Automotive Crankcase Ventilation System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435494 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Automotive Crankcase Ventilation System Market Size

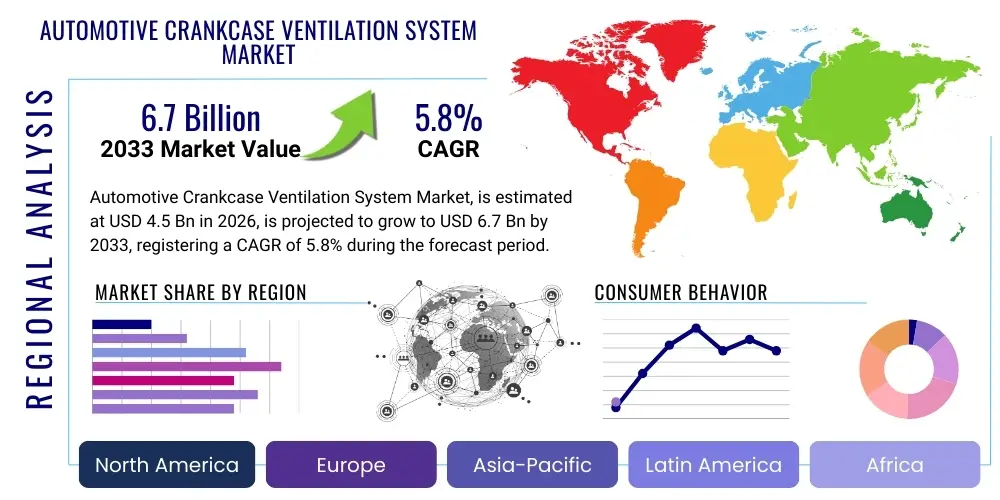

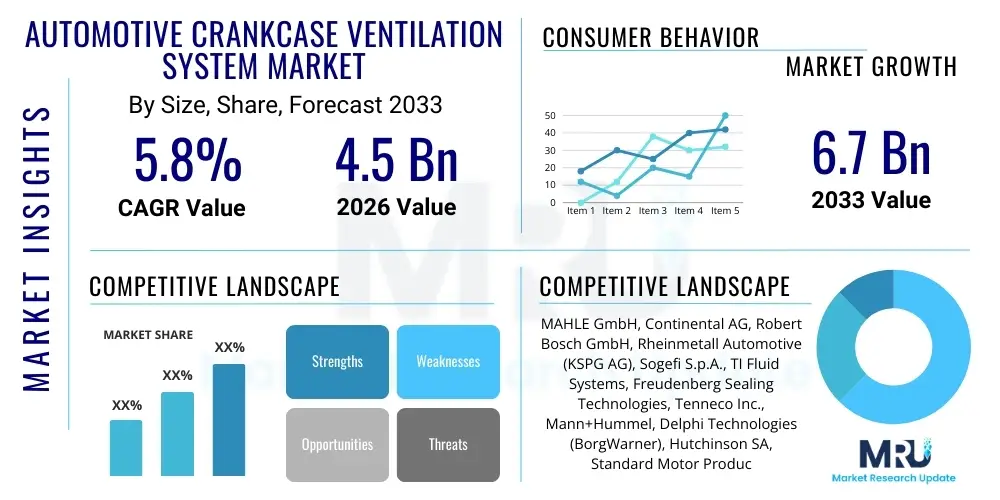

The Automotive Crankcase Ventilation System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Automotive Crankcase Ventilation System Market introduction

The Automotive Crankcase Ventilation System (CCV) Market encompasses the technologies and components essential for managing blow-by gases generated during the combustion process within an internal combustion engine (ICE). Blow-by gases, which consist of unburnt hydrocarbons, exhaust fumes, and moisture, leak past the piston rings into the crankcase. Without effective ventilation, these gases can lead to sludge formation, oil contamination, increased pressure, and ultimately, engine damage and significant environmental pollution. Modern CCV systems, predominantly closed crankcase ventilation (CCV) or positive crankcase ventilation (PCV) systems, are mandated by strict emission regulations worldwide to redirect these gases back into the intake manifold for re-combustion, thus preventing their release into the atmosphere. The fundamental shift from open to closed systems has been the primary technological driver in this market over the last two decades, aligning with global efforts to reduce smog and harmful airborne pollutants from vehicular sources. This focus on environmental compliance is the core defining characteristic of the CCV market landscape.

The primary function of the Automotive Crankcase Ventilation System is dual: maintaining engine health and ensuring environmental compliance. Products in this market include complex assemblies such as PCV valves, oil separators, filtration media, pressure control valves, and specialized hoses designed to withstand high temperatures and corrosive vapors. Major applications span the entire spectrum of vehicular categories, including passenger vehicles, light commercial vehicles, and heavy-duty trucks, across gasoline, diesel, and increasingly, hybrid powertrains where the system is crucial during cold start and transient operation phases. The escalating global production of ICE vehicles, particularly in emerging economies, combined with the increasing stringency of Euro 6, EPA Tier 3, and equivalent emission standards in regions like China and India, provides a robust foundation for consistent market demand and sustained component upgrades.

Key benefits derived from advanced crankcase ventilation systems include improved engine longevity due to reduced oil contamination and sludge buildup, enhanced fuel efficiency through optimized air-fuel mixture management, and crucial adherence to mandatory regulatory emission ceilings. Driving factors fueling the market growth include the persistent need for effective emissions control, the increasing complexity of engine design (such as turbocharging and downsizing), which elevates crankcase pressure management requirements, and the requirement for lightweight, durable components to meet vehicle performance and efficiency targets. Furthermore, the necessity of replacing worn-out CCV components (PCV valves, hoses) as part of routine maintenance ensures a significant and stable aftermarket revenue stream, further solidifying the market’s inherent resilience and growth prospects independent of purely new vehicle sales volumes.

Automotive Crankcase Ventilation System Market Executive Summary

The Automotive Crankcase Ventilation System Market is navigating a complex transition driven by immediate regulatory demands for lower emissions and the long-term industry shift toward electrification. Current business trends indicate a strong focus on developing highly efficient, modular oil separation systems, particularly those utilizing advanced coalescing filters and cyclonic separators capable of handling the high blow-by rates associated with modern turbocharged and downsized engines. Manufacturers are concentrating investments on polymer-based materials and integrated module designs that simplify installation, reduce weight, and offer superior resistance to aggressive contaminants found in blow-by gas. Pricing pressure remains high due to intense competition and OEM demands for cost reduction, pushing suppliers towards automated manufacturing processes and globalized supply chain optimization to maintain profitability and market share in high-volume production segments. The aftermarket segment is rapidly adopting diagnostic technologies to aid in the identification and replacement of failing CCV components, recognizing this as a high-margin opportunity.

Regionally, Asia Pacific (APAC), particularly China and India, dominates both in terms of volume and growth potential, driven by booming automotive production and the rapid adoption of stringent emission standards (e.g., China 6 and BS VI). Europe represents the technological vanguard, characterized by high penetration of sophisticated pressure control valves and advanced filtration technologies, largely mandated by stringent Euro 7 preparatory measures and a strong focus on diesel engine efficiency and longevity. North America shows stable growth, primarily fueled by the substantial size of its light-duty vehicle fleet and the ongoing maintenance requirements of older vehicles, alongside the implementation of EPA Tier 3 standards requiring highly precise blow-by management across different operating conditions. Emerging markets in Latin America and MEA are gradually transitioning from open to closed systems, presenting localized opportunities for cost-effective, durable CCV components as regulatory frameworks mature and vehicle parc modernization accelerates across these regions.

Analysis of segment trends highlights the Closed Crankcase Ventilation (CCV) system segment, particularly the Positive Crankcase Ventilation (PCV) subtype, as the undisputed market leader, owing to its regulatory necessity and superior emission control capabilities—the Open CCV segment is rapidly diminishing globally. Component-wise, the Oil Separator and PCV Valve segments are expected to experience the fastest revenue growth due to their critical role in efficiency and compliance, necessitating frequent technological upgrades and periodic replacement. Furthermore, while passenger vehicles account for the majority of the current market size, the commercial vehicle segment, driven by the need for robust, heavy-duty systems capable of handling prolonged high-load operation, presents significant technological complexity and higher average selling prices for component manufacturers. The shift towards Gasoline Direct Injection (GDI) engines further complicates blow-by management, driving demand for specialized systems that mitigate carbon deposits and maintain precise pressure levels in demanding engine architectures.

AI Impact Analysis on Automotive Crankcase Ventilation System Market

User inquiries concerning AI's influence on the Automotive Crankcase Ventilation System market primarily center on predictive maintenance, component lifespan optimization, and integration with advanced engine control units (ECUs). Users frequently ask how AI algorithms can monitor blow-by rates and pressure fluctuations in real-time to prevent catastrophic failures or mandated downtime, especially in commercial fleet applications. Key concerns revolve around the cybersecurity risks associated with connected CCV systems and the economic viability of integrating sophisticated sensor technology and machine learning models into relatively low-cost components like PCV valves or oil separators. There is also significant interest in how AI can optimize the design phase, specifically through generative design, to create lighter, more efficient components that meet extreme thermal and pressure resilience requirements.

The primary application of Artificial Intelligence (AI) and Machine Learning (ML) in this domain is shifting from theoretical exploration to practical implementation in data-intensive areas. AI algorithms are increasingly being deployed within diagnostic platforms and fleet management systems to monitor engine health parameters, including subtle changes in crankcase pressure or oil quality that signify impending CCV system failure. By analyzing vast datasets collected from on-board sensors, ML models can accurately predict the remaining useful life (RUL) of critical components like PCV valves and hoses, enabling scheduled maintenance rather than reactive repairs. This proactive approach significantly reduces operational costs, minimizes vehicle downtime for commercial operators, and enhances vehicle safety and overall environmental compliance by ensuring the CCV system operates at peak efficiency.

Furthermore, AI-driven simulations and optimization techniques are streamlining the R&D process for CCV component manufacturers. Generative design, powered by AI, is being utilized to optimize the internal geometry of oil separators and coalescing filters, maximizing separation efficiency while minimizing pressure drop across the system—a crucial factor for turbocharged engines. This not only leads to lighter components but also improves overall engine performance and fuel economy. The integration of advanced sensors (e.g., MEMS pressure sensors) with edge computing capabilities allows for localized data processing, enabling the CCV system to dynamically adjust pressure control valves or heating elements based on real-time driving conditions, temperature, and engine load, representing a significant leap towards truly adaptive and intelligent engine management. This convergence of hardware and software intelligence is crucial for meeting future stringent emission mandates.

- AI algorithms enable predictive maintenance scheduling for PCV valves and hoses, minimizing vehicle downtime.

- Machine Learning models analyze real-time engine data to optimize crankcase pressure control and blow-by management dynamically.

- Generative design powered by AI accelerates the development of lighter, high-efficiency oil separators and integrated modules.

- Data analytics derived from connected vehicles identify common failure modes, improving component durability and reliability.

- AI integration facilitates advanced diagnostics, ensuring optimal function necessary for compliance with stringent emission standards.

DRO & Impact Forces Of Automotive Crankcase Ventilation System Market

The Automotive Crankcase Ventilation System Market is heavily influenced by a potent combination of stringent regulatory drivers, inherent technical challenges related to engine complexity, and the overarching threat posed by the long-term structural shift towards Battery Electric Vehicles (BEVs). The primary driver is the global mandate for emission reduction, forcing OEMs to adopt advanced Closed Crankcase Ventilation (CCV) systems, which directly translates into increased demand for sophisticated components like multi-stage oil separators and high-precision pressure control valves capable of operating under varying conditions mandated by Euro 6d and EPA Tier 3 standards. Restraints largely center on the cost sensitivity of the components, as manufacturers strive to integrate complex technology without significantly raising the vehicle's manufacturing cost. Furthermore, the inherent susceptibility of CCV systems to clogging from oil deposits and sludge necessitates frequent maintenance, often leading to customer complaints and potential engine issues if neglected.

Significant opportunities arise from two key areas: the aftermarket and advanced engine technologies. The aftermarket segment offers robust revenue streams due to the required periodic replacement of critical CCV components, such as PCV valves and hoses, providing stability even during downturns in new vehicle sales. Technologically, the proliferation of Gasoline Direct Injection (GDI) and highly turbocharged engines creates a necessity for specialized CCV systems that can manage the increased volume and complexity of blow-by gases, particularly the heightened risk of developing carbon deposits on intake valves. Manufacturers focusing on innovative self-cleaning or maintenance-free oil separation systems are well-positioned to capitalize on these high-specification requirements. Furthermore, the development of robust components suitable for hybrid vehicles, where the ICE operates intermittently, presents a unique design challenge and corresponding market opportunity for specialized thermal management integration.

The market impact forces are driven by environmental compliance and engine performance demands. High impact forces stem from regulatory deadlines (Driver) and the sustained growth of the global vehicle fleet (Driver). Conversely, the long-term automotive industry transformation towards zero-emission vehicles acts as the most significant Restraint/Threat, signaling eventual market stagnation for ICE-dependent systems. Opportunities are maximized through innovation in materials science—using advanced polymers and composites for lighter, more durable systems resistant to aggressive oil vapors, which enhances performance (Impact Force: Engine Efficiency). Ultimately, the market trajectory is dictated by the global balance between immediate emission control needs and the long-term strategic pivot towards electrification, compelling manufacturers to maximize the efficiency and lifespan of current generation CCV systems before the mass market transition occurs.

Segmentation Analysis

The Automotive Crankcase Ventilation System Market is meticulously segmented based on the component type, system technology, vehicle application, and fuel type to provide granular insights into market dynamics and growth pockets. The component segmentation is critical as it highlights the revenue concentration areas, specifically distinguishing between replaceable parts (like valves and hoses) and complex modules (like oil separators and integrated manifolds). Technological segmentation differentiates between the older, obsolete open systems and the modern, regulatory-compliant closed systems, which dominate the current and forecast market landscape. Analyzing these segments helps stakeholders understand the technological maturity and regulatory compliance level required across different regional markets and specific vehicle categories, guiding strategic product development and distribution efforts to maximize compliance and performance.

Vehicle application segmentation is essential for understanding scale and complexity. Passenger Vehicles (PVs) represent the highest volume demand, driven by mass production cycles and rapid fleet turnover, requiring cost-effective, high-volume production solutions. Conversely, Commercial Vehicles (CVs), encompassing light and heavy-duty trucks, demand extremely robust and high-capacity CCV systems designed for prolonged, high-load operation and extended maintenance intervals, commanding higher unit prices and demanding specialized material resilience. Fuel type segmentation (Gasoline, Diesel) is particularly important due to the differing chemical compositions and volumes of blow-by gases produced by each engine type. Gasoline engines, especially those with direct injection (GDI), require specific mitigation strategies for intake valve deposits, while modern diesel engines require specialized oil mist separation to protect sensitive turbocharger and exhaust aftertreatment components from oil carryover, thereby driving separate innovation pathways for each fuel segment.

The segmentation structure not only details current market distribution but also projects future growth vectors. The Closed Crankcase Ventilation (CCV) system, specifically the Positive Crankcase Ventilation (PCV) mechanism, maintains overwhelming dominance due to its legal necessity for environmental compliance worldwide. The fastest growth is expected within the specialized component segment—advanced oil separators using centrifugal or coalescing principles—due to the increasing prevalence of turbocharged, downsized engines that generate higher volumes of pressurized blow-by gas demanding more efficient management. This segmentation framework allows market participants to tailor their offerings, whether focusing on high-volume, standardized parts for the PV aftermarket or specialized, robust systems required for high-performance diesel applications in the CV sector, ensuring targeted resource allocation and market entry strategies based on regulatory compliance needs and technical sophistication.

- By Component:

- PCV Valves

- Oil Separators (Baffle, Labyrinth, Cyclone, Coalescing)

- Hoses and Tubes

- Pressure Control Valves

- Filtration Media

- By System Type:

- Open Crankcase Ventilation (OCV)

- Closed Crankcase Ventilation (CCV) / Positive Crankcase Ventilation (PCV)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- By Fuel Type:

- Gasoline Engines (GDI and Port Fuel Injection)

- Diesel Engines

- Hybrid and Alternative Fuel Vehicles

Value Chain Analysis For Automotive Crankcase Ventilation System Market

The Value Chain for the Automotive Crankcase Ventilation System Market begins with the upstream suppliers providing crucial raw materials and specialized manufacturing services. Key upstream activities involve the supply of engineering plastics (like Polyamides and specialized elastomers for hoses), high-performance metals (for valves and structural housing), and filtration media materials. Material suppliers play a critical role in innovation, focusing on developing compounds that offer exceptional thermal stability, chemical resistance to aggressive oil additives, and mechanical durability, essential for components operating in the harsh under-hood environment. Furthermore, specialized manufacturing providers, including injection molding experts and advanced precision machining firms, constitute a significant portion of the upstream value, ensuring components meet the tight tolerances required for effective pressure management and oil separation efficiency.

The middle segment of the value chain is dominated by the Tier 1 suppliers, such as MAHLE, Continental, and Mann+Hummel, who design, assemble, and integrate complex CCV modules. These manufacturers undertake extensive research and development to optimize proprietary oil separation technologies (e.g., labyrinth or cyclone designs) and integrate these components into engine platforms, often in close collaboration with Original Equipment Manufacturers (OEMs). The distribution channel encompasses both direct sales to OEMs for new vehicle production (accounting for the majority of the market volume) and indirect sales through a robust network of authorized distributors, wholesalers, and independent repair shops for the high-volume aftermarket. Direct channels require stringent quality control and high volume capacity, while indirect channels necessitate efficient logistics and comprehensive product cataloguing to service diverse global vehicle applications.

Downstream activities focus on installation, maintenance, and end-of-life management. OEMs and their assembly plants represent the immediate downstream customer for new systems. However, the recurring revenue cycle is driven by the aftermarket, where independent repair garages, franchised dealerships, and DIY enthusiasts purchase replacement PCV valves, hoses, and filters. This downstream maintenance activity is crucial because CCV components are subject to wear and tear and require periodic replacement to maintain emission compliance and engine health. The overall chain emphasizes quality control and material sourcing in the upstream, technological integration and cost-efficiency in the middle tier, and reliable product availability and technical service in the downstream, ensuring the continuous functional life and regulatory compliance of millions of vehicles globally.

Automotive Crankcase Ventilation System Market Potential Customers

The primary customers for Automotive Crankcase Ventilation Systems are categorically divided into two main groups: Original Equipment Manufacturers (OEMs) and the expansive Aftermarket segment. OEMs represent the largest volume purchasers, integrating CCV modules directly into new engine designs and vehicle platforms during the production stage. Major global automotive manufacturers, including giants like Volkswagen Group, General Motors, Toyota, and Ford, are constant customers. The procurement cycle for OEMs is characterized by long-term contracts, rigorous testing, demanding volume pricing, and strict adherence to specific platform requirements concerning weight, space constraints, and durability specifications. As emissions legislation tightens, these customers increasingly demand sophisticated, integrated CCV solutions that guarantee compliance across varied operating cycles and extreme environmental conditions, pushing Tier 1 suppliers towards continuous innovation and vertical integration of sensor technology within the CCV unit.

The secondary, yet highly critical, customer base is the Aftermarket. This segment consists of a diverse group of entities purchasing replacement parts, including authorized dealership service centers, independent automotive repair garages, fleet operators managing large vehicle parks (especially heavy-duty CVs), and individual vehicle owners performing DIY maintenance. The demand from the aftermarket is primarily driven by the scheduled replacement interval of CCV components, especially PCV valves and hoses which degrade over time due to exposure to corrosive blow-by gases and heat. Fleet operators, in particular, are keen buyers of robust, extended-life components to minimize vehicle downtime and ensure continuous regulatory compliance, recognizing the CCV system as a vital engine health component that prevents costly failures elsewhere. This customer group values accessibility, reliability, and cost-effectiveness of replacement parts.

In addition to these core segments, specialized engine builders and high-performance vehicle modifiers also constitute a niche customer segment. These customers require bespoke, high-performance CCV systems designed to manage extremely high levels of blow-by gas associated with forced induction (turbocharged/supercharged) racing or heavily modified engines. These specialized requirements demand components made from high-temperature resistant materials and optimized oil separation efficiency under high G-forces and sustained high RPMs. While smaller in volume, this segment drives innovation in material science and system architecture. Consequently, market participants must tailor their offerings—from high-volume, standardized OE parts to robust, heavy-duty fleet solutions, and specialized, high-performance components—to effectively address the distinct quality, durability, and cost expectations across the entire customer spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MAHLE GmbH, Continental AG, Robert Bosch GmbH, Rheinmetall Automotive (KSPG AG), Sogefi S.p.A., TI Fluid Systems, Freudenberg Sealing Technologies, Tenneco Inc., Mann+Hummel, Delphi Technologies (BorgWarner), Hutchinson SA, Standard Motor Products, Melling Engine Parts, NGK Spark Plug Co., Ltd., ElringKlinger AG, Dana Incorporated, Trelleborg AB, Denso Corporation, Schaeffler Group, AVL List GmbH, Eberspächer Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Crankcase Ventilation System Market Key Technology Landscape

The core technological advancement in the Automotive Crankcase Ventilation System market revolves around enhancing the efficiency of oil mist separation and improving pressure control accuracy within increasingly complex engine architectures. Traditional passive systems relied on simple baffling or gravitational separation, which is insufficient for modern high-performance, downsized engines that generate substantial blow-by gases and require precise pressure management to prevent seal failure and oil leakage. Current technology heavily utilizes multi-stage active oil separation systems, primarily incorporating cyclonic separators (using centrifugal force) and sophisticated coalescing filters. These advanced systems are capable of capturing aerosolized oil particles down to sub-micron sizes, significantly reducing oil consumption and preventing carryover into the intake system, which is critical for protecting turbochargers and catalytic converters from contamination.

A second critical area of technological innovation is the integration of high-precision pressure control valves (PCVs) and electronic regulation systems. Modern PCV valves are no longer simple mechanical diaphragms; they often incorporate heating elements to prevent freezing in cold climates and are electronically controlled to modulate crankcase vacuum/pressure dynamically based on engine load, RPM, and boost pressure (in forced induction engines). This dynamic pressure regulation is paramount for engine sealing effectiveness and managing the specific operational challenges of GDI engines, where precise air management is essential to mitigate the formation of harmful intake valve carbon deposits. Manufacturers are also focusing on designing integrated modules that combine the oil separator, pressure control, and sometimes the intake manifold components into a single unit, leading to reduced assembly time, decreased weight, and optimized system performance through simplified pathways.

Furthermore, material science is playing an increasingly vital role. Components are shifting towards advanced, lightweight engineering plastics and specialized elastomers that offer superior resistance to thermal cycling, chemical degradation from biofuel contaminants, and oil additives, ensuring longer service life and reduced warranty claims. Specific technological focus is also placed on developing "maintenance-free" CCV systems for commercial vehicles, using self-cleaning coalescing media or permanent labyrinth designs that eliminate the need for routine filter replacement, thus lowering the total cost of ownership for fleet operators. The integration of sophisticated sensors (pressure and temperature) within the CCV module for real-time diagnostics and predictive maintenance, leveraging the principles discussed in the AI analysis, represents the forward-looking technological frontier, connecting the ventilation system directly to the vehicle's broader Engine Control Unit (ECU) for holistic engine health management.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive automotive production volumes in China, India, and Southeast Asia. The adoption of stringent emission standards (e.g., China 6 and Bharat Stage VI) has accelerated the shift from simple open systems to complex closed crankcase ventilation solutions. Investment in lightweight and cost-effective CCV components suitable for high-volume manufacturing is concentrated here, with China being a critical hub for both OEM production and component manufacturing.

- Europe: Europe is characterized by high technological sophistication and regulatory leadership, particularly concerning diesel engine standards (Euro 6d and preparing for Euro 7). The region demands high-efficiency coalescing oil separators and specialized pressure control systems to handle sophisticated diesel particulate filter (DPF) regeneration cycles and strict NOx reduction requirements. The focus is on precision engineering, modular integration, and maximizing fuel efficiency across the vehicle parc.

- North America: North America maintains a mature and stable market, heavily influenced by EPA Tier 3 standards and the substantial demand generated by the replacement aftermarket for light-duty trucks and SUVs. The increasing penetration of GDI engines in this region drives specific demand for CCV systems designed to aggressively mitigate intake valve deposits. Component suppliers must meet durability standards suitable for extreme temperature variations across the continent.

- Latin America, Middle East, and Africa (LAMEA): These regions represent emerging market opportunities characterized by ongoing fleet modernization efforts and gradual regulatory tightening. While historically dominated by simpler, older technology, the increasing presence of global OEMs and stricter local emission mandates are compelling a phased transition to modern CCV systems. Growth is projected for robust, reliable systems that can handle varying fuel qualities and maintenance conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Crankcase Ventilation System Market.- MAHLE GmbH

- Continental AG

- Robert Bosch GmbH

- Rheinmetall Automotive (KSPG AG)

- Sogefi S.p.A.

- TI Fluid Systems

- Freudenberg Sealing Technologies

- Tenneco Inc.

- Mann+Hummel

- Delphi Technologies (BorgWarner)

- Hutchinson SA

- Standard Motor Products

- Melling Engine Parts

- NGK Spark Plug Co., Ltd.

- ElringKlinger AG

- Dana Incorporated

- Trelleborg AB

- Denso Corporation

- Schaeffler Group

- AVL List GmbH

Frequently Asked Questions

Analyze common user questions about the Automotive Crankcase Ventilation System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Automotive Crankcase Ventilation System?

The primary function is to manage and evacuate "blow-by" gases—unburnt fuel and combustion products leaking past the piston rings—from the engine crankcase. This process relieves internal pressure, prevents oil contamination, and, crucially, redirects these gases back into the intake manifold for re-combustion to comply with strict global emission standards, ensuring environmental protection and engine longevity.

How do stringent emission regulations influence the design of CCV systems?

Stringent emission regulations, such as Euro 6 and EPA Tier 3, mandate the use of Closed Crankcase Ventilation (CCV) systems. This necessitates the integration of high-efficiency oil separators (e.g., coalescing or cyclone types) and precision pressure control valves to ensure that virtually all harmful blow-by gases are captured and recycled, minimizing the release of unburnt hydrocarbons and particulate matter.

What is the projected impact of Electric Vehicles (EVs) on the CCV market?

The long-term shift toward Battery Electric Vehicles (BEVs) acts as a structural restraint on the CCV market, as EVs do not require traditional crankcase ventilation. However, the market for components remains robust in the medium term due to the growing global vehicle fleet, sustained production of highly complex hybrid vehicles, and significant ongoing demand from the essential aftermarket replacement segment.

Which component segment drives the highest growth in the CCV market?

The Oil Separators and Pressure Control Valves segment is projected to experience the highest growth. This is driven by the increasing complexity of modern engines, particularly downsized and turbocharged Gasoline Direct Injection (GDI) engines, which require more sophisticated and efficient systems for high-precision oil mist separation and dynamic pressure management to prevent engine fouling.

How is AI being utilized in the maintenance of crankcase ventilation systems?

AI and Machine Learning are primarily used for predictive maintenance. Algorithms analyze real-time data from engine sensors (pressure, temperature) to forecast the potential failure or clogging of PCV valves or filters, allowing fleet operators and service centers to schedule preventative maintenance proactively, optimizing engine performance and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager