Automotive Center Caps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435160 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Center Caps Market Size

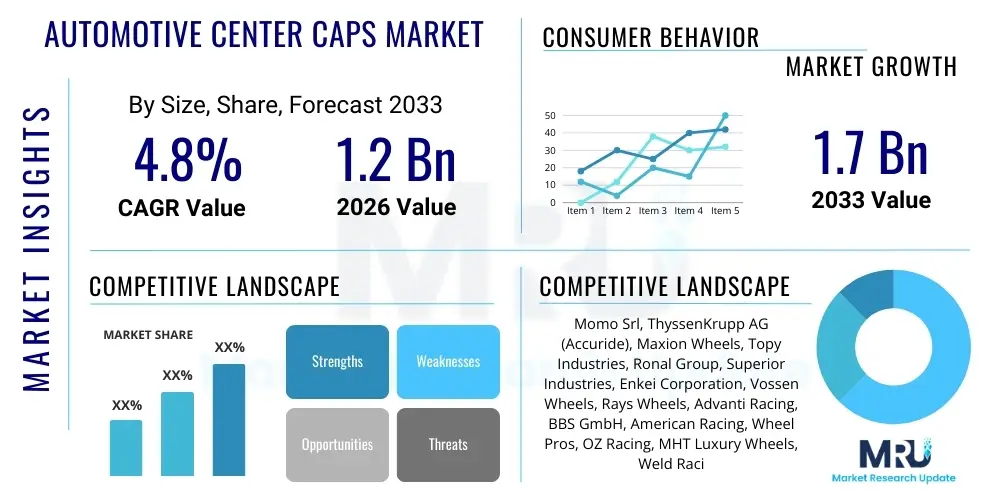

The Automotive Center Caps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.7 Billion by the end of the forecast period in 2033.

Automotive Center Caps Market introduction

The Automotive Center Caps Market encompasses the manufacturing and distribution of decorative and protective caps designed to fit into the center bore of automotive wheels. These components serve dual purposes: enhancing the aesthetic appeal of the vehicle, often featuring the manufacturer's logo or a custom design, and protecting the wheel hub assembly, bearings, and axle nuts from corrosive elements like dirt, moisture, and road salt. Center caps are critical elements in both Original Equipment Manufacturer (OEM) assembly and the aftermarket customization sector, acting as brand identifiers and contributing significantly to the overall visual integrity of the wheel and tire ensemble.

The product range is diverse, primarily categorized by material (ABS plastic, chrome, aluminum), method of attachment (snap-in, bolt-on), and compatibility with specific wheel types (steel, alloy). Major applications span across passenger vehicles, light commercial vehicles, and heavy-duty trucks. The increasing global production of vehicles, driven by rising consumer affluence in emerging economies, directly fuels the demand for center caps in the OEM segment. Furthermore, the robust aftermarket sector, focused on vehicle personalization and replacement of damaged or worn components, provides sustained revenue streams, especially as consumers seek premium or unique aesthetic upgrades.

Driving factors for this market include the sustained global growth of the automotive industry, particularly the high demand for customized wheels and accessories, and the continuous trend toward vehicle personalization. The benefits provided by center caps extend beyond aesthetics, offering crucial protection that prolongs the life of vulnerable hub components. Technological advancements in durable coatings and lightweight materials, coupled with stringent quality requirements from major automotive OEMs, are further shaping the market landscape, pushing manufacturers toward innovation in design robustness and material longevity.

Automotive Center Caps Market Executive Summary

The Automotive Center Caps Market demonstrates significant resilience, anchored by steady expansion in global vehicle production and robust demand within the aftermarket segment. Key business trends indicate a strong shift towards advanced, lightweight materials, particularly high-durability plastics and specialized alloy composites, aimed at meeting stringent weight reduction targets set by automotive manufacturers. The aesthetic component remains vital, driving innovation in surface finishes, including chrome plating, PVD coatings, and specialized paint applications, enabling higher perceived value and customization options for consumers globally. The competitive landscape is characterized by established OEM suppliers maintaining stringent quality standards and a highly fragmented aftermarket segment focused on rapid innovation and competitive pricing.

Regionally, the Asia Pacific (APAC) stands as the dominant market, primarily driven by mass production capabilities in China, India, and Japan, coupled with rapidly expanding vehicle parc and growing middle-class expenditure on vehicle maintenance and customization. North America and Europe, while representing mature markets, exhibit high demand for premium and custom-designed center caps, emphasizing high-margin specialty products. Trends across these regions suggest increasing outsourcing of accessory production, leading to growth opportunities for specialized component manufacturers capable of adhering to global quality certifications like ISO/TS 16949. Furthermore, digitalization in distribution, leveraging e-commerce platforms, is transforming the aftermarket supply chain.

Segment trends highlight the dominance of plastic (ABS/PC) center caps due to their cost-effectiveness, design flexibility, and light weight, although the aluminum segment continues to grow in the luxury and performance vehicle categories where premium aesthetics are paramount. By vehicle type, passenger cars represent the largest application, closely followed by light commercial vehicles which require robust, durable caps suitable for diverse operational environments. The market exhibits clear segmentation where OEMs prioritize longevity and branding integration, while the aftermarket focuses on rapid product cycles, diversity of design, and accessibility through online retail channels.

AI Impact Analysis on Automotive Center Caps Market

User inquiries regarding the impact of AI on the Automotive Center Caps Market frequently center on three main themes: optimizing the manufacturing process for complex geometries, enhancing quality control consistency across high-volume production runs, and personalizing design through generative algorithms. Users are concerned about how AI-driven simulation can reduce material waste and shorten the design-to-production cycle for new wheel styles. Specific questions address the use of computer vision systems integrated with machine learning (ML) to detect microscopic flaws in surface coatings and intricate logo detailing, ensuring A-class surface quality. Expectations are high that AI will lead to predictive maintenance in injection molding machinery and automated inventory management, optimizing the just-in-time delivery model crucial for Tier 1 suppliers in this low-cost, high-volume component category.

- AI-Powered Generative Design: Utilized for rapid prototyping and simulation of complex cap geometries, optimizing material usage (e.g., lightweight polymers) while ensuring structural integrity and aerodynamic performance.

- Machine Vision Quality Control (QC): Implementation of ML-driven vision systems capable of real-time inspection of aesthetic quality, checking for imperfections, color consistency, and logo alignment with sub-millimeter precision, exceeding human inspection capabilities.

- Predictive Maintenance: AI algorithms analyzing sensor data from injection molding and plating equipment to forecast potential mechanical failures, significantly reducing unplanned downtime and maintaining consistent production throughput.

- Supply Chain Optimization: ML models enhancing inventory management and logistics planning, particularly managing the fluctuating demand between OEM schedules and highly seasonal aftermarket requirements.

- Automated Tooling Optimization: AI applied to simulate thermal and stress distribution during the molding process, prolonging the lifespan of expensive molds and ensuring dimensional accuracy across millions of units.

DRO & Impact Forces Of Automotive Center Caps Market

The Automotive Center Caps Market is primarily driven by the consistent global growth in new vehicle registrations, which directly dictates OEM procurement volumes. The pervasive trend of vehicle personalization and customization, particularly the adoption of alloy wheels in entry-level and mid-range vehicles, significantly bolsters the aftermarket sector. Moreover, the necessity of replacing damaged or faded center caps, driven by environmental exposure and road debris, ensures a steady, non-discretionary replacement market demand. These core drivers create a persistent market requirement, making center caps an indispensable accessory both functionally and aesthetically.

However, market growth faces restraints, notably the intense price competition, particularly in the mass-market plastic segment, leading to compressed profit margins. Counterfeiting and the prevalence of low-quality unauthorized products, especially in emerging economies, pose significant threats to brand reputation and market integrity for established manufacturers. Furthermore, strict environmental regulations concerning the use of certain plating chemicals and the disposal of composite materials necessitate significant investment in sustainable manufacturing processes, adding to operational complexity and cost.

Opportunities for expansion lie heavily in leveraging advanced manufacturing technologies, such as additive manufacturing (3D printing) for niche, custom-designed, or limited-edition caps, catering to high-end customization desires. Developing highly durable, anti-scratch, and UV-resistant coatings using nanotechnology presents a significant value proposition, justifying premium pricing. The increasing popularity of electric vehicles (EVs), which often incorporate unique aerodynamic wheel designs requiring specialized cap solutions, opens a new, high-growth application segment. The impact forces are characterized by moderate technological disruption through automation, high regulatory scrutiny concerning material sustainability, and intense competitive rivalry, particularly between domestic Asian suppliers and established Western Tier 2 component manufacturers.

Segmentation Analysis

The Automotive Center Caps Market is extensively segmented based on material type, vehicle type, and distribution channel, providing a clear framework for analyzing market dynamics and competitive positioning. Material segmentation highlights the trade-offs between cost-efficiency (plastics) and aesthetic value/durability (metals). Vehicle type segmentation dictates the volume requirements and quality standards, with passenger vehicles demanding the highest volumes but light commercial vehicles requiring greater physical robustness. The distribution channel analysis is crucial for understanding the revenue streams, differentiating between the high-volume, quality-controlled OEM channel and the highly diversified, e-commerce-driven Aftermarket channel.

- By Material Type:

- Plastic (ABS, Polycarbonate, Nylon)

- Metals (Aluminum, Chrome Plated Steel)

- Composite Materials

- By Vehicle Type:

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

- By Cap Type:

- Snap-in

- Bolt-on

- Wire Clip

Value Chain Analysis For Automotive Center Caps Market

The value chain for automotive center caps is characterized by a high reliance on raw material procurement, specialized manufacturing processes, and highly regulated downstream distribution. Upstream analysis involves sourcing raw materials, primarily specialized engineering plastics like ABS and PC/ABS blends for high impact resistance, and high-grade aluminum alloys. Suppliers must maintain rigorous quality standards and offer consistent material batches suitable for injection molding and subsequent plating or coating processes. Fluctuations in petrochemical and aluminum prices significantly impact upstream costs, requiring manufacturers to implement sophisticated hedging strategies and long-term supply contracts to maintain competitive pricing.

The manufacturing stage involves detailed design (often dictated by the OEM), mold creation, injection molding or die-casting, followed by critical secondary operations such as surface finishing (e.g., chrome plating, painting, PVD coating), logo application (e.g., pad printing, laser etching), and rigorous quality inspection. Direct and indirect distribution channels define the downstream movement. The direct channel focuses on OEM contracts, characterized by large, scheduled bulk deliveries and tight tolerance quality assurance. The indirect channel involves wholesalers, retailers, specialized automotive parts stores, and increasingly, direct-to-consumer e-commerce platforms for the aftermarket segment.

The distribution network is bifurcated: OEM delivery requires localized manufacturing close to assembly plants (JIT delivery), whereas the aftermarket relies heavily on efficient global logistics and warehousing capabilities to cater to diverse consumer demands for thousands of different cap designs and sizes. Success in the aftermarket requires strong brand recognition, robust inventory management for slow-moving parts, and digital marketing proficiency. Value addition primarily occurs during the mold design and the complex surface treatment stages, where durable, aesthetically superior finishes command higher market prices.

Automotive Center Caps Market Potential Customers

The primary customers for automotive center caps are broadly categorized into Original Equipment Manufacturers (OEMs) and the diverse Aftermarket (AM) segment. OEMs, including global automotive giants such as Toyota, Volkswagen, Ford, and BMW, represent the highest volume buyers, requiring mass-produced caps integrated perfectly with their factory-installed wheels. These customers prioritize long-term contractual stability, adherence to stringent quality control documentation (e.g., PPAP), and consistent material quality, often resulting in long procurement cycles but guaranteed high volumes.

The aftermarket consists of multiple layers of buyers. This includes wholesale distributors who supply regional parts retailers and independent garages for repair and replacement purposes. Furthermore, specialist wheel manufacturers (e.g., BBS, Enkei, Vossen) also procure center caps, either customized or branded, for their proprietary wheel lines. Finally, end-users purchasing directly through online platforms or retail stores represent a growing segment, particularly those seeking performance upgrades or aesthetic personalization. The key difference in serving AM customers is the need for product diversity, shorter lead times, and competitive pricing for smaller batch sizes.

Servicing OEMs demands sophisticated engineering capabilities and ISO certifications, while catering to the aftermarket necessitates a wide product catalog, effective digital cataloging, and competitive logistics solutions. Specialized customers, such as restoration shops or custom car builders, also represent a high-value niche, often requiring bespoke or vintage-style center caps produced through low-volume custom manufacturing runs. Understanding these distinct purchasing behaviors—volume vs. customization—is critical for market segmentation and sales strategy alignment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Momo Srl, ThyssenKrupp AG (Accuride), Maxion Wheels, Topy Industries, Ronal Group, Superior Industries, Enkei Corporation, Vossen Wheels, Rays Wheels, Advanti Racing, BBS GmbH, American Racing, Wheel Pros, OZ Racing, MHT Luxury Wheels, Weld Racing, Center Cap Store, Discount Tire, GKN Wheels, Konig Wheels. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Center Caps Market Key Technology Landscape

The core technology underpinning the Automotive Center Caps Market remains high-precision injection molding for plastic components and low-pressure die casting or forging for metallic caps. Recent technological advancements, however, focus heavily on improving surface durability, achieving complex aesthetic finishes, and optimizing lightweight material usage. Advanced multi-shot injection molding allows manufacturers to produce two-tone or multi-material caps in a single cycle, enhancing design possibilities while maintaining efficiency. Precision tooling, often utilizing advanced computer-numerical control (CNC) machining and electrode discharge machining (EDM), is crucial to ensure the molds produce components with the extremely tight tolerances required for secure fitment and integration with diverse wheel designs.

Surface finishing represents a critical technological frontier. Traditional chrome plating is being supplemented or replaced by Physical Vapor Deposition (PVD) coating, which offers superior environmental compliance (avoiding toxic plating chemicals) while providing highly durable, metallic finishes in various colors. Furthermore, specialized clear coats and UV-resistant polymers are incorporated to protect the underlying material and decorative logos from environmental degradation, road chemicals, and persistent sunlight exposure. The adoption of laser etching technology for permanent, high-resolution branding and serialization is also becoming a standard practice for premium OEM caps.

Digital technology is increasingly integrated into the design and production workflow. Computer-Aided Engineering (CAE) software is used extensively to simulate fitment, stress points, and thermal expansion, ensuring the cap remains securely fastened under diverse operational conditions, from extreme heat to vibration. For low-volume customization and rapid prototyping, Additive Manufacturing (3D Printing) technologies, particularly Selective Laser Sintering (SLS) and Stereolithography (SLA), are utilized to produce unique, high-detail caps efficiently, bypassing the high initial costs associated with traditional hard tooling.

Regional Highlights

Regional dynamics play a crucial role in shaping the Automotive Center Caps Market, influenced by varying levels of vehicle production, consumer spending power on accessories, and regulatory standards.

- Asia Pacific (APAC): APAC commands the largest share of the global market, primarily driven by massive vehicle production volumes in China, India, Japan, and South Korea. This region serves as the global manufacturing hub for low-cost, high-volume components. The market here is characterized by fierce competition, high adoption rates of replacement parts due to large vehicle parc, and rapidly rising demand for vehicle customization among affluent urban populations. The emphasis is on scalable production efficiency and controlling manufacturing costs, making it the epicenter for plastic center cap manufacturing.

- North America: North America represents a mature, high-value market where the demand is driven significantly by the aftermarket customization segment, particularly for light trucks, SUVs, and performance vehicles. Consumers often prefer high-quality, branded aluminum and chrome-plated caps. Stringent quality standards for durability and fitment are required, and the growth is supported by a strong e-commerce distribution network, facilitating direct-to-consumer sales of premium accessory brands. The region also hosts significant R&D centers focused on material science and coating technologies.

- Europe: The European market is characterized by high demand for premium aesthetics and adherence to strict environmental regulations, particularly concerning chemical usage in finishing processes. The OEM segment is strong, driven by major German, French, and Italian luxury vehicle manufacturers who prioritize design integration and high-durability finishes. The region shows a preference for integrated, aerodynamic cap designs, especially as EV penetration increases, which requires specialized components that minimize drag and complement specific alloy wheel designs.

- Latin America & MEA: These emerging regions show steady growth, primarily fueled by rising disposable incomes and expanding automotive manufacturing bases (e.g., Brazil, Mexico, South Africa). The market remains price-sensitive, with strong demand for basic, durable plastic center caps. Growth in the aftermarket is accelerating as vehicles age and replacement cycles shorten, providing opportunities for both local and international manufacturers focused on robust distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Center Caps Market.- Momo Srl

- ThyssenKrupp AG (Accuride)

- Maxion Wheels

- Topy Industries

- Ronal Group

- Superior Industries

- Enkei Corporation

- Vossen Wheels

- Rays Wheels

- Advanti Racing

- BBS GmbH

- American Racing

- Wheel Pros

- OZ Racing

- MHT Luxury Wheels

- Weld Racing

- Center Cap Store

- Discount Tire

- GKN Wheels

- Konig Wheels

Frequently Asked Questions

Analyze common user questions about the Automotive Center Caps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used for automotive center caps and why?

The primary materials are ABS (Acrylonitrile Butadiene Styrene) plastic and aluminum alloys. ABS plastic is favored for its low cost, impact resistance, and ease of molding and plating, making it ideal for high-volume mass-market vehicles. Aluminum is used in premium and performance segments due to its superior durability, aesthetic appeal (often chrome or painted), and ability to withstand higher heat loads from performance braking systems.

How is the growth of the electric vehicle (EV) market impacting the demand for center caps?

The EV market is driving demand for highly specialized, aerodynamic center caps. EVs require wheels designed to minimize drag to maximize battery range. Manufacturers are developing custom, flush-fitting caps and full wheel covers, often made from lightweight composites, to improve vehicle efficiency, positioning these components as crucial functional elements rather than purely decorative accessories.

What are the key differences between OEM and Aftermarket center cap segments?

The OEM segment demands extremely high volumes, stringent quality certifications (TS 16949), and long-term supply contracts focused on branding integration and tight dimensional tolerances. The Aftermarket (AM) is characterized by product diversity, smaller batch sizes, a focus on unique customization/design aesthetics, shorter product lifecycles, and distribution heavily reliant on e-commerce and specialized retail channels.

What are the current technological trends in surface finishing for center caps?

Current trends are shifting away from traditional wet chrome plating toward more environmentally sustainable processes like Physical Vapor Deposition (PVD) coating. PVD offers superior scratch resistance, a variety of metallic finishes, and reduced toxic waste. UV-resistant clear coats and nanotechnology-based protective layers are also critical to ensure long-term aesthetic integrity against harsh weather and cleaning agents.

How does counterfeiting affect the Automotive Center Caps Market?

Counterfeiting is a significant restraint, particularly impacting the aftermarket for popular high-end brands. Illegitimate products undermine consumer trust, dilute brand equity, and introduce safety risks due to inferior material quality or poor fitment. Leading manufacturers combat this by implementing serial numbers, holographic tags, and strict enforcement of intellectual property rights, particularly in high-growth regions like APAC.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager