Automotive Carbon Ceramic Brakes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435186 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Automotive Carbon Ceramic Brakes Market Size

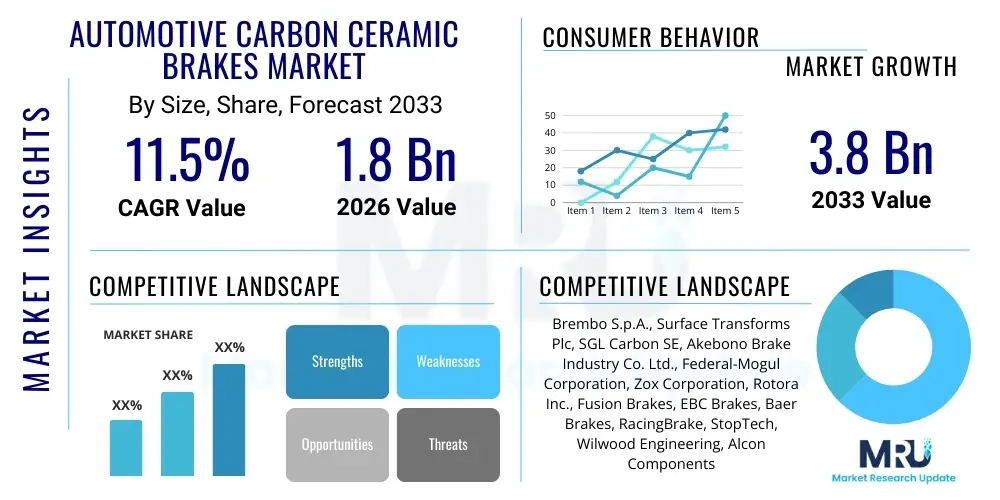

The Automotive Carbon Ceramic Brakes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Automotive Carbon Ceramic Brakes Market introduction

The Automotive Carbon Ceramic Brakes Market encompasses the manufacturing, distribution, and utilization of high-performance braking systems where the rotor material is primarily composed of carbon fiber reinforced silicon carbide (C/SiC). These systems are distinct from traditional cast iron or steel brakes due to their significantly reduced weight, superior thermal resistance, and consistent performance under extreme operating conditions, making them standard equipment in the ultra-high-performance and luxury vehicle segments. Carbon ceramic brakes offer exceptional fade resistance, crucial for racing and intense track driving, contributing directly to enhanced vehicle safety and performance metrics, thereby justifying their premium cost.

The primary applications for carbon ceramic braking systems reside within specialized sectors of the automotive industry, predominantly serving high-end sports cars, supercars, luxury SUVs, and professional motorsports categories. Key benefits driving their adoption include a considerable reduction in unsprung mass, which improves handling and suspension dynamics, and their exceptional longevity, often exceeding the lifespan of the vehicle under normal road use. Furthermore, the aesthetic appeal of these rotors, often coupled with large, multi-piston calipers, enhances the overall perceived value and technological sophistication of the host vehicle, targeting discerning consumers who prioritize engineering excellence.

Driving factors propelling the expansion of this niche market include the continuous proliferation of high-power internal combustion and electric vehicles requiring advanced thermal management in braking, stringent safety regulations mandating superior stopping power, and the rising disposable income globally, particularly in emerging luxury markets. Technological advancements in manufacturing processes, such as improved Chemical Vapor Deposition (CVD) techniques, are gradually optimizing production efficiency, though the high raw material costs and complex sintering stages continue to pose a barrier to mass-market penetration. Nonetheless, the prestige and performance advantages secure a robust demand trajectory in the premium sector.

Automotive Carbon Ceramic Brakes Market Executive Summary

The Automotive Carbon Ceramic Brakes Market is defined by intense technological competition and a strong reliance on Original Equipment Manufacturer (OEM) relationships within the elite segments of the automotive industry. Current business trends indicate a critical focus on reducing production cycle times and mitigating the high energy consumption associated with the manufacturing of carbon ceramic matrices, pushing key players toward collaborative research and development efforts with material science specialists. Furthermore, there is a discernible trend toward developing lighter and more cost-effective hybrid matrix structures that retain the core benefits of pure carbon ceramic compositions while potentially lowering the entry barrier for high-end electric vehicles (EVs) that face significant challenges related to battery weight and range optimization.

Regionally, the market exhibits a bifurcated demand pattern, dominated by established luxury and performance vehicle manufacturing hubs in Europe and North America, alongside rapidly accelerating demand in the Asia Pacific (APAC) region, particularly China and Japan, driven by growing wealth and an increasing appetite for imported luxury and performance vehicles. European manufacturers, particularly those based in Italy and Germany, remain central to innovation and production volume, leveraging decades of motorsports heritage. Meanwhile, North America provides a crucial aftermarket segment driven by performance enthusiasts and specialized tuners seeking upgrades for track usage, contributing substantially to the market’s total revenue.

Segmentation trends reveal that the OEM channel dominates revenue generation, given that carbon ceramic brakes are typically factory-installed options bundled into high-value performance packages. However, the aftermarket segment is growing dynamically, spurred by the need for replacement parts and performance upgrades, especially as vehicles equipped with these systems age. By vehicle type, high-performance sports cars remain the largest consumer, though the fastest growing segment is luxury performance SUVs, reflecting the shift toward high-riding, powerful daily drivers that require commensurate braking capacity. The market structure emphasizes highly specialized supply chains and proprietary material formulations, maintaining high barriers to entry for new competitors.

AI Impact Analysis on Automotive Carbon Ceramic Brakes Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Automotive Carbon Ceramic Brakes Market primarily revolve around optimizing manufacturing efficiency, enhancing quality control, and predicting brake component wear and failure in real-time. Users are keen to understand how AI-driven predictive maintenance algorithms, integrated into vehicle telematics, can extend the lifespan of these costly components and reduce unplanned downtime. Furthermore, there is interest in the application of Machine Learning (ML) models to simulate complex thermal stress distributions during high-G braking scenarios, aiming to accelerate the design and validation cycle for next-generation ceramic compounds. The key themes summarize user expectations for AI to deliver substantial cost savings, superior material science outcomes, and safer, more reliable performance through advanced monitoring systems.

AI is set to revolutionize the demanding manufacturing process of carbon ceramic rotors, which currently requires highly precise temperature control and lengthy thermal cycling (sometimes spanning weeks) during the carbonization and siliconization phases. ML algorithms can analyze massive datasets pertaining to kiln performance, gas flow rates, and material shrinkage to identify optimal process parameters dynamically, significantly reducing defect rates and potentially shortening the manufacturing window. This optimization is crucial for addressing the current supply constraints faced by OEMs relying on these high-end components. By predicting material behavior under various atmospheric conditions within the furnace, AI ensures greater consistency in the final product's microstructure, crucial for brake performance integrity.

Beyond manufacturing, AI integration in the vehicle itself promises enhanced consumer value. AI-powered diagnostics systems can monitor microscopic wear patterns on the brake discs and pads, correlating usage data (speed, temperature, G-forces) with material degradation models. This allows the system to alert the driver or maintenance facility well in advance of critical failure, maximizing safety and ensuring that the exceptionally long potential life of the carbon ceramic system is fully realized. Moreover, in autonomous or assisted driving systems, AI will integrate braking actuation with predictive driving models, fine-tuning energy recovery (in EVs) and ensuring optimal heat management for sustained high-performance operation, thus indirectly increasing the efficiency and safety envelope of the ceramic components.

- AI-driven optimization reduces thermal cycling duration in C/SiC manufacturing.

- Machine learning enhances quality control by predicting microstructural defects in rotors.

- Predictive maintenance algorithms extend component lifespan and reduce unexpected failures.

- AI aids in rapid simulation and testing of novel ceramic matrix compositions.

- Integrated vehicle diagnostics utilize AI to monitor wear rates and thermal stress distribution.

- AI optimizes brake blending (friction braking and regenerative braking) in high-performance EVs.

DRO & Impact Forces Of Automotive Carbon Ceramic Brakes Market

The dynamics of the Automotive Carbon Ceramic Brakes Market are governed by a robust interplay between performance requirements, cost structures, and technological maturity. The primary drivers include the relentless pursuit of high-performance capabilities in both traditional supercars and high-end battery electric vehicles (BEVs), where reduced unsprung mass and exceptional thermal management are non-negotiable prerequisites. Opportunities arise from expanding applications into premium SUVs and potential market entry into high-speed rail or specialized military sectors, while restraints are dominated by the exceptionally high initial cost of the systems, the complexity of the proprietary manufacturing processes, and the relatively limited supply chain capacity which struggles to meet sporadic high-volume OEM demands. These four elements—Drivers (D), Restraints (R), Opportunities (O), and Impact Forces—collectively dictate the pace and direction of market development.

Key drivers center around consumer willingness to pay a premium for safety and performance differentiation, particularly as average vehicle weights increase due to electrification and added safety features. Restraints significantly challenge widespread adoption; the material cost, coupled with the capital expenditure required for high-vacuum, high-temperature sintering facilities, makes these components prohibitive outside the luxury tier. Furthermore, the specialized disposal and recycling requirements for composite materials pose an environmental and logistical restraint that necessitates future innovation. The specialized knowledge required for maintenance and repair, often limited to high-end dealerships, also impacts customer service models and limits aftermarket accessibility.

The major opportunities lie in the electrification shift. While EVs often rely on regenerative braking, the sheer mass and instantaneous torque of performance EVs require carbon ceramic systems as a critical fail-safe and high-deceleration solution, opening a significant new market vertical. Furthermore, continuous R&D into lower-cost matrix materials (e.g., combining shorter carbon fibers or using alternative polymers) presents a long-term opportunity to slightly lower the cost floor. Impact forces are predominantly driven by regulatory shifts concerning vehicle safety standards (pushing braking performance envelopes) and volatile pricing of key raw materials like carbon fiber and silicon, which directly influence the final product cost and market accessibility.

Segmentation Analysis

The Automotive Carbon Ceramic Brakes Market is comprehensively segmented based on parameters crucial to both manufacturing and end-user application. These segmentation criteria help stakeholders understand the specific demand patterns emerging from different vehicle categories, the dominance of various sales channels, and the preferred component types driving replacement cycles. The analysis reveals a market structure strongly weighted toward OEM adoption, indicating the component's critical role in factory-built performance specifications. The segmentation by vehicle type underscores the shift in performance vehicle definitions, moving beyond traditional sports cars to include ultra-luxury performance SUVs and high-end electric platforms, all demanding superior C/SiC braking technology.

Further delineation based on component type, primarily discs, calipers, and pads, highlights the technological focus within the industry. While the discs (rotors) represent the highest value and technological hurdle due to the material complexity, the accompanying specialized brake pads and multi-piston calipers are essential system enablers, ensuring optimal performance matching the ceramic properties. The distinction between the OEM channel, characterized by high volume, long-term contracts, and strict quality mandates, and the aftermarket channel, driven by replacement cycles and performance tuning upgrades, provides crucial insight into distribution strategies and pricing elasticity across different segments. Understanding these segments is vital for effective inventory management and strategic capacity planning among leading manufacturers.

- By Vehicle Type:

- Sports Cars and Supercars

- Luxury Sedans

- High-Performance SUVs (HPSUVs)

- Racing and Motorsports Vehicles

- By Component:

- Carbon Ceramic Discs/Rotors

- Brake Calipers (Optimized for Ceramic Use)

- Brake Pads (Specialized Ceramic-compatible Compounds)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Manufacturing Process:

- Chemical Vapor Deposition (CVD)

- Liquid Silicon Infiltration (LSI)

- Others (e.g., Resin Transfer Molding)

Value Chain Analysis For Automotive Carbon Ceramic Brakes Market

The value chain for Automotive Carbon Ceramic Brakes is highly specialized, beginning with the procurement of critical raw materials, primarily high-grade carbon fibers, phenolic resins, and silicon powder. The upstream segment is characterized by a limited number of specialized material suppliers, giving them substantial bargaining power, particularly concerning aerospace-grade carbon fiber precursors. The manufacturing stage, which involves intensive processes like preform creation, carbonization, and high-temperature silicon infiltration (often via CVD or LSI), represents the core value addition and high-cost element. This stage is dominated by a few integrated brake system manufacturers and material science giants that possess the proprietary technology and capital-intensive infrastructure necessary for production.

The distribution channel is predominantly direct or highly controlled. For the vast majority of output, the flow is directly from the system manufacturer (Tier 1 supplier, e.g., Brembo or Surface Transforms) to the Original Equipment Manufacturers (OEMs) such as Ferrari, Porsche, or Lamborghini. This direct link ensures seamless integration, bespoke component sizing, and stringent quality assurance required by high-performance vehicle production lines. The relationship between Tier 1 suppliers and OEMs is often characterized by long-term exclusive contracts due to the component's safety-critical nature and integration complexity.

The downstream segment includes the aftermarket channel, which is significantly smaller but crucial for replacement cycles. Aftermarket components can be supplied directly through the OEM's authorized service network (indirect distribution) or through specialized high-performance parts distributors and tuners (direct to independent workshops). Due to the high cost and sensitivity of the components, indirect channels (OEM authorized service centers) hold considerable control over replacement sales, ensuring that specialized tools and trained technicians handle the maintenance. The high barrier to entry at the manufacturing level means counterfeit risks are low, but ensuring proper installation and component compatibility remains a key focus for downstream activities.

Automotive Carbon Ceramic Brakes Market Potential Customers

The primary and most critical customer base for the Automotive Carbon Ceramic Brakes Market comprises Original Equipment Manufacturers (OEMs) specializing in the ultra-high-performance and luxury segments. These manufacturers integrate the braking systems into vehicles where maximum speed, aggressive deceleration, and consistent track performance are core selling propositions. Examples include manufacturers of supercars, grand tourers, and specialized high-performance variants of standard models (e.g., Porsche GT series, Ferrari, McLaren, Aston Martin, and high-spec BMW M or Mercedes-AMG vehicles). Their purchasing decisions are driven by performance guarantees, component quality, and supplier capacity reliability.

The secondary, but rapidly expanding, customer segment involves the end-user base—affluent private consumers, professional racing teams, and specialized tuning houses. Affluent consumers purchasing high-end vehicles opt for carbon ceramic brakes primarily for performance superiority, aesthetic appeal (the distinctive look of large ceramic rotors and bright calipers), and the promise of exceptional longevity under typical road conditions. Racing teams and tuning houses represent the most demanding segment, prioritizing maximum heat resistance and weight reduction for competitive advantage, often purchasing through the aftermarket channel for upgrades and rapid replacement during the racing season. Specialized high-performance EV manufacturers also constitute a growing pool of potential customers, recognizing the necessity of these brakes to manage the immense kinetic energy of heavy battery packs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brembo S.p.A., Surface Transforms Plc, SGL Carbon SE, Akebono Brake Industry Co. Ltd., Federal-Mogul Corporation, Zox Corporation, Rotora Inc., Fusion Brakes, EBC Brakes, Baer Brakes, RacingBrake, StopTech, Wilwood Engineering, Alcon Components Ltd., PFC Brakes, Carbotech Engineering, Carbon Revolution, Movit, AP Racing, EBC Brakes Racing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Carbon Ceramic Brakes Market Key Technology Landscape

The technology landscape of the Automotive Carbon Ceramic Brakes Market is dominated by advanced material science and complex, energy-intensive manufacturing techniques centered on creating a durable, high-performance ceramic matrix composite (CMC). The core technology is the production of the C/SiC rotor, typically achieved through two primary proprietary methods: Chemical Vapor Deposition (CVD) or Liquid Silicon Infiltration (LSI). CVD involves depositing silicon carbide onto a porous carbon preform, which provides superior density and homogeneity but is extremely time-consuming and expensive. LSI is generally quicker and relatively less capital intensive, involving soaking a carbonized preform in molten silicon which then reacts to form the SiC matrix. Continuous innovation focuses on optimizing these processes to reduce the total production cycle time from weeks to days while maintaining structural integrity.

A secondary, yet crucial, area of technological advancement involves the formulation of specialized brake pads designed specifically to interact with the ceramic rotors. Unlike standard metallic pads, carbon ceramic-compatible pads require specific friction materials—often low-metallic or non-asbestos organic (NAO) compounds containing high amounts of friction modifiers—that minimize wear on the expensive rotor while providing consistent friction across a vast temperature range (from ambient start-up to over 1,000 degrees Celsius). Manufacturers are constantly refining these pad formulations to address common consumer complaints, such as noise (squealing) and brake dust, without compromising the thermal stability inherent in the ceramic system.

The integration of these braking systems with modern vehicle electronics, particularly those supporting Advanced Driver-Assistance Systems (ADAS) and high-performance electric powertrains, also defines the current technological landscape. New electronic components, including advanced sensors and monitoring systems, are being developed to measure the minute thermal expansion and wear of the ceramic rotors, providing critical feedback to the vehicle’s brake control module. Furthermore, research is ongoing into hybrid brake systems, which blend the benefits of carbon ceramic rotors (in terms of weight and high-temperature performance) with metal hat designs, aiming to optimize the component balance between cost, performance, and weight reduction, thereby potentially broadening the application scope to higher-volume premium segments.

Regional Highlights

The global market for Automotive Carbon Ceramic Brakes shows significant geographical concentration, mirroring the distribution of ultra-high-performance and luxury vehicle manufacturing and consumption.

- Europe: Europe holds the largest market share and remains the epicenter of innovation and production capacity. Countries like Germany (home to Porsche, Mercedes-AMG, and BMW M) and Italy (Ferrari, Lamborghini) mandate carbon ceramic brakes as key options for their performance flagships. The region benefits from established Tier 1 suppliers like Brembo and SGL Carbon, along with a rich motorsports ecosystem that drives continuous R&D. High disposable incomes and a strong cultural affinity for automotive engineering excellence ensure consistent OEM and high-end aftermarket demand.

- North America: North America represents the second-largest market, characterized by strong consumer demand for high-horsepower vehicles and a robust aftermarket tuning culture. While domestic OEM production of supercars is smaller, the high volume of imported luxury and performance vehicles ensures substantial demand. The aftermarket segment, driven by enthusiasts seeking track-day performance upgrades, is particularly vital here, often involving specialized distributors and installers catering to high-net-worth individuals.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid economic expansion, especially in China and emerging economies. The rising number of ultra-high-net-worth individuals in these countries is driving significant imports of European and American luxury and performance vehicles. Japan and South Korea also possess strong domestic OEM segments prioritizing technological integration and superior components. Government initiatives promoting high-end, technologically advanced automotive imports further boost market growth.

- Middle East and Africa (MEA): This region is a crucial, high-value consumer market, particularly the GCC countries, due to extreme wealth concentration and a strong inclination toward luxury and exotic vehicle ownership. Demand is almost exclusively centered on finished vehicle imports, making the region a strong driver for OEM installation growth rather than aftermarket activity. The extreme heat prevalent in parts of the region also highlights the necessary thermal stability offered by ceramic composites.

- Latin America: While currently a smaller contributor, market growth is focused on specific affluent pockets, primarily Brazil and Mexico. Demand is generally restricted to imported vehicles and is highly sensitive to macroeconomic volatility and import tariffs. The market structure here favors a very small, specialized aftermarket segment focused on service and replacement parts for imported high-end vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Carbon Ceramic Brakes Market.- Brembo S.p.A.

- Surface Transforms Plc

- SGL Carbon SE (Through Joint Ventures and Licensing)

- Akebono Brake Industry Co. Ltd.

- Federal-Mogul Corporation (Tenneco)

- Zox Corporation

- Rotora Inc.

- Fusion Brakes

- EBC Brakes

- Baer Brakes

- RacingBrake

- StopTech (Centric Parts)

- Wilwood Engineering

- Alcon Components Ltd.

- PFC Brakes (Performance Friction)

- Carbotech Engineering

- Carbon Revolution

- Movit

- AP Racing

- EBC Brakes Racing

Frequently Asked Questions

Analyze common user questions about the Automotive Carbon Ceramic Brakes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using carbon ceramic brakes over traditional iron brakes?

The primary benefit is superior thermal fade resistance under extreme use, combined with a significant reduction in unsprung mass (typically 50-70% lighter per rotor), which dramatically enhances vehicle handling, acceleration, and suspension performance.

Are carbon ceramic brakes suitable for everyday driving, and what is their typical lifespan?

Yes, they are suitable for everyday driving. Under normal road conditions, carbon ceramic rotors often exceed the lifespan of the vehicle itself. However, brake pads require replacement, and track usage will significantly accelerate rotor wear, necessitating specialized inspection.

Why are carbon ceramic brakes significantly more expensive than standard braking systems?

The high cost stems from the expensive raw materials (high-grade carbon fiber and silicon) and the complex, proprietary, and time-intensive manufacturing processes, which involve prolonged high-temperature treatments like Chemical Vapor Deposition (CVD) or Liquid Silicon Infiltration (LSI).

How does the shift to Electric Vehicles (EVs) impact the demand for carbon ceramic brakes?

While EVs use regenerative braking extensively, their heavy battery packs require powerful, reliable friction brakes as a safety and high-performance backup. Carbon ceramic brakes are increasingly essential for high-performance EVs to manage inertia, reduce weight, and ensure consistent braking under extreme thermal load.

What are the key maintenance differences for carbon ceramic brakes compared to conventional brakes?

Maintenance requires specialized, often proprietary, pads and rotors must be inspected using specific tools (sometimes proprietary gauges or advanced scanning) to detect microscopic cracking or delamination, which are signs of thermal stress, rather than simply measuring thickness reduction.

Is the manufacturing process for carbon ceramic brakes environmentally sustainable?

Currently, the manufacturing process is highly energy-intensive due to the prolonged, extremely high-temperature sintering and infiltration stages required. However, manufacturers are investing in process optimization and closed-loop systems to reduce energy consumption and improve material utilization efficiency, targeting long-term sustainability improvements.

Do carbon ceramic brakes perform well in cold or wet conditions?

Early generations exhibited some limitations in initial bite when cold or wet. However, modern C/SiC formulations and matching pad materials have largely mitigated these issues, offering excellent, predictable performance across various environmental conditions, though slightly longer warm-up periods may still be observed compared to iron brakes.

Which segments represent the highest growth potential in the carbon ceramic brakes market?

The highest growth potential is concentrated in the High-Performance SUV (HPSUV) segment and the high-end Battery Electric Vehicle (BEV) segment, as manufacturers look to equip these heavier, high-torque platforms with the necessary stopping power and weight-saving components.

What role do motorsports play in the development of commercial carbon ceramic brake technology?

Motorsports act as the primary crucible for technology validation. Extreme conditions encountered in Formula 1 and endurance racing drive immediate material innovations and manufacturing process refinements, which are then gradually transferred to high-performance road car applications, ensuring continuous product improvement.

What is the difference between Carbon Fiber Reinforced Ceramic (CFRC) and Carbon-Carbon (C/C) brakes?

Carbon-Carbon (C/C) brakes, used primarily in aerospace and specialized racing, are pure carbon matrices and are vulnerable to oxidation at high temperatures. Carbon Ceramic (C/SiC) brakes, used in road vehicles, incorporate silicon carbide, providing superior hardness, wear resistance, and high-temperature stability in atmospheric conditions, making them suitable for long-term road use.

How is digital manufacturing impacting the quality and cost structure of ceramic rotors?

Digital manufacturing, including advanced robotics and AI-driven process control, is enhancing quality assurance by monitoring microstructural uniformity during sintering. This precision reduces scrap rates and, in the long term, incrementally lowers the total manufacturing cost per unit, though significant cost reduction remains a challenge.

Which regions are leading in the consumption of high-performance luxury vehicles equipped with these brakes?

Europe and North America currently lead consumption due to historical market maturity, but the Asia Pacific region, particularly China and the Gulf Cooperation Council (GCC) countries in the Middle East, are accelerating rapidly and driving future growth in luxury vehicle sales.

What are the key material components used in the friction pads for ceramic brakes?

Key components include specialized ceramic compounds, non-asbestos organic (NAO) materials, complex resin binders, and various fillers designed to ensure high friction stability, minimal dusting, and long rotor life without excessive abrasive wear.

Do carbon ceramic brakes require a special type of brake fluid?

While the rotor material itself does not mandate a specific fluid type, the calipers paired with ceramic rotors often operate at significantly higher temperatures than standard systems, necessitating the use of high-performance brake fluids (DOT 4 or better, typically DOT 5.1 or racing fluids) with extremely high boiling points.

What technological advancements are being pursued to make ceramic brakes more affordable?

Research focuses on optimizing the silicon infiltration process (LSI advancements), developing hybrid rotor architectures that use C/SiC only on the friction surface, and exploring novel, faster curing processes to reduce the energy and time costs associated with traditional Chemical Vapor Deposition (CVD).

How does the weight reduction achieved by carbon ceramic brakes affect overall vehicle dynamics?

Reducing unsprung weight directly improves the suspension's ability to react quickly to road surface changes. This leads to better grip, enhanced steering precision, superior ride comfort, and overall more responsive handling characteristics, particularly during high-speed maneuvering and cornering.

Are there specific risks associated with repairing or replacing carbon ceramic rotors?

Yes, carbon ceramic rotors are brittle compared to iron and can be permanently damaged by impact or improper handling during maintenance. Additionally, replacement is extremely costly, and using non-approved pads can cause rapid and irreversible rotor wear, necessitating specialized dealer or professional service.

What is the typical ratio of OEM sales versus Aftermarket sales in this industry?

The OEM channel dominates, accounting for the vast majority of revenue (often over 75%), as these brakes are high-cost, factory-installed options. Aftermarket sales are primarily limited to expensive replacement cycles and high-performance vehicle modification and tuning segments.

What material science challenges are currently faced by manufacturers of ceramic rotors?

Manufacturers struggle with maintaining consistent density and preventing porosity or micro-cracking during the high-temperature synthesis phase. Balancing the ceramic matrix to optimize both friction coefficient and wear resistance under diverse temperature ranges remains a critical ongoing material science challenge.

Do carbon ceramic brakes generate brake dust?

Yes, but the dust generated is significantly less noticeable and chemically different from the black, abrasive dust produced by traditional metallic pads. Ceramic brake dust is generally lighter colored and less damaging to wheel finishes, though specific pad formulations can influence the amount and color of the residue.

Which vehicle segment is witnessing the fastest adoption rate of carbon ceramic brakes?

The High-Performance Sport Utility Vehicle (HPSUV) segment is currently demonstrating the fastest growth in adoption, driven by manufacturers integrating performance technology into larger, heavier platforms that necessitate the stopping power and weight benefits of ceramic systems.

How do global supply chain constraints affect the market for carbon ceramic brakes?

The market is highly susceptible to supply chain constraints due to reliance on specialized, high-purity carbon fiber and limited global capacity for the sophisticated, proprietary manufacturing equipment (kilns and CVD reactors). Geopolitical instability impacting raw material access can cause significant production bottlenecks for OEMs.

What is the role of 3D printing in the future development of carbon ceramic braking systems?

3D printing (Additive Manufacturing) is being explored for creating complex internal cooling channel structures in the ceramic preforms, optimizing airflow and thermal management within the rotor design, and potentially reducing material waste and lead times in the prototyping phase.

Are carbon ceramic brakes prone to noise (squealing)?

Squealing can occur, particularly at low speeds or when the brakes are cold, due to the unique vibration characteristics of the stiff ceramic material interacting with the specialized pads. Modern systems utilize advanced pad shims and dampening materials to minimize noise, but it remains a known characteristic under certain operating conditions.

What are the key differences in system requirements between ceramic brakes for road cars versus dedicated racing cars?

Road car ceramic brakes (C/SiC) are designed for longevity and all-weather performance. Dedicated racing systems (often C/C or specialized C/SiC) prioritize maximum friction coefficient at extreme temperatures, accepting a shorter lifespan and poor cold-weather performance in favor of peak track capability.

How is the aerospace industry technology influencing automotive carbon ceramic brake development?

Many material science principles and high-temperature manufacturing techniques, especially those related to carbon fiber preform creation and the Chemical Vapor Deposition (CVD) process, are direct transfers from the aerospace industry, where similar composite materials are used for thermal protection systems.

What is the influence of luxury vehicle customization trends on the brake market?

Customization trends drive demand for unique caliper colors and aesthetic treatments, as the visible, high-tech carbon ceramic rotors serve as a major visual differentiator. This pushes manufacturers to offer extensive personalization options for the braking system aesthetics as a premium feature.

How do manufacturers ensure the consistent high quality of carbon ceramic rotors?

Quality assurance relies heavily on non-destructive testing (NDT), including ultrasonic testing and computed tomography (CT) scanning, to inspect the internal microstructure for voids, cracks, or non-uniform density that could compromise the rotor’s integrity under thermal stress.

What is the impact of vehicle autonomy levels on the future demand for performance brakes?

High-level autonomy (Level 4/5) requires absolute reliability and predictable performance. While autonomous systems may drive more smoothly, the need for fail-safe, high-deceleration braking capability, particularly for heavy autonomous platforms, sustains the demand for premium components like carbon ceramic systems.

What are the typical weight savings achieved when replacing iron brakes with carbon ceramics?

Depending on the vehicle and rotor size, the total weight savings per vehicle typically ranges from 35 to 50 pounds (16 to 23 kilograms), contributing significantly to reduced unsprung weight, which is critical for dynamic vehicle performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager