Automotive Carbon Brush Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432211 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Carbon Brush Market Size

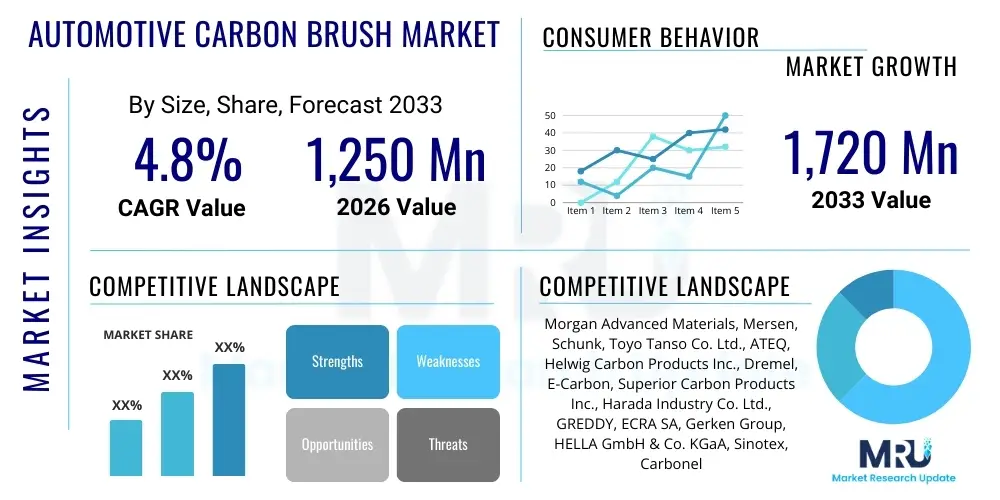

The Automotive Carbon Brush Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1,250 Million in 2026 and is projected to reach USD 1,720 Million by the end of the forecast period in 2033.

Automotive Carbon Brush Market introduction

The Automotive Carbon Brush Market encompasses the manufacturing, distribution, and utilization of electrically conductive components essential for transferring current between stationary and rotating parts in various automotive subsystems. These brushes are integral to the functionality of DC motors, starter motors, alternators, and small auxiliary motors responsible for operations like window lifters, fuel pumps, and HVAC blowers. The fundamental premise of carbon brushes lies in their lubricating properties and high resistance to wear, which ensures reliable electrical contact and mechanical longevity under harsh operating conditions, including high temperature fluctuations, vibration, and dust exposure, common within the automotive environment. Market growth is structurally linked to global vehicle production rates, the increasing integration of electronics in modern vehicles, and the mandatory maintenance and replacement cycle of these wear-and-tear components.

Carbon brushes are typically manufactured from materials like electrographite, carbon graphite, copper graphite, and silver graphite, with the material composition precisely tailored to the specific application requirements, such as current density, friction coefficient, and commutator material compatibility. For high-current applications like starter motors, copper graphite brushes are often preferred due to their excellent conductivity, while electrographite brushes are common in high-speed, low-current applications like auxiliary motors. The continuous evolution of vehicle design, particularly the shift towards hybrid and electric vehicles (HEVs/EVs), subtly alters the demand landscape. While internal combustion engine (ICE) vehicles rely heavily on carbon brushes in traditional components, HEVs and EVs require specialized brushes for new motor types and auxiliary systems, driving innovation in material science and production precision to meet higher performance standards related to efficiency and noise reduction.

Key benefits derived from automotive carbon brushes include reliable electrical commutation, minimal sparking, and predictable lifespan, contributing significantly to the overall operational efficiency and safety of a vehicle’s electrical architecture. The driving factors propelling this market include the sustained demand for new vehicles globally, the aftermarket necessity for replacement brushes, and technological advancements focusing on reducing brush wear and improving conductivity. Furthermore, stringent regulatory standards related to vehicle emissions and fuel efficiency indirectly promote the development of more efficient electrical systems, thereby increasing the technical complexity and value proposition of high-performance carbon brush solutions. This reliance on robust electrical transfer components solidifies the carbon brush's role as a critical, non-negotiable part of the automotive supply chain.

Automotive Carbon Brush Market Executive Summary

The global Automotive Carbon Brush Market is characterized by stable growth driven primarily by the high volume of vehicle manufacturing and a robust aftermarket replacement cycle, particularly in developing economies. Current business trends indicate a critical focus on material innovation, shifting from traditional graphite composites to advanced formulations incorporating metals and specialized resins to optimize performance in high-stress applications, notably in micro-hybrid systems and efficient alternators. Key market players are concentrating on strategic vertical integration and expanding their manufacturing footprints in high-growth regions like Asia Pacific to leverage lower operational costs and proximity to major automotive Original Equipment Manufacturers (OEMs). Furthermore, the push towards miniaturization and higher power density in modern automotive motors necessitates precision engineering in brush design, acting as a key competitive differentiator among established suppliers.

Regionally, the Asia Pacific (APAC) market, spearheaded by countries like China, India, and Japan, dominates the volume landscape due to high domestic vehicle production and increasing penetration of electric two-wheelers and passenger vehicles, which still rely on various types of DC motors. North America and Europe, while experiencing slower overall volume growth, maintain high market value due to the stringent quality requirements and the adoption of premium, long-life brush technologies in their advanced vehicle fleets. European trends are heavily influenced by environmental regulations, spurring demand for carbon brushes utilized in sophisticated start-stop systems and regenerative braking components. The aftermarket in all regions remains a significant revenue stream, driven by the average service life of brushes, typically requiring replacement every 50,000 to 100,000 kilometers.

Segment trends reveal that the Copper Graphite brush segment is experiencing strong growth, largely attributed to its superior performance in high-current applications such as robust starter motors required for modern ICE vehicles. By application, starter motors and alternators continue to represent the largest segments, though the DC Motor segment (including components for EPS, fuel pumps, and cooling fans) is accelerating rapidly due to the rising count of auxiliary electrical systems per vehicle. The passenger vehicle segment commands the majority market share, yet the commercial vehicle segment presents specialized, high-durability requirements, often demanding larger, custom-engineered carbon brushes designed to withstand extreme duty cycles. These structural dynamics underscore a stable, essential market undergoing gradual technological refinement rather than disruptive change.

AI Impact Analysis on Automotive Carbon Brush Market

User inquiries regarding AI's influence on the Automotive Carbon Brush Market primarily revolve around three central themes: how AI-driven predictive maintenance systems might alter the aftermarket replacement cycle, whether AI can optimize the manufacturing process for material precision, and if the rise of autonomous and electric vehicles (which rely on highly complex electrical systems) will necessitate AI tools for diagnosing and managing brush wear. Users are concerned about whether enhanced predictability could lead to reduced demand for emergency replacements, potentially impacting aftermarket supplier revenues. Conversely, they also anticipate that AI could lead to hyper-optimized brush performance and longevity through sophisticated material composition analysis and quality control during production, ensuring brushes meet the extremely high reliability standards required for autonomous driving systems where component failure is catastrophic.

While carbon brushes themselves are passive, mechanical-electrical components, AI significantly impacts the systems they serve and the processes used to create them. In manufacturing, AI and machine learning algorithms are being integrated into quality control systems to analyze complex data derived from material input consistency, thermal characteristics during sintering, and final dimensional tolerances. This allows manufacturers to achieve zero-defect production runs, crucial for OEM suppliers where specifications are exceptionally rigid. Furthermore, AI-powered computer vision systems can monitor brush surfaces and commutators in real-time during durability testing, providing deeper insights into wear patterns than traditional monitoring, thereby accelerating R&D cycles for new, longer-lasting brush grades.

The operational impact of AI centers on vehicle diagnostics and predictive maintenance (PdM). Modern vehicles generate vast amounts of operational data, and AI systems can analyze electrical load fluctuations, motor temperature trends, and commutator signals to predict the exact remaining useful life (RUL) of critical components, including carbon brushes within the starter or major auxiliary motors. For fleet operators, PdM minimizes costly downtime and optimizes maintenance scheduling. Although this may standardize the replacement cycle and slightly reduce unpredictable aftermarket purchases, it ensures a constant, planned demand flow for high-quality, specified brushes, shifting the market focus toward reliability and certified OEM or OES products over generic replacements.

- AI optimizes material blending and sintering processes, ensuring higher consistency and precision in brush composition.

- Machine learning algorithms enhance predictive maintenance (PdM) systems, forecasting carbon brush end-of-life based on electrical load monitoring.

- AI-driven computer vision systems improve quality control, identifying micro-defects in brushes and increasing production yield reliability.

- Adoption of AI in motor design simulation aids in optimizing brush geometry and material pairing for reduced friction and extended life in next-generation electric systems.

- AI analysis of field data helps manufacturers quickly refine brush grades to address specific failure modes observed in operational vehicle fleets.

DRO & Impact Forces Of Automotive Carbon Brush Market

The Automotive Carbon Brush Market dynamics are shaped by a delicate interplay of powerful drivers stemming from global vehicle production and the aftermarket, inherent limitations concerning component lifespan and technological substitution, and significant opportunities arising from vehicle electrification and increased complexity of auxiliary systems. The primary impact force is the mandatory replacement cycle; as wear components, carbon brushes guarantee sustained revenue regardless of short-term economic fluctuations in new vehicle sales. However, this stability is counterbalanced by the rise of Brushless DC (BLDC) motors, particularly in high-performance or high-reliability applications, which pose the most significant long-term restraint by directly eliminating the need for brushes in certain subsystems. Strategic innovation in materials and design, aimed at extending brush lifespan and improving efficiency in legacy applications (starters/alternators) and new HEV/EV auxiliary motors, is crucial for mitigating this restraint.

Key drivers include the massive global vehicle parc (the total number of vehicles in operation), which ensures consistent and high-volume demand for replacement components. Furthermore, emerging markets, especially in Asia and Latin America, continue to show robust growth in ICE vehicle sales, where traditional brushed motors remain cost-effective and prevalent in entry-level vehicles. Regulatory pressures for enhanced fuel economy also act as a driver, forcing OEMs to adopt high-efficiency alternators and micro-hybrid start-stop systems, which often require specialized, high-durability carbon brushes capable of handling frequent, high-stress commutation cycles. These drivers create a continuous, underlying stability for market expansion.

Restraints are dominated by the continuous push for electrification and the preference for brushless motor technology in new designs, driven by their superior longevity, reduced maintenance, and higher efficiency. While BLDC motors are more expensive, their adoption is accelerating in premium and specialized applications, gradually displacing brushed counterparts. Opportunities lie primarily in the hybridization of vehicles; HEVs require carbon brushes for specific functions, such as within sophisticated power steering or braking systems, demanding brushes with extremely low resistance and superior thermal stability. Additionally, the industrialization of advanced material formulations (e.g., silver graphite) to enhance performance and reduce component size presents an opportunity for value-added differentiation in a typically commoditized segment. Impact forces, therefore, revolve around balancing the high replacement demand of legacy systems against the inevitable, albeit slow, transition towards brushless architectures in the future mobility landscape.

Segmentation Analysis

The Automotive Carbon Brush Market is highly fragmented and segmented based on material composition, application area, and vehicle type, reflecting the diverse electrical requirements across the automotive ecosystem. Segmentation is crucial for manufacturers to target specific performance requirements; for instance, brushes used in high-heat starter motors require different material characteristics (high current capacity, metallic content) compared to the smaller brushes used in low-torque window regulator motors. The material type dictates conductivity, wear resistance, and cost structure, directly influencing the final application. Analyzing these segments provides strategic insights into areas of rapid growth, such as applications in auxiliary DC motors, which are proliferating due to the increased adoption of comfort, safety, and electronic features in modern vehicles, necessitating precise customization in brush manufacturing.

The application segmentation clearly illustrates the revenue reliance on traditional high-power components—starter motors and alternators—which are mandatory in every ICE and mild-hybrid vehicle. However, the rise of the DC Motor segment, encompassing components such as Electronic Power Steering (EPS) motors, Electric Water Pumps (EWP), and HVAC blower motors, signifies a shift in growth potential. As vehicles become more electrically dependent, the sheer number of small motors per vehicle increases, creating sustained volume demand for various specialty brushes. Furthermore, the segmentation by vehicle type differentiates demand characteristics: passenger vehicles drive mass volume, while commercial vehicles (heavy-duty trucks, buses) require brushes engineered for extreme durability and longer operational hours, often commanding a higher price point per unit.

Understanding the interplay between these segments is vital for supply chain forecasting. For example, the increasing regulatory pressure for reduced emissions favors advanced brush materials like copper-impregnated graphite for high-efficiency alternators, thereby driving the value share of the Copper Graphite segment. Conversely, the aftermarket remains strongly focused on cost-effective, durable carbon graphite brushes for general repairs. The market structure, therefore, is defined by dual requirements: high-performance, precision-engineered products for OEMs in industrialized nations, and robust, cost-optimized solutions for the high-volume aftermarket, particularly in emerging markets where affordability is a key purchase criterion.

- By Type (Material):

- Electrographite Brushes

- Carbon Graphite Brushes

- Copper Graphite Brushes

- Silver Graphite Brushes

- Resin Bonded Graphite Brushes

- By Application:

- Starter Motors

- Alternators

- DC Motors (Wiper Motors, Fuel Pump Motors, Power Window Motors, HVAC Blowers, Cooling Fans, EPS Motors)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Automotive Carbon Brush Market

The Value Chain of the Automotive Carbon Brush Market begins with the upstream procurement and processing of raw materials, primarily various forms of carbon (natural graphite, coke, pitch), copper, silver, and specialized resins. This upstream segment is characterized by specialized suppliers who focus on achieving the precise purity and particle size distribution required for molding and sintering processes. Cost volatility and supply reliability of high-ppurity materials, especially graphite and copper, significantly influence the final product price and manufacturing strategy. Manufacturers typically perform proprietary compounding and molding techniques to create green compacts, followed by high-temperature sintering and graphitization, which are energy-intensive and require stringent process control to achieve the desired mechanical and electrical properties.

Midstream activities involve the core manufacturing of the brush body, followed by lead attachment, terminal assembly, and rigorous quality inspection, often involving automated optical systems. Key manufacturers maintain high levels of technological expertise in these stages, as variations in dimensions or material density directly affect brush longevity and performance, particularly sparking characteristics. Distribution channels for carbon brushes are highly bifurcated: the Direct Channel serves the Original Equipment Manufacturers (OEMs) who demand high volumes under long-term contracts with extremely strict specifications and zero-defect tolerances. This channel requires significant supplier audits and specialized logistics to integrate into assembly lines, making barriers to entry relatively high for new players.

The downstream market is dominated by the Aftermarket (AM) channel, served primarily through Indirect Channels, including independent distributors, wholesalers, and retail automotive parts stores. This segment focuses on high accessibility, competitive pricing, and broad coverage across various vehicle makes and models. The aftermarket often utilizes standardized designs and is a critical source of revenue, capitalizing on the recurring need for replacement. End-users, including vehicle owners and repair garages, depend on the efficiency and reliability of both the direct (OEM-fitted) and indirect (replacement) products, making brand reputation and quality consistency critical factors driving downstream market competitiveness and consumer trust.

Automotive Carbon Brush Market Potential Customers

The primary customers for the Automotive Carbon Brush Market are fundamentally categorized into two major groups: the Original Equipment Manufacturers (OEMs) of vehicles and automotive component manufacturers, and the vast network of independent service repair shops and vehicle owners comprising the aftermarket segment. OEMs, including giants like Toyota, Volkswagen, and General Motors, represent the volume customer base, purchasing brushes in bulk for integration into newly manufactured starter motors, alternators, and increasingly complex auxiliary DC motors. These customers prioritize technical compliance, long-term supply agreements, and the ability of suppliers to meet rigorous quality standards (e.g., IATF 16949) and just-in-time delivery schedules, viewing the carbon brush as a high-reliability component crucial for vehicle warranty performance.

The secondary, but equally vital, customer group comprises component manufacturers (Tier 1 suppliers) who specialize in building the complete motors and generators, such as Bosch, Denso, and Continental. These Tier 1 suppliers are sophisticated buyers, often possessing in-house R&D capabilities and dictating precise brush specifications regarding current capacity, friction coefficient, and noise profile. Their purchasing decisions are highly technical, driven by performance targets for the entire electrical unit they supply to the vehicle assembly lines. For suppliers of carbon brushes, establishing long-term relationships with these Tier 1 companies ensures market stability and access to high-value product lines requiring specialized materials, such as those used in advanced start-stop systems.

The aftermarket customers—spanning wholesalers, distributors, independent repair garages, and DIY consumers—constitute the segment focused on replacement. For these buyers, availability, price-to-performance ratio, and ease of installation are paramount considerations. While quality remains important, the willingness to pay a premium for specific materials may be lower than in the OEM segment. This segment sustains the market between new vehicle cycles and is particularly robust in regions with aging vehicle populations or where maintenance is performed by local mechanics rather than authorized service centers. Successful engagement in this segment requires effective distribution logistics, robust cataloging capabilities, and competitive branding to capture replacement demand efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,250 Million |

| Market Forecast in 2033 | USD 1,720 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Morgan Advanced Materials, Mersen, Schunk, Toyo Tanso Co. Ltd., ATEQ, Helwig Carbon Products Inc., Dremel, E-Carbon, Superior Carbon Products Inc., Harada Industry Co. Ltd., GREDDY, ECRA SA, Gerken Group, HELLA GmbH & Co. KGaA, Sinotex, Carbonel, Panasonic Corporation, Hitachi Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Carbon Brush Market Key Technology Landscape

The technology landscape for automotive carbon brushes is primarily focused on material science advancement, precision manufacturing, and surface treatment technologies aimed at maximizing lifespan, minimizing electrical noise, and enhancing performance under extreme operating conditions. A significant area of development involves the refinement of copper-graphite and silver-graphite composites, particularly for high-efficiency alternators and specialized motors in mild-hybrid systems. Technological efforts are directed towards achieving a lower coefficient of friction while maintaining high current carrying capacity, which is essential to reduce energy losses and heat generation. Advanced compounding techniques, including pressure infiltration and specialized powder metallurgy, are utilized to ensure uniform distribution of metal components within the carbon matrix, directly translating into predictable wear rates and improved commutation stability across varied speeds and loads.

Another critical technological focus is the development of environmentally stable brushes. Modern vehicles operate in diverse climates, demanding carbon brushes that maintain consistent electrical and mechanical properties regardless of high humidity or extreme dryness. Manufacturers are investing in brush treatments and impregnation technologies—such as specialized resin or lubricant application—to create a stable, low-friction film on the brush surface and the commutator, mitigating excessive wear due to environmental factors. Furthermore, the push for component miniaturization, driven by tighter packaging constraints in advanced vehicles, requires highly complex brush geometries and smaller cross-sections. This necessitates ultra-precise machining and molding techniques to ensure dimensional accuracy, often employing computer numerical control (CNC) grinding and automated assembly processes for integrating the pigtails and terminals.

Electrification also dictates the technological trajectory. While BLDC motors are replacing brushed motors in many areas, specific HEV/EV auxiliary applications still rely on high-performance brushed systems. The technology here is concentrated on noise, vibration, and harshness (NVH) reduction. Brushes must be designed to operate silently, often through specialized damping materials and optimized spring pressure mechanisms, particularly for motors located near the passenger cabin (e.g., HVAC blowers, power seat adjusters). Consequently, the key technologies center on developing brushes capable of high current surges, exceptional thermal management, and robust mechanical stability, thereby ensuring the longevity and reliable operation of complex, electronically controlled automotive subsystems throughout the vehicle's service life.

Regional Highlights

The regional dynamics of the Automotive Carbon Brush Market are fundamentally linked to regional vehicle production volumes, the maturity of the vehicle parc, and the regulatory environment influencing component choices. Asia Pacific (APAC) stands out as the dominant region, driven by its status as the global epicenter for automotive manufacturing, particularly in China and India, where high volumes of conventional ICE vehicles and electric two-wheelers are produced. The APAC market exhibits high demand across both the OEM segment, due to continuous capacity expansion, and the vast, price-sensitive aftermarket, necessitating a diverse supply chain catering to various quality tiers.

Europe and North America represent highly developed, high-value markets. Demand in these regions is characterized by stringent technical specifications, emphasizing reliability, longevity, and high-performance materials like silver-graphite and advanced copper-graphite composites, driven by the wide adoption of sophisticated systems such as start-stop technology and advanced electronic stability systems. Although new vehicle volumes are generally lower than in APAC, the value generated per vehicle component is higher due to premium brush technology integration. Regulatory mandates promoting fuel efficiency and reducing emissions further catalyze the demand for high-efficiency electrical components in these western markets.

Latin America and the Middle East & Africa (MEA) constitute emerging markets with unique dynamics. Latin America, particularly Brazil and Mexico, features significant local assembly operations and a very strong aftermarket driven by large fleets of older vehicles requiring frequent replacement of standard graphite and carbon brushes. The MEA region is characterized by volatile but growing demand, heavily reliant on imported vehicles and components. Extreme climate conditions in parts of MEA often necessitate specific brush material grades capable of enduring high temperatures and dust, creating a specialized niche demand for robust and durable components that can tolerate harsher operational environments than those found in temperate zones.

- Asia Pacific (APAC): Dominates the global volume due to high automotive manufacturing output in China, India, and Japan; strong growth in both OEM and cost-competitive aftermarket segments.

- Europe: High-value market focused on advanced, specialized brush grades for micro-hybrid start-stop systems and stringent emission-compliant alternators; emphasis on quality and performance.

- North America: Stable OEM demand driven by technological integration in light trucks and SUVs; robust aftermarket sustained by a large, aging vehicle parc; strong adoption of premium carbon brush solutions.

- Latin America (LATAM): Growth propelled by localized vehicle assembly and a high-volume, price-sensitive aftermarket; key focus on standard, durable brush materials.

- Middle East & Africa (MEA): Niche demand for specialized high-temperature and dust-resistant brushes; market growth tied to infrastructure development and vehicle fleet expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Carbon Brush Market.- Morgan Advanced Materials

- Mersen

- Schunk

- Toyo Tanso Co. Ltd.

- ATEQ

- Helwig Carbon Products Inc.

- Dremel

- E-Carbon

- Superior Carbon Products Inc.

- Harada Industry Co. Ltd.

- GREDDY

- ECRA SA

- Gerken Group

- HELLA GmbH & Co. KGaA

- Sinotex

- Carbonel

- Panasonic Corporation

- Hitachi Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Carbon Brush market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Automotive Carbon Brush Market?

The primary driver is the massive global vehicle parc and the non-negotiable aftermarket replacement cycle. Carbon brushes are wear-and-tear components with finite lifespans, ensuring consistent demand for replacement units in millions of existing vehicles worldwide, supplemented by ongoing new vehicle production volumes.

How does the shift to Electric Vehicles (EVs) impact the carbon brush industry?

The transition to battery EVs reduces demand for traditional starter/alternator brushes. However, EVs still require carbon brushes in various auxiliary DC motors (e.g., HVAC, pumps, electronic stability control) and, more significantly, in the slip rings and commutators of certain traction motors and generator systems in Hybrid Electric Vehicles (HEVs), driving demand for specialized, high-performance silver-graphite brushes.

What is the main technological threat to the Automotive Carbon Brush Market?

The main technological threat is the increasing adoption of Brushless DC (BLDC) motors across various automotive applications. BLDC motors offer superior longevity, higher efficiency, and reduced maintenance by eliminating the need for carbon brushes, leading to gradual displacement in high-reliability and premium vehicle subsystems.

Which material segment holds the largest market share in terms of revenue?

The Copper Graphite and Electrographite segments collectively hold the largest market share. Copper graphite is essential for high-current applications like starter motors, while electrographite is widely used across alternators and small DC auxiliary motors, representing the core volume and value of the traditional automotive electrical system.

Why is the Asia Pacific region projected to be the fastest-growing market?

APAC is the fastest-growing market primarily due to rapid expansion in domestic vehicle production volumes, robust sales of conventional passenger and commercial vehicles, and the emergence of massive aftermarket replacement demand across populous nations like China and India, alongside technological adoption in industrialized nations like Japan and Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager