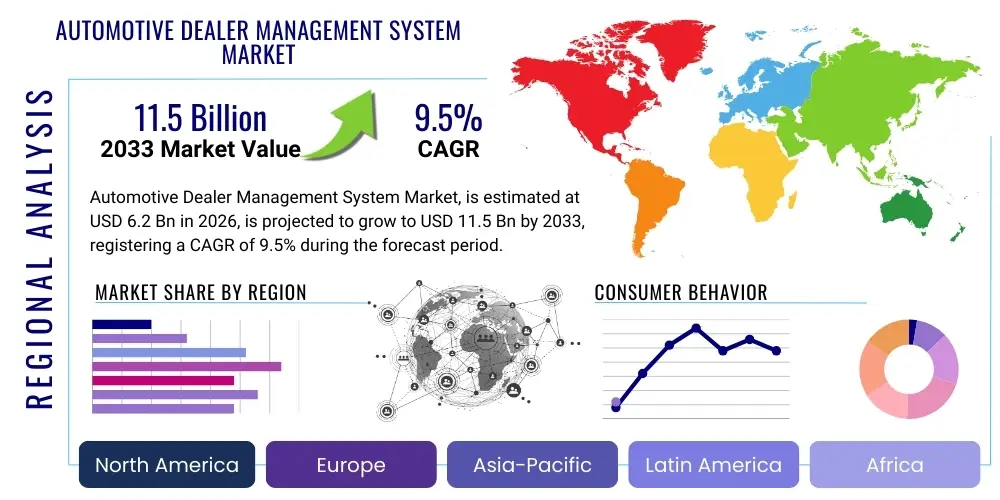

Automotive Dealer Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439176 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Dealer Management System Market Size

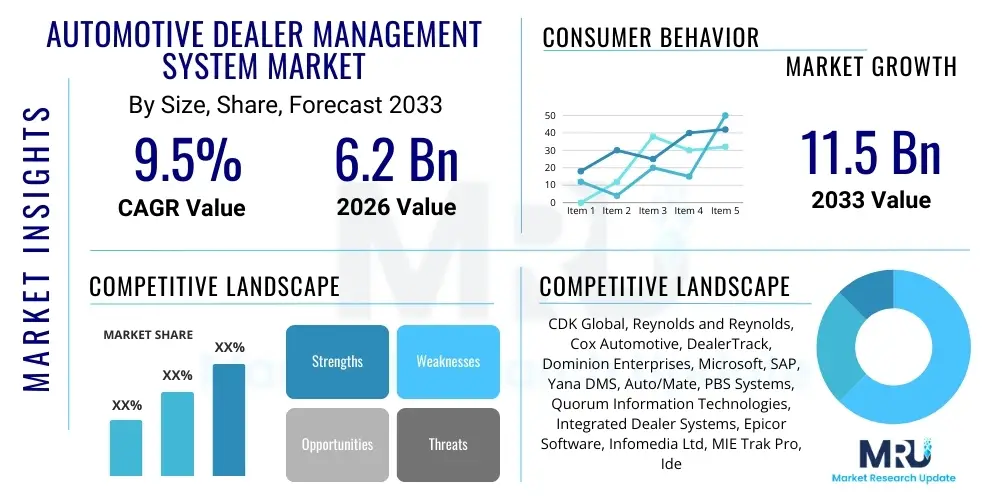

The Automotive Dealer Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033.

Automotive Dealer Management System Market introduction

The Automotive Dealer Management System (DMS) Market encompasses comprehensive software solutions designed to streamline and automate critical operational functions for automotive dealerships, ranging from inventory management and sales processing to customer relationship management (CRM) and service department scheduling. These integrated platforms serve as the central nervous system for modern dealerships, ensuring efficiency, compliance, and optimized profitability across all departments. The core product offering provides a unified database structure, facilitating seamless communication and data flow between finance, parts, sales, and service sectors, thereby eliminating data silos and enhancing decision-making capabilities.

Major applications of DMS solutions include sophisticated financial accounting tailored to automotive industry standards, complex inventory tracking that optimizes stocking levels based on real-time sales data, and robust customer engagement tools that manage leads and post-sale follow-ups. The integration of digital retailing tools, facilitating online vehicle purchasing and financing, further accelerates the adoption of advanced DMS platforms. These systems are pivotal in transitioning traditional dealerships into digitally empowered enterprises capable of meeting the demands of modern, tech-savvy consumers who expect transparency and speed in transactions.

Key driving factors fueling market growth involve the increasing complexity of vehicle sales regulations, the necessity for enhanced operational transparency to meet stringent OEM requirements, and the accelerating digital transformation within the automotive retail sector. Furthermore, the shift towards cloud-based and mobile-accessible DMS solutions provides flexibility and scalability, making these systems highly attractive to both large franchise groups and independent dealers seeking reduced infrastructure costs and improved accessibility. The measurable benefits include significant reductions in administrative overhead, improved lead conversion rates, and enhanced customer satisfaction scores stemming from faster, more organized service delivery.

Automotive Dealer Management System Market Executive Summary

The Automotive Dealer Management System (DMS) market is currently experiencing robust growth, primarily driven by the imperative for operational efficiency and the increasing integration of digital tools across the automotive retail value chain. Major business trends highlight a decisive shift toward cloud-based subscription models (SaaS), allowing dealerships to access advanced features with lower upfront capital expenditure, fostering innovation cycles among solution providers who can deploy updates rapidly. Consolidation among DMS vendors, through strategic mergers and acquisitions, is shaping a competitive landscape dominated by comprehensive, all-in-one platforms that offer superior integration capabilities across third-party software ecosystems, addressing the sophisticated needs of large multi-franchise dealer groups.

Regional trends indicate North America maintaining market leadership due to high adoption rates of advanced IT infrastructure and large average dealership sizes that necessitate sophisticated management tools. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by the rapid expansion of vehicle sales volumes, increasing consumer digitalization, and the professionalization of dealership operations in emerging economies like China and India. Europe shows steady growth, driven by stringent data privacy regulations (GDPR compliance) that mandate advanced data management features within DMS, pushing vendors towards secure, compliant solutions.

Segment trends emphasize the growing dominance of Cloud-based deployment over traditional On-premise installations, favored for their scalability, automatic updates, and resilience. Functionally, the Sales & Finance application segment remains critical, but the Repair & Maintenance and Customer Relationship Management (CRM) modules are gaining prominence as dealerships focus increasingly on maximizing long-term customer value and recurring service revenue. Franchise dealers represent the largest end-user segment due to complex reporting and brand compliance requirements, yet the independent dealer segment is rapidly adopting simplified, modular DMS solutions to compete effectively in the used vehicle market.

AI Impact Analysis on Automotive Dealer Management System Market

Common user questions regarding AI's impact on the Automotive DMS Market often revolve around predictive capabilities, process automation, and personalized customer interactions. Users frequently inquire about how AI can optimize used car pricing strategies, forecast parts and service demand accurately, and automate lead routing and qualification to improve sales conversion efficiency. A significant concern relates to data security and the integration complexity of AI models into existing legacy DMS infrastructure. Expectations are high concerning AI's ability to provide proactive insights into customer churn and personalize service communications, moving DMS systems beyond mere transactional records to strategic intelligence platforms that fundamentally redefine operational workflows and customer engagement.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into DMS platforms is fundamentally transforming how dealerships manage inventory, engage customers, and optimize service workflows. AI algorithms enable sophisticated predictive analytics for vehicle demand forecasting, allowing dealerships to optimize inventory levels, minimizing carrying costs, and reducing the likelihood of obsolescence. This precision in stocking not only improves cash flow but also ensures that the right mix of vehicles is available to meet localized market preferences, thereby enhancing sales velocity.

Furthermore, AI significantly enhances the Customer Relationship Management (CRM) component of DMS. AI-driven chatbots and virtual assistants handle initial customer inquiries, qualify leads based on behavioral data, and personalize communication touchpoints across the entire customer journey. In the service department, AI optimizes scheduling algorithms, predicts potential equipment failures based on telematics data, and generates highly targeted service reminders, drastically improving shop utilization rates and elevating customer satisfaction through hyper-personalized, timely interactions.

- AI-driven Predictive Inventory Management: Optimization of vehicle stocking levels and parts inventory based on localized historical sales data and market trends.

- Enhanced Customer Lead Qualification: Automated scoring and routing of leads using ML models to prioritize high-potential customers, increasing sales efficiency.

- Service Department Optimization: AI scheduling tools maximize bay utilization, reduce wait times, and predict necessary preventative maintenance.

- Personalized Digital Retailing: Customized financing offers, vehicle recommendations, and trade-in valuations based on customer profiles and browsing behavior.

- Automated Compliance and Reporting: Use of AI to audit transaction data for compliance adherence and instantly generate complex regulatory reports.

- Fraud Detection: ML models analyze transaction patterns in finance and parts departments to flag suspicious activities and minimize financial risk.

DRO & Impact Forces Of Automotive Dealer Management System Market

The Automotive Dealer Management System (DMS) market is powerfully influenced by the ongoing digital imperative within automotive retail, driving demand for integrated, cloud-native solutions. The primary drivers include the necessity for real-time inventory visibility across large dealer networks and the escalating consumer demand for seamless, personalized online-to-offline buying experiences. Restraints include the significant capital investment required for implementing and migrating complex DMS systems, particularly for smaller independent dealers, alongside persistent concerns regarding data security and the interoperability of various legacy systems. Opportunities are centered on the expansion into emerging markets, the development of specialized solutions for electric vehicle (EV) dealerships, and the integration of advanced technologies like AI/ML for predictive operations.

The impact forces are high and multidirectional. Regulatory pressures, especially concerning data privacy and financial transparency, necessitate continuous updates and sophisticated compliance features, acting as a strong driver for adopting modern DMS platforms capable of handling evolving legal landscapes. Simultaneously, competitive forces among dealerships compel rapid technology adoption, as efficient operations and superior customer experience become primary differentiators. The increasing complexity of vehicle manufacturing, including detailed technical specifications and telematics data integration, requires DMS systems to evolve rapidly to manage these new data streams effectively, placing pressure on vendors to continuously innovate their core offerings.

Technological impact forces are arguably the most transformative, with the shift from traditional on-premise licensing to scalable Software-as-a-Service (SaaS) models dictating the pace of market penetration and profitability structure. The rise of integrated digital retailing suites, which directly connect the DMS with customer-facing e-commerce platforms, is transforming the sales function entirely. Vendors failing to embrace open APIs and flexible architectures that allow easy integration with third-party CRM, marketing automation, and inventory pricing tools risk losing market share to more adaptable platforms, thereby making technological agility a crucial impact force.

Segmentation Analysis

The Automotive Dealer Management System market is comprehensively segmented based on deployment type, application function, and end-user profile, reflecting the diverse operational needs within the automotive retail ecosystem. Analyzing these segments provides critical insights into market penetration rates and growth opportunities. The transition from monolithic, tightly controlled on-premise systems to flexible, scalable cloud solutions is the most significant trend defining the market structure. Functional segmentation underscores the high value placed on modules that directly impact revenue generation and customer satisfaction, such as Sales & Finance and Repair & Maintenance, while end-user segmentation reveals differing requirements between high-volume franchise operations and specialized independent dealers.

Deployment segmentation differentiates between traditional installations requiring significant infrastructure investment (On-premise) and modern, subscription-based models accessed via the internet (Cloud-based). Cloud-based DMS is rapidly capturing market share due to its lower total cost of ownership (TCO), improved accessibility, automatic updates, and superior disaster recovery capabilities, appealing strongly to dealer groups looking for centralized data management across multiple locations. Application segmentation helps vendors focus product development on areas that offer the highest return on investment for dealerships, emphasizing the move toward holistic customer lifecycle management rather than fragmented departmental solutions.

End-user segmentation highlights the distinction between franchise dealers, who require complex OEM integration, standardized reporting, and adherence to brand guidelines, and independent dealers, who prioritize cost-effectiveness, simplicity, and flexibility, especially in managing diverse used vehicle inventories. Future market growth is expected to be fueled by enhanced feature sets targeting the service and parts departments across all end-user categories, recognizing these areas as key profitability centers beyond the initial vehicle sale.

- Deployment Type

- On-premise

- Cloud-based

- Application

- Sales & Finance Management

- Inventory Management

- Customer Relationship Management (CRM)

- Parts Management

- Service & Repair Management

- Dealer Management Reporting & Analytics

- End User

- Franchise Dealers

- Independent Dealers

Value Chain Analysis For Automotive Dealer Management System Market

The value chain for the Automotive Dealer Management System market commences with upstream technology providers, including software developers, database management system (DBMS) vendors, and specialized AI/ML service providers who supply the foundational technology and infrastructure necessary for DMS platform creation. Key activities at this stage involve rigorous research and development, continuous integration of new regulatory compliance features, and the development of robust, scalable cloud architectures. The quality and security of these upstream components directly dictate the performance and reliability of the final DMS product offered to dealerships.

Midstream activities involve the core DMS platform providers—the major market players—who focus on system integration, customization, testing, and deployment. These providers consolidate the upstream technologies into functional, user-friendly modules tailored specifically for automotive retail processes. Distribution channels are predominantly direct, involving proprietary sales teams managing large accounts and providing implementation and training services. However, indirect channels, utilizing strategic partnerships with IT consultants or regional system integrators, are also utilized, particularly in fragmented international markets to ensure localized support and expertise.

Downstream analysis focuses on the final consumption and service stages. This includes the installation, data migration (often a significant point of friction), ongoing technical support, maintenance, and continuous software updates provided to the end-user (dealerships). The efficiency of the downstream support structure is critical for customer retention and overall system success. Continuous feedback from dealers is incorporated back into the R&D cycle (upstream) to refine features, addressing practical challenges like complex OEM reporting requirements and integration with localized third-party finance portals, completing the cyclical value creation process.

Automotive Dealer Management System Market Potential Customers

The primary customers for Automotive Dealer Management Systems are entities involved directly in the retail, service, and financing of vehicles. This includes large multinational franchise dealer groups that operate across multiple geographies and require highly centralized, robust systems for complex compliance and reporting across different brands (e.g., Ford, Toyota, BMW). These groups demand advanced features such as multi-store inventory management, consolidated financial reporting, and deep integration with proprietary OEM incentive programs and parts ordering systems.

A second crucial segment comprises independent used vehicle dealerships. While these customers often require less complexity in terms of OEM integration, their need for efficient, accurate vehicle sourcing, valuation, and marketing tools is paramount. They seek scalable, often cloud-based, solutions that offer strong integration with third-party appraisal tools and online marketplaces, focusing heavily on maximizing profit margins on high-turnover inventory with minimal overhead. The independent sector values rapid deployment and ease of use highly.

Furthermore, specialized automotive entities, such as large commercial fleet management companies, vehicle leasing firms, and high-volume service centers that operate independent of a specific sales department, also represent potential customers. These entities utilize specific DMS modules, particularly those related to detailed service tracking, parts inventory control, and fleet lifecycle management, underscoring the modular flexibility required by DMS vendors to capture the full breadth of the automotive services sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CDK Global, Reynolds and Reynolds, Cox Automotive, DealerTrack, Dominion Enterprises, Microsoft, SAP, Yana DMS, Auto/Mate, PBS Systems, Quorum Information Technologies, Integrated Dealer Systems, Epicor Software, Infomedia Ltd, MIE Trak Pro, Ideal Computer Systems, Blue Skies, Autosoft, VUE DMS, TIQQE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Dealer Management System Market Key Technology Landscape

The core technology landscape of the Automotive Dealer Management System market is defined by several key architectural and functional advancements that prioritize integration, scalability, and data intelligence. Modern DMS platforms are predominantly built upon microservices architecture, moving away from monolithic designs. This allows for modular development and deployment, enabling dealerships to select and scale specific functionalities (e.g., service scheduling or finance processing) independently. Cloud computing platforms, particularly hyperscalers like AWS, Azure, and Google Cloud, provide the backbone for SaaS delivery, offering high availability, robust security, and the necessary compute power for real-time analytics and transaction processing across vast networks of dealerships.

Crucial to system functionality is the utilization of Application Programming Interfaces (APIs). Open API strategies are essential for vendor interoperability, facilitating seamless data exchange with third-party applications, including specialized CRM tools, digital marketing platforms, and OEM-specific systems. This commitment to openness combats vendor lock-in and fosters a more competitive and innovative ecosystem. Furthermore, advanced relational and non-relational database technologies are employed to manage the massive datasets generated by sales, inventory, and service transactions, ensuring data integrity and high-speed querying capabilities necessary for instantaneous reporting and decision support.

The emerging technological frontier is anchored by the integration of Artificial Intelligence (AI) and Machine Learning (ML). These tools utilize advanced statistical models and neural networks for predictive applications, such as identifying optimal pricing strategies for used vehicles, forecasting maintenance requirements based on vehicle usage patterns, and automating complex administrative tasks like document processing and preliminary finance application checks. Blockchain technology, while nascent, is also being explored for secure, transparent recording of vehicle history and ownership transfers, potentially transforming the documentation module of future DMS platforms.

Regional Highlights

- North America: Dominates the global DMS market characterized by the presence of major domestic vendors and high technology penetration. The region’s large dealer groups frequently invest in integrated, enterprise-level solutions that support complex multi-franchise operations and stringent compliance requirements. Growth is driven by the continuous upgrade cycle from on-premise to sophisticated cloud platforms and early adoption of AI tools for hyper-personalization.

- Europe: Represents a mature, yet steadily growing market, highly regulated by data privacy standards such as GDPR. This necessitates DMS solutions with advanced data governance features. Germany, the UK, and France are key contributors, focusing on optimizing service department profitability and integrating digital sales channels with existing inventory management systems to cater to a demanding consumer base.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by rapid motorization, rising disposable incomes, and the expansion of structured, franchised dealership models, particularly in China and India. The demand here is often for highly scalable, modular cloud solutions that can accommodate rapid market expansion and adapt to diverse local regulatory environments and language requirements.

- Latin America (LATAM): A developing market where DMS adoption is accelerating, moving away from manual processes or basic accounting software. Economic volatility and varying infrastructure quality mean vendors must offer flexible pricing and robust, affordable solutions. Brazil and Mexico lead the adoption, focusing primarily on efficient inventory management and basic sales processing tools to improve transactional efficiency.

- Middle East and Africa (MEA): Characterized by strong demand in the GCC countries (Saudi Arabia, UAE) due to high luxury vehicle sales and robust dealer networks. The focus is on integrated CRM and service management to enhance customer experience in a highly competitive premium segment. Adoption remains lower in many African nations but is growing steadily in conjunction with general IT infrastructure improvements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Dealer Management System Market.- CDK Global LLC

- The Reynolds and Reynolds Company

- Cox Automotive (DealerTrack)

- Dominion Enterprises

- PBS Systems Inc.

- Quorum Information Technologies Inc.

- Autosoft, Inc.

- Auto/Mate Dealership Systems

- VUE DMS

- Yana DMS

- Microsoft Corporation (via vertical solutions)

- SAP SE (via enterprise resource planning integration)

- Epicor Software Corporation

- Integrated Dealer Systems (IDS)

- MIE Trak Pro

- Ideal Computer Systems

- Infomedia Ltd

- Blue Skies

- TIQQE

- DealerSocket (now part of Solera)

Frequently Asked Questions

Analyze common user questions about the Automotive Dealer Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating from on-premise to cloud-based DMS?

The primary benefit of cloud migration is the significant reduction in Total Cost of Ownership (TCO) achieved by eliminating local server maintenance and infrastructure investment. Cloud-based systems also offer superior scalability, automatic software updates, improved accessibility, and enhanced data security and resilience against downtime.

How is Artificial Intelligence (AI) being utilized within modern DMS platforms?

AI is utilized for predictive analytics, optimizing inventory levels and pricing strategies, forecasting service department demand, and automating customer interactions via advanced CRM modules. It transitions the DMS from a record-keeping tool to a strategic, proactive intelligence platform.

Which application segment is expected to show the highest growth in the DMS market?

While Sales & Finance remains the largest segment, the Service & Repair Management and Customer Relationship Management (CRM) modules are anticipated to show the highest growth, driven by dealerships' increasing focus on maximizing recurring revenue streams and improving long-term customer loyalty.

What major regulatory factors influence the development of DMS software?

Major regulatory factors include strict data privacy laws like GDPR (in Europe) and various state-level data security mandates in North America, along with complex financial reporting requirements and mandated OEM compliance standards that dictate specific data capturing and transmission protocols.

What are the key differences between the needs of Franchise Dealers and Independent Dealers?

Franchise Dealers require deep integration with specific OEM systems, standardized branding, and complex compliance reporting. Independent Dealers typically prioritize cost-effectiveness, simplicity, rapid deployment, and strong integration with used vehicle valuation and marketing platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager