Automotive Die Casting Lubricants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432107 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Die Casting Lubricants Market Size

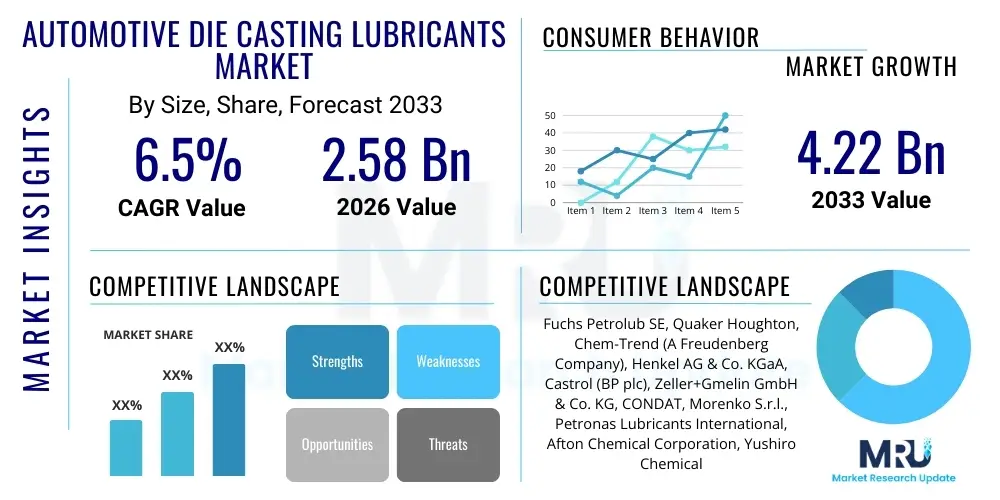

The Automotive Die Casting Lubricants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.58 Billion in 2026 and is projected to reach USD 4.22 Billion by the end of the forecast period in 2033.

Automotive Die Casting Lubricants Market introduction

The Automotive Die Casting Lubricants Market encompasses specialized chemical formulations essential for the high-volume production of automotive components using various die-casting processes, predominantly high-pressure die casting (HPDC). These lubricants, primarily water-based, oil-based, and synthetic, serve crucial functions including mold release, temperature control, and lubrication of moving parts, ensuring high component quality, extended die life, and efficient operational cycles. The market is characterized by a continuous demand for advanced lubricants capable of handling increasingly complex geometries, higher operating temperatures, and stringent environmental regulations demanding low volatile organic compounds (VOCs) and non-toxic compositions. The fundamental product description involves barrier coatings that prevent the molten metal (often aluminum or magnesium) from welding to the die cavity, thus facilitating flawless component ejection.

Major applications of these lubricants span structural components such as engine blocks, transmission casings, chassis parts, and specialized electric vehicle (EV) battery housings and thermal management systems. The benefits derived from high-performance die casting lubricants are substantial, including enhanced surface finish quality, reduced scrap rates, improved thermal stability, and minimization of die wear, which directly translates into cost efficiency and sustained production output for automotive original equipment manufacturers (OEMs) and Tier 1 suppliers. Furthermore, modern lubricants are designed to prevent residue buildup, which is a major constraint in achieving long production runs and requires frequent die cleaning.

The market is primarily driven by the consistent global demand for lightweight vehicles, particularly fueled by regulatory pressure to enhance fuel efficiency and reduce carbon emissions. The transition towards Electric Vehicles (EVs) is a significant accelerant, as EVs require lightweight structural components, intricate battery pack casings, and specialized cooling plates, all manufactured via complex die casting methods. Innovations in material science, combined with the push for sustainable manufacturing practices, further propel the adoption of advanced, high-efficiency, water-based lubricant systems, positioning the market for sustained growth throughout the forecast period.

Automotive Die Casting Lubricants Market Executive Summary

The Automotive Die Casting Lubricants Market is experiencing robust growth driven by the acceleration of automotive lightweighting strategies and the paradigm shift toward Electric Vehicle (EV) manufacturing, which relies heavily on large-format structural die castings using aluminum and magnesium alloys. Business trends indicate a strong move toward specialization, where lubricant manufacturers are partnering with die-casting machine suppliers to develop tailor-made solutions optimizing performance for specific alloys and casting pressures, focusing heavily on improving thermal shock resistance and reducing cycle times. Sustainability remains a central business theme, leading to the proliferation of high-performance water-based lubricants with extremely low residue formation and reduced VOC content, aligning with global environmental compliance standards like REACH and EPA directives, simultaneously driving R&D investments in bio-degradable formulations.

Regionally, the Asia Pacific (APAC) region dominates the market, primarily due to the massive volume of automotive manufacturing concentrated in China, India, and Japan, complemented by significant investments in EV production capacity across these economies. Europe is characterized by stringent environmental regulations, fostering demand for advanced synthetic and environmentally compliant water-based products, while North America’s growth is anchored by the reshoring of automotive manufacturing and substantial domestic investment in EV battery ecosystems. Segment trends reveal that High-Pressure Die Casting (HPDC) remains the largest segment by application, owing to its ability to produce highly complex, high-strength structural parts. Furthermore, water-based lubricants hold the dominant market share due to their cost-effectiveness and increasing performance parity with oil-based alternatives in high-temperature applications, driven by continuous innovation in additive packages.

Overall, the market trajectory is highly dependent on the pace of global automotive sales recovery post-pandemic disruptions and the rate of EV adoption. Key strategic focuses for major market players include vertical integration, geographical expansion into emerging APAC and MEA markets, and diversification of product portfolios to address the demanding specifications of mega-casting and gigacasting techniques increasingly employed in EV structural component manufacturing. The competitive landscape is moderately fragmented, with large multinational chemical companies competing fiercely on product performance, technical service support, and commitment to sustainable product development, ensuring a steady evolution toward higher-performing and ecologically safer lubrication solutions.

AI Impact Analysis on Automotive Die Casting Lubricants Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) in the die casting lubricants domain center around optimizing operational efficiency, ensuring consistency in component quality, and managing inventory and application rates. Users frequently ask about how AI can predict die wear based on lubricant degradation analysis, optimize spray patterns to minimize lubricant usage while maintaining effective mold release, and integrate real-time sensor data from casting machines to adjust lubricant concentration or flow dynamically. The key themes revolve around achieving 'zero-defect' manufacturing through data-driven quality control and maximizing the lifespan of expensive die tooling by preventing thermal fatigue, which is often exacerbated by inconsistent lubricant application. Expectations are high for AI to transform lubricant management from a reactive maintenance task to a proactive, predictive science, ensuring optimal performance under varying production parameters, especially as casting complexity increases.

AI's influence is transforming the application, formulation, and life-cycle management of die casting lubricants. In manufacturing operations, AI algorithms process continuous streams of data from temperature sensors, pressure transducers, and robotic spray systems to establish optimal parameters for lubricant dosing, reducing waste and ensuring uniform cooling. Machine learning models can analyze spectroscopic data and thermal images of the mold surface post-ejection to predict lubricant film thickness and potential areas of insufficient coverage or excessive residue buildup. This predictive capability minimizes component defects like soldering and pitting, which are critical quality issues in aluminum and magnesium die casting, leading directly to reduced scrap rates and increased operational throughput.

Furthermore, AI significantly impacts the supply chain and formulation development. ML models are being utilized in R&D to simulate the performance of new additive packages under extreme thermal conditions, accelerating the development of highly stable and non-toxic synthetic and water-based formulas. On the logistics side, AI helps optimize inventory management by forecasting lubricant consumption based on projected production schedules, machine utilization rates, and historical performance data, thereby ensuring timely supply and reducing storage costs. The integration of AI with Industrial IoT (IIoT) infrastructure facilitates a closed-loop control system, allowing lubricant suppliers to offer enhanced, data-driven technical services, moving beyond simple product supply to providing comprehensive casting process optimization solutions.

- AI-driven Predictive Maintenance: Uses sensor data to monitor lubricant integrity and predict necessary die re-lubrication or cleaning cycles, extending die life.

- Optimized Spray Control: ML algorithms adjust robotic spray parameters (volume, pressure, nozzle angle) in real-time based on die temperature and component complexity, minimizing lubricant overuse.

- Quality Assurance Automation: Machine vision coupled with AI detects defects caused by inadequate lubrication (e.g., sticking, flow marks) instantly, enabling immediate process correction.

- Formulation R&D Acceleration: AI simulates the thermal and chemical stability of new lubricant additives, reducing physical testing time for environmentally compliant formulations.

- Supply Chain Efficiency: Predictive analytics optimize inventory levels and logistics for specialized lubricant products across distributed automotive manufacturing sites.

DRO & Impact Forces Of Automotive Die Casting Lubricants Market

The Automotive Die Casting Lubricants Market dynamics are governed by a complex interplay of regulatory drivers mandating efficiency and sustainability, technological opportunities arising from advanced casting methods, and restraints related to the capital intensity and operational challenges of high-pressure environments. The primary driving force is the global imperative for automotive lightweighting, spurred by stringent carbon emission reduction targets and the rapid adoption of electric vehicles, necessitating complex aluminum and magnesium structures manufactured through die casting. This demand translates directly into a need for high-performance lubricants that facilitate flawless ejection of large, intricate components like battery trays and structural nodes. Opportunities are amplified by the shift towards bio-degradable and minimal-residue lubricants, enabling manufacturers to meet green manufacturing standards and reduce maintenance downtime associated with die cleaning, thereby creating a premium market segment for sustainable solutions. Conversely, the market faces significant restraints, chiefly the volatile cost structure of raw materials (specialty chemicals and synthetic base oils) and the high initial investment required for sophisticated lubricant application systems that ensure precision coating and waste reduction.

Key drivers include the technological advancements in die-casting equipment, particularly the emergence of gigacasting (mega-casting) technologies, which require specialized lubricants to handle immense pressure, extremely high temperatures, and large surface areas, pushing the limits of current water-based formulations regarding thermal management and release properties. The continued urbanization and industrialization in emerging economies, particularly in Asia, fuel automotive production volumes, significantly increasing the baseline demand for these essential consumables. Furthermore, increased awareness among die casters regarding Total Cost of Ownership (TCO) emphasizes the value proposition of premium lubricants that, despite a higher upfront cost, deliver substantial long-term savings through extended die life, reduced scrap, and minimized downtime. This paradigm shift from focusing solely on the price per gallon to evaluating the lubricant's overall contribution to operational efficiency profoundly impacts purchasing decisions.

Restraints are prominently linked to the technical challenges inherent in the die casting process itself. Lubricant residues, if not optimally formulated, can lead to hydrogen porosity in the final casting or interfere with subsequent treatment processes, such as painting or adhesion. The strict regulatory environment mandates continuous product reformulation, imposing high R&D costs on manufacturers to eliminate hazardous substances while maintaining or improving performance, particularly thermal stability. Opportunities for expansion include penetrating non-traditional automotive manufacturing hubs and diversifying application profiles into related sectors that utilize similar high-temperature metal processing techniques. The impact forces are currently skewed positively, with technological drivers and EV adoption momentum outweighing the cost and regulatory restraints, ensuring a strong demand outlook for innovative and performance-enhanced die casting lubricant solutions throughout the forecast period.

Segmentation Analysis

The Automotive Die Casting Lubricants market is segmented based on product type, application method, casting process, and vehicle type, reflecting the diverse operational needs of the global automotive manufacturing ecosystem. The analysis of these segments reveals a market trending toward specialized, high-performance formulations tailored for specific metal alloys (aluminum vs. magnesium) and casting methodologies (HPDC vs. GDC). Product segmentation highlights the dominance of water-based lubricants, primarily driven by environmental compliance and improvements in performance that allow them to compete with traditional oil-based and synthetic options in terms of thermal stability and release efficacy. Application segmentation focuses on manual spraying versus automated robotic systems, with the latter commanding greater market share due to precision, consistency, and alignment with Industry 4.0 automation trends in modern foundries.

- By Product Type:

- Water-Based Lubricants

- Oil-Based Lubricants

- Synthetic Lubricants (e.g., Graphite, Boron Nitride, Wax Emulsions)

- By Application Method:

- Manual Spraying

- Automated Robotic Spraying Systems

- By Casting Process:

- High-Pressure Die Casting (HPDC)

- Low-Pressure Die Casting (LPDC)

- Gravity Die Casting (GDC)

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles (LCVs and HCVs)

- Electric Vehicles (EVs/PHEVs)

Value Chain Analysis For Automotive Die Casting Lubricants Market

The value chain for automotive die casting lubricants is complex, starting with the sourcing of specialized raw materials, flowing through formulation and manufacturing, distribution, and culminating in application by the end-user. Upstream analysis involves the procurement of highly specialized chemical additives, emulsifiers, synthetic base oils, and performance enhancers (such as specific grades of graphite or boron nitride) from chemical producers. The quality and stability of these raw materials are critical, as they dictate the thermal performance and longevity of the final lubricant product. Key challenges in the upstream segment include ensuring consistent supply of highly refined raw materials and managing the volatility of petrochemical feedstock prices, which directly impacts the cost of synthetic and oil-based formulations. Major lubricant manufacturers invest heavily in R&D and quality control at this stage to optimize the interaction between the base fluid and the additive package.

The midstream segment involves the blending, formulation, and manufacturing of the finished lubricants. This stage requires significant technical expertise to balance crucial performance attributes such as thermal diffusivity, release capability, residue minimization, and environmental compliance. Manufacturers utilize state-of-the-art blending facilities and implement stringent quality assurance protocols to ensure batch consistency. Distribution channels are highly critical; they are categorized into direct and indirect methods. Direct distribution involves suppliers working straight with large, multinational automotive OEMs or Tier 1 casting operations, often providing integrated technical support and customized solutions. Indirect distribution leverages a network of specialized chemical distributors and regional agents who cater to smaller, independent foundries and local component manufacturers, providing localized inventory and logistical support, which is particularly vital in fragmented markets like Southeast Asia.

Downstream analysis focuses on the end-users: the die casting facilities responsible for producing automotive components. Effective application of the lubricant is paramount, requiring specialized equipment (manual or robotic spray systems) and process control expertise. Lubricant manufacturers often provide technical consultancy and training to ensure optimal dilution ratios and spray consistency, maximizing product efficacy and minimizing waste. The final stage of the value chain addresses disposal and recycling, with increasing emphasis on sustainable practices. The shift towards water-based, minimal-residue products simplifies wastewater treatment and aligns the entire value chain toward greater environmental responsibility, creating a cyclical demand for advanced, sustainable products.

Automotive Die Casting Lubricants Market Potential Customers

The primary customers for Automotive Die Casting Lubricants are entities involved in the production of metal components used across the entire spectrum of vehicle manufacturing, ranging from internal combustion engine (ICE) vehicles to advanced Electric Vehicles (EVs). The largest customer segments include captive die casting facilities operated directly by global Original Equipment Manufacturers (OEMs), such as major automakers who produce engine blocks or transmission casings in-house to maintain strict quality control and proprietary intellectual property. These customers typically require high-volume, standardized products coupled with sophisticated technical service and direct supply chain integration, favoring global suppliers with established track records.

The second major group comprises large Tier 1 and Tier 2 automotive component suppliers, often independent foundries specializing in high-pressure die casting of critical structural parts, braking system components, and increasingly, complex battery enclosures for electric vehicles. These commercial foundries operate with tighter margins and seek lubricants that offer the best balance between performance, cost-effectiveness, and compliance with diverse client specifications. They are motivated by lubricants that maximize throughput and minimize scrap rates, utilizing both direct and indirect (distributor-led) procurement channels based on their scale and geographical location.

A rapidly growing segment of potential customers includes specialized manufacturers focusing exclusively on EV component production, such as dedicated giga-casting foundries. These facilities require extremely advanced, custom-formulated lubricants capable of handling the unique thermal and pressure demands of massive, thin-walled aluminum structures, necessitating deep technical collaboration between the lubricant supplier and the casting equipment manufacturer. Ultimately, the end-users are driven by the need to produce lighter, stronger, and more aesthetically superior castings efficiently and sustainably, defining the buying criteria across all customer categories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.58 Billion |

| Market Forecast in 2033 | USD 4.22 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fuchs Petrolub SE, Quaker Houghton, Chem-Trend (A Freudenberg Company), Henkel AG & Co. KGaA, Castrol (BP plc), Zeller+Gmelin GmbH & Co. KG, CONDAT, Morenko S.r.l., Petronas Lubricants International, Afton Chemical Corporation, Yushiro Chemical Industry Co., Ltd., Shell plc, Exxon Mobil Corporation, Kluber Lubrication, Idemitsu Kosan Co., Ltd., Milacron Holdings Corp. (Ferro-Term Div.), Ultrachem Inc., Oel-Held GmbH, Grindaix GmbH, Wuxi South Petroleum Additives Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Die Casting Lubricants Market Key Technology Landscape

The technology landscape of the automotive die casting lubricants market is rapidly evolving, driven primarily by the need for enhanced thermal management, reduced residue formation, and improved environmental profiles. The core technological innovation lies in the advanced formulation of water-based lubricants. Modern water-based formulations utilize highly refined synthetic polymers, specialized emulsifiers, and performance additives (often proprietary nanostructures like engineered silicates or advanced wax dispersions) to create robust barrier films. These films must withstand instantaneous high temperatures—upwards of 600°C—upon metal injection while offering superior wetting and release properties. The technological challenge involves maintaining the integrity of the release agent film at high temperatures while ensuring the lubricant evaporates cleanly, leaving minimal solid residue that can contaminate the casting surface or erode the die cavity. Continuous R&D focuses on incorporating non-toxic, inorganic pigments and bio-degradable components to replace older, environmentally harmful compounds.

Another crucial technological development is the implementation of advanced application systems, moving away from conventional manual spraying to highly precise, robotic, proportional dosing systems integrated with real-time temperature monitoring (RTDM). These systems employ sophisticated nozzle designs and ultrasonic technology to ensure consistent, micro-thin application across the complex geometries of modern automotive components, dramatically reducing overspray and overall lubricant consumption—a key factor in reducing operational costs and waste. The integration of IIoT and sensor technology allows these systems to dynamically adjust the spray volume and dilution ratio based on the real-time thermal state of the die surface, maximizing cooling efficiency and minimizing thermal shock, thus extending the working life of expensive die tooling. This precision application technology is foundational for the emerging gigacasting processes used in EV manufacturing.

Furthermore, the development of specialty synthetic lubricants, particularly those utilizing advanced boron nitride (BN) or proprietary fluoropolymer dispersions, represents a critical niche technology. These materials are used in extremely challenging applications where metal flow is complex or where ultra-high surface finish is required, particularly for gravity die casting or low-pressure processes involving critical safety components. Technological advancement in this area focuses on creating stable suspensions that do not settle or clog sophisticated robotic spray nozzles. The overall technological direction points toward customized, data-driven solutions where the lubricant is viewed not merely as a consumable, but as an integral, programmable component of the entire metal casting process, leveraging advancements in material science and digital manufacturing to achieve unprecedented levels of casting precision and efficiency.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the dominant and fastest-growing region in the Automotive Die Casting Lubricants Market, driven by the sheer scale of automotive production, particularly in China, which is the world's largest vehicle manufacturing base, and India and Southeast Asia, characterized by rapidly expanding component manufacturing hubs. The region is the epicenter of the global EV transition, with significant government backing and massive investment in giga-factories for battery and structural component production. This requires high volumes of specialized, high-performance water-based lubricants suited for aluminum and magnesium mega-castings. While cost-sensitivity remains a factor, increasing regulatory awareness in nations like Japan and South Korea is pushing demand toward premium, environmentally conscious products.

- Europe: Europe represents a mature market segment defined by strict environmental legislation, such as the EU's REACH regulation, which dictates continuous reformulation toward sustainable, low-VOC, and bio-degradable lubricant solutions. The European automotive sector, centered around Germany, France, and Italy, emphasizes high-quality, complex components, driving demand for advanced synthetic and performance-enhanced water-based lubricants to maintain tight tolerances and superior surface finishes. The region is a pioneer in advanced casting technology and precision lubricant application systems, prioritizing technical efficiency and long-term TCO benefits over initial product cost.

- North America: North America, led by the US and Mexico, shows significant revitalization, fueled by investment in domestic EV production capacity, battery manufacturing, and associated supply chain establishment. The market demand is heavily influenced by the need for robust lubricants suitable for high-pressure die casting of large aluminum body structures. The region is witnessing a trend towards automation and digitization in casting facilities, increasing the adoption of robotic spray systems and advanced thermal management lubricants. Demand is shifting from conventional oil-based formulations towards high-solid, water-based solutions that support higher production throughput and meet evolving EPA standards.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions represent emerging market opportunities, characterized by growing localized automotive assembly and component manufacturing. While demand volumes are smaller compared to APAC, the automotive sector in countries like Brazil, Turkey, and South Africa is expanding, leading to a steady increase in lubricant consumption. The market is often price-sensitive, resulting in a preference for cost-effective, high-volume products, although specialized applications in the MEA region related to luxury vehicle component supply are increasingly requiring performance-grade synthetic formulations. Future growth is tied to regional economic stability and the establishment of robust local manufacturing ecosystems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Die Casting Lubricants Market.- Fuchs Petrolub SE

- Quaker Houghton

- Chem-Trend (A Freudenberg Company)

- Henkel AG & Co. KGaA

- Castrol (BP plc)

- Zeller+Gmelin GmbH & Co. KG

- CONDAT

- Morenko S.r.l.

- Petronas Lubricants International

- Afton Chemical Corporation

- Yushiro Chemical Industry Co., Ltd.

- Shell plc

- Exxon Mobil Corporation

- Kluber Lubrication

- Idemitsu Kosan Co., Ltd.

- Milacron Holdings Corp. (Ferro-Term Div.)

- Ultrachem Inc.

- Oel-Held GmbH

- Grindaix GmbH

- Wuxi South Petroleum Additives Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Die Casting Lubricants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Automotive Die Casting Lubricants Market?

The primary driver is the global automotive lightweighting trend, necessitated by stricter emission standards and the rapid expansion of Electric Vehicle (EV) production, which relies heavily on high-volume aluminum and magnesium die-cast components (e.g., battery casings and structural nodes) requiring specialized lubrication for complex molding processes.

How are environmental regulations influencing lubricant formulation?

Environmental regulations, such as REACH in Europe, are strictly limiting the use of hazardous substances and volatile organic compounds (VOCs). This mandates manufacturers to develop high-performance, water-based, and synthetic lubricants with minimal residue and increasing bio-degradability, balancing efficacy with ecological compliance.

Which product segment dominates the market and why?

Water-based lubricants dominate the market due to their superior safety profile, cost-effectiveness, and continuous performance improvements, enabling them to effectively manage the high thermal demands of modern High-Pressure Die Casting (HPDC) while meeting the low-VOC regulatory requirements of major global automotive OEMs.

What role does automation play in the application of die casting lubricants?

Automation, particularly robotic spray systems integrated with IIoT sensors, ensures precision dosing and consistent lubricant film thickness across the die cavity. This reduces lubricant consumption, minimizes residue buildup, prevents thermal shock to the die, and significantly improves overall casting quality and throughput.

Which geographical region holds the largest market share for these lubricants?

The Asia Pacific (APAC) region holds the largest market share, driven by its massive automotive manufacturing base, particularly in China and India, coupled with substantial governmental and private sector investments in establishing high-volume Electric Vehicle and component production facilities across the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager