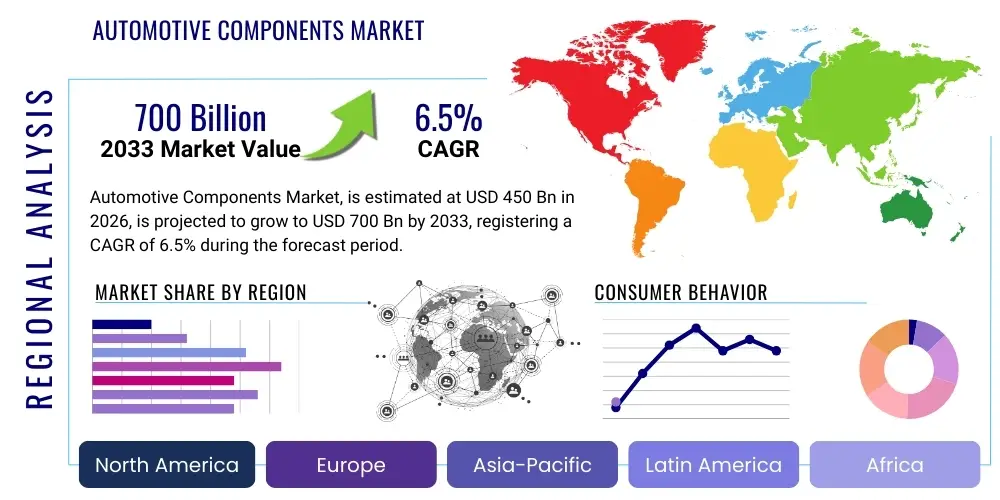

Automotive Components Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438002 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Components Market Size

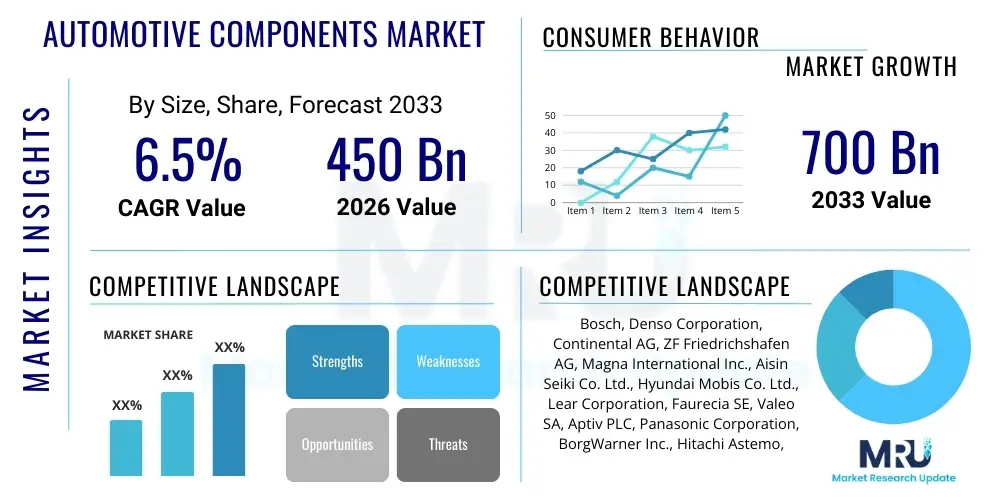

The Automotive Components Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $450 Billion in 2026 and is projected to reach $700 Billion by the end of the forecast period in 2033.

Automotive Components Market introduction

The Automotive Components Market encompasses a vast ecosystem of parts, systems, modules, and accessories required for the manufacturing, maintenance, and enhancement of motor vehicles, ranging from traditional internal combustion engine (ICE) vehicles to rapidly expanding electric vehicles (EVs) and autonomous systems. This market is fundamentally defined by continuous technological innovation, driven significantly by global mandates for reduced emissions and improved vehicle safety. Components span across powertrain systems, chassis, electrical and electronics (E/E), exterior and interior trims, and essential safety systems such as airbags and anti-lock braking systems (ABS). The shift towards electrification has radically redefined core components, substituting complex mechanical transmissions and combustion elements with sophisticated battery systems, electric motors, power electronics, and thermal management modules critical for EV performance and longevity. Furthermore, the integration of advanced driver assistance systems (ADAS) requires high-precision sensors, processors, and intricate wiring harnesses, elevating the complexity and value of electronic components within the supply chain.

Major applications for automotive components fall into two primary categories: Original Equipment Manufacturing (OEM) and the Aftermarket. OEM components are installed during the assembly process of new vehicles, demanding stringent quality control and high-volume consistency, aligning closely with vehicle design cycles. The Aftermarket, conversely, focuses on replacement parts, accessories, and wear-and-tear items necessary for vehicle repair, maintenance, and customization throughout the operational life of the vehicle fleet. Benefits derived from advanced components include enhanced fuel efficiency (through lightweight materials and optimized engine controls), superior safety performance (via sophisticated sensors and integrated braking systems), and improved driver and passenger experience (through advanced infotainment and connectivity solutions). The competitive dynamics within this market are shaped by global sourcing strategies, vertical integration efforts by major suppliers, and the necessity to comply with varied international regulatory standards concerning safety, environment, and performance.

Several critical driving factors are propelling the growth of this market, chief among them being the accelerated global transition toward sustainable mobility, mandated by government policies and consumer preferences favoring zero-emission vehicles. The robust penetration of Electric Vehicles (EVs) mandates massive investment in new component manufacturing capacities, particularly for battery packs and power conversion units. Simultaneously, the proliferation of connected car technology and the stepwise evolution toward fully autonomous driving (L3 to L5) necessitate high-value electronic and sensor components, fundamentally transforming the vehicle from a mechanical device into a sophisticated, software-defined platform. Moreover, rising vehicle production in emerging economies, coupled with stricter vehicle inspection regimes globally, ensures steady demand for both OEM and high-quality aftermarket components, supporting continuous research and development efforts across the entire supplier base to meet increasingly complex technological and environmental challenges.

Automotive Components Market Executive Summary

The Automotive Components Market is undergoing a rapid and irreversible transformation, driven primarily by three megatrends: electrification, autonomous driving, and digitalization, leading to significant shifts in business models and investment priorities across the supply chain. Business trends highlight a strong movement away from traditional powertrain components toward high-value electronic content, including semiconductor modules, advanced sensors (LiDAR, radar, cameras), and thermal management systems optimized for battery performance. Leading suppliers are actively restructuring their portfolios, divesting legacy ICE-related assets while aggressively acquiring or partnering with technology firms specializing in software, AI, and power electronics. Operational excellence and resilience in supply chains have become paramount following recent global disruptions, leading to increased regionalization of manufacturing, dual-sourcing strategies, and strategic stockpiling of critical raw materials, particularly rare earth elements and specialized metals essential for battery and electronic production. Furthermore, sustainability is becoming a core business KPI, compelling component manufacturers to adopt circular economy principles, utilize recycled materials, and minimize energy consumption in production, meeting stringent environmental standards imposed by OEMs and regulatory bodies.

Regional trends reveal Asia Pacific (APAC), particularly China and India, maintaining their dominance in terms of volume manufacturing and market consumption, fueled by surging domestic EV production and expanding middle-class vehicle ownership. APAC is positioned as a global hub for battery component innovation and low-cost manufacturing, attracting substantial foreign direct investment. North America and Europe, while facing slower overall vehicle production growth compared to APAC, are leading the shift in high-value component segments, specifically in sophisticated ADAS integration, advanced battery chemistry research, and cybersecurity solutions for connected vehicles. Regulatory frameworks in these Western markets, such as the EU's Green Deal and stringent safety mandates, are accelerating the uptake of premium, high-tech components. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are demonstrating stable demand for traditional components and are gradually beginning the integration of basic electrification technologies, often through localized assembly and specific regional partnerships focusing on affordability and robustness.

Segment trends clearly illustrate the decoupling of growth between the powertrain segments. Components related to conventional mechanical transmission, fuel systems, and engine blocks are projected to experience contraction or modest growth, driven solely by the installed global fleet and replacement demand. In stark contrast, the Electrical and Electronics segment is witnessing exponential growth, fueled by the rising per-vehicle content value associated with advanced safety, connectivity, and infotainment systems, alongside the foundational requirements of EV architectures (e-motors, inverters, converters). Material segmentation shows increasing adoption of lightweight materials, such as high-strength steel alloys, aluminum, and advanced composites, driven by the persistent need to offset the weight of large battery packs in EVs and improve energy efficiency across all vehicle types. This dynamic shift necessitates significant retooling and reskilling among traditional metal-forming and plastics component manufacturers to meet the evolving demands of OEMs for lighter, smarter, and highly integrated component modules.

AI Impact Analysis on Automotive Components Market

User queries regarding the impact of Artificial Intelligence (AI) on the Automotive Components Market predominantly focus on four interconnected themes: manufacturing efficiency, component complexity management, autonomous system integration, and predictive maintenance capabilities. Users are highly interested in how AI can optimize production lines, specifically querying about AI-driven quality control systems that identify microscopic defects in sensitive components like semiconductor wafers or battery cells, thereby reducing waste and improving reliability. A significant concern revolves around the increased computational demands placed on electronic components by AI algorithms required for Level 3 and Level 4 autonomy; users seek clarity on the necessary upgrades in Electronic Control Units (ECUs), high-performance computing (HPC) platforms, and specialized AI accelerators (like GPUs and custom ASICs) designed for vehicular use. Furthermore, there is strong curiosity regarding the role of AI in supply chain resilience—specifically, using predictive analytics to foresee component shortages or logistical bottlenecks. Ultimately, the market expects AI to transition automotive components from passive hardware to active, learning systems capable of self-diagnosis and real-time operational optimization.

The integration of AI is profoundly reshaping the design, manufacturing, and functionality of automotive components, moving beyond simple automation into complex cognitive tasks. In manufacturing, AI-powered computer vision systems are deployed for 100% inspection of critical parts, ensuring zero-defect quality, especially in components destined for high-reliability systems like steering, braking, and battery thermal management. Predictive maintenance utilizes machine learning models analyzing sensor data from existing components (e.g., bearings, actuators, cooling pumps) to predict impending failures with high accuracy, enabling component suppliers and fleet managers to optimize replacement cycles, significantly reducing vehicle downtime and operational costs. This shift is turning traditionally mechanical components into "smart components" equipped with integrated micro-sensors and edge-computing capabilities to process data locally before transmitting actionable insights.

For autonomous driving, AI is the central processing element, relying heavily on specialized hardware components. The rise of Software-Defined Vehicles (SDVs) means that components must be upgradable and compatible with evolving AI software stacks. This drives demand for modular, high-throughput component architectures, including robust, error-correcting memory and fast interconnects to handle the enormous data streams generated by perception sensors (LiDAR data processing, fused camera imagery, and radar tracking). Component suppliers are actively developing AI-ready hardware platforms that are highly energy-efficient and capable of operating reliably under extreme automotive environmental conditions, ensuring the safety and real-time decision-making capabilities required for safe autonomous operation. This paradigm shift requires component manufacturers to become experts not just in hardware engineering, but also in embedded software and AI deployment.

- AI-Enhanced Manufacturing: Implementation of generative design and machine learning for defect detection in battery cells and semiconductor components, optimizing yield rates and reducing material waste.

- Autonomous Hardware Requirements: Increased demand for high-performance computing (HPC) modules, specialized AI accelerators (ASICs/GPUs), and automotive-grade memory components to support complex ADAS and autonomous decision-making algorithms.

- Predictive Maintenance Integration: Embedding sensors and utilizing AI algorithms within components (e.g., brakes, powertrain) to forecast wear-and-tear, minimizing unexpected failures and optimizing component lifespan.

- Supply Chain Resilience: Use of AI and advanced analytics to model supply chain risks, forecast demand fluctuations, and optimize inventory levels for critical components.

- Software-Defined Components: Developing components with integrated firmware that supports over-the-air (OTA) updates and machine learning functionality, making the hardware adaptable throughout the vehicle's lifecycle.

DRO & Impact Forces Of Automotive Components Market

The dynamics of the Automotive Components Market are currently dictated by a powerful interplay of drivers, restraints, and opportunities, culminating in significant impact forces that reshape investment and strategic planning. Key drivers include the global push for vehicle electrification and the associated regulatory requirements mandating zero-emission vehicles, which necessitates massive redesigns of vehicle platforms and component structures. Furthermore, the persistent advancement in ADAS and the gradual realization of autonomous driving capabilities ensure robust growth in high-value electronic components. Opportunities are predominantly found in the burgeoning battery component value chain—spanning anode, cathode, electrolyte, and thermal management systems—and the development of sophisticated cybersecurity solutions for connected vehicle architectures. These driving forces create an environment where rapid technological adoption and substantial capital expenditure are prerequisites for maintaining market competitiveness and relevance, particularly for suppliers moving into the EV and SDV segments.

However, the market faces formidable restraints, primarily centered around complex global supply chain fragilities, most notably the persistent shortage of semiconductors and critical raw materials essential for advanced components. The high capital investment required for transitioning production lines from ICE components to EV-specific components represents a significant financial hurdle, especially for smaller suppliers. Additionally, the rapid pace of technological change poses challenges in standardization and interoperability, creating complexity for OEMs in integrating components from diverse vendors. These restraints collectively exert pressure on profit margins and demand strategic risk management, compelling suppliers to focus heavily on vertical integration or forging long-term strategic raw material procurement agreements to secure future production capacity and hedge against volatile commodity prices, thereby mitigating the negative impact forces stemming from external economic instability.

The impact forces generated by this DRO landscape are systemic and transformative. The dominant force is the shift in manufacturing focus from mechanical precision to electronic complexity, requiring workforce re-skilling and substantial R&D expenditure. Geopolitical tensions are accelerating regionalization, with strong pressure to establish localized supply chains in North America, Europe, and Asia to reduce reliance on single-country sourcing, fundamentally altering global trade flows of components. This localized manufacturing, while increasing resilience, often results in higher initial production costs. Ultimately, the cumulative effect of these forces accelerates market consolidation, favoring large, diversified Tier 1 suppliers who possess the financial capacity to invest simultaneously in legacy support (for the existing fleet) and advanced future technologies (EVs, ADAS, and connectivity), solidifying their dominance in the rapidly evolving landscape.

Segmentation Analysis

The Automotive Components Market is segmented based on rigorous criteria including Component Type, Vehicle Type, End-User, and Sales Channel, reflecting the diverse applications and end-market needs across the global automotive industry. Component segmentation is vital as it differentiates between high-growth, high-value electronic segments (like sensors and ECUs) and traditional, volume-driven mechanical segments (like body panels and chassis parts). The market structure is highly complex, adapting to the bifurcated demands of the conventional ICE vehicle base and the emerging requirements of battery electric and fuel cell vehicles. Understanding these segments is crucial for suppliers to allocate R&D capital effectively, optimize production capacity, and tailor strategic marketing efforts to address specific OEM or aftermarket demands, particularly in the context of global manufacturing footprint adjustments driven by supply chain security concerns and electrification mandates.

- By Component Type:

- Powertrain Components (Engine Systems, Transmission, Exhaust Systems, Fuel Systems)

- Electrical and Electronics (ECUs, Sensors, Lighting, Wiring Harnesses, Infotainment Systems, Semiconductors)

- Chassis Components (Suspension, Steering, Braking Systems, Wheels and Tires)

- Exterior Components (Body Panels, Bumpers, Mirrors, Glass)

- Interior Components (Seating Systems, Dashboard, HVAC, Safety Systems like Airbags)

- Battery and Charging Components (Cells, Modules, Battery Management Systems, Inverters, Converters)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Trucks, Buses)

- By End-User:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement and Repair)

- By Sales Channel:

- Direct Sales (to OEMs)

- Indirect Sales (through Distributors, Retailers, Service Garages)

Value Chain Analysis For Automotive Components Market

The value chain of the Automotive Components Market is intricate, spanning from raw material extraction and component design to final vehicle assembly and post-sale service. The upstream phase is characterized by the sourcing and processing of essential raw materials, including metals (steel, aluminum, copper), plastics, rubber, and increasingly critical materials like lithium, nickel, and cobalt for battery manufacturing, alongside specialized rare earth elements for sensors and magnets. Key upstream activities involve refining, chemical processing, and the initial fabrication of semi-finished goods (e.g., castings, forgings, semiconductor wafers). Suppliers in this tier face significant cost volatility and geopolitical risks related to sourcing, making long-term resource contracts and recycling initiatives critical strategic levers. The dependency on reliable material supply directly influences the manufacturing stability and final cost of the components, forcing greater integration between Tier 2/3 suppliers and raw material providers.

The central phase involves component manufacturing, dominated by Tier 1 and Tier 2 suppliers who specialize in designing, engineering, and assembling complex systems and modules (e.g., complete brake systems, cockpit modules, or battery packs). Tier 1 suppliers often act as system integrators, leveraging their technological expertise to manage sophisticated interfaces and ensure component compatibility with OEM vehicle platforms. The distribution channel plays a crucial intermediary role, handling the complex logistics of delivering components—both direct-to-OEM for assembly plants (Just-in-Time/Just-in-Sequence delivery models) and indirect-to-aftermarket via large centralized distributors, wholesalers, and regional retailers. Efficiency in this middle layer is essential for minimizing inventory costs and ensuring rapid availability of parts globally, particularly critical for high-volume maintenance items.

The downstream analysis focuses on the end-users: Original Equipment Manufacturers (OEMs) and the Aftermarket. OEMs receive components directly for vehicle assembly, demanding extremely high quality and adherence to tight production schedules. The Aftermarket segment utilizes components through a network of independent repair shops, franchised dealerships, and DIY consumers for maintenance and repair, characterized by strong demand for standardization and broad product availability. Direct channels dominate the OEM segment, relying on sophisticated EDI (Electronic Data Interchange) systems and long-term contracts. Indirect channels are the lifeblood of the Aftermarket, utilizing vast distribution networks to achieve market penetration. The trend toward modularity and high software content is gradually shifting value capture downstream, where software updates and replacement electronics become high-margin service opportunities, demanding a closer partnership between component suppliers and service providers.

Automotive Components Market Potential Customers

The potential customers for the Automotive Components Market are broadly segmented into two distinct but interconnected groups: Original Equipment Manufacturers (OEMs) and the expansive Aftermarket ecosystem. OEMs, including global automotive giants such as Toyota, Volkswagen Group, General Motors, and emerging EV manufacturers like Tesla and Rivian, represent the highest volume demand segment. These customers require bespoke, highly engineered, and validated components that meet stringent performance, safety, and integration specifications for new vehicle platforms. Their purchasing decisions are driven by factors like technological capability, quality assurance, cost efficiency, and the supplier's ability to support global production schedules and adhere to sustainability mandates. Long-term supplier relationships, often involving deep collaborative design and engineering work, define interactions in the OEM space, where securing placement on a high-volume platform guarantees years of steady revenue for component suppliers.

The Aftermarket segment serves the needs of vehicles already in operation, encompassing independent repair facilities, franchised dealerships, specialized service garages, fleet operators, and direct consumers. These buyers primarily seek replacement parts, maintenance items (filters, brake pads, fluids), and accessories. The criteria for these customers prioritize availability, reliability, competitive pricing, and standardized fitment. Aftermarket components can be supplied as original equipment parts (OES), which are identical to OEM parts, or as certified or uncertified replacement parts (IAM). Fleet operators, who manage large vehicle portfolios, are increasingly demanding durable, high-quality components and comprehensive service support to minimize vehicle downtime and optimize total cost of ownership (TCO). The growth of the global vehicle fleet, coupled with the rising average age of vehicles in key markets, ensures stable and growing demand in this profitable sector.

Furthermore, an emerging customer base includes non-traditional automotive technology firms focused on mobility services, autonomous fleet management, and specialized commercial applications (e.g., delivery robots, niche industrial vehicles). These customers often require cutting-edge, low-volume components such as advanced sensors, specialized LiDAR units, and robust vehicle-to-everything (V2X) communication modules. Component suppliers engaging with these new entrants must offer flexibility, rapid prototyping capabilities, and expertise in highly specific electronic and software integration, often bypassing traditional Tier 1 structures. The shift toward subscription-based software and hardware monetization also transforms component buyers into integrated service customers, demanding continuous component support and OTA upgrade compatibility throughout the operational lifespan of the product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Billion |

| Market Forecast in 2033 | $700 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Denso Corporation, Continental AG, ZF Friedrichshafen AG, Magna International Inc., Aisin Seiki Co. Ltd., Hyundai Mobis Co. Ltd., Lear Corporation, Faurecia SE, Valeo SA, Aptiv PLC, Panasonic Corporation, BorgWarner Inc., Hitachi Astemo, Inc., Schaeffler AG, Sumitomo Electric Industries Ltd., TI Fluid Systems, Gestamp Automoción, American Axle & Manufacturing Holdings Inc., Visteon Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Components Market Key Technology Landscape

The Automotive Components Market is characterized by a dynamic and rapidly evolving technology landscape, primarily shaped by the disruptive forces of electrification and autonomous mobility. Key technological advancements revolve around miniaturization, integration, and the transition to software-centric hardware. For electric vehicles, the primary focus is on battery component technology, including solid-state battery chemistry development aimed at increasing energy density and reducing charging times, alongside advanced thermal management systems utilizing highly efficient coolants and specialized heat exchangers to maintain optimal battery performance and longevity. Simultaneously, the power electronics segment is transitioning towards Silicon Carbide (SiC) and Gallium Nitride (GaN) based components for inverters and converters. These wide-bandgap semiconductors offer superior switching efficiency, lower power loss, and reduced size/weight compared to traditional silicon-based components, directly impacting the range and performance of EVs. Suppliers heavily invested in these material science innovations are gaining a significant competitive edge.

The second major technological thrust is centered on components required for Advanced Driver Assistance Systems (ADAS) and eventual full autonomy. This involves rapid advancements in sensor fusion technologies, integrating data from high-resolution cameras, robust radar systems (moving towards 4D imaging radar), and sophisticated LiDAR units (including solid-state LiDAR components that are smaller, cheaper, and more durable than mechanical counterparts). Crucially, the backbone of this technology relies on high-performance computing (HPC) platforms—often centralized domain controllers or zonal architectures—which integrate multiple ECUs into a single unit capable of processing petabytes of data in real-time. Component manufacturers are therefore shifting from supplying isolated components to offering highly integrated, modular computing platforms that are inherently cyber-secure and compatible with continuous over-the-air (OTA) software updates, facilitating the Software-Defined Vehicle (SDV) paradigm.

Furthermore, lightweighting technologies continue to be essential across all vehicle segments, driven by regulatory mandates and the necessity to offset battery weight in EVs. This includes the increased use of advanced high-strength steels (AHSS), multi-material joining techniques (e.g., friction stir welding, advanced bonding), and polymer composites, particularly carbon fiber reinforced plastics (CFRPs) and glass fiber reinforced polymers (GFRPs) in body structures and interior components. Manufacturing technologies are also evolving, with additive manufacturing (3D printing) gaining traction for prototyping and producing complex, customized components in low volumes, offering faster design iteration cycles and potential supply chain simplification. Cybersecurity is another critical technology area, where components must incorporate hardware security modules (HSMs) and robust encryption mechanisms at the chip level to protect vehicle systems from increasingly complex cyber threats targeting connected and autonomous functions.

Regional Highlights

Asia Pacific (APAC): The APAC region remains the undisputed engine of growth for the Automotive Components Market, driven by its dual status as the largest global manufacturing base and the most significant consumption market, particularly in China and India. China's unparalleled dominance in electric vehicle production and its control over the battery supply chain (raw material refining, cell manufacturing, and battery system assembly) ensures massive demand for EV-specific components, including power electronics and advanced thermal management systems. Government support for indigenous technology and the rapid expansion of domestic OEMs are creating enormous economies of scale. India is also emerging as a critical hub, spurred by government incentives (like the PLI scheme) aimed at increasing localized component manufacturing and promoting cleaner mobility, driving strong demand for chassis parts, wiring harnesses, and high-quality aftermarket components.

North America: North America is characterized by robust investment in re-shoring and regionalization of the supply chain, particularly for batteries and semiconductors, stimulated by governmental policies such as the Inflation Reduction Act (IRA) in the United States. This legislation is fundamentally altering investment patterns, favoring domestic or near-shored component production to qualify for tax incentives. The region leads in the adoption and implementation of cutting-edge ADAS and L3 autonomous systems, driving strong demand for complex sensor suites (LiDAR/radar), advanced computing platforms, and specialized software integration components. While production volumes are lower than APAC, the focus is squarely on high-value, technologically advanced components, necessitating high-cost, automated manufacturing facilities capable of producing complex modules with extreme precision.

Europe: The European market is defined by stringent environmental regulations, aggressive decarbonization targets, and high consumer expectations for premium vehicle quality and safety. The EU’s ambitious CO2 reduction targets and upcoming Euro 7 standards are accelerating the phase-out of ICE components and mandating investment in electrification infrastructure and related parts. Europe holds a leading position in advanced materials research and sophisticated manufacturing techniques, driving innovation in lightweight chassis components, sustainable interior materials, and advanced thermal management for complex battery architectures. Geopolitical volatility and the drive for strategic autonomy are increasing the focus on building domestic battery manufacturing gigafactories and reducing dependency on non-European suppliers for critical electronic components, necessitating significant restructuring of traditional supply routes.

Latin America and Middle East & Africa (MEA): These regions represent growing markets driven by increasing urbanization, infrastructure development, and rising vehicle penetration. Latin America, specifically Brazil and Mexico, serves as a crucial component manufacturing hub, largely catering to North American demand, primarily focused on traditional component supply, body parts, and basic electronic assemblies, though they are slowly beginning the transition towards hybrid and entry-level EV components. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits consistent demand for durable aftermarket components due to harsh operating environments, and concurrently, shows early signs of adopting high-end EV technology, particularly in smart cities like NEOM, which require specialized components for unique mobility solutions and autonomous fleet operations.

- Asia Pacific (APAC): Dominates in manufacturing scale and EV battery component production; China leads the global transition, while India focuses on localization and aftermarket growth.

- North America: High-value segment growth driven by ADAS/Autonomy; policies like the IRA stimulate domestic supply chain investment in battery and semiconductor components.

- Europe: Focus on high-quality, sustainable components; driven by stringent CO2 targets and rapid shift to sophisticated EV platforms and localized supply resilience.

- Latin America: Key hub for traditional component manufacturing and export to North America; gradual integration of basic electrification components driven by regional assembly operations.

- Middle East & Africa (MEA): Stable aftermarket demand due to challenging conditions; early adoption of high-tech components tied to specialized urban mobility projects and luxury EV imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Components Market.- Bosch (Robert Bosch GmbH)

- Denso Corporation

- Continental AG

- ZF Friedrichshafen AG

- Magna International Inc.

- Aisin Seiki Co. Ltd.

- Hyundai Mobis Co. Ltd.

- Lear Corporation

- Faurecia SE

- Valeo SA

- Aptiv PLC

- Panasonic Corporation

- BorgWarner Inc.

- Hitachi Astemo, Inc.

- Schaeffler AG

- Sumitomo Electric Industries Ltd.

- TI Fluid Systems

- Gestamp Automoción

- American Axle & Manufacturing Holdings Inc.

- Visteon Corporation

- Novelis Inc.

- LG Chem

- CATL (Contemporary Amperex Technology Co. Limited)

- Marelli S.p.A.

Frequently Asked Questions

Analyze common user questions about the Automotive Components market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most rapidly growing segment in the Automotive Components Market?

The Electrical and Electronics (E&E) segment, specifically components related to high-voltage battery systems (inverters, converters, thermal management) and ADAS sensors (LiDAR, radar, and cameras), is experiencing the fastest growth, driven by vehicle electrification and autonomous capabilities.

How is the transition to electric vehicles impacting traditional component manufacturers?

The EV transition is forcing traditional manufacturers to restructure by divesting ICE-related assets and heavily investing in new technologies, such as power electronics and lightweight structural materials, requiring significant retooling and expertise in battery technology integration.

Which geographical region holds the largest market share for automotive components?

Asia Pacific (APAC), primarily led by manufacturing and consumption demands in China and Japan, holds the largest market share due to high production volumes of both conventional and electric vehicles, coupled with strong regional supply chain control.

What are the primary restraints affecting the short-term growth of the components market?

The primary restraints include persistent global semiconductor shortages, volatility in critical raw material pricing (e.g., lithium and copper), and significant capital expenditure demands required for the mandated shift from mechanical manufacturing to complex electronic system production.

What role does cybersecurity play in the design of future automotive components?

Cybersecurity is critical; components, especially connectivity modules and ECUs, must incorporate integrated hardware security modules (HSMs) and robust encryption methods at the design level to protect the software-defined vehicle architecture against hacking and unauthorized access, essential for maintaining vehicle safety and data integrity.

What is the key differentiator between OEM components and Aftermarket components?

OEM components are supplied directly to vehicle assembly lines, demanding perfect integration and stringent quality control, defining the initial vehicle standard. Aftermarket components are used for repair, maintenance, and personalization after the vehicle is sold, prioritizing availability and cost-effectiveness for the consumer or repair shop.

How are suppliers managing the complexity of components for autonomous vehicles?

Suppliers are moving toward zonal and centralized computing architectures, consolidating multiple functions into fewer, high-performance computing units (HPCs). This modularity reduces component count while increasing software dependency and integration complexity, requiring expertise in embedded systems and AI optimization.

Which material technologies are crucial for meeting future component efficiency standards?

Advanced High-Strength Steel (AHSS), aluminum alloys, and carbon fiber reinforced plastics (CFRPs) are crucial. These lightweighting materials are necessary to offset the heavy weight of EV battery packs, thereby enhancing energy efficiency, improving range, and ensuring structural integrity.

What is the expected impact of Over-The-Air (OTA) updates on component lifecycle?

OTA capabilities transform components into continuous service platforms. They extend component viability by allowing software upgrades, bug fixes, and feature enhancements post-sale, shifting revenue models toward software subscriptions and extended component lifecycle support rather than solely initial hardware sale.

In the value chain, which tier is most affected by raw material price volatility?

Tier 2 and Tier 3 suppliers, who are responsible for the initial processing and fabrication of raw materials (metals, polymers, and battery precursors) into standardized parts, are most directly exposed to raw material price volatility and supply chain shocks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager