fleet managers precisely when a brake component needs replacement, shifting the industry from reactive failure correction to proactive component management, thereby maximizing vehicle uptime and safety compliance.

- AI enhances system responsiveness for ADAS and full autonomy, demanding faster actuation mechanisms.

- Predictive maintenance using machine learning extends component life and minimizes unexpected failure rates.

- AI optimizes brake blending (friction vs. regenerative) in Electric Vehicles, reducing mechanical brake wear.

- Improved manufacturing quality control through AI vision systems detecting defects in pads and rotors.

- Algorithms contribute to dynamic brake force distribution, improving stability and tire adherence during aggressive braking.

DRO & Impact Forces Of Automotive Braking Component Market

The Automotive Braking Component Market is significantly influenced by powerful systemic forces, including relentless global safety regulations (Driver), the high development cost of advanced electronic systems (Restraint), the emergence of electric and autonomous vehicle platforms (Opportunity), and the intense competitive pressure from consolidation among Tier 1 suppliers (Impact Force). The market's resilience is built upon the non-negotiable requirement for safety components, making it relatively immune to minor economic downturns, although volume is intrinsically linked to global vehicle production cycles.

Key drivers include the global mandate for technologies like ABS and ESC, particularly in developing nations, ensuring steady demand for electronic control units and sensors. Furthermore, the aging vehicle fleet in mature markets fuels the high-volume aftermarket sector. Conversely, restraints include the high capital expenditure required for developing brake-by-wire systems and the complex regulatory hurdles involved in certifying new safety-critical technologies. The cyclical nature of the automotive industry and volatility in raw material prices (steel, iron, copper) also exert financial pressure on component manufacturers.

The foremost opportunities lie in the transition to e-mobility, demanding tailored braking solutions that integrate regenerative functionality efficiently, alongside the burgeoning demand for highly redundant and fail-safe braking systems essential for Level 4 and Level 5 autonomous vehicles. Impact forces are characterized by rapid supplier consolidation, creating fewer, larger entities with extensive technological portfolios, intensifying competition, and forcing smaller players to focus on niche performance or aftermarket segments. This environment necessitates continuous investment in R&D to stay ahead of evolving safety and performance standards.

Segmentation Analysis

The Automotive Braking Component Market is comprehensively segmented based on component type, technology utilized, the type of vehicle employing the system, and the sales channel through which the product is distributed. Analyzing these segments provides a nuanced understanding of market dynamics, revealing where investment is focused—such as the shift towards electronic control systems—and identifying the high-volume sectors, like passenger vehicle component replacement. The market structure reflects the inherent division between mechanical wear parts (pads, rotors) requiring frequent replacement and complex electronic systems (ABS modules) associated with initial vehicle manufacture and long-term durability requirements.

The component segmentation is crucial as it dictates material requirements and manufacturing complexity. Wear components drive aftermarket volume, while complex assemblies like calipers and master cylinders are highly dependent on OEM contracts. Technology segmentation highlights the shift from purely mechanical systems to highly integrated electronic platforms, reflecting regulatory pressure and consumer demand for superior safety performance. Understanding these segments is vital for suppliers to align their production capabilities with future regulatory and technological roadmaps, ensuring compliance with global standards such as UNECE regulations concerning braking performance.

- By Component: Pads, Rotors/Discs, Calipers, Drums, Master Cylinders, Brake Lines/Hoses, Brake Fluid.

- By Technology: Anti-lock Braking System (ABS), Electronic Stability Control (ESC), Electronic Brakeforce Distribution (EBD), Traction Control System (TCS), Conventional Braking System, Integrated Braking Systems (IBS), Brake-by-Wire.

- By Vehicle Type: Passenger Cars (PC), Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Two-Wheelers (2W).

- By Sales Channel: Original Equipment Manufacturer (OEM), Aftermarket.

Value Chain Analysis For Automotive Braking Component Market

The value chain for the Automotive Braking Component Market is complex, beginning with upstream raw material suppliers and culminating in the end-user (vehicle owner). Upstream analysis involves the procurement of essential materials such as specialized high-carbon steel and cast iron for rotors and drums, friction materials (ceramics, semi-metallic compounds) for pads and linings, and sophisticated electronic components (sensors, microcontrollers) crucial for ABS and ESC modules. Suppliers in this stage face constant pressure regarding material quality, cost stability, and adherence to strict specifications necessary for safety-critical applications.

Midstream activities involve Tier 2 and Tier 1 manufacturers. Tier 2 suppliers process raw materials into specific parts (e.g., machining rotor blanks or producing electronic sub-components). Tier 1 suppliers (e.g., Bosch, Continental, Brembo) integrate these parts into complete braking systems or modules, managing complex manufacturing processes, rigorous testing, and quality assurance. These Tier 1 companies invest heavily in R&D to develop proprietary friction formulas, lightweight caliper designs, and software for advanced electronic control units, serving as the primary interface with major OEM assembly lines.

Downstream activities cover distribution channels, which bifurcate into OEM sales (direct supply to vehicle manufacturers for new assembly) and Aftermarket sales. Aftermarket distribution relies on a network of independent distributors, authorized service centers, and retail auto parts stores. Direct channels are characterized by high volume and intense quality requirements, while indirect channels (aftermarket) focus on availability, brand recognition, and pricing flexibility. The aftermarket is growing in complexity due to the rise of specialized performance parts and the need for components compatible with advanced electronic systems.

Automotive Braking Component Market Potential Customers

Potential customers for the Automotive Braking Component Market are broadly categorized into Original Equipment Manufacturers (OEMs), who constitute the primary high-volume customer base, and the vast global aftermarket, comprising independent repair shops, authorized service centers, fleet operators, and individual vehicle owners. OEMs prioritize reliability, integration capabilities (especially for ADAS), volume scalability, and competitive pricing, typically entering into long-term supply contracts with Tier 1 component manufacturers like Continental and ZF.

The aftermarket represents the consistent demand stream fueled by routine maintenance and mandatory component replacement due to wear and tear. Customers in this segment often seek a balance between performance, durability, and cost. Fleet operators (bus companies, trucking firms, large logistics providers) represent a highly lucrative subset of the aftermarket, demanding heavy-duty, long-life components engineered for extreme stress and minimum downtime. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO) and component longevity.

A growing segment of potential customers includes specialized vehicle manufacturers, such as those producing high-performance sports cars and racing vehicles, who require bespoke braking solutions (e.g., carbon-ceramic rotors, multi-piston calipers) often supplied by specialized performance brake brands like Brembo or StopTech. Furthermore, as the EV market matures, battery electric vehicle (BEV) manufacturers become unique customers requiring systems optimized for seamless integration with regenerative braking systems and demanding lightweight construction to preserve battery range.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 66.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, ZF Friedrichshafen AG (incl. TRW and WABCO), Continental AG, Brembo S.p.A., Akebono Brake Industry Co., Ltd., Aisin Seiki Co., Ltd., Tenneco Inc., Knorr-Bremse AG, Hitachi Astemo, Mando Corporation, Haldex AB, BWI Group, EBC Brakes, Carlisle Brake & Friction, StopTech, Baer Brakes, Wilwood Engineering, Bendix (part of FMP), ADVICS Co., Ltd., FTE Automotive. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Braking Component Market Key Technology Landscape

The Automotive Braking Component Market is undergoing a fundamental technological transformation, moving from purely hydraulic and mechanical systems to integrated electro-hydraulic and purely electronic control units. The most significant advancement is the widespread adoption of Integrated Braking Systems (IBS), which combine vacuum amplification, master cylinder, and electronic stability control into a single, compact unit. This integration reduces complexity, saves weight, and, crucially, provides the faster reaction times and redundancy required by advanced ADAS functions like Automatic Emergency Braking (AEB) and adaptive cruise control. IBS is particularly essential for hybrid and electric vehicles as it efficiently manages the blending between regenerative energy recovery and conventional friction braking, maximizing energy efficiency while ensuring consistent pedal feel.

Further pushing the technological frontier is the ongoing development and gradual implementation of Brake-by-Wire (BBW) systems, where there is no mechanical or hydraulic link between the brake pedal and the wheel end actuators, substituting physical connection with electronic signals. This technology offers unparalleled control precision, instantaneous response, and simplifies vehicle assembly. While full BBW remains complex and faces high certification hurdles, its potential benefits in autonomous vehicles—where precise, redundant, and remote-controllable braking is non-negotiable—are driving significant research investment from major Tier 1 suppliers. Material science also plays a key role, with high-performance vehicles and EVs increasingly utilizing ceramic matrix composites and advanced aluminum alloys for rotors and calipers to manage heat dissipation, reduce unsprung mass, and minimize brake dust emissions.

In the friction material sector, there is a strong shift toward Low-Copper (or copper-free) and Non-Asbestos Organic (NAO) formulations to comply with environmental regulations in regions like North America and Europe, which restrict copper content in brake pads due to environmental concerns regarding waterways. Manufacturers are focused on developing new material combinations that meet stringent performance criteria (stopping distance, fade resistance) while maintaining acceptable Noise, Vibration, and Harshness (NVH) levels. Lastly, sensor technology embedded within the system is becoming more sophisticated, incorporating temperature, pressure, and wear sensors that feed real-time data to the vehicle’s central electronic control unit, facilitating both predictive maintenance and dynamic performance adjustments.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC, particularly China, India, and ASEAN nations, dominates the market due to high-volume vehicle manufacturing and accelerating motorization rates. Regulatory pushes, such as mandatory ABS for two-wheelers in India and stringent safety mandates in China, drive strong OEM demand. The region is characterized by a high volume of replacement components due to challenging road conditions and high utilization rates, making it the largest and fastest-growing aftermarket segment globally.

- North America (NA) Advanced Adoption: North America is a critical market for high-value technologies, including performance braking systems and early adoption of integrated electronic braking technologies (IBS). Demand is heavily influenced by safety standards like FMVSS (Federal Motor Vehicle Safety Standards). The replacement market is robust, with consumers frequently opting for premium or semi-premium brand components. The rapid proliferation of electric trucks and SUVs further necessitates specialized, heavy-duty braking components optimized for regenerative technology.

- Europe Mature Market and Regulatory Driver: Europe is characterized by stringent emission standards and advanced safety legislation (e.g., mandatory ESC since 2014). This region leads in the adoption of lightweight materials, copper-free friction materials, and sophisticated electronic control units. Western Europe is a key innovation hub for brake-by-wire R&D and is a crucial market for suppliers specializing in premium, low-NVH components tailored for high-end automotive brands.

- Latin America (LATAM) Infrastructure Growth: LATAM is experiencing steady growth, driven by increasing regulatory requirements for basic safety features like ABS and EBD in high-volume markets such as Brazil and Mexico. The market is highly price-sensitive, balancing the need for quality safety components with cost-effectiveness, leading to a strong demand for reliable, standard components, particularly in the aftermarket sector.

- Middle East & Africa (MEA) Emerging Opportunity: Growth in the MEA region is segmented; the GCC countries demand high-performance components suitable for extreme temperature conditions, while Africa represents an emerging market focused on commercial vehicles and basic passenger car safety upgrades. Infrastructure projects and fleet modernization programs are key demand drivers across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Braking Component Market.- Robert Bosch GmbH

- ZF Friedrichshafen AG (including TRW and WABCO)

- Continental AG

- Brembo S.p.A.

- Akebono Brake Industry Co., Ltd.

- Aisin Seiki Co., Ltd.

- Tenneco Inc.

- Knorr-Bremse AG

- Federal-Mogul (now part of Tenneco)

- Hitachi Astemo, Ltd.

- Mando Corporation

- Haldex AB

- BWI Group

- EBC Brakes

- Carlisle Brake & Friction

- ADVICS Co., Ltd.

- Bendix (part of FMP)

- StopTech

- Baer Brakes

- Wilwood Engineering

Frequently Asked Questions

Analyze common user questions about the Automotive Braking Component market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Automotive Braking Component Market?

Market growth is primarily driven by stringent global mandates for active safety systems such as ABS and ESC, the increasing global vehicle population requiring consistent component replacement in the aftermarket, and the structural shift towards electric vehicles (EVs) necessitating specialized regenerative braking components and Integrated Braking Systems (IBS) for optimized energy recovery and blending.

How is the transition to electric vehicles (EVs) impacting the demand for traditional braking components?

EV adoption leads to lower wear rates for friction braking components (pads and rotors) due to the heavy reliance on regenerative braking for deceleration. However, it increases demand for specialized lightweight components, robust corrosion protection, and advanced electronic control units necessary for precise brake blending, ensuring the physical brakes are highly reliable when needed.

What is Brake-by-Wire (BBW) technology, and what is its market significance?

Brake-by-Wire (BBW) is an advanced technology where braking is controlled entirely by electronic signals, eliminating the traditional mechanical and hydraulic link between the pedal and the wheels. Its significance lies in enabling faster response times, highly accurate control, and critical redundancy required for advanced autonomous driving systems (Level 4 and 5), positioning it as a key disruptive technology for future market development.

Which segmentation—OEM or Aftermarket—holds the larger share of the Automotive Braking Component Market?

While the OEM segment dictates technological adoption and volume based on new vehicle production, the Aftermarket segment typically holds a significant and stable share in terms of value and volume due to the necessary replacement cycle of wear components (pads, rotors, drums) throughout the average lifespan of a vehicle. The aftermarket often sees consistent growth regardless of short-term fluctuations in new vehicle sales.

What major material trends are emerging in the production of brake friction components?

The key material trend is the mandated phase-out of copper in brake pads (driven by environmental regulations in North America and Europe), leading manufacturers to develop advanced Low-Copper or copper-free friction materials. Additionally, there is an increased use of ceramic matrix composites and high-carbon cast iron for rotors to enhance performance, thermal management, and durability while reducing noise and dust emissions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager