Automotive Camera Lens Heaters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432120 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Camera Lens Heaters Market Size

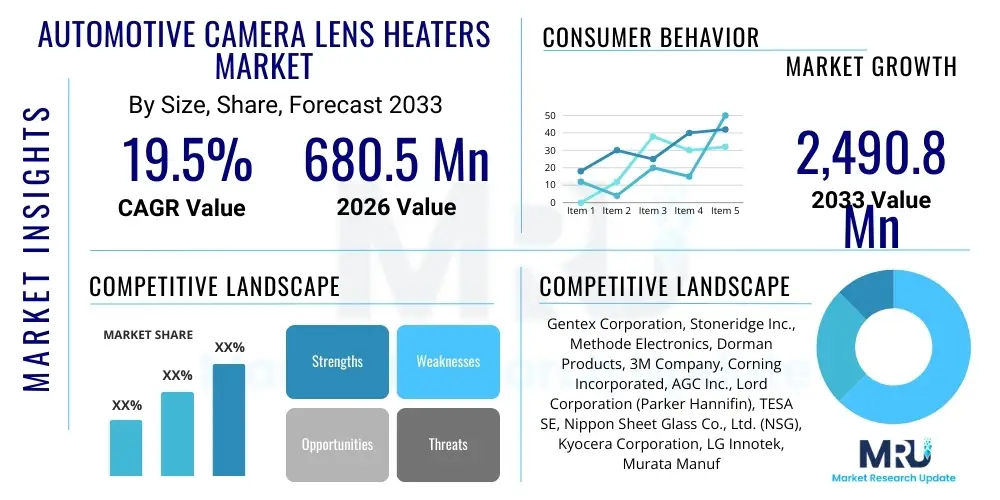

The Automotive Camera Lens Heaters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 680.5 Million in 2026 and is projected to reach USD 2,490.8 Million by the end of the forecast period in 2033.

Automotive Camera Lens Heaters Market introduction

The Automotive Camera Lens Heaters Market encompasses specialized heating elements integrated into camera modules used in modern vehicles. These heaters are crucial components designed to prevent moisture condensation, frost accumulation, and icing on the camera lens surface, ensuring clear image capture under adverse weather conditions. The primary function of these systems is to maintain optimal operational clarity for safety-critical applications, including Advanced Driver Assistance Systems (ADAS), parking assistance, and autonomous driving functionalities. As regulatory mandates around vehicle safety increase globally and consumer demand for high-end driver assistance features rises, the adoption of reliable lens heating solutions has become non-negotiable for automotive original equipment manufacturers (OEMs).

Product descriptions typically involve components such as transparent conductive films (TCFs), positive temperature coefficient (PTC) heaters, or resistive heating elements strategically placed near or directly on the camera lens cover. These heaters are generally low-power consumption devices, integrated seamlessly into the vehicle's electrical architecture and often managed by the electronic control unit (ECU) based on external temperature and humidity readings. Major applications span across front-facing cameras (for traffic sign recognition and collision mitigation), surround-view cameras (for 360-degree visibility), rear-view cameras, and side-view cameras, ensuring the integrity of the sensor input necessary for complex vehicular processing algorithms.

The primary benefits driving this market include enhanced vehicle safety and reliability, especially in regions prone to extreme cold or high humidity. The proliferation of ADAS features, such as lane keeping assist, adaptive cruise control, and automated emergency braking, directly relies on consistent and high-quality visual data from the cameras. Driving factors include stringent safety ratings like NCAP (New Car Assessment Program), rapid progress towards Level 3 and Level 4 autonomy which demands redundancy and reliability from all sensors, and technological advancements leading to more compact, efficient, and cost-effective heating solutions that minimize power draw while maximizing de-icing speed.

Automotive Camera Lens Heaters Market Executive Summary

The Automotive Camera Lens Heaters Market is experiencing robust expansion fueled by legislative actions promoting vehicle safety and the irreversible industry transition towards software-defined and autonomous vehicles. Current business trends indicate a strong push for integration, with OEMs preferring modular solutions where the heating element is factory-installed and perfectly calibrated with the camera module and housing. Furthermore, there is a distinct trend towards intelligent heating systems that employ pulse width modulation (PWM) or dynamic power management to optimize energy consumption, shifting away from always-on resistive heating. Supply chain stability, particularly for specialized films and micro-electronics, remains a key focus area as production volumes surge to meet global automotive output.

Regionally, Asia Pacific (APAC), led by China, Japan, and South Korea, is the most dynamic market due to high vehicle production volumes and aggressive adoption of domestic ADAS standards. North America and Europe, while having lower overall vehicle production growth rates, demonstrate superior penetration rates of high-level ADAS features, driving demand for premium, highly reliable lens heating solutions. Regulatory environments in Europe, specifically concerning pedestrian safety and mandatory features like rear-view cameras, ensure sustained growth, while North America’s focus on Level 2+ autonomy mandates dependable sensor performance in varied climatic conditions, from extreme cold to humid coastal areas.

In terms of segment trends, the heating technology segment is seeing increasing dominance from transparent conductive film (TCF) heaters over traditional wire-based or ceramic heaters, primarily due to better optical transparency and flexibility, which is critical for maintaining image quality. By application, the surround-view system (SVS) segment is exhibiting the highest growth rate, as these systems rely on four to five cameras simultaneously, requiring uniform, reliable thermal management across the vehicle perimeter. The Electric Vehicle (EV) segment presents a unique challenge and opportunity, demanding ultra-low power consumption for all ancillary systems, pushing manufacturers to develop even more energy-efficient thermal management solutions for camera lenses.

AI Impact Analysis on Automotive Camera Lens Heaters Market

User queries regarding the impact of Artificial Intelligence often revolve around whether AI algorithms can predict and preempt fogging or icing events more effectively than traditional temperature sensors, how AI-driven diagnostics will improve heater reliability, and if machine learning can optimize power usage. Users are concerned about the seamless integration of lens heating controls within complex AI-managed thermal management systems, seeking confirmation that AI will enhance, not complicate, the fundamental reliability of visual data. The key themes emerging are optimization, predictive maintenance, and seamless integration of thermal controls within the broader AI-driven perception stack.

AI's primary influence is moving the lens heating system from a reactive component to a proactive, integrated element of the vehicle's environmental perception system. By analyzing complex data streams—including predictive weather patterns, ambient temperature, humidity, GPS location, vehicle speed, and internal camera temperature fluctuations—AI algorithms can determine the minimal necessary heating power required, starting the heating cycle preemptively or adjusting power levels dynamically. This transition ensures maximum image clarity while significantly reducing the energy burden, a critical factor for extending the range of battery-electric vehicles (BEVs). Furthermore, machine learning models can identify subtle shifts in heater performance or diagnose potential failures before they manifest, enabling proactive maintenance alerts to the driver or the OEM.

- AI optimizes power consumption by calculating minimum thermal requirements based on predictive models.

- Machine Learning enhances sensor reliability by enabling predictive failure detection of heating elements.

- AI-driven fusion systems prioritize visual data integrity, making lens clarity a critical input variable.

- Integration of heater controls into AI-managed thermal loops ensures seamless operation across varied climates.

- AI processes meteorological data (humidity, temperature change rate) to preemptively activate heating before condensation occurs.

- Improved diagnostic capabilities reduce downtime and maintenance costs associated with camera system failure.

- Reinforcement learning can dynamically adjust heating profiles based on specific regional driving conditions and user habits.

- AI supports the development of micro-zone heating, targeting specific areas of the lens cover for efficiency.

- Enhanced data filtering algorithms compensate for minor residual fogging, improving overall perception accuracy.

- AI validation tools ensure the heater system meets rigorous functional safety standards (ISO 26262).

DRO & Impact Forces Of Automotive Camera Lens Heaters Market

The Automotive Camera Lens Heaters Market is principally driven by stringent global safety regulations mandating sophisticated ADAS features, countered by restraints related to high component complexity and cost pressures in mass-market vehicles. Opportunities lie in the rapidly expanding autonomous vehicle sector and the necessity for ultra-reliable sensor systems across all operating conditions. These dynamics create powerful impact forces centered around regulatory compliance, technological innovation in material science, and the pervasive need for energy efficiency, especially within the electric vehicle ecosystem.

Key drivers include the global push for higher crash safety ratings (e.g., Euro NCAP, NHTSA), which increasingly require the flawless operation of camera-based systems like automated emergency braking and lane assist. The foundational requirement for autonomous driving (Level 3+) is sensor redundancy and reliability; since visual input is paramount, maintaining lens clarity is non-negotiable, thereby solidifying the demand for lens heaters. Furthermore, the exponential growth in the production of high-definition, multi-megapixel automotive cameras necessitates precise temperature management to prevent not just external environmental effects but also internal component heating which can degrade image quality and sensor life.

Restraints primarily involve the added manufacturing cost and complexity associated with integrating the heater, power management circuitry, and thermal sensors into compact camera modules. For mass-market vehicles, price sensitivity remains a major challenge, pushing manufacturers to find cost-effective material solutions. Another significant restraint is the power consumption overhead, particularly critical for battery electric vehicles (BEVs), where every watt impacts range. Opportunities abound in developing smart, highly integrated lens heating modules that utilize advanced materials like nano-coatings or graphene-based elements for rapid heating and minimal power draw. The replacement market, as existing ADAS cameras age and fail due to prolonged exposure to harsh conditions, also presents a long-term revenue opportunity for specialized aftermarket components and services.

Segmentation Analysis

The Automotive Camera Lens Heaters Market is systematically segmented based on heating technology, application type, vehicle type, and sales channel, allowing for granular analysis of market dynamics and growth trajectories across various end-use segments. Understanding these segmentations is critical for market participants to tailor their product development and market entry strategies effectively. The complexity of automotive camera systems, requiring robust performance in diverse operational environments, drives the differentiation across these segments, particularly regarding the choice between thin-film technology and traditional resistive elements.

The application segmentation, covering front-view, rear-view, surround-view, and driver monitoring systems, highlights where the highest concentration of demand lies, with surround-view systems (SVS) currently driving high volumes due to their reliance on multiple interconnected cameras. Furthermore, the segmentation by vehicle type—Passenger Vehicles (PV) dominating volume and Commercial Vehicles (CV) providing specialized, high-durability demand—illustrates the varied performance requirements across the automotive fleet. Technological advancements in materials science, particularly the miniaturization and efficiency gains in transparent conductive films, are continuously reshaping the competitive landscape within the technology segments, favoring high-performance, optically invisible heating solutions.

- By Heating Technology:

- Transparent Conductive Films (TCF) Heaters

- Resistive Wire Heaters

- Positive Temperature Coefficient (PTC) Heaters

- ITO (Indium Tin Oxide) Heaters

- By Application:

- Front View Cameras (FVC)

- Rear View Cameras (RVC)

- Surround View Systems (SVS)

- Side View Cameras

- Driver Monitoring Systems (DMS)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Automotive Camera Lens Heaters Market

The value chain for Automotive Camera Lens Heaters begins with upstream analysis involving the sourcing and processing of specialized raw materials, primarily focusing on materials required for transparent conductive films (e.g., ITO, silver nanowires, carbon nanotubes) and high-performance polymers or ceramics used in resistive heating elements. Key upstream activities include the development of precise deposition techniques for conductive layers and the manufacturing of flexible substrate materials that can withstand harsh automotive operating conditions. Relationships with material suppliers specializing in thin-film technology are crucial, as material purity and uniformity directly dictate the heater’s optical clarity and electrical efficiency. Price fluctuations of raw materials, particularly precious metals or specialized rare earths used in sensors and circuitry, can significantly influence the overall manufacturing cost.

The midstream process involves the manufacturing and assembly of the lens heater module itself. This includes patterning the conductive material, integrating the heating element with the lens cover or housing, and attaching the necessary electrical connections and thermal sensors. Companies in this stage focus on stringent quality control, especially concerning thermal uniformity and optical distortion measurements. Major manufacturers often integrate vertical capabilities, combining heater production with the molding of the plastic or glass lens housing. This stage demands precision engineering and adherence to automotive quality standards (e.g., IATF 16949). The resultant product is typically a semi-finished component ready for integration into the camera module.

Downstream analysis focuses on the distribution channels and the final integration into the vehicle. The primary distribution channel is Direct to OEM, where heater manufacturers supply Tier 1 suppliers (e.g., Continental, Bosch, Aptiv) who integrate the heater into their complete camera systems, which are then delivered to automotive OEMs for vehicle assembly. The indirect channel involves the Aftermarket, supplying replacement parts either through authorized service centers or independent component distributors. Due to the safety-critical nature of ADAS systems, the OEM channel commands the majority market share. Efficient logistics and robust inventory management are vital to meet the just-in-time (JIT) delivery requirements typical in the automotive supply chain.

Automotive Camera Lens Heaters Market Potential Customers

Potential customers and primary buyers of Automotive Camera Lens Heaters are predominantly large Tier 1 automotive electronics suppliers who specialize in camera systems and advanced driver assistance modules. These Tier 1 companies (like Magna, Bosch, Continental, and ZF) integrate the heater components into their proprietary camera platforms, functioning as the crucial link between specialized component manufacturers and the global automotive Original Equipment Manufacturers (OEMs). Their purchasing decisions are driven by factors such as component reliability, compliance with functional safety standards (ASIL ratings), component size, weight, and, critically, low power draw, given the tight thermal and power budgets of modern vehicles.

The secondary group of potential customers comprises the Automotive OEMs themselves (e.g., Volkswagen Group, Toyota, General Motors, Tesla). While most lens heaters are procured indirectly through Tier 1 providers, some OEMs, especially those heavily investing in autonomous capabilities or insourcing specific electronic components, may engage directly with heater component manufacturers for custom-designed solutions or proprietary integrated sensor clusters. These direct OEM relationships prioritize long-term supply agreements, technological partnership, and adherence to specific vehicle architectural requirements, particularly concerning cybersecurity and data integrity of the connected components.

Finally, the aftermarket segment represents the end-users who require replacement or retrofit camera modules. This segment includes independent garages, specialized repair shops, and insurance-related repair networks. Although smaller in volume compared to the OEM segment, the aftermarket demands high component availability and interoperability. Furthermore, manufacturers focusing on commercial vehicles (trucks, buses) and heavy equipment (construction, agriculture) represent niche but high-value buyers, often requiring ruggedized, high-durability lens heater systems capable of operating reliably under extreme and continuous operational stresses not typically faced by passenger cars.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 680.5 Million |

| Market Forecast in 2033 | USD 2,490.8 Million |

| Growth Rate | CAGR 19.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gentex Corporation, Stoneridge Inc., Methode Electronics, Dorman Products, 3M Company, Corning Incorporated, AGC Inc., Lord Corporation (Parker Hannifin), TESA SE, Nippon Sheet Glass Co., Ltd. (NSG), Kyocera Corporation, LG Innotek, Murata Manufacturing Co., Ltd., Bosch (Camera Division), Continental AG (ADAS Division), Gentherm Inc., TDK Corporation, HELLA GmbH & Co. KGaA, Valeo S.A., Aptiv PLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Camera Lens Heaters Market Key Technology Landscape

The technology landscape of the Automotive Camera Lens Heaters Market is rapidly evolving, driven by the need for enhanced optical clarity, reduced power consumption, and better integration flexibility within compact camera modules. The fundamental shift is moving away from traditional, bulky wire-wound resistive heaters towards advanced thin-film heating technologies. Transparent Conductive Film (TCF) heaters, often utilizing Indium Tin Oxide (ITO) or newer materials like Silver Nanowires (AgNWs) and Carbon Nanotubes (CNTs), dominate the innovation space. These films are applied directly onto the inner surface of the camera lens cover, offering superior light transmission and near-invisible integration, which is paramount for high-resolution cameras used in sophisticated ADAS applications where image quality degradation is unacceptable.

A key focus area for technological advancement is the development of next-generation heating materials, with graphene and advanced polymer composites showing significant promise. Graphene-based heaters, in particular, offer exceptional thermal conductivity and mechanical strength, potentially enabling extremely rapid de-icing capabilities with minimal applied voltage. Furthermore, innovation extends beyond the heating element itself to the integration of sophisticated power electronics and control systems. Positive Temperature Coefficient (PTC) heaters remain relevant, offering self-regulating thermal properties that prevent overheating, although their application is often limited to less optically sensitive areas or secondary heating loops.

Another crucial technological development involves integrated thermal management solutions. Modern lens heater systems are incorporating micro-sensors (thermocouples or thermistors) directly embedded within the camera housing to provide real-time thermal feedback. This data feeds into the vehicle’s ECU, enabling precise pulse width modulation (PWM) control of the heater power. This intelligent power management significantly reduces overall energy usage compared to legacy systems, making these components viable for energy-sensitive electric vehicles. The trend is towards "smart heating," where the system diagnoses the specific type of obscuration (fog, frost, or internal temperature rise) and applies the optimal power profile dynamically, thereby maximizing efficiency and minimizing latency.

Regional Highlights

The Automotive Camera Lens Heaters Market exhibits pronounced regional variations in terms of growth drivers, regulatory environment, and technological adoption rates. Asia Pacific (APAC) currently holds the largest market share and is projected to demonstrate the fastest growth throughout the forecast period. This dominance is attributed to several factors: high volume automotive manufacturing in countries like China, South Korea, and Japan; rapid adoption of domestically developed ADAS technologies; and the presence of diverse climatic zones (ranging from extremely cold northern regions to highly humid coastal areas) necessitating reliable lens de-fogging and de-icing solutions. Furthermore, increasing urbanization and the resulting need for improved parking assist and surround-view systems in dense traffic environments bolster demand in this region.

Europe represents a mature market characterized by stringent safety regulations imposed by the European Union and Euro NCAP, which consistently drive the penetration of camera-based safety features across all new vehicle segments. European OEMs maintain high standards for component quality and functional safety (ISO 26262), creating robust demand for premium, highly reliable lens heating solutions, especially TCF and integrated systems. The mandatory implementation of features like Rear-View Cameras (RVC) and the rapid shift towards electric vehicles place a strong emphasis on energy-efficient heating technologies in this region. Germany, France, and the UK are key contributors to market revenue, driven by luxury vehicle manufacturers and specialized Tier 1 suppliers headquartered there.

North America is another critical market, marked by high consumer expectation for advanced technology and the vast array of climate conditions, from severe snow belts to arid deserts. Regulatory bodies, including NHTSA, push for advanced crash prevention features that rely on camera fidelity. The U.S. market, in particular, is a strong adopter of Level 2 and Level 3 autonomous driving technologies, requiring multiple redundant camera systems, each equipped with dependable thermal management. The transition to EVs and the continued investment in Silicon Valley-led autonomous vehicle innovation ensure sustained demand for technologically advanced, low-power lens heaters. Latin America and the Middle East & Africa (MEA) currently represent smaller but emerging markets, with growth concentrated in commercial fleet vehicles and imported premium passenger cars that feature advanced safety packages.

- Asia Pacific (APAC): Highest volume manufacturing base; rapid growth in ADAS adoption in China and South Korea; strong demand driven by diverse climatic needs; leading consumer of surround-view camera systems.

- Europe: High penetration rates of premium ADAS features; rigorous functional safety and quality standards; focus on energy efficiency due to high EV penetration; mandatory RVC implementation driving baseline demand.

- North America: Early and strong adopter of autonomous driving technologies (Level 2+); extensive regional climate variation mandates high reliability; significant market for luxury and high-tech vehicle segments.

- Latin America (LATAM): Emerging market driven by regulatory updates in Brazil and Mexico; growth focused primarily on high-end passenger vehicles and fleet safety enhancements.

- Middle East & Africa (MEA): Growth constrained by lower vehicle volumes but increasing adoption in luxury/premium segments; specific regional needs include dust/sand resistance and coping with extreme ambient heat fluctuations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Camera Lens Heaters Market.- Gentex Corporation

- Stoneridge Inc.

- Methode Electronics

- Dorman Products

- 3M Company

- Corning Incorporated

- AGC Inc.

- Lord Corporation (Parker Hannifin)

- TESA SE

- Nippon Sheet Glass Co., Ltd. (NSG)

- Kyocera Corporation

- LG Innotek

- Murata Manufacturing Co., Ltd.

- Bosch (Camera Division)

- Continental AG (ADAS Division)

- Gentherm Inc.

- TDK Corporation

- HELLA GmbH & Co. KGaA

- Valeo S.A.

- Aptiv PLC

Frequently Asked Questions

Analyze common user questions about the Automotive Camera Lens Heaters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an automotive camera lens heater and why is it critical for ADAS?

The primary function is to maintain clear visibility by preventing the buildup of moisture, fog, frost, or ice on the camera lens surface. It is critical for Advanced Driver Assistance Systems (ADAS) because these systems, such as automated emergency braking and lane keep assist, rely entirely on accurate, uninterrupted visual data from the cameras to function reliably and safely, particularly in adverse weather conditions.

How do Transparent Conductive Film (TCF) heaters compare to traditional resistive wire heaters?

TCF heaters, often using ITO or silver nanowires, offer superior optical transparency and minimal impact on image quality compared to traditional resistive wire heaters, which can sometimes interfere with the viewing area or create minor distortions. TCF technology also allows for thinner, more flexible integration, making it the preferred choice for high-resolution automotive cameras seeking minimal visual footprint and enhanced aesthetic integration.

What impact does the growth of Electric Vehicles (EVs) have on the demand for camera lens heaters?

The growth of EVs increases the demand for highly efficient, low-power camera lens heaters. Since maintaining battery range is paramount in EVs, manufacturers require heating solutions that minimize power draw while maximizing de-icing speed. This drives innovation toward smart, AI-optimized thermal management systems and advanced materials like graphene for rapid, energy-efficient heating cycles.

Which geographical region is leading the adoption and manufacturing of automotive camera lens heaters?

The Asia Pacific (APAC) region, primarily driven by China, Japan, and South Korea, is currently leading both the manufacturing volume and the market adoption of automotive camera lens heaters. This is due to high-volume vehicle production, rapid integration of domestic ADAS solutions, and the necessity to manage highly diverse and extreme climatic conditions across the region.

What is the expected Compound Annual Growth Rate (CAGR) for the Automotive Camera Lens Heaters Market?

The Automotive Camera Lens Heaters Market is projected to experience robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 19.5% between the forecast period of 2026 and 2033. This high growth rate is directly linked to global regulatory mandates requiring advanced camera systems and the irreversible trend towards vehicle autonomy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager