Automotive Cockpit Modules Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439965 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Automotive Cockpit Modules Market Size

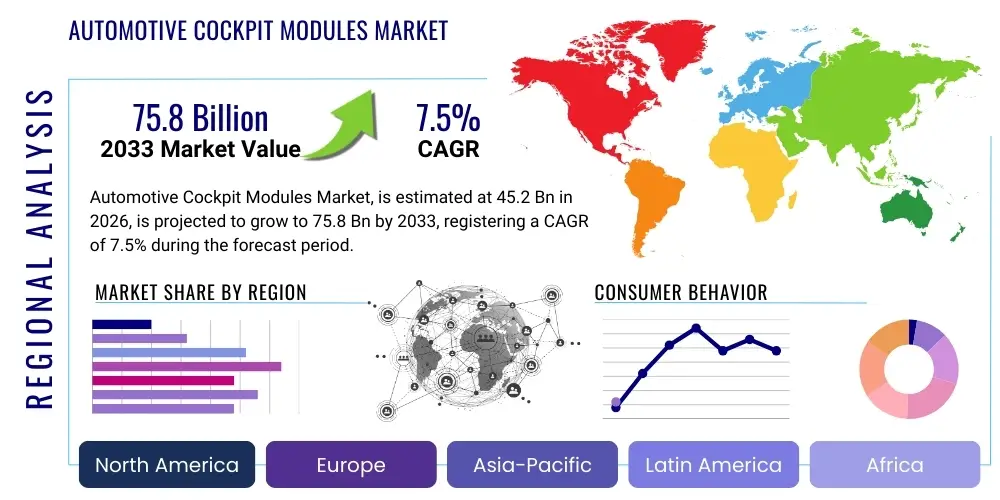

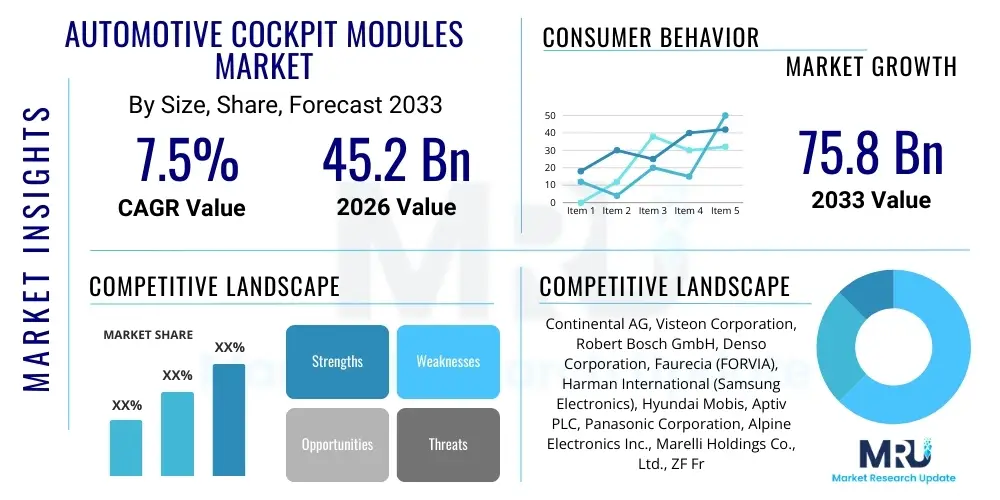

The Automotive Cockpit Modules Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 75.8 Billion by the end of the forecast period in 2033.

Automotive Cockpit Modules Market introduction

The automotive cockpit modules market encompasses the design, development, and integration of various interconnected systems that form the primary interface between the driver/occupants and the vehicle. These modules have evolved significantly from basic instrument clusters to highly sophisticated, multi-functional digital cockpits that integrate infotainment, navigation, advanced driver-assistance systems (ADAS), and connectivity features into a seamless, user-centric experience. Key product descriptions include integrated central control units, digital instrument clusters, head-up displays (HUDs), advanced human-machine interfaces (HMIs) with touchscreens, voice control, and gesture recognition, as well as ambient lighting and climate control interfaces. Major applications span across passenger vehicles, commercial vehicles, and increasingly, electric and autonomous vehicles, where the cockpit becomes a vital hub for information and control. The benefits derived from these advanced modules include enhanced safety through reduced driver distraction and improved situational awareness, increased comfort and convenience for occupants, superior aesthetic appeal, and robust connectivity for real-time data access and over-the-air updates. Driving factors for this market's expansion are predominantly centered around the escalating consumer demand for connected car features, personalized in-cabin experiences, stringent safety regulations necessitating advanced ADAS integration, the rapid proliferation of electric vehicles with their unique digital architecture, and the continuous technological advancements in display, sensor, and processing capabilities that enable more sophisticated and intuitive cockpit designs.

Automotive Cockpit Modules Market Executive Summary

The automotive cockpit modules market is currently undergoing a transformative phase, driven by several key business, regional, and segment trends. From a business perspective, original equipment manufacturers (OEMs) and Tier-1 suppliers are increasingly focusing on strategic partnerships, collaborations, and mergers and acquisitions to pool resources, accelerate technological development, and gain a competitive edge in integrated solutions. There is a strong emphasis on software-defined cockpits, predictive maintenance, and cybersecurity to enhance system reliability and user trust, prompting significant R&D investments in these areas. Regional trends indicate Asia-Pacific as the dominant and fastest-growing market, primarily due to the burgeoning automotive production, rising disposable incomes, and rapid adoption of advanced vehicle technologies in countries like China, India, Japan, and South Korea. Europe and North America also remain strong markets, characterized by stringent safety regulations, a high demand for premium and luxury vehicle segments, and pioneering efforts in autonomous driving technology integration. Segment-wise, the market is witnessing a pronounced shift towards larger, higher-resolution digital displays, multi-screen setups, and augmented reality head-up displays, reflecting a demand for more immersive and informative interfaces. The integration of advanced HMI technologies, including sophisticated voice assistants, haptic feedback, and camera-based gesture recognition, is gaining traction. Furthermore, the increasing penetration of electric vehicles (EVs) is driving demand for specific cockpit module designs that prioritize energy efficiency, battery management information display, and novel interior aesthetics tailored for the EV ecosystem, signaling a clear trajectory towards more personalized, connected, and intelligent automotive interiors across all vehicle categories.

AI Impact Analysis on Automotive Cockpit Modules Market

User inquiries about AI's influence on automotive cockpit modules frequently revolve around its potential to revolutionize the in-car experience, enhance safety, and enable greater personalization. Common questions delve into how AI will facilitate more intuitive human-machine interaction, improve decision-making for autonomous features, provide predictive capabilities for maintenance, and tailor cabin environments to individual preferences. There's also significant interest in AI's role in cybersecurity for connected cockpits and optimizing manufacturing processes. Based on this analysis, the pervasive theme is an expectation that AI will transition the cockpit from a mere control panel into an intelligent co-pilot and personalized living space. It's anticipated to drive innovation in adaptive interfaces, natural language processing for voice commands, real-time data analytics for vehicle health, and context-aware responses, fundamentally changing how occupants interact with their vehicles and the surrounding digital ecosystem, while also presenting concerns related to data privacy, system reliability, and ethical considerations in autonomous decision-making.

- Enhanced Human-Machine Interface (HMI): AI powers advanced voice recognition and natural language processing, enabling more intuitive, conversational control of vehicle functions and infotainment systems, significantly reducing driver distraction. It also supports sophisticated gesture recognition and eye-tracking, allowing for hands-free and gaze-based interactions, thereby making the cockpit more responsive and user-friendly.

- Personalized User Experience: AI algorithms learn driver and passenger preferences over time, adapting climate control settings, seat positions, infotainment playlists, navigation routes, and even ambient lighting to individual profiles. This creates a highly customized and anticipatory environment, automatically adjusting to the occupant's mood or historical choices, thereby improving comfort and satisfaction.

- Predictive Diagnostics and Maintenance: AI analyzes real-time sensor data from various vehicle components to predict potential malfunctions or maintenance needs for the cockpit modules themselves, or other vehicle systems. This proactive approach helps prevent breakdowns, schedules timely servicing, and extends the lifespan of components, optimizing vehicle uptime and reducing operational costs.

- Integration with Autonomous Driving Systems: As vehicles become more autonomous, AI in the cockpit facilitates seamless transitions between manual and automated driving modes, providing clear and concise information about the vehicle's autonomy status, environmental perceptions, and planned maneuvers. It also manages passenger monitoring for engagement and safety during automated operations, ensuring a secure and informed experience.

- Advanced Driver Monitoring and Safety: AI-powered cameras and sensors monitor driver attention, fatigue, and potential distractions, issuing alerts or intervening if necessary. This capability significantly enhances active safety by understanding the driver's state and surroundings, contributing to collision prevention and promoting safer driving habits.

- Manufacturing and Design Optimization: AI is increasingly used in the design and manufacturing phases of cockpit modules for generative design, predictive quality control, and optimizing assembly processes. This leads to more efficient production, reduced waste, improved component reliability, and faster iteration cycles for new designs, ultimately lowering production costs and time-to-market.

DRO & Impact Forces Of Automotive Cockpit Modules Market

The automotive cockpit modules market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, each contributing to its dynamic evolution. Key drivers propelling market growth include the escalating global demand for advanced safety features, connectivity solutions, and enhanced in-car user experiences, largely fueled by rising consumer expectations for digital integration and seamless interaction with their vehicles. The rapid proliferation of electric vehicles (EVs) and autonomous driving technologies also acts as a major catalyst, as these vehicles necessitate sophisticated digital cockpits for displaying critical information like battery status, range, and intricate ADAS data, along with enabling novel passenger experiences. Restraints, however, pose significant challenges to the market's trajectory; these primarily encompass the high research and development (R&D) costs associated with developing cutting-edge technologies, the inherent complexity of integrating diverse systems from multiple vendors into a cohesive module, and the persistent concerns around cybersecurity risks that could compromise connected cockpits and sensitive user data. Additionally, supply chain disruptions and the intense competition among market players to innovate while maintaining cost-effectiveness also present considerable hurdles. Amidst these challenges, substantial opportunities emerge, particularly in the realm of software-defined cockpits that allow for over-the-air (OTA) updates and feature customization, catering to evolving consumer preferences and extending vehicle lifecycle value. The untapped potential in emerging markets, coupled with the development of new display technologies like augmented reality (AR) HUDs and flexible OLEDs, offers avenues for significant market expansion and differentiation. The push towards sustainable manufacturing processes and the exploration of new, lightweight, and recyclable materials for cockpit components also present long-term growth prospects, aligning with broader industry trends towards environmental responsibility and resource efficiency, thereby shaping the impact forces of innovation, regulation, and consumer demand across the automotive ecosystem.

Segmentation Analysis

The automotive cockpit modules market is segmented across various critical dimensions to provide a comprehensive understanding of its structure, growth dynamics, and emerging trends. These segmentations allow for detailed analysis of market performance based on different product categories, technological approaches, vehicle types, and geographical regions, reflecting the diverse requirements and preferences within the global automotive industry. Understanding these distinct segments is crucial for stakeholders to identify niche opportunities, tailor product development strategies, and optimize market penetration in a highly competitive landscape.

- By Component: This segment analyzes the individual technological elements that constitute a complete cockpit module.

- Display Systems: Includes various screen technologies such as LCD, TFT, OLED, and increasingly, curved and free-form displays for instrument clusters, central information displays (CIDs), and passenger displays.

- Instrument Clusters: Traditional analog, semi-digital, and full-digital clusters providing essential driving information.

- Head-Up Displays (HUDs): Conventional projection HUDs and advanced Augmented Reality (AR) HUDs that overlay navigation and ADAS information onto the driver's field of view.

- Infotainment Systems: Central processing units, multimedia players, navigation systems, and connectivity modules (Bluetooth, Wi-Fi, 5G).

- Human-Machine Interface (HMI) Solutions: Touchscreens, haptic feedback systems, rotary controllers, voice control systems, and gesture recognition sensors.

- Telematics Units: Systems for vehicle tracking, emergency calls (eCall), remote diagnostics, and concierge services.

- Control Panels: Buttons, switches, and other physical interfaces for climate control, audio, and vehicle settings.

- Driver Monitoring Systems (DMS): Cameras and sensors to detect driver fatigue, distraction, and engagement.

- Connectivity Modules: Modules enabling vehicle-to-everything (V2X) communication, Wi-Fi hotspots, and smartphone integration.

- By Vehicle Type: This segmentation differentiates market demand based on the end-use application of the modules.

- Passenger Cars: The largest segment, including sedans, SUVs, hatchbacks, and luxury vehicles, with a high demand for advanced digital features and personalized experiences.

- Commercial Vehicles: Trucks, buses, and vans, where robust and functional cockpits are prioritized for fleet management, navigation, and driver productivity.

- Electric Vehicles (EVs): A rapidly growing segment requiring specialized cockpit designs to display battery status, charging information, and energy consumption, often featuring minimalist and futuristic aesthetics.

- By Technology: Categorizes modules based on their level of technological sophistication and integration.

- Conventional Cockpit Modules: Typically found in entry-level and older vehicles, featuring analog gauges and basic infotainment systems.

- Digital Cockpit Modules: Incorporate full-digital instrument clusters and larger central displays, offering more customization and advanced graphics.

- Smart Cockpit Modules: Represent the cutting edge, integrating AI, advanced HMI, extensive connectivity, multi-screen setups, and cloud-based services for a highly intelligent and personalized experience.

- By Sales Channel: Distinguishes between modules supplied for new vehicle assembly and those for aftermarket upgrades or replacements.

- OEM (Original Equipment Manufacturer): Modules supplied directly to vehicle manufacturers for integration into new vehicles. This is the dominant channel.

- Aftermarket: Components and systems sold for installation or upgrade in vehicles after their initial sale, though less prominent for fully integrated cockpit modules.

- By End-User Application: Focuses on the specific use-case or type of vehicle.

- Entry-Level Vehicles: Basic functionalities, cost-effective solutions.

- Mid-Range Vehicles: Balance of features and cost, some digital integration.

- Luxury and Premium Vehicles: High-end, fully integrated, and personalized smart cockpits with advanced HMI and connectivity.

Value Chain Analysis For Automotive Cockpit Modules Market

The value chain for the automotive cockpit modules market is intricate, involving a series of specialized stages from raw material procurement to final vehicle assembly and aftermarket support, highlighting the interconnectedness of various industry players. The upstream segment primarily consists of raw material suppliers providing semiconductors, display panels, plastics, metals, and specialized chemicals, followed by component manufacturers who produce microcontrollers, sensors, display drivers, and various electronic parts that form the building blocks of cockpit modules. These components are then integrated by Tier-2 and Tier-1 suppliers who specialize in designing and assembling complex sub-systems like digital instrument clusters, infotainment units, and complete cockpit modules, often working closely with automotive OEMs to meet specific vehicle requirements. Downstream analysis focuses on the distribution channels, which are predominantly direct, with Tier-1 suppliers delivering integrated modules directly to automotive original equipment manufacturers (OEMs) for assembly into new vehicles on production lines. Indirect channels, while less significant for complete modules, exist for specific aftermarket components or software updates delivered through authorized service centers or digital platforms. The market also sees collaboration between traditional automotive suppliers and technology firms, blurring the lines of the conventional value chain and emphasizing the shift towards a more software- and services-oriented ecosystem. This complex network necessitates robust logistics, quality control, and strategic partnerships across all stages to ensure seamless product flow and innovation.

Automotive Cockpit Modules Market Potential Customers

The primary potential customers for the automotive cockpit modules market are overwhelmingly original equipment manufacturers (OEMs) within the global automotive industry. These encompass major passenger car manufacturers, including luxury brands, mass-market producers, and emerging electric vehicle (EV) startups, all requiring sophisticated and integrated cockpit solutions for their diverse vehicle lineups. Commercial vehicle manufacturers, producing trucks, buses, and vans, also represent a significant customer segment, albeit with different priorities focusing on durability, functionality, and fleet management integration rather than solely luxury or entertainment. Tier-1 automotive suppliers, who often act as integrators, are also key purchasers of individual components and technologies from sub-suppliers to assemble complete modules before delivering them to OEMs. Beyond new vehicle manufacturing, the aftermarket segment, comprising vehicle owners seeking upgrades, specialized customization shops, and independent repair facilities, represents a smaller but growing base for certain modular components like infotainment systems or digital instrument clusters, particularly as older vehicles are retrofitted with newer technologies to enhance their functionality and extend their useful life. Emerging service providers focused on connected car services and data analytics also indirectly influence demand, as their offerings often rely on the capabilities embedded within modern cockpit modules. Therefore, the customer base is diverse, driven by both immediate production needs and long-term technological evolution in the automotive sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 75.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Visteon Corporation, Robert Bosch GmbH, Denso Corporation, Faurecia (FORVIA), Harman International (Samsung Electronics), Hyundai Mobis, Aptiv PLC, Panasonic Corporation, Alpine Electronics Inc., Marelli Holdings Co., Ltd., ZF Friedrichshafen AG, Pioneer Corporation, Garmin Ltd., Clarion Co., Ltd. (Hitachi Astemo), Magna International Inc., Yanfeng Automotive Interiors, Panasonic Automotive Systems Co., Ltd., Ficosa International, Desay SV Automotive. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Cockpit Modules Market Key Technology Landscape

The automotive cockpit modules market is characterized by a rapidly evolving technological landscape, driven by the relentless pursuit of enhanced user experience, safety, and connectivity. Central to this evolution are advanced display technologies, moving beyond traditional LCDs to embrace high-resolution, curved, and free-form OLED and TFT displays that offer superior aesthetics, deeper blacks, and greater design flexibility, creating immersive visual environments. Human-Machine Interface (HMI) advancements are critical, with multi-modal interaction systems combining sophisticated voice recognition powered by natural language processing, intuitive gesture control facilitated by infrared sensors and cameras, and haptic feedback on touchscreens to provide tactile confirmations, thereby reducing driver distraction and improving usability. Connectivity solutions are foundational, integrating 5G modules, Wi-Fi hotspots, and Vehicle-to-Everything (V2X) communication capabilities to enable real-time traffic updates, cloud-based services, over-the-air (OTA) software updates, and seamless smartphone integration. Augmented Reality Head-Up Displays (AR HUDs) represent a significant leap, projecting contextual information directly onto the driver's view of the road, enhancing navigation and ADAS warnings. Integrated electronic control units (ECUs) and high-performance system-on-chips (SoCs) are consolidating various cockpit functions into a single, powerful domain controller, simplifying architecture, improving processing speed, and enabling complex AI-driven features. Furthermore, advanced sensor technologies, including interior cameras for driver monitoring systems (DMS) and occupant sensing, are crucial for personalized safety features and future autonomous driving capabilities. Cybersecurity measures, encompassing hardware security modules and secure boot mechanisms, are paramount to protect these interconnected systems from potential threats. Lastly, the adoption of sustainable and lightweight materials, along with energy-efficient component design, is becoming increasingly important to meet environmental regulations and optimize vehicle performance in the context of electric mobility, collectively shaping a highly sophisticated and interconnected digital cockpit ecosystem.

Regional Highlights

- North America: This region represents a mature and technologically advanced market for automotive cockpit modules, driven by a strong demand for premium and luxury vehicles, early adoption of advanced driver-assistance systems (ADAS), and a robust ecosystem for connected car technologies. Key factors include stringent safety regulations that necessitate advanced HMI and display systems, a high penetration of digital infotainment, and significant investments in autonomous vehicle research and development by both traditional OEMs and technology giants. Consumers in North America prioritize seamless smartphone integration, comprehensive navigation, and sophisticated voice control, pushing manufacturers to continuously innovate in these areas. The presence of major automotive players and a strong semiconductor industry also fosters technological advancements and competitive dynamics within the region, ensuring a steady stream of cutting-edge cockpit solutions.

- Europe: Europe is a significant market characterized by a strong emphasis on innovation, high quality standards, and environmental consciousness. The region leads in the adoption of advanced display technologies, sophisticated HMI, and increasingly, augmented reality (AR) features in cockpit modules, particularly within its luxury and premium automotive segments. Strict emissions regulations are accelerating the transition to electric vehicles (EVs), which in turn drives demand for specialized digital cockpits optimized for EV-specific information and user experience. Moreover, European consumers prioritize both safety and aesthetic design, prompting manufacturers to integrate ADAS information elegantly into digital clusters and central displays, alongside personalized ambient lighting and premium material finishes. The presence of leading Tier-1 suppliers and a culture of collaborative research among industry players further fuels the development and market penetration of advanced cockpit module technologies.

- Asia Pacific (APAC): The Asia Pacific region stands as the largest and fastest-growing market for automotive cockpit modules, primarily fueled by the burgeoning automotive production volumes, rapid economic growth, and increasing disposable incomes in countries like China, India, Japan, and South Korea. This region exhibits a dual demand: on one hand, a strong appetite for entry-level and mid-range vehicles integrating basic digital cockpits and connectivity; on the other, a rapidly expanding luxury segment demanding highly sophisticated, AI-driven smart cockpits with extensive personalization and advanced infotainment. China, in particular, is a powerhouse, driving innovation in large-format displays, multi-screen cockpits, and advanced human-machine interfaces, often integrating localized digital ecosystems and services. The rapid electrification of the automotive fleet across the region also creates substantial demand for cockpit modules specifically designed for EVs, displaying critical battery and range information, making APAC a critical hub for both manufacturing and consumption.

- Latin America: The Latin American market for automotive cockpit modules is characterized by moderate growth, largely influenced by economic stability and increasing vehicle penetration. While demand for highly advanced smart cockpits is emerging in higher-end segments, the mainstream market still focuses on digital and semi-digital clusters with essential infotainment and connectivity features that balance cost-effectiveness with modern functionality. Safety features, particularly those mandated by local regulations, are becoming increasingly important, driving the integration of basic ADAS displays within cockpit modules. Local manufacturing capacities and regional trade agreements play a significant role in market dynamics, influencing supply chains and product availability. As disposable incomes rise and urbanization continues, there is a gradual shift towards vehicles equipped with more sophisticated digital interfaces, although adoption rates for cutting-edge technologies may lag behind more developed regions.

- Middle East and Africa (MEA): The MEA region presents a diverse market landscape. The Middle East, particularly the GCC countries, demonstrates a high demand for luxury vehicles equipped with premium, fully integrated smart cockpits, driven by significant purchasing power and a preference for advanced technology and comfort features. Investments in smart city initiatives and technological infrastructure also support the adoption of connected car technologies. In contrast, the African market is more varied, with some countries seeing growing demand for entry-level and mid-range vehicles that feature basic digital instrument clusters and essential infotainment systems, with cost-effectiveness and durability being key considerations. Infrastructure development and economic growth are gradual drivers of market expansion across the continent. While the adoption of highly advanced cockpit modules is slower compared to other regions, there is a steady upward trend as urbanization increases and consumers seek more modern and connected vehicle experiences, albeit with a focus on value and reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Cockpit Modules Market.- Continental AG

- Visteon Corporation

- Robert Bosch GmbH

- Denso Corporation

- Faurecia (FORVIA)

- Harman International (Samsung Electronics)

- Hyundai Mobis

- Aptiv PLC

- Panasonic Corporation

- Alpine Electronics Inc.

- Marelli Holdings Co., Ltd.

- ZF Friedrichshafen AG

- Pioneer Corporation

- Garmin Ltd.

- Clarion Co., Ltd. (Hitachi Astemo)

- Magna International Inc.

- Yanfeng Automotive Interiors

- Panasonic Automotive Systems Co., Ltd.

- Ficosa International

- Desay SV Automotive

Frequently Asked Questions

What are the primary drivers for the growth of the Automotive Cockpit Modules Market?

The primary drivers include the escalating consumer demand for highly integrated and intuitive in-car experiences, characterized by advanced connectivity, personalized infotainment, and seamless human-machine interfaces. Additionally, stringent global safety regulations requiring the integration of advanced driver-assistance systems (ADAS) and driver monitoring systems are compelling manufacturers to embed sophisticated displays and control mechanisms within the cockpit. The rapid global shift towards electric vehicles (EVs) and the ongoing development of autonomous driving technologies also significantly contribute, as these require entirely new digital architectures and advanced information presentation within the cockpit for efficient vehicle management and occupant interaction. Technological advancements in display quality, processing power, and sensor integration further fuel this market expansion by enabling more immersive and functional cockpit designs.

How is artificial intelligence (AI) transforming the automotive cockpit modules market?

Artificial intelligence is profoundly transforming the automotive cockpit by enabling a more personalized, intuitive, and safer driving experience. AI-powered voice assistants are becoming more sophisticated, allowing for natural language interactions with vehicle functions and infotainment, reducing the need for manual controls. AI also facilitates adaptive HMIs that learn driver preferences, adjusting settings like climate control, seat position, and media content automatically. Furthermore, AI is crucial for predictive diagnostics, analyzing vehicle data to anticipate maintenance needs for various cockpit components. In the context of autonomous driving, AI in the cockpit provides essential information and seamless transitions between manual and automated modes, while driver monitoring systems leverage AI to detect fatigue or distraction, significantly enhancing overall vehicle safety and occupant well-being. This integration moves the cockpit from a static interface to an intelligent co-pilot.

What are the key technological trends shaping the future of automotive cockpit modules?

The future of automotive cockpit modules is being shaped by several transformative technological trends. These include the widespread adoption of large-format, curved, and free-form OLED and Mini-LED displays that offer superior visual quality and design flexibility, creating a more integrated and aesthetically pleasing cabin. Advanced multi-modal human-machine interfaces (HMIs) featuring highly accurate voice recognition, gesture control, and haptic feedback are becoming standard, enhancing user interaction while minimizing driver distraction. Augmented Reality Head-Up Displays (AR HUDs) are emerging as a key innovation, overlaying critical information directly onto the driver's view of the road. Furthermore, the shift towards software-defined cockpits, enabled by powerful domain controllers and high-performance system-on-chips (SoCs), allows for over-the-air (OTA) updates, customization, and the seamless integration of new features throughout the vehicle's lifespan, ensuring adaptability and future-proofing. Enhanced cybersecurity measures are also critical to protect these highly connected and complex systems.

What challenges does the Automotive Cockpit Modules Market face, and how are they being addressed?

The automotive cockpit modules market faces several significant challenges, including the high cost of research and development for cutting-edge technologies, which can impede mass market adoption. The complexity of integrating diverse hardware and software components from multiple suppliers into a seamless, robust system also presents engineering hurdles. Furthermore, cybersecurity risks are a growing concern, as connected cockpits become vulnerable to malicious attacks that could compromise data privacy or vehicle functionality. Supply chain disruptions, exacerbated by geopolitical events and material shortages, also pose a continuous challenge. To address these, manufacturers are increasingly forming strategic partnerships and collaborations to share R&D burdens and accelerate innovation. Standardized software platforms and modular hardware designs are being developed to simplify integration. Robust cybersecurity frameworks, including encryption and secure boot technologies, are being implemented to protect systems, while diversification of supply chains and investment in localized production are strategies to mitigate disruption risks, fostering resilience in the market.

Which regions are expected to show the most significant growth in the Automotive Cockpit Modules Market?

The Asia Pacific (APAC) region is projected to exhibit the most significant growth in the Automotive Cockpit Modules Market. This robust expansion is primarily driven by the region's rapidly increasing automotive production, especially in countries like China, India, and Southeast Asia, coupled with a surging demand for technologically advanced and connected vehicles due to rising disposable incomes and urbanization. The aggressive adoption of electric vehicles (EVs) across APAC, particularly in China, is also a major catalyst, as EVs inherently require sophisticated digital cockpits for battery management and interactive displays. While North America and Europe remain strong markets with consistent demand for premium and advanced solutions, the sheer volume and accelerated technological adoption in the developing economies of APAC position it as the leading growth engine for the foreseeable future. Strategic investments by both global and local manufacturers in manufacturing and R&D within this region further underscore its critical role in market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager