Automotive Consulting Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434179 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Consulting Service Market Size

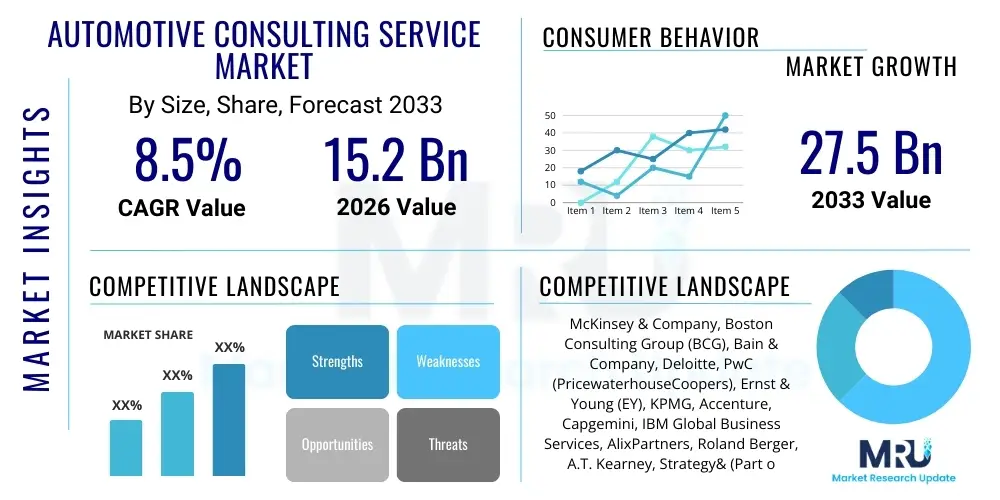

The Automotive Consulting Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Automotive Consulting Service Market introduction

The Automotive Consulting Service Market encompasses a specialized field providing expert advisory services to Original Equipment Manufacturers (OEMs), Tier 1 and Tier 2 suppliers, automotive retailers, and new mobility startups. These services address complex challenges spanning strategy, operations, technology, and organizational transformation within the rapidly evolving automotive ecosystem. Key offerings include advising on the transition to Electric Vehicles (EVs), implementing autonomous driving technology frameworks, optimizing global supply chains for resilience and efficiency, and navigating stringent environmental and safety regulations. The primary benefits derived by clients are enhanced operational efficiency, accelerated digital transformation initiatives, effective risk mitigation related to geopolitical and supply chain disruptions, and the strategic positioning required to capitalize on emerging mobility models (such as Mobility-as-a-Service or MaaS). Driving factors propelling market expansion include the mandatory shift towards sustainable mobility, the pervasive integration of software-defined vehicle architectures, the fierce competition for consumer data ownership, and the ongoing necessity for major automotive corporations to overhaul legacy manufacturing processes to embrace Industry 4.0 standards.

Automotive Consulting Service Market Executive Summary

The global Automotive Consulting Service Market is currently defined by significant volatility driven by transformative technological shifts rather than incremental growth, positioning it as a high-value sector focused heavily on innovation and compliance. Business trends indicate a pivot away from traditional operational consulting towards specialized digital and sustainability advisory services, where firms specializing in AI integration, cybersecurity, and ESG (Environmental, Social, and Governance) compliance are securing premium contracts. The demand for resilience consulting, particularly concerning rare earth element sourcing and semiconductor allocation, remains exceptionally high due as major automotive companies seek to establish robust, localized supply chains that minimize exposure to global political risks. Segment trends show that the Technology Consulting segment, specifically focused on software integration, cloud infrastructure migration, and advanced data analytics, is growing at the fastest CAGR, overshadowing growth in traditional strategy planning as immediate execution and technological enablement take priority for OEMs. Geographically, the Asia Pacific (APAC) region, spearheaded by intensive EV production in China and supportive regulatory environments in South Korea and Japan, exhibits the highest growth potential. Conversely, established markets in North America and Europe are focused primarily on high-cost, specialized services related to autonomous vehicle regulation and deep decarbonization strategies.

AI Impact Analysis on Automotive Consulting Service Market

Common user questions regarding the impact of Artificial Intelligence on the Automotive Consulting Service Market revolve primarily around three core themes: the automation potential of routine consulting tasks, the necessity for consultants to possess deep AI implementation expertise, and the regulatory challenges associated with deploying AI in mission-critical automotive systems, particularly autonomous vehicles. Users frequently inquire about which specific consulting services—such as market forecasting, supply chain predictive modeling, and quality control diagnostics—are most susceptible to automation, and what new, high-value advisory roles are emerging as a result of AI proliferation. Furthermore, there is significant concern regarding the ethical implications and data governance frameworks required when utilizing advanced machine learning models across global manufacturing operations. The overarching expectation is that AI will fundamentally redefine the consultant-client relationship, moving it from data-gathering and report generation to complex strategic validation and the design of enterprise-wide generative AI integration strategies.

The integration of AI tools and platforms is fundamentally altering the service delivery model within the automotive consulting domain. Consulting firms are moving beyond merely recommending AI strategies; they are actively deploying proprietary AI solutions to deliver faster, more data-driven, and highly personalized insights. For instance, sophisticated AI algorithms are now used to simulate thousands of potential market scenarios related to EV adoption rates or competitive pricing strategies, providing clients with predictive modeling capabilities that were previously unattainable. This shift necessitates that consulting teams include data scientists and AI ethicists, transforming the typical consulting engagement from a labor-intensive analysis to a technology-enabled solution deployment, requiring significant upfront investment in internal intellectual property development.

The long-term impact dictates that while foundational data analysis tasks are being automated, the strategic oversight and complex human judgment remain crucial. Consultants are increasingly serving as translators between highly technical AI engineering teams and executive management, focusing on quantifying the Return on Investment (ROI) of AI investments and ensuring alignment with overarching business objectives, particularly in areas like factory digitalization (smart manufacturing) and enhanced customer experience through hyper-personalized vehicle services. The adoption curve of AI is not uniform across the industry; legacy OEMs often require extensive change management consulting to adopt these tools, whereas pure-play EV startups are integrating AI from the design phase, driving demand for specialized consulting around scalable, cloud-native AI infrastructure.

- AI-driven predictive maintenance consulting reducing warranty costs by utilizing sensor data analysis to anticipate component failures in fleet operations.

- Generative AI employed for scenario planning in supply chain optimization, simulating geopolitical shifts and logistics bottlenecks to enhance resilience strategies.

- Automation of routine data analysis and report generation, freeing human consultants to focus exclusively on complex problem-solving and client relationship management.

- Mandatory consulting services focused on AI governance, ensuring compliance with evolving global regulations like the EU AI Act concerning vehicle safety and data privacy (GDPR, CCPA).

- Development of specialized advisory practices around software-defined vehicle (SDV) architectures, utilizing AI to manage over-the-air updates (OTA) and vehicle functionality changes efficiently.

- Deployment of machine learning algorithms for optimizing manufacturing line efficiency, utilizing computer vision for quality control and throughput improvements in complex assembly operations.

- AI impacting HR consulting by automating skill gap analysis and designing targeted training programs necessary for transitioning workforce skills toward electric and autonomous technologies.

- Enhanced market entry strategies facilitated by AI-powered demand forecasting, allowing OEMs to accurately gauge regional adoption rates for new EV models and mobility services.

DRO & Impact Forces Of Automotive Consulting Service Market

The Automotive Consulting Service Market is governed by a powerful interplay of Drivers, Restraints, and Opportunities, collectively forming the key impact forces shaping its trajectory. The dominant Drivers include the monumental regulatory push for electrification and carbon neutrality, forcing OEMs globally to restructure their entire product portfolios and manufacturing footprint; simultaneously, the necessity to manage highly intricate and cyber-secure vehicle software systems is driving demand for specialized technology consulting. Restraints largely center on the proprietary nature of internal R&D data held by OEMs, leading to resistance in sharing sensitive information with external consultants, coupled with the persistent shortage of high-caliber, multidisciplinary consultants possessing expertise simultaneously in traditional automotive engineering, software development, and AI ethics. Opportunities are abundant in the emerging field of Circular Economy consulting, helping clients design vehicle lifecycles for optimal recyclability and material reuse, alongside the rapidly expanding sector of cybersecurity consulting dedicated to protecting connected and autonomous vehicle ecosystems from escalating threats. These forces combined dictate that successful consulting firms must balance high technical competence with adaptable strategic partnership models.

The most immediate and critical Impact Force is the velocity of technology change, specifically the convergence of electrification (BEV/PHEV), connectivity (5G/V2X), and automation (Level 3-5). This rapid convergence means that strategic planning cycles are drastically compressed, compelling OEMs to outsource specialized strategic expertise to consulting firms capable of offering immediate, proven implementation roadmaps. Consequently, consultants are moving from periodic strategy review roles to embedded partners, managing large-scale transformation programs. The secondary major force is the global supply chain fragmentation, exacerbated by geopolitical tensions and the concentration risk of critical components like semiconductors and battery raw materials. Consulting firms are now indispensable in performing complex network modeling, supplier diversification analysis, and implementing localized manufacturing strategies (e.g., in North America or Europe) to comply with regional content requirements.

Furthermore, internal organizational inertia within established automotive corporations acts as a significant restraint. Large, traditionally managed OEMs often struggle to adopt the agile, software-centric methodologies advocated by their consulting partners. Bridging this cultural and structural gap requires extensive change management consulting, presenting both a challenge and a lucrative, long-term opportunity for advisory services focused on organizational effectiveness. The increasing complexity of regional regulatory compliance, ranging from battery disposal mandates in Europe to new safety standards in the US, means that regulatory compliance consulting has transitioned from a specialized niche to a mandatory core service offering, providing a stable revenue stream resistant to economic downturns.

Segmentation Analysis

The Automotive Consulting Service Market is comprehensively segmented based on three primary dimensions: the type of service delivered, the category of client served, and the nature of the engagement model utilized. This granular segmentation allows market participants to tailor their offerings precisely to the evolving needs of the automotive industry's diverse stakeholders. Segmentation by service type reveals a major shift toward technology-focused segments, including IT and Digital Transformation Consulting, which involves advising on cloud migration, cybersecurity frameworks, and the development of in-vehicle software stacks. Meanwhile, Operation Consulting remains critical, focusing on lean manufacturing principles adapted for EV production lines and complex logistics optimization, particularly in inventory management and distribution network resilience.

Segmentation by client type highlights the differentiated needs of Original Equipment Manufacturers (OEMs), who generally require high-level strategic transformation advice, versus automotive suppliers (Tier 1 and Tier 2), who typically seek operational efficiency improvements, cost reduction strategies, and support in managing complex component procurement processes. Furthermore, the rise of new mobility providers—including ride-sharing platforms, autonomous fleet operators, and specialized battery recycling firms—has created a rapidly growing segment requiring bespoke consulting related to regulatory frameworks, consumer adoption modeling, and platform economics. Understanding the specific pain points and regulatory pressures unique to each client category is essential for market penetration.

The engagement model segmentation reflects how services are purchased and delivered, influencing revenue stability and project scope. Retainer-based consulting offers consistent, long-term revenue streams, typically utilized for ongoing organizational transformation or regulatory monitoring. Conversely, project-based consulting, common for discrete activities like M&A due diligence or single-site operational audits, remains prevalent but is subject to higher cyclical volatility. The increasing preference for outcome-based or performance-based contracts, where consultant fees are tied to achieved results (e.g., cost savings realized or time-to-market reduction), further showcases the evolution toward high-accountability consulting partnerships.

- By Service Type:

- Strategy Consulting (Market Entry, M&A, Corporate Strategy, Portfolio Management)

- Operations Consulting (Supply Chain Optimization, Manufacturing Process Improvement, R&D Efficiency, Procurement)

- IT & Digital Consulting (Cybersecurity, Cloud Migration, Data Analytics, Software-Defined Vehicle Architecture)

- HR Consulting (Talent Management, Workforce Transition, Change Management)

- Risk & Regulatory Compliance Consulting (ESG Strategy, Emissions Compliance, Safety Standards)

- By Client Type:

- Original Equipment Manufacturers (OEMs)

- Automotive Suppliers (Tier 1, Tier 2, and Component Manufacturers)

- Dealers and Retailers

- Mobility Service Providers (Fleet Operators, Ride-Sharing Companies)

- Government and Regulatory Agencies (Indirectly)

- By Engagement Model:

- Project-Based Consulting

- Retainer-Based Consulting (Long-term Partnership)

- Managed Services and Outsourcing

Value Chain Analysis For Automotive Consulting Service Market

The value chain for the Automotive Consulting Service Market is fundamentally driven by knowledge acquisition, expert delivery, and outcome-focused implementation, connecting specialized knowledge sources with end-client value realization. The upstream segment primarily involves the foundational elements: the sourcing of specialized data, the development of proprietary methodologies, and the continuous professional development of consultants, which includes partnerships with technology vendors, academic institutions, and specialized data providers (e.g., telematics data firms or market intelligence aggregators). Investing heavily in internal knowledge management systems and creating customized datasets related to EV battery performance or autonomous vehicle failure rates is critical for firms to maintain a competitive edge. These upstream inputs ensure the quality and relevance of the advice provided, forming the intellectual backbone of the service offering.

The core service delivery phase, representing the midstream, involves the direct interaction between the consulting teams and the automotive client. This phase is characterized by intensive project execution, data analysis, strategic recommendation development, and, increasingly, co-development of technology solutions (such as customized supply chain visualization dashboards). Distribution channels are predominantly direct, characterized by high-touch, long-term client relationships cultivated through executive-level sales and proven track records. However, indirect channels are gaining traction through strategic technology alliances, where consulting firms partner with major cloud providers (AWS, Azure, Google Cloud) or industrial software providers (SAP, Siemens) to jointly offer comprehensive transformation packages to automotive clients.

The downstream stage focuses entirely on value realization and client capability building. This involves implementing the recommended strategies, often requiring consultants to remain involved during the initial deployment of new manufacturing systems or organizational structures. Successful downstream activities result in measurable improvements, such as reduced production costs, successful product launches (e.g., new EV platforms), or enhanced regulatory compliance standing. The effectiveness of the overall value chain is maximized when there is seamless integration between the initial strategic recommendations and the final implementation support, guaranteeing that the consulting engagement translates directly into sustainable business outcomes for the automotive client base.

Automotive Consulting Service Market Potential Customers

The primary customers for Automotive Consulting Services are the large-scale entities responsible for designing, manufacturing, and distributing vehicles and associated mobility services. Original Equipment Manufacturers (OEMs)—such as established global giants and emerging pure-play electric vehicle manufacturers—constitute the largest segment, demanding services that span corporate strategy realignment, massive capital investment optimization for gigafactories, and complex organizational transformation to shift from hardware focus to software focus. These clients require comprehensive, multi-year engagements addressing the existential challenges posed by the industry's rapid transformation and the need to achieve carbon neutrality goals.

Automotive Suppliers, ranging from Tier 1 systems integrators (e.g., Continental, Bosch) to niche Tier 2 component providers, form another crucial customer base. Their purchasing decisions are primarily driven by the need for operational excellence, cost reduction through lean methodologies, and navigating the complexities of transitioning their existing component portfolios (like internal combustion engine parts) toward electric vehicle components. These suppliers often seek specialized consulting in areas like diversification strategy, managing intellectual property related to proprietary EV components, and improving supply chain visibility to meet the stringent quality and just-in-time delivery requirements of their OEM partners.

Finally, the emerging ecosystem of Mobility Service Providers and specialized dealerships/retailers represents a fast-growing customer segment. Mobility providers (e.g., autonomous fleet operators, last-mile logistics firms) require consulting focused on platform monetization strategies, regulatory negotiation for urban deployments, and safety certifications for new forms of transport. Automotive retailers and dealer networks seek advisory services related to digital sales transformation, integrating online and offline customer journeys, and preparing their service centers to handle complex EV maintenance and software updates, ensuring they remain relevant in a future where direct-to-consumer sales models are increasingly challenging traditional distribution frameworks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | CAGR 8.5 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte, PwC (PricewaterhouseCoopers), Ernst & Young (EY), KPMG, Accenture, Capgemini, IBM Global Business Services, AlixPartners, Roland Berger, A.T. Kearney, Strategy& (Part of PwC), Ricardo plc, FTI Consulting, Oliver Wyman, L.E.K. Consulting, BDO, Mazars |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Consulting Service Market Key Technology Landscape

The technology landscape underpinning the delivery of automotive consulting services is highly sophisticated, relying heavily on advanced data analytics, proprietary simulation tools, and robust cybersecurity platforms. Consulting firms are leveraging Digital Twin technology to create virtual representations of client manufacturing facilities, supply chains, or entire vehicle fleets, allowing them to test operational changes, optimize layouts for EV battery integration, and simulate the impact of new technologies (like robotics or advanced automation) without disrupting physical operations. This reliance on high-fidelity simulation accelerates decision-making and significantly reduces the inherent risk associated with large-scale industrial transformations, offering demonstrable ROI to clients focused on factory modernization and capacity expansion for electric powertrain components.

Furthermore, the strategic application of proprietary Artificial Intelligence and Machine Learning (AI/ML) platforms is central to market competitiveness. These tools are used for predictive modeling, enabling consultants to forecast shifts in consumer behavior regarding mobility services, predict component failure rates for maintenance optimization, and identify potential vulnerabilities in complex vehicle software stacks. Consulting firms that have successfully integrated customized Natural Language Processing (NLP) tools can rapidly analyze vast amounts of unstructured regulatory documentation or customer feedback data, extracting actionable insights far faster than traditional methods. This technological advantage allows leading consultancies to deliver superior market intelligence and implementation blueprints focused on next-generation connected services.

Another crucial element is the use of robust cloud-based collaboration platforms, often incorporating blockchain technologies for secure, transparent data sharing and supply chain tracking. Given the global nature of automotive manufacturing and the sensitivity of intellectual property, consulting engagements require secure environments where complex, multi-national teams can collaborate on sensitive strategic data. Blockchain, while still emerging, offers a means to audit supply chain provenance—essential for demonstrating compliance with ESG reporting requirements concerning raw material sourcing (e.g., cobalt or lithium)—thereby providing critical advisory services regarding ethical sourcing and transparency to major OEMs facing intense public scrutiny.

Regional Highlights

- North America: This region is characterized by high demand for consulting related to autonomous vehicle regulation and deployment, particularly in urban environments and long-haul trucking. The US market is heavily influenced by domestic policy initiatives, such as incentives for localized EV battery and component manufacturing (e.g., Inflation Reduction Act - IRA), driving substantial consulting demand for supply chain restructuring, factory localization strategy, and navigating complex trade compliance requirements. Canada and Mexico focus heavily on optimizing continental supply chain integration. The emphasis here is on technology implementation and securing proprietary software architectures against cyber threats.

- Europe: Driven by stringent environmental legislation, including the Green Deal and ambitious phase-out dates for Internal Combustion Engines (ICE), Europe leads in sustainability and decarbonization consulting. OEMs in Germany, France, and the UK require deep expertise in Circular Economy principles, battery lifecycle management, and achieving complex ESG reporting standards. High consulting activity is also seen in strategic mergers and acquisitions (M&A) as legacy firms divest non-core assets and forge alliances to share high R&D costs for next-generation platforms. Regulatory compliance remains a primary revenue driver.

- Asia Pacific (APAC): APAC is the engine of global volume growth, particularly spearheaded by China’s dominance in the EV manufacturing and battery supply chain. Consulting demand here focuses on operational scalability, establishing efficient gigafactories, and managing rapid, hyper-localized digital transformation tailored to highly competitive domestic markets. South Korea and Japan are prioritizing consulting in advanced robotics integration and establishing intellectual property safeguards in connected car technologies. This region exhibits the highest growth potential for operational and IT consulting services related to mass production optimization.

- Latin America (LATAM): This region typically exhibits consulting demand focused on market entry strategies, optimization of aging manufacturing infrastructure, and navigating macroeconomic volatility (e.g., currency fluctuations and trade tariffs). The primary focus for OEMs operating in Brazil and Argentina is on operational resilience, cost reduction, and adapting global EV strategies to local market affordability and infrastructure limitations. Consulting services often target improving logistics and distribution network efficiency.

- Middle East and Africa (MEA): While smaller in scale, the MEA region shows nascent high-growth areas, particularly in the Gulf Cooperation Council (GCC) countries. Consulting services are driven by large-scale government-backed mobility projects (e.g., smart city initiatives in Saudi Arabia and the UAE) and the strategic development of local automotive assembly hubs. Demand is typically project-based, centered on feasibility studies for new vehicle manufacturing plants and advising on smart infrastructure deployment necessary for autonomous public transport systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Consulting Service Market.- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Deloitte

- PwC (PricewaterhouseCoopers)

- Ernst & Young (EY)

- KPMG

- Accenture

- Capgemini

- IBM Global Business Services

- AlixPartners

- Roland Berger

- A.T. Kearney

- Strategy& (Part of PwC)

- Ricardo plc

- FTI Consulting

- Oliver Wyman

- L.E.K. Consulting

- BDO

- Mazars

Frequently Asked Questions

Analyze common user questions about the Automotive Consulting Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are currently driving the demand for automotive consulting services?

The primary drivers are the irreversible industry shift toward electric vehicles (EVs), the rapid evolution of software-defined vehicle architectures requiring significant IT strategy overhaul, and the critical need to secure complex global supply chains against geopolitical disruption and semiconductor shortages. Consulting demand is shifting specifically toward digital transformation and ESG compliance.

How is the adoption of Artificial Intelligence (AI) reshaping the role of automotive consultants?

AI is automating routine data analysis and predictive modeling, which shifts the consultant's role from data gathering to strategic interpretation, ethical deployment, and complex change management. Consultants must now be proficient in designing and integrating proprietary AI solutions that drive measurable outcomes in manufacturing efficiency and customer experience.

Which segments of the Automotive Consulting Market are experiencing the fastest growth?

The IT and Digital Consulting segment is growing the fastest, specifically services related to cybersecurity, cloud infrastructure migration, and the development of over-the-air (OTA) update capabilities for connected vehicles. Sustainability and ESG consulting also represent a high-growth, high-value niche, particularly in European markets.

What are the key challenges faced by OEMs when implementing consulting recommendations?

Major challenges include overcoming internal organizational inertia and cultural resistance to agile methodologies, managing the high capital cost required for technological transformation (e.g., retooling for EV production), and bridging the significant skill gap between existing engineering staff and the specialized requirements of software-centric vehicle development.

Why is the Asia Pacific (APAC) region critical to the future growth of automotive consulting?

APAC, particularly China, dominates the global manufacturing scale-up for electric vehicles and batteries. Consulting in this region is essential for operational optimization, establishing large-scale sustainable production capacities (gigafactories), and navigating the competitive landscape of local EV startups, making it the highest potential growth area for high-volume operational and technology services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager