Automotive Drive Shaft Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440197 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Drive Shaft Market Size

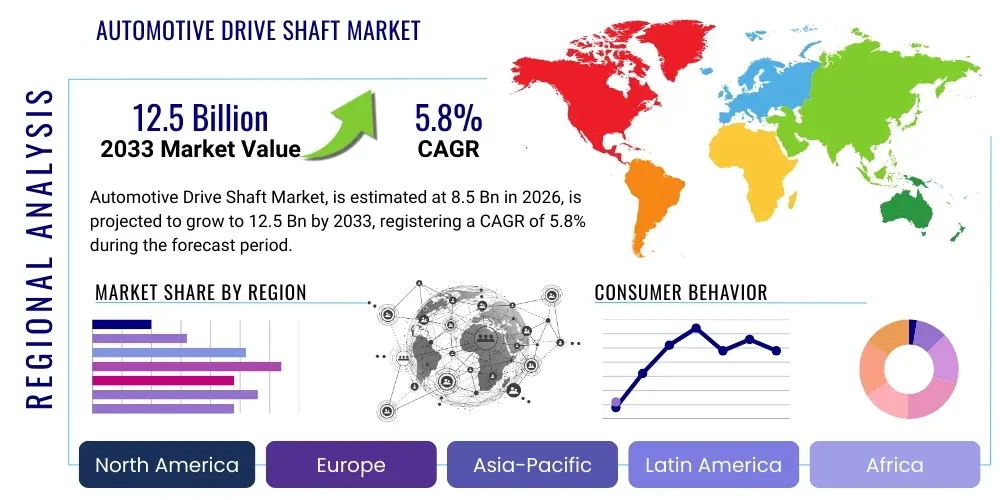

The Automotive Drive Shaft Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.5 Billion by the end of the forecast period in 2033.

Automotive Drive Shaft Market introduction

The automotive drive shaft, a critical mechanical component, serves as the primary conduit for power transmission from a vehicle's engine and gearbox to its wheels. Essential for propulsion, drive shafts are engineered to accommodate angular and length variations that occur due to suspension movement and steering, ensuring smooth power delivery under diverse operating conditions. This complex interplay necessitates robust design and material selection, allowing the vehicle to transfer torque efficiently and reliably, thereby defining its operational performance and driving dynamics. The continuous evolution of vehicle architectures, particularly the rise of electric vehicles and sophisticated all-wheel-drive systems, places new demands on drive shaft design and manufacturing.

Major applications for automotive drive shafts span across a wide spectrum of vehicle types, including passenger cars, light commercial vehicles, heavy commercial vehicles, and off-road machinery. Each application demands specific drive shaft characteristics regarding strength, weight, flexibility, and vibration damping. The benefits of advanced drive shaft designs include enhanced fuel efficiency through lightweight construction, improved vehicle handling and stability, and reduced noise, vibration, and harshness (NVH) levels, contributing significantly to overall ride comfort. These benefits are increasingly vital as consumer expectations for vehicle performance and refinement continue to rise across global markets.

Driving factors propelling the automotive drive shaft market include the global expansion of vehicle production, particularly in emerging economies, alongside a consistent demand for vehicles equipped with sophisticated driveline technologies. The increasing adoption of all-wheel-drive (AWD) and four-wheel-drive (4WD) systems in SUVs and premium passenger cars significantly contributes to market growth, as these configurations typically require multiple drive shafts. Furthermore, the burgeoning electric vehicle (EV) market presents both challenges and opportunities, driving innovation in lighter, more compact, and highly efficient drive shaft designs tailored for electric powertrains, which often require specialized drive shaft solutions to manage high torque and unique packaging constraints.

Automotive Drive Shaft Market Executive Summary

The Automotive Drive Shaft Market is undergoing significant transformation, driven by evolving business trends that prioritize lightweighting, efficiency, and advanced material integration. Original Equipment Manufacturers (OEMs) are increasingly seeking drive shaft solutions that contribute to overall vehicle weight reduction, directly impacting fuel economy and emissions for internal combustion engine (ICE) vehicles, and extending range for electric vehicles. This focus on performance optimization is leading to a surge in demand for composite and advanced steel alloys, while also fostering modular design approaches that simplify assembly and enhance supply chain flexibility. The competitive landscape is characterized by strategic partnerships and mergers aimed at consolidating technological expertise and market reach, with key players investing heavily in R&D to meet future mobility demands.

Regionally, the market exhibits diverse growth patterns. Asia Pacific stands out as the dominant and fastest-growing region, fueled by robust vehicle production and sales in countries like China, India, and Japan. The burgeoning middle class, coupled with increasing disposable incomes and government initiatives supporting automotive manufacturing, drives this growth. Europe and North America represent mature markets, characterized by stringent emission regulations and a strong emphasis on premium and high-performance vehicles, which, in turn, spurs demand for technologically advanced and lightweight drive shaft systems. Latin America, the Middle East, and Africa are emerging as significant growth areas, albeit with varying paces, as industrialization and infrastructure development bolster vehicle sales and manufacturing capabilities.

Segment-wise, the market is witnessing notable shifts. The passenger car segment remains the largest consumer of drive shafts, continuously demanding innovation for enhanced performance and comfort. However, the electric vehicle segment is projected to experience the highest growth rate, propelled by global decarbonization mandates and consumer shift towards sustainable transportation. This acceleration in EV adoption necessitates specialized drive shaft designs that can handle instantaneous torque delivery, operate quietly, and integrate seamlessly with electric powertrains. Furthermore, the increasing popularity of SUVs and light commercial vehicles (LCVs) requiring AWD/4WD configurations is driving demand for multi-piece and high-strength drive shafts, pushing manufacturers to innovate across material science and manufacturing processes to deliver durable yet lightweight solutions.

AI Impact Analysis on Automotive Drive Shaft Market

User inquiries regarding AI's impact on the automotive drive shaft market frequently center on themes of design optimization, manufacturing efficiency, predictive maintenance, and supply chain resilience. Common questions explore how AI can enhance the performance and durability of drive shafts, reduce production costs, and predict component failures before they occur. There is significant interest in AI's role in accelerating the adoption of new materials and complex geometries, streamlining quality control, and ensuring a robust and responsive supply chain in an increasingly volatile global environment. Users are keen to understand how AI will transition from a theoretical concept to practical applications that deliver tangible improvements in the drive shaft lifecycle, from initial conceptualization to end-of-life considerations.

- Generative Design Optimization: AI algorithms can explore thousands of design iterations for drive shafts, optimizing for weight, strength, vibration damping, and cost simultaneously, far beyond human capabilities, leading to more efficient and durable designs.

- Predictive Maintenance: AI-powered sensors integrated into drive shafts can monitor real-time performance data, predicting potential failures before they occur and enabling proactive maintenance, thus extending component lifespan and reducing vehicle downtime.

- Manufacturing Process Optimization: AI can analyze manufacturing data to identify inefficiencies, optimize machine parameters, and enhance quality control in real-time, leading to reduced scrap rates, improved consistency, and lower production costs.

- Supply Chain and Inventory Management: AI systems can forecast demand more accurately, optimize logistics, and manage inventory levels for raw materials and finished drive shafts, ensuring timely delivery and minimizing supply chain disruptions.

- Material Science Innovation: AI can accelerate the discovery and development of novel lightweight and high-strength materials for drive shafts, simulating material properties and performance under various conditions to identify optimal compositions.

- Enhanced Quality Assurance: AI-driven vision systems and sensors can conduct highly precise inspections of drive shaft components during manufacturing, detecting minute defects that might be missed by human inspection, thereby ensuring higher product quality and reliability.

DRO & Impact Forces Of Automotive Drive Shaft Market

The automotive drive shaft market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all shaped by various impact forces. Key drivers include the consistent growth in global vehicle production, especially in emerging economies, and the escalating demand for vehicles equipped with all-wheel-drive (AWD) and four-wheel-drive (4WD) systems. The increasing focus on fuel efficiency and emission reduction further propels the adoption of lightweight and high-strength drive shafts. Furthermore, the rapid expansion of the electric vehicle (EV) market presents a unique driver, as EVs require specialized drive shaft designs optimized for instant torque delivery, quiet operation, and integration with electric powertrains, necessitating innovation in materials and manufacturing processes.

Conversely, several restraints impede market growth. Volatility in raw material prices, particularly for steel, aluminum, and composites, directly impacts manufacturing costs and profit margins. The complex manufacturing processes involved in producing high-precision drive shafts, coupled with stringent quality control standards, can lead to higher production costs and longer lead times. Additionally, intense competition among manufacturers, along with the continuous pressure from OEMs for cost reduction, can compress profit margins and limit investment in research and development for smaller players. Furthermore, the inherent durability and longevity of existing drive shaft designs can sometimes reduce the aftermarket demand for replacements, affecting revenue streams for some participants.

Despite these restraints, substantial opportunities exist within the market. The pursuit of advanced lightweight materials, such as carbon fiber composites and advanced high-strength steels, offers avenues for product differentiation and performance enhancement, catering to the industry's drive for efficiency. The ongoing transition to electric vehicles opens up new design possibilities for drive shafts, including integrated motor-axle units and specialized half-shafts, which require novel engineering solutions. Moreover, the growing demand for customization and modularity in drive shaft systems, enabling easier integration into diverse vehicle platforms and facilitating more flexible manufacturing, represents a significant growth opportunity for agile manufacturers. The development of intelligent drive shafts with embedded sensors for real-time monitoring and predictive maintenance also presents a lucrative niche.

Impact forces on the market are broad and varied, encompassing economic, technological, regulatory, and environmental factors. Economic stability and disposable income levels directly influence new vehicle sales, thereby affecting drive shaft demand. Technological advancements in materials science, manufacturing processes (e.g., friction welding, hydroforming), and simulation software continuously reshape product capabilities and production efficiencies. Regulatory pressures, such as increasingly stringent fuel economy standards and emissions regulations globally, compel manufacturers to invest in lightweight and efficient drive shaft solutions. Environmental concerns also drive the demand for sustainable manufacturing practices and the use of recyclable materials, influencing strategic decisions across the value chain and shaping the future trajectory of the automotive drive shaft industry.

Segmentation Analysis

The Automotive Drive Shaft Market is meticulously segmented across various dimensions to provide a comprehensive understanding of its intricate dynamics and potential growth trajectories. This granular analysis allows stakeholders to identify specific market niches, understand demand patterns, and strategically position their offerings. Key segmentation criteria include the type of vehicle, the structural design of the drive shaft, the materials used in its construction, and the specific application within the vehicle's drivetrain. These categories are crucial for dissecting market trends and forecasting future demand, reflecting the diverse engineering requirements and evolving consumer preferences across the global automotive landscape.

- By Vehicle Type

- Passenger Car: Includes sedans, hatchbacks, SUVs, and luxury vehicles.

- Commercial Vehicle: Encompasses Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs).

- Electric Vehicle (EV): Comprises Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs), each with unique drive shaft requirements.

- By Drive Shaft Type

- Hollow Drive Shaft: Offers weight reduction and improved torsional rigidity.

- Solid Drive Shaft: Traditional design, robust and cost-effective.

- By Material

- Steel: Most common material, offering a balance of strength and cost.

- Aluminum Alloy: Used for lightweighting, particularly in high-performance and premium vehicles.

- Carbon Fiber Composite: Premium material providing significant weight reduction and high strength-to-weight ratio.

- By Application

- Front Wheel Drive (FWD): Utilizes half-shafts for power transmission to the front wheels.

- Rear Wheel Drive (RWD): Employs a single-piece or multi-piece drive shaft to the rear axle.

- All Wheel Drive (AWD)/Four Wheel Drive (4WD): Requires multiple drive shafts (propeller shafts, half-shafts) for power distribution to all wheels.

Value Chain Analysis For Automotive Drive Shaft Market

The value chain for the automotive drive shaft market begins with extensive upstream analysis, focusing on the procurement of raw materials and primary components. This stage involves suppliers of specialized steels, aluminum alloys, and carbon fibers, which form the foundational elements of modern drive shafts. Manufacturers of universal joints, constant velocity (CV) joints, rubber boots, and bearings also play a crucial role here, providing essential sub-components that ensure the flexibility, durability, and smooth operation of the final product. The quality and cost-effectiveness of these upstream inputs significantly impact the overall cost, performance, and reliability of the assembled drive shaft, necessitating strong supplier relationships and rigorous quality control at this initial phase.

Moving downstream, the value chain encompasses the sophisticated manufacturing and assembly processes carried out by drive shaft producers. This stage involves precision machining, welding, heat treatment, balancing, and integration of various components to form the complete drive shaft assembly. Following manufacturing, the products are supplied to Original Equipment Manufacturers (OEMs) for integration into new vehicles on assembly lines, or directed towards the aftermarket for replacement and repair purposes. OEMs, including major global automotive brands, represent the primary direct customers, requiring high volumes of customized and validated drive shaft solutions that align with their specific vehicle platforms and performance standards. This direct supply channel is characterized by long-term contracts, rigorous testing, and strict adherence to automotive industry standards.

Distribution channels for automotive drive shafts are bifurcated into direct and indirect routes. The direct channel primarily serves automotive OEMs, where drive shaft manufacturers deliver directly to vehicle assembly plants. This direct relationship facilitates seamless integration into vehicle production schedules and allows for close collaboration on design and engineering specifications. The indirect channel caters to the aftermarket segment, involving a network of wholesalers, distributors, independent workshops, and retail outlets. These entities ensure that replacement drive shafts and components are readily available to end-users for vehicle maintenance and repair throughout the product's lifecycle. The efficiency of these distribution networks is critical for market penetration and customer satisfaction, particularly in regions with a large installed base of older vehicles.

The interplay between direct and indirect channels is crucial for market participants. While direct sales to OEMs secure large, consistent orders and establish foundational revenue, the aftermarket provides a steady stream of business influenced by vehicle age, driving conditions, and regional maintenance practices. Companies often leverage robust logistics and supply chain management to optimize both channels, ensuring timely delivery and competitive pricing. The ability to effectively manage both direct OEM relationships and a widespread aftermarket presence is a key differentiator in this market, requiring specialized sales teams, technical support, and inventory management systems tailored to the distinct demands of each customer segment.

Automotive Drive Shaft Market Potential Customers

Potential customers for the automotive drive shaft market primarily consist of key players across the automotive manufacturing and service sectors. At the forefront are global automotive Original Equipment Manufacturers (OEMs) who integrate drive shafts into new vehicles across their diverse product lines, including passenger cars, commercial trucks, buses, and off-highway vehicles. These OEMs represent the largest customer segment, requiring high-volume, precision-engineered drive shafts that meet stringent performance, durability, and safety standards for their specific vehicle platforms. The complex design and validation processes involved mean that relationships with OEMs are often long-term and built on strong collaborative engineering efforts, making this segment highly strategic for drive shaft manufacturers.

Beyond new vehicle production, the aftermarket segment constitutes another significant customer base. This includes independent automotive parts distributors, wholesale suppliers, and retail chains that provide replacement drive shafts and associated components to repair shops, service centers, and individual consumers. The demand in this segment is driven by vehicle wear and tear, accidents, and the need for maintenance over the lifespan of a vehicle. For the aftermarket, factors such as product availability, competitive pricing, and a broad range of compatible parts for various makes and models are paramount. Companies targeting this segment often focus on efficient logistics and a robust catalog of parts to serve a geographically dispersed and diverse customer base effectively.

Furthermore, specialized vehicle manufacturers and performance tuning companies also represent potential customers, albeit for lower volume, high-value drive shaft solutions. This niche includes manufacturers of custom-built vehicles, racing cars, armored vehicles, and specialized industrial or agricultural machinery. These customers often require bespoke drive shaft designs with enhanced strength, lighter weight, or specific performance characteristics not found in standard OEM offerings. The focus here is on tailored engineering solutions, specialized materials (like carbon fiber), and rapid prototyping capabilities. The ability to offer highly customized and performance-optimized drive shafts positions manufacturers favorably within these specialized segments, often commanding premium pricing due to the unique technical expertise required.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GKN Driveline (part of Melrose Industries), American Axle & Manufacturing (AAM), Dana Incorporated, ZF Friedrichshafen AG, JTEKT Corporation, Hitachi Astemo, Hyundai WIA, Meritor (now part of Cummins), Neapco Holdings LLC, IFA Rotorion, Nexteer Automotive, Bharat Forge, SKF, Tenneco, BorgWarner, Sona BLW Precision Forgings Ltd., CIE Automotive, Gestamp Automocion S.A., SHOWA CORPORATION, Metaldyne Performance Group (MPG) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Drive Shaft Market Key Technology Landscape

The automotive drive shaft market is continuously shaped by a dynamic technological landscape focused on enhancing performance, reducing weight, improving durability, and optimizing manufacturing efficiency. One prominent area of innovation involves the adoption of advanced materials. While high-strength steels remain a staple, there's a growing shift towards lightweight alternatives such as aluminum alloys and, increasingly, carbon fiber composites. These materials offer superior strength-to-weight ratios, directly contributing to improved fuel economy for internal combustion engine vehicles and extended range for electric vehicles, aligning with stringent emissions regulations and consumer demand for greater efficiency. The integration of these materials often requires sophisticated manufacturing techniques, including specialized welding, bonding, and forming processes to ensure structural integrity and reduce production costs effectively.

Another crucial technological development revolves around design optimization and manufacturing processes. Techniques such as hydroforming allow for the creation of complex, hollow drive shaft geometries that maximize strength while minimizing material usage. Friction welding is widely used for joining different sections of drive shafts, providing strong, reliable bonds with minimal material distortion. Advanced computational fluid dynamics (CFD) and finite element analysis (FEA) software are extensively employed in the design phase to simulate performance under various loads and environmental conditions, identifying potential failure points and optimizing designs before physical prototyping. This digital twin approach significantly reduces development time and costs, allowing manufacturers to bring innovative drive shaft solutions to market more rapidly and with higher confidence in their performance capabilities.

Furthermore, the drive shaft market is witnessing the integration of smart technologies aimed at improving vehicle dynamics and enabling predictive maintenance. This includes the incorporation of advanced sensor technologies, such as accelerometers and strain gauges, directly into the drive shaft assembly. These sensors can monitor critical parameters like torque, rotational speed, and vibration in real-time, providing valuable data for vehicle control systems and diagnostic platforms. The data collected can be analyzed by artificial intelligence (AI) algorithms to predict potential component failures, enabling proactive maintenance and reducing unexpected vehicle downtime. Beyond sensing, innovations in noise, vibration, and harshness (NVH) reduction technologies, such as advanced damping materials and optimized joint designs, are paramount to enhancing passenger comfort, particularly in the quiet operating environment of electric vehicles, where drive shaft noise can become more noticeable and thus requires meticulous engineering attention.

Regional Highlights

- Asia Pacific: Emerging as the largest and fastest-growing market due to robust automotive production bases in China, India, Japan, and South Korea. High vehicle sales, increasing disposable incomes, and the rapid expansion of EV manufacturing are key drivers. The region also benefits from a competitive manufacturing ecosystem and significant government support for the automotive sector.

- Europe: A mature market characterized by stringent emission norms and a strong focus on premium and luxury vehicles. Demand for lightweight, high-performance drive shafts is driven by continuous innovation in vehicle architecture and the accelerating transition towards electric mobility, pushing manufacturers to adopt advanced materials and technologies.

- North America: Holds a significant market share, primarily fueled by the strong demand for SUVs, pickup trucks, and light commercial vehicles, which typically require robust drive shaft systems. The region is also a hub for technological innovation, with increasing investments in advanced manufacturing techniques and the growing adoption of electric vehicles, particularly in states like California.

- Latin America: An emerging market with steady growth, influenced by recovering automotive production and sales in key countries like Brazil and Mexico. Economic stability and infrastructure development are contributing to the increased demand for both passenger and commercial vehicles, creating opportunities for drive shaft suppliers focused on cost-effective and durable solutions.

- Middle East and Africa (MEA): Represents a nascent but growing market, driven by urbanization, infrastructure projects, and increasing vehicle parc. The demand is often for resilient and robust drive shafts suitable for diverse terrains and sometimes challenging operational conditions. Investment in localized manufacturing and assembly plants is gradually increasing across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Drive Shaft Market.- GKN Driveline (part of Melrose Industries)

- American Axle & Manufacturing (AAM)

- Dana Incorporated

- ZF Friedrichshafen AG

- JTEKT Corporation

- Hitachi Astemo

- Hyundai WIA

- Meritor (now part of Cummins)

- Neapco Holdings LLC

- IFA Rotorion

- Nexteer Automotive

- Bharat Forge

- SKF

- Tenneco

- BorgWarner

- Sona BLW Precision Forgings Ltd.

- CIE Automotive

- Gestamp Automocion S.A.

- SHOWA CORPORATION

- Metaldyne Performance Group (MPG)

Frequently Asked Questions

What is an automotive drive shaft and its primary function?

An automotive drive shaft is a mechanical component that transmits torque and rotational motion from a vehicle's engine and transmission to its wheels. Its primary function is to propel the vehicle by delivering power efficiently while accommodating variations in distance and angle caused by suspension movement, ensuring smooth and consistent power delivery across diverse driving conditions.

What factors are driving the growth of the Automotive Drive Shaft Market?

Key growth drivers include the continuous increase in global vehicle production, especially in emerging economies, the rising adoption of All-Wheel-Drive (AWD) and Four-Wheel-Drive (4WD) systems in SUVs, and the growing demand for lightweight components to improve fuel efficiency. Furthermore, the rapid expansion of the electric vehicle (EV) market is a significant driver, necessitating specialized drive shaft designs.

How do electric vehicles (EVs) impact the design and demand for drive shafts?

EVs significantly impact drive shaft design by demanding solutions optimized for instantaneous high torque delivery, quiet operation, and lighter weight to extend range. While some EVs integrate motors directly into axles, others still require traditional or modified half-shafts and propeller shafts, pushing innovation towards advanced materials and compact, efficient designs to suit electric powertrains and specific vehicle architectures.

What are the latest technological innovations in the Automotive Drive Shaft Market?

Recent innovations focus on lightweighting through advanced materials like carbon fiber composites and aluminum alloys, improving manufacturing processes such as hydroforming and friction welding for precision and durability. Furthermore, the integration of smart sensors for real-time monitoring and predictive maintenance, along with AI-driven generative design, are key technological advancements enhancing performance and reliability.

Which regions are leading in the Automotive Drive Shaft Market and why?

Asia Pacific is the leading region, driven by its large vehicle production volumes, rising disposable incomes, and robust EV market growth in countries like China and India. Europe and North America also hold significant shares due to their focus on premium vehicles, stringent emission regulations, and continuous technological advancements in driveline systems, pushing demand for high-performance and lightweight drive shafts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager