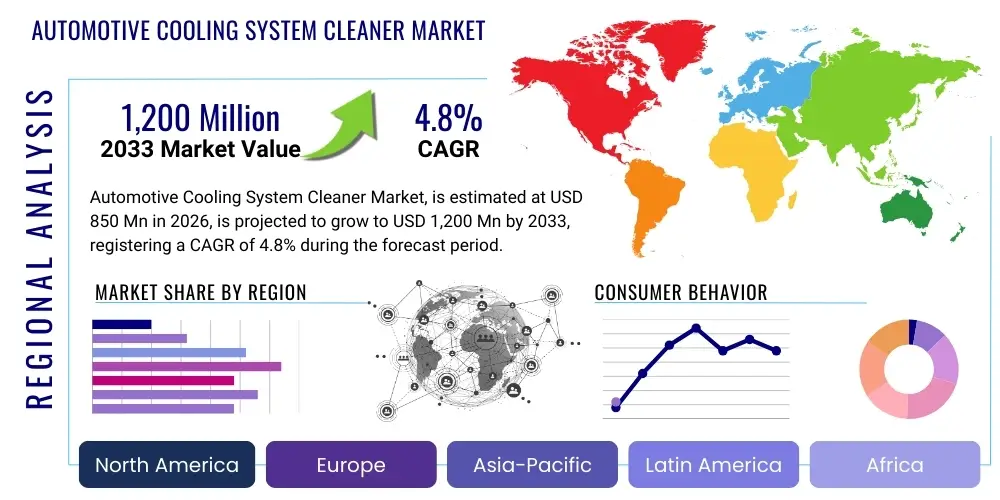

Automotive Cooling System Cleaner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436453 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Cooling System Cleaner Market Size

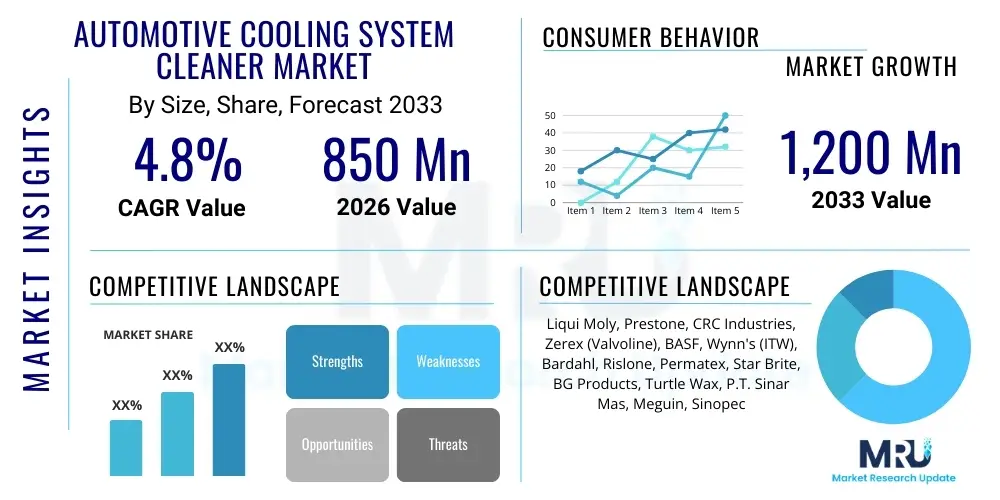

The Automotive Cooling System Cleaner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $850 million in 2026 and is projected to reach $1,200 million by the end of the forecast period in 2033.

Automotive Cooling System Cleaner Market introduction

The Automotive Cooling System Cleaner Market encompasses specialized chemical formulations designed to remove contaminants such as rust, scale, grease, oil residue, and sludge from the internal components of a vehicle's cooling system, including the radiator, engine block passages, heater core, and hoses. These cleaners are crucial for maintaining the operational efficiency and longevity of internal combustion engines (ICEs), as accumulated debris severely hinders heat transfer, potentially leading to engine overheating, gasket failure, and premature wear of critical components like the water pump and thermostat. The formulations typically leverage mild acids, alkaline agents, or chelating compounds combined with surfactants and corrosion inhibitors to safely dissolve or suspend deposits, preparing the system for the introduction of fresh coolant. The essential role of these products in preventative maintenance schedules drives consistent demand across both professional service centers and the do-it-yourself (DIY) consumer segment, particularly in aging vehicle fleets where corrosion issues are more pronounced.

Product description highlights the sophisticated chemistry involved in modern cooling system cleaners, which must be powerful enough to eliminate resilient deposits without damaging sensitive materials such as aluminum, rubber seals, and various plastic components found in modern radiators and reservoirs. Key applications span across passenger vehicles, commercial trucks, heavy-duty equipment, and off-road vehicles, with specialized products formulated for light-duty gasoline engines versus heavy-duty diesel applications, the latter often facing higher thermal stresses and specific challenges related to silicate drop-out. The primary benefit derived from regular use is the restoration of optimal thermal efficiency, leading to improved fuel economy, reduced emissions due to stable engine operating temperatures, and significant protection against catastrophic engine failure caused by localized overheating. As manufacturers extend vehicle service intervals, the importance of robust cooling system maintenance, facilitated by high-quality cleaners, becomes paramount for ensuring warranty compliance and overall vehicle reliability.

Driving factors for sustained market growth include the substantial average age of vehicles globally, necessitating increased maintenance inputs, and the rising awareness among consumers and fleet operators regarding the critical link between cooling system health and engine performance. Furthermore, the increasing complexity of engine designs, including turbocharging and direct injection, generates higher localized temperatures, placing greater stress on coolants and accelerating the need for effective cleaning agents to maintain internal component integrity. Regulatory pressure aimed at reducing vehicle emissions also inadvertently supports the market, as an optimally functioning cooling system is vital for efficient catalytic converter operation and stable combustion cycles. Although the long-term shift toward Electric Vehicles (EVs) presents a eventual constraint, the massive global installed base of ICE vehicles guarantees robust demand for cooling system maintenance products throughout the current forecast period.

Automotive Cooling System Cleaner Market Executive Summary

The Automotive Cooling System Cleaner Market is poised for stable growth, fueled primarily by the extensive global vehicle population, particularly the increasing average age of ICE vehicles requiring diligent preventative maintenance. Business trends indicate a strong shift towards highly effective, fast-acting, and environmentally conscious cleaning formulations, with manufacturers focusing on non-acidic and pH-neutral solutions that minimize the risk of damage to composite materials and simplify the disposal process. Strategic collaborations between chemical providers and major automotive parts retailers are enhancing product visibility and accessibility, especially within the highly competitive aftermarket channel. Regional trends show robust expansion in Asia Pacific (APAC), driven by rapid motorization, inadequate maintenance practices leading to higher incidence of cooling system issues, and the subsequent demand for restorative chemical solutions. North America and Europe remain mature markets characterized by established maintenance cycles and a preference for premium, professional-grade products used in quick-lube and dealership settings. Segment trends highlight the dominance of the chemical liquid segment due to ease of application, although powder-based concentrates maintain relevance in specialized heavy-duty applications. The DIY segment is growing, spurred by user-friendly packaging and the availability of online instructional content, democratizing complex maintenance tasks and expanding the overall customer base.

AI Impact Analysis on Automotive Cooling System Cleaner Market

Common user questions regarding the impact of AI on the Automotive Cooling System Cleaner Market center on how artificial intelligence can optimize maintenance schedules, predict component failure related to cooling system contamination, and potentially enhance the chemical formulation and application process. Users are keen to know if AI diagnostics can accurately determine the specific type and severity of contamination (e.g., rust vs. oil sludge) remotely, thereby recommending the exact type and dose of cleaner required, moving away from generic preventative treatments. Furthermore, there is significant interest in how AI-powered supply chain management systems could optimize inventory and distribution based on real-time fleet data regarding vehicle usage patterns and regional climatic stressors, ensuring mechanics always have the right specialty cleaners available. The underlying expectation is that AI will introduce predictive maintenance for cooling systems, reducing reliance on reactive repairs and making cleaning an integral, data-driven step in vehicle health management, ultimately standardizing the market through enhanced diagnostic precision and tailored product recommendations based on advanced telematics data.

- AI-driven Predictive Maintenance: Utilizing telematics data (engine temperature anomalies, coolant degradation metrics) to accurately forecast when a cooling system flush and cleaning is necessary, shifting the market from time-based to condition-based servicing.

- Optimized Chemical Formulation: Employing machine learning algorithms to analyze material compatibility and cleaning efficacy data across thousands of vehicle models and contamination types, accelerating the R&D process for new, specialized cleaner compositions.

- Enhanced Diagnostic Tools: Integration of AI into workshop diagnostic equipment to identify the precise nature of cooling system blockage or corrosion, allowing mechanics to select the most effective cleaner type (e.g., acidic vs. alkaline).

- Automated Supply Chain Management: AI-based demand forecasting optimizing the distribution of cleaners, ensuring regional stocking levels align with anticipated fleet maintenance needs and environmental conditions.

- Customer Service Personalization: AI chatbots and recommendation engines providing DIY consumers with model-specific cleaning procedures and product advice, increasing customer satisfaction and correct usage rates.

DRO & Impact Forces Of Automotive Cooling System Cleaner Market

The dynamics of the Automotive Cooling System Cleaner market are significantly shaped by a confluence of driving forces (D), restraints (R), and opportunities (O), collectively exerting influence as impact forces. Primary drivers include the large and aging population of internal combustion engine vehicles globally, which inherently requires frequent maintenance interventions to prevent overheating and corrosion. The increasing mechanical complexity of modern engines, demanding higher thermal stability and precision cooling, further necessitates the use of high-quality cleaning agents to maintain optimal heat exchange capacity. Counteracting these drivers are significant restraints, notably the growing penetration of Electric Vehicles (EVs), which utilize fundamentally different thermal management systems, reducing the need for traditional glycol-based coolant flushing and heavy-duty radiator cleaners in the long term. Additionally, environmental regulations regarding the safe disposal of spent coolants and associated cleaning chemicals pose logistical and cost challenges for service providers, sometimes disincentivizing comprehensive cleaning procedures.

Opportunities within the market largely revolve around innovation and market penetration strategies. The development of advanced, biodegradable, and non-toxic cleaner formulations presents a critical opportunity for manufacturers to address environmental concerns and appeal to eco-conscious fleet operators and consumers. Furthermore, expansion into fast-growing economies in Asia and Latin America, where vehicle maintenance standards are rapidly professionalizing, offers substantial avenues for market penetration. The continuous aftermarket demand for specialized cleaners targeting specific contamination issues, such as oil migration into the cooling system due to failed heat exchangers or head gaskets, provides a niche opportunity for high-margin, problem-solving products. Companies focusing on delivering integrated cooling system maintenance packages, bundling diagnostic services, cleaning products, and advanced coolants, are positioned to capture greater market share and build strong brand loyalty.

The impact forces currently driving the market growth are strongly related to consumer education and regulatory stability. If environmental regulations become excessively stringent regarding the use and disposal of certain cleaning chemicals, the short-term market for conventional formulations could contract, forcing rapid innovation towards greener alternatives. Conversely, a sustained increase in global fuel prices could enhance consumer focus on vehicle efficiency, indirectly boosting the demand for cooling system cleaners as part of efficiency-optimization maintenance routines. The overarching force is the transition to electrification; while not immediately impacting the massive legacy fleet, strategic planning for manufacturers must account for this shift by diversifying portfolios toward thermal management fluids for EVs and specialty component maintenance. The immediate impact, however, remains overwhelmingly positive, supported by the large ICE vehicle base ensuring robust near-to-mid-term demand for cleaning chemicals essential for system health.

Segmentation Analysis

The Automotive Cooling System Cleaner Market is comprehensively segmented based on product type, application, sales channel, and chemical nature, reflecting the diverse needs of different vehicle types and maintenance environments. Segmentation by product type typically separates liquid formulations from powder or pellet concentrates, with liquids currently dominating due to their convenience and ready-to-use nature, particularly in professional service settings where quick turnaround is essential. Application segmentation distinguishes between passenger vehicles (PV) and commercial vehicles (CV), where CVs—including heavy-duty trucks and buses—require more robust, industrial-strength cleaners tailored to manage higher duty cycles and greater volumes of coolant. Understanding these segments is crucial for manufacturers to tailor product specifications, packaging, and marketing strategies effectively. For instance, PV products often emphasize ease of use and environmental safety for DIY consumers, while CV products focus on efficiency, cost-effectiveness per volume, and compliance with fleet management standards.

Segmentation by sales channel is vital, distinguishing between the Aftermarket and Original Equipment Manufacturer (OEM) service providers. The Aftermarket segment, comprising retail auto parts stores, independent repair shops, and online platforms, represents the largest volume driver, fueled by consumer choice and competitive pricing. Conversely, the OEM service channel utilizes cleaners primarily during warranty maintenance and official service procedures, often preferring approved, higher-priced proprietary formulations that guarantee compatibility with specific engine materials and coolant types. Chemical nature segmentation provides insight into the underlying technology, classifying products into acidic, alkaline, and pH-neutral/chelating agent-based cleaners. While acidic cleaners offer powerful rust removal, the market is increasingly favoring pH-neutral chelating agents due to their superior safety profile concerning sensitive aluminum and plastic components, aligning with modern engine material trends and minimizing risk during application.

Further analysis of the end-user base reveals crucial distinctions between professional mechanics, large-scale fleet operators, and individual DIY consumers. Professional mechanics prioritize speed, reliable results, and bulk purchasing options, making them susceptible to technical sales pitches emphasizing performance metrics and labor savings. Fleet operators prioritize cost per mile, long-term component protection, and regulatory compliance, driving demand for concentrated and high-performance solutions designed for rigorous schedules. The interplay between these segments determines pricing power and innovation trajectories. The overall segmentation analysis underscores a highly specialized market where success depends on targeted product development that addresses the specific thermal, chemical, and operational requirements of diverse automotive applications while adhering to evolving environmental standards.

- By Product Type:

- Liquid Cleaners (Dominant segment due to ease of use)

- Powder/Granule Concentrates (Preferred in heavy-duty applications)

- By Application:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Heavy Duty Equipment and Off-Road Vehicles

- By Chemical Nature:

- Acidic Cleaners (For heavy rust/scale removal)

- Alkaline Cleaners (For grease and oil sludge)

- pH-Neutral/Chelating Cleaners (Gentle, multi-purpose solutions)

- By Sales Channel:

- Aftermarket (Retail stores, independent workshops)

- OEM Service Centers (Dealerships)

Value Chain Analysis For Automotive Cooling System Cleaner Market

The value chain for the Automotive Cooling System Cleaner Market commences with upstream activities involving the sourcing of raw chemical inputs, primarily including organic acids (e.g., citric acid), inorganic acids (e.g., phosphoric acid, though usage is diminishing), alkaline agents (e.g., sodium hydroxide), various surfactants, chelating agents (like EDTA), and specialized corrosion inhibitors. Key suppliers in this stage are large commodity chemical manufacturers and specialty intermediate producers. Manufacturers in the middle of the chain focus on formulation, blending, quality control, and rigorous testing to ensure the cleaner is effective against specific contaminants while being safe for modern multi-metal cooling systems, especially those containing aluminum and magnesium alloys. This stage requires significant R&D investment to meet increasingly complex material compatibility demands and environmental regulations. Efficiency in sourcing and formulation directly impacts final product cost and performance, providing a crucial competitive advantage.

Downstream analysis focuses on the distribution and end-user engagement channels. Distribution is bifurcated into direct channels (selling directly to large fleet operators or OEM service networks) and indirect channels (utilizing wholesalers, distributors, and retailers to reach independent repair shops and individual consumers). The importance of the indirect channel, particularly the automotive aftermarket retail ecosystem, cannot be overstated, as it provides high visibility and geographical reach. Marketing and technical support activities are critical downstream components; manufacturers must provide comprehensive application guides and safety data sheets (SDS) to ensure professional and DIY users apply the products correctly, maximizing efficacy and minimizing environmental risks associated with disposal. Logistical efficiency, including packaging solutions that prevent spillage and simplify handling, is paramount for high-volume sales in the retail environment.

Direct channels, while offering lower volume, often involve specialized contractual agreements focusing on specific performance metrics, especially in the heavy-duty sector where fleet operational costs are highly sensitive to maintenance downtime. Indirect distribution relies heavily on brand recognition and shelf placement, making SEO and AEO strategies vital for driving retail sales both online and in physical stores. The effectiveness of the overall value chain hinges on seamless coordination between chemical input suppliers and formulators to ensure consistent quality, followed by robust distribution networks capable of handling a wide array of chemical products across vast geographic areas, ultimately catering to the diverse needs of both high-volume professional service providers and individual car owners seeking preventative maintenance solutions.

Automotive Cooling System Cleaner Market Potential Customers

The primary consumers and end-users of Automotive Cooling System Cleaners fall into three distinct categories: professional service providers, institutional fleet operators, and individual vehicle owners. Professional service providers, including authorized dealership service centers, independent general repair workshops, and specialty radiator shops, constitute the largest volume segment. These entities require bulk quantities of high-performance, fast-acting cleaners as part of routine flushing and repair services. Their purchasing decisions are driven by product reliability, labor cost savings (due to speed of action), and brand trust, preferring commercial-grade formulations that are effective on severe contamination commonly found during remedial repairs, making them critical buyers of concentrated and advanced chemical solutions designed for rigorous use.

Institutional fleet operators represent another significant customer base. This group includes trucking companies, municipal bus services, government agencies (e.g., postal services, military), and large rental car agencies. For fleet managers, the focus shifts heavily towards preventative maintenance to maximize vehicle uptime and control total cost of ownership. They typically purchase cleaners in very large containers or drums and prioritize products that integrate easily into established maintenance protocols, often requiring detailed technical support and material safety data adherence. Their demand is highly inelastic and driven by stringent internal maintenance standards and compliance requirements, leading to long-term contracts with preferred chemical suppliers who can guarantee consistent supply and high-efficacy results across diverse vehicle types.

The individual vehicle owner, or the Do-It-Yourself (DIY) consumer, forms a highly visible yet smaller volume segment on a per-transaction basis. These consumers purchase cleaners through retail auto parts stores and e-commerce platforms, typically seeking packaged, single-application products that are simple to use and safe for home disposal, whenever feasible. Their motivation is cost savings and personal control over vehicle maintenance. Manufacturers target this segment through user-friendly packaging, clear instructions, and strong retail branding. The growth of online video tutorials related to automotive maintenance is continually expanding the confidence and capability of this segment, making them increasingly important for overall market volume and brand awareness, particularly for general-purpose, non-acidic cleaning solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 million |

| Market Forecast in 2033 | $1,200 million |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Liqui Moly, Prestone, CRC Industries, Zerex (Valvoline), BASF, Wynn's (ITW), Bardahl, Rislone, Permatex, Star Brite, BG Products, Turtle Wax, P.T. Sinar Mas, Meguin, Sinopec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Cooling System Cleaner Market Key Technology Landscape

The technological landscape of the Automotive Cooling System Cleaner Market is characterized by a continuous drive toward enhanced material compatibility, faster cleaning action, and improved environmental profiles. Historically, cleaners relied heavily on strong mineral acids or harsh alkaline agents, which were highly effective but posed significant risks to aluminum radiators, plastic components, and sensitive seals common in modern cooling systems. The shift has been pronounced toward advanced chelation technology. Chelating agents, such as complex polymeric compounds and sophisticated organic acids, work by chemically binding to metal ions (like iron in rust or calcium in scale) and suspending them in the solution without reacting aggressively with the base metals of the cooling system. This technology allows for highly effective cleaning in a pH-neutral environment, dramatically reducing the risk of component damage and simplifying the neutralization requirements before disposal, addressing key performance and regulatory challenges faced by chemical manufacturers.

A second major technological advancement involves the integration of specialty dispersants and highly effective surfactant packages within the cleaner formulations. Dispersants are crucial for preventing re-deposition of contaminants once they have been dislodged, ensuring that particles and residues remain suspended in the fluid until the system is flushed out. Modern surfactants are designed to aggressively emulsify oil and grease residues, which often leak into the cooling system due to failed oil coolers or head gaskets. The synergy between chelants, dispersants, and surfactants allows for multi-purpose cleaners that can tackle a wide spectrum of contamination simultaneously, reducing the need for multiple cleaning cycles and decreasing service time, which is a major selling point for professional mechanics. Furthermore, advancements in specialized corrosion inhibitors ensure that the cleaner protects the internal surfaces during the cleaning process itself, preventing flash rusting immediately after the removal of scale.

The future trajectory of cleaning technology is intrinsically linked to green chemistry principles. There is substantial research focused on developing biodegradable formulations derived from renewable resources, moving away from petroleum-based solvents and harsh conventional chemicals. Bio-based chelants and organic cleaning agents are gaining traction, providing high performance while meeting increasingly strict global environmental standards for Volatile Organic Compounds (VOCs) and wastewater discharge. This movement towards sustainability is not just regulatory compliance but is becoming a significant marketing differentiator, especially in the European and North American markets. Moreover, the emergence of advanced diagnostic technologies, including sensors and telematics that monitor coolant conductivity and particulate levels, is driving the need for cleaners that are specifically formulated to leave zero residue, ensuring the accuracy of these sophisticated monitoring systems post-cleaning. The overall technology landscape is moving towards safer, faster, and smarter chemical solutions that integrate seamlessly with modern vehicle maintenance practices and environmental stewardship goals.

Regional Highlights

- North America: Characterized by a highly mature and organized automotive aftermarket. Demand is stable, driven by the consistently high average age of vehicles (often exceeding 12 years) and stringent preventative maintenance habits among consumers and large commercial fleets. The preference is strong for premium, branded products, with professional service centers adopting fast-acting, high-performance formulations. Regulatory compliance concerning disposal practices is strict, pushing manufacturers toward advanced, eco-friendlier chemical solutions.

- Europe: Europe exhibits high demand driven by the complexity of modern European engines, including advanced diesel thermal management systems and smaller displacement, high-output gasoline engines, which require meticulous cooling system maintenance. The market is highly segmented, with strong preference for OEM-approved or proprietary cleaners. Environmental regulations (REACH compliance, waste disposal directives) significantly influence product formulation, fostering innovation in non-toxic and readily biodegradable cleaning agents. Germany, France, and the UK are the dominant consumption centers.

- Asia Pacific (APAC): Represents the fastest-growing region, driven by rapid motorization in China, India, and Southeast Asia. The large volume of new and aging vehicles, coupled with often delayed or inadequate maintenance practices, results in higher incidence of severe cooling system contamination and subsequent demand for powerful restorative cleaners. Price sensitivity is higher than in Western markets, leading to strong competition among local and international brands, particularly in the aftermarket segment. The expanding commercial vehicle fleet in countries like India further boosts demand for industrial-grade solutions.

- Latin America: Characterized by a large fleet of older vehicles and often harsh operating conditions (dust, extreme temperatures), leading to accelerated cooling system degradation. The market is moderately mature, with demand focused heavily on the aftermarket. Economic volatility can sometimes favor lower-cost cleaning solutions, but increasing standardization and professionalization of repair shops are gradually increasing the uptake of higher-quality, branded products. Brazil and Mexico are the primary regional hubs for consumption and distribution.

- Middle East and Africa (MEA): Demand is concentrated in regions with large vehicle populations and extreme ambient temperatures (e.g., GCC countries), where overheating is a critical, common issue. This high thermal stress necessitates regular cooling system cleaning and preventative maintenance. The market relies heavily on imports from Europe and North America, with localized distribution chains being developed to serve rapidly expanding commercial and passenger vehicle segments in South Africa and the UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Cooling System Cleaner Market.- Liqui Moly

- Prestone

- CRC Industries

- Zerex (Valvoline)

- BASF

- Wynn's (ITW)

- Bardahl

- Rislone

- Permatex

- Star Brite

- BG Products

- Turtle Wax

- P.T. Sinar Mas

- Meguin

- Sinopec

- The 3M Company

- Shell Lubricants

- TotalEnergies

- Sonnax

Frequently Asked Questions

Analyze common user questions about the Automotive Cooling System Cleaner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of cooling system cleaners in vehicle maintenance?

The primary role is to restore the cooling system's thermal efficiency by removing rust, scale, and oil residues that impede heat transfer. This prevents engine overheating, protects internal components like the water pump and radiator, and ensures the longevity of the entire engine system.

Are acidic or pH-neutral cleaners better for modern cooling systems?

pH-neutral, chelating-based cleaners are generally preferred for modern cooling systems, especially those containing aluminum and plastics. Acidic cleaners are powerful for heavy rust but pose a greater risk of damaging seals and sensitive aluminum alloys, while neutral cleaners offer safe and comprehensive removal of diverse contaminants.

How often should a cooling system cleaner be used?

Most vehicle manufacturers and chemical experts recommend using a cooling system cleaner prior to every complete coolant replacement or flush. This typically aligns with the vehicle’s maintenance schedule, generally every 30,000 to 50,000 miles, or every three to five years, depending on the coolant type and vehicle usage.

How does the shift to electric vehicles (EVs) impact the demand for traditional cooling system cleaners?

The shift to EVs is a long-term restraint, as EVs require thermal management fluids and specialized system maintenance distinct from ICE vehicles. However, the immediate impact is minimal, as the massive global installed base of ICE vehicles guarantees robust demand for traditional cleaners throughout the forecast period until 2033.

Which geographical region exhibits the fastest growth rate for the cooling system cleaner market?

The Asia Pacific (APAC) region, driven by countries like China and India, shows the fastest market growth. This is due to rapid growth in vehicle density, increasing awareness of preventative maintenance, and a large aftermarket catering to diverse and often aging vehicle fleets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager