Automotive Drive Shafts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434850 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Drive Shafts Market Size

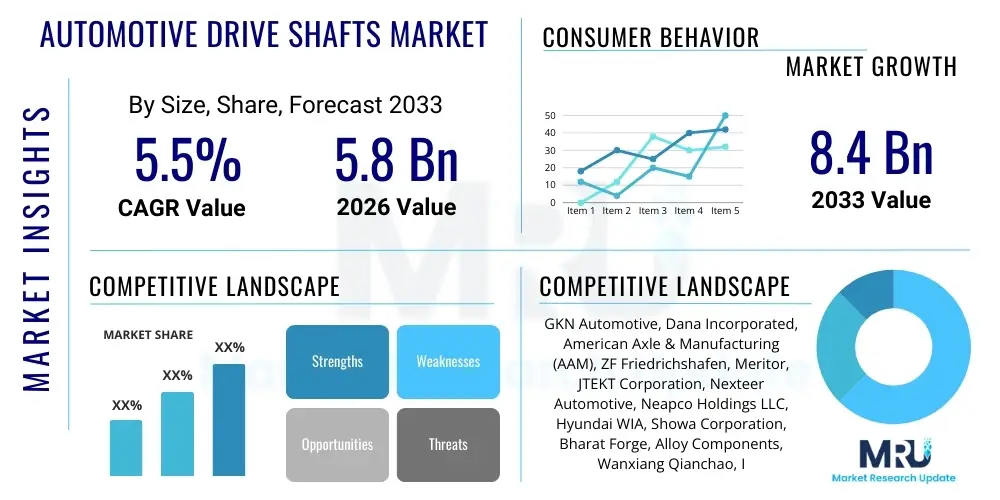

The Automotive Drive Shafts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 8.4 Billion by the end of the forecast period in 2033.

Automotive Drive Shafts Market introduction

The Automotive Drive Shafts Market encompasses the manufacturing and distribution of crucial mechanical components responsible for transmitting torque and rotation, essential for driving the wheels of various vehicles. A drive shaft, also known as a propeller shaft or prop shaft, connects the engine/transmission to the differential or directly to the wheels (in front-wheel-drive configurations) and must efficiently handle angular misalignment and dynamic stresses during operation. Historically dominated by solid steel construction, the market is rapidly transitioning towards lightweight materials like aluminum alloys and carbon fiber reinforced plastics (CFRP) to meet stringent fuel economy and emissions standards mandated globally, particularly in developed regions such as North America and Europe.

Major applications of drive shafts span across all vehicle classes, including Passenger Vehicles (sedans, SUVs, crossovers), Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). The shift towards modular vehicle architectures and the increasing adoption of all-wheel-drive (AWD) and four-wheel-drive (4WD) systems, especially in the booming SUV segment, significantly fuel the demand for advanced drive shaft designs. Furthermore, the advent of electric vehicles (EVs) is reshaping the product landscape, requiring specialized drive shafts optimized for high-torque, instant power delivery, and noise, vibration, and harshness (NVH) mitigation, often leading to integrated half-shaft designs rather than traditional long propeller shafts.

Key market benefits include improved vehicle performance through reduced parasitic losses, enhanced safety due to superior strength and durability, and lower overall vehicle weight contributing directly to fuel efficiency and reduced CO2 emissions. Driving factors are predominantly linked to global vehicle production rates, regulatory pressures concerning vehicle weight, technological evolution in material science enabling lighter and stronger components, and increasing aftermarket demand driven by the rising average age of vehicles requiring periodic replacement and maintenance.

Automotive Drive Shafts Market Executive Summary

The Automotive Drive Shafts Market is undergoing a fundamental transformation driven by technological advancements in powertrain systems and an aggressive global push towards vehicle lightweighting. Business trends indicate a robust investment in research and development focused on composite materials, particularly carbon fiber, to replace traditional steel shafts, leading to reduced inertial mass and improved rotational dynamics. Mergers, acquisitions, and strategic collaborations among Tier 1 suppliers and material science firms are common strategies employed to consolidate market share and integrate complex manufacturing processes required for high-performance components. Original Equipment Manufacturers (OEMs) are increasingly demanding customized drive shaft solutions tailored for specific EV platforms, prioritizing NVH characteristics and minimizing component footprint.

Regionally, Asia Pacific (APAC) stands out as the primary engine of growth, underpinned by high volume vehicle production in China, India, and Southeast Asian nations, coupled with increasing disposable incomes driving passenger vehicle sales. North America and Europe, while slower in volume growth, lead in technology adoption, particularly in premium and performance segments where lightweight and high-durability shafts are standard. Regulatory mandates, such such as CAFE standards in the US and WLTP in Europe, compel regional markets to prioritize drive shaft efficiency, supporting the premiumization of materials and the shift from solid to hollow constructions.

Segment trends highlight the dominance of Passenger Vehicles in terms of market volume, though Commercial Vehicles remain critical due to the demand for high-strength, durable components. The Material segment is experiencing a pivotal shift, moving beyond steel dominance toward aluminum and, increasingly, carbon fiber for weight reduction. Furthermore, Constant Velocity (CV) joint-equipped half shafts are experiencing exponential growth, directly correlating with the proliferation of front-wheel-drive (FWD) and all-wheel-drive (AWD) architectures, especially in the burgeoning crossover utility vehicle (CUV) category, which requires complex articulation and efficient power transfer at varying angles.

AI Impact Analysis on Automotive Drive Shafts Market

Common user questions regarding AI’s influence on the Automotive Drive Shafts Market center on how artificial intelligence can optimize manufacturing processes, predict component failure rates, and assist in designing lightweight, high-performance materials. Users are keen to understand the shift from traditional physical testing to AI-driven virtual simulations for stress analysis, material compatibility, and NVH characteristics. Key concerns revolve around the integration costs of AI tools in established production lines and the availability of specialized data scientists capable of leveraging predictive modeling for condition monitoring of shafts in operational vehicles. The overall expectation is that AI will dramatically accelerate the innovation cycle and reduce warranty claims by enhancing quality control and enabling predictive maintenance.

The application of AI is primarily felt in two critical areas: optimizing the complex manufacturing processes for composite materials and enhancing the durability and lifespan of the product through advanced simulations. AI algorithms can analyze vast datasets from Finite Element Analysis (FEA) simulations, accelerating the iteration cycles required for optimal weight distribution and stress resistance in lightweight designs. By implementing machine learning models on the shop floor, manufacturers can achieve near-perfect quality control by identifying microscopic defects in welding or composite lay-up processes that human inspection or traditional sensors might miss. This leads to higher yield rates and superior component consistency, crucial for safety-critical parts like drive shafts.

Furthermore, AI-driven predictive maintenance (PdM) represents a significant opportunity, particularly in the commercial vehicle sector. Machine learning models, fed data from vehicle telematics (vibration, torque load, speed, temperature), can accurately forecast the remaining useful life (RUL) of a drive shaft assembly. This capability allows fleet operators to schedule replacements precisely, avoiding costly unplanned downtime and maximizing operational efficiency. This data loop also feeds back into the design process, providing real-world operational insights that AI systems use to continuously refine future drive shaft designs for specific usage profiles and environmental stresses, moving the industry towards highly customized, data-informed component engineering.

- AI optimizes composite material layup sequences, minimizing defects and improving structural integrity.

- Predictive maintenance algorithms use telematics data to forecast drive shaft failure, reducing unplanned vehicle downtime.

- Machine learning enhances manufacturing quality control (QC) by analyzing sensor data for micro-defects in welding and balancing.

- Generative Design capabilities, powered by AI, accelerate the development of complex, topology-optimized lightweight designs.

- AI simulates millions of operational scenarios (stress, torque, angle) faster than traditional engineering methods, shortening R&D cycles.

DRO & Impact Forces Of Automotive Drive Shafts Market

The market dynamics of the Automotive Drive Shafts sector are characterized by a strong push-pull effect between regulatory demands for lightweighting and the inherent complexities of designing durable components for high-power modern powertrains. Drivers such as the pervasive global demand for SUVs and CUVs, which often utilize AWD systems requiring multiple drive shafts, provide a steady volumetric increase. Simultaneously, opportunities emerge from the electrification trend, demanding new, specialized half-shafts tailored for the unique torque characteristics of electric motors, favoring suppliers capable of innovative NVH solutions and material substitution.

However, the market faces significant restraints. The initial high cost associated with advanced materials like carbon fiber reinforced polymers (CFRP) often limits their adoption primarily to premium and high-performance vehicles, inhibiting mass-market penetration. Moreover, the integration of new drive shaft designs into sophisticated electric vehicle architectures requires extensive re-tooling and rigorous validation processes, demanding substantial capital investment from manufacturers. Supply chain volatility, particularly concerning critical raw materials (e.g., aluminum, specialized steel alloys), adds another layer of complexity, affecting production stability and pricing.

Impact forces currently shaping the competitive landscape include strict global fuel economy standards (e.g., EU CO2 targets), which elevate the importance of every gram of weight reduction, making the drive shaft a prime candidate for innovation. Technological shifts towards modular electric vehicle platforms necessitate collaborative component design, favoring suppliers who can integrate sophisticated joints and dampening elements. Furthermore, intensifying competition from APAC-based manufacturers focused on cost-effective steel and aluminum solutions pressures traditional Western suppliers to accelerate their lightweight and advanced material offerings to maintain margin viability.

Segmentation Analysis

The Automotive Drive Shafts Market is rigorously segmented based on product characteristics, the type of vehicle application, the materials used for construction, and the specific configuration utilized within the vehicle’s drivetrain architecture. This segmentation is crucial for market participants as it reflects the differing performance requirements and cost structures across various vehicular segments. For instance, the transition from traditional solid shafts to hollow shafts is driven by the imperative to reduce weight while maintaining structural rigidity, directly impacting the material and configuration segments. Understanding these segments allows suppliers to tailor their offerings, optimize production efficiency, and strategically target high-growth areas such as the electric vehicle segment, which relies heavily on specialized Constant Velocity (CV) half shafts.

The segmentation by material underscores the market's evolution, moving from low-cost, high-durability steel to medium-cost, lightweight aluminum, and finally, to premium-cost, ultralight carbon fiber. This hierarchy directly correlates with the expected performance envelope and price point of the final vehicle. Similarly, the vehicle type segmentation highlights the volume dominance of Passenger Vehicles (PVs) but acknowledges the crucial revenue stream and demanding technical specifications characteristic of Heavy Commercial Vehicles (HCVs), which require shafts built for extreme load and prolonged operational life. Analyzing these segment intersections provides a clear map of technological maturity and emerging demand patterns within the global automotive industry.

Specific segmentation based on configuration, such as Hotchkiss, Torque Tube, and CV Joint Drive Shafts, reflects the varying drivetrain layouts (RWD, FWD, AWD). The accelerating popularity of AWD systems in CUVs and SUVs has notably bolstered the CV Joint Drive Shaft segment. This complexity necessitates suppliers possessing diverse engineering capabilities capable of delivering tailor-made solutions for differing requirements in torque management, angular misalignment, and vibration dampening across all major automotive manufacturers.

- By Type: Hollow Drive Shaft, Solid Drive Shaft

- By Vehicle Type: Passenger Vehicles (PV), Commercial Vehicles (CV) (Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV))

- By Material: Steel, Aluminum, Carbon Fiber Reinforced Plastic (CFRP)

- By Configuration: Hotchkiss Drive Shaft, Torque Tube Drive Shaft, Constant Velocity (CV) Joint Drive Shaft (Half Shaft)

- By Sales Channel: OEM (Original Equipment Manufacturer), Aftermarket

Value Chain Analysis For Automotive Drive Shafts Market

The value chain for the Automotive Drive Shafts Market is characterized by highly integrated tiers of suppliers, starting with upstream raw material providers and culminating in the final integration by vehicle OEMs. Upstream activities involve the procurement and processing of specialized steel alloys, high-grade aluminum, and composite precursor materials like carbon fiber. Success at this stage relies heavily on securing stable, cost-effective supplies of specialized metals that meet stringent automotive specifications regarding fatigue strength and material density. Fluctuations in commodity prices significantly impact the upstream cost structure, directly affecting the final component price negotiated with Tier 1 suppliers.

The core manufacturing process, involving Tier 1 and Tier 2 suppliers, includes complex steps such as forging, machining, welding, precision balancing, and assembly of universal joints (U-joints) or constant velocity (CV) joints. Tier 1 suppliers, such as GKN Automotive and Dana Incorporated, are crucial as they typically handle the system-level design, testing, and direct supply to OEMs. They often invest heavily in robotic welding and automated balancing systems to ensure components meet critical NVH and reliability requirements. The shift towards aluminum and composites demands specialized, high-precision manufacturing techniques, adding complexity to this mid-stream segment.

Downstream distribution channels are segmented into the Original Equipment Manufacturer (OEM) channel, which accounts for the vast majority of volume, and the Aftermarket channel, which handles replacement parts. Direct distribution dominates the OEM segment, involving highly formalized contracts and just-in-time delivery systems. Indirect distribution plays a larger role in the Aftermarket, utilizing distributors, wholesalers, and specialized repair shops. Effective downstream management is essential for maintaining brand presence and ensuring the availability of replacement parts, particularly as vehicles age and require maintenance for durable components like drive shafts.

Automotive Drive Shafts Market Potential Customers

The primary customers for the Automotive Drive Shafts Market are global automotive manufacturers (OEMs) who require these components for the assembly of new vehicles across all segments. This includes major players specializing in Passenger Vehicles (sedan, hatchback, SUV, CUV), Light Commercial Vehicles (pickups, vans), and Heavy Commercial Vehicles (trucks, buses). OEMs are the most demanding customers, seeking high volumes, custom-designed specifications (often unique to a specific platform, such as an EV architecture), guaranteed long-term reliability, and competitive pricing, all delivered through strict quality protocols.

A second, highly stable customer base is the Aftermarket segment, encompassing independent workshops, fleet maintenance operators, specialized driveline repair services, and individual vehicle owners. These customers purchase drive shafts for replacement purposes due to wear, damage, or required upgrades. Fleet operators, especially those managing HCVs and LCVs, represent significant potential, as their focus is on minimizing vehicle downtime and maximizing component life, driving demand for robust, high-quality replacement parts, often opting for components that meet or exceed OEM specifications to ensure longevity under strenuous operating conditions.

The increasing prominence of vehicle electrification is creating a specialized cohort of potential customers: emerging electric vehicle manufacturers and technology startups. These entities require components optimized for high RPMs and instantaneous torque delivery characteristic of battery-electric powertrains, driving demand for specialized, low-NVH half-shaft assemblies. Suppliers who can offer modular, lightweight solutions tailored specifically for skateboard EV platforms are strategically positioned to capture this rapidly expanding customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 8.4 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GKN Automotive, Dana Incorporated, American Axle & Manufacturing (AAM), ZF Friedrichshafen, Meritor, JTEKT Corporation, Nexteer Automotive, Neapco Holdings LLC, Hyundai WIA, Showa Corporation, Bharat Forge, Alloy Components, Wanxiang Qianchao, IFA Rotorion, SSV Drive Shafts, SWR Auto Parts |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Drive Shafts Market Key Technology Landscape

The Automotive Drive Shafts Market is defined by continuous technological innovation focused primarily on lightweighting, improving power density, and minimizing Noise, Vibration, and Harshness (NVH). A critical technological advancement is the widespread adoption of Constant Velocity (CV) joint technology, which allows for efficient power transfer at high angles and varying speeds, essential for modern FWD, AWD, and EV architectures. Furthermore, the development of advanced composite materials, specifically Carbon Fiber Reinforced Plastic (CFRP), represents a major breakthrough, offering up to 70% weight savings compared to traditional steel shafts while maintaining superior torque capacity and fatigue resistance. Manufacturing technologies supporting CFRP, such as automated filament winding and precise curing processes, are becoming central competitive advantages for leading suppliers.

Another crucial area of technological focus involves NVH mitigation techniques, increasingly important due to the quiet nature of electric vehicles, which amplifies noise originating from drivetrain components. Innovations here include the integration of highly specialized damping elements, tuned mass dampers, and optimized joint designs (e.g., tripods and double offset joints) to counteract torsional and bending vibrations across various operating speeds. These engineering refinements are often coupled with advanced analytical tools like computational fluid dynamics (CFD) and sophisticated finite element analysis (FEA) to predict and eliminate potential noise sources early in the design phase.

The manufacturing landscape is also seeing significant integration of Industry 4.0 technologies. Automated precision welding, laser-based quality inspection, and dynamic balancing machines integrated with real-time process monitoring systems are enhancing component quality and reducing manufacturing variability. The shift toward modular and scalable designs allows manufacturers to adapt components quickly for different vehicle platforms (Internal Combustion Engine, Hybrid, or Battery Electric Vehicle), necessitating flexible production lines capable of switching between steel, aluminum, and composite material processing with minimal downtime.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive vehicle production volumes, particularly in China and India, alongside the rapid expansion of the middle class driving passenger vehicle sales. This region is characterized by high demand for cost-effective, high-volume steel and aluminum shafts, although premium segments in Japan and South Korea are quickly adopting advanced lightweight materials. Government initiatives promoting domestic EV manufacturing further fuel the demand for specialized EV half-shafts.

- North America: North America represents a mature, technology-intensive market defined by high demand for robust drive shafts suitable for large SUVs, trucks, and high-performance muscle cars. The region leads in the adoption of advanced materials like carbon fiber in high-end models. Regulatory pressures regarding fuel efficiency, coupled with the rising popularity of AWD/4WD light trucks, ensure continuous demand for durable, yet lightweight, driveline components, supporting suppliers focused on complex CV joint assemblies.

- Europe: The European market is characterized by stringent environmental regulations and a strong emphasis on reducing vehicle weight and emissions, making it a critical hub for innovation in aluminum and composite drive shaft technologies. The rapid proliferation of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) across major economies like Germany, France, and the UK necessitates suppliers to focus on high-efficiency, low-NVH half-shafts optimized for electric powertrains and high-speed operation on autobahns.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions offer emerging market potential, driven by infrastructure development and increasing fleet modernization efforts. While steel shafts dominate due to cost constraints and rugged usage conditions, LCV and HCV segments show steady growth. Market expansion is dependent on stable economic conditions and foreign direct investment into local automotive manufacturing hubs, particularly in Brazil, Mexico, and South Africa, focusing on localized production strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Drive Shafts Market.- GKN Automotive (now part of Melrose Industries PLC)

- Dana Incorporated

- American Axle & Manufacturing (AAM)

- ZF Friedrichshafen AG

- Meritor (now part of Cummins)

- JTEKT Corporation

- Nexteer Automotive

- Neapco Holdings LLC

- Hyundai WIA

- Showa Corporation

- Bharat Forge

- Alloy Components Co., Ltd.

- Wanxiang Qianchao Co., Ltd.

- IFA Rotorion Holding GmbH

- SSV Drive Shafts

- SWR Auto Parts

- TVS Drivetrain

- Talbros Engineering Ltd.

- Fawer Automotive Parts Limited Company

- Rheinmetall AG (KS Kolbenschmidt)

Frequently Asked Questions

Analyze common user questions about the Automotive Drive Shafts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards lightweight drive shaft materials?

The primary driver is stringent global emissions and fuel economy regulations (such as CAFE and WLTP). Lightweight materials like aluminum and CFRP reduce vehicle inertia and overall weight, directly contributing to lower fuel consumption and reduced CO2 emissions, crucial for both ICE and EV efficiency.

How is the rise of electric vehicles impacting drive shaft design?

EVs demand specialized half-shafts optimized for high instantaneous torque, elevated rotational speeds, and superior Noise, Vibration, and Harshness (NVH) performance. The focus shifts from long propeller shafts (common in RWD/4WD ICE vehicles) to compact, high-performance Constant Velocity (CV) joint assemblies.

Which region holds the largest market share for Automotive Drive Shafts?

Asia Pacific (APAC) currently dominates the market share, primarily due to the vast scale of vehicle manufacturing and assembly operations in countries like China and India, supported by robust domestic consumer demand across the passenger and commercial vehicle segments.

What are the key technological advancements expected in the drive shaft market?

Key advancements include increased commercial viability of carbon fiber drive shafts, further integration of AI/ML for manufacturing optimization and predictive maintenance, and the development of modular driveline components compatible with multiple EV skateboard platforms.

What are the main types of drive shafts used in modern vehicles?

Modern vehicles primarily utilize Solid Drive Shafts (traditional durability), Hollow Drive Shafts (weight reduction), and Constant Velocity (CV) Joint Drive Shafts (Half Shafts), which are essential for front-wheel-drive and independent suspension systems found in most contemporary passenger cars and CUVs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager