Automotive Crash Impact Simulator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433597 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Automotive Crash Impact Simulator Market Size

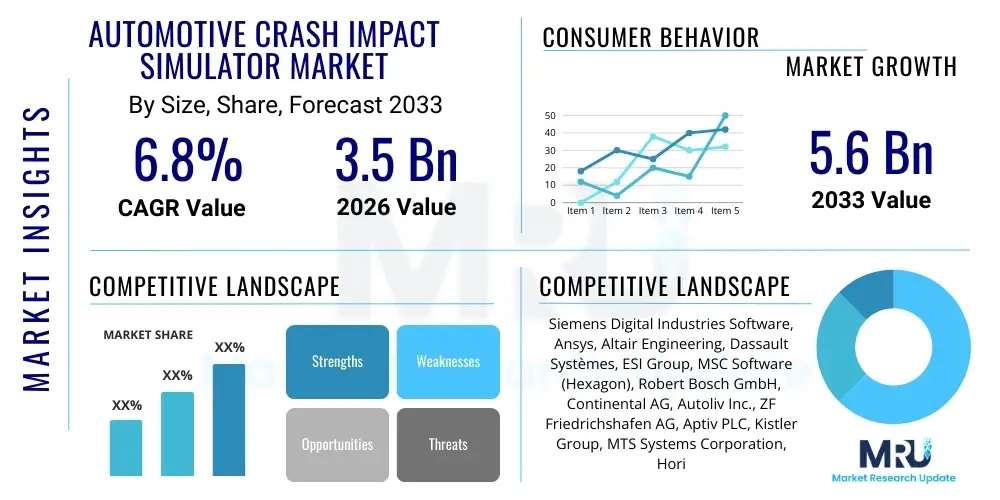

The Automotive Crash Impact Simulator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Automotive Crash Impact Simulator Market introduction

The Automotive Crash Impact Simulator Market encompasses advanced engineering tools and software solutions designed to model, analyze, and predict the structural deformation, occupant injury risk, and overall safety performance of vehicles during various types of collisions. These simulators utilize sophisticated computational mechanics, primarily Finite Element Analysis (FEA) and Multibody Dynamics (MBD), to replace or significantly reduce the need for expensive physical crash tests, accelerating the product development cycle and ensuring compliance with stringent global safety regulations like NCAP (New Car Assessment Program) and regional standards (FMVSS, ECE). The core product involves high-fidelity simulation software, specialized hardware (e.g., high-performance computing clusters), and professional engineering services.

Major applications span across the entire automotive development lifecycle, including initial concept design, material optimization (such as high-strength steel and carbon fiber integration), passive safety system design (airbag deployment, seatbelt pre-tensioners), and pedestrian protection evaluation. The primary beneficiaries are Original Equipment Manufacturers (OEMs), Tier 1 suppliers providing critical safety components, and independent testing laboratories focused on certification. The continuous push for lighter, safer, and more fuel-efficient vehicles drives the demand for accurate predictive simulation tools that can handle complex non-linear material behaviors under high strain rates.

Key driving factors fueling market expansion include the global mandate for five-star safety ratings, the increasing integration of Advanced Driver Assistance Systems (ADAS) requiring virtual validation of crash scenarios, and the rising cost and time associated with conducting physical prototype testing. Furthermore, the shift towards electric vehicles (EVs) introduces new structural challenges related to battery pack protection during impact, demanding highly specialized simulation capabilities to model thermal runaway and structural integrity simultaneously. This technological evolution underscores the critical role of simulation in modern automotive engineering.

Automotive Crash Impact Simulator Market Executive Summary

The Automotive Crash Impact Simulator Market is characterized by robust growth, primarily propelled by global regulatory pressures emphasizing occupant and pedestrian safety, coupled with the industry-wide adoption of virtual validation techniques to optimize development timelines and reduce costs. Business trends indicate a strong move toward integrated simulation platforms that combine various physics domains, such as structural mechanics, fluid dynamics (for airbag modeling), and thermal analysis (for EV batteries). Major vendors are heavily investing in cloud-based High-Performance Computing (HPC) solutions, making sophisticated simulation capabilities more accessible to smaller Tier 2 suppliers and reducing the time required for complex non-linear simulations, thereby democratizing advanced safety analysis.

Regional trends reveal that Asia Pacific (APAC), particularly China, Japan, and India, is emerging as the fastest-growing market due to escalating vehicle production, increased consumer awareness regarding safety, and the rapid establishment of domestic NCAP programs. North America and Europe, while mature, maintain dominance in terms of technological adoption and software expenditure, driven by rigorous local safety standards and the early integration of AI/Machine Learning algorithms into simulation post-processing for optimization. The competitive landscape in these regions is dominated by established global simulation software giants focusing on seamless integration with CAD/PLM systems.

Segment trends highlight the dominance of the Software segment, specifically Non-Linear Finite Element Analysis (FEA) codes optimized for crashworthiness. There is also a significant uptake in simulation services, as OEMs increasingly outsource specialized crash analysis tasks requiring advanced expertise. The application segment sees strong momentum in validating Electric Vehicle structures, addressing unique crash modes involving side impacts and battery penetration. Furthermore, the rising complexity of vehicle design—incorporating numerous sensors, lightweight materials, and ADAS components—necessitates high-fidelity Human Body Models (HBMs) and standardized virtual test protocols, driving innovation in modeling specialized components like pedestrian impact attenuation systems and autonomous driving sensors.

AI Impact Analysis on Automotive Crash Impact Simulator Market

Common user questions regarding the impact of AI on the Automotive Crash Impact Simulator Market primarily revolve around how machine learning can accelerate simulation turnaround times, enhance the accuracy of material constitutive models, and optimize design parameters automatically. Users are highly interested in the potential for AI to manage the vast output data generated by crash simulations (terabytes per run), specifically through automated injury prediction mapping and sensitivity analysis to identify critical design flaws faster than traditional post-processing methods. Key concerns center on the reliability and validation of AI-derived surrogate models and whether these models can maintain the high fidelity required for regulatory compliance compared to physics-based solvers. Expectations are high for AI to enable true 'virtual prototyping' where optimization loops are closed automatically, moving beyond traditional parametric studies toward generative design guided by crash performance metrics.

- AI-driven surrogate modeling drastically reduces computational time for iterative design optimization cycles.

- Machine learning algorithms enhance the calibration of complex material properties and failure criteria under impact loading.

- AI enables automated sensitivity analysis, quickly identifying design variables that most influence crash performance and occupant safety.

- Generative design leveraging AI suggests novel structural layouts optimized for specific crash scenarios (e.g., frontal, side pole impact).

- Deep learning is used for high-speed automated post-processing, visualizing and interpreting injury metrics (e.g., HIC, chest deflection) from simulation results.

- Predictive maintenance analytics, derived from crash simulation data, are used to inform the robustness of physical test setups.

- AI assists in developing statistical and probabilistic crash models, moving away from purely deterministic simulation.

DRO & Impact Forces Of Automotive Crash Impact Simulator Market

The Automotive Crash Impact Simulator Market is fundamentally shaped by a dynamic interplay of regulatory requirements and technological advancements. Drivers include the global regulatory push for enhanced vehicle safety, coupled with the financial incentive for OEMs to reduce reliance on expensive and time-consuming physical crash testing. Opportunities lie primarily in the integration of Artificial Intelligence and cloud computing, which drastically improves simulation efficiency and accessibility, especially in validating the complex architectures of Electric Vehicles and autonomous systems. However, the market faces significant restraints, notably the exceedingly high upfront investment required for specialized software licenses and HPC infrastructure, alongside the scarcity of highly skilled engineers capable of executing and interpreting non-linear crash simulations accurately. The complexity of modeling highly non-linear materials and ensuring regulatory-grade accuracy also poses a constant challenge.

In terms of Porter’s Five Forces analysis, the Intensity of Rivalry among existing competitors is moderate to high, as the market is dominated by a few major, entrenched software providers (e.g., Ansys, Dassault Systèmes, Altair) who continuously compete on solver speed, accuracy, and integration capabilities. The Bargaining Power of Suppliers (e.g., hardware providers for HPC) is generally low due to standardization, but the bargaining power of specialized software suppliers is high, given the proprietary nature of their crash solvers. The Threat of Substitutes is low, as physical testing is highly complementary rather than a direct substitute, and no other technology offers the predictive design capabilities of high-fidelity FEA simulation at the early design stage. The Threat of New Entrants is low due to the substantial intellectual property, high computational expertise required, and significant barrier to entry regarding regulatory validation of new simulation codes.

The core impact forces driving investment are the acceleration of the product development cycle and the critical need for first-time-right design. Modern vehicles, especially those incorporating multiple crash-safety systems (e.g., multiple stages of airbags, pre-crash sensing), require thousands of simulated scenarios for comprehensive validation. This regulatory and economic pressure mandates the continuous refinement of simulation accuracy and speed, ensuring that the simulator market remains a non-negotiable component of automotive R&D expenditure globally. The increasing deployment of Human Body Models (HBMs) in simulation adds another layer of complexity, demanding greater computational power and validated model libraries.

Segmentation Analysis

The Automotive Crash Impact Simulator Market is segmented based on the type of product provided (Software, Hardware, Services), the underlying simulation platform technology utilized, the specific vehicle application, and the various components modeled during the simulation process. This detailed segmentation allows market players to target specific client needs, from OEMs requiring comprehensive enterprise software licenses to smaller suppliers needing specialized consulting services or temporary cloud access. The most lucrative segments are typically tied to proprietary FEA software and specialized engineering services, particularly those focusing on emergent areas like battery crash safety and virtual testing of autonomous vehicle structures.

- By Type: Software, Hardware (HPC, Data Acquisition), Services (Consulting, Integration, Training)

- By Simulation Platform: Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), Multibody Dynamics (MBD)

- By Application: Passenger Vehicles (Sedans, SUVs, Hatchbacks), Commercial Vehicles (Trucks, Buses, Vans)

- By Component: Impact Attenuators, Dummies (Hybrid III, SID, THOR), Barrier Models, Data Acquisition Systems, Airbag Deployment Models

Value Chain Analysis For Automotive Crash Impact Simulator Market

The value chain of the Automotive Crash Impact Simulator Market starts with upstream activities involving the research and development of core physics solvers and computational algorithms. This stage is dominated by specialized software vendors who invest heavily in R&D to enhance numerical stability, improve solution speed, and integrate advanced material models (e.g., composite materials, foam) critical for non-linear dynamic analysis. Upstream providers also include hardware manufacturers supplying specialized high-performance computing (HPC) clusters and cloud service providers essential for running large-scale crash simulations efficiently. Intellectual property protection and continuous software updates are key competitive elements at this stage.

The midstream phase involves software packaging, customization, integration, and distribution. Distribution channels are typically a mix of direct sales teams employed by the major software vendors, specialized value-added resellers (VARs) who offer localized support and integration services, and cloud marketplace platforms (indirect channel) offering pay-per-use licenses for computing resources. Training and technical support are crucial services offered in this phase, given the technical complexity of the simulation packages. High margins are often achieved through long-term software licensing agreements and maintenance contracts rather than one-time sales.

Downstream activities center on the end-users—automotive OEMs and Tier 1 suppliers—who utilize the software and services for product design validation and regulatory compliance. Direct distribution allows vendors to maintain close relationships with major OEMs, providing tailored consulting services for specific vehicle programs. Indirect channels, primarily VARs and system integrators, focus on smaller market players or niche applications, ensuring broader market penetration and specialized expertise implementation, such as developing specialized Virtual Crash Dummies (VCDs) or customizing regulatory testing protocols for new markets. The final value captured is the reduction in physical testing costs and the acceleration of time-to-market for safer vehicles.

Automotive Crash Impact Simulator Market Potential Customers

The primary customers for Automotive Crash Impact Simulator products and services are automotive Original Equipment Manufacturers (OEMs), encompassing global passenger car and commercial vehicle producers who bear the ultimate responsibility for vehicle crash safety compliance. These entities require comprehensive simulation suites (software, HPC infrastructure) for integrating crash analysis across their entire product portfolio, including traditional combustion engine vehicles, electric vehicles, and future autonomous platforms. The need to optimize structures for multiple impact scenarios (frontal, side, rear, rollover, and pedestrian) makes them the largest spending group.

Tier 1 suppliers represent the second major segment of potential customers. These companies design and manufacture critical safety components such as seating systems, airbags, seatbelts, steering columns, and specialized interior components. They use simulation tools to validate their components' performance under impact conditions before integrating them into the OEM platform. Their purchasing decisions are often influenced by the specific simulation tools mandated or preferred by their major OEM clients, leading to high adoption rates of industry-standard software packages.

Further potential customers include independent automotive testing and certification bodies (e.g., crash test labs, NCAP organizations) that use simulators for developing new test protocols and validating physical tests, as well as specialized engineering consulting firms that provide outsourced crashworthiness analysis services to clients lacking internal expertise or resources. Educational and research institutions also form a customer base, utilizing simulators for advanced academic research in vehicle safety and structural mechanics, thereby nurturing the next generation of industry engineers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Digital Industries Software, Ansys, Altair Engineering, Dassault Systèmes, ESI Group, MSC Software (Hexagon), Robert Bosch GmbH, Continental AG, Autoliv Inc., ZF Friedrichshafen AG, Aptiv PLC, Kistler Group, MTS Systems Corporation, Horiba Ltd., AICON 3D Systems GmbH, Photron, Micro-Measurements, Simulia, TASS International, National Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Crash Impact Simulator Market Key Technology Landscape

The technology landscape of the Automotive Crash Impact Simulator Market is dominated by advanced explicit solvers, primarily based on the Finite Element Method (FEM), specifically tailored for highly non-linear, short-duration dynamic events. Key proprietary codes such as LS-DYNA (now part of Ansys), ABAQUS/Explicit (Dassault Systèmes), PAM-CRASH (ESI Group), and RADIOSS (Altair) form the technological foundation, specializing in accurately modeling contact interfaces, material failure criteria (such as damage and fracture), and complex constraints inherent in crash scenarios. Continuous innovation focuses on enhancing solver efficiency through parallel processing capabilities, exploiting massive core architectures (CPU/GPU acceleration), and developing robust, efficient algorithms to handle element types ranging from thin shells to solid hex elements used for modeling structures and foams.

Complementing the core solvers are advancements in auxiliary modeling technologies. High-Fidelity Human Body Models (HBMs), such as the THUMS and GHBMC series, are increasingly used in conjunction with traditional crash test dummies (Hybrid III, THOR) models to provide detailed predictions of internal organ injury risk. Furthermore, technology is rapidly evolving to simulate multi-physics scenarios required for Electric Vehicles (EVs), integrating structural crash analysis with thermal management simulations (Computational Fluid Dynamics - CFD) to predict the risk of thermal runaway in battery packs post-impact. This integration demands sophisticated coupling techniques and efficient data exchange between different solver types.

The virtualization trend is further solidified by the adoption of High-Performance Computing (HPC) platforms, increasingly deployed through cloud infrastructures (e.g., AWS, Azure). This provides flexible, on-demand scalability crucial for optimizing crash designs that often require thousands of simulation runs. Other emerging technologies include the application of Machine Learning (ML) for model calibration, uncertainty quantification, and developing high-speed surrogate models to replace full FEA runs in early design loops. This reliance on computational efficiency and multi-domain integration defines the technological competitive edge in the crash simulation market, driving software vendors to provide holistic, platform-based solutions rather than standalone tools.

Regional Highlights

Regional dynamics significantly influence the adoption and growth patterns of the Automotive Crash Impact Simulator Market, driven primarily by local regulatory environments, vehicle production volumes, and technological maturity.

- North America: A mature market characterized by early adoption of simulation technologies and high expenditure on software licenses. Driven by stringent FMVSS standards and ongoing development in autonomous vehicle safety protocols. The region focuses heavily on integrating simulation with advanced sensor modeling and AI-driven optimization techniques.

- Europe: A leading region in terms of safety regulation (Euro NCAP, ECE standards) and technological sophistication. Demand is high for high-fidelity simulation of pedestrian protection, complex side impact tests (e.g., pole impact), and the structural integrity of next-generation lightweight materials, supporting major German and French OEMs.

- Asia Pacific (APAC): Expected to be the fastest-growing market due to massive growth in vehicle manufacturing, increased consumer awareness, and the establishment or reinforcement of domestic NCAP programs (e.g., Bharat NCAP, China NCAP). Japan and South Korea are key technology adopters, while China is rapidly increasing its internal simulation capability to support indigenous automotive brands.

- Latin America (LATAM): Growth is moderate but accelerating, primarily influenced by growing local vehicle safety standards (e.g., Latin NCAP). The market primarily focuses on basic crashworthiness simulations to meet minimum regulatory requirements, often utilizing outsourced services or localized software solutions.

- Middle East and Africa (MEA): Currently represents the smallest market share. Demand is highly concentrated in countries with established automotive assembly operations (e.g., South Africa, Turkey) and is driven by the necessity to comply with export market standards (Europe, North America). Adoption is primarily focused on mandatory regulatory simulation rather than advanced R&D.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Crash Impact Simulator Market.- Siemens Digital Industries Software

- Ansys

- Altair Engineering

- Dassault Systèmes

- ESI Group

- MSC Software (Hexagon)

- Robert Bosch GmbH

- Continental AG

- Autoliv Inc.

- ZF Friedrichshafen AG

- Aptiv PLC

- Kistler Group

- MTS Systems Corporation

- Horiba Ltd.

- AICON 3D Systems GmbH

- Photron

- Micro-Measurements

- Simulia

- TASS International

- National Instruments

Frequently Asked Questions

Analyze common user questions about the Automotive Crash Impact Simulator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using crash impact simulators over physical testing?

The primary benefit is substantial cost reduction and accelerated design iteration. Simulators allow engineers to conduct hundreds of virtual crash tests rapidly, optimizing vehicle design parameters (materials, structure, safety systems) before committing to expensive physical prototypes required for final regulatory validation.

How is the market evolving concerning Electric Vehicle (EV) safety simulation?

The market is evolving to integrate multi-physics capabilities, specifically coupling structural mechanics (crash) with thermal analysis. This is essential for modeling battery housing integrity during impact and predicting potential thermal runaway events, a critical safety concern unique to EV architecture.

Which simulation platforms dominate the Automotive Crash Impact Simulator Market?

Finite Element Analysis (FEA) using explicit dynamic solvers dominates the market. Proprietary software suites such as LS-DYNA, ABAQUS/Explicit, and RADIOSS are industry standards for modeling non-linear deformation, fracture, and complex contact phenomena inherent in high-speed crashes.

What role does Artificial Intelligence play in modern crash simulation?

AI accelerates simulation workflows by creating high-speed surrogate models, automating the calibration of complex material data, and enhancing post-processing through automated injury risk assessment, significantly reducing the time required for design optimization loops.

What are the key restraint factors limiting market growth?

Key restraints include the extremely high upfront capital expenditure for specialized, proprietary software licenses and the essential requirement for highly skilled simulation engineers and robust High-Performance Computing (HPC) infrastructure, which creates significant entry barriers for smaller firms.

Detailed Segmentation and Technology Deep Dive

Software Segment Analysis

The Software segment holds the largest market share within the Automotive Crash Impact Simulator Market, driven by the critical need for advanced, validated, and regulatory-compliant explicit solvers. These simulation tools are proprietary and require years of development and validation against physical test data to achieve the necessary accuracy for safety certification. The continuous demand for new features, such as advanced material modeling capabilities (e.g., predicting failure in complex composites, specialized adhesives), integration with AI/ML tools, and seamless connectivity within larger Product Lifecycle Management (PLM) ecosystems, ensures sustained revenue growth through licensing and maintenance contracts. The software solutions are moving towards modular architectures, allowing users to select specialized tools for occupant safety (dummy modeling), structural crashworthiness, and pedestrian protection independently or as an integrated suite.

The competitive differentiation in the software segment revolves around solver speed, robustness in handling complex contact algorithms, and the richness of the pre- and post-processing environment. High-fidelity meshing tools and automated model setup features are crucial for reducing the engineer's workload. Furthermore, software vendors are increasingly focusing on providing specialized libraries for virtual test devices, including highly detailed Finite Element Human Body Models (HBMs) and validated virtual crash barriers (e.g., IIHS, Euro NCAP barriers). These digital assets are indispensable for modern safety engineering, ensuring that simulation results directly correlate with regulatory test outcomes.

The shift towards cloud-based simulation (SaaS model) is a major trend within the software segment, reducing the need for OEMs to manage large, internal HPC resources. Subscription models are becoming more popular, offering greater flexibility and accessibility, especially to Tier 2 and Tier 3 suppliers who might not afford large perpetual licenses. The adoption of open-source components for visualization and data handling, while maintaining proprietary core solvers, reflects a strategy to enhance user flexibility and integration capabilities while protecting core intellectual property.

- Key Sub-segments: Explicit Dynamic Solvers (FEA), Pre-Processing & Meshing Tools, Post-Processing & Visualization Software.

- Technological Focus: Multi-physics Coupling, GPU Acceleration, Advanced Material Constitutive Models (e.g., visco-elastic foams, hyper-elastic materials).

- Driving Factor: Mandated use of validated solvers for NCAP rating submissions and regulatory compliance across major global markets.

Hardware and HPC Requirements

The Hardware segment, particularly High-Performance Computing (HPC) clusters, forms the backbone of the crash simulation infrastructure. Accurate crash simulation requires solving large systems of non-linear equations over millions of elements for very short time durations (milliseconds), demanding massive computational resources. OEMs and large Tier 1 suppliers typically maintain dedicated HPC centers featuring hundreds to thousands of high-core processors, specialized network interconnects (like InfiniBand), and high-speed parallel file systems to manage the massive datasets (often terabytes per simulation) generated by full vehicle crash models.

The evolution of hardware technology, including the increasing integration of Graphical Processing Units (GPUs) for specific solver tasks (where supported by software vendors like Ansys LS-DYNA), is continuously improving throughput and reducing simulation time. This technological advancement directly addresses the critical industry need for faster turnaround times, allowing more design iterations within tight development schedules. The investment cycle in HPC hardware is long but essential, as computational complexity (e.g., adding detailed HBMs or highly refined meshes) perpetually increases the demand for raw processing power.

The rise of cloud computing services has partially cannibalized the traditional internal hardware market but also democratized access to extreme computing power. Cloud-based HPC allows customers to dynamically scale computational resources based on peak simulation load, eliminating the need for over-provisioning internal data centers. This trend is highly favorable for smaller organizations and provides a flexible expenditure model (OpEx instead of CapEx). Nonetheless, concerns over data security and proprietary model protection remain a factor for large OEMs when choosing between on-premise and cloud solutions for highly sensitive core vehicle programs.

- Core Components: High-Core Central Processing Units (CPUs), Graphics Processing Units (GPUs), High-Speed Interconnects, Specialized Data Storage Solutions.

- Deployment Models: On-Premise Data Centers, Cloud-Based HPC (IaaS).

- Impact on Workflow: Directly influences the number of feasible design optimization cycles and overall time-to-market.

Services Segment Overview

The Services segment comprises specialized engineering consultation, software customization, system integration, and advanced training. While software licenses drive the initial investment, services provide consistent, high-margin revenue stream crucial for complex, long-term programs. Many OEMs and suppliers opt to outsource specific, highly complex crash scenarios (e.g., advanced rollover modeling, complex battery impact simulations) to specialized consulting firms due to a lack of internal capacity or specific expertise in niche domains like HBM implementation.

System integration services are vital, ensuring that the crash simulation software seamlessly interfaces with other engineering tools, including Computer-Aided Design (CAD), Product Data Management (PDM), and enterprise PLM systems. This integration minimizes data translation errors and optimizes the overall engineering workflow. Training services are consistently required to onboard new engineers and educate existing staff on the latest solver features, regulatory changes, and modeling best practices, given the high turnover and continuous evolution of the technology.

Consulting services often bridge the gap between regulatory requirements and simulation capabilities, helping clients interpret new safety standards (e.g., updated side pole requirements, new head impact criteria) and translate them into accurate virtual test protocols. Furthermore, consultants specializing in correlation and validation help OEMs benchmark simulation results against physical crash tests, ensuring the accuracy and trustworthiness of the virtual models used for critical decision-making. This segment’s growth is directly tied to the complexity of new vehicle architectures (EVs, autonomous vehicles) requiring specialized validation approaches.

- Service Types: Engineering Consulting, System Integration, Customized Model Development (e.g., HBMs), Software Training, Validation & Correlation Studies.

- Value Proposition: Provides specialized expertise, scales human resources dynamically, and ensures high confidence in simulation results for regulatory filing.

- Target Clients: Small to mid-sized Tier suppliers and large OEMs needing supplementary, specialized support.

Regulatory Compliance and Safety Standards Influence

Regulatory compliance is the single most significant driver sustaining and accelerating the Automotive Crash Impact Simulator Market. Global safety bodies and consumer organizations—such as the National Highway Traffic Safety Administration (NHTSA) in the US, Euro NCAP in Europe, and consumer NCAP programs worldwide—continuously update their testing protocols, often requiring more severe and complex impact scenarios. These updates force automotive manufacturers to enhance their simulation capabilities to validate performance against these new, rigorous requirements before physical testing begins. The simulator market thrives on the perpetual cycle of regulatory revision and technological response.

The shift towards consumer-focused safety ratings (e.g., five-star ratings) means that OEMs cannot merely meet minimum legal requirements but must strive for superior safety performance to gain market advantage. Simulators are indispensable in achieving this, allowing engineers to incrementally optimize designs for peak performance across multiple crash modes (e.g., optimizing for both 40% offset frontal crash and full-width frontal crash). The ability to use high-fidelity simulation results as partial evidence during the early stages of certification significantly streamlines the regulatory submission process, reducing delays associated with failed physical tests.

Moreover, the integration of new technologies, especially Advanced Driver Assistance Systems (ADAS) and Autonomous Driving (AD) features, introduces entirely new compliance challenges. Simulators are now utilized to model pre-crash scenarios, evaluating the performance of sensors and structural responses to low-speed collisions and potential impacts on sensor functionality post-crash. This expansion of safety domains—from pure passive safety to integrated active-passive safety evaluation—ensures that simulation tools remain central to the compliance landscape. The strict validation required for simulation models used in regulatory contexts mandates the constant collaboration between software vendors and regulatory bodies.

- Key Regulatory Bodies: NHTSA (FMVSS), ECE Regulations, Euro NCAP, IIHS, China NCAP.

- Simulation Requirement: Validation of structural integrity, occupant restraint systems (airbags, seatbelts), and injury assessment metrics (HIC, P-max, Chest Deflection).

- Future Trend: Simulation required for validation of ADAS system functionality in defined crash-avoidance and low-speed impact scenarios.

Impact of Electric Vehicles (EVs) on Simulation Demand

The mass adoption of Electric Vehicles (EVs) represents a pivotal shift that significantly increases the complexity and, consequently, the demand for sophisticated crash impact simulation. EVs introduce unique structural elements, most notably the large, heavy battery pack often integrated into the vehicle chassis. This battery structure must be protected from intrusion and deformation during severe impacts, as mechanical damage can lead to thermal runaway, posing a severe safety risk. Simulators are essential for optimizing the complex load paths around the battery structure during side-impact and underbody scenarios, ensuring energy absorption without compromising the high-voltage system integrity.

Furthermore, the inherent differences in mass distribution and overall vehicle weight in EVs compared to traditional vehicles require re-evaluation of crash energy management strategies. Lightweighting techniques, crucial for maximizing EV range, often involve the use of advanced materials (e.g., composites, specialized aluminum alloys) whose complex non-linear failure characteristics demand highly accurate and calibrated material models within the simulation software. This necessity drives vendors to invest heavily in developing sophisticated constitutive models that can accurately predict the crash behavior of these materials, thereby driving growth in the high-end software segment.

Beyond structural safety, the overall architecture of EVs (e.g., lack of traditional engine block) changes the way frontal crash energy is absorbed, requiring innovative design solutions that are only feasible through iterative virtual testing. The integration of high-fidelity thermal simulation alongside mechanical crash simulation, previously niche, is becoming standard practice for EV programs, demonstrating a multi-physics convergence driven by safety regulations specific to high-voltage systems. This expanding scope of simulation ensures sustained market growth focused on specialized EV safety validation.

- EV Challenges Modeled: Battery enclosure protection, intrusion resistance, localized structural stiffening, thermal runaway prediction post-impact.

- Simulation Focus: Multi-Physics (Structural & Thermal), High-Fidelity Material Modeling (for composites and aluminum), Underbody and Side Impact Scenarios.

- Growth Indicator: Increased complexity drives demand for specialized engineering services and advanced solver features.

Competitive Landscape and Strategic Initiatives

The competitive landscape in the Automotive Crash Impact Simulator Market is dominated by a few key players—large software conglomerates that offer integrated engineering solutions. The primary competitive strategy revolves around comprehensive portfolio integration, ensuring that crash simulation tools are seamlessly linked with Computer-Aided Engineering (CAE), PLM, and CAD environments. This platform approach minimizes data loss and improves workflow efficiency for large OEM clients, locking in major accounts through deep software integration across the enterprise.

A secondary, yet critical, competitive front is technological superiority, focusing on solver speed, accuracy, and the ability to handle emerging physics. Companies continuously race to optimize their solvers for new hardware (GPUs, faster CPUs) and to introduce advanced models, such as probabilistic simulation techniques, which account for manufacturing variability. Strategic acquisitions play a major role, with large players frequently acquiring smaller, niche firms specializing in areas like HBM development, specific material modeling, or post-processing visualization, thus quickly filling portfolio gaps and eliminating potential threats.

Furthermore, marketing and distribution strategies focus heavily on forming strategic partnerships with leading automotive research institutions and regulatory bodies to ensure their software models are continuously validated and adopted as industry standards. Providing extensive educational resources and training programs to cultivate future users is also a key strategy, aiming to establish early brand loyalty among engineering students and researchers, ensuring a steady adoption pipeline across the industry. The successful provision of robust cloud-based simulation options is quickly becoming a non-negotiable factor in maintaining a competitive edge.

- Core Strategies: Portfolio Integration (CAE/PLM), Solver Performance Enhancement (Speed/Accuracy), Strategic Acquisitions, Cloud Service Deployment.

- Competitive Advantages: Large installed base among top OEMs, proprietary HBM libraries, and proven regulatory validation history.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager