Automotive Cabin Air Filter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435071 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Cabin Air Filter Market Size

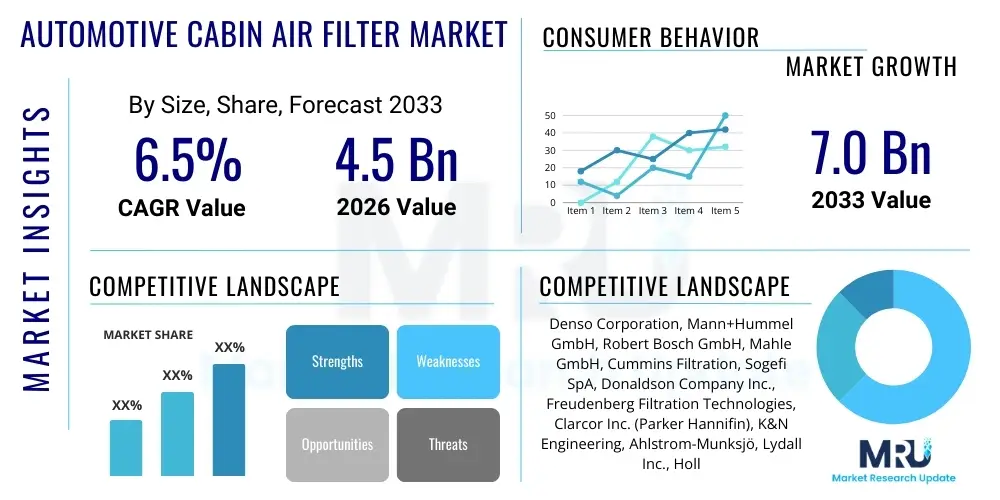

The Automotive Cabin Air Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033.

Automotive Cabin Air Filter Market introduction

The Automotive Cabin Air Filter Market encompasses the entire lifecycle and supply chain associated with high-efficiency particulate air filtration components integrated within vehicle Heating, Ventilation, and Air Conditioning (HVAC) systems globally. These critical components are designed to serve as the primary barrier against the ingress of external airborne contaminants, including fine dust particles, allergenic pollens, industrial soot, and biological aerosols, thereby safeguarding passenger respiratory health and significantly elevating the overall cabin environment quality. The modern cabin air filter has evolved beyond rudimentary dust screens into sophisticated, multi-layered filtration systems, frequently incorporating melt-blown synthetic media and complex pleat geometries engineered for maximized surface area and minimized airflow restriction, meeting increasingly strict air quality demands from both regulatory bodies and discerning consumers. The technological sophistication ensures compliance with regional standards aiming to mitigate passenger exposure to harmful pollutants.

Major applications of these filtration systems span the entire automotive spectrum, ranging from standard passenger vehicles—including sedans, compact cars, SUVs, and luxury electric vehicles—to specialized commercial fleets such as long-haul trucks, city buses, and heavy-duty agricultural or construction machinery operating in highly polluted or dusty environments. The diversification of the filter product line reflects these varied application requirements, with products tailored to high humidity resistance, extreme dust loading capacity, or specialized gas absorption needs. The principal benefits driving sustained market demand include the documented reduction in airborne allergens, which is critical for allergy sufferers; the neutralization of stale or hazardous odors (e.g., from exhaust fumes); and the protection of the HVAC system components themselves from particulate buildup, ensuring longevity and efficient operation of the costly climate control systems, further justifying the necessity for regular replacement across all vehicle types and geographic locations.

The market trajectory is overwhelmingly driven by fundamental societal shifts and technological mandates. Increasing public health consciousness globally, fueled by rising incidences of respiratory ailments and heightened awareness regarding the dangers of ultrafine particulate matter (PM2.5 and PM1.0), exerts powerful pull demand for premium, high-efficiency filters. Simultaneously, governmental authorities in key economies, particularly in the European Union and Asia, are implementing tighter air quality standards, indirectly compelling automakers to install superior factory-fitted filters. Furthermore, the rapid expansion of the global vehicle parc, especially the growing penetration of electric vehicles (EVs) which market pristine air quality as a core value proposition, guarantees a continually expanding base for both OEM initial installation and the consistently lucrative replacement aftermarket, positioning cabin air filters as indispensable safety components rather than mere comfort accessories.

Automotive Cabin Air Filter Market Executive Summary

The global Automotive Cabin Air Filter Market is experiencing robust and continuous expansion, underpinned by an intricate interplay of consumer health concerns, rapid technological material advances, and proactive regulatory enforcement focused on air quality standards. Key business trends point toward aggressive investment in advanced filtration media, particularly composite structures utilizing electrostatically charged nanofiber layers and enhanced activated carbon granules sourced from highly porous materials such as coconut shells, aimed at capturing ultra-fine particulates and volatile organic compounds (VOCs). Market competition is intense, centered on optimizing the balance between high filtration efficiency (up to 99.9% for particulates) and minimizing the pressure drop, which directly affects the HVAC system's energy consumption and airflow rates. Strategic mergers and acquisitions are common as major players seek to consolidate supply chains and gain technological dominance in specialized filtration sectors, particularly concerning biosafety features like antiviral coatings, addressing post-pandemic consumer priorities.

Regionally, the market dynamic is heavily skewed towards the Asia Pacific (APAC) region, which commands the highest growth rate and market volume. This dominance is attributable not only to the overwhelming concentration of automotive manufacturing (OEM demand) but critically, to the high levels of ambient urban air pollution in populous nations like China and India, mandating swift and frequent replacement cycles in the aftermarket. North America and Europe, while representing mature markets, exhibit strong demand for premium filters and are the primary early adopters of sensor-integrated smart filter technologies and HEPA-grade solutions. The regulatory environments in these developed regions often dictate the minimum performance standards, forcing suppliers to innovate continuously to maintain competitive edge and regulatory compliance, ensuring a steady, high-value replacement stream.

Segment trends reveal a significant structural shift away from basic particulate filters toward combination filters (particulate and carbon) as the de facto standard globally, driven by their superior multi-functionality in addressing both solid particles and gaseous pollutants simultaneously. The vehicle type segmentation confirms that passenger cars remain the largest consumer, yet the Light Commercial Vehicle (LCV) segment is demonstrating above-average growth, linked to the surge in e-commerce and last-mile delivery services, requiring healthy air environments for commercial drivers. The aftermarket sales channel consistently outweighs the OEM channel, providing the economic stability and resilience characteristic of this market, largely immune to cyclical volatility in new vehicle sales due to the compulsory replacement nature of the product, providing lucrative, recurring revenue opportunities for distributors and manufacturers.

AI Impact Analysis on Automotive Cabin Air Filter Market

Analysis of common user questions concerning AI’s role in the cabin air filter market indicates a strong focus on automation, efficiency, and customized air quality management. Users are primarily seeking to understand how AI can eliminate the guesswork associated with filter replacement, maximize the functional lifespan of high-cost filters, and provide a truly proactive, personalized cabin environment. The core themes coalesce around predictive maintenance, leveraging telematics and environmental data, and optimizing filter media design through complex simulations. Users expect AI integration to transform filters from passive consumables into active components of a vehicle’s smart health ecosystem, ensuring filtration is always appropriate for the specific driving conditions encountered, such as high-pollen seasons or polluted tunnels.

The integration of Artificial Intelligence (AI) and sophisticated Machine Learning (ML) models is introducing unprecedented levels of efficiency and personalization across the entire cabin air filter value chain, starting from vehicle operation. In vehicle applications, AI algorithms process continuous streams of data—including pressure differential sensors across the filter, external air quality index (AQI) reports sourced via GPS, internal air quality monitors (for CO2 and VOCs), and driver routing history. By correlating these variables, the AI accurately predicts the precise moment the filter reaches its performance degradation threshold, triggering a notification for replacement. This AI-driven condition-based maintenance (CBM) model maximizes the utility of the filter, eliminates unnecessary service visits, and ensures that the vehicle owner enjoys continuous, verifiable air quality protection, greatly enhancing the value proposition of premium filtration systems, especially those installed in connectivity-enabled vehicles.

Furthermore, AI is fundamentally changing the manufacturing and materials science underpinning filter design. Generative design tools utilize ML to simulate millions of filter configurations—varying pleat geometry, material thickness, layering order, and fiber density—to instantaneously identify optimal structures that yield maximum particle capture efficiency while minimizing the associated pressure drop, a critical tradeoff in filter performance. This accelerated R&D cycle allows manufacturers to rapidly develop specialized filters (e.g., highly efficient antiviral filters or extreme dust filters) tailored for specific geographic markets or regulatory mandates. Supply chain management is also revolutionized, with AI-powered forecasting predicting aftermarket demand with granular accuracy, optimizing global inventory levels by proactively responding to regional pollution forecasts or unexpected weather events, thereby preventing stockouts of critical filter types and improving overall market responsiveness.

- Predictive Maintenance Scheduling: AI uses real-time sensor data (pressure drop, flow rate) and telematics to forecast optimal filter replacement intervals, moving beyond fixed mileage schedules.

- Smart HVAC Integration: ML algorithms autonomously adjust filtration modes based on ambient air quality data, internal sensor readings, and geographical pollution zones for dynamic cabin purification.

- Optimized Manufacturing Processes: AI analyzes production line data and quality control metrics to reduce material waste, optimize pleating precision, and enhance filter uniformity and performance consistency.

- Demand Forecasting Accuracy: Advanced analytics improve inventory management and logistics efficiency by predicting regional and seasonal spikes in replacement filter requirements based on environmental factors and vehicle density.

- Accelerated Material Innovation: AI simulations expedite the Research and Development (R&D) of novel high-efficiency filtration media, including advanced electrostatic nanofiber composites and specialized chemical adsorption layers.

DRO & Impact Forces Of Automotive Cabin Air Filter Market

The market trajectory for automotive cabin air filters is strongly defined by a confluence of accelerating drivers and persistent restraints, counterbalanced by emerging opportunities that necessitate strategic resource allocation. The primary drivers are indisputably rooted in public health imperatives and regulatory mandates; specifically, the documented connection between rising urban pollution levels (particulate matter and toxic gases) and respiratory health issues compels consumers and regulators to demand superior interior air filtration. This is coupled with the continuous expansion of the global vehicle parc, which naturally increases the addressable market for replacements. The market is restrained, however, by the global prevalence of low-cost, substandard counterfeit filters that erode brand value and compromise vehicle performance, alongside a residual lack of consumer education in emerging economies regarding the criticality and frequency of mandatory filter replacement, leading to delayed or forgone maintenance.

Significant opportunities are materializing through technological paradigm shifts. The rapid, global transition towards Battery Electric Vehicles (BEVs) and hybrid vehicles provides a unique opportunity, as automakers often leverage advanced filtration systems (e.g., bio-hazard filters or HEPA equivalents) as a premium feature to enhance the EV ownership experience and minimize energy strain on the HVAC system. Furthermore, the development and mass adoption of novel materials, such as media incorporating antiviral, antimicrobial, and antiallergenic treatments, present clear avenues for product differentiation and premium pricing, capitalizing on post-pandemic consumer sensibilities regarding in-cabin hygiene. The transition toward sensor-integrated, smart filters that can communicate saturation levels to the driver or service center also promises to convert passive consumers into proactive replacement purchasers, maximizing service revenue.

The overall impact forces are strongly positive, favoring market acceleration toward high-performance solutions. The cumulative impact of stricter regulatory frameworks (such as those governing emissions and interior air quality), combined with increasing consumer health awareness, exerts strong, directional pressure on manufacturers to invest heavily in combination and composite filter technologies. This impact force ensures that standard particulate filters will increasingly be relegated to the budget segment, while the majority of OEM and aftermarket sales will focus on value-added products that offer multi-functional filtration, odor adsorption, and guaranteed protection against sub-micron particles. These forces collectively minimize the negative impact of restraints like counterfeiting, as consumers are increasingly willing to pay a premium for certified, branded protection, thus guaranteeing the market's robust long-term growth.

Segmentation Analysis

The Automotive Cabin Air Filter market structure is defined by robust segmentation across material type, product architecture, vehicle application, and critical sales channel pathways, reflecting the high degree of specialization required to meet global vehicle standards and diverse consumer needs. Segmentation by material type is particularly indicative of technological advancement, differentiating between basic synthetic media, which excels at particulate capture, and advanced carbon-impregnated or composite media, engineered to provide comprehensive protection against both solid particles and volatile gaseous contaminants. The choice of material directly impacts the filter's performance parameters, including efficiency rating (e.g., ISO ePM1, HEPA), dust holding capacity, and associated pressure drop across the media. This complex material landscape drives competitive positioning, focusing on providing maximum barrier function without compromising HVAC system airflow.

In terms of product architecture, the market splits primarily between single-layer particulate filters and multi-layer combination filters, which typically sandwich an activated carbon layer between two or more particulate layers. Combination filters currently represent the fastest-growing segment, demonstrating the market's migration towards multi-functional products that justify a higher price point through superior all-weather, all-contaminant protection. Furthermore, segmentation by vehicle type—Passenger Cars, LCVs, and HCVs—is essential because each category imposes unique demands: passenger vehicles prioritize silent operation and high-efficiency odor control, LCVs demand high dust-holding capacity for urban logistics, and HCVs require robust designs capable of withstanding extreme environmental stresses over extended operational hours, affecting filter housing design and media rigidity.

The segmentation by sales channel—Original Equipment Manufacturer (OEM) versus Aftermarket—is perhaps the most commercially critical distinction. The OEM segment is characterized by large volume, low-margin contracts tied to vehicle production cycles and long-term supplier agreements demanding stringent quality control (QC). Conversely, the Aftermarket dominates the revenue landscape, driven by the mandatory, periodic replacement cycle (typically annually). This channel, served by independent distributors, retail auto parts chains, and flourishing e-commerce platforms, requires wide SKU coverage to service the global vehicle parc and relies heavily on strong brand presence, efficient logistics, and consumer education campaigns to capture replacement demand and drive consistent, stable cash flow independent of new vehicle sales volatility.

- By Material Type:

- Particulate Filters (Standard Cellulose and High-Efficiency Synthetic Media)

- Activated Carbon Filters (Enhanced odor and gas adsorption capabilities)

- HEPA Equivalent & Composite Filters (Targeting sub-micron particles and biological agents)

- By Product Type:

- Single-Layer Filters (Focus on basic dust and pollen)

- Multi-Layer Filters (Combination filters offering comprehensive gas and particle mitigation)

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, EVs - Highest volume)

- Light Commercial Vehicles (LCVs - Increasing demand due to e-commerce logistics)

- Heavy Commercial Vehicles (HCVs - Require heavy-duty, robust media)

- By Sales Channel:

- Original Equipment Manufacturer (OEM) (Initial installation during vehicle assembly)

- Aftermarket (Replacement market: Independent Workshops, Retail Chains, Online Sales)

Value Chain Analysis For Automotive Cabin Air Filter Market

The value chain of the Automotive Cabin Air Filter market is complex, spanning raw material synthesis, precision manufacturing, intricate logistical distribution, and culminating in final consumer installation. The upstream phase is crucial, dominated by specialized chemical and non-woven fabric suppliers providing highly engineered synthetic fibers (e.g., melt-blown polypropylene) and specialized activated carbon media. Manufacturers at this stage focus on optimizing fiber diameter and charge density to ensure superior filtration efficiency while maintaining low airflow resistance, requiring significant capital investment in textile technology. Stable sourcing relationships for these proprietary materials are essential for midstream manufacturers to maintain cost control and performance consistency, particularly for high-efficiency products utilizing patented media compositions.

The midstream manufacturing phase involves converting raw filtration media rolls into finished, pleated filter elements housed within rigid plastic or composite frames. This stage is characterized by high precision engineering, demanding automated pleating machinery to ensure uniform pleat height and spacing, which directly determines the filter's operational lifespan and efficiency. Quality control protocols are exceptionally stringent, adhering to IATF 16949 standards, to prevent air bypass due to poor seals or frame leakage. Manufacturers must strategically locate facilities near major OEM assembly plants to fulfill just-in-time (JIT) delivery requirements for the new car market, while simultaneously maintaining large, centralized manufacturing hubs capable of supplying the diverse, global aftermarket with a massive variety of specific product SKUs designed to fit hundreds of different vehicle models efficiently.

The downstream distribution network is bifurcated between direct supply to OEMs and indirect supply to the aftermarket. Direct sales to OEMs involve sophisticated, long-term procurement contracts and highly centralized logistics managed by the manufacturer. The aftermarket relies predominantly on indirect channels, utilizing global and regional master distributors who manage inventory and deliver to key retail outlets, independent repair garages, and franchised service dealerships. The proliferation of e-commerce has introduced a significant direct-to-consumer element, requiring manufacturers to invest in packaging, digital marketing, and robust traceability systems to combat the rise of counterfeit products. Success in the aftermarket hinges on the efficiency of the supply chain in delivering the correct filter rapidly and reliably, catering to demand driven by seasonal pollution spikes and mandatory vehicle service intervals, ensuring that the necessary replacement product is readily accessible worldwide.

Automotive Cabin Air Filter Market Potential Customers

The ecosystem of potential customers for automotive cabin air filters comprises two foundational pillars: institutional buyers (Original Equipment Manufacturers or OEMs) and the diverse, high-volume consumer base served by the aftermarket. OEMs, including global entities such as Volkswagen Group, Toyota, General Motors, and Tesla, purchase filters for integration into newly manufactured vehicles. Their procurement decisions are governed by criteria focused on cost optimization, guaranteed long-term supply stability, conformity to design specifications (fit, form, and function), and validation testing against rigorous NVH (Noise, Vibration, and Harshness) standards and performance benchmarks. The increasing trend of vehicle premiumization means OEMs are progressively shifting towards requesting suppliers provide advanced, HEPA-grade or bio-functional filters as standard equipment to differentiate their products in the highly competitive global automotive landscape, especially within luxury and electric vehicle segments.

The aftermarket customer base, which drives the market's recurring revenue and stability, is heterogeneous, encompassing both professional service providers and individual vehicle owners. Professional buyers include national chains of fast-lube centers, independent automotive repair garages, and authorized dealership service centers, who prioritize filters offering high reliability, wide application coverage (to minimize stocked SKUs), and attractive margins for service profitability. These customers require prompt delivery from distributors and often rely on training materials and technical support from filter manufacturers. The availability of high-quality replacement guides and certification of adherence to original equipment standards are key decision-making factors for professional installers, who seek efficiency and customer retention through reliable parts supply.

The end-user segment, the individual vehicle owner, is increasingly influenced by health concerns and digital information. This segment includes DIY (Do-It-Yourself) consumers who purchase filters through online platforms or major retail auto parts stores, and DIT (Do-It-To-Me) consumers who rely entirely on service garages. Factors influencing the DIY buyer include brand reputation, perceived performance benefits (e.g., "allergy protection" or "smell reduction"), and ease of self-installation. Manufacturers must invest heavily in consumer education, utilizing packaging and digital channels to highlight the tangible health benefits of advanced filters, thereby justifying the price differential over basic alternatives. The increasing awareness regarding air pollution ensures that vehicle owners are highly receptive to messaging emphasizing the health-protective capabilities of premium, multi-layered filtration technology, particularly in densely populated urban centers with persistent smog issues.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Denso Corporation, Mann+Hummel GmbH, Robert Bosch GmbH, Mahle GmbH, Cummins Filtration, Sogefi SpA, Donaldson Company Inc., Freudenberg Filtration Technologies, Clarcor Inc. (Parker Hannifin), K&N Engineering, Ahlstrom-Munksjö, Lydall Inc., Hollingsworth & Vose, Hengst Filtration, Champion Laboratories, AC Delco, UFI Filters, Purflux, GUD Holdings, and Affinia Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Cabin Air Filter Market Key Technology Landscape

The contemporary technology landscape of the Automotive Cabin Air Filter market is defined by continuous innovation focused on maximizing filtration efficiency for ever-smaller particulates (PM2.5 and PM1.0) and managing the increasing complexity of airborne chemical pollutants without creating detrimental pressure drops that compromise HVAC efficiency. The core technological advancement involves sophisticated multi-layered composite media. This includes blending synthetic fibers, such as fine denier melt-blown synthetics, with coarser upstream layers to create a depth-loading effect that enhances dust-holding capacity and lifespan. Furthermore, specialized impregnation processes are used to apply proprietary chemical treatments, ensuring the structural integrity and performance of the filter media under challenging conditions of high humidity and wide temperature fluctuations found within engine bay proximity, thereby guaranteeing consistent high-quality air delivery.

A major technological frontier is the transition toward highly functional, value-added filtration media. This is exemplified by the widespread adoption of electrostatically charged media, where fibers are permanently charged to enhance the capture of sub-micron particles through Coulombic attraction, achieving HEPA-level performance without the restrictive thickness of traditional HEPA materials. Simultaneously, advancements in activated carbon technology are crucial; instead of merely mixing carbon powder, modern filters utilize highly porous, pelletized, or fibrous activated carbon, often surface-treated to selectively adsorb specific harmful gases prevalent in urban environments, such as ozone, formaldehyde, and various Volatile Organic Compounds (VOCs). Research and development efforts are currently focused on integrating these carbon layers seamlessly, ensuring uniform air distribution across the media for optimal gas adsorption kinetics and maximizing the functional life of the expensive carbon components.

Looking forward, the convergence of material science with digital technology is driving the concept of the “smart filter.” Key technological advancements involve integrating miniaturized IoT sensors—including differential pressure transducers, humidity gauges, and even chemical sniffers—directly into the filter housing or surrounding HVAC ductwork. These sensors generate real-time data on filter status and air quality, transmitting information via the vehicle’s communication bus. This enables AI-driven predictive maintenance and allows the vehicle's climate control system to dynamically optimize recirculation and fresh air intake modes based on external pollution threats. Moreover, the latest frontier includes antiviral and antibacterial coatings, often incorporating metallic nanoparticles, which actively destroy biological contaminants captured on the filter surface, offering unparalleled hygiene protection and positioning the cabin air filter as a critical component in the vehicle’s biosafety architecture, a feature becoming essential in post-pandemic consumer demands globally.

Regional Highlights

The global Automotive Cabin Air Filter Market exhibits a geographically diversified growth profile, highly sensitive to regional regulatory divergence, vehicle production dynamics, and localized environmental stressors. Asia Pacific (APAC) stands as the undisputed epicenter of market growth, characterized by dual demand drivers: explosive growth in new vehicle manufacturing in nations like China, India, and ASEAN countries generating enormous OEM demand, coupled with severe, persistent air pollution issues (smog, dust, industrial output) that necessitate frequent and often premium filter replacements in the aftermarket. Urban density and high pollution levels in major APAC cities mean that vehicle owners are highly motivated to upgrade to activated carbon and composite filters, driving high average selling prices (ASPs) for advanced filtration solutions in this region, solidifying its volume and value leadership position.

Europe represents a mature market defined by regulatory innovation and a strong inclination toward advanced product quality. European Union regulations, particularly those related to fine particulates and the management of diesel emissions and ground-level ozone, mandate high performance standards for OE filters, effectively making combination filters the market norm. The replacement market in Europe is robust and highly formalized, with strong distribution channels ensuring high penetration of branded, quality products. North America follows a stable growth trajectory, supported by a massive, aging vehicle fleet, ensuring steady aftermarket demand. While particulate filters remain common, there is increasing demand for specialized filters (e.g., HEPA-grade or those certified against allergens) driven by changing climate patterns (e.g., increasing severity of wildfire smoke events across the continent) and rising consumer health spending, leading to consistent uptake of premium filtration solutions.

Emerging markets in Latin America and the Middle East & Africa (MEA) are experiencing accelerated growth rates, albeit from a lower base. Market expansion here is structurally linked to increasing vehicle ownership rates, urbanization, and the formalization of automotive service sectors. However, these regions face unique challenges, including high temperatures and dusty road conditions that necessitate filters engineered for maximum durability and dust-holding capacity. Additionally, the MEA region often contends with gaps in consumer awareness regarding mandatory service schedules and a higher incidence of non-certified or counterfeit product use, which requires targeted educational campaigns and stronger enforcement of quality standards by regulatory bodies. Despite these hurdles, as new vehicle sales rise and emissions standards gradually tighten, these regions are projected to transition rapidly toward higher-efficiency filtration products, offering manufacturers long-term strategic opportunities.

- Asia Pacific (APAC): Dominates the market in both volume and value; propelled by massive OEM manufacturing and severe, localized air pollution (PM2.5), leading to high consumer adoption of premium carbon and composite filters.

- Europe: Highly mature and technologically advanced market; growth driven by stringent EU environmental regulations mandating high-efficiency combination filters and stable, high replacement frequency across all segments.

- North America: Sustained steady growth primarily through a vast, consistently maintained aftermarket; increasing demand for specialized, high-performance filters addressing specific regional environmental stressors like allergens and smoke.

- Latin America & MEA: Emerging markets with high long-term potential; growth tied to rising vehicle parc and urbanization, requiring filtration solutions optimized for high dust load and challenging climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Cabin Air Filter Market.- Denso Corporation

- Mann+Hummel GmbH

- Robert Bosch GmbH

- Mahle GmbH

- Cummins Filtration

- Sogefi SpA

- Donaldson Company Inc.

- Freudenberg Filtration Technologies

- Clarcor Inc. (Parker Hannifin)

- K&N Engineering

- Ahlstrom-Munksjö

- Lydall Inc.

- Hollingsworth & Vose

- Hengst Filtration

- Champion Laboratories

- AC Delco

- UFI Filters

- Purflux

- GUD Holdings

- Affinia Group

Frequently Asked Questions

Analyze common user questions about the Automotive Cabin Air Filter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key benefits of using an Activated Carbon Cabin Air Filter compared to a standard particulate filter?

Activated Carbon filters provide superior performance by not only capturing particulate matter (dust, pollen) but also adsorbing harmful gaseous pollutants (such as ozone, nitrogen dioxide, and sulfur dioxide) and neutralizing unpleasant odors, significantly improving the overall air quality and driving comfort inside the vehicle cabin. They are essential for urban driving environments where toxic gas concentrations are high.

How often should an automotive cabin air filter be replaced to maintain optimal air quality?

The general recommendation for replacing an automotive cabin air filter ranges from every 15,000 to 30,000 miles or once every 12 months. However, vehicles frequently operated in heavily polluted or dusty environments, such as construction zones or dense urban centers, require more frequent replacement, often every six months, to prevent reduced airflow, minimize strain on the HVAC system, and mitigate the potential proliferation of harmful microbes on the filter media.

What is the primary role of cabin air filters in the context of Electric Vehicles (EVs)?

In Electric Vehicles, the cabin air filter plays a crucial role in maintaining interior air quality, which is often a key selling point for EVs, compensating for the lack of traditional engine noise. High-efficiency filtration systems (often HEPA equivalent) are employed to ensure the cabin remains a clean zone, managing the thermal load of the battery and protecting sensitive electronic components while offering premium, verifiable air quality and comfort to passengers.

Are aftermarket cabin air filters comparable in quality to filters provided by Original Equipment Manufacturers (OEMs)?

Reputable aftermarket suppliers manufacture filters that often meet or exceed strict OEM specifications, offering high filtration efficiency and proper fitment. Consumers must ensure they purchase from recognized, high-quality brands that adhere to international filtration standards (like ISO or IATF) to guarantee performance consistency and structural integrity, thereby avoiding low-cost, uncertified counterfeit products that severely compromise vehicle air quality and safety.

How will smart sensor technology impact the future maintenance of cabin air filters?

The integration of smart sensors and IoT technology will enable advanced predictive maintenance protocols. These systems monitor real-time filter saturation (clogging) and pressure drop, allowing the vehicle’s onboard diagnostics to accurately signal precisely when a replacement is needed based on actual operating conditions and performance degradation, optimizing filter life and ensuring continuous superior, verifiable cabin air quality without unnecessary premature replacements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager