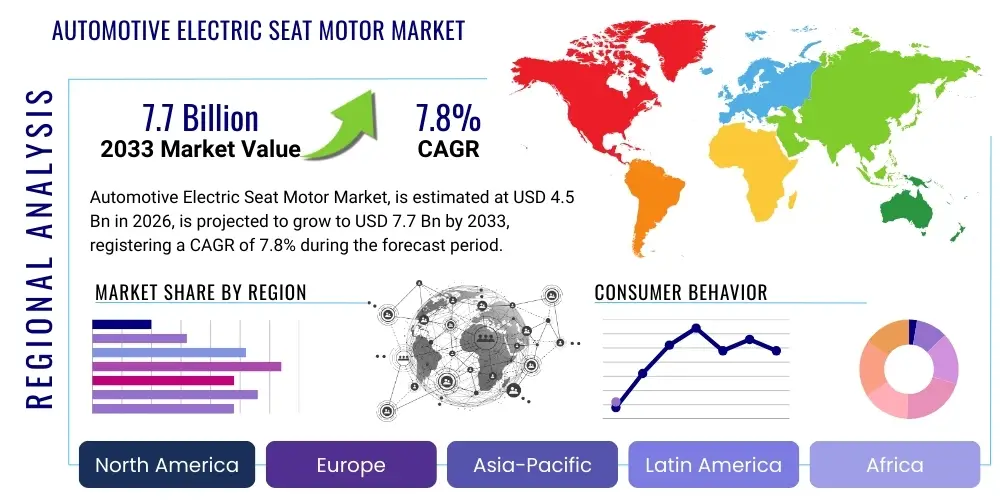

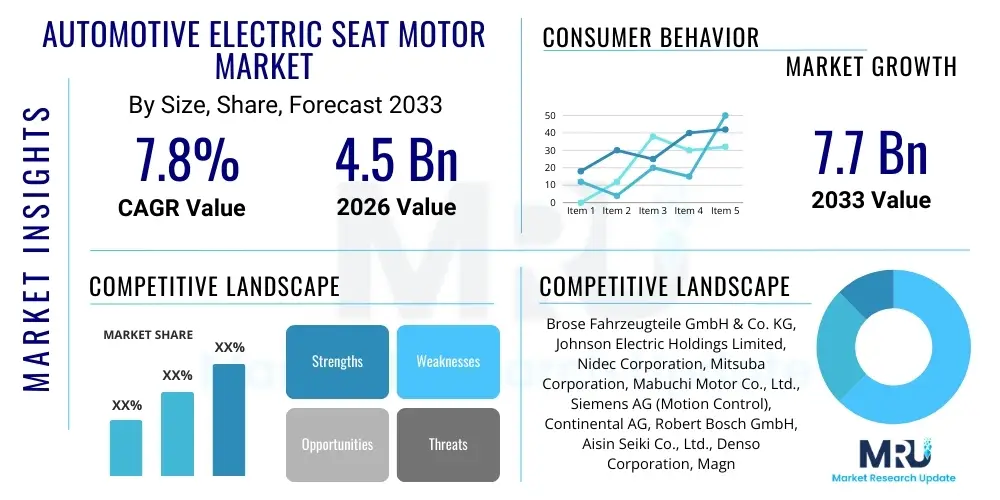

Automotive Electric Seat Motor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439037 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Automotive Electric Seat Motor Market Size

The Automotive Electric Seat Motor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $4.5 Billion USD in 2026 and is projected to reach $7.7 Billion USD by the end of the forecast period in 2033.

Automotive Electric Seat Motor Market introduction

The Automotive Electric Seat Motor Market encompasses the manufacturing and supply of electric motors specifically designed for the movement and adjustment mechanisms within vehicle seats. These motors are crucial components in modern vehicle ergonomics, enabling features such as horizontal slide adjustment, backrest recline, height and tilt adjustment, and lumbar support. The primary function of these systems is to enhance driver and passenger comfort, safety, and convenience, particularly in high-end, luxury, and electric vehicles where premium interior features are standard expectations. The integration of electric motors allows for precise, effortless, and often memory-enabled positioning, which is increasingly vital as vehicles incorporate personalized settings profiles.

Product descriptions typically involve various motor types, including brushed DC motors for cost-effective applications, and more advanced brushless DC (BLDC) and stepper motors for high-precision, low-noise operations, often found in luxury and premium segment vehicles. Major applications span across passenger vehicles (sedans, SUVs, trucks) and increasingly in commercial vehicles where long-haul driving necessitates superior ergonomic support. The core benefit derived from electric seat motors is improved cabin comfort and enhanced safety through optimized seating posture, reducing driver fatigue and increasing alertness, which directly contributes to overall vehicle safety ratings and consumer satisfaction.

Driving factors propelling market expansion include stringent regulatory mandates regarding vehicle safety, the global trend towards premiumization of vehicle interiors, and the escalating demand for advanced comfort features in developing economies. Furthermore, the rising proliferation of electric vehicles (EVs) and autonomous vehicles (AVs) necessitates sophisticated electric mechanisms, as internal combustion engine (ICE) space constraints are redefined, making customizable, lightweight, and energy-efficient electric actuators essential for future mobility solutions. The transition toward intelligent cabin systems heavily relies on the precision offered by electric seat motors.

Automotive Electric Seat Motor Market Executive Summary

The Automotive Electric Seat Motor Market is experiencing robust growth fueled primarily by the global shift toward electric and luxury vehicles, coupled with stringent consumer demand for personalized and memory-enabled seating configurations. Key business trends indicate a strong focus on miniaturization and lightweight design to accommodate the energy constraints and packaging requirements of electric vehicle architectures, leading manufacturers to invest heavily in advanced BLDC motor technology which offers higher efficiency and reduced noise profiles compared to traditional brushed DC motors. Supply chain optimization remains a critical factor, with Tier 1 suppliers increasingly focusing on vertical integration and localized production strategies, particularly in fast-growing regions like Asia Pacific, to mitigate geopolitical risks and stabilize input costs.

Regional trends clearly highlight Asia Pacific (APAC), led by China and India, as the fastest-growing market due to rapid urbanization, increasing disposable incomes, and the massive scale of automotive manufacturing bases, particularly for electric vehicles. North America and Europe maintain dominance in terms of technology adoption, showcasing high penetration rates for advanced features such as multi-axis adjustment and integrated massage functions driven by consumer preference for premium safety and comfort standards. Segments trends show a distinct preference for high-power, high-precision motors used in fully automatic and memory-seat applications, especially within the SUV and premium sedan categories. The shift from standard four-way adjustment to complex 8-way, 10-way, or 12-way adjustment systems is a primary segment driver.

In terms of component breakdown, brushless DC motors are gaining market share due to their superior longevity and lower maintenance requirements, although conventional DC motors retain a significant share in entry-level and commercial vehicle applications where cost sensitivity is higher. The integration of motors with sophisticated Electronic Control Units (ECUs) is defining the market's technological trajectory, facilitating seamless interaction with the vehicle's central computing system for personalized user profiles and enhanced safety features linked to occupant detection and pre-collision bracing mechanisms. This focus on intelligent integration dictates future product development and market competitiveness.

AI Impact Analysis on Automotive Electric Seat Motor Market

Common user questions regarding AI's impact on the electric seat motor market frequently revolve around how artificial intelligence and machine learning algorithms can enhance occupant comfort, safety personalization, and motor performance. Users are concerned about the shift from fixed memory positions to dynamic, real-time adjustments based on biometric data, driving conditions, and fatigue levels. Key themes include the implementation of predictive posture correction systems, optimization of motor efficiency through AI-driven wear prediction, and the seamless integration of seating adjustments within the broader context of the autonomous driving experience. Users anticipate that AI will fundamentally change the role of the seat from a static component to an intelligent, proactive element of the vehicle cabin.

AI will revolutionize the functionality of electric seat motors by enabling personalized, dynamic seating adjustments that move beyond simple preset memory positions. Machine learning algorithms, utilizing data from in-cabin sensors (e.g., pressure sensors, cameras monitoring driver posture, fatigue sensors), can predict optimal ergonomic positioning in real time. This capability is paramount for long-duration journeys in autonomous vehicles, ensuring sustained comfort and minimizing the physiological strain associated with static sitting. Furthermore, AI assists in predictive maintenance by analyzing motor load patterns and duty cycles, anticipating potential failures, and scheduling preventative adjustments, thus enhancing the reliability and lifespan of the seat mechanisms.

The application of AI also significantly impacts safety features. For instance, in an imminent collision scenario, AI-driven systems can rapidly adjust seat position and tension the seatbelts (pre-safe positioning), optimizing occupant restraint effectiveness before impact. This dynamic safety response requires extremely precise and high-speed motor actuation capabilities. Moreover, Generative AI (GenAI) tools are increasingly used during the design phase to optimize the motor's size, weight, and noise profile (Noise, Vibration, and Harshness or NVH) for specific vehicle architectures, speeding up product development cycles and ensuring the motors meet stringent next-generation comfort and acoustic requirements set by premium Original Equipment Manufacturers (OEMs).

- Real-time Predictive Posture Correction: AI algorithms analyze occupant biometrics and environmental factors (road conditions) to dynamically adjust seat support, surpassing static memory functions.

- Enhanced Safety Integration: AI facilitates rapid, automated seat positioning (pre-safe bracing) linked to autonomous driving systems and active safety features during emergency maneuvers.

- Optimized Motor Control and Efficiency: Machine learning fine-tunes motor torque and speed profiles, reducing energy consumption and NVH levels, crucial for battery-dependent EVs.

- Predictive Maintenance: AI analyzes motor operational data (current draw, temperature) to forecast wear and tear, improving reliability and reducing warranty claims for electronic components.

- Personalized Comfort Profiles: Integration with user accounts allows AI to learn individual preferences, offering customized seating, climate, and massage adjustments across different driving modes.

DRO & Impact Forces Of Automotive Electric Seat Motor Market

The market dynamics are governed by a complex interplay of strong drivers related to luxury vehicle sales and electrification, significant restraints stemming from high component costs and supply chain volatility, and substantial opportunities arising from autonomous mobility and emerging market penetration. The primary driving force is the rising consumer expectation for in-cabin luxury, which mandates multi-way adjustable seats equipped with advanced features like ventilation, heating, and massage functions, all requiring precise electric actuation. However, the market faces headwinds from the substantial capital investment required for manufacturing high-precision, low-noise motors, coupled with the cyclical nature of the global automotive industry and persistent inflationary pressures impacting raw material prices for copper, steel, and rare-earth magnets used in motor construction.

The opportunity landscape is vast, especially in the development of intelligent, lightweight motor solutions for electric vehicles (EVs), where power efficiency is paramount. The shift toward Level 3 and higher autonomy means that the front seats must pivot, fold, or recline to facilitate new cabin configurations, demanding innovative motor designs that can handle complex movements reliably. Conversely, impact forces, such as regulatory mandates (e.g., crash test standards impacting seat structure) and intense price competition among Tier 1 suppliers, consistently shape profitability and market entry strategies. Technological acceleration in competitor markets, such as advancements in pneumatic adjustment systems, poses an indirect impact force that requires continuous product innovation within the electric motor domain to maintain competitive edge.

Restraints are further exacerbated by the semiconductor shortage, which affects the integrated Electronic Control Units (ECUs) necessary to manage the motors. Furthermore, the complexity associated with integrating 10 or more motors per seat assembly increases the risk of electromagnetic interference (EMI) and requires specialized shielding and control software, adding to development time and cost. Despite these challenges, the overwhelming trend toward enhanced passenger experience and safety standardization ensures that the demand for high-quality, dependable electric seat motors will continue its upward trajectory, making strategic investments in automated assembly lines and specialized magnet materials essential for market leaders seeking sustainable growth.

- Drivers: Increased production of luxury and premium vehicles; rapid global adoption of Electric Vehicles (EVs) necessitating advanced cabin ergonomics; consumer demand for multi-axis adjustment, memory function, and personalized comfort systems; strict global automotive safety standards requiring optimized seating posture.

- Restraints: High initial manufacturing cost of high-precision, low-noise BLDC motors; sensitivity of raw material costs (magnets, copper); vulnerability to global semiconductor supply chain constraints affecting ECUs; increased complexity and cost associated with integrating numerous motors (up to 12) per seat.

- Opportunities: Development of ultra-lightweight and compact motor designs specifically for battery electric vehicles; integration with autonomous driving technology for dynamic cabin reconfigurations; untapped market potential in entry-level commercial vehicles and buses seeking ergonomic upgrades; potential for AI-driven predictive maintenance and performance optimization software packages.

- Impact Forces: Intense competition among Tier 1 suppliers driving down unit prices; evolving international safety regulations demanding robust motor reliability; rapid technological obsolescence necessitating continuous R&D investment; geopolitical factors impacting global supply chains and trade stability.

Segmentation Analysis

The Automotive Electric Seat Motor Market is strategically segmented based on factors including motor type, application vehicle type, and the level of adjustment automation, allowing for a granular analysis of market demand drivers across different product tiers. Segmentation by motor type—DC brushed, stepper, and BLDC—reveals distinct purchasing patterns, with BLDC motors dominating the high-end luxury and electric vehicle segments due to superior performance characteristics (longevity, silence, precision), while the cost-effectiveness of DC brushed motors ensures their continued prominence in budget and entry-level models. Analyzing these segments helps manufacturers tailor production processes and investment strategies according to the specific technical requirements of various OEM clientele.

The segmentation by application (Passenger Vehicles vs. Commercial Vehicles) demonstrates that Passenger Vehicles, particularly SUVs and luxury sedans, remain the dominant revenue generator due to the high number of motors required per unit (often exceeding 10 motors per car for front seats alone). However, the Commercial Vehicle segment is poised for accelerated growth, driven by regulatory pressures mandating improved ergonomic conditions for professional drivers and the increasing deployment of premium long-haul trucks equipped with comfort seating. Furthermore, the segmentation by level of automation—ranging from basic 2-way manual support with electric motors only for recline, to fully automatic 12-way adjustment with memory function and integrated sensors—directly reflects the vehicle’s price point and technological sophistication, creating clear boundaries for product positioning within the global market.

- By Motor Type:

- Brushed DC Motor (Dominant in cost-sensitive applications)

- Brushless DC (BLDC) Motor (Leading segment in luxury and EV applications)

- Stepper Motor (Used for high-precision, lower-torque movements like lumbar support)

- By Application:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- By Seat Type:

- Bucket Seats (High motor count per unit)

- Bench Seats (Lower motor count, typically for rear adjustments)

- By Level of Automation/Adjustment:

- 2-Way/4-Way Adjustment (Basic entry-level function)

- 8-Way/10-Way Adjustment (Mid-range and standard premium features)

- 12-Way and Above (Fully automatic, luxury, memory-enabled seating)

Value Chain Analysis For Automotive Electric Seat Motor Market

The value chain for the automotive electric seat motor market begins with upstream activities focused on securing essential raw materials and components, including magnetic materials (ferrite, Neodymium), copper wiring, steel housings, and specialized semiconductors for the motor controllers (ECUs). Key upstream suppliers include material providers and specialized magnet manufacturers, whose pricing volatility significantly impacts the profitability of motor producers. The core manufacturing process involves precision winding, assembly, and rigorous testing of the motor units, often performed by highly specialized Tier 2 or Tier 1 automotive suppliers who possess expertise in electromagnetic design and noise suppression techniques necessary to meet demanding OEM specifications.

Downstream analysis focuses on the integration and distribution channels. Manufactured electric seat motors are primarily sold directly to Tier 1 seat system integrators (e.g., Adient, Lear, Faurecia), who combine the motors with seat frames, foam, wiring harnesses, and upholstery to deliver the complete seat assembly to the Original Equipment Manufacturers (OEMs). Direct distribution to OEMs is less common for individual motor components but occurs in niche scenarios or for specialized aftermarket systems. The integration phase is critical as the motor's performance must be seamlessly validated within the complex mechanical and electronic architecture of the complete seat unit, requiring strong collaborative partnerships between the motor suppliers and seat integrators to ensure optimal noise and vibration performance.

The aftermarket distribution channel, while smaller than the OEM market, plays a role in replacement and repair, utilizing specialized distributors and service centers. However, given the high reliability and long lifecycle of modern motors, the primary focus remains on the indirect channel through Tier 1 integration into new vehicle production. Success in this value chain hinges on quality control (zero-defect tolerance), competitive pricing, and the ability to innovate quickly, particularly concerning packaging size reduction and thermal management within tight spatial constraints dictated by modern vehicle designs.

Automotive Electric Seat Motor Market Potential Customers

The primary end-users and buyers of electric seat motors are the global Original Equipment Manufacturers (OEMs) and, more immediately, the major Tier 1 automotive suppliers specializing in complete seat system assemblies. These customers purchase motors in extremely high volumes and require strict adherence to automotive quality standards (e.g., IATF 16949) and customized performance specifications regarding torque, speed, and size. Major Tier 1 seat manufacturers like Lear Corporation, Adient PLC, Faurecia, and TS Tech are the critical intermediate customers who integrate thousands of motors daily into their globally distributed seat production lines before delivering the final product to vehicle assembly plants.

Beyond the core automotive sector, secondary customer segments include specialized vehicle manufacturers such as those producing high-end luxury buses, trains, and recreational vehicles (RVs) where enhanced ergonomic adjustment is a significant selling point. Furthermore, the burgeoning aftermarket segment represents potential customers seeking replacement motors or upgrade kits, although this segment is generally less technologically demanding and volume-sensitive than the OEM space. The rise of new electric vehicle manufacturers (e.g., Tesla, Rivian, Lucid) also represents a rapidly growing and highly influential customer base, often preferring advanced, customized BLDC motor solutions designed for lower voltage consumption and minimal acoustic output.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion USD |

| Market Forecast in 2033 | $7.7 Billion USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brose Fahrzeugteile GmbH & Co. KG, Johnson Electric Holdings Limited, Nidec Corporation, Mitsuba Corporation, Mabuchi Motor Co., Ltd., Siemens AG (Motion Control), Continental AG, Robert Bosch GmbH, Aisin Seiki Co., Ltd., Denso Corporation, Magna International Inc., Hella GmbH & Co. KGaA, BorgWarner Inc., Schaeffler AG, E-Motor Co., Ltd., Bühler Motor GmbH, ASMO Co., Ltd., ZF Friedrichshafen AG, Valeo S.A., Dorman Products Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Electric Seat Motor Market Key Technology Landscape

The core technology landscape is characterized by ongoing optimization of motor efficiency, particularly through the widespread adoption of Brushless DC (BLDC) motors. BLDC technology offers superior torque density, longer operational lifespan, and significantly reduced electromagnetic noise compared to traditional brushed motors, making it the preferred choice for premium and electric vehicle manufacturers where acoustic quality is a key differentiating factor. Technological advancements focus heavily on integrating advanced magnetic materials, such as Neodymium iron boron magnets, to achieve higher power output within smaller, lighter motor footprints. Miniaturization is a crucial trend, driven by the limited packaging space available under modern vehicle seats, particularly in electric platform vehicles where the battery occupies significant underfloor volume.

Another significant technological focus is the development of sophisticated motor control units (MCUs) and dedicated application-specific integrated circuits (ASICs) designed to manage complex, multi-motor systems. These controllers facilitate high-precision position sensing (often using Hall-effect sensors or encoders) and enable advanced functionalities such as memory positions, synchronized movement for multi-axis adjustments, and communication via automotive networks like CAN bus or LIN bus. The transition toward smart motors incorporates advanced thermal management techniques and protective circuitry to ensure reliability under varying load conditions and extreme temperature fluctuations typical of automotive environments.

Furthermore, noise, vibration, and harshness (NVH) reduction remains a paramount technological challenge. Suppliers are implementing innovative gear reduction mechanisms (worm gears, planetary gears) optimized for quiet operation, alongside advanced motor housing designs that dampen vibration transmission into the seat structure. The convergence of electric actuation with tactile feedback and haptic technologies is an emerging area, enhancing safety and driver alertness. Future technological progress is intrinsically linked to software integration, allowing over-the-air (OTA) updates for motor control logic and seamless linkage with AI-driven personalized comfort systems, thereby transforming the motor from a simple actuator into an intelligent component of the vehicle's digital ecosystem.

Regional Highlights

Asia Pacific (APAC) currently dominates the Automotive Electric Seat Motor Market in terms of volume and exhibits the highest growth trajectory globally. This rapid expansion is primarily driven by the massive automotive manufacturing bases in China, Japan, South Korea, and India, coupled with the aggressive electrification mandates and substantial government subsidies promoting EV adoption, which inherently require advanced electric seating solutions. China, in particular, leads the global market in both production and consumption of EVs, ensuring sustained, high-volume demand for precise, durable electric seat motors. The increasing middle-class income levels across Southeast Asia also contribute to higher penetration rates of comfort features in newly purchased vehicles.

North America and Europe represent mature markets characterized by high Average Selling Prices (ASPs) due to the strong preference for complex, multi-way adjustable, and luxury seating features (e.g., 12-way adjustments with memory and massage functions). In Europe, stringent safety standards and a strong premium segment, spearheaded by German luxury automakers (BMW, Mercedes-Benz, Audi), necessitate the highest quality BLDC motors with minimal NVH characteristics. North America's market growth is buoyed by the strong sales of large SUVs and pickup trucks, which are increasingly equipped with premium interior packages demanding extensive electric seat mechanisms for both front and second rows, driving sustained revenue generation in the high-value segment.

Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares but are projected to see incremental growth, albeit constrained by economic volatility and higher price sensitivity. Growth in MEA is largely concentrated within the Gulf Cooperation Council (GCC) countries, driven by the import and sale of high-end luxury vehicles. However, manufacturing investment and local supply chain development remain limited compared to APAC and Europe. Strategic focus in these regions remains on supplying reliable, mid-range DC motor systems for standard four-way and six-way adjustments, catering primarily to mass-market segments and essential vehicle fleets, though electric vehicle penetration is expected to gradually elevate the demand for advanced motors in the latter half of the forecast period.

- Asia Pacific (APAC): Highest volume market; fastest CAGR driven by China's immense EV market and India's growing passenger vehicle premiumization; significant local manufacturing presence for Tier 1 and Tier 2 suppliers.

- Europe: High-value market focused on premium features (low NVH, high complexity); strong demand spurred by German luxury manufacturers; strict regulatory environment for vehicle components quality and longevity.

- North America: Stable, high-revenue segment fueled by robust SUV and light truck sales; high penetration of 8-way and 10-way adjustment systems; technological focus on reliability and heavy-duty applications.

- Latin America (LATAM): Developing market with increasing adoption of electric features in mid-range vehicles; growth sensitive to local economic stability and vehicle production output.

- Middle East & Africa (MEA): Niche luxury market driven by high-end vehicle imports; lower overall volume but potential for growth driven by emerging regional automotive assembly hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Electric Seat Motor Market.- Brose Fahrzeugteile GmbH & Co. KG

- Johnson Electric Holdings Limited

- Nidec Corporation

- Mitsuba Corporation

- Mabuchi Motor Co., Ltd.

- Continental AG

- Robert Bosch GmbH

- Aisin Seiki Co., Ltd.

- Denso Corporation

- Magna International Inc.

- Hella GmbH & Co. KGaA

- BorgWarner Inc.

- Schaeffler AG

- E-Motor Co., Ltd.

- Bühler Motor GmbH

- ASMO Co., Ltd.

- ZF Friedrichshafen AG

- Valeo S.A.

- Dorman Products Inc.

- Adient PLC (As a key customer/integrator)

Frequently Asked Questions

Analyze common user questions about the Automotive Electric Seat Motor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What motor types are predominantly used in modern electric seat adjustment systems?

Modern electric seat systems predominantly utilize Brushed DC motors for cost-effective, standard adjustments (like fore/aft motion) and Brushless DC (BLDC) motors for premium applications requiring high precision, minimal acoustic noise (NVH), and extended durability. Stepper motors are often employed for very fine, low-torque positioning, such as intricate lumbar support mechanisms.

How is the rise of Electric Vehicles (EVs) impacting the demand for electric seat motors?

EV adoption significantly increases demand for highly efficient, compact, and lightweight electric seat motors. Since EV battery placement limits under-seat space, motors must be smaller, and their high energy efficiency (such as BLDC technology) is crucial to minimize drain on the vehicle's primary battery pack, making motor selection a critical design priority for EV manufacturers.

Which geographical region exhibits the fastest growth in the Automotive Electric Seat Motor Market?

The Asia Pacific (APAC) region, spearheaded by the massive production and sales volumes in China and the burgeoning automotive sectors in India and Southeast Asia, is projected to register the fastest Compound Annual Growth Rate (CAGR). This growth is primarily fueled by rapid market electrification and increasing consumer demand for vehicle premiumization.

What are the primary technological challenges faced by motor manufacturers in this market?

The major technological challenges include achieving stringent Noise, Vibration, and Harshness (NVH) targets, minimizing the motor's size and weight without compromising torque density, ensuring seamless integration with complex electronic control units (ECUs), and developing systems capable of handling the precise, dynamic adjustments required for future AI-driven and autonomous seating configurations.

What role does Artificial Intelligence (AI) play in the future development of electric seat motors?

AI's role involves transitioning seats from static devices to intelligent, dynamic systems. AI utilizes sensor data to provide real-time, personalized posture adjustments, optimizes motor performance for energy efficiency, and contributes to enhanced vehicle safety through pre-safe bracing systems that use the motors to rapidly position the occupant before a collision.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager